Statutory Paternity Pay (Birth)

Your employee may be entitled to Statutory Paternity Pay (SPP) if their spouse or partner gives birth to a child. This replaces their normal earnings and helps them take time off to care for the child.

As their employer, whether you have to pay them SPP depends on how long they have worked for you, how much they earn and the date of the baby's birth. They will also have to provide you with documentary evidence at least 28 days before they wish their SPP payments to start.

Payments of SPP count as earnings. You must deduct tax and National Insurance Contributions (NICs) from them in the usual way.

You'll normally be able to recover some or all of the SPP you pay.

Entitlements

SPP following the birth of a child is available to an employee who is:

- a biological father

- a mother's husband, civil partner or partner (this includes a mother's female partner in a same sex relationship)

and who is taking time off to support the mother or care for the baby.

To qualify for SPP, the employee must have:

- worked for you continuously - full or part-time - for at least 26 weeks up to and including the Qualifying Week (the 15th week before the week the baby is due) and must continue to work for you up until the date the baby is born.

- average earnings at least equal to the lower earnings limit for NICs, £118.00 a week for 2019/20, in the relevant period up to the Qualifying Week.

- given you the right documentary evidence and at least 28 days notice of when they would like their SPP payments to start.

Average Weekly Earnings

The calculation of the average weekly earnings is very important because it not only determines if the employee qualifies for SPP but also how much they qualify for. To qualify for SPP, an employee must have average weekly earnings of at least the NIC LEL amount, £118.00 for 2019/20, in the relevant period up to the Qualifying Week.

For the tax year 2019/20, SPP is paid for one or two consecutive whole weeks at the lower of £148.68 per week or 90% of the employee's average weekly earnings.

Recovery of SPP

All employers are entitled to recover 92% of SPP they pay, however if the employer qualifies for Small Employers Relief, where the total NIC in the qualifying tax year was under £45,000, they can recover 100% of SPP paid plus an additional 3% in compensation for the employer’s share of NIC due on these payments.

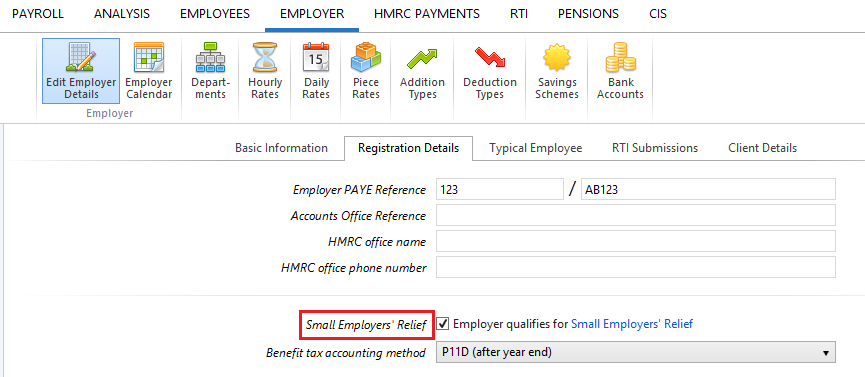

Should you qualify for Small Employer's Relief, ensure the box is ticked within Employer > Edit Employer Details > Registration Details:

Calculating SPP in BrightPay

To access this utility, simply click 'Payroll' and select the employee’s name on the left:

- Under Statutory Pay, click Calendar

- On the Calendar, select the start date the employee wishes to start their Paternity Leave

- Select Paternity Leave from the Parenting Leave section at the top right of the screen

- Enter all relevant dates and select the employee's Length of Leave from the drop down menu

- Average Weekly Earnings (AWE) - the program will automatically calculate the employee’s average weekly earnings for the purpose of calculating SPP due

The user can at their own discretion override the automatic calculation and manually enter an employee’s average weekly earnings. However it is recommended to seek advice from an accountant before doing so. To override the automatic calculation, simply untick the box and enter the amount. - Click Save when completed. The program will automatically update the calendar accordingly and apply the SPP due.

Overriding the 'Average Weekly Earnings' Calculation

If existing payment records have not been recorded in BrightPay, the automatic calculation performed by the program after completing the above may be inaccurate. In the event of this occurring, the user may override the AWE by doing the following:

- On the main Payroll screen, click the Edit icon in the employee’s Statutory Payments section

- In Paternity Leave, select the option ‘Override average weekly earnings’

- Enter the average weekly earnings amount for the employee, then click out of this box

- The program will now calculate SPP based on the AWE manually entered by the user

Editing the Length of the Statutory Paternity Leave

Should an employee wish to extend or reduce the length of their ordinary paternity leave, the length of leave already entered for the employee can be edited as follows:

- In Payroll, select the employee’s name on the left

- Under Statutory Pay, click on Calendar

- On the Calendar, select any date in advance of the current payroll date and which is currently marked as Paternity Leave

- Within the Paternity Leave section that will appear to the right of the calendar, click the Edit icon

- Amend the employee’s Length of Leave by selecting the number of weeks now applicable from the drop down menu

- Click Save

- Close the Calendar to return to the main Payroll screen

Return To Work Days

No SPP is payable for any week in which an employee works during their paternity leave period.

To record Return To Work Days in BrightPay:

1. Under Employees, select the employee from the listing and click their Calendar tab.

2. On the Calendar, select the date of the Return To Work day and click 'Return To Work Day' on the right hand side

3. Repeat if further Return To Work Days are taken

If a Return To Work day is recorded on the employee's calendar, BrightPay will notify you in the relevant pay period that the employee is not entitled to any SPP having returned to work for one or more days.

How BrightPay calculates SPP

BrightPay uses the full statutory week method when calculating & applying SPP (Birth).

Example:

Paternity Leave begins on a Wednesday. Therefore the last day of the SPP week will be a Tuesday.

SPP will thus begin in the pay period in which the first Tuesday of the paternity leave falls.

SPP1 Form

In the event that an employee is not entitled to SPP, employers are to use form SPP1 to tell the employee the reason why.

Form SPP1 can be completed in BrightPay and subsequently printed or exported to PDF for emailing.

To complete form SPP1:

a) Within Employees, select the employee in question from the left hand listing

b) Click 'More' on the employee's menu bar, followed by 'SPP1...'

c) Complete the SPP1 form accordingly

d) Click Print/ Preview to view the completed form

e) Click Print, Email or Export PDF, as required.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.