Tax Rates and Thresholds for 2021-22

Tax Rates and Thresholds

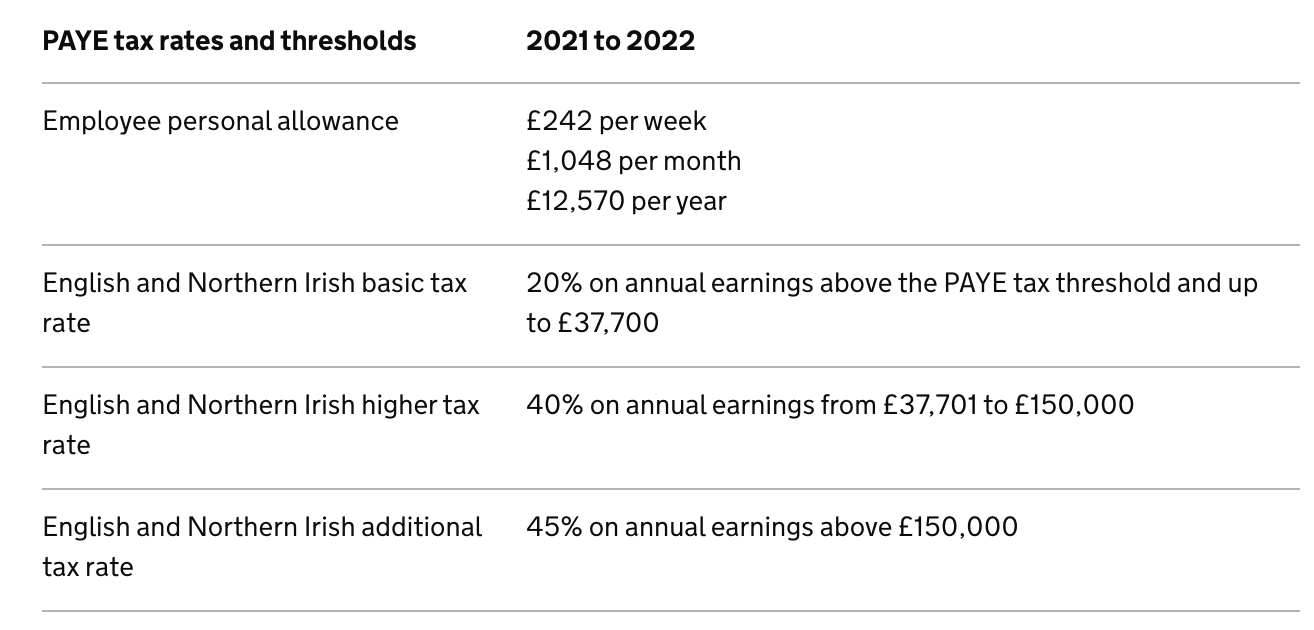

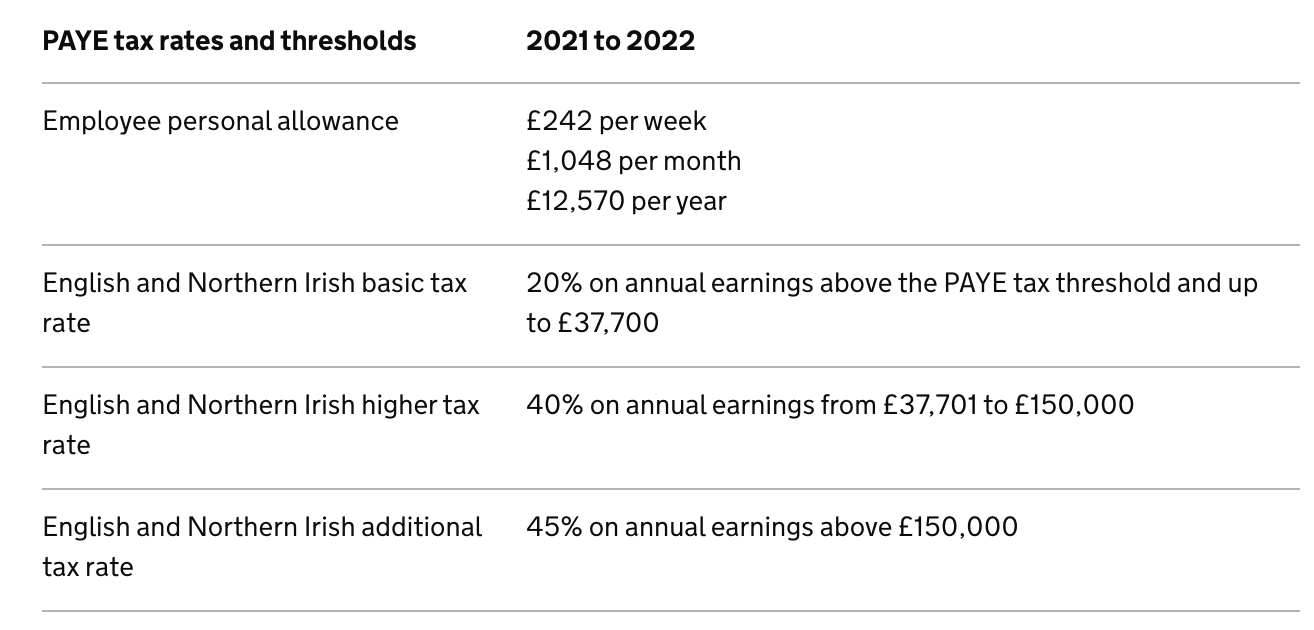

England & Northern Ireland

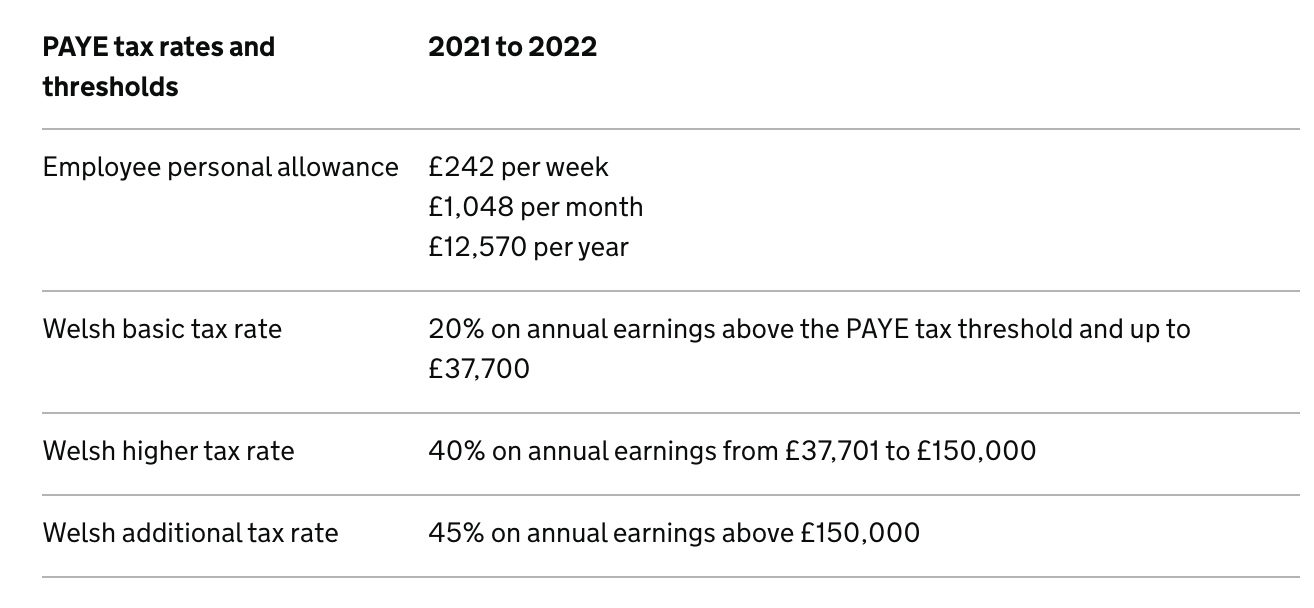

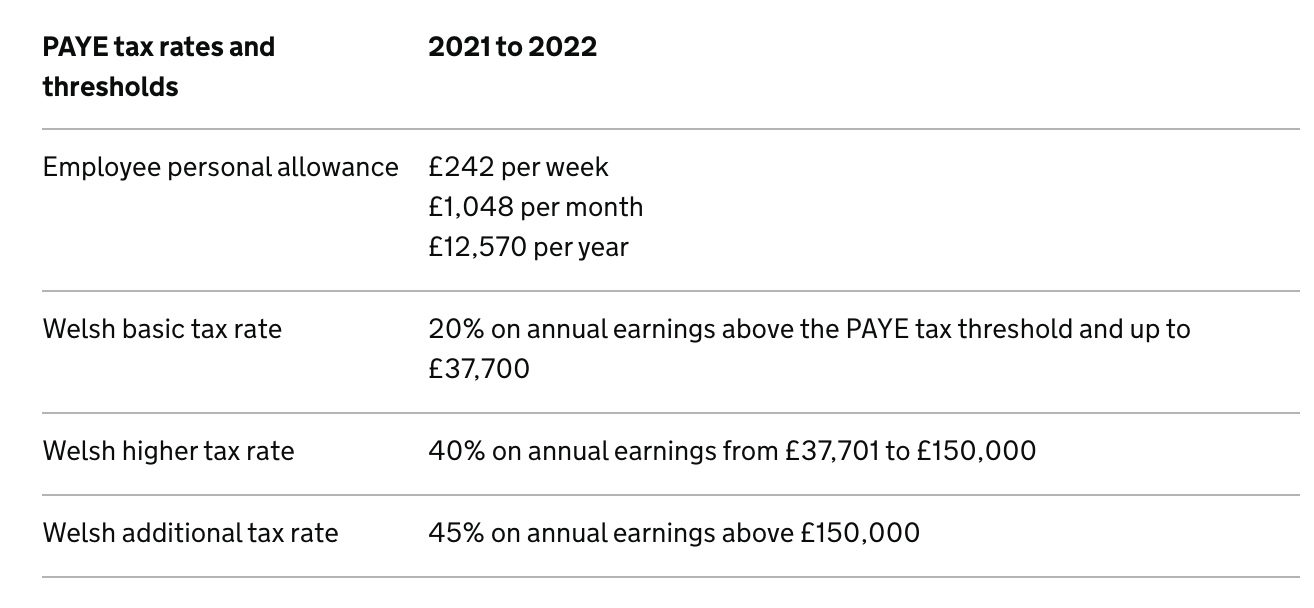

Wales

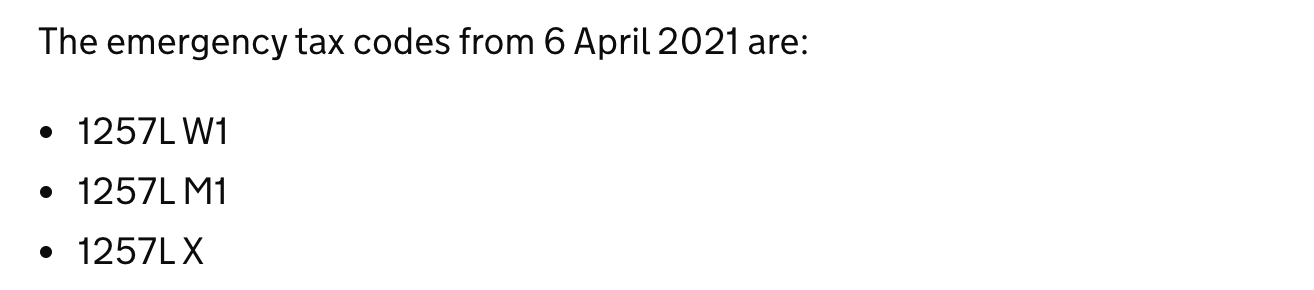

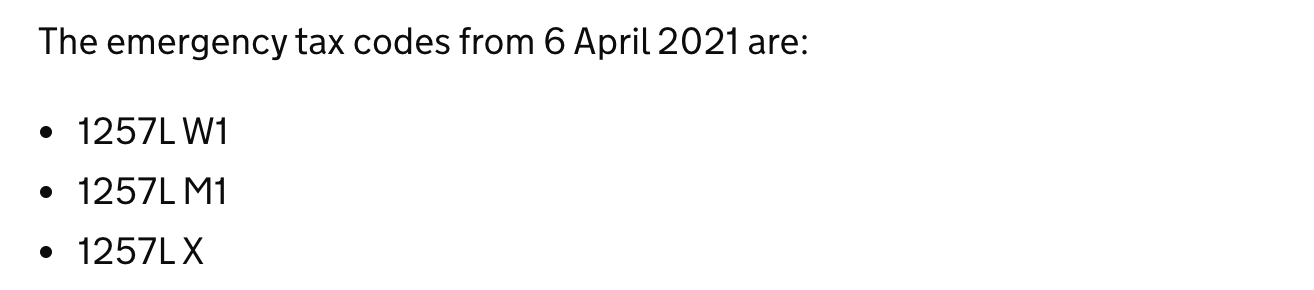

Emergency Tax

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.

Copyright © 2024 Thesaurus Software Ltd T/A Bright Software Group.

3 Shortlands, Hammersmith, London, W6 8DA

Email ushellobrightpayuk@brightsg.com 0345 9390019BrightPay desktop licences can be purchased in the Bright ID portal. (If you don't have a Bright ID, sign up here.)

Check out our video tutorial or help documentation which takes you through the ordering process step-by-step. If you have any difficulties, get in touch.

Before you purchase

BrightPay's new cloud version is the future. If you are a current BrightPay for Windows/Mac customer, you should consider moving to the cloud version. If you are a new customer, we highly recommend that you sign up for the cloud version instead of purchasing the desktop version. Annual and monthly pricing plans are available.