Welsh Rate of Income Tax

The Welsh Rate of Income Tax comes into effect on 6 April 2019. HM Revenue and Customs (HMRC) collect the Welsh rate of Income Tax on behalf of the Welsh Government.

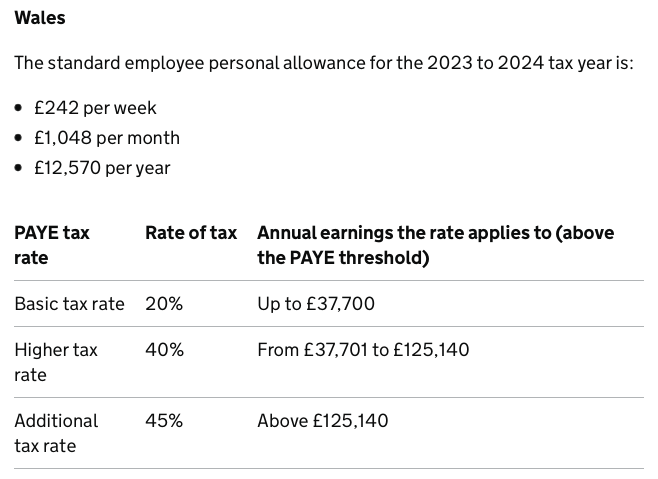

The 2023-24 Welsh rates and thresholds to apply are as follows:

Who pays the Welsh Rate?

HM Revenue and Customs (HMRC) are responsible for identifying who is a Welsh taxpayer and in doing so issue new tax codes which begin with the letter 'C'. Employers and pension providers don’t need to decide this and should only use a Welsh tax code if HMRC tell them to.

Employees will be classed as a Welsh taxpayer if the address HMRC holds for them is in Wales. It is the employee's responsibility (not the employer) to notify HMRC if their address has changed, or which home counts as their main home if they have one in Wales and one somewhere else in the UK.

If an employee disagrees with their tax code, they are advised to read the guidance on the Welsh rate of Income Tax before contacting HMRC.

Employer Duties

Employers don't need to change how they report or make payments for Income Tax to HMRC, other than to apply the Welsh rate of Income Tax code to their Welsh taxpayer employees.

If you are given a P45 with a Welsh tax code, follow the normal procedure. Week 1/ Month 1 basis also applies to Welsh tax codes.

Employers don't need to show the Welsh rate separately on employees' P60s or payslips, but should show the Welsh tax code.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.