Termination Awards & Sporting Testimonials

On 6th April 2020, new regulations came into effect requiring employers and testimonial committees to report and pay Class 1A NICs on termination awards and sporting testimonials in real time.

Termination Awards

Section 1 of the National Insurance contributions (Termination Awards and Sporting Testimonials) Act 2019 has introduced an employer Class 1A National Insurance contributions charge on termination awards above a £30,000 threshold that have not already been subjected to Class 1 National Insurance contribution deductions.

A termination award is a payment made to an employee as compensation for the loss of their employment. (It is recommended that guidance is sought as to what constitutes a termination award should you be unsure).

This Class 1A NIC is to be calculated, reported and paid as part of the existing PAYE cycle, that is in real time.

BrightPay facilitates the processing of a termination award and will calculate the applicable employer Class 1A NIC due.

In line with HMRC requirements, these Class 1A NICs will be reported to HMRC via the Full Payment Submission and should be paid as part of the PAYE bill.

To process a termination award in BrightPay:

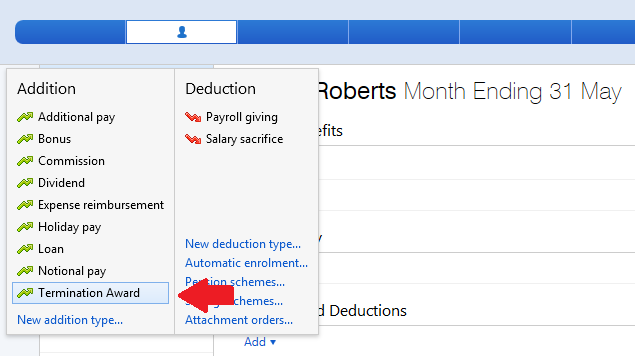

- Within Payroll, select the employee to access their payslip

- Under Additions and Deductions, click Add, followed by Termination Award

- Enter the termination award amount - BrightPay will automatically calculate any tax and Class 1A NIC due.

Sporting Testimonials

Section 3 of the National Insurance contributions (Termination Awards and Sporting Testimonials) Act 2019 has introduced a Class 1A charge on certain sporting testimonial payments from 6 April 2020 onwards.

A sporting testimonial is a one-off event, or a series of related events, held for the benefit of sportspersons who have played for a certain sports club for a long time.

Prior to April 2017, non-contractual and non-customary sporting testimonial payments paid to a sportsperson were not liable to income tax or National Insurance contributions. However, changes to the tax treatment of these types of sporting testimonial payments were implemented in April 2017, with a tax liability arising on any amount of testimonial payment above a £100,000 threshold.

Since April 2020, non-contractual and non-customary testimonials arranged by third parties are also now subject to a Class 1A National Insurance contributions liability on any amount of testimonial payment above the £100,000 threshold.

This Class 1A NIC is to be calculated, reported and paid as part of the existing PAYE cycle, in real time.

HMRC expect that the majority of sporting testimonials will be unaffected as the proceeds they raise for the sportsperson will not exceed the £100,000 threshold.

BrightPay facilitates the processing of a sporting testimonial and will calculate the applicable employer Class 1A NIC due.

In line with HMRC requirements, these Class 1A NICs will be reported to HMRC via the Full Payment Submission and should be paid as part of the PAYE bill.

To process a Sporting Testimonial in BrightPay:

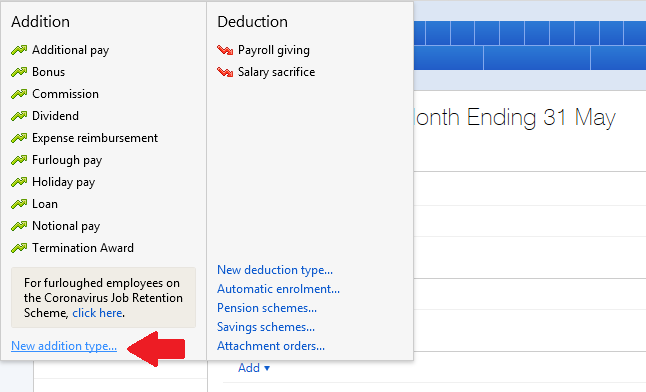

- Within Payroll, select the employee to access their payslip

- Under Additions and Deductions, click Add, followed by New Addition Type

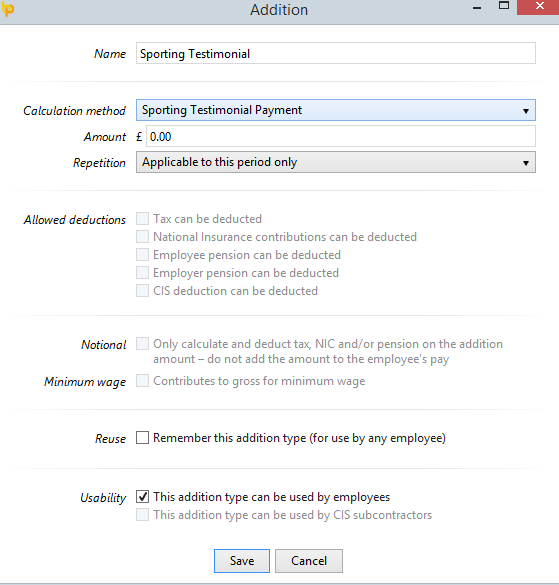

- Enter Sporting Testimonial as the addition name and select 'Sporting Testimonial Payment' as the Calculation Method using the dropdown menu.

BrightPay will now automatically apply the correct treatment in line with HMRC regulation.

Click Save

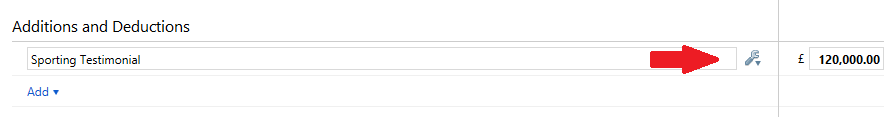

- Enter the sporting testimonial payment amount - BrightPay will automatically calculate any tax and Class 1A NIC due.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.