Dec 2022

20

Christmas Opening Hours 2022

Here are our opening hours for the Christmas period:

| Friday 23rd | 09:00 - 13:00 |

| Saturday 24th | Closed |

| Sunday 25th | Closed |

| Monday 26th | Closed |

| Tuesday 27th | Closed |

| Wednesday 28th | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 29th | 09:00 - 13:00 | 14:00 - 17:00 |

| Friday 30th | 09:00 - 13:00 | 14:00 - 16:45 |

| Saturday 31st December | Closed |

| Sunday 1st January | Closed |

| Monday 2nd January | Closed |

All of the staff here at BrightPay would like to thank you for your valued custom in 2022. We would like to take this opportunity to wish you and your families a Merry Christmas and a prosperous New Year.

To contact our support team you can call us on 0345 939 0019, or email us at support@brightpay.co.uk

Nov 2022

14

The ultimate auto enrolment guide for payroll processors

Auto enrolment can be a confusing and time-consuming aspect to payroll, especially for small businesses and start-ups. From enrolment letters to re-enrolment eligibility, it can be difficult to find the correct guidance you need, especially with non-compliance penalties looming in the background. Streamlining your auto enrolment duties can really free up your time each pay period and allow you to focus on your business’ growth or other exciting developments in the pipeline. Using a HMRC compliant payroll software with full auto enrolment functionality can provide you with a clear and concise path on how to fulfil your auto enrolment duties.

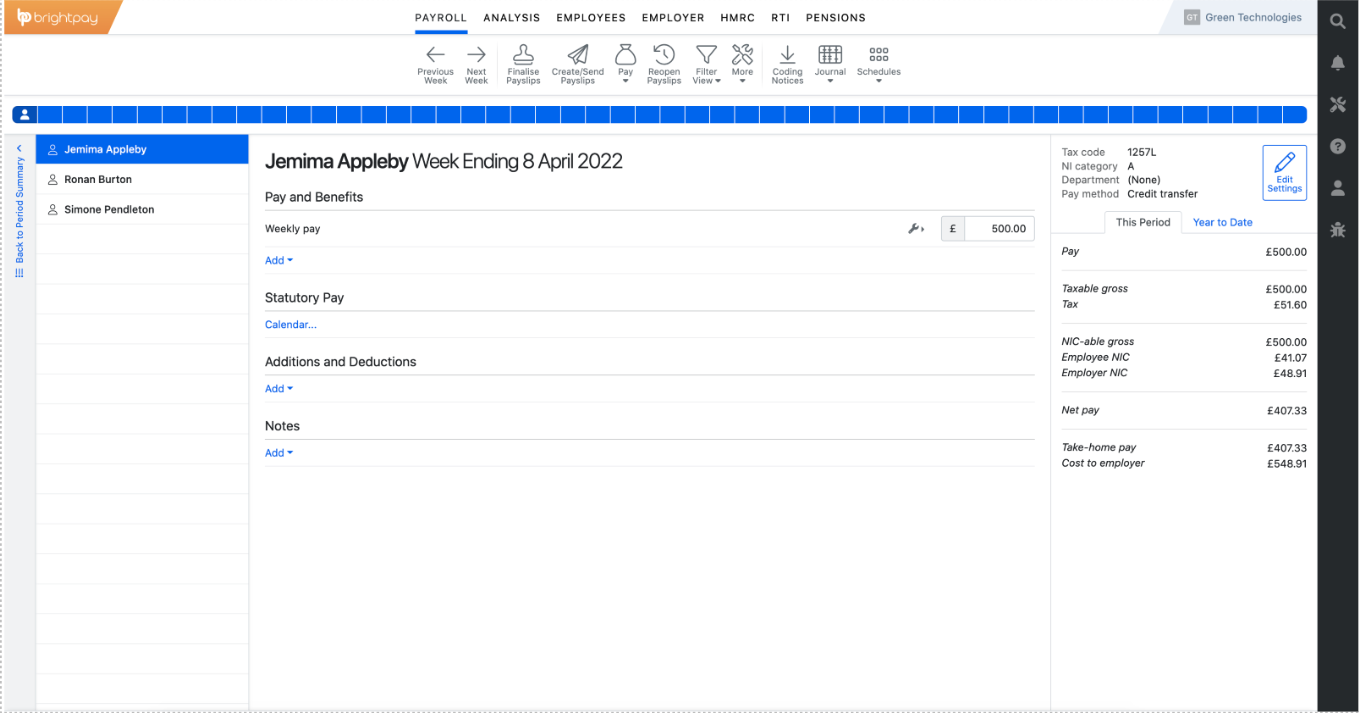

Let your payroll software do the hard work

Along with HMRC compliance, using a payroll software that automatically checks your employees’ eligibility for auto enrolment can save you the hassle and time of manually evaluating them yourself. Along with that, using a payroll software that notifies you of any new employees that need to be enrolled, saves you time when hiring new staff.

Auto enrolment and re-enrolment letters can be a tedious aspect of the auto enrolment process too. Re-enrolment is a requirement that takes place every three years, involving a re-declaration of compliance submission to The Pensions Regulator and sending a re-enrolment letter to each employee. Having a payroll software in place that can send personalised templates of auto enrolment and re-enrolment letters can save you the time it takes to type up these letters for each employee.

Integrated with pension providers

Manually exporting pension files and uploading them to pension provider portals can feel like a chore each pay period. It’s time to automate this task by integrating your payroll software with a pension scheme provider. This is streamlines setting up new employees into pension scheme and allows you to submit pension data easily, from within the payroll software.

Send auto enrolment letters to employees’ smartphones

Using a software that sends enrolment letters for you to your staff can really take a weight off your shoulders. For example, BrightPay’s cloud extension, BrightPay Connect, generates personalised enrolment letters and send them automatically through the employee app. This saves you the mountain of workload it would take to write up each enrolment letter individually, and offers employees a much more streamlined form of communication, improving their satisfaction levels.

BrightPay is an award-winning HMRC compliant payroll software that offers full auto enrolment functionality, at no extra cost. Once your employees’ details have been setup, you will have access to all the features mentioned above. We are also integrated with some of the UK’s leading pension providers, including Aviva, NEST, The People’s Pension and Smart Pension.

Start your auto enrolment journey with BrightPay today, for a stress-free and streamlined experience. To see our software in action, book a free 15-minute demo today.

Oct 2022

5

Bright new beginnings: Our latest acquisition and new branding

It’s an exciting day here at Bright, as today we are launching our new Bright branding, as well as announcing our latest acquisition. We’re thrilled to let all our customers know that BTCSoftware are now part of the Bright family. BTCSoftware offer multi-award-winning tax software solutions which help accountants to streamline and simplify tax and compliance work.

The addition of BTCSoftware to Bright makes sense to us as leading providers of software solutions to accountants and businesses. We believe that BTCSoftware’s product offering slots in nicely with our current payroll, HR, bookkeeping, accounts production and practice management software solutions.

This development is the next big step in Bright’s mission to streamline business processes for accountants and businesses, by delivering excellent products that enable automation and integration of core business sectors and functions. This mission is underpinned by offering world class support, a common philosophy which unifies all of Bright’s software solutions. This focus on serving customers above everything else, makes BTCSoftware a perfect addition to Bright, as they pride themselves on their highly rated, responsive customer support.

Same great products, Bright new brand

What’s different?

We now have a shiny new website which can be found at www.brightsg.com. The Bright website will be home to all of our products going forward, and each of our products will have their own pages within the website. Moving all our content and resources to the new website will be a gradual process, and so, the existing BrightPay website is not going anywhere just yet.

Our product logos have also changed from their varying colours to white or navy versions, ensuring all our logos have a uniform look and feel.

Why have we rebranded?

Since forming in 2021, Bright has brought a wide range of products together, and in doing so has integrated teams from across the UK and Ireland. Bright’s software solutions, including BrightPay Payroll Software, Thesaurus Payroll Manager, Surf Accounts Production, AccountancyManager, and now BTCSoftware give us the ability to offer accountants a fully comprehensive solution to their needs. While this range of products, expertise and support, allows us to combine the strengths of each brand, it also requires us to create a more unified voice.

With the launch of Bright, our new logo, and our new website, customers can find all our products under the one name and location. Customers will still see familiar product logos but should in time become used to seeing Bright appear more often, reflecting our future plans.

We hope that our new cohesive branding will help communicate who we are, what we offer, and reinforce our position as a one stop provider of software solutions for accountants and businesses.

Check out Bright’s new podcast

In other exciting news, Bright is introducing its first podcast series, Lightbulb Moments, which features disruptors and thought leaders from the accounting industry, revealing the bright ideas that gave them the power to switch things up for their business, practice and clients.

Sep 2022

29

Customer Update: October 2022

Welcome to BrightPay's October update. Our most important news this month includes:

-

Six-month “lifeline” for businesses struggling with energy bills announced

-

Give clients more responsibility over their payroll

-

AM’s Tasks become full-blown Workflow

How payroll can propel your practice beyond the competition

In next week's webinar, our experts will explore how you can work faster and smarter, while making a profit. Don’t undervalue your service offering to clients. Expand your services even further to stand out from the competition.

Protect your payroll: Top 5 security tips

Almost everything online is accessible at our fingertips, so just how safe is your clients’ data? In our latest guide, we explore five key payroll security tips that you can start offering your clients, before it's too late.

Mini budget reveals big changes for payroll

While a lot of what was announced in last week's mini-budget had been expected, many were surprised to see so many changes that will have a direct impact on payroll.

In this article, we’ve listed the changes that will most affect payroll processors and what steps, if any, you need to take to implement these changes.

Time and money saving features for your practice

Why are some accountants not profiting from payroll? In our upcoming webinar, we discuss how using cloud technology and automation can help save you time and money by eliminating time-consuming tasks.

Make HMRC payments painless

Missed out? Watch back our webinar and learn how your business can remove the pain from HMRC payments. Our integration with Modulr lets you pay HMRC, subcontractors and employees in just 90 seconds, directly through your payroll software.

Sep 2022

28

Mini budget reveals big changes for payroll

On the 18th of October 2022, there was an announced reversal of some of the measures previously outlined in September's mini-budget.

The new chancellor, Jeremy Hunt, has made changes to the mini-budget, ahead of the medium-term fiscal plan at the end of October. Hunt will be reversing almost all of the tax cuts, that the previous chancellor, Kwasi Kwarteng, announced in September. Hunt stated that stability is the objective and that this new approach will cost taxpayers much less than originally planned.

Whether you’re an accountant, payroll bureau, business owner or payroll professional, you’re probably wondering what effect this will have on how you run payroll.

Below, we’ve listed the changes which will most affect payroll processors and what steps, if any, you need to take to implement these changes.

1. Income tax stays the same

The reduction of the basic rate of income tax by 1% will be scrapped ‘indefinitely’, and so will remain at 20%.

What do I need to do?

No action from payroll processors is required.

2. Health & Social Care Levy scrapped

- The planned abolishment of the Health and Social Care Levy will go ahead as planned. From 6th November 2022, the temporary increase to National Insurance (NI) contributions will end and the rates which were applicable in the 2021/22 tax year will apply once again.

- The 1.25% Health and Social Care Levy will no longer come into force next year.

- Those who pay National Insurance on an annual basis will pay a blended rate of NI for the 2022/23 tax year to take into accountant the changes in NI rates throughout the year.

The blended rates are as follows:

| National Insurance Class | Main rate | Additional rate |

| Directors | 12.73% | 2.73% |

| Class 1A and 1B | 14.53% | N/A |

| Class 4 | 9.73% | 2.73% |

What do I need to do?

The new rates will mean that payroll software providers will need to update their software from November 6th to account for these changes.

3. IR35 rules to remain the same

It was previously announced that rules regarding off-payroll working would return to what they were pre-2017, however this is now no longer the case. The reform, which would have cost £2bn a year, has now been cancelled and IR35 rules will remain the same.

What do I need to do?

No action from payroll processors is required.

4. Retained EU Law (Revocation and Reform) Bill

The Retained EU Law (Revocation and Reform) Bill is a new bill which will end all EU retained laws by 31st December 2023 to make way for new regulations, tailor-made for the UK.

What do I need to do?

This bill could potentially have massive implications for UK employment law, so it is one to watch in the coming year.

Further changes to the mini-budget

Hunt introduced other changes to the mini-budget, which included:

- The universal help on energy prices will only apply for six months, until April 2023 (instead of the two years that it was originally intended for)

- There will be no rise in corporation tax

- The basic rate of income tax will remain at 20%

- No cuts on dividend tax rates

- New VAT-free shopping for overseas visitors will no longer be going ahead

- There will be no freeze on alcohol duty rates

Related articles:

Sep 2022

16

3 signs your payroll process is outdated

Staying on top of the latest digital business trends isn’t just difficult, it can be quite costly too. From banking apps, to Making Tax Digital – digital processes are becoming the mainstream. The payroll industry is no different and how well you keep up with the rapidly changing industry can often depend on the payroll software you use.

When your business becomes more digitalised, this can have a ripple effect on your entire company – from boosting employee satisfaction to increasing the competency and efficiency of your payroll workflow. But how do you know if your business’ payroll process is outdated, and if so, how can you update it? Let’s look at the top 3 signs your payroll process is outdated, with some easy-to-use tools you can start using today to modernise your business.

Having paper-based payslips

Do you still send employees’ paper-based payslips? Whether you send them by post or leave them in the break room for employees, these can both pose security risks. For example, if you leave payslips around the office floor, or even somewhere such as underneath a till, there’s a good chance that someone in the company could pick up the wrong payslip; exposing a staff member’s personal data to unauthorised persons.

Another way you can distribute payslips is by email. However, this can post security risks, as people might forget their password, or their payslips might get sent to the wrong email, exposing sensitive data to unauthorised users.

Luckily, these days there are much more secure and cost-effective alternatives for distributing your employees’ payslips. One way is by having staff use an employee app that syncs with your payroll software. This streamlines your payroll process by letting your payroll software distribute payslips automatically, at a time of your choosing. Employees can then view, print and download their payslips from anywhere, at any time, from their employee app on their iOS or android device. This streamlines your payroll process by letting your payroll software distribute payslips for you.

BrightPay’s cloud extension, BrightPay Connect, can offer employees access to their own employee app, where they can access payslips from anywhere at any time. As well as a payslip hub, an employee app can come with many other innovative features, such as an annual leave tool and a HR document hub.

Payments take days to land in employees’ bank accounts

If wages take days to land in employees’ bank accounts, it can leave you feeling on edge until you know they’ve been paid. Not only that, but if an error occurs and an employee is underpaid, for example, it could leave them waiting for up to a week to be paid what they are owed. Not to mention the manual workload that’s involved in creating bank files and rectifying such errors, each pay period.

Thankfully, there are faster, easier and more reliable methods of paying employees – some can even allow employees to be paid in as little as 90 seconds. An example of this would be using BrightPay’s integration with Modulr, a direct payments platform that lets you pay employees, HMRC and subcontractors in under 90 seconds, through your payroll software. This saves you time by removing the need to export bank files,and offers your business a more flexible solution to pay employees.

Manually backing up your payroll data

Manually backing up your payroll data to your PC, a third-party cloud server or an external hard drive isn’t just time-consuming, it can also pose security risks. For example, if your PC got hacked, or your external hard drive wasn’t ejected properly, you could potentially lose your data backups or employees’ payroll information could be leaked to unauthorised users. On top of that, manually backing up your payroll data each pay period takes time and it can be easy to forget to do it.

That’s why having your payroll data automatically backed up for you can save you time, while providing your business with a more digitalised and up-to-date solution. This ensures that your payroll data is backed up securely and remotely in the cloud, which increases your GDPR compliance and improves the overall security of your business. Allowing technology to do this tedious work for you in the background means you can attend to other important matters of your business.

A great example of this can be seen in BrightPay’s cloud extension, BrightPay Connect, which backs up your payroll data automatically to the cloud every 15 minutes, and once again when you exit the software. These backups are stored chronologically on the secure Microsoft Azure platform.

BrightPay is one of the UK’s leading providers of payroll software for SMEs. Interested in learning more about their cloud extension, BrightPay Connect? Book a free online 15-minute demo today. To stay up to date with all the latest payroll news and legislative updates, sign up to our weekly newsletter here.

Sep 2022

8

6 features your payroll software should have

Running payroll can be a headache, depending on what payroll software provider you use. Nobody wants to be using outdated, clunky software that isn’t updated regularly, or one that is not compliant with the latest payroll legislation. On top of that, using outdated software can take up a lot of time that could be spent on developing your business instead.

It’s time to choose a payroll software that not only processes payroll quicker, but that automates many other payroll tasks for you, such as paying employees, and submitting payroll information to HMRC. This means less evenings spent in the office processing payroll, and more free time to focus on customers or exciting plans for the company you’ve been putting on hold.

Here are the top six features that payroll software providers should be offering your business in 2022.

1. HMRC functionality

Using a HMRC compliant payroll software is the most important feature to look out for when choosing a payroll software provider. Staying compliant with the latest legislation should be at the forefront of your decision-making process. From automatically generating FPSs to submitting RTI forms, there are many automated features out there that are available to businesses that can streamline their duties to HMRC. This allows your business to both save time and reduce the workload involved in running payroll.

2. Integration with Accounting Software

Manually re-entering figures from your payroll software into your accounting software can be a tedious part of your payroll workflow. Not only that but inputting the wrong figures or entering the same data twice can lead to errors, which can be time-consuming to rectify. Using a payroll software that’s integrated with your accounting software can transform this process into a simple and seamless task, by transferring the data from your payroll journals directly into the general ledger within your accounting package. This can greatly reduce the time you spend on payroll, each pay period.

3. Distribute payments from within the software

Running payroll and paying employees used to be entirely separate processes. Between creating bank files, ensuring all the pay information is correct, and ensuring that payments will land in employees’ accounts on time; paying employees can take up a significant amount of time each pay period. Thankfully, choosing a payroll software provider that’s integrated with a direct payment platform can now offer you the ability to pay employees from directly within the payroll software.

An example of this can be seen when using an integrated payment platform which uses the Faster Payments service, where you can pay employees in as little as 90 seconds from within the payroll software. This integration can also provide you with more flexibility in your business by letting you schedule payments in advance. This offers you peace of mind around your payments by allowing you to make any necessary last-minute changes to your payments, before they’re distributed.

4. Auto enrolment and pension integration

While auto enrolment has made saving for retirement easier for employees, it has made payroll a more time-consuming process for employers. Whether you’re assessing employees’ eligibility, enrolling them into a pension scheme or sending out enrolment letters to employees, this can be incredibly time-consuming as a busy employer.

Thankfully, with the right payroll software in place, these tasks can now be more automated from within your payroll software. The Pensions Regulator has encouraged businesses to use a software that can help you comply with these auto-enrolment duties. For an even smoother experience, we also recommend choosing a payroll software provider that is integrated with leading pension scheme providers, streamlining this process even further for you.

5. Generate payroll reports

Producing payroll reports is an important tool for many businesses, as it can be used for financial forecasting. Having a payroll software that can generates reports which can include a variety of metrics is key when it comes to analysing your business’ finances. Whether you’re looking for reports across multiple pay periods, department totals, or amounts you’ve paid to HMRC, it’s important to choose a payroll software that can accommodate this, rather than spending hours creating reports in excel from scratch.

6. Multi-user access

Whether you have multiple people in your business working on payroll, or some payroll processors working remotely, having a payroll software that allows multiple users to work in the payroll software at the same time is a must-have feature for 2022. This aligns with the growing popularity in hybrid working models and assures that no matter where your payroll processors are, they can easily access the payroll software from anywhere, at any time.

Which software do we recommend?

While there are many software providers out there, BrightPay Payroll Software provides all these features we’ve mentioned above and more, such as:

- Integration with leading accounting software, pension scheme providers and direct payment platforms, such as Modulr.

- Free migration support

- Installation on up to 10 different devices

- Excellent customer phone and email support, at no extra charge

BrightPay is one of the UK’s leading providers of payroll software for businesses, with a 5-star rating on Trustpilot and a 99.1% customer satisfaction rate.

Our 60-day free trial offers full functionality and is contract-free, so you can use our software to the fullest, without making any commitments. Interested in learning more about BrightPay? Book a free 15-minute demo online today, to see the software in action.

Get a software that offers more than just payroll…

To automate your business even further, BrightPay’s cloud extension, BrightPay Connect, provides a host of HR and payroll solutions that can revolutionise your business internally, including:

Online hub where you can upload confidential and important HR documents

- Employee app where employees can access a chronological history of their payslips that automatically sync from the payroll software

- Employer dashboard where you can view all of your employees’ payroll information at a glance

- Annual leave management tool where you can easily approve and reject leave requests and view all of your company’s leave in a user-friendly calendar format

Click here to see a one-minute video on BrightPay Connect, or book a free online demo of our cloud-extension today, to take your business to the next level.

Aug 2022

31

Our 2022 customer survey results: BrightPay in the cloud

It's that time of the year again, the BrightPay customer satisfaction survey results are in. This was our first customer survey since becoming part of Bright which, as well as being the provider of BrightPay payroll software, is a provider of accounts production, bookkeeping and practice management software.

The aim of our annual customer surveys has been to discover what we are doing right and what we can improve on. However, this year especially, one of the main objectives of our survey was to learn more about our customers' expectations, hopes and ambitions as a business, and see how we, as software providers, can best support these aspirations.

Over 1000 BrightPay users took part in this year’s survey, including accountants and payroll bureaus who process payroll for their clients, and businesses who take care of their payroll in-house.

BrightPay’s 2022 customer survey: The results

One of the first questions we ask our customers each year is “How satisfied are you with BrightPay?,” and we’re happy to announce that BrightPay have achieved a 99.1% customer satisfaction rating for 2022. This means that our customer satisfaction rate has now been 99% or higher for 9 years in a row.

Another important question for us has always been “How happy are you with our customer support?”. This year, BrightPay received an impressive customer support rating of 98.9%.

An important metric for us is our Net Promoter Score (NPS) which is used to determine how likely users are to recommend our software to a friend or colleague. BrightPay’s NPS for 2022 was 71.4, putting us well above the industry average of 40 for B2B software and SaaS.

BrightPay in the cloud

In this year's customer survey, there was a lot of focus on BrightPay’s fully cloud version*, which will become available as a Beta version later this year. We asked why you’re likely or unlikely to switch to the online version of BrightPay, and what worries or apprehensions you may have about switching to the cloud payroll software.

Reasons why users said they were interested in moving to the online version of BrightPay included:

- The ability to access the software from anywhere, at any time

- The multi-user capabilities that come with having full online access to the software

- The fact that hosting and data security is transferred to Bright

- Having the ability to scale your payroll service offering

- Having an edge over competitors

- The possibility of increasing profitability

- The ability to track user updates

- Automatic software updates

- To reduce the need for an in-house server

Reasons why users were unlikely or unsure about making the switch, were a lot less varied than those that said they were likely to switch. The majority gave the reason that they were happy with the functionality of BrightPay’s desktop version and felt no reason to move.

A number of users said that they had limited internet access or were living in areas with a slow internet connection, and so felt that an online software wasn’t an option for them. However, we are aware that a proportion of our customers may face this issue, which is why the Windows version of BrightPay will remain available.

The main theme we noticed amongst respondents who said they were unlikely to make the move were concerns of the learning curve that may be associated. Others expressed a lack of knowledge surrounding cloud technology, with comments such as “I’m not sure I understand cloud technology,” “As a small business, I’m unsure if I need it” and “I need to learn more about the cloud software’s features.” However, as you can see from the list above of why users will most likely make the switch, cloud software has many benefits, with the main ones encompassing flexibility, scalability, and security.

At BrightPay, we aim to make the migration process as automated and as seamless as possible for our users to switch from the desktop to cloud payroll solution. The online payroll software’s screen layouts and user design will be almost identical to BrightPay’s desktop version and so there will be almost no learning curve. Our aim is to ensure that the software continues to be user-friendly.

How the online version of BrightPay will look

We understand there is always apprehension when switching to a new system, but users can rest assured that the cloud software will be just as easy to use as the BrightPay you’re used to, with the added benefits.

To celebrate National Payroll week, which is from 5th - 9th September and organised by the CIPP to demonstrate the impact the payroll industry has in the UK through the collection of income tax and National Insurance, BrightPay will be holding a free online webinar. The webinar is on the evolution of payroll, from its beginnings to what we can expect in the future. Register now to confirm your place. Check out our dedicated National Payroll Week webpage for more payroll news and updates.

The development of our fully cloud version of BrightPay is progressing as expected. At the moment, we are on track for a target beta release towards the end of 2022. Fill in this form if you wish to be notified when the beta version is available to use. If you want to learn more about BrightPay and our current cloud payroll extension, BrightPay Connect, book a free online demo today.

*While you will be able to process payroll using BrightPay’s online version, features of the cloud software won’t include the same functionality as the desktop version upon initial release. However, we will be working hard to get the online software in line with the desktop version.

Aug 2022

29

Customer Update: September 2022

Welcome to BrightPay's September update. Our most important news this month include:

-

Organised labour fraud: Warning to employers from HMRC

-

Identifying payroll client pain points and how to address them

-

Weather alert: How to handle last-minute annual leave requests

National Payroll Week Special

National Payroll week is next week and we have a whole range of fun events lined up to celebrate and give payroll the recognition it deserves. From live webinars to quizzes – register now to avoid disappointment, as places are limited.

Customer Survey 2022 Results

Our customer survey results are in and we’re happy to announce that BrightPay have achieved a 99.1% customer satisfaction rating and a 98.9% customer support rating for 2022. Our Net Promoter Score was 71.4, putting us well above the industry average of 40 for B2B software and SaaS.

Security alert! Top 5 payroll security tips

There are a surprising number of bureaus that aren’t aware of the cyber-security threats we face today. Almost everything online is accessible at our fingertips, so just how safe is your clients’ data? In our latest guide, discover 5 top payroll security tips you can start offering your clients today.

6 exciting ways to boost the speed of your payroll

Tasks such as annual leave management, distributing payslips and backing up your payroll data can often be quite tedious and time-consuming. In this free guide, we’ll zoom in on 6 exciting ways cloud technology can help boost your payroll processes today.

How payroll and practice management work together

In our upcoming webinar on 22nd of September, see how your payroll and practice management software can work together to give your practice a more organised, streamlined and structured workflow. From automating your admin to speeding up your onboarding process – the opportunities are endless!

Warning from HMRC: Organised labour fraud

HMRC’s recent employer bulletin included warnings to employers on organised labour fraud. Organised labour fraud affects HMRC, businesses, employees, and the general public. Learn about the 3 types of fraud, and how to avoid it, in our latest blog post.

Save your practice over £20,000 a year

In this webinar, we will look at what’s most important to accountants and bureaus when choosing a payroll software - exactly how much value can it bring to your practice? We will also share results of our customer research to highlight how much time and money you can save by using BrightPay and BrightPay Connect.

5 ways to boost the efficiency of your payroll process

Join our most popular webinar for employers on the 7th of September, where our payroll experts will discuss 5 ways you can boost the efficiency of your payroll and HR processes by using next-generation cloud technology.

Aug 2022

18

Organised labour fraud: Warning to employers from HMRC

HMRC’s August employer bulletin was released last week and included in it were warnings to employers on organised labour fraud. Organised labour fraud is the umbrella term HMRC gives to three main types of fraud which all share similar features.

The three types of fraud are:

- Payroll company fraud

- Labour fraud in construction

- Mini-umbrella company fraud

These types of fraud are orchestrated by organised crime groups and involve a genuine supply of labour. Crime groups may grow their operations to include other types of fraud where the supply of labour is central to how the fraud operates.

Organised labour fraud affects HMRC, businesses, employees, and the general public. These frauds steal vital revenue that funds the UK’s public services, can hurt the finances and reputations of businesses, and for employees, it can affect their employment rights and may impact their ability to claim benefits in the future.

Payroll company fraud

This type of fraud takes place when a business outsources its payroll responsibilities to a fraudulent third party who claim to be a payroll provider. The fraudulent ‘payroll provider’ will process the payroll of their victims’ employees. While they will pay the employees their wages, they will fail to pay income tax, National Insurance and VAT to HMRC. This is how they get away with the scam for some time, as the employer may take a while to notice what has been happening. With this type of fraud, there is a risk that the employer could still be deemed liable for the tax, NI and VAT payments that were never received by HMRC.

Labour fraud in construction

This is another type of fraud which targets employers. HMRC defines it as “the fraudulent use of contrived labour supply chains in the construction industry.” This fraud involves the abuse of the Construction Industry Scheme to move labour-related VAT and Income Tax liabilities into “shell corporations.” Shell corporations are companies which have no business operations or significant assets. These companies are sometimes used in organised crime. The shell companies will then go default and will owe a debt to HMRC.

Mini-umbrella company fraud

The third fraud is one that can affect businesses which use temporary labour. It works by criminals creating multiple limited companies, with each one employing a small number of temporary employees. Each of these micro companies may fraudulently claim Employment Allowance and abuse the VAT Flat Rate Scheme which are government incentives aimed at helping small businesses.

Common traits of organised labour fraud

In their 2022, August bulletin, HMRC have listed a number of red flags or common traits to watch out for in fraudulent businesses, including:

- Businesses with a short life span — sometimes as little as 12 months. These businesses will then be abandoned or become insolvent, and another entity will take their place

- Hijacked VAT registration, Construction Industry Scheme registration and, or PAYE scheme numbers

- Unusually long supply chains which often make no commercial sense

- Turnover rises at an exponential rate and debt accrues quickly

- The director’s business history suggests they lack the experience to run a company of that type and size

- Directors may have a history of ‘phoenixing’ companies which is when a business is conducted through a succession of companies. Each in turn becomes insolvent and transfers the business onto the next company.

What can you do to avoid being a victim of organised labour fraud

HMRC recommends that businesses have a system in place whenever they receive a supply of labour. Every business should:

- Check the legal, financial, tax and social obligations of suppliers

- conduct robust due diligence on suppliers and act to mitigate or remove risks

- Continuously monitor and review your due diligence

HMRC also recommends that individuals register for their Personal Tax Account as regular checking ensures that the information shown there is accurate.

You should contact HMRC as soon as possible if you have information or concerns regarding a supplier.

Related articles:

-1.png)