Nov 2016

2

After Auto Enrolment Staging - What happens next??

Once you have completed the initial setup of auto enrolment you will need to complete a set of tasks on an ongoing basis. Clients will need to comply with their ongoing duties to avoid being fined by the Pensions Regulator.

Ongoing Assessment: All employees must be monitored on an ongoing basis to see if there are any changes to their worker category. For example, if an employee turns 22 or their qualifying earnings increase then they may become an eligible jobholder. Even if this occurs after staging, your client will still need to carry out new AE assessment duties for this individual employee.

Your payroll software should easily monitor the ages and earnings of any new and existing staff. Good payroll will automatically notify you of any changes to an employee's status therefore there should be no need to run a report every pay period. Any employees that become eligible will need to be enrolled and an AE communication letter issued to them.

Record Keeping: Clients must keep records of their auto enrolment activities for six years. They must also keep any employee opt-out notices for a period of four years. By law, there are two different types of records that an client must keep.

- Pension staff records- including employees names and addresses that have been enrolled, records of when the contributions were paid to the pension scheme, any opt-out notices and much more.

- Pension Scheme records - including the client pension scheme reference and scheme name and address.

These records or reports should be available in your payroll software

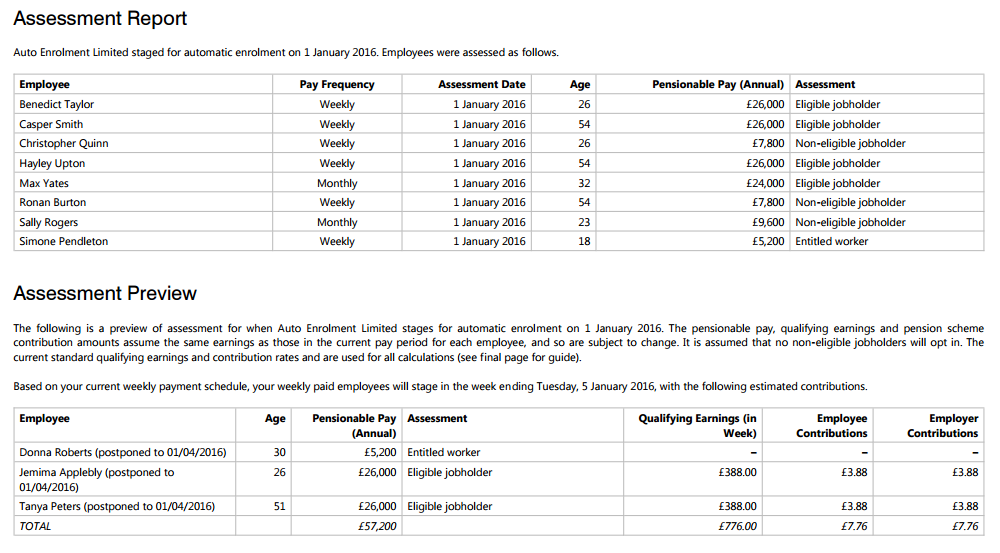

Post Assessment Report: A useful report to run is a post assessment report after your client has staged. The report will give your client a clear picture of what has taken place on the staging date for each employee. Your payroll software should easily produce this report to include each employee, pay frequency, assessment date, employee’s age, pensionable pay and assessment category. It would also be valuable to see employees who have been postponed. PDF Example post assessment report.

Pension Submission: Your payroll software should work and support your auto enrolment pension scheme. Each pension provider requires their data files in a certain format. Check to see if your payroll allows for the easy transfer of data files to the pension scheme. Some providers such as NEST and Smart Pension offer a direct integration or an API facility between payroll and pension provider which will save you time each pay period. Read: How useful will the NEST API tool be?

Paying Contributions: Your client will need to pay the correct level of employee and employer contributions to the AE pension scheme in a timely fashion. The contribution amounts will either be based on a fixed amount or a percentage of earnings. You payroll software should easily calculate both fixed or percentage amounts for you. One you have set up the contribution calculation basis then you payroll should deduct the correct amounts automatically for you.

To conclude..

The responsibility for meeting your automatic enrolment duties ultimately lies with your client. However if you are contracted to carry out AE on behalf of your client then you have an obligation to fulfill the terms of the contract. View a full list of Auto Enrolment Features in BrightPay.

25% BrightPay when you Switch!!

New bureau customers can now save 25% when they switch to BrightPay. To avail of the discount, you can purchase online or contact our sales team on 0845 3004 304 or sales@brightpay.co.uk and quote '25% Discount Sale'.

*Offer applies to new bureau customers who switch from a different payroll software provider for the first year subscription only. Applies to BrightPay 16/17 bureau licences only.