Sep 2017

27

What do you mean…. “Do I have a backup?”

One of the most common calls I get on the support line is from a distressed customer who tells me they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer, holding files to ransom or fire or water damage to the computers in the office.

The first question I’ll ask on a call of this type will be “do you have a backup?”. Honestly, I can’t tell you the number of people that say “No” to this. People are also mistakenly under the impression that we have a copy of their payroll data. Unfortunately this is never the case, we do not have access to the employer’s payroll information so this can add to the customer's stress levels as you can imagine!

We would always stress the importance of taking a backup of your payroll information.

You would have your computers and office equipment insured against anything happening so why would you not do the same for your data? Think of your backup as your information’s insurance policy, after all it is almost irreplaceable or at the very least a major inconvenience to try and rebuild your payroll.

In a lot of cases, the call to our customer support line comes too late for us to be of any real assistance and the only advice we have to give is to start over and process payroll from the beginning again.

We never think anything like this will happen to us, but take it from me, it does, so go ahead and take out that insurance policy and backup before it is too late!

The following links will guide you to taking a backup in your software or book a demo of BrightPay Connect our latest cloud add on that offers an automated online backup feature :

- BrightPay UK: https://www.brightpay.co.uk/docs/17-18/backing-up-restoring-your-payroll/

- BrightPay Ireland: https://www.brightpay.ie/docs/2017/backing-up-restoring-data-files/backing-up-your-payroll-data/

- Thesaurus Payroll Manager: https://www.thesaurus.ie/docs/2017/processing-payroll/backup-data-files/

Sep 2017

26

42 Year Low in UK Unemployment

The UK's unemployment rate has fallen to its lowest level since 1975, according to official figures which also show a growing gap between price rises and wage growth. The unemployment rate fell to 4.3% in the three months to July, down from 4.4% in the previous quarter and 4.9% a year earlier.

The employment rate, which measures the proportion of people aged 16- 64 in work, hit 75.3% - the highest since comparable records began in 1971. In total, there are 32.1 million people at work in the UK, according to the figures, or 181,000 more than the previous quarter.

While that performance suggests the labour market is continuing to shrug off uncertainties and other headwinds in the wake of the Brexit vote, the figures also highlighted a worsening squeeze for family budgets. It is also reported that average wage growth remained static at an annual rate of 2.1% over the same three months. With inflation coming in at 2.9%, the real value of wage growth is falling.

Sep 2017

18

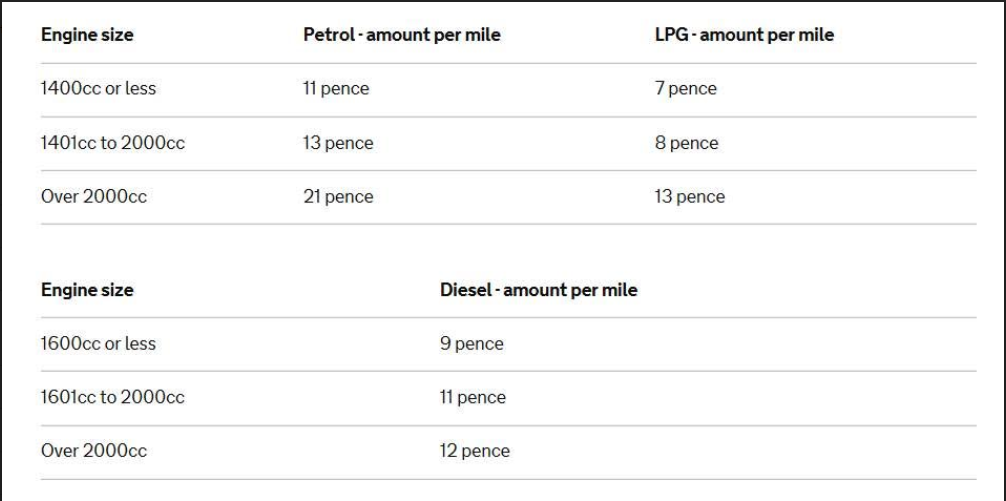

Latest Advisory Fuel Rates for Company Cars

For company cars, HMRC has released details regarding the latest Advisory Fuel Rates. From the date of change, employers may use the old rates or new rates for one month. Employers are under no obligation to make supplementary payments to reflect the new rates but can do so if they wish. Hybrid cars are treated as either petrol or diesel cars for this purpose for the fuel rates.

The changes are to engine size from 1401cc to 2000cc and to LPG engine over 2000cc. To view the latest rates click here.

The rates are as below:

Sep 2017

11

GDPR - what businesses need to know

Data protection and how personal data is managed is changing forever. On 25 May 2018 the new General Data Protection Regulation (GDPR) will come into force. The GDPR is a European privacy regulation replacing all existing data protection regulations.

Current data protection legislation in the UK dates back to 1998, predating current levels of internet usage and cloud technology, making it unsuitable for today’s digital economy.

The GDPR will apply to any personal data of EU citizens, regardless of whether it is stored within or outside the EU. Most, if not all companies, process a level of personal data, whether it is customer details or employee details, therefore businesses need to be aware and plan for the new legislation.

What is Personal Data?

The GDPR substantially expands the definition of personal data. Under GDPR, personal data is any information related to a person, for example a name, a photo, an email address, bank details, their personnel file, or a computer IP address.

High Penalties

Ignoring the new legislation is ill advised as there are tough new fines for non-compliance. Companies or organisations found to be in breach of the legislation will face fines of up to 4% of annual global revenue or 20 million Euros, whichever is greater.

GDPR & Brexit

The UK will not have departed the EU on 25 May 2018 and will still be an EU member state. The GDPR will consequently become domestic law and compliance will be mandatory.

Key Changes

Some of the key changes included as part of the GDPR include:

Consent must be clear, distinguishable from other matters and provided in an easily accessible form, using clear and plain language. It must be as easy to withdraw consent as it is to give it.

Breach Notifications; where a breach occurs, the Information Commissioner’s Office and affected data subjects must be notified within 72 hours of the breach coming to light.

Data subjects will have additional rights, including:

- Access Rights: data subjects may obtain from a data controller confirmation as to whether or not personal data concerning them is being processed, where and for what purpose.

- Right to be Forgotten; data subjects will have the right to request that their personal data be erased, or ceased to be processed.

- Data Portability: data subjects will have the right to receive the personal data concerning them, and the right to transmit that data to another controller.

To Do

If you haven’t already started planning for GDPR click here for guidance on how to prepare.

BrightPay - Payroll and Auto Enrolment Software

Bright Contracts - Employment Contracts and Handbooks

Sep 2017

11

New Student Loan Plan 1 Thresholds for 2018-19

It has been confirmed that the student loan repayment threshold will rise to £18,330 for Student Loan Plan 1 for the new tax year 2018-19 by the Student Loans Company. This will come into effect from 6th April 2018. Student Loan Plan 1 is for pre-2012 loans and the current 2017-18 threshold is £17,775. This new threshold will apply to all borrowers who have a Plan 1 loan for whom employers make student loan deductions.

For Student Loan Plan 2, which is for post 2012 loans, there will be no change to the current threshold of £21,000 in the new tax year. There is no change to the student loan repayment threshold for postgraduate loans, which is also £21,000.

In BrightPay 2018-19, the new student loan repayment thresholds for Plan 1 will automatically be calculated and the appropriate student loan deduction applied.

Sep 2017

1

Parental Bereavement (Pay and Leave) Bill

The Parental Bereavement (Pay and Leave) Bill has been introduced to Parliament on 19 July 2017.

Under the proposed new law, employed parents who suffer the death of a child will for the first time be entitled to statutory paid leave. The law is supported by the government in line with its initiative to “enhance the rights and protections in the workplace” to ensure that grieving parents in employment receive paid leave to mourn away from the workplace.

Kevin Hollinrake MP who introduced the Bill said: “This is such an important Bill for parents going through the most terrible of times. There is little any of us can do to help, but at least we can make sure that every employer will give them time to grieve.”

At present, under the Employment Rights Act, there are no legal requirements for employers to give paid leave to grieving parents. Employees, however, have a right to take a “reasonable” amount of unpaid time off work to make arrangements following the death of a dependant.

The new Bereavement Law will make it compulsory for employers to offer two weeks of paid bereavement leave to parents after the death of a child under the age of 18 or in full-time education. The Bill states that grieving parents must be paid no less than 90 per cent of their average weekly earnings, or £139.58 per week (which was the statutory weekly rate in force at the time the Bill was originally published, but is currently £140.98), whichever is lesser. This amendment could help parents deal with the financial implications of bereavement, including paying for funeral arrangements.

It has not yet been confirmed whether or not the law will include parents who have lost a child during pregnancy.

The Bill is expected to have its second reading in the House of Commons in the autumn. In the meantime, the Department for Business, Energy and Industrial Strategy will be talking to employers, employee representatives and campaigners to better understand the needs of bereaved parents.