Sep 2017

18

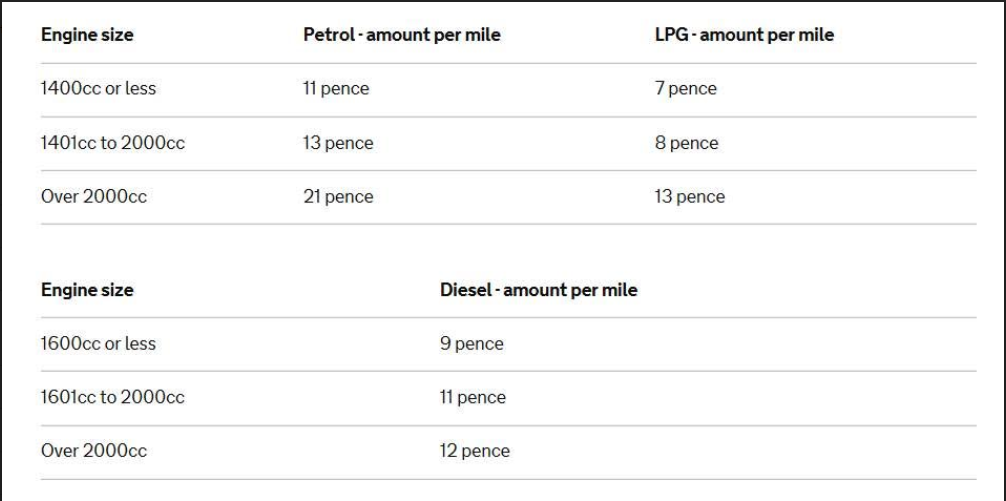

Latest Advisory Fuel Rates for Company Cars

For company cars, HMRC has released details regarding the latest Advisory Fuel Rates. From the date of change, employers may use the old rates or new rates for one month. Employers are under no obligation to make supplementary payments to reflect the new rates but can do so if they wish. Hybrid cars are treated as either petrol or diesel cars for this purpose for the fuel rates.

The changes are to engine size from 1401cc to 2000cc and to LPG engine over 2000cc. To view the latest rates click here.

The rates are as below: