Dec 2017

20

Employer NICs to be paid on Termination Payments from 6th April 2019

In the Spring Budget 2017, it was announced by the Chancellor of the Exchequer, Philip Hammond, that termination payments over £30,000 which are currently subject to income tax, would be subject to Employer National Insurance Contributions from April 2018. The government, however, has announced on 2nd November that the introduction of the National Insurance Contributions bill has been delayed.

From 6th April 2019 rather than 6th April 2018 Class 1A employer National Insurance contributions will be payable on termination payments over £30,000.

At the moment, generally the first £30,000 of a termination payment is free of tax and no National Insurance contributions will be due on any part of the payment to the extent that it would have qualified for tax exemption. In the Finance Bill 2017, the tax treatment of termination payments will be clarified and this will include all contractual and non-contractual payments in lieu of notice taxable as earnings and requiring employers to tax the equivalent of an employee’s basic pay if notice is not worked. The changes, including to Foreign Service Relief, will take effect from 6 April 2018.

For further information select here.

Related Articles

- Payroll for Bureaus: From loss leader to profit centre

- Autumn Budget 2017 - Employer Focus

- The Benefits of BrightPay Connect for Employers

Dec 2017

18

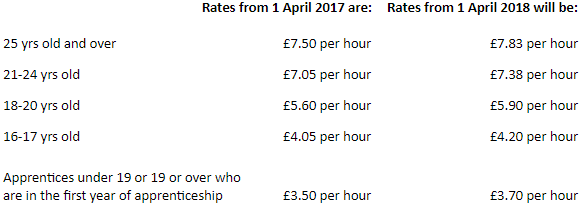

Minimum Wage Increase on 1st April 2018

The Low Pay Commission’s Autumn 2017 report has been published and on the 1st April 2018, the minimum wage will increase again.

The National Minimum Wage (NMW) is the minimum pay per hour most employees are entitled to by law. An employee's age and if they are an apprentice will determine the rate they will receive.

Dec 2017

6

Autumn Budget 2017 - Employer Focus

The main points to be noted by employers from Autumn Budget 2017, as announced by Chancellor of the Exchequer, Philip Hammond are:

- The personal tax allowance will increase by £350 from £11,500 to £11,850 from 6th April 2018. This is in line with the government's goal to have the personal tax allowance at £12,500 by 2020.

- The higher rate tax threshold will increase to £46,350 from £45,000.

- As previously announced, there has been a delay by one year on the series of changes for NICs to be implemented. These changes will now take effect from April 2019. They include the reforms to the NIC treatment of termination payments, abolition of Class 2 NICs and changes to NICs treatment of sporting testimonials.

- The planned increase in Class 4 NICs from 9% to 10% in April 2018 and to 11% in April 2019 by the government will no longer be happening.

- There is an increase in the Company Car Tax (CCT) diesel supplement to 4% from 3%. The supplement will apply to diesel cars registered on or after 1st January 1998 that are not certified to the Real Driving Emissions 2 standard. It will not apply to diesel hybrids or other vehicles except cars.

- From 6th April 2018 there will be no Benefit in Kind charge on electricity that employers provide to charge employees’ electric vehicles.

- The Government has announced its intention to consult on the extension to the private sector of the IR35 reforms, introduced in the public sector earlier this year.

- There is an increase of the lifetime allowance for pension savings, rising to £1,030,000 for 2018-19.

- The National Minimum Wage details for 1st April 2018 were published.

- HMRC's compliance team are monitoring employers that are claiming the Employment Allowance, as it has been reported that some employers are using avoidance schemes to avoid paying National Insurance amounts due.

Related Articles

Dec 2017

5

Customer Update - December 2017

5 simple scenarios to stop pension scams

A pension scam – when someone tries to con you out of your pension money – will often start by someone contacting you unexpectedly with one of many pension scenarios. If you find yourself in one of these scenarios make sure to act fast to prevent becoming a victim of a pension scam.

Sign up to BrightPay’s newsletter

Do you want to hear more about future CPD events, free ebooks, industry updates and special offers? Subscribe to BrightPay’s newsletter today. You will have the option to unsubscribe at anytime.

Does automatic enrolment apply to you?

It is essential that all employers understand that if they employ just one person, they have certain legal duties for automatic enrolment. After the 1st October 2017, new employers who employ their first member of staff will have to comply with auto enrolment from the day the new employee starts.

Free Webinar - What does GDPR mean for your business?

All businesses process large amounts of personal data, not least in relation to their customers and their own employees. Consequently, the GDPR will impact most if not all areas of businesses and the impact it will have cannot be overstated. Places are limited.

Bureau Webinar: 6th February | Employer Webinar: 13th March

How to avoid harassment in the workplace

The recent allegations against Harvey Weinstein in the US have created somewhat of a snowball effect worldwide with thousands of women and men speaking out about their accounts of sexual harassment and assault, many of them being work related.

Cut down on payroll processing time with BrightPay Connect

Employers across the UK are automating the process of providing payroll and HR documents to employees, such as payslips, P60s, employment contracts and company handbooks. Annual leave management can also be simplified and automated giving you more time to focus on pressing business matters.

Out with the staging date - in with the duties start date!

The ‘duties start date’ is the date that an employee first begins to work for a company. For those recruiting after October 1st 2017, it is important to be aware that as soon as their new hire begins working for them, their automatic enrolment duties will also begin straight away.

Did you know BrightPay offers a free licence to micro businesses?

BrightPay offers a free employer licence to businesses with up to three employees which includes payslip and auto enrolment functionality? Also, our standard employer licence is just £99 + VAT per tax year. BrightPay has a 99% customer satisfaction rate.

Download free 60-day trial | Book a demo

More for bureaus -

Payroll for bureaus: From loss leader to profit centre

New technologies can positively impact the way bureaus offer payroll services. There are several exciting developments that are happening right now in the cloud. Be ready to offer a new level of payroll and HR services by embracing new-world online technologies.

Free CPD Webinar - The Future of Auto Enrolment

Auto enrolment has well and truly evolved since the rollout began in 2012. There are a number of changes coming over the next 12 months that payroll bureaus need to be aware of, including instant duties for new employers, increases in minimum contribution rates and automatic re-enrolment.

Accountants are making the big switch to BrightPay

BrightPay has been operating in the UK since 2012. Year on year, more accountants are moving payroll providers to BrightPay for several reasons. You may ask yourself, why are so many accountants and payroll bureaus moving to BrightPay.

The benefits of offering cloud payroll services

The payroll landscape is changing and many payroll bureaus are offering clients a certain level of cloud functionality that automates otherwise time consuming tasks. Online access to payroll information for your clients and their employees offers significant benefits for today's bureau which can will streamline many workforce management tasks.