Jan 2018

31

BrightPay & Aviva: Hello one-click pension submissions.

Time-consuming pension file CSV uploads can now become a thing of the past as BrightPay have teamed up with Aviva to bring both employers and payroll bureaus a one-click pension submission. Using Aviva’s API technology, files can be directly sent from one system to another electronically. An API facility is a similar concept to RTI where one system (i.e. payroll software) can instantly communicate with another system (i.e. pension provider.

If Aviva is your chosen workplace pension scheme you can simply send your pension contributions to Aviva in an instant. There is no need to leave the BrightPay application to submit your pension contributions as the Aviva API accesses the pension file that BrightPay has created. This pension file can then be sent through to the Aviva portal with just a few clicks on BrightPay.

Whether you process payroll and automatic enrolment (AE) for your small business or for your payroll bureau’s multiple clients, you can easily comply with your legal duties without having to tirelessly toggle between tabs on your PC.

BrightPay are pleased to be the first payroll software to offer this API integration with Aviva. BrightPay and Aviva customers are saving invaluable time each pay period. If you’d like to see how BrightPay can streamline other tedious automatic enrolment tasks you can book an online demo today. Find out more on our Aviva API webpage.

Written by Cailín Reilly.

Jan 2018

19

Recognised Overseas Pension Schemes notification list

The list of Recognised Overseas Pension Schemes (ROPS) notifications has been updated. 17 schemes have been added and 1 scheme has been removed. This is a list of workplace pension schemes that have told HMRC they meet conditions to be a ROPS and have been asked to be included on the list.

The ROPS notifications list is updated and published on the 1st and 15th day of each month. The list will be published on the next working day if this date falls on a weekend or UK public holiday. From time to time, the list is updated at short notice to temporarily remove schemes while reviews are carried out. For example, this could be when there is suspected fraudulent activity.

The requirements for ROPS changes from 6th April 2017.

You need to meet the new requirements on or after the date you transfer from one scheme to another. HMRC can’t guarantee these are ROPS or that any transfers to them will be free of UK tax. The responsibility lies with you to find out if you have to pay tax on any transfer of pension savings.

HMRC will usually pursue any UK tax charges (and interest for late payment) arising from transfers to overseas entities that don’t meet the ROPS requirements even when they appear on this list. This includes where the ROPS requirements have changed and where taxpayers are overseas. HMRC will also charge penalties in appropriate cases.

Related Articles:

Jan 2018

12

2018-19 Rates and Thresholds for Employers

For 2018-19 the new personal allowance for an employee is £11,850.

The 20% PAYE tax threshold is for annual earnings up to £34,500.

The UK higher tax rate of 40% is on annual earnings from £34,501 to £150,000.

The UK additional tax rate is 45% on annual earnings over £150,001.

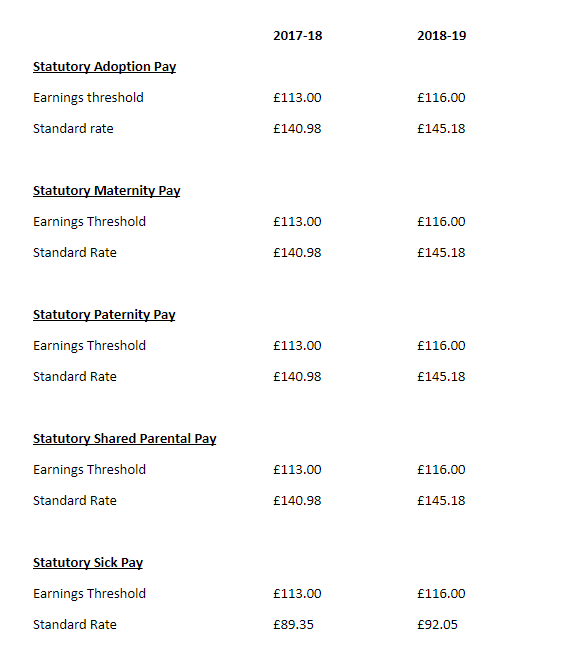

For the new tax year 2018-19, the Department for Work and Pensions have published the statutory payment rates for benefits and pensions.

Click here to see the full list published.

Please see some rates details below:

Jan 2018

5

The UK’s gender pay gap has risen. Here’s how you can help.

The Prime Minister has announced that she is taking action to close the pay gap between male and female employees and ultimately improve workplace equality.

This push being taken by the Prime Minister came after new figures were published. The figures showed that the UK’s overall gender pay gap has risen to 18.4%. Interestingly, the gap for full time workers has fallen from 9.4% in 2016 to 9.1% in 2017.

By law, businesses with 250 plus employees must report the pay gaps and bonus data as a mandatory requirement.

In a bid to seal the gender pay gap The Prime Minister is now asking all companies for their help.

“The gender pay gap isn’t going to close on its own – we all need to be taking sustained action to make sure we address this.”

Here are some of the recommended ways that all businesses can help:

- Ensure there are female representatives at senior level. This can be achieved by ensuring there are opportunities to progress for females within a company. This can also be achieved by introducing a return to work scheme for women.

- Publish gender pay gap information. This can prove helpful in closing the gender pay gap if all companies, even those with fewer than 250 employees, publish this information.

- Make flexible working a reality. This should be advertised with a new position from the start.

Related Articles: