Mar 2019

20

BrightPay 2019/20 is Now Available. What's New?

BrightPay 2019/20 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2019/20 Tax Year Updates

- 2019/20 rates, thresholds, triggers and calculations for PAYE tax, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Automatic Enrolment pensions, company cars, vans and fuel.

- The emergency tax code has changed from 1185L to 1250L. When importing from the previous tax year, L codes are uplifted by 65, M codes are uplifted by 71 and N codes by 59.

- Full support for the 2019/20 Welsh Rate of Income Tax (WRIT) codes, rates and thresholds, as well as continued support for those of the Scottish Rate of Income Tax (SRIT).

- Support for the new Postgraduate Loan deductions.

- Ability to process 2019/20 HMRC coding notices (including new PGL1 and PGL2 notices).

- April 2019 National Living Wage rates.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

Automatic Enrolment Updates

- From April 2019 onwards, the minimum required pension contribution level is 8%, at least 3% of which must be contributed by the employer. BrightPay 2019/20 now uses and validates against this increased level by default. Where pre-April 2019 minimum levels were being used in 2018/19, BrightPay 2019/20 will automatically uplift them on import.

- With the concept of 'staging' for automatic enrolment now very much in the past, BrightPay is instead focused on asking for and working with the Next Re-enrolment Date.

- Various improvements have been made to make the automatic re-enrolment process more clear:

- For opted-out or ceased employees (as well as employees who are flagged for re-enrolment) the previous opt out/cessation date is now clearly visible and can be edited if need be.

- If an employee is marked as opted out or ceased, but the opt-out/cessation date is not known, BrightPay now flags for automatic re-enrolment anyway (and allows the missing date to be entered).

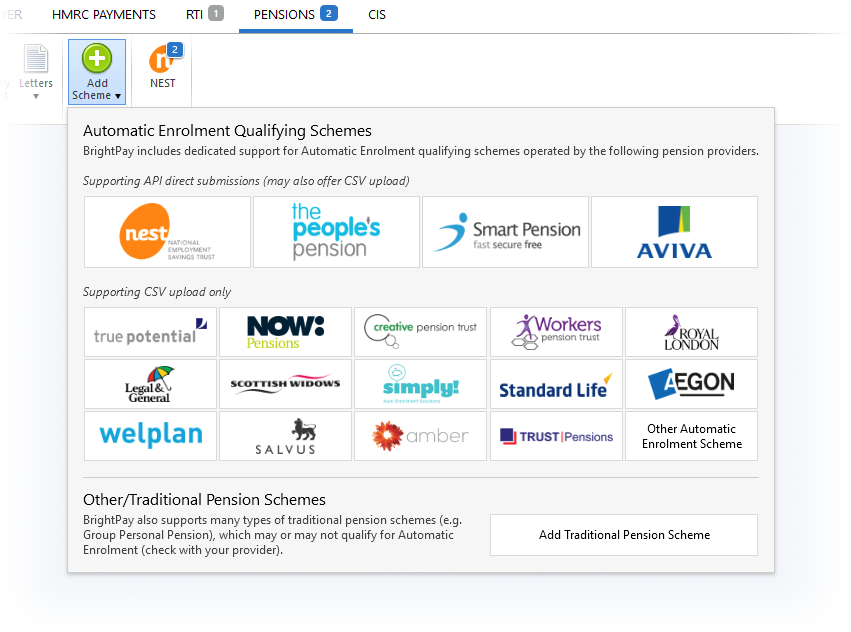

- Redesigned menu when adding a new pension scheme:

- The auto enrolment qualifying schemes are now categorised by API/CSV support, and ordered by popularity.

- The traditional pension scheme 'types' have been removed – when adding a traditional scheme you can now simply set the tax relief and AVC options directly instead of having to first choose the right type.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions.

Real Time Information

- As mentioned in the release notes for the most recent upgrade to BrightPay 2018/19, the EYU (Earlier Year Update) submission is no longer supported by HMRC and has now been removed from BrightPay altogether. To make corrections to 2018/19 or 2019/20 payroll data going forward, an Additional FPS is to be used.

- Ability to exclude an employee pay record from an FPS if it has zero amounts only.

- Ability to force include an employee's starter/leaver declaration on an FPS submission that covers a different period to the employee's starting/leaving period.

- Ability to unmark an unsent submission as contributing towards the Number of Unsent RTI Submissions count in BrightPay.

- New HMRC Receipt document which presents HMRC's response to an RTI submission in a clear, shareable format.

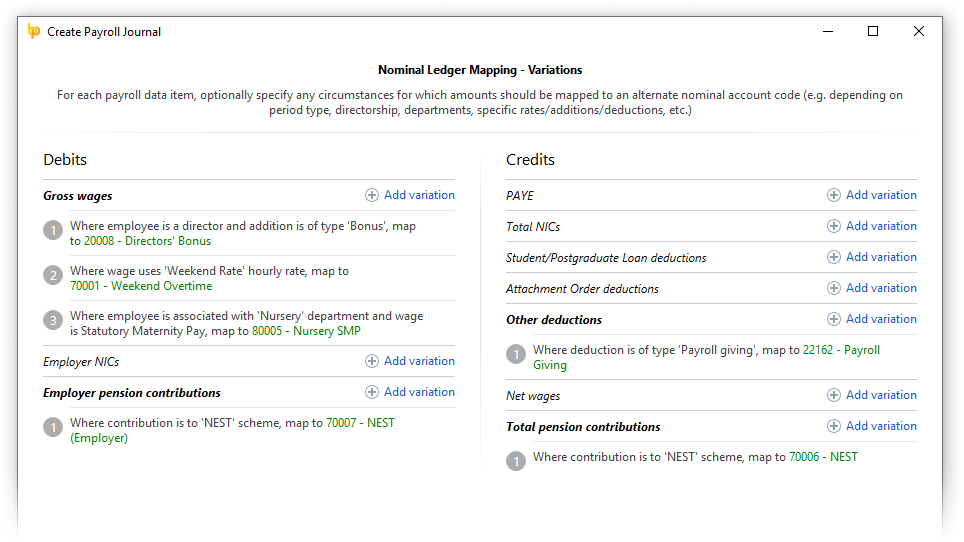

More Flexible Journals

A popular customer request has been to create a 'departmental' payroll journal in BrightPay. We've went one step further, allowing not only for a simple departmental mapping of nominal account codes, but for an advanced multi-option mapping as well.

For example, if you want to map commission paid to directors on a weekly basis in the sales department to a particular account code, you now can.

For Xero journals, BrightPay now supports including the department as the Xero tracking option, including where employees are split across multiple departments.

To make all this easier to manage, the Create Journal window in BrightPay now remembers it's size and position between usages.

Journal API Support

BrightPay now supports posting journals directly to Sage, Quickbooks and Xero via API (while continuing to offer the creation of a CSV journal as an option if need be).

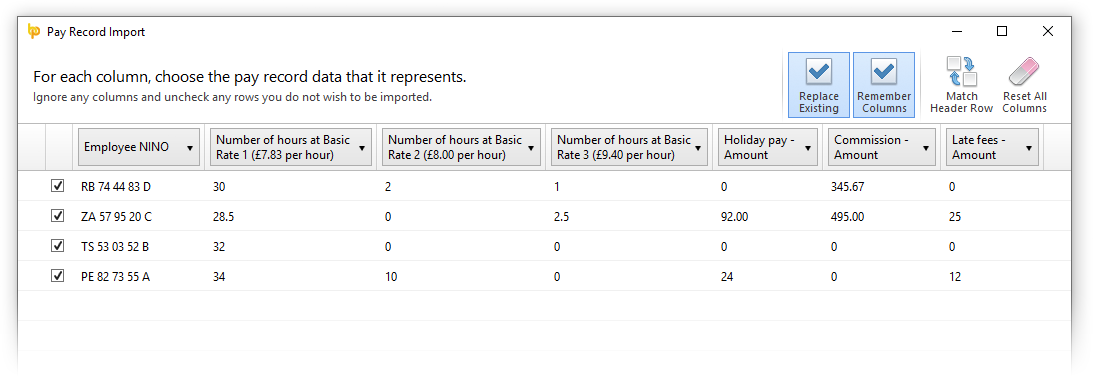

Importing Pay Records from CSV

We have significantly improved the power and flexibility of how pay records are imported from CSV, effectively allowing an entire pay run to be imported from a single CSV file if need be.

- Multiple pay items (of a single payment type, or mixed types) can now be imported from a single CSV line.

- Daily/hourly payments can more easily be imported under a named employer-wide daily/hourly rate

- Additions/deductions can more easily be imported under an employer-wide addition/deduction type

- The Import from CSV window has been redesigned to be more user-friendly and intuitive.

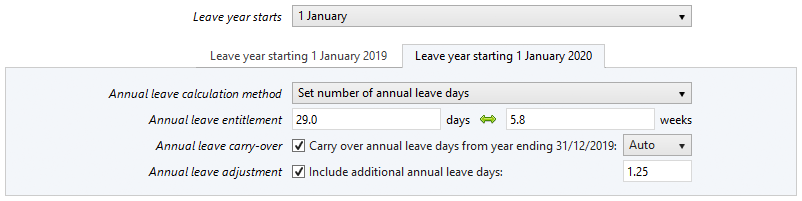

Improved Support for Offset Annual Leave Year

A popular customer request has been for BrightPay to better handle the definition, carry-over and adjustment of annual leave in the situation where the annual leave year is offset from the tax year.

In BrightPay 2019/20, you can now enter the annual leave settings for each overlapping year individually, giving you full control and helping you work out entitlements more accurately.

CIS Updates

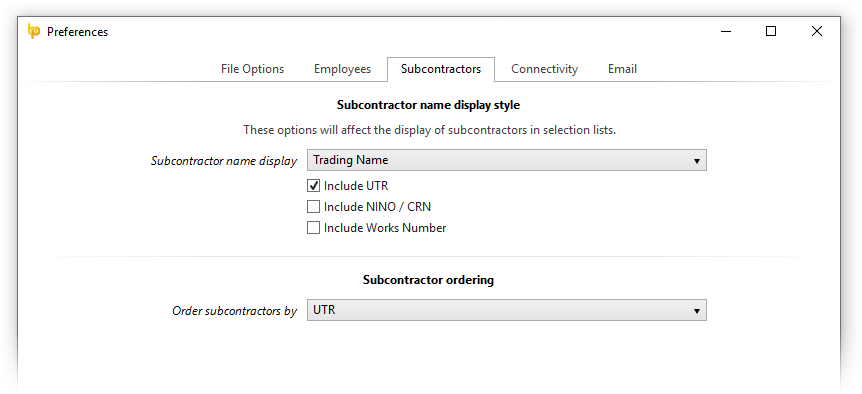

- You can now customise how subcontractors are displayed and ordered across the BrightPay interface.

- When selecting from a list of subcontractors, BrightPay now includes a new 'Select By' button that allows you easily and quickly select only the subcontractors that match specific criteria.

- New Payments menu in the subcontractor toolbar which includes various handy functions including the ability to batch print multiple P&D statements for a single subcontractor.

- New CIS Year End Statement document.

- Ability to unmark an unsent submission as contributing towards the Number of Unsent CIS Submissions count in BrightPay.

- New HMRC Receipt document which presents HMRC's response to a CIS submission in a clear, shareable format.

BrightPay Connect

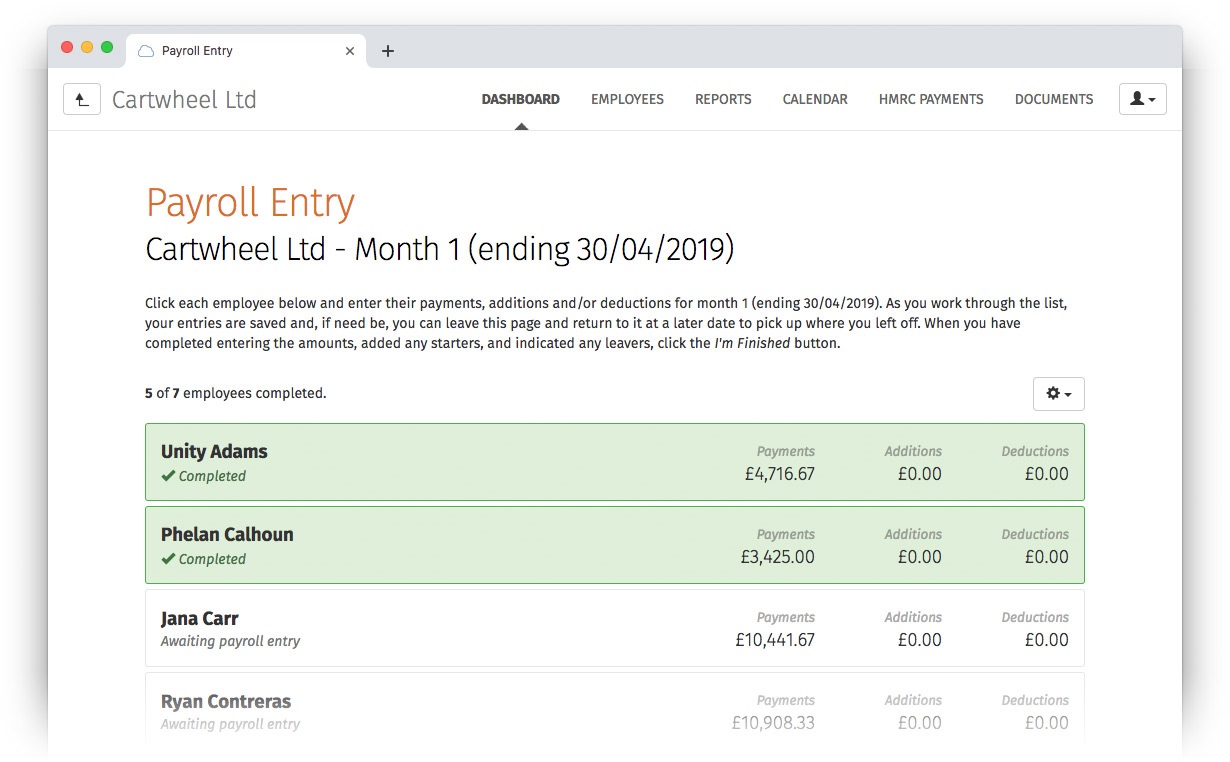

In late 2018 we introduced a powerful new feature for Bureau customers of BrightPay Connect: the ability to request client payroll entry and/or approval for a payroll run, which is then automatically facilitated though a secure, GDPR-compliant process within the BrightPay Connect dashboard.

Sign in to your BrightPay Connect account and click the Requests header link to find out more.

Other 2019/20 Updates in BrightPay

- When hovering over the 'number of submissions' for an employer on the BrightPay startup window, a popup displays what the number(s) represent.

- The full description of an hourly or daily payment is now shown on-screen for finalised pay periods.

- BrightPay will now prompt you to change an apprentice employee who is set to be on NI table H but is over 25 years old.

- On the employee calendar, the parenting leave info panel now shows the total number of KIT days taken for the selected period of leave.

- Corrects handling of Statutory Adoption Pay and Statutory Shared Parental Pay in weeks beyond the week that employee took their 10th KIT day (or 20th SPLIT day).

- When selecting which analysis columns to include in a report, they are now grouped by category.

- New analysis columns:

- Separate 'cash equivalent' columns for each of the benefit/expense types.

- Total attachment order deductions excluding admin charge.

- Primary department name.

- Adds a 'description' field for all kinds of benefits, and shows the entered description for each benefit on the payroll interface.

- Options to show separate benefit payments on employee payslip, rather than just a rolled up 'taxable benefits' figure.

- The Number of Actionable Coding Notices is now shown on the coding notices toolbar icon, and is available as a column on the BrightPay startup window.

- New A4 payslip template, designed to be used where there are too many items to fit on the A5 template.

- As part of our new licensing model, Bureau customers can now view/edit the list of employers for which they have access.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

Includes all updates made to BrightPay during the 2018/19 tax year

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2018/19, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2019/20. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Ability to send enrolment/contribution submissions directly to the People's Pension via API.

- Ability to quickly create an new/additional employment for a previous/existing employee.

- Coding notice checks can now use agent credentials if available.

- Many improvements to emailing documents directly from BrightPay:

- Ability to specify the default starting body content to use when emailing a document.

- Ability to quickly turn on/off the stored email signature.

- When emailing a document, there is a new menu to quickly select and re-use recently used body content.

- Email body content now accepts 'Markdown' formatting.

- Ability to edit the list of saved third-party email recipients

- New startup window column for Next Estimated Pay Date.

- Two new tick boxes in BrightPay Preferences to indicate where Next Estimated Pay Date is in the past (which shows a red background colour for applicable employers on the startup window) or indicate where Next Estimated Pay Date is within X days (where X is customisable – shows a yellow background colour for applicable employers on the start screen).

- Ability to batch finalise the payroll for multiple employers.

- Ability to select employers by label colour when preparing a batch operation.

- Ability to persist a “Net to Gross” setting going forward (i.e. rolling net pay).

- Ability to create a bank file for paying HMRC.

- Allows a deduction to be calculated as a percentage of Auto Enrolment qualifying earnings.

- Enables subcontractors with zero amounts in a pay period to be excluded from a CIS300 submission.

- When in Payroll, the name of the active employee (i.e. the part of large text title) can now be clicked to navigate directly into the Employee > Edit Details screen for that employee.

- Employment Allowance report

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.