Sep 2019

26

Good Work Plan

The Government’s Good Work Plan sets out their vision for the future of the UK labour market.

Whilst some of the initiatives are still at the planning and consultation stage, others have been giving legal effect.

On 6th April 2020 three new pieces of employment legislation will come into force.

- The Employment Rights (Employment Particulars and Paid Annual Leave) (Amendment) Regulations 2018

- The draft Employment Rights (Miscellaneous Amendments) Regulations 2019

- The draft Agency Workers (Amendment) Regulations 2018

Under the new legislation the following changes will be introduced:

- It will become a day one right to receive a written statement of terms and conditions (or contract of employment). The information to be included in the written statement has also been extended. This right will now include workers as well as employees.

- The holiday pay reference period will increase from 12 weeks to 52 weeks. This reform is intended to improve the holiday pay for seasonal workers, who tend to lose out over the way it is currently calculated.

- The Employment Rights (Miscellaneous Amendments) Regulations 2019 will increase the maximum fine an Employment Tribunal can impose on an employer from £5,000 to £20,000 where there has been an aggravated breach of workers’ rights.

- A loophole which allowed agency workers to be paid at a cheaper rate than permanent employees performing the same role will now be closed.

Sep 2019

26

Are employees receiving the National Minimum Wage?

According to Office for National Statistics figures, wage growth has risen to 3.6% in the year to May 2019, outpacing inflation since March 2018. While unfortunately we don’t have a crystal ball to predict how long this will last, we know something for certain: the National Minimum Wage (NMW) and National Living Wage (NLW) will continue to change every year.

Tracking employee hourly rates depending on their circumstances might seem complicated, but it doesn’t have to be. Here at BrightPay, we are constantly working to provide you with a platform that makes payroll and amendments easy. In this short guide, we have summarised all the key information and steps to make changes to the NMW and NLW on BrightPay.

Hourly rates

The hourly rate for the minimum wage depends on an employee's age and whether they are an apprentice:

- The apprentice rate is applicable to apprentices aged under 19 and those aged 19 or over when they are in the first year of their apprenticeship

- Employees under 24 years old are entitled to the National Minimum Wage

- Employees aged 25 or over are entitled to the National Living Wage

The rates for the National Living Wage and the National Minimum Wage change every April and are currently:

| Category of worker | Hourly rate |

| Aged 25 and over (National Living Wage rate) | £8.21 |

| Aged 21 to 24 inclusive | £7.70 |

| Aged 18 to 20 inclusive | £6.15 |

| Aged under 18 (but above compulsory school leaving age) | £4.35 |

| Apprentices aged under 19 | £3.90 |

| Apprentices aged 19 and over, but in the first year of their apprenticeship | £3.90 |

BrightPay can track all employee hourly rates depending on their circumstances. That is including all the cases above, as well as the London Living Wage, and they can also be marked as not eligible.

Checking if an employee is receiving the NMW

You can use BrightPay to determine if an employee is receiving the National Minimum Wage, which is automatically calculated for hourly paid employees.

Once the number of hours worked for a pay period is entered, the payroll software will use the rest of data available about the employee, such as their age, hours worked in period and minimum wage profile to calculate how the hourly rate used compares to the minimum hourly rate, and alert the user if it falls below the relevant minimum wage.

Non-hourly employees

The process is simple for most employees, but you might be wondering about non-hourly employees. The good news is that on BrightPay you will also find a Minimum Wage Report feature that allows you to enter/confirm the number of hours worked for each employee and generate a report that confirms who is above or below the minimum wage. Easy, isn’t it?

If an employee's wage is below the National Minimum/Living Wage, BrightPay will flag it with a yellow status bar within 'Payroll' – or you can choose to hide this notification if you prefer.

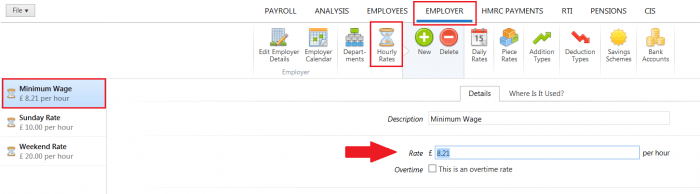

Amending a global hourly rate

When the Minimum Wage changes, you can amend the global hourly rates automatically. Hourly rates can also be set up at the employer level in BrightPay from the 'Employer' tab, selecting 'Hourly Rates'. Once the hourly rate has been determined, the changes will automatically be applied to all employees assigned to that hourly rate.

Sep 2019

17

Payroll Software in a hyper-connected internet era

All of us, in the hyper-connected internet era, have found ourselves at a loss when using some software, website or app. You just want to do one thing, or you want to set something up and... you just can’t.

It might feel like specific software or apps are testing us in some way. Only those who can navigate through the narrow tunnels of this software are genuinely worthy, in some weird twist on the Arthurian legend of Excalibur.

But all of this struggle defeats the entire purpose of working digitally and efficiently, particularly for already busy professionals like accountants. All payroll software should be straightforward to use and set up. This is true for BrightPay’s payroll software, and even easier again is BrightPay Connect - the payroll add-on offering cloud integration and an online portal.

BrightPay Connect requires no downloads or manual data input. Everything is automatically available for your clients, where your clients can just login to their own password-protected portal anytime, anywhere. The online portal gives clients access to all employee payslips, employee leave and payroll reports that you would have previously emailed to clients each pay period.

And there are levels to this, too. Senior employees or managers can be given different levels of administration to approve leave, change employee details, view employee payslips, and access payroll reports.

We understand that you don’t offer one-size-fits-all service to your clients, and your payroll software functionality needs to match that. BrightPay is flexible, and your involvement in the payroll process can be ramped up or scaled back as required.

BrightPay’s employer self-service portal has built-in features giving your clients a ready-to-go and easy-to-use HR solution. HR documents can be uploaded including employee handbooks and contracts, disciplinary documents, company newsletters, training material and more.

Clients can also manage all leave for their employees. These features will automate and streamline many of the day-to-day HR functions that your clients deal with. The benefits of the payroll service you offer cascades down throughout the business.

BrightPay Connect gives accountants the ability to send requests to their clients where the clients can now enter payments, additions and deductions for their employees and can also add new starters through their online employer dashboard.

From there, BrightPay Connect goes one step further with the approval feature, allowing you to securely send clients a payroll summary for them to approve before the payroll is finalised. Ultimately, your client will be accountable for ensuring that the payroll information is 100% correct before the payroll is finalised.

Very quickly, your payroll bureau becomes an indispensable part of the business’s administration. By embracing cloud innovation, accountants can really streamline and automate much of the payroll process. And with BrightPay’s easy-to-use, automated software, it’s a low touch, easy-to-manage process. What more can you ask for?

Book a BrightPay Connect demo today to see just how much time cloud automation and integration can save you.

Sep 2019

5

Changes to Student Loans from 6th April 2020

New rates for the tax year 2020/21 for Student Loan Plans 1 and 2 have been announced by the Department of Education. The Student Loan Plan 1 rate will rise to £19,390 on 6th April 2020 from £18,935. The current Plan 2 rate of £25,725 will also rise to £26,575. Earnings above the thresholds for both Plan 1 and Plan 2 for 2020/21 will be calculated as normal at 9%.

The rate of the postgraduate loan type introduced in the 2019/20 tax year of £21,000 will remain the same in 2020/21 and will continue to be calculated at 6%.

Summary of the Student Plan thresholds:

- Plan 1 loans will increase by £455 from the current threshold of £18,935 to £19,390 in 2020/21.

- Plan 2 loans will increase by £850 from the current threshold of £25,725 to £26,575 in 2020/21.

This figure will apply to all current and future borrowers for whom employers make Student

Loan deductions. In BrightPay Payroll Software 2020/21, the new student loan repayment thresholds for both plans will automatically be calculated and the appropriate student loan deduction applied.