Jan 2020

30

Customer Update: January 2020

Welcome to BrightPay's January update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

Easily integrate BrightPay with your accounting software

-

BrightPay Connect monthly subscription pricing - How will it work?

-

What the Tory victory means for IR35 and off-payroll working

Free Webinar: Last chance to register!

Payroll transformed: How cloud platforms supercharge the payroll process for employers

Join BrightPay for a free webinar where we look at cloud innovation and how it is positively impacting the payroll process for employers. Not in the distant or even medium-term future: this is happening right now. Register now to see how next-generation cloud features can revolutionise your business.

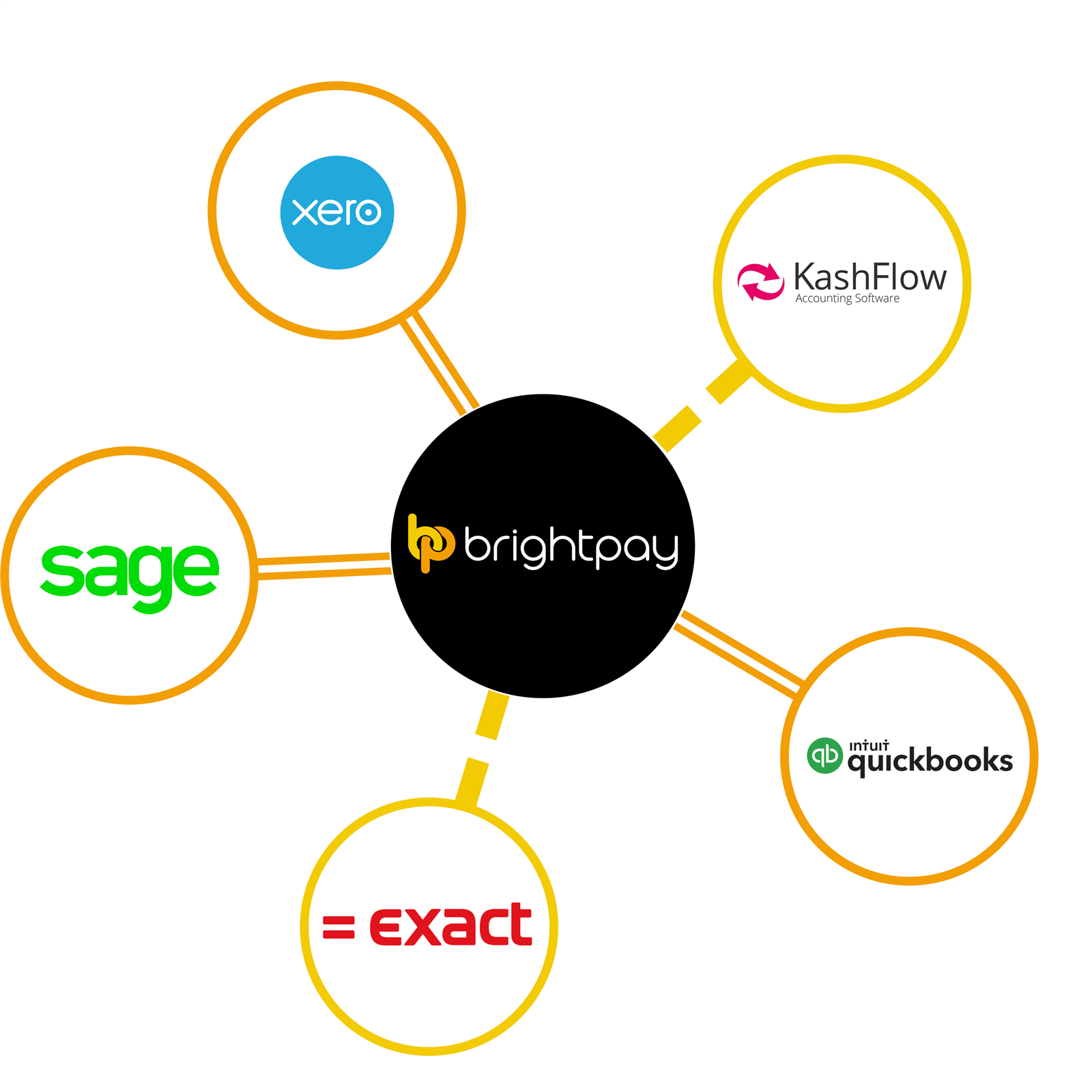

Easily integrate BrightPay with your accounting software

BrightPay’s payroll journal feature allows users to create wage journals from finalised pay periods so that they can be added into various accounting packages. With this direct integration, users will be able to send the payroll journal to the accounting package directly from within BrightPay. BrightPay includes direct API integration with Sage One, Quickbooks Online and Xero, and coming soon is integration with FreeAgent, AccountsIQ, Kashflow and Twinfield.

Employer obligations: Simple ways to comply using BrightPay Connect

There's been a lot of talk recently about online client platforms. They can bring many benefits to both employers and employees alike - from online payslip access to annual leave management to a HR document hub. But can cloud payroll portals really help with employer obligations? Here we look at how BrightPay Connect can help with record keeping requirements, employment law obligations and GDPR compliance.

Annual Leave Management: Say Goodbye to Paper Trails and Excel Spreadsheets

Minimum Wage Rates Increase from 1st April 2020

It has been announced that on the 1st April 2020 the minimum wage will increase by amounts ranging from 4.6% to 6.5%. An employee's age and if they are an apprentice will determine the rate they will receive. BrightPay can track employee hourly rates against the National Minimum/Living Wage (including apprentices), UK Living Wage, London Living Wage, or they can be marked as not eligible.