Mar 2020

19

BrightPay 2020/21 is Now Available. What's New?

BrightPay 2020/21 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2020/21 Tax Year Updates

- There are no changes to tax bands, rates or the emergency tax code in 2020/21. BrightPay continues full support for Welsh Rate of Income Tax (WRIT) and Scottish Rate of Income Tax (SRIT).

- 2020/21 employee and employer National Insurance contribution rates, thresholds and calculations.

- 2020/21 Student Loan and Postgraduate Loan thresholds.

- 2020/21 rate of Statutory Sick Pay, including support for COVID-19 related periods of sick leave (in which SSP is paid from day one).

- 2020/21 rates for Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, and Statutory Shared Parental Pay.

- Support for new Parental Bereavement Leave and Statutory Parental Bereavement Pay.

- 2020/21 rates for company cars, vans and fuel. BrightPay now allows input of 'zero emission miles' for cars with a C02 rating of less than or equal to 50g/km (which is now used in the calculation of cash equivalent).

- Support for real-time PAYE tax and Employer Class 1A NICs due on year-to-date termination awards over the £30K annual threshold and on year-to-date sporting testimonial payments over the £100K annual threshold.

- Ability to process 2020/21 HMRC coding notices.

- April 2020 National Living Wage rates.

- Eligible employers can continue to claim Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC. For 2020/21, the maximum Employment Allowance claim has been increased to £4,000.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications, including the new De Minimis State Aid declaration on the EPS. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

- Support for off-payroll workers subject to April 2020 rules. Off-payroll working rules have been postponed until April 2021.

Automatic Enrolment Updates

- 2020/21 qualifying earnings thresholds.

- For 2020/21, the minimum required pension contribution level continues to be 8%, at least 3% of which must be contributed by the employer.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions to ensure continued compatibility with all pension scheme providers.

- Additional one-off contributions can now be optionally persisted to following pay periods.

- Makes it more clear on the Automatic Enrolment journey report when an assessment is part of automatic re-enrolment.

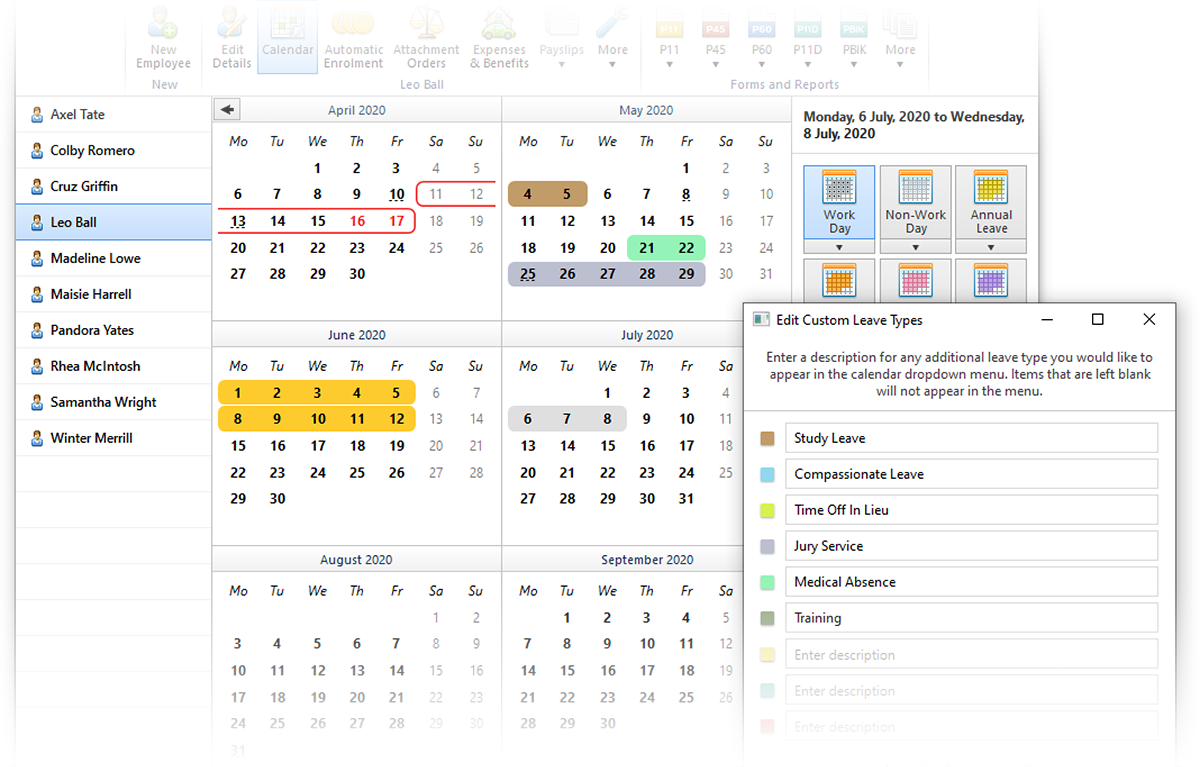

Define and Set Custom Leave Types on Employee Calendar

- You can now define up to nine additional custom types of employee leave. Six of the custom types are set up with default descriptions, which you can edit, add to, or remove as need be.

- Custom leave types act like the existing built-in kinds of leave, in that they are mutually exclusive and can only be applied to working days. They can be set on a per-employee basis, or batch set for multiple employees at once.

- Custom leave types also appear on the employer calendar. Mouse-hover tooltips have been added to the various views of the employer calendar to help determine what each colour indicates where it's not clear.

- A new Calendar Report (which replaces the previous Print Calendar functionality) gives you the power and flexibility to create and/or share a customised report of employee leave that can be filtered by type of leave, and presented individually for each employee, or as a summary containing multiple employees.

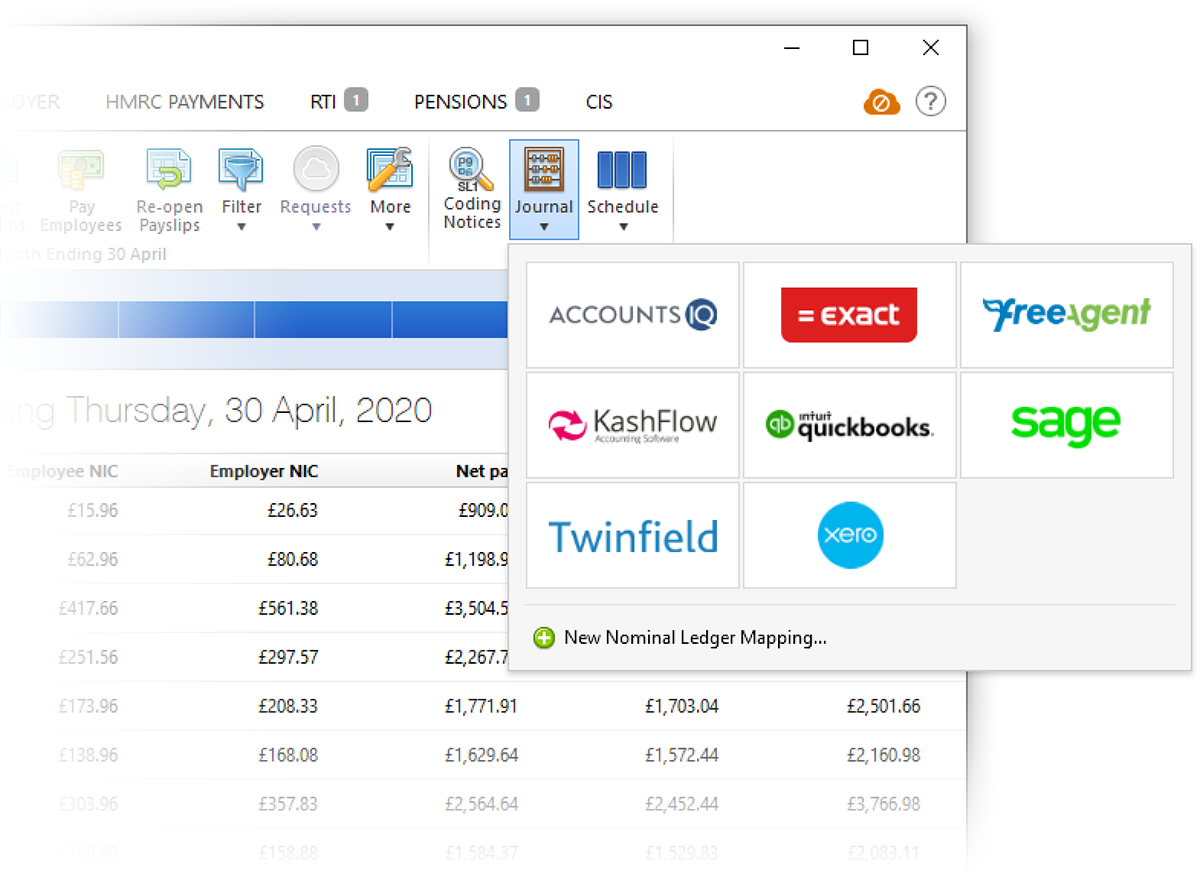

More Journal API Support

Along with the API support added for Sage, Quickbooks and Xero in 2019/20, BrightPay 2020/21 now supports posting journals directly via API to FreeAgent, Kashflow, Twinfield and AccountsIQ. The option to create a CSV journal is also still available where supported.

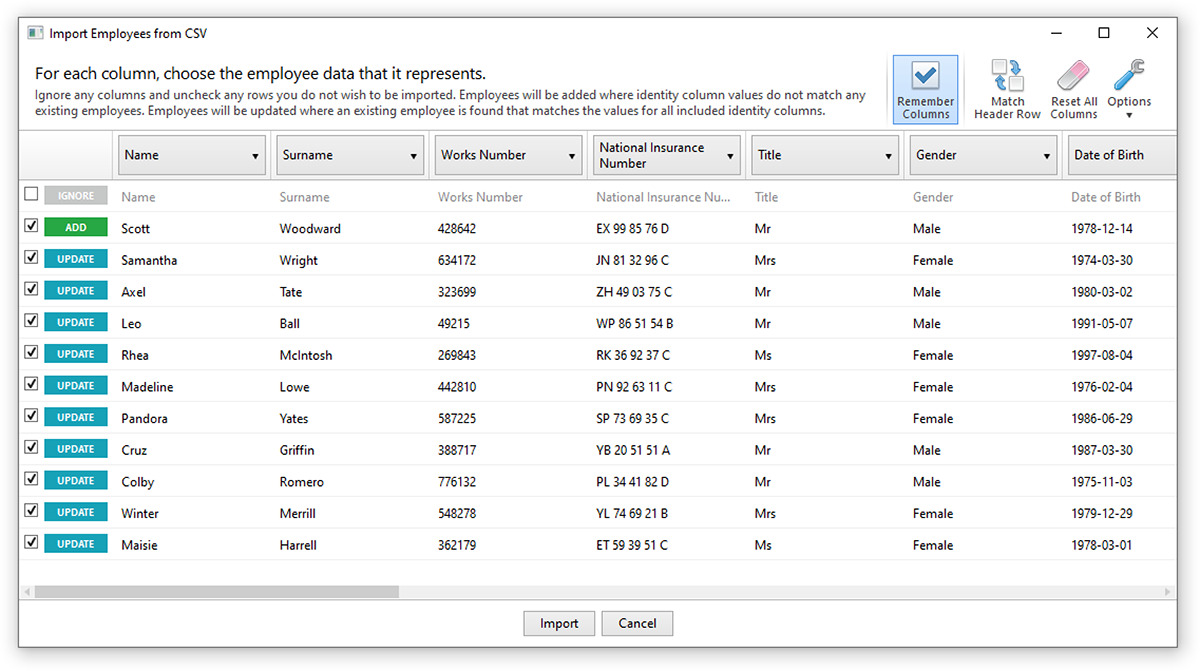

Update Employees from CSV File

BrightPay has traditionally only allowed new employees to be added from a CSV file. Now, you can both add new employees and update existing employees from a CSV file. (The same has been done for subcontractors).

BrightPay Connect

- The Connect tab on the start-up window now directly shows your sign-in status.

- The list of employers (in the Open/Create Employer tab of start-up window) now shows cloud icons for employers that are linked to the signed-in BrightPay account.

- Ability to download and import a 2019/20 Connect backup into BrightPay 2020/21 (only applies for employers which have not yet been linked and synchronised for 2020/21).

- When an employer is opened in BrightPay 2020/21 that is not linked to Connect, but it is known that the 2019/20 version of that file was linked to Connect, BrightPay will now automatically prompt you to link the 2020/21 file to Connect.

Other 2020/21 Updates in BrightPay

- Annual leave entitlement calculations now include 'upcoming booked annual leave days', which can optionally be included on reports and payslips.

- When zero-ising payslips (or subcontractor payments), new options to set amount to zero, or remove items altogether.

- Ability to create an SSP1 document in BrightPay.

- When importing payments from CSV, any lines which failed to import (e.g. due to not matching an employee pay record, or due to the matching pay record being already finalised) are now clearly indicated in the response dialog (instead of the previously unhelpful 'X of Y succeeded' message).

- Public holidays on employee calendar are now shown with a dotted text underline (rather than appearing as if they were non-working days by default).

- In analysis, if the column ordering settings of a report is manually changed from the 'default' settings (which are derived from employee UI display preferences), and then that report is saved, the custom ordering is now maintained, and this report will no longer receive 'default' column ordering settings when it is re-opened.

- Ability to import saved reports from another BrightPay data file into the currently open file.

- Allows one of the added emergency contacts for an employee to be set as the 'primary' contact. New analysis columns (and a new report) for emergency contact details have been added.

- New 'notes' input for parenting leave and attachment orders.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

Includes all updates made to BrightPay during the 2019/20 tax year

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2019/20, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2020/21. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Supports the latest UK and London Living Wage rates, announced in November 2019.

- New flexibility and control over when an employee's P60 and P11D are to be made available in Self Service in Connect.

- Ability to batch print, email and export P45 for multiple employees.

- Ability to print, export or email currently open payslips (i.e. those which have not yet been finalised). Such payslips are decorated with a 'DRAFT' watermark.

- Bureau features

- New 'Bureau Statistics Report' which shows various totals for each employer for informational or billing purposes. Accessed via the BrightPay startup window employer menu, it can be viewed/printed or exported to CSV.

- Ability to batch check for coding notices for multiple employers.

- Ability to sort employers by label colour on the BrightPay startup window.

- Improved interface and workflow for viewing/entering the 'average weekly earnings' for statutory parenting pay, including new warnings where BrightPay detects that there are more or fewer historic payment records than expected.

- Several new payroll period summary column options for amounts "in previous period" (allowing you to compare current and previous period amounts on the period summary view). Also new column options for tax code, NI number, department, payment method and directorship.

- Improves rounding of calculated weighted departmental amounts (which prevents penny differences both in analysis and when posting a departmental journal).

- Ability to ignore BrightPay's "Auto enrolment scheme contributions are below minimum level" warning for any given membership (e.g. where employee has opted down).

- Coding notices – where an employee is unable to be matched, the NINO or works number that HMRC have on file is now clearly shown to help determine why.

- 'Contracted hours per week' and 'Is payment to a non-individual' fields are now available as column options in Analysis.

- When using the ’Select By’ button in lists of employees, the ’Name Initial’ and ’Surname Initial’ options now show grouped selection choices (e.g. A–F, G–L, etc., depending on total number of selectable employees).

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.