Apr 2020

30

BrightPay release CJRS claim report

A CJRS Claim Report was released on the 23rd April in BrightPay to assist users in ascertaining the amounts needed for input into HMRC's Coronavirus Job Retention Scheme online service.

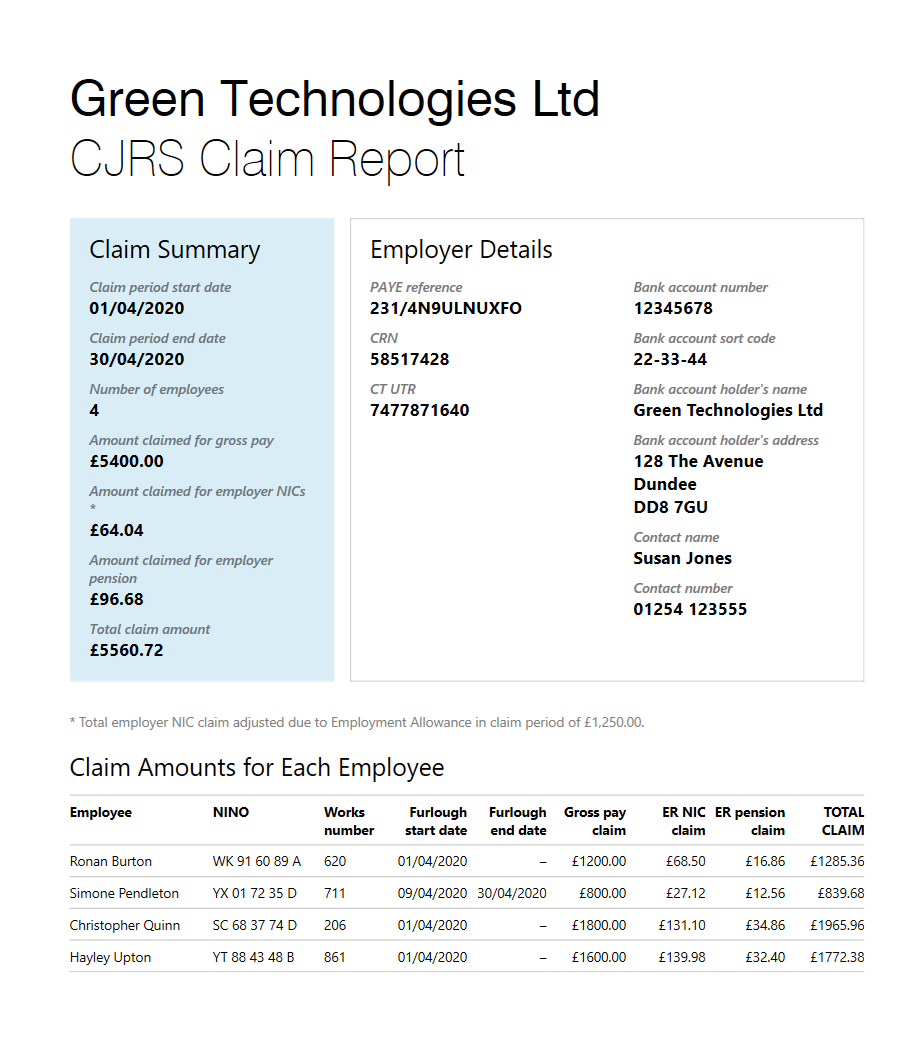

BrightPay’s CJRS Claim Report includes claim amounts for each employee detailing furlough start date, furlough end date (if known), gross pay claim, employer NIC claim, employer pension claim and the total claim amount.

Employers will need to make a claim for wage costs through an online portal on GOV.UK, which was launched on 20th April. The only way to make a claim is online. HMRC has worked to make the portal simple to use and any support you need is available on GOV.UK. Businesses will need their Government Gateway user ID and password to login to the online portal.

Video Tutorial: See how BrightPay's CJRS Claim Report works

How to make a claim

You’ll need to provide the following to make a claim:

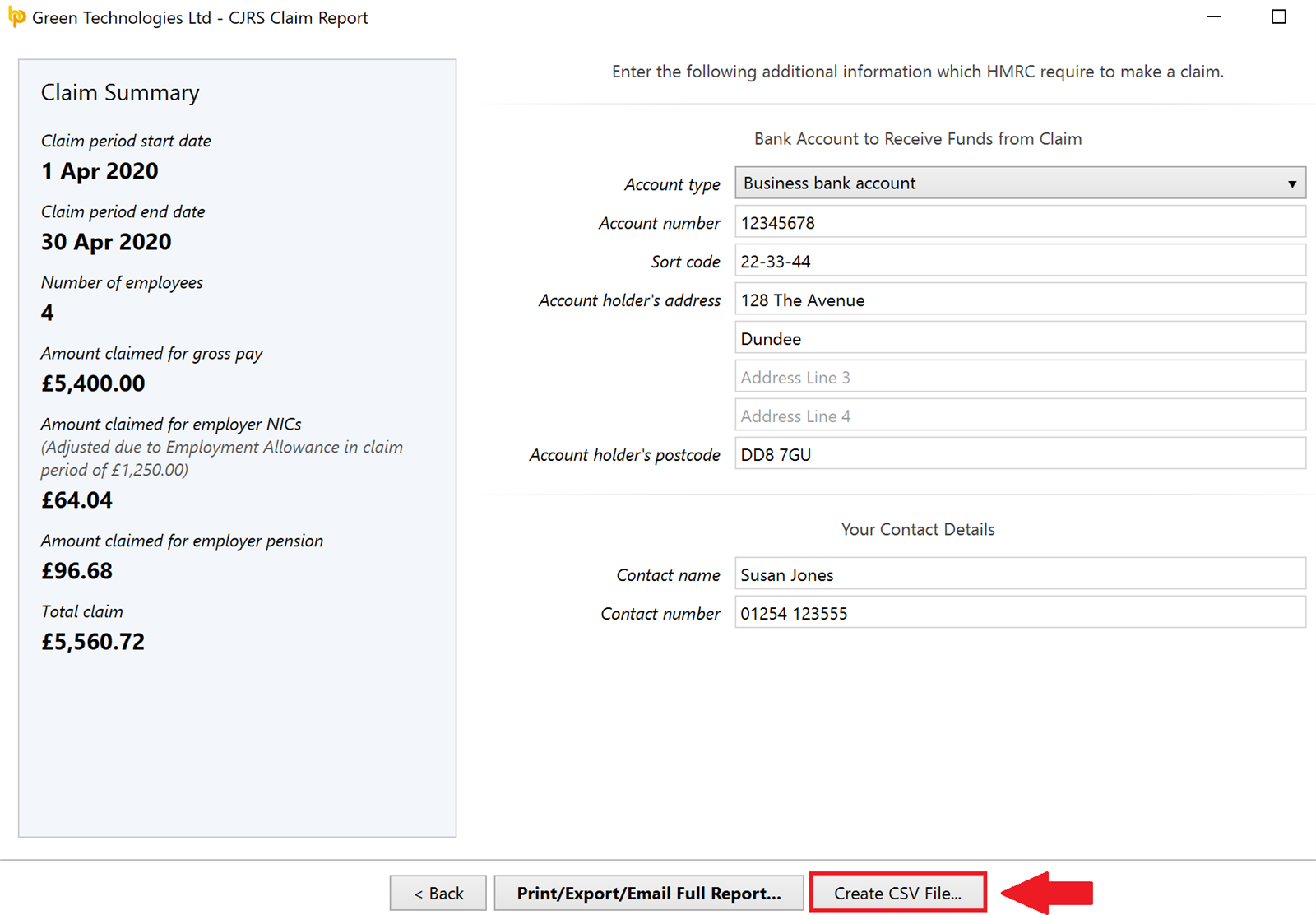

- The bank account number and sort code you’d like HMRC to use when they pay the claim.

- The name and phone number of the person in your business for HMRC to call with any questions.

- Your Self-Assessment UTR (Unique Tax Reference), Company UTR or CRN (Company Registration Number), where applicable.

- The name, employee number and National Insurance number for each of your furloughed employees.

- The total amount being claimed for all employees and the total furlough period.

If you have fewer than 100 furloughed staff, you will need to input your information directly into the system for each employee.

If you are an employer with more than 100 employees, you will need to upload a file with additional information for each employee, including the claim amount per furloughed employee and the furlough start and end date (if known) for each furloughed employee. If you have more than 100 employees, BrightPay gives users the option to create a CSV file, ready to be uploaded into HMRC's online service containing the details of your claim.

Free COVID-19 & Payroll Webinar

What You Need To Know about HMRC’s Claim Portal, COVID-19 Related SSP & Furlough Leave

All businesses, regardless of size, will be affected by the government measures for the foreseeable future. As the COVID-19 virus spreads across the UK, the government has introduced measures for employers to continue to pay their employees and to support businesses.

This webinar covers:

- Claiming for wages through the Coronavirus Job Retention Scheme

- How BrightPay’s CJRS Claim Report works

- Catering for COVID-19 Related Statutory Sick Pay (SSP)

- How furlough leave applies to your employees