Nov 2021

29

5 payroll resolutions for January 2022

New year’s resolutions can divide people into two camps. Those who love to start the new year with a clean slate and fresh goals, and those who’ve lost all optimism and scoff at their naivety. Understandably, there are cynics. Changing your behaviour is hard and more often than not, these resolutions fail. The resolutions most likely to fail are those that are too vague with no clear path on how to achieve them.

If you’re setting resolutions for your business or job this year, then break them up into manageable and uncomplicated steps. You’ve likely heard of SMART goals – specific, measurable, achievable, realistic, and time limited. If you’re looking to improve your business, for example, the payroll service you offer, then using this established tool is how you can go about it. Rather than simply saying “I want to make my payroll services better for clients” or “I want to reduce the time I spend on payroll”, decide on specific goals which will help you achieve this.

Achieving payroll goals for 2022

1. Provide an employee app for your clients

This one is a specific, easily achievable goal that can help you provide a better payroll service to your clients. Employee apps have risen in use in recent years and are popular among employers and employees alike. BrightPay Connect, the cloud add-on to BrightPay Payroll Software, includes one and your clients will immediately gain extra value from it. Their employees can book their annual leave through the employee app, view confidential documents, and use it to view their payslips. From a marketing perspective, an employee app can also have multiple benefits. The extra value if offers can encourage customer loyalty, and its frequent use by clients and their employees can increase awareness of your business.

2. Offer clients instant access to reports

Similar to the goal above, this is a simple and achievable step that you can take to improve your payroll services. By using BrightPay Connect, you can offer your clients access to payroll reports whenever they like. This can be more convenient for your clients and can reduce the amount of back-and-forth communication between you and the client.

Once you finalise payroll on BrightPay Payroll Software, the report will automatically become available for the client to view via their BrightPay Connect self-service portal. Your clients will also be able to use the portal to access a number of preprogramed reports, as well as any other payroll reports which have been set up and saved on the payroll application.

3. Spend less time on manual entry

By setting this goal you can reduce the overall time you spend on delivering your payroll services. How can you go about this? First, decide where you want to reduce manual entry. For example, your payroll journal is a good place to start. By using a payroll software which is integrated with the accounting software you use, you can send your payroll journal directly to it. This means you no longer need to spend time on double entry and manually copying figures from your payroll software into your general ledger.

4. Process payroll for multiple clients at once

This goal goes back to your aim of spending less time on payroll. Not all payroll software has batch processing, but one that does is BrightPay. This feature allows you to complete a number of tasks for multiple clients at once. You can batch finalise open pay periods, batch send outstanding RTI and CIS submissions to HRMC, and batch check for coding notices. This can end up saving you a huge amount of time, especially if you have a lot of single director clients whose payroll doesn’t change from month to month.

5. Review your GDPR compliance

It’s always advisable to review your compliance with GDPR and ensure you’re keeping your client’s payroll data secure. By keeping on top of this, you can assure clients that security is a priority for your practice. Make sure the data you collect is the minimum amount required and remember to provide your clients and their employees access to their personal information. Again, an employee app can help with this. Using BrightPay Connect, employees can view and update their personal information, whenever they like.

Discover more:

Now that you’ve decided on what steps you can take to improve your payroll services, make sure you have the right payroll software and employee app to support you. Book a demo today to discover more about BrightPay and BrightPay Connect. BrightPay also offers a 60-day free trial of its payroll software, an ideal way to test out the software to see if it’s the right fit for your business. The free trial version has full functionality with no limitations on any of the features.

Related Articles:

Nov 2021

26

The must-have integration for Xero customers

Customers of Xero accounting software now have the option of integrating their accounting package with their payroll software. With BrightPay payroll software, Xero customers can make use of an API (Application Programme Interface) to send their payroll journal directly from BrightPay to their general ledger in Xero. This straight-forward integration saves time, increases efficiency and make the payroll workflow that much smoother. A free trial of BrightPay is available to Xero customers through Xero’s marketplace.

The importance of integrating your accounting software:

As your business grows, so too do the number of financial tools you need to successfully manage your employees, operations, and customers. The amount of software you need, can at times, be overwhelming, confusing, and inadvertently result in time being wasted.

API integrations have become increasingly popular because, aside from their obvious benefit of saving you time, they also mitigate the risk of mistakes, reduce administrative tasks, and free you up, allowing you to focus on other responsibilities.

Save time:

With your payroll system communicating directly with your accounting software, you no longer need to spend time on the tedious task of manually exporting, importing, and entering figures multiple times. Instead, you can send payroll information to the correct account with just a click of a button.

Reduce data entry and errors:

Double entry of figures is well known for producing errors. By using the API, you will be able to send payroll information quickly and reliably, without the chance of human error. Nor will you have to spend time searching for errors and correcting them.

Improve efficiency:

With the API integration, you can benefit from a quicker and smoother workflow. Once the initial set-up is complete, you can begin sending your payroll information to the relevant ledgers. Where there are circumstances for which payroll figures should be mapped to an alternative nominal account, you can set these up as exceptions.

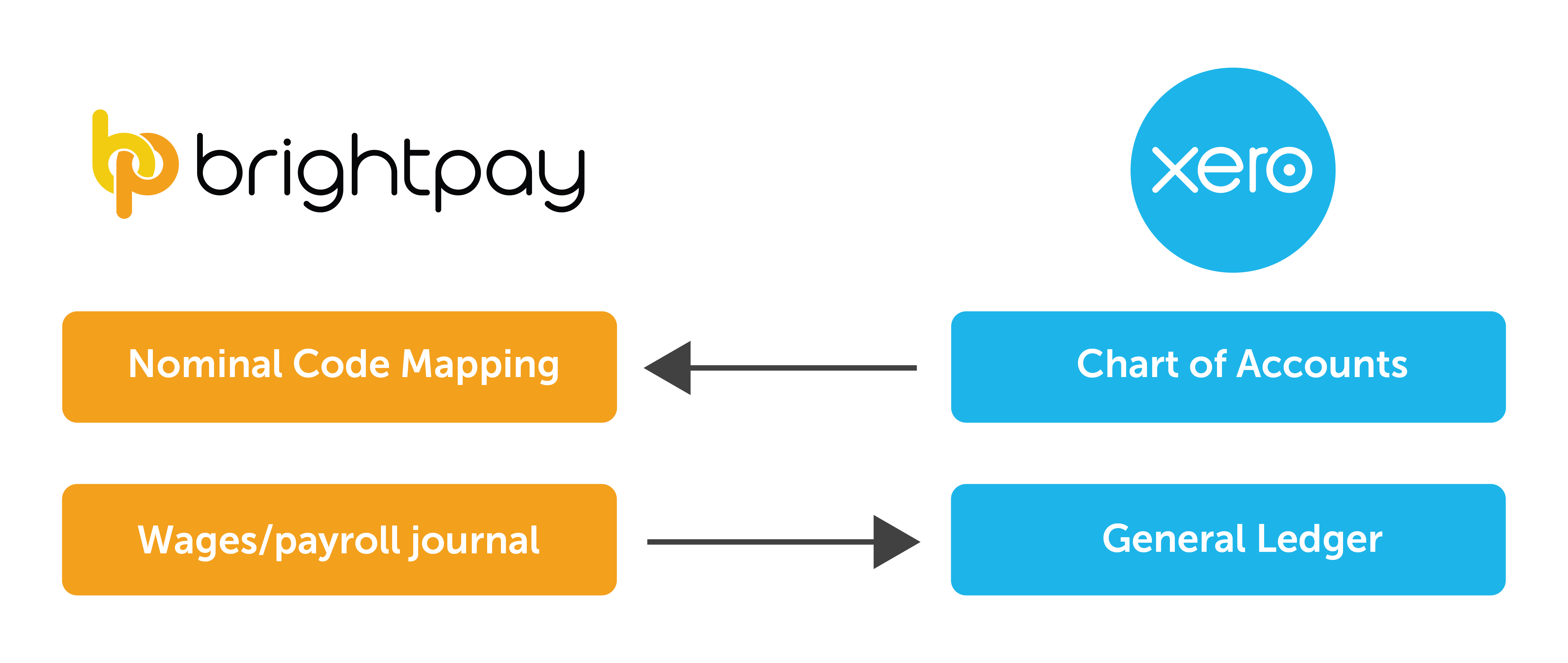

How does the BrightPay and Xero integration work?

An Application Programming Interface is a software intermediary that allows two applications to talk to each other. It helps to make communication between the two applications faster.

- When you sign into your Xero account in BrightPay, your nominal ledger accounts will be retrieved from Xero.

- Then, you map each payroll data item to the relevant nominal accounts.

- The payroll journal can include records for payslips across multiple pay frequencies and a nominal account can be used for multiple items.

- Learn more about how the integration works here.

What other integrations does BrightPay offer?

Along with Xero, BrightPay includes payroll journal API integration with several other accounting packages, such as Sage, QuickBooks Online, FreeAgent, and AccountsIQ. This is not the only integration BrightPay offers. The payroll software also includes integrations with various pension providers which helps make submitting pension files and carrying out auto-enrolment easier and quicker. Users of the software have direct API integration with NEST, The People’s Pension, Smart Pension, and Aviva.

Learn more:

If you’re interested in learning how BrightPay can improve your payroll services and save you time, schedule a 15-minute demo with a member of our team today. Or, to try the software for yourself, download your free 60 day trial today.

Related Articles:

Nov 2021

16

What to include on a payslip and how they should be shared with employees

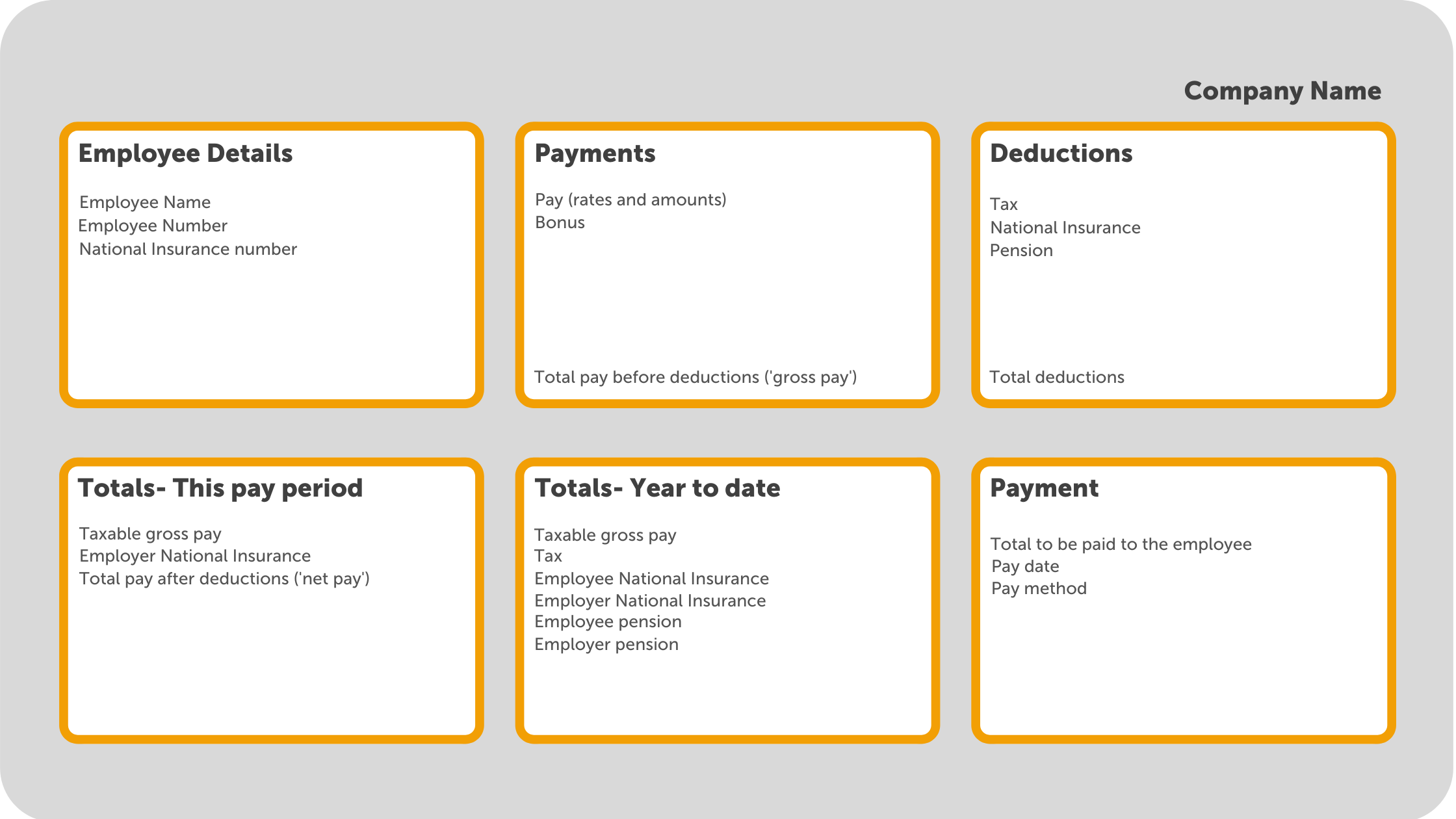

By law, employers must provide all employees with a payslip for each pay period. As well as giving employees a rundown of their earnings and any deductions there might be to their pay, payslips may be required as proof of income when applying for a mortgage or other loans. Payslips should be provided to employees either before or on the day they receive payment and are usually generated within the payroll software. According to ACAS, payslips must include:

- Total pay before deductions

- Total pay after deductions

- Amounts of any variable or fixed deductions

- A breakdown of how the wages will be paid if more than one payment method is used

Below is an example of information you may find on a payslip:

How should payslips be shared with employees?

- Employees’ payslips should be provided to them as at least one of the following:

- A hard copy

- Attached in an email

- An online copy

Giving employees a printed copy of their payslip is becoming less common. As well as the fact many businesses are digitising their paper processes, a payslip contains a lot of sensitive employee information, and a printed payslip could easily fall into the wrong hands. When emailing payslips, it is important that the payslip is password protected. More and more businesses are choosing to opt for sharing payslips with employees online. Not only do they save on paper on ink, but they are also more secure and can be easily retrieved when needed.

How can I provide employees with online payslips?

Some payroll software providers include an option to share employees' payslips through an online portal. BrightPay payroll software has a cloud add-on, BrightPay Connect, which includes an employee self-service mobile app where employees can view and download all new and historic payslips. Once a payslip becomes available, the employee will receive a push notification on their phone. If they do not have access to the app, they can also access their employee portal online from any device.

Sharing employees' payslips through an online portal such as BrightPay Connect is the best way to avoid payslip data breaches and insure you are in compliance with UK data protection laws. It also means that employees will always have access to all their past payslips and won’t need to come to their employer to request them.

Can you produce payslips using Basic PAYE tools?

You can use Basic PAYE tools (BPT) to produce payslips for your employees. However, the payslips produced will not include all the details which you are required to provide by law. By using a payroll software such as BrightPay, the payslips produced will contain all the information required by law, while also being customizable with the option of including additional information.

To find out more about how you can share payslips with employees online, book a free online demo of BrightPay Connect today.

Related articles:

Nov 2021

10

Brexit and GDPR

GDPR’s impact on payroll

The General Data Protection Regulation (GDPR) came into effect in May 2018, and it brought the biggest changes in data privacy regulation in over 20 years. Payroll processors deal with personal and sensitive employee information all the time (e.g., names, emails, addresses, bank details, social security numbers, etc), so it’s critical that this information is kept secure and compliant with the GDPR.

Many companies had to review their data handling processes and equip themselves with new tools to ensure GDPR compliance. For example, keeping payroll records stored safely by using an online cloud server such as BrightPay Connect.

Brexit and GDPR

The EU GDPR is an EU Regulation, and it no longer applies to the UK since Brexit. However, the provisions of the EU GDPR have been incorporated directly into UK law and will be now known as UK GDPR. In simple terms, there’s virtually no difference between the UK version of GDPR and the original EU GDPR. Data can continue to flow as it did before, in most circumstances.

How BrightPay Connect is helping with GDPR

BrightPay Connect is an add-on product to BrightPay payroll software. It provides a remote and secure online portal where you can access payslips, payroll reports, amounts due to HMRC, annual leave requests and employee contact details. The portal allows employers to share and upload HR documents in a secure environment hosted on Microsoft Azure.

BrightPay Connect automatically backs up the payroll data to the cloud every 15 minutes and once again when closing the file. It keeps a chronological history of all backups which can be restored or downloaded anytime, keeping payroll records safely stored at all times, with no risk of losing them.

But that’s just a quick taster of the features that BrightPay Connect has to offer. Book a 15-minute demo today and see for yourself. Or if you are new to BrightPay, why not try our payroll software for free for 60 days. The free trial is fully featured with all functionality.

Don’t take our word for it! View our library of BrightPay Connect testimonials on our website from real customers.

Related articles:

Nov 2021

4

How BrightPay can help with your IR35 obligations

IR35 - also known as “off-payroll working rules” has been both a much-needed bit of legislation to tackle people not paying enough tax, and a massive headache for businesses. It has been marred in controversy since being rolled out to the private sector in April of this year due to mixed messages and confusion on how to properly comply

Basically, since the reforms were introduced, instead of the individual letting HMRC know if they’re an employee or contractor, and therefore treated differently when paying tax, the onus is now on the client engaging them to let HMRC know.

So this is now proving to be a headache as off-payroll workers are not entitled to receive or have deducted from their pay things like statutory payments such as SSP, SMP etc, National Minimum/Living Wage rate, holiday pay, student loans and automatic enrolment pension scheme contributions. So where the hell do you even start? How do you know who should be off-payroll or not?

First of all, you can quickly and easily check employment status for tax here. Once you have identified a worker who is inside IR35 you set them up on BrightPay Payroll Software and tick “off-payroll worker” which will disable entitlements that do not apply to contractors who fall inside the off-payroll working rules. Then, once the employee has been set up, BrightPay will automatically disable some settings such as student loans and annual leave entitlements.

Further to this, if a user tries to add statutory leave, BrightPay will automatically flag this to you and the statutory payment will not be processed. For automatic enrolment, an alert will appear for off-payroll workers for you to mark them as being exempt, which then disables any auto-enrolment features that may appear. Then, when making a full payment submission, it will automatically include details of workers who fall inside IR35, ready to send to HMRC.

If you are the contractor who is working for a large/medium-size company or public sector and are deemed to be inside IR35 then BrightPay has your back here too. Salaries paid to you via your own limited company can be paid without deductions of PAYE and NIC. This is because taxes have already been suffered on the payments from your client.

Now doesn’t that sound like a dream? Get someone to do all the hard work for you - sounds like my cup of tea. By using BrightPay you’ll save yourself a lot of time and energy, but more importantly, remain compliant in a time when HMRC are cracking down hard. One less stress to worry about in these very stressful times! For a full demo on all these amazing features head over to BrightPay and see what all the fuss is about!

Written by Aoibheann Byrne

Related Articles:

Nov 2021

2

BrightPay wins ‘Payroll and HR Software of the Year 2021’

BrightPay was announced as the WINNER of Payroll and HR Software of the Year 2021 at this year’s Institute of Certified Bookkeepers (ICB) LUCA awards.

Last night, the ICB held their annual awards in Leicester Square, London. The LUCA awards are considered the ‘Oscars’ of the bookkeeping profession and are awarded in recognition of the year’s outstanding bookkeepers and the many organisations and software services that support the valuable work they do. This year was even more special as not only were the awards held in-person again, but they were also celebrating the 25th Anniversary of ICB's inception. ICB members and students vote to decide the winners of each category. BrightPay are thrilled and honoured to have won Payroll and HR Software of the Year 2021, beating out tough competition from fellow nominees being Intuit Quickbooks, Moneysoft, Sage Payroll, and Xero Payroll.

Picture: Paul Byrne, CEO of BrightPay, poses with the award, a statuette of Luca Pacioli, the Cistercian monk who is credited with first documenting the process of double-entry bookkeeping.

An award-winning payroll software

The award for Payroll and HR Software of the Year comes just under a year after BrightPay won the COVID-19 Hero Supplier Award at the Accounting Software Excellence Awards 2020. During 2020 and beyond, BrightPay quickly responded to frequent changes to payroll legislation, allowing our customers to carry on processing their payroll uninterrupted.

It is a credit to the entire team at BrightPay, amidst the pandemic and throughout 2021, that they continued to develop BrightPay Payroll Software. New and enhanced features were added, all the while BrightPay continued to deliver excellent support to our customers.

Not simply a payroll software

A particular exciting aspect of this award is the ‘HR’ in the title. While BrightPay has been well known for its excellent payroll functionality, we have been working hard on delivering more and more useful HR features to our customers. Bookkeepers using BrightPay alongside the optional cloud add-on, BrightPay Connect, have access to a more streamlined workflow between human resources and payroll.

- Using BrightPay Connect’s self-service portal, annual leave can be requested by clients’ employees and approved by the employer before flowing back into the payroll software.

- With the self-service portal, bookkeepers can also offer their clients access to run and view payroll reports whenever they like. With the reports automatically available to their clients, it improves the bookkeeper’s workflow as well as saving them time.

- Once payroll has been finalised, payslips are automatically sent to employees’ Connect portal. Employees have access to their payslip archive at any time. It ensures they never lose a payslip, and they have access to them whenever they require it.

To discover more about BrightPay’s features such as batch processing capabilities, integration with numerous accounting packages, and the ability to streamline your payment methods, download a 60-day free trial of BrightPay now. To learn more about BrightPay Connect’s payroll and HR functionality, book a demo today.

Related Articles:

Nov 2021

1

Customer Update: November 2021

Welcome to BrightPay's November update. Our most important news this month include:

-

Autumn Budget 2021 – An Employer Focus

-

Horror Stories about Data Loss (and how payroll backups can help)

-

Automatic enrolment checklist for your clients

How to Make a Profit while Streamlining your Payroll Services

New cloud technologies are positively impacting the way bureaus and accountants offer payroll services to their clients. Join us for a free webinar on 23rd November where our experts discuss 6 tips for payroll success while making a profit.

5 Tips for a Better Payroll Process from Start to Finish

New cloud technologies are positively impacting the way employers process payroll and manage employee leave. Join us for a free webinar on 25th November where our experts discuss how you can streamline the entire process from start to finish.

Easily Manage Attachment of Earnings Orders with BrightPay

BrightPay allows users to easily add an attachment of earnings order to an employee’s payslip. Once it is set up, BrightPay will continue to apply the Attachment Order to the employee’s payslip from the relevant payslips.

Good News for Accountants: Pay Your Clients’ Employees Instantly

Are you looking for an easy and fast way to pay employees, subcontractors and HMRC? BrightPay’s integration with the payments platform, Modulr, eliminates the need to create bank files when paying employees. Find out more and register for our upcoming webinar on 11th November at 10 am.

Good News for Employers: Pay Employees Instantly

Are you looking for an easy and fast way to pay employees, subcontractors and HMRC? BrightPay’s integration with the payments platform, Modulr, eliminates the need to create bank files when paying employees. Find out more and register for our upcoming webinar on 11th November at 12 pm.

Payroll and Accounting Software Integration - The Best of Both Worlds

BrightPay includes direct API integration with some of the UK’s leading accounting packages such as Sage, QuickBooks and Xero. This accounting software integration allows for the payroll data to be sent directly into the accounting system from within BrightPay. Book an online demo of BrightPay today to see how the accounts integration features can benefit your business.

The Year that was: 2021 in Review

2021 was a year of both personal and business challenges. COVID-19 changed life as we knew it and resulted in a lot of changes being made worldwide. New policies were introduced, people's places of work changed as well as a number of other adjustments.

Join Bright Contracts for a look back at 2021 where we detail all the employment law changes that were made and a look forward as to what the year 2022 will bring.