Dec 2021

28

Additional data protection with two-factor authentication

As the digital world becomes more and more advanced, cyber threats are on the rise. According to a recent report from Microsoft, enabling two-factor authentication (2FA) blocks 99.9% of automated attacks on your accounts. This is because there is an additional security layer that the hacker must crack. Most major websites and banks offer an option to enable two-factor authentication and it is recommended that you turn it on wherever possible as prevention is better than the cure!

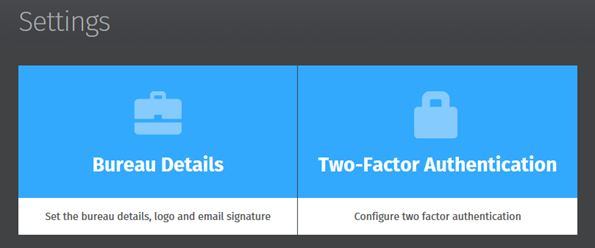

Payroll software should be no exception when it comes to adding an extra layer of security. That’s why BrightPay’s add-on product BrightPay Connect has the option for users to enable 2FA when logging in. The account administrator can enable this feature in the Settings tab on their main dashboard in BrightPay Connect.

Tick the box for ‘Enable two-factor authentication’ and Save Changes. When any user on the Connect account tries to sign into Connect via an internet browser or through BrightPay they will have to enter the security code sent by email or text as a second security feature.

BrightPay Connect’s two factor authentication feature adds an additional layer of security to an already secure hosted platform as data stored on Connect is backed up to Microsoft Azure servers. By enabling this feature, users will have more reassurance that their payroll data or client’s payroll data is safer and even more secure.

BrightPay is a leading UK payroll software that makes managing payroll quick and easy for accountants, payroll bureaus and employers. BrightPay’s optional online add-on product BrightPay Connect enables cloud payroll software features including an automatic cloud backup, an annual leave management tool, an employer dashboard, an employee self-service portal and much, much more. Book a free online demo of BrightPay and BrightPay Connect to learn about how you can run your payroll more efficiently and most importantly, safer.

Related articles:

Dec 2021

22

Documents you must share with employees (and how you should share them)

What documents do I need to share with a new employee?

When hiring a new employee or worker there is certain information which you, the employer, must share with them. On the employee’s first day, they must be provided with a document known as a ‘principal statement’. The principal statement must include:

- The employer’s name

- The employee/worker’s name, their job title and/or description of work and their start date

- The employee/worker’s pay and how often they will be paid

- The employee/worker’s hours of work

- The employee/worker’s holiday entitlement

- Location/locations that the employee/worker will be working from (further details will need to be included if the employee is expected to work abroad)

- The length of the employment

- The length of the probation period and its conditions

- Information on any benefits

- Employee training information

Other information which the employee must be given on their first day which can be included on the ‘principal statement’ or can be provided separately includes:

- Sick pay and procedures

- Information on paid leave (eg. parental leave, bereavement leave.)

- Notice periods

Within two months of the employee starting, they must be given a ‘wider written statement’ which must include information on:

- Pensions and pension schemes

- Collective agreements

- Information on any other right to non-compulsory training provided by the employer

- Disciplinary and grievance procedures

Providing employees with payslips

For each pay period, employees must receive an itemised payslip which clearly shows:

- Total pay before deductions

- Total pay after deductions

- Amounts of any variable or fixed deductions

- A breakdown of how the wages will be paid if more than one payment method is used

What other documents should you share with employees?

While it is a legal requirement to share the documents which are listed above with employees, it is also important to clearly communicate company policies and procedures with employees. Examples could be an employee handbook, an IT policy, a working from home policy or a code of conduct document. Documents such as these helps establish what behaviour is expected of employees by the employer and to explain any consequences of breaching the guidelines. Not keeping employees up to date on what the company expects from them in terms of ethics and morals could result in legal or financial consequences for your business.

A regular staff newsletter is another example of a document that may be shared with employees. While not imperative, newsletters can be used as a way of keeping employees informed of staff events while also reinforcing your company culture.

How do I share documents with employees?

All documents should be easily accessed by employees. While you can share physical documents with employees, to save time and money, it is better to share these documents digitally. Sharing documents by email is another option but this can also become time-consuming. One of the best ways of sharing documents with employees is through an online employee portal where you can share tailored documents with individual employees or share company documents with multiple employees at once.

BrightPay Connect is an optional cloud add-on to BrightPay’s payroll software that allows employers to upload documents through their own online portal. Employees can then access these documents anytime, anywhere from the BrightPay Connect employee app on their smartphones or from an internet browser. Sharing documents with employees this way means they are instantly available for employees to view, whether in the office or working from home. Employees will receive a push notification on their mobile every time a new document has been uploaded or when the employer has updated a document. From the employer dashboard, you can also keep track of which employees have viewed which documents.

How can I generate employee documents?

BrightPay’s sister product Bright Contracts, syncs with BrightPay’s payroll software and allows you to easily create tailored employee contracts and staff handbooks which fully conform to the latest employment law guidelines. When there are any changes in employment law, Bright Contracts will automatically send you an update, making it easy for you to comply with employment law, even with no HR experience. These documents can then be uploaded via BrightPay Connect’s employer dashboard and shared instantly with employees.

To learn more about sharing documents with employees using BrightPay Connect, book a free online demo today.

Related articles:

Dec 2021

20

Christmas Opening Hours 2021

All of the staff here at BrightPay would like to thank you for your valued custom in 2021. We would like to take this opportunity to wish you and your families a Merry Christmas and a prosperous New Year.

Here are our opening hours for the Christmas period:

| Monday 20th | 09:00 - 13:00 | 14:00 - 17:00 |

| Tuesday 21st | 09:30 - 13:00 | 14:00 - 17:00 |

| Wednesday 22nd | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 23rd | 09:00 - 13:00 | 14:00 - 17:00 |

| Friday 24th | Closed |

| Saturday 25th | Closed |

| Sunday 26th | Closed |

| Monday 27th | Closed |

| Tuesday 28th | Closed |

| Wednesday 29th | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 30th | 09:00 - 13:00 | 14:00 - 17:00 |

| Friday 31st | 09:00 - 13:00 | 14:00 - 17:00 |

| Saturday 1st January | Closed |

| Sunday 2nd January | Closed |

| Monday 3rd January | Closed |

To contact our support team you can call us on 0345 939 0019, email us at support@brightpay.ie or complete our online form.

Dec 2021

14

New Advisory Fuel Rates from 1st December 2021

The Advisory Fuel Rates that will come into effect from 1st December 2021 have been announced by HMRC. Employers may use the old rates for up to one month from the date the new rates apply. Employers are under no obligation to make supplementary payments to reflect the new rates but can do so if they wish. Hybrid cars are treated as either petrol or diesel cars for this purpose for the fuel rates. For fully electric cars the Advisory Electricity Rate are 5 pence per mile. Click here to view details per HMRC.

The new rates are as below:

| Engine size | Petrol - amount per mile | LPG - amount per mile |

| 1400cc or less | 13 pence | 9 pence |

| 1401cc to 2000cc | 15 pence | 10 pence |

| Over 2000cc | 22 pence | 15 pence |

| Engine size | Diesel - amount per mile |

| 1600cc or less | 11 pence |

| 1601cc to 2000cc | 13 pence |

| Over 2000cc | 16 pence |

Related articles:

Dec 2021

10

Real Living Wage Rates Increase

The Living Wage Week took place from 15th to 21st November 2021 and the New Living Wage rates details were announced. The real Living Wage is the only UK wage rate that is paid voluntarily by nearly 9,000 employers and is an hourly pay rate set independently and is updated every year. It is calculated based on the basic cost of living in the UK. Employees aged 18 years of age and older can be paid this new rate from 15th November by employers who pay the Living Wage and all employees should have this rate applied by 15th May 2022.

The new London Real Living Wage announced by the Living Wage Foundation, has increased by 20p from £10.85 to £11.05 per hour. This helps reflect the higher cost of living facing employees in London. The UK Living Wage rate has increased to £9.90 from £9.50, an increase of 40p or 4.2%. The Government's current national minimum wage for over 23s is £8.91, though it will increase to £9.50 from 1st April 2022, which is £99p less than this rate currently.

Nearly 300,000 employees will be affected by the new real living wage increase. A full-time weekly employee being paid the new Living Wage rate of £9.90 will earn £1,930 more annually than an employee on the current national minimum wage for over 23s. An employee working the same hours per week in London being paid the new Living Wage rate of £11.05 will earn £4,173 more per year compared to an employee on the National Minimum Wage for over 23s.

More than 3,000 employers have been accredited by the Living Wage Foundation since the start of the Coronavirus pandemic. New companies that have signed up are Fujitsu, Aviva, Everton FC and Burberry. For information about the Living Wage Foundation and Living Wage Week visit the Living Wage Foundation website here.

Related articles: