Jan 2022

27

How to process a leaver in BrightPay

When an employee leaves their job, they must be marked as a leaver in the payroll. The employee’s leave date must be entered before their final pay period is finalised. This sends information to HMRC when the Full Payment Submission (FPS) is sent to let them know that the employee has left. Even though employers are no longer required to submit a P45 to HMRC when an employee leaves, it’s still best practice for the employer to send the employee a P45 to keep for their own records.

How to process a leaver in BrightPay

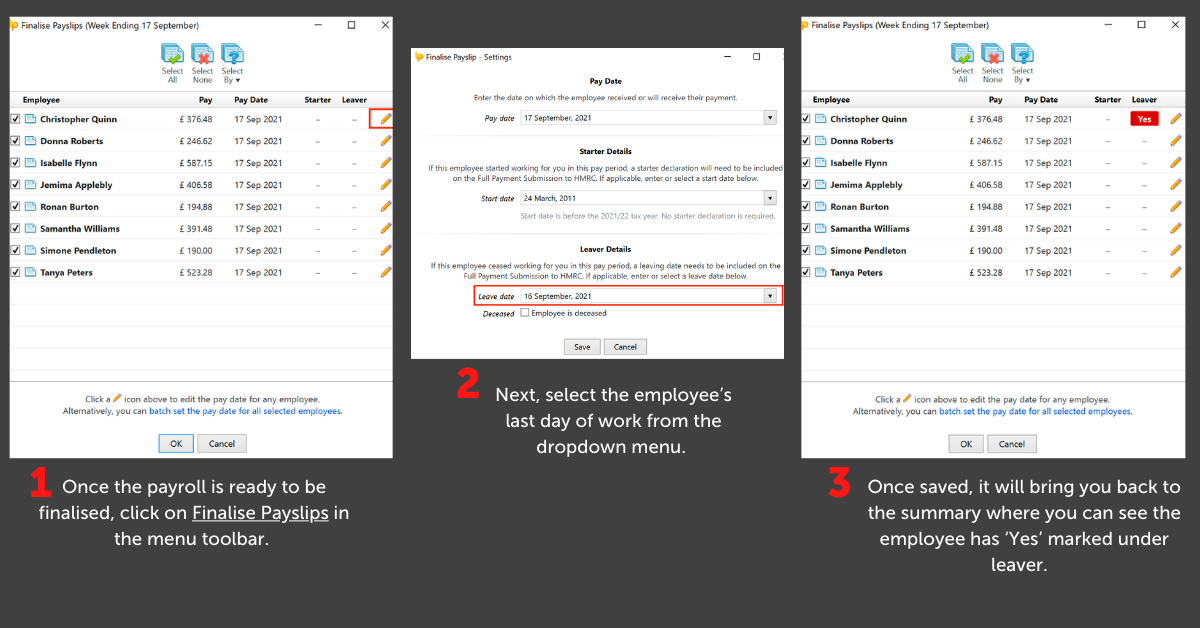

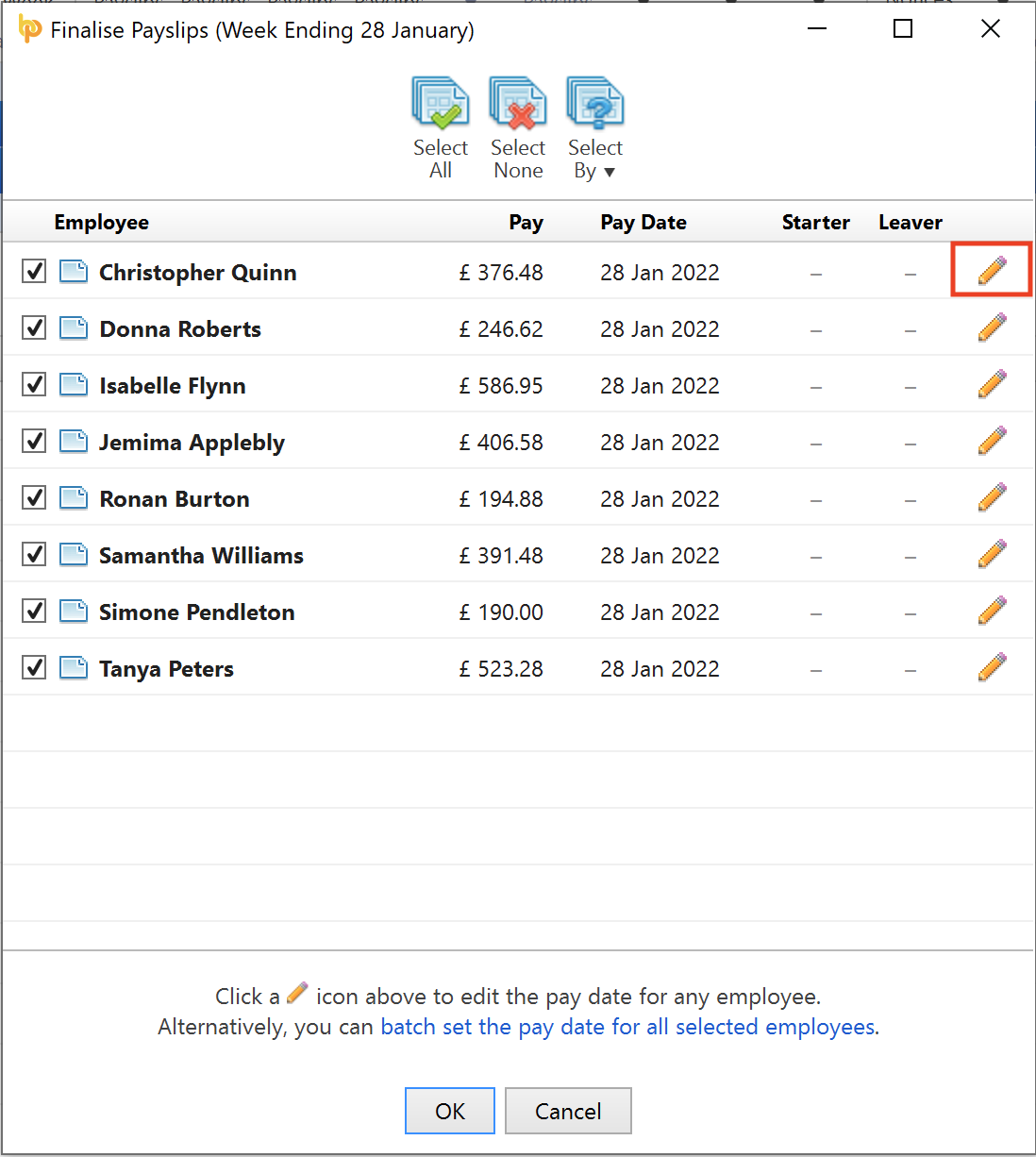

It couldn’t be easier to process a leaver in BrightPay. To do so, follow the step-by-step instructions below:

1) Once the payroll is ready to be finalised, click on Finalise Payslips in the menu toolbar. You will be shown a summary of employees as seen below where you can edit each individually.

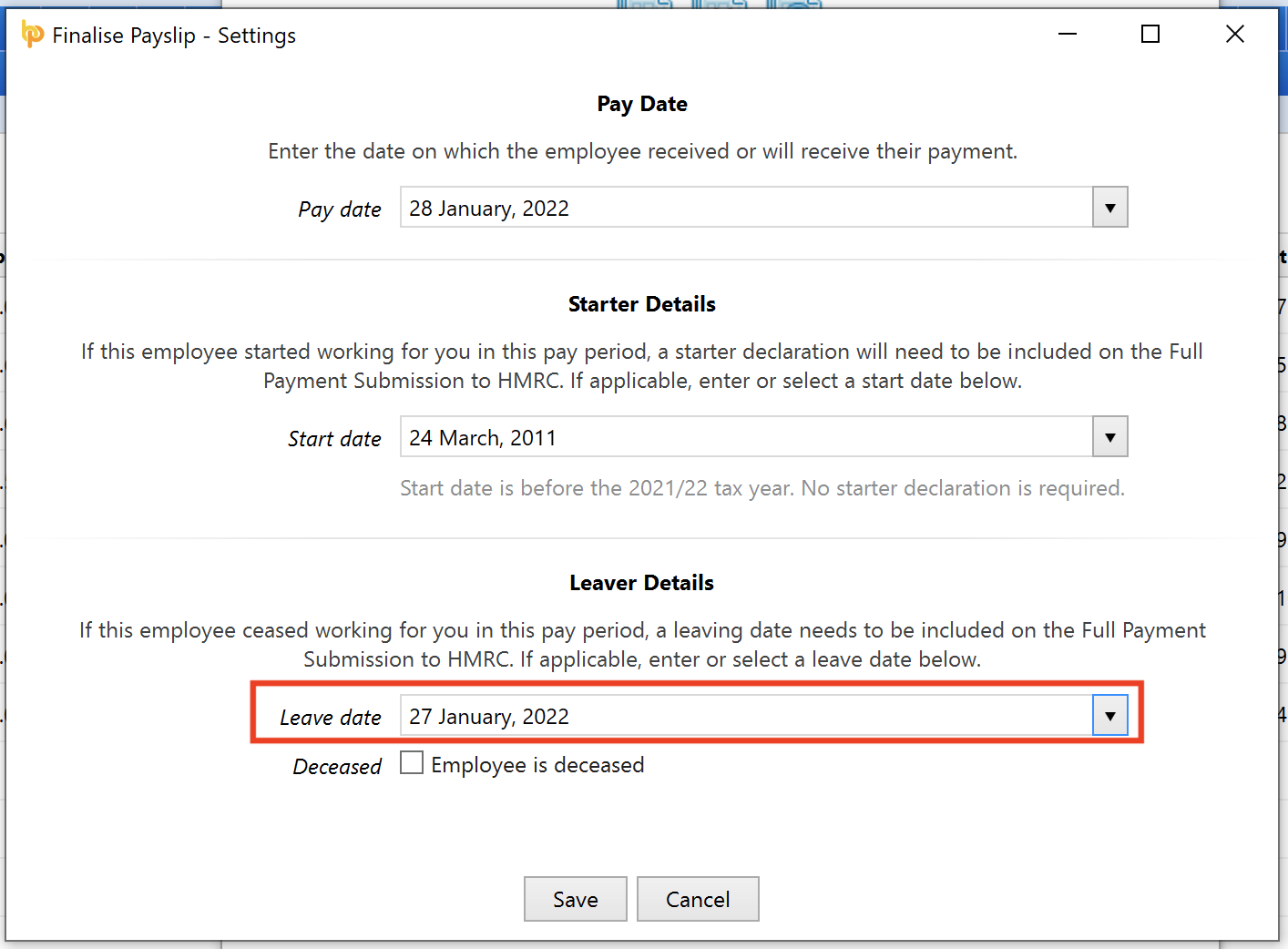

2) Next, you can select the employee’s last day of work from the dropdown menu.

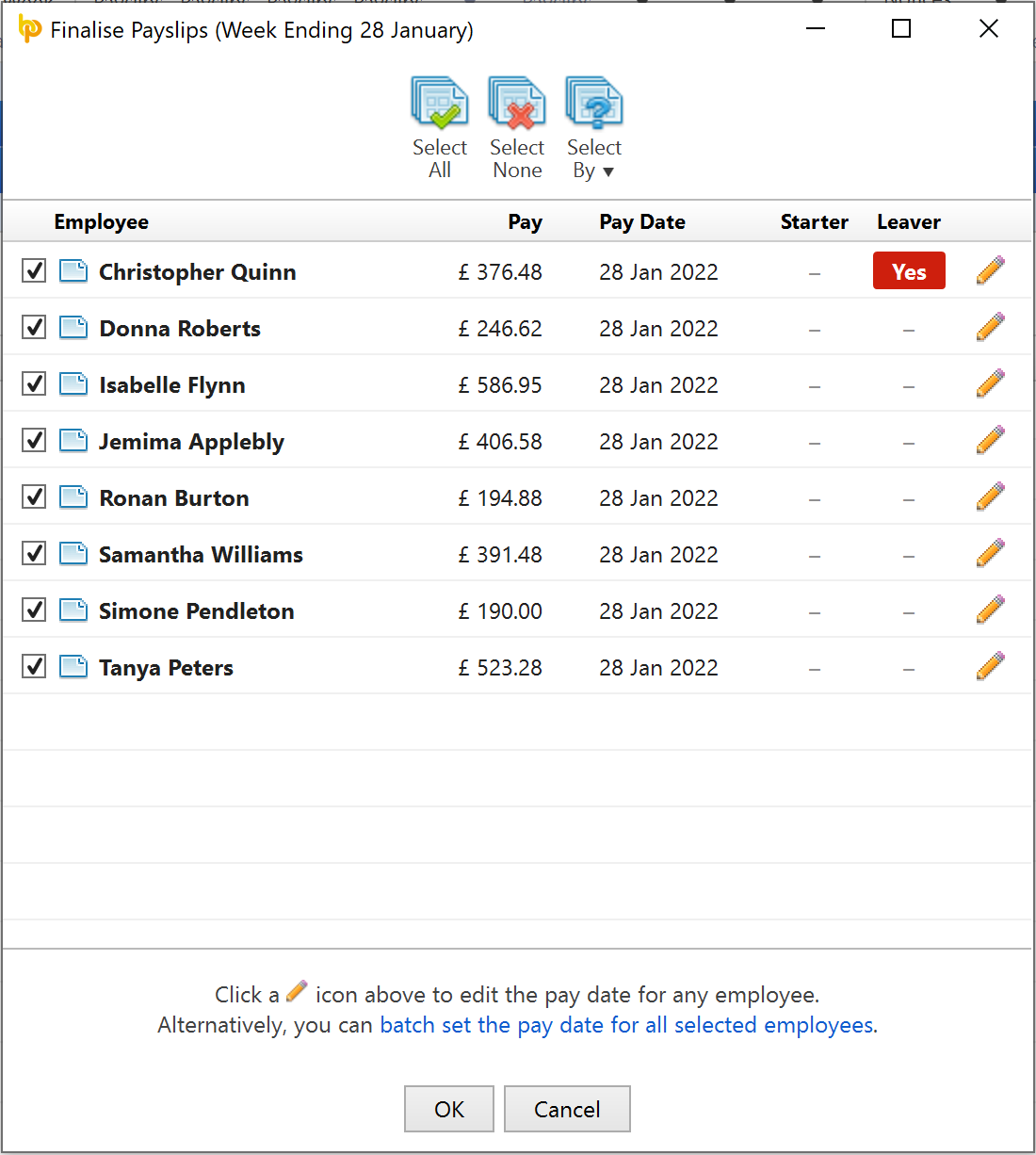

3) Once saved, it will bring you back to the summary where you can see the employee has ‘Yes’ marked under leaver.

When the Full Payment Submission is sent to HMRC, the employee marked as a leaver will no longer be included in any future pay periods. However, the employees’ payslip history will be still available on BrightPay if needed.

What to do if the wrong leave date is entered

If you select the wrong leave date for an employee in the FPS, you must update your payroll records with the correct date. Do not wait to update the leave date in the next FPS as this may create a duplicate record for the employee.

What to do if the employee continues to work for you

If you submit an FPS with an employee's leave date and they carry on working for you, there are two options, you can:

- Use the same payroll ID if you haven’t issued a P45 yet and remove the leave date (do not enter a new start date).

- Give them a new payroll ID if a P45 has already been issued.

Related articles: