Oct 2021

18

The tools you need to make hybrid working a success

The evolution and growth of hybrid working has been a silver lining of the pandemic for many employees and employers. Despite the challenges of working from home, hybrid working can offer a better work-life balance, fewer distractions, time and money saved commuting, and greater flexibility. Employers have also been able to see that it works; tasks can still be completed on time and to a high standard, regardless of location.

As restrictions have eased in the UK, how employers have approached the adoption of hybrid working has been varied. Grappling with how they’ll implement it, employers have been testing out different models; from allowing a number of set day at home, or an entirely opt-in model, to a model where it's suited to only certain roles. In the accounting sector, we’ve seen major firms embrace the new workplace options. Most recently in the US, we’ve seen PwC announce that 40,000 of its employees can work remotely. If bigger businesses continue to implement hybrid working options, it is likely that it will impact smaller and mid-sized firms, with growing competitiveness among them to offer remote options to employees.

How can smaller firms adopt hybrid working and truly make it a success? It can be challenging, not only to productivity but also to the company culture. It’s made even more challenging when businesses don’t invest in the tools required to work from home. Research published in September 2021 by Ricoh Europe shows that that only a third (36%) of employers say their organisation has provided the tools and technology to maintain employee productivity while working from any location. This is despite over half of employers understanding that investing in automation boosts productivity.

To help you prepare for the realities of hybrid working and what accounting and payroll software tools are available to help you and your firm, we’ve teamed up with BTC Software to deliver a webinar. BTC Software provides feature-rich accounting and tax software. In the webinar we will examine the changes which have occurred at work due to COVID-19 and highlight what can be done to establish the best way of working. Register for the free webinar here.

Webinar agenda:

- Part 1: How COVID-19 has changed how we work

- Part 2: Restructure of how we work post-pandemic

- Part 3: What can accountants do to ensure they are digitally savvy to keep up with the new way of working?

- Part 4: Q&A session

Please note: This webinar is specifically designed for accountants, bookkeepers, and payroll bureaus.

Webinar Information:

The webinar takes place on 26th October at 1.00pm and is free to attend for accountants in practice and payroll bureaus. If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related Articles:

Oct 2021

8

Easily Manage Attachment of Earnings Orders with BrightPay

What is an attachment of earnings order?

As an employer, you can be directed to deduct money from an employee’s pay. You will receive a formal notice, referred to as an attachment of earnings order, typically from a court, but can also be from the DWP Debt Management or from the Child Maintenance Group.

The order instructs an employer to divert money directly from an employee’s wages to pay back an outstanding debt. The order is issued because it is believed that the employee has failed or is likely to fail to pay the sums through other means. The money is sent to the court that made the order which is then forwarded to the employee’s creditor. Attachments can be issued for a number of reasons including unpaid fines and child support.

Deduct an attachment of earnings order using BrightPay

BrightPay Payroll has the facility to process a variety of attachment of earnings orders. This includes:

- Council Tax Attachment of Earnings Order

- Civil Judgment Debt Attachment of Earnings Order

- Child Support Deductions from Earnings Order

- View BrightPay’s full list of attachment of earning orders here

Fast and easy deductions:

BrightPay payroll software allows customers to easily add attachment of earnings to an employee’s payslip. In the employee’s profile, under ‘Additions and Deductions’, the user can choose from the different attachment orders available. Once selected, the description and relevant dates are added along with the amounts and status.

An AEO can either be a priority order or a non-priority order, which impacts the way deductions are calculated. If an employee has more than one order, priority orders will need to be deducted first. In BrightPay, tick the ‘priority’ box if the order is a priority order. The priority orders will be deducted in the order the employee received them.

Once it is set-up, BrightPay will continue to apply the Attachment Order on the employee’s payslip from the relevant period. To see how to apply an Attachment of Earnings Order click here.

What happens if you don’t comply?

Although attachment of earnings can be issued by different authorities, these authorities have the power to impose a fine. An employer that does not comply may be liable to a fine in the magistrate’s court, in the county court, or in the High Court. The employer must also notify the authority when the employee is no longer in its employment, or risk paying a fine.

Find out more about BrightPay Payroll:

BrightPay Payroll makes processing payroll quick and easy. Its comprehensive functionality, covering AEOs to auto-enrolment and CIS, provides a complete solution to your payroll needs. To learn more about BrightPay’s features and how they can benefit your business, book a free demo today.

Related Articles:

Sep 2021

28

BrightPay & Relate Software join forces to create an accounting & payroll software champion

We are delighted to announce that BrightPay has joined forces with Relate Software, a leader in post-accounting, practice management, and bookkeeping software. The partnership will aim to create a software champion serving payroll and accounting bureau and SMEs across Ireland and the UK.

BrightPay is a modern payroll and HR software which takes care of every aspect of running your payroll, from entering employee and payment details to creating payslips and sending real-time payroll submissions. The software has been designed from the ground up to be clear and simple, and yet no compromise has been made on its payroll features.

Likewise, Relate is dedicated to building innovative and focused products designed specifically for the accounting profession. Its offering includes Surf products, a cloud native product suite of bookkeeping, post-accounting, and practice management software. Relate is an industry-leader in Ireland and has been building software for over 25 years.

By partnering with Relate and combining products and strengths from both businesses, we can provide a greater offering to our customers, with scope and backing for further innovation and development. This is an exciting moment in BrightPay’s journey to delivering a one stop solution for businesses and accountancy firms. Together we will aim to provide a best-in-class software suite with a clear value proposition to drive efficiency and reduce errors, all with increased flexibility from working with a cloud offering.

For more information, please see the press release and customer FAQs.

Sep 2021

24

Harness the power of phone notifications for employee communications

Push notifications are 7 times more likely to be opened than an email. This high ‘open rate’ has meant marketers have been utilising them as an important communication tool for a number of years. Now, employers and HR departments are examining how this marketing trend can be used to engage employees.

What are push notifications?

Recent research carried out in the UK has shown that 25% of smartphone users have between 11 and 20 apps on their phone, and 24% have 31 or more. With potentially dozens of apps on a user’s smartphone, it has become increasingly difficult to engage them.

Push notifications are short messages or alerts sent by an app or website to a user’s phone or desktop in real-time. They ‘pop-up’ on the screen, prompting the user to take some action. The messages can be personalised and can contain images, GIFs or video. They don’t deliver the primary message, but rather give an instruction to the user. The notifications are very effective; they engage users and encourage action.

How can employers use them?

Employers and HR departments can use push notifications to send important information to employees, anytime and anywhere. For example, BrightPay Connect customers commonly use the push notifications feature to notify employees of their latest payslip, Health & Safety updates, changes to the employee handbook, and even to direct them to the latest company newsletter.

How does BrightPay Connect harness the power of push notifications?

BrightPay Connect is an optional cloud add-on that works with BrightPay’s desktop payroll software. It is primarily focused on improving payroll workflows by automating tasks to save a business significant time, but its functionality also offers employers a ready-to-go, easy-to-use HR software solution.

With BrightPay Connect, employers and employees have their own self-service app which can be accessed by a web browser or by the app. Using the calendar feature on the app, employees can easily manage their annual leave, view how much they’ve already taken, how much is left, and can make leave requests, which are sent to their manager. The push notification then alerts employees of whether or not their request for leave has been approved.

Notifying employees of important changes:

The push notification is used to alert individuals, teams, or the whole company that a new document has been shared to their self-service portal. The HR team can share with an employee their contract of employment, their performance review, training records and other confidential information. To the wider company, they can share the company handbook and return-to-work procedures including the company’s social distancing and COVID-19 policies.

Additionally, the app’s activity log allows managers and HR to keep track of who has viewed documents and who has not. This can be significantly helpful to employers who are legally required to provide employees with certain documents.

Push notifications can be used to help ensure important messages are not missed. With overflowing inboxes, employees are more likely to click on these alerts and remain updated on any company news.

To learn more about BrightPay Connect and how it can help your business, book a demo to speak to a member of our team.

Related Articles:

Sep 2021

10

How is payroll impacted by the new national insurance levy?

On Tuesday, the Prime Minister announced a 1.25% health and social care levy on earned income, which will come into effect in April 2022. Speaking to the House of Commons, Boris Johnson declared that this additional levy was required in order to raise funds for health and social care across the UK.

Speaking about the National Health Service, the Prime Minster said “Covid has put enormous pressure on the NHS” and in order to not only “tackle Covid backlogs” but to also reform an already struggling service, a record investment would be required. The additional levy is expected to raise £36 billion over three years.

How will the new health and social care levy be introduced?

In April 2022, the 1.25% levy will be raised via a temporary increase to the National Insurance Contributions (NICs). This will impact Class 1 (employee and employer), Class 1A, Class 1B, and Class 4 (self-employed). In April 2023, the NI will revert back to its current rates and the health and social care levy will be separated out on its own.

Who will be affected by the 1.25% levy?

The new levy will then be paid by all working adults and will also include those above the state pension age who are still working. The exception is those earning less than £9,564 a year or £797 a month, who don't pay National Insurance and won't have to pay the new levy.

How has dividend tax been affected?

The Prime Minister also announced on Tuesday that dividend tax would rise from 2022 by 1.25% to help cover the costs of the social care package. This will not affect shares held in tax-exempt savings accounts, known as ISAs. The £2,000 tax-free allowance for dividend income will also remain unaffected.

What does this mean for payroll?

As typical with any changes to legislation, BrightPay payroll software will be updated to apply the new rates to your employees' earnings. This will first be reflected on an employee’s payslip with an increase to their NIC deduction, and then in April 2023 the new levy will be introduced as a separate deduction on the payslip.

Discover more:

To keep up to date on deadlines, industry insights, and news, subscribe to BrightPay’s newsletter. BrightPay is an industry-leading payroll software with over 320,000 customers in the UK and Ireland. BrightPay publishes blogs, guides and hosts frequent webinars, free-of-charge, to support the accounting and bookkeeping community. Check out the full list of our upcoming webinars here.

Sep 2021

8

A spotlight on employee-led sustainability projects

Early this year at BrightPay we moved into our new energy-efficient offices in Meath, Ireland. BrightPay’s employees have formed the 'Green Team', a company-wide committee tasked with identifying and implementing opportunities that can improve the sustainability of our company.

From the start the Green Team have demonstrated their enthusiasm for environmental sustainability and passion for sharing their knowledge. This is highlighted below in a number of projects they’ve undertaken:

Making the Garden Bloom:

While the initial focus was on the new purpose-built offices, the Green Team soon turned their attention to the green spaces outside. Inspired by their Earth Week guest, Dr Emma Reeves, a Senior Ecologist at the Forest, Environmental Research, & Services (FERS), the group was particularly keen to plant native, bee-friendly plants and trees that would help pollinators and further benefit biodiversity. The first planting phase has been completed with the group planning the layout of the garden and planting shrubs, flowers, and trees. In September, the second phase will begin, with the team planting Spring bulbs including hyacinths, tulips, and daffodils.

Single-Use Plastics Awareness Campaign:

On the 3rd of July, the Single-Use Plastics Directive came into effect for all EU member states. In Ireland, this means that certain single-use plastics such as straws and coffee cups have been banned from the Irish market. Supporting this initiative, the Green Team created an awareness campaign highlighting the use of plastic in the beauty industry and introduced a single-use plastics ban in the office. With 10 of the most commonly found single-use plastic items representing 70% of all marine litter, this is an important and useful step all employees can take.

Future projects:

The Green Team’s future plans are focused on tackling pollution and engaging with more employees at Thesaurus Software. In September, the company will take part in a clean-up at a local beach and will also develop a new project highlighting the unsustainable nature of fast fashion and what options are available to address it.

If you’re interested in keeping up to date with BrightPay’s journey, sign up to our sustainability newsletter for future updates.

Aug 2021

26

BrightPay Connect User Permissions: What a Bureau Needs to Know

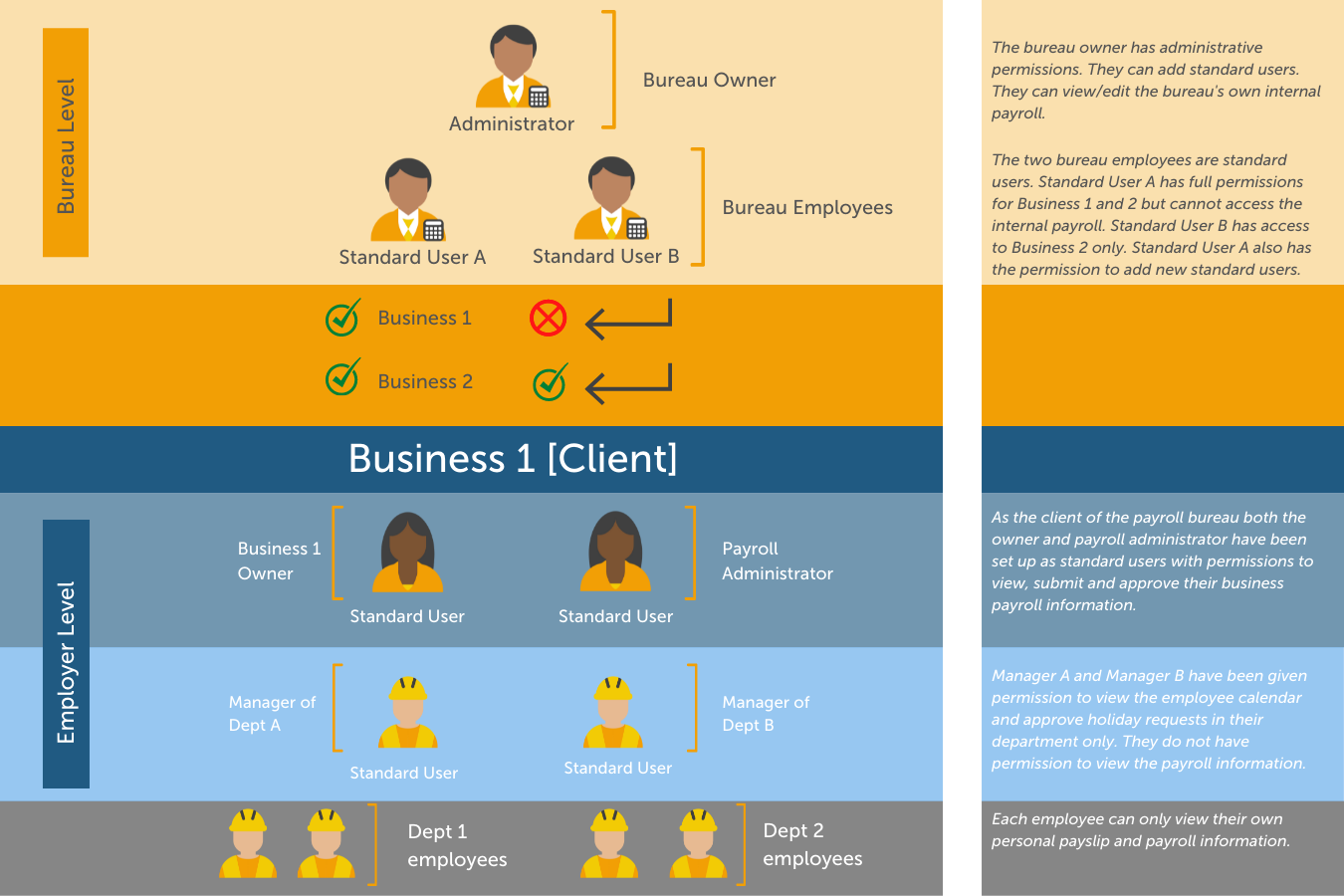

BrightPay Connect’s User Management interface makes it quick and easy for bureaus to set users up or to change their permissions. The different levels of access allow for greater flexibility, security, and management of your clients’ data.

Organising your user permissions efficiently can save you and your employees time while ensuring that confidential information is kept secure. You have the option of marking certain clients as confidential, setting employees up as standard users with full access to multiple clients, and allowing standard users to connect and synchronise employers from BrightPay Payroll to BrightPay Connect.

Types of Users for Connect

There are two main types of users: Administrator and Standard User.

Administrator

- An administrator has full control over a BrightPay Connect account, with the ability to edit account settings, add other users, redeem purchase codes, connect employers and manage all employer and employee information and processes.

- You have the option of adding multiple administrators. However, all administrators can view the bureau’s own internal payroll (if it’s associated with the BrightPay Connect account), and so it is recommended to have as few administrators as possible.

Standard User

-

A standard user can have access to one or more employers in your BrightPay Connect account. Therefore, both clients and payroll staff can be set up as standard users.

- Unlike administrators, user permissions can be added for standard users so that they only have access to information that they need.

Types of Standard Users

Standard User – Payroll Staff

Payroll staff can be set up as standard users where they only have access to the clients that they are working on. You also have the option of granting the standard user access to all existing clients, along with any new clients linked to the Connect account going forward.

If required, an employer can be marked as confidential in Connect (for example, the bureau’s own internal payroll) and only administrators on the Connect account will be able to view this employer. Standard users can only access confidential employers if they are given permission to do so.

Payroll staff can also be granted access to invite other standard users (e.g. clients) to Connect, and to connect and synchronise the payroll, so that they can process payroll on the desktop application or BrightPay.

Standard User - Clients

Clients can be added as standard users so that they can only view information related to their company. If the employer details are entered in the ‘Client Details’ tab in the employer section in BrightPay, the employer can be added as a standard user by the bureau very quickly and easily.

On the employer dashboard, you will see the option to ‘Invite your client’. Selecting this populates the client’s information for a new standard user and you can then choose the permissions for the client. This will let you avail of the payroll entry and payroll approval request features, which can have significant benefits for bureaus.

Standard User – Client's Managers

As well as setting up the client as a standard user, you can also add various managers within the client’s company with restricted access. For example, you can add department managers, where they can only access employees within their department. The user can also be set up where they can only view the leave calendar and approve employee requests, without having access to the payroll information or HR documents.

Book Your Free BrightPay Connect Demo Now

If you’re interested in learning more, book your free BrightPay Connect demo. A member of our team will walk you through the various features of BrightPay Connect and explain how they can benefit you and your clients.

Related Articles:

Aug 2021

20

Payslips explained: Top tips to help your employees

As an employer, it’s easy to assume that all employees understand the information on their payslips. However, research carried out shows this is not the case. Although some employees will examine their payslip each pay period, checking the tax and other deductions, others will never glance at theirs, assuming it is correct.

Understanding a payslip can be confusing and it’s worth taking the time to explain to new and existing employees what everything means. By breaking down each piece of information displayed on their payslip, you will find it easier to resolve unexpected payroll issues that arise and to communicate the full benefits of their employment package. Importantly, if you have employees who work unpredictable shifts and periods of overtime, it can help to encourage these employees to consistently share the most up-to-date information in order for payroll to be processed more accurately.

To help your employees understand their payslips better, check out the following tips:

1. Explain the basics:

Payslips contain a lot of information so it’s useful to break down what the employee will see. This includes the gross pay, net pay, and their personal information such as their payroll number, tax code, and their National Insurance (NI) number.

2. Be clear on how their pay is calculated:

Understanding how a salary is calculated for each month can cause confusion for employees, especially if they are paid on a monthly or a 4-weekly schedule. Moreover, employees being paid different rates depending on their hours worked will need to understand the differences.

Any deductions, both variable and fixed, should be explained. This includes those required by law, for example National Insurance, income tax, or student loan repayments, as well as those agreed to by your employee. Pension contributions will also be shown on the employee’s payslip, and this can be a good opportunity to explain its benefits as well as to highlight the employer’s contribution to their pension fund.

3. Choose the right time:

Onboarding new employees is the ideal time to explain the information a payslip contains. While onboarding, the employee will likely be partaking in induction training, filling out forms, and getting ready for their new role. This is a good opportunity to go through their payslip as well as emphasise any benefits included on it, such as a bonus, commission or other rewards.

4. Use your payroll software to customise payslips:

If you use payroll software, such as BrightPay Payroll, you will be able to customise your payslips. This can help make the payslips more easily understood. For example, use a custom description for specific payment periods such as daily payments, piece payments, as well as additions or deductions.

5. Make payslips easily accessible:

Providing a digital payslip is convenient for both you and your employees. Not only does it save you money and time printing out payslips (and improves your sustainability efforts), but it also allows employees to access their payslips whenever they want. Using an employee app, such as BrightPay Connect, employees can access their payslip on an online browser or on an app on their smartphone or tablet. Additionally, employees have access to their payslip archive, a record of all their payslips which date back to when you first started using BrightPay Payroll. The payslip archive ensures they never lose their payslip and allows employees to easily access them when applying for mortgages or other financial banking options.

Find out more:

If you’re interested in learning more about BrightPay Connect and the added benefits of using an employee app, including its HR functionality, book a free BrightPay Connect demo today.

Related articles:

Jul 2021

20

Paying employees for the first time: A small business checklist

Have you started the business you’ve always dreamed of? It’s an exciting time but as I’m sure you know, there is a lot to figure out. When you throw tax, employment law and pensions into the mix, it can feel overwhelming.

When you’re under pressure to get going, spending time figuring out how payroll works, may feel frustrating. However, running payroll yourself will help keep overheads down, which is something every new business owner is interested in. It’s essential you get it right and if you get it right from the beginning, it can make your life a lot easier in the long term.

Here’s a quick checklist to ensure you don’t fall foul of HMRC or end up having some very unhappy employees.

How do I run my own payroll?

- First, register as an employer with HMRC to receive your employer PAYE reference number. You’ll need to do this even if you are the only employee of the company.

- Choose an RTI and HMRC recognised payroll software such as BrightPay Payroll to run your payroll and report to HMRC on. Using BrightPay payroll software can help you fulfil your legal obligations as an employer, make processing payroll much quicker, while also offering useful HR solutions.

- Add your employees’ information to your payroll software. Importantly, you need to enter the employee’s tax code for the year, choose the appropriate National Insurance rate to use, and include any deductions the employee is liable to (e.g. student loan).

How do I set up auto enrolment for a new business?

Once you decide to hire an employee, you need to ensure you are ready to comply with the workplace pension law. Your legal duties begin on the day your first member of staff starts work. This is known as your duties start date.

- Upon hiring, assess whether your employees are eligible jobholders and are entitled to be put into a pension scheme. BrightPay payroll automatically assesses employees for enrolment, and if they meet the criteria to be enrolled in a pension scheme, on-screen alerts will appear.

- As soon as possible, choose a pension scheme that can be used for automatic enrolment. Your payroll software may provide direct integration with a number of pension providers which will save you a significant amount of time. View BrightPay’s API integrations with pension providers here.

- Within 6 weeks of your duties start date, use your payroll software to send letters informing your employees of auto enrolment and how it applies to them. With BrightPay, auto enrolment letters are automatically created and customised for each individual employee.

- Complete a declaration of compliance to the Pensions Regulator within 5 months after your duties start date.

How do I pay my employees?

- Once you’re happy that all the payroll information is correct, you’re ready to run your first payroll. Once finalised, the employees' payslips need to be sent to them. With BrightPay, payslips can be printed or emailed directly to employees, or if you use BrightPay Connect, payslips are automatically sent to the employee’s smartphone via the self-service app.

- Next, you’ll need to actually pay your employees. You can do this either by cash, cheque or direct debit. If your payroll software offers it, you can also pay directly from the software using a direct payments method. This eliminates the need to create bank files associated with direct debits and allows you to pay employees in a fast and secure way.

Reporting and paying HMRC for the first time:

- Make sure you register your employees with HMRC. This can be done by including their details (pay and deductions) on a Full Payment Submission (FPS) the first time you pay them. Going forward, an FPS must be sent to HMRC on or before each pay day, notifying HMRC of a payment made to that employee.

- Pay HMRC the tax and National Insurance (and any other deductions) you owe as reported on your FPS.

- You can pay HMRC a number of ways but a simple way of doing it is through your payroll software. See Pay HMRC through payroll software for more information.

Interested in learning more?

If you would like to learn more about BrightPay payroll software and how it can help you get ready for running your first payroll, speak to a member of our team today.

Jun 2021

30

Managing Payroll Access: Essential Advice for Employers

How can you make payroll more secure?

Do you process payroll in-house? If so, you are likely aware of how important it is to keep your employee’s pay information secure and to control who has access to the payroll and who can process it. However, maintaining such tight control over payroll functions can cause frustration and delays.

BrightPay Connect, the optional cloud add-on to BrightPay Payroll, makes it easier to manage who has access to the payroll information. The User Management interface offers flexibility and security by allowing you to set employees up as either Administrators or Standard Users. Both sets of users have different levels of permissions and there are advantages for both.

Connect Users:

An administrator has full control over the BrightPay Connect account. Typically, the business owner and the payroll processor are set up as administrators. As an administrator, they have the ability to edit account settings, add new users, and manage all employee information and processes. Access restrictions cannot be added for administrators and so it is recommended to have as few administrators as possible.

An administrator can add a new standard user. Standard users can be set-up with certain types of permissions and restrictions. For example, the HR Manager can be given permission to approve employee leave requests for all departments, to view financial information including payslips and reports, and upload HR documents to distribute to employees. However, the Marketing Manager can be given permission to only approve leave requests for employees in their specific department, without any access to the payroll information or HR documents.

To watch how to set up an administrator or standard user, click here.

Benefits

There are a number of benefits to having an easy, secure and flexible User Management system.

- Save Time: Effective user management can save you time in a number of ways. By setting up your accountant as a standard user with permissions to view payroll reports, you will no longer have to communicate back and forth with them about payroll. Additionally, communications between HR and employees regarding leave requests can be reduced by delegating the responsibility among department managers.

- Improve Operations Management: Department managers are likely to have a much better understanding of their project timelines and deadlines than the HR department. By allowing these managers to have control over leave requests, they can better manage their team’s schedule and workload.

- Increase Security: Payroll data holds sensitive financial and personal information that you are legally obliged to keep secure. No-one wants a situation where an employee can view personal and financial information that they shouldn’t. With the User Management system, you can securely manage who can access payroll data, which also helps you with GDPR compliance.

- Improve Flexibility: What happens if you are not available to run this month’s payroll? With BrightPay Connect, standard users can be given permission to ‘Connect and sync employer data’. This means that, although the other person is a standard user, they can still be given permissions to run the payroll on the desktop application of the payroll software, and synchronise the payroll to Connect when completed, so that both users will have the most up-to-date version of the payroll. BrightPay Connect also includes improved multi-user access, where the software will notify you if another user is currently in the payroll, or if you are not using the most up-to-date version of the payroll.

Interested in learning more? Book an online demo today to discover more about BrightPay Connect and the many other ways it can benefit your business.

Related Articles: