Feb 2021

22

Plan for Jobs - £1,000 for Traineeships

In the July 2020 Plan for Jobs announced by Chancellor Rishi Sunak, an investment fund of £111 million is available to assist the largest development ever for traineeships and employers that provide a traineeship. An employer can claim a £1,000 bonus for each trainee that is enrolled under this new traineeship programme. The new project will help young people learn new skills and experience that will assist them in finding employment or an apprenticeship or equip them for further study options.

Registration for applicants for this scheme can now be made online here. The bonus of £1,000 will be available to employers to claim until 31st July 2021 and will help employers with the traineeship costs such as uniforms, travel cost and providing facilities. The maximum number of trainees an employer can claim under this programme is 10 trainees. Employers can claim this incentive of £1,000 per trainee for any trainee placement they have since 1st September 2020

The traineeship programme period will last for a period of at least 6 weeks and can be as long as 12 months. The programmes will help the trainees develop skills for the workplace such as digital skills in conjunction with English and maths skills. Traineeships will be combined with job placements for a minimum of 70 hours.

Research has shown that traineeship programmes have previously assisted nearly 120,000 young people since 2013 and two thirds of trainees either progress to employment or study further or partake in an apprenticeship within six months of completing the traineeship programme.

This scheme encourages and assists employers to help train or educate young people in conjunction with the apprenticeship scheme. Under the apprenticeship scheme employers can claim £2,000 for any new apprentice aged under 25 that is hired and £1,500 for any new apprentice aged 25 or older. This scheme will end in March 2021 and over 10,000 have already availed of this scheme.

Related articles:

- Minimum Wage Increase on 1st April 2021

- Changes to the Kickstart Scheme

- New Proposed Statutory Payment Rates Announced for 2021-22

Feb 2021

12

Minimum Wage Increase on 1st April 2021

The Low Pay Commission’s recommendations for the new National Minimum Wage were approved by Government and these new wage rates will come into effect on the 1st April 2021. The National Living Wage of £8.91 per hour will now be paid to employees aged 23 years and over instead of the previous age threshold of 25 years and older. This is an increase of 2.2% from £8.72.

The National Minimum Wage (NMW) is the minimum pay per hour most employees are entitled to by law. An employee's age and if they are an apprentice will determine the rate they will receive. The hourly rate for the minimum wage depends on an employee's age and whether they are an apprentice:

- The apprentice rate is applicable to apprentices aged under 19 and those aged 19 or over when they are in the first year of their apprenticeship

- Employees under 23 years old are entitled to the National Minimum Wage

- Employees aged 23 or over are entitled to the National Living Wage

Rates from 1 April 2021 will be:

Related articles:

Feb 2021

8

Two Factor Authentication Explained

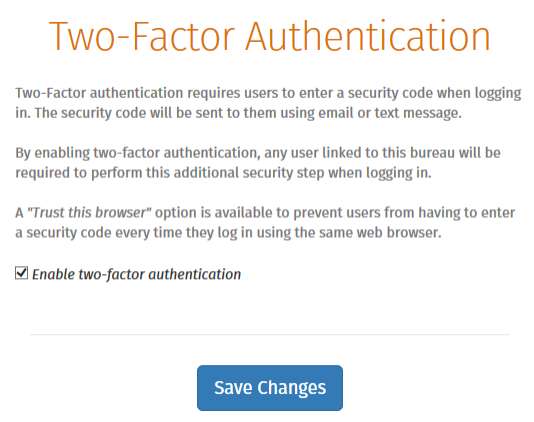

As security is a large concern for many businesses nowadays as data breaches are a threat to all entities, Two Factor Authentication can now be enabled as a feature for users of BrightPay Connect. Two Factor Authentication is a second layer of protection to re-confirm the identity for users logging into Connect through an internet browser or through BrightPay. This improves security, protects against fraud and lowers the risk of data breaches as users can access sensitive employer and employee data in Connect with the increased security layer.

BrightPay Connect is an optional cloud add-on feature that works with BrightPay. BrightPay Connect provides a secure, automated and user-friendly way to backup and a self-service dashboard to both accountants and employers so they can access payslips, payroll reports, amounts due to HMRC, annual leave requests and employee contact details.

How it works

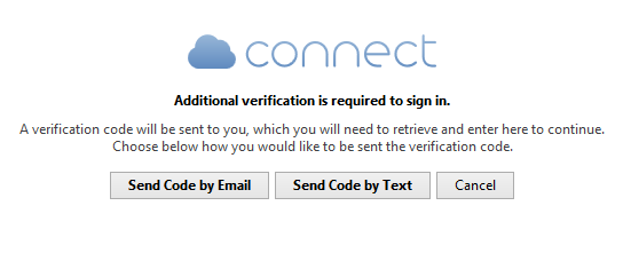

If Two Factor Authentication is enabled for a Connect account, when any user on the Connect account tries to sign into Connect via their internet browser here or through BrightPay, they will be asked to enter in a security code that needs to be sent to them. The user can select to have the security code to be sent by email or by text to the user.

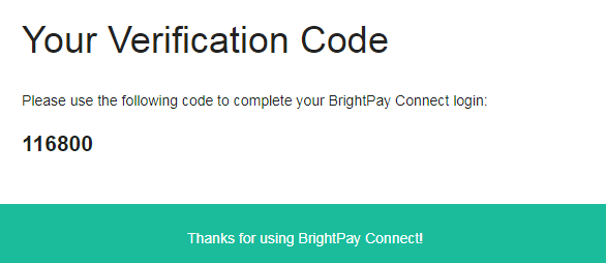

Once the user receives the security code the user enters this in the 'verify code' field and selects 'Verify Code'. The user will only be able to access the security code if they have access to the email account or mobile device. The random generated 6 digit security code will expire after fifteen minutes so a new code will have to be sent if the code is not used in the time limit.

This Two Factor Authentication uses a second security measure of identification ensuring the user is the correct user when logging into Connect. It adds an additional layer of security to an already secure hosted platform and gives the user more reassurance that their payroll data is safer and more secure.

To Enable this option in Connect when you are logged in > Go to 'Settings' > Go to 'Two Factor Authentication' > Tick the box > 'Save Changes'.

Related Articles:

- GDPR: Frequently Asked Questions

- GDPR and BrightPay

- Five Challenges Businesses Face When Switching Payroll Software

Feb 2021

1

Changes to the Kickstart Scheme

The Kickstart Scheme was introduced by the Department for Work and Pensions for employers in September 2020. This new scheme has created over 120,000 jobs since September 2020 for employees aged between 16 and 24 years old. It is helping young people start their careers as they have been some of the people hardest hit due to economic conditions from the global pandemic.

This scheme allows an employer or group of employers to create new placements for young people and apply for funding from the scheme. The 6 month placements are open to those currently claiming Universal Credit and in danger of long term unemployment. The job placements will allow the participants to gain experience and skills that will assist them in finding employment when they have completed the scheme.

There was a condition previously that an employer had to have a minimum of 30 job placements in order to qualify under this scheme but from 3rd February this threshold will be removed and employers will be able to apply to the Kickstart Scheme without this condition. The closing date for new applicants under this scheme was 28th January, but for employers who want to partake in this scheme they can contact one of the 600 gateway organisations that have been set up such as a Local Authority or Chamber of Commerce. The Department for Work and Pensions welcomes existing gateways continuing to apply to add more employers and job placements. There is £2 billion available under this scheme and the scheme will run until December 2021.

Under the Kickstart Scheme funding for 25 hours per week for 100% of the relevant National Minimum Wage category in addition to employer National Insurance contributions and employer minimum automatic enrolment pension contributions is available per participant. Funding of £1,500 for setup, support and training costs per placement is also paid. This scheme is available to employers in England, Scotland and Wales.

The job placements must:

- Be a minimum of 25 hours per week, for 6 months

- Pay at least the National Minimum Wage or National Living Wage for the person’s age category

- Only require basic training

Every application ought to include how the employer will aid the participants grow their skills and experience.

Development options could include:

- Providing support to the participants to seek long-term work, including career advice and setting goals

- Support with CV and interview preparations

- Developing their skills in the workplace such as timekeeping, attendance and teamwork

Related Articles:

Jan 2021

26

New Proposed Statutory Payment Rates Announced for 2021-22

As there was no Autumn Statement or Budget from Chancellor Rishi Sunak, the financial secretary to the Treasury, Jesse Norman announced a written ministerial statement in the House of Commons with details of the increase of the National Insurance thresholds. The 2020 Autumn Spending Review confirmed that the personal tax allowance and tax basic rate threshold would increase by 0.5%. This is based on the consumer price index.

This would mean that the personal tax allowance for 2021-22 would increase by £70 from £12,500 to £12,570 and the tax basic rate threshold for 2021-22 would increase to £37,700 from £37,500.

The annual National Insurance threshold for Small Employer’ Relief remains at £45,000.

Please see some rates details below:

Statutory Adoption Pay |

2020-21 | 2021-22 |

| Earnings threshold | £120.00 | £120.00 |

| Standard rate | £151.20 | £151.97 |

Statutory Maternity Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £151.20 | £151.97 |

Statutory Paternity Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £151.20 | £151.97 |

Statutory Shared Parental Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £151.20 | £151.97 |

Statutory Sick Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £95.85 | £96.35 |

Nov 2020

18

New Real Living Wage Rates Announced

The Living Wage Week took place from 9th to 15th November 2020 and as part of this week the new living wage rates details were announced. The new rates apply to employees aged 18 years of age and older from 9th November 2020, but employers who are already part of this scheme will have six months to apply the new pay rises.

The new London Real Living Wage announced by the Living Wage Foundation, has increased by 10p from £10.75 to £10.85 per hour. This helps reflect the higher cost of living facing families in the city. The UK Living Wage rate has increased by 20p from £9.30 to £9.50, an increase of 2.1%. The Government's current national minimum wage for over 25s is £8.72, which is £78p less than this rate.

It is estimated that over 250,000 employees will be affected by the new real living wage increase. An employee working 37.5 hours per week being paid the new Living Wage rate of £9.50 will earn more than £1,500 more annually compared to an employee on the current national minimum wage for over 25s. And an employee working the same hours per week in London being paid the new Living Wage rate of £10.85 will earn more than £4,000 per year compared to an employee on the national minimum wage for over 25s.

The total number of accredited Living Wage organisations is nearly at 7,000. Over 800 employers have been accredited by the Living Wage Foundation since the start of the Coronavirus pandemic. New companies that have signed up include Capital One, Tate & Lyle and All England Lawn Tennis Club.

An upgrade to BrightPay payroll software has now been released catering for the new Living Wage rates. For information about the Living Wage Foundation visit the Living Wage Foundation website here.

Sep 2020

17

Kickstart Scheme

The Kickstart Scheme allows an employer or group of employers to create new placements for young people and can apply for funding from the scheme. The people who are currently receiving Universal Credit and are in danger of long-term unemployment can be placed in these 6-month job placements. The jobs placements will allow the participants to gain experience and skills that will assist them in finding employment when they have completed the scheme.

Under the Kickstart Scheme funding for 25 hours per week for 100% of the relevant National Minimum Wage category in addition to Employer National Insurance contributions and Employer automatic enrolment pension minimum contributions is available per participant. Funding of £1,500 for setup, support and training costs per placement is available too. This scheme is available to employers in England, Scotland and Wales.

In order to apply for funding under this scheme an employer must have a minimum of 30 job placements. If an employer cannot offer the 30 job placements, they can become partners with other employers in order to reach the minimum number of placements required. Other organisations could include similar employers, registered charities, local authorities and trade bodies. Information about applying for a grant as a group of employers can be found here.

A company, regardless of their size, can apply for funding under the Kickstart Scheme. The job placements created by employers under this scheme have to be for new jobs and cannot be to replace existing or planned jobs or result in any existing employee or contractor to lose or reduce their employment.

The job placements must be:

- A minimum of 25 hours per week for a 6-month duration

- Paid at least the National Minimum Wage for the person’s age category

- Not need the participant to undergo lengthy training in order to undertake the job placement

Every application ought to include how the employer will aid the participants grow their skills and experience. Development options to be supplied by the organisations include providing support to the participants to seek long-term work and support with CV and interview preparation and assisting participants with basic functions such as timekeeping, attendance and teamwork.

Aug 2020

21

Thresholds to rise for Student Loan repayment from 6th April 2021

The Department of Education have announced the new student loan thresholds that will apply from 6th April 2021.

The repayment threshold for Student Loan Plan 1 will increase by 3% and the repayment threshold for Student Loan Plan 2 will increase by 2.7%.

The repayment threshold for the Postgraduate loans will remain the same.

For any loans before 2012, Plan 1 Loans will apply and for loans after 2012 Plan 2 Loans will apply.

Earnings above the thresholds for both Plan 1 and Plan 2 for 2021/22 will be calculated as normal at 9%. The rate of the postgraduate loan type introduced in the 2019/20 tax year will continue to be calculated at 6%.

Summary of the Student Plan thresholds:

- Plan 1 loans will increase from the current threshold of £19,390 to £19,895 in 2021/22.

- Plan 2 loans will increase from the current threshold of £26,575 to £27,295 in 2021/22.

- Postgraduate loans will not change and remain at the current threshold of £21,000.

A Student Loan Type 4 will come into effect from 6th April 2021 for students who have taken a loan out in Scotland. The First Minister has committed to the student loan repayment threshold which will rise to £25,000 in Scotland from April 2021.

In BrightPay 2021/22, the new student loan repayment thresholds for both plans will automatically be calculated by the payroll software and the appropriate student loan deduction applied.

Jul 2020

27

Connect – Calendar Updates

The calendar functionality in BrightPay Connect has been updated and improved, making it more user friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

Calendar Display

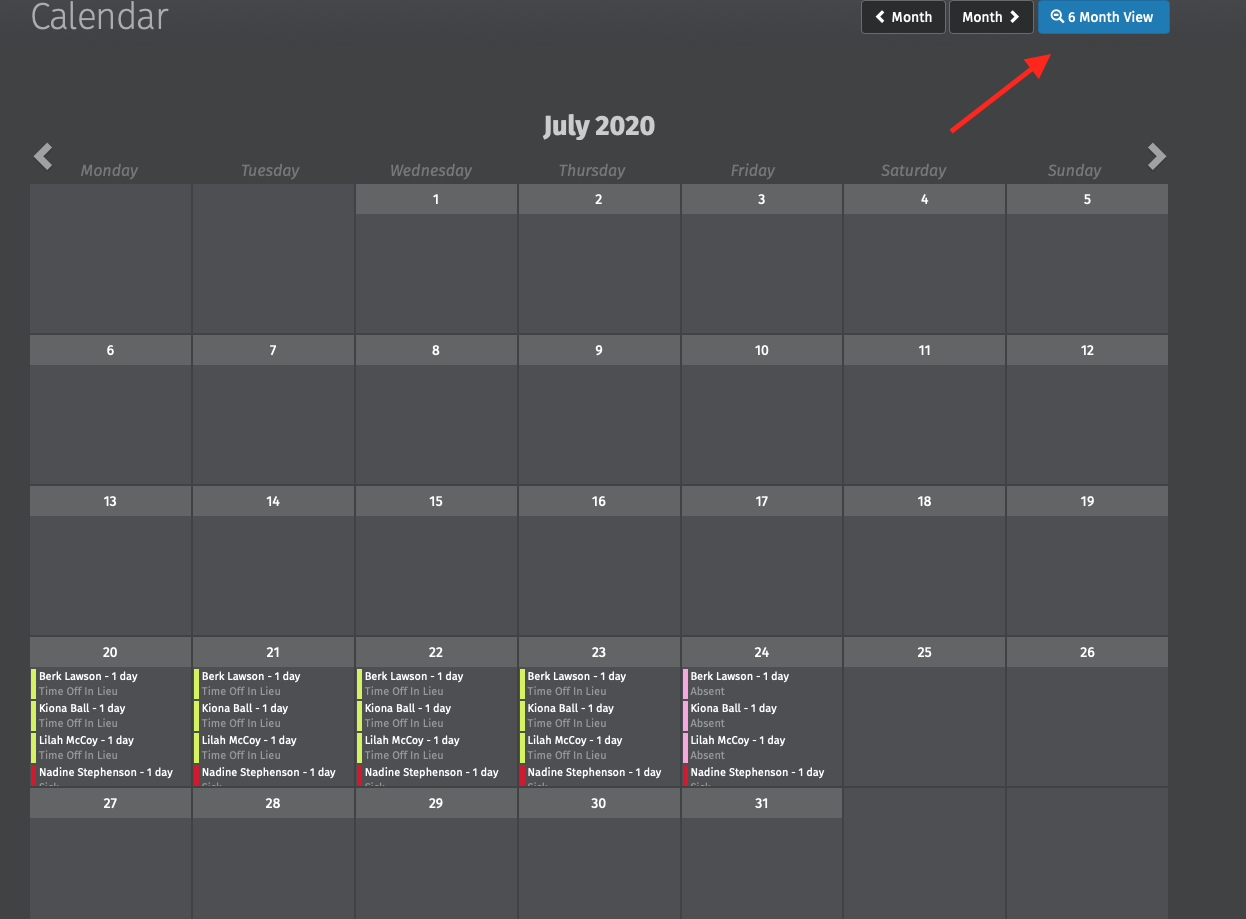

The number of months displayed on the calendar for both employers and employees can be selected, the options available are 3 months, 6 months, 9 months and 12 months. This can be selected under the Settings tab in the Employer portal, further details can be found here.

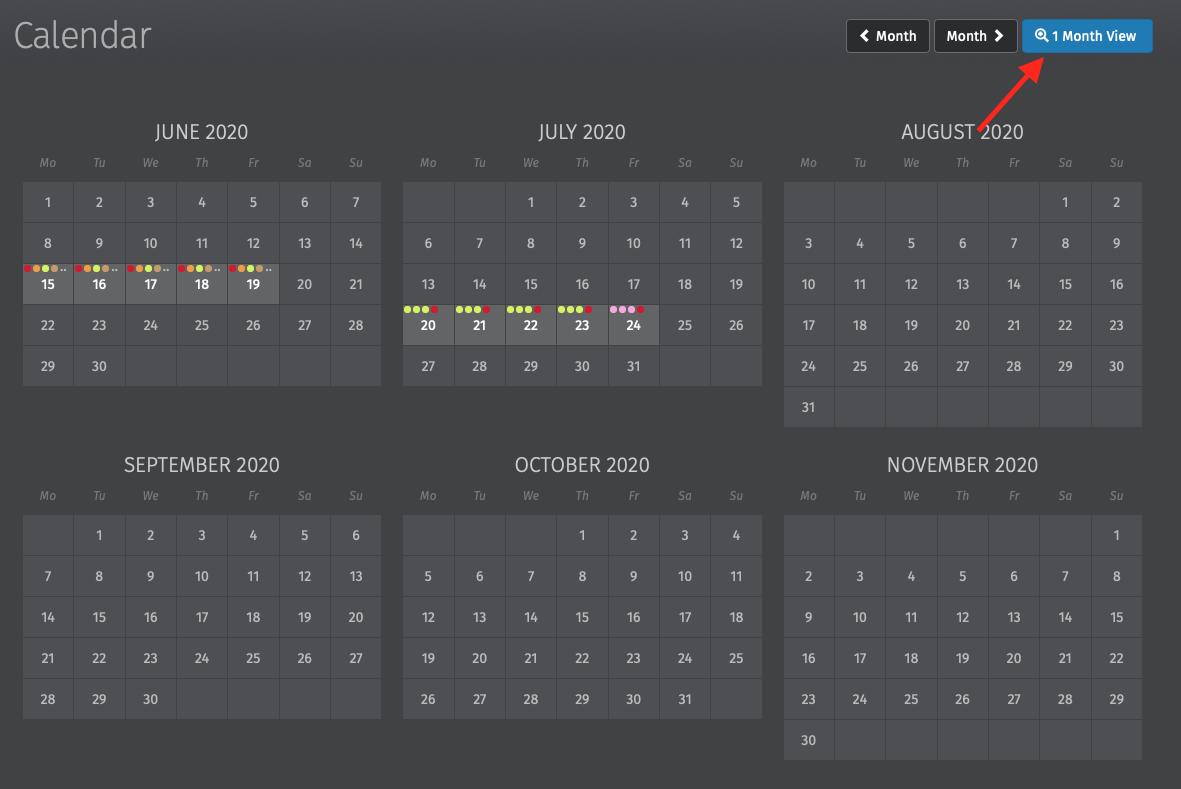

On the Employer or Employee Calendar in Connect the calendar can be displayed for one month or multiple months. One month view can be seen by selecting the '1 Month View' option. The view can be returned to the default number of months view by selecting ‘3 / 6 / 9 / 12 Month View’. On the ‘1 Month View’ there are new widgets for scrolling up and down through the number of leave entries on a particular date.

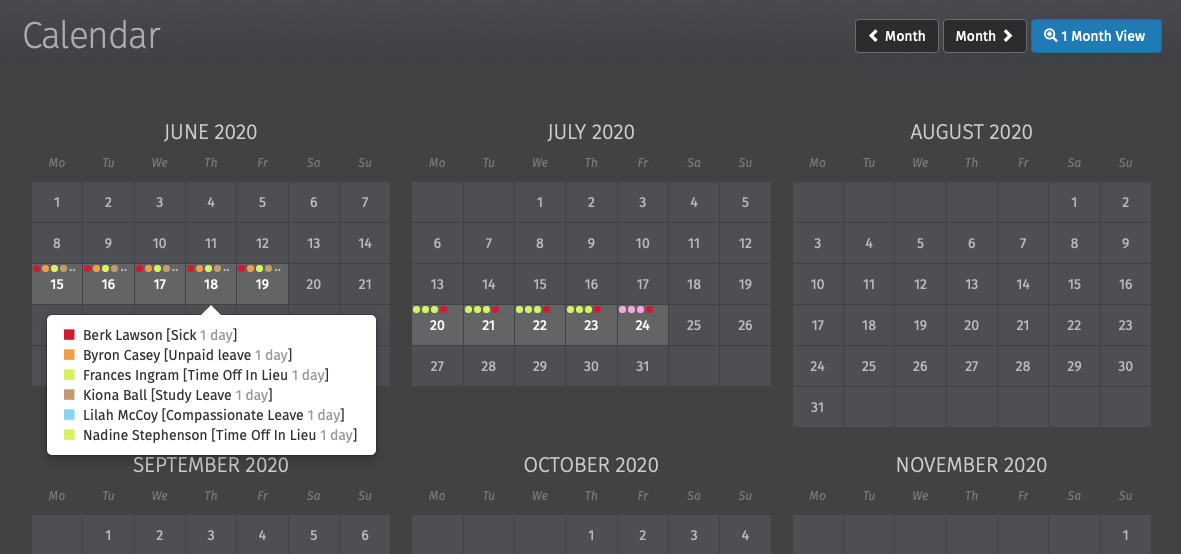

Dates with multiple types of events are dotted with the relevant colours. To see the breakdown, simply hover your mouse over the date. By selecting a date on the calendar a dialog box will open to show all the entries on that date without having to scroll.

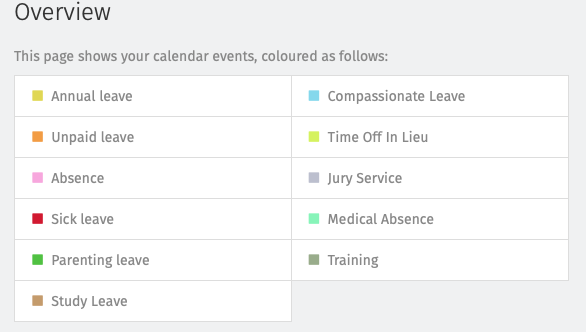

Custom Leave Types

Custom leave types are now available in BrightPay Connect. In BrightPay 2020/21 you can define nine additional custom leave types for employees. Six of the custom leave types are set up with default descriptions such as time in lieu and study leave. Instructions on how to add, edit or remove these custom leave types can be found here.

When a custom leave type is entered on the employee’s calendar in BrightPay and synchronised to Connect the leave type will be displayed on the calendar for both the employer and the employee to view on their online portal or mobile app. Custom leave can only be entered on an employee’s calendar by a user in Connect or on the employee’s calendar in the BrightPay employer file. Employees cannot request any custom leave types.

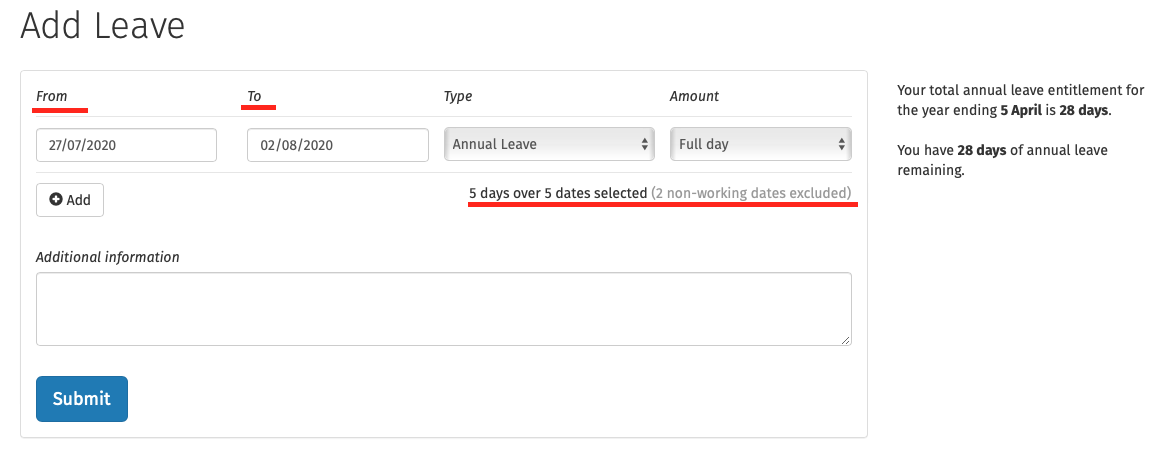

Adding/Requesting Leave

When employers are adding leave on an employee’s calendar in Connect or an employee is requesting leave, they are now entered as date ranges simplifying leave dates being selected. If the employer or an employee enter in an invalid date range (e.g. including non-working days in the date range) it will automatically correct this and only working days will be included in the request.

Interested in finding out more about how BrightPay Connect can streamline your leave management processes? Book an online demo of BrightPay Connect today.

Jul 2020

24

Coronavirus Job Retention Scheme (CJRS) Updates

Employers need to submit claims on HMRC’s CJRS online portal for any furlough payments under the CJRS that relate to periods ending on or before 30th June by 31st July 2020. You will no longer be able to submit a claim for the period up to 30th June after 31st July.

The CJRS was originally introduced by the government from 1st March in response to the coronavirus pandemic in order to give financial support to businesses and employees. Under this scheme all employers, regardless of size or business sector, could claim from HMRC a payment for 80% of the wage costs for employees that were furloughed up to a maximum of £2,500 per month per employee.

From 1st July 2020 employees that were previously furloughed can be brought back to work on a part time basis by their employers once an agreement is reached between the employer and the employee. Employers will still be able to claim under the CJRS for hours that are not worked by the employee. The new grant claim will be based on hours not worked by the employee and the normal hours an employee would usually work.

HMRC has also updated their guidance to confirm employers can claim amounts paid to an employee who is serving their statutory or contractual notice period up to the claim limit of 80% of their pay up to a maximum of £2,500 per month. However, grants cannot be used to substitute redundancy payments.

HMRC plan on introducing a method through the tax system to recover grant amounts overclaimed by employers under the CJRS. Repaying overclaimed grant amounts back will reduce or prevent any potential tax liability under that legislation. Tax liabilities may be due on any overclaim amounts. Further details will follow.

Interested in finding out more? Join BrightPay for a free webinar where we explore the key changes in relation to flexible furlough, phasing out of the Coronavirus Job Retention Scheme and changes to making a claim. Places are limited - click here to book your place now.