Feb 2022

15

The Updated Statutory Sick Pay Rebate Scheme

28/02/2022 Update: The Statutory Sick Pay Rebate Scheme will close on 17th March 2022 and employers have until 24th March to submit any new claims for absence periods up to 17th March, or to amend claims you have already submitted. You will no longer be able to claim back Statutory Sick Pay (SSP) for any COVID-19 related absences that occur after 17th March.

As of 25th March, there’ll be a return to the normal SSP rules, meaning it will be payable from the fourth qualifying day an employee is off work, regardless of the reason for their sickness absence.

BrightPay users should be aware of this change and select the normal SSP option when recording any sickness related absences from 25th March, regardless of whether or not it is COVID-19 related.

On 21st December 2021, it was announced that the Statutory Sick Pay Rebate Scheme (SSPRS) would be reopened in January 2022 for small and medium sized businesses across the UK. The scheme has been reintroduced as support for businesses impacted by the Omicron variant of COVID-19.

The updated SSPRS allows eligible employers to claim back some of their Statutory Sick Pay (SSP) costs for employees who are eligible for sick pay due to COVID-19. Businesses can also claim back SSP retrospectively for employees for any qualifying days on or after 21st December 2021.

Who can claim

The 30th of November, 2021 is the date used to establish an employer's eligibility for the SSP Rebate Scheme. To qualify to claim back SSP the employer must:

- Have a PAYE payroll scheme that was created and started on or before 30th November 2021

- Have had fewer than 250 employees on 30th November 2021, across all PAYE payroll schemes

Which employees can you claim for

Employers can claim back SSP for employees who qualify for SSP and who cannot work because they are off sick or self-isolating due to COVID-19 on or after 21st December, 2021 up until 17th March, 2022.

To claim back SSP for an employee they must meet the following criteria:

- The employee must be classed as an employee and have done work for you under their contract

- Must be sick for 4 or more days in a row (including non-working days)

- Must provide you with a “fit note” after 7 days

- Must earn an average of at least £120.00 per week for the 2021/22 tax year

Employees qualify as being off due to COVID-19 if they:

- Have COVID-19

- Have symptoms of COVID-19 and are self-isolating

- Are living with someone with symptoms of COVID-19 and are self-isolating

- Are in a support bubble with someone with symptoms of COVID-19 and are self-isolating

- Have been notified by the NHS that they've come into contact with someone with COVID-19

- Have been notified by the NHS that they need to self-isolate before surgery

How much can be claimed

- Employers can claim back up to 2 weeks SSP for each employee, which is in-line with the recommended 7 to 14 day isolation period.

- The SSP statutory weekly rate for 2021/22 is £96.35

- The maximum number of employees a business can claim for is the number of employees which were registered on the employer’s PAYE scheme on November 30th, 2021.

- SSP is paid only for the days an employee normally works

How to make a claim

- If you haven’t already, you must enroll for PAYE Online.

- Sign into the Gov.UK online service using your Government Gateway user ID and password that you got when you registered for PAYE Online to make your claim.

How your payroll software will cater for the SSPRS

BrightPay Payroll Software has recently upgraded their software to cater for employers making claims for employees who were off work due to COVID-19 on or after 21st December, 2021. Our Coronavirus SSP Rebate Scheme tool has been designed to assist users in ascertaining SSP reclaimable amounts for entry into Gov.UK’s online service for claiming back SSP.

The SSPRS will close on 17th March 2022 and employers have until 24th March 2022 to submit any new claims for absence periods up to 17th March 2022, or to amend claims you have already submitted. You will no longer be able to claim back Statutory Sick Pay (SSP) for any COVID-19 related absences that occur after 17th March.

Find out how to use BrightPay’s Coronavirus SSPRS claim report tool. To learn more about BrightPay, book a free online demo now and see the software in action for yourself.

If you’re looking to switch to BrightPay, we offer dedicated migration specialists to help you through the importing and set-up process. You can book a free migration consultation here.

Related articles:

Feb 2022

14

What the New Health and Social Care Levy means for employers

On the 7th of September 2021, the government announced a new 1.25% Health and Social Care Levy. The objective of the levy is to fund investment in the NHS, health and social care. This new plan for health and social care will lead to a permanent increase in spending.

In 2020 and 2021, government borrowing was at an all-time high, due to the COVID-19 pandemic. Because of this, it has been decided that increased taxation would be the most responsible way to fund these investments in health and social care.

What does this mean for employers?

The scheme is set to come into effect on 6th April 2022 and will mean that employees’ National Insurance contributions will increase. As an employer, if you pay Class 1, Class 1A or Class 1B National Insurance contributions, you’ll need to start paying the 1.25% increase in contributions from 6th April 2022. These changes will not affect employees who are above State Pension age and are not an employee or self-employed.

From April 2023, NICs rates will return to 2021-22 levels and the 1.25% levy will become a separate new tax. You will need to pay the separate 1.25% levy, and this will also apply to the earnings of individuals who are working and are above State Pension age.

See the gov.uk website for guidance on the Health and Social Care Levy.

What does this mean for payroll?

Your 2022/23 payroll software should be updated to cater for this increase. HMRC are also asking payroll processors to include the following message on the payslips of those affected by the increase:

‘1.25% uplift in NICs, funds NHS, health & social care’.

They are asking that this note be added so that employees understand the increase and what it is helping to fund. Users have the ability to remove this messaging, if they wish to do so.

From the 2023/24 tax year, when the levy becomes a separate tax, it will need to be shown on payslips as a new item. Your payroll software should be updated for the 2023/24 tax year to cater for this.

How do I add the HMRC message to payslips?

If you are a BrightPay customer, this message will be automatically added to the payslips of affected employees. If you are not a customer of BrightPay, depending on the software you use, this message may need to be added manually to payslips by the payroll processor.

While the 1.25% levy will show as a message by default on the payslips, it is optional. This option can be unticked under > Print Payslips > Options in the Payroll section of BrightPay 2022-23

Free Migration

If you’re looking to switch to BrightPay, we offer dedicated migration specialists to help you through the importing and set-up process. You can book a free migration consultation here.

Related articles:

Feb 2022

9

Case Study: Why this family run firm remains loyal to BrightPay

Fernhill Accountants are a family run accountancy firm located in Farnborough, Hampshire and have been in business since 2013. When they first started off, owner Judy Dean looked after the accountancy and taxation side of the business while her daughter Lucy later joined to take care of marketing and customer service. Fernhill Accountants’ clients are primarily micro businesses, and they have a mix of sole traders and limited companies. One of Fernhill Accountants’ first clients was a Community Interest Company (CIC), and since then they’ve built up their CIC client base. Fernhill Accountants offer bookkeeping, accounting, taxation and payroll services to their clients.

A software that grows with the business

Fernhill Accountants didn’t initially offer payroll services to their clients but when one of their CIC clients asked if they would do it, they agreed. As they were not sure if the payroll side of their business would work out and not wanting to commit resources too quickly to it, they started off by using HMRC’s Basic PAYE Tools. However, using Basic PAYE Tools to process payroll was time-consuming and because the functionality was so limited, tasks such as auto-enrolment were taking far longer than they should. “The functionality just wasn’t there. With the pensions and auto-enrolment duties coming in, it was all taking too long,” This is when Judy decided she needed to start looking for payroll software that would meet all their requirements.

Judy began researching the different payroll software available. This is when she first became aware of BrightPay. After looking into the various features of BrightPay and weighing the benefits up against other payroll systems, Judy felt confident that BrightPay could take care of her payroll needs. Reading BrightPay’s reviews on AccountingWEB reaffirmed her decision.

The importance of telephone support

Another payroll software provider which had been mentioned to Judy and which she had considered was Moneysoft. However, what helped her make the final decision was the fact that Moneysoft didn’t provide any customer phone support at that time, while BrightPay did. “One of the big reasons we went with BrightPay in the end was because you have telephone support,” Judy told us. Judy preferred speaking directly to a payroll specialist because from experience, phone support often solved problems quicker than email. And so, happy with all the information she gathered, Judy made the final decision and started using BrightPay for the 2017/18 tax year.

Time saved through integrations

Since Judy started using BrightPay to process payroll she hasn’t looked back. Straight away Judy noticed how quick and easy BrightPay was to use.

BrightPay includes direct API integration with a number of accounting packages. For Judy, BrightPay’s integration with accounting software Xero was important to have. “The integration with Xero has been great. It has saved me a lot of time. Thanks to the integration I can just send it over and adjust it if I need to – it’s so easy. I’ve also quite a few clients on BrightPay and Xero and it just flows through quite happily.” Another integration that has saved Judy time is BrightPay’s integration with pension providers, in particular, Nest. “We’ve clients who are on Nest and once we got through the initial set up it was very easy. It works out everything for you and the clients just pay them what they’re meant to pay and that’s it, job done,” she said. Judy also found the in-software notifications very handy for remembering pension related tasks, “The nudges the software gives you all the time to remind you what you need to do for auto-enrolment have been great. So yes, it works brilliantly; it’s secure and saves us so much time.”

BrightPay’s cloud add-on saves more time by cutting down on emails

Fernhill Accountants are also using the optional cloud add-on, BrightPay Connect. One of the ways Judy has saved time using BrightPay Connect is by giving clients access to an online dashboard where they can run payroll reports anytime, anywhere. “It’s more secure and saves me from having to email clients and add in the attachments. Everything the client needs is there. I don’t have to worry about making mistakes or not attaching the correct report.” “Before, when I had to save the reports and then go and find them and attach them to the emails it was taking me about 15 minutes per client each time. So now that we have BrightPay Connect we don’t need to do that anymore. It cuts out a lot of emails that would come in as well. The time saving is immense for me.” BrightPay Connect’s automatic online backup has also saved Judy time when processing payroll. “An additional benefit of BrightPay Connect is that your payroll data is automatically backed up to the cloud so we no longer have to back it up manually.”

Speaking to someone gets problems solved quicker

Another feature of BrightPay that has been very important for Judy and Fernhill Accountants is the level of assistance she receives from the support team. As mentioned, it is important for Judy that she gets to speak to someone over the phone whenever she needs help. “The support is excellent. Both email and phone. It’s great to be able to speak to a real person because when you’re not sure about what you’re doing, you don’t always explain it very well in an email. So, I find when I’m unsure about something when running payroll and I speak to BrightPay’s support team, they can kind of prise out of me what it is I’m doing or not doing and the issue gets solved a lot quicker.”

So, after four years of Fernhill Accountants using BrightPay to process payroll for their clients we asked Judy if she would be renewing her BrightPay licence next year. “Definitely, without a doubt,” Judy answered without hesitation. “When I first made the decision to use BrightPay I was hopeful that I wouldn’t be dissatisfied in any way, and I can honestly say I haven’t.”

If you want to find out exactly why Judy hasn’t looked back since making the move to BrightPay, schedule a free 15-minute demo of BrightPay and BrightPay Connect with a member of our team today. Or why not book a free 60-day trial of BrightPay and try the software for yourself with no obligation to purchase.

Dec 2021

22

Documents you must share with employees (and how you should share them)

What documents do I need to share with a new employee?

When hiring a new employee or worker there is certain information which you, the employer, must share with them. On the employee’s first day, they must be provided with a document known as a ‘principal statement’. The principal statement must include:

- The employer’s name

- The employee/worker’s name, their job title and/or description of work and their start date

- The employee/worker’s pay and how often they will be paid

- The employee/worker’s hours of work

- The employee/worker’s holiday entitlement

- Location/locations that the employee/worker will be working from (further details will need to be included if the employee is expected to work abroad)

- The length of the employment

- The length of the probation period and its conditions

- Information on any benefits

- Employee training information

Other information which the employee must be given on their first day which can be included on the ‘principal statement’ or can be provided separately includes:

- Sick pay and procedures

- Information on paid leave (eg. parental leave, bereavement leave.)

- Notice periods

Within two months of the employee starting, they must be given a ‘wider written statement’ which must include information on:

- Pensions and pension schemes

- Collective agreements

- Information on any other right to non-compulsory training provided by the employer

- Disciplinary and grievance procedures

Providing employees with payslips

For each pay period, employees must receive an itemised payslip which clearly shows:

- Total pay before deductions

- Total pay after deductions

- Amounts of any variable or fixed deductions

- A breakdown of how the wages will be paid if more than one payment method is used

What other documents should you share with employees?

While it is a legal requirement to share the documents which are listed above with employees, it is also important to clearly communicate company policies and procedures with employees. Examples could be an employee handbook, an IT policy, a working from home policy or a code of conduct document. Documents such as these helps establish what behaviour is expected of employees by the employer and to explain any consequences of breaching the guidelines. Not keeping employees up to date on what the company expects from them in terms of ethics and morals could result in legal or financial consequences for your business.

A regular staff newsletter is another example of a document that may be shared with employees. While not imperative, newsletters can be used as a way of keeping employees informed of staff events while also reinforcing your company culture.

How do I share documents with employees?

All documents should be easily accessed by employees. While you can share physical documents with employees, to save time and money, it is better to share these documents digitally. Sharing documents by email is another option but this can also become time-consuming. One of the best ways of sharing documents with employees is through an online employee portal where you can share tailored documents with individual employees or share company documents with multiple employees at once.

BrightPay Connect is an optional cloud add-on to BrightPay’s payroll software that allows employers to upload documents through their own online portal. Employees can then access these documents anytime, anywhere from the BrightPay Connect employee app on their smartphones or from an internet browser. Sharing documents with employees this way means they are instantly available for employees to view, whether in the office or working from home. Employees will receive a push notification on their mobile every time a new document has been uploaded or when the employer has updated a document. From the employer dashboard, you can also keep track of which employees have viewed which documents.

How can I generate employee documents?

BrightPay’s sister product Bright Contracts, syncs with BrightPay’s payroll software and allows you to easily create tailored employee contracts and staff handbooks which fully conform to the latest employment law guidelines. When there are any changes in employment law, Bright Contracts will automatically send you an update, making it easy for you to comply with employment law, even with no HR experience. These documents can then be uploaded via BrightPay Connect’s employer dashboard and shared instantly with employees.

To learn more about sharing documents with employees using BrightPay Connect, book a free online demo today.

Related articles:

Nov 2021

16

What to include on a payslip and how they should be shared with employees

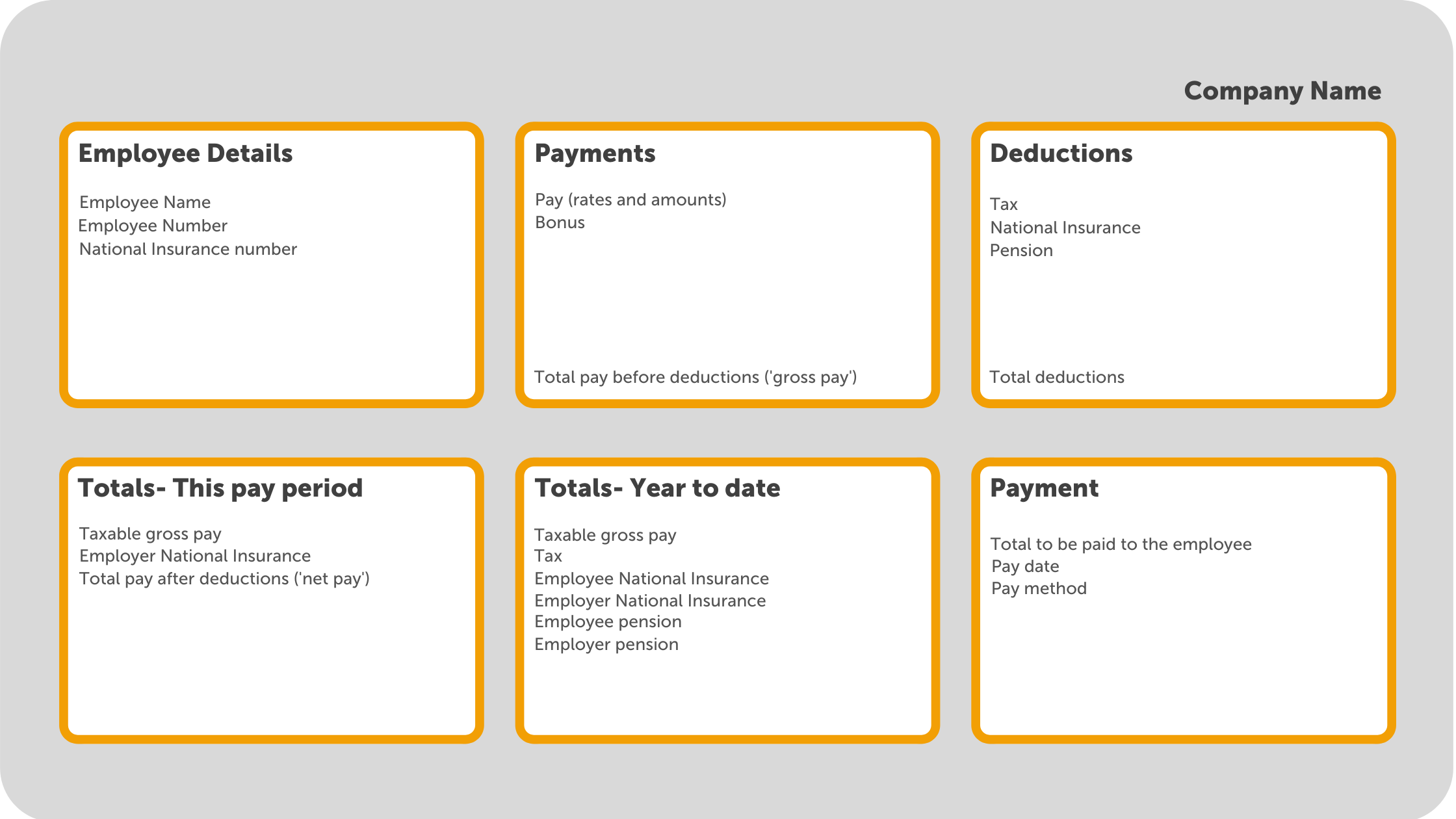

By law, employers must provide all employees with a payslip for each pay period. As well as giving employees a rundown of their earnings and any deductions there might be to their pay, payslips may be required as proof of income when applying for a mortgage or other loans. Payslips should be provided to employees either before or on the day they receive payment and are usually generated within the payroll software. According to ACAS, payslips must include:

- Total pay before deductions

- Total pay after deductions

- Amounts of any variable or fixed deductions

- A breakdown of how the wages will be paid if more than one payment method is used

Below is an example of information you may find on a payslip:

How should payslips be shared with employees?

- Employees’ payslips should be provided to them as at least one of the following:

- A hard copy

- Attached in an email

- An online copy

Giving employees a printed copy of their payslip is becoming less common. As well as the fact many businesses are digitising their paper processes, a payslip contains a lot of sensitive employee information, and a printed payslip could easily fall into the wrong hands. When emailing payslips, it is important that the payslip is password protected. More and more businesses are choosing to opt for sharing payslips with employees online. Not only do they save on paper on ink, but they are also more secure and can be easily retrieved when needed.

How can I provide employees with online payslips?

Some payroll software providers include an option to share employees' payslips through an online portal. BrightPay payroll software has a cloud add-on, BrightPay Connect, which includes an employee self-service mobile app where employees can view and download all new and historic payslips. Once a payslip becomes available, the employee will receive a push notification on their phone. If they do not have access to the app, they can also access their employee portal online from any device.

Sharing employees' payslips through an online portal such as BrightPay Connect is the best way to avoid payslip data breaches and insure you are in compliance with UK data protection laws. It also means that employees will always have access to all their past payslips and won’t need to come to their employer to request them.

Can you produce payslips using Basic PAYE tools?

You can use Basic PAYE tools (BPT) to produce payslips for your employees. However, the payslips produced will not include all the details which you are required to provide by law. By using a payroll software such as BrightPay, the payslips produced will contain all the information required by law, while also being customizable with the option of including additional information.

To find out more about how you can share payslips with employees online, book a free online demo of BrightPay Connect today.

Related articles:

Oct 2021

26

The hassle-free way to maximise profits from payroll processing

Accountants and payroll bureaus sometimes find that processing payroll takes a lot longer than they would like. Because of this, some accountants may be making little to no profit from offering payroll as a service. Nevertheless, it is a service expected by customers. If you aren’t making a profit from payroll processing, this could be down to not using the right payroll software. By switching to a payroll software that automates tasks you can transform payroll from a time-consuming manual process and into an easy process where certain tasks take care of themselves, saving you both time and money.

Accountants and payroll bureaus, have you found that that offering #payroll as a service is not cost-effective and that it can be a time-consuming and tedious process? If so, this doesn’t need to be the case. Discover how by joining our upcoming #webinar: https://t.co/fd7pWygAgm pic.twitter.com/jbsl9eVuaw

— BrightPay UK (@BrightPayUK) October 15, 2021

Not only can you make a profit from processing payroll but depending on what payroll software you use it can be an opportunity to maximise profits by allowing you to offer new services to your clients which you may not have considered before. When it comes to introducing your staff and your clients to new services, you may think you have enough on your plate and that it would take up too much of your time. However, BrightPay Connect, a cloud add-on to BrightPay Payroll software, has little to no learning curve, allowing you to immediately begin offering additional services to clients. Offering new features such as a self-service dashboard for clients, a mobile app for their employees or giving your clients access to new HR tools is a lot easier than you think.

In our upcoming free webinar “Optimising your payroll offering to improve profitability” you can find out all you need to know to stop payroll processing from being a loss leader and turn it into a money spinner. Register now.

In the webinar you’ll learn:

- The benefits of integrated payroll and accounting systems

- How batch processing can transform your payroll performance

- How you can streamline client communications

- Top tips for expanding your client base

- Pricing strategies that work – what other practices are doing

Please note: This webinar is specifically designed for accountants, bookkeepers, and payroll bureaus.

Webinar Information:

The webinar takes place on 28th October at 11.00 am and is free to attend for all accountants and payroll bureaus.

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related articles:

Sep 2021

22

What to include on a hybrid working policy

Post lockdown, as restrictions lifted across the UK, many of us returned to the office for the first time in over a year. And while it was great to have the option of returning to the office, it didn't necessarily mean that everyone wanted to, not on a full-time basis at least. Experiencing the longer lie-ins, no commute, and an overall better work-life balance, employers and employees alike have enjoyed the benefits of remote working. However, each employee is different and working from home may not be as suitable for some as it is for others. A 2021 survey by Forbes found that 97% of employees surveyed would prefer flexibility between working remotely and working in the office. Because of this, many businesses have adopted a hybrid working model.

What is hybrid working and how can an employee request it?

In the UK, hybrid working falls under flexible working and is when an employee works part of their time in the workplace provided by their employer and part of their time from home or anywhere else other than the normal place of work. Employees have the right to request that they work this way once they have worked continuously for the same employer for at least the last 26 weeks. Employees can do so by making a statutory application to their employer. The employer must then make a decision on the matter within three months, or longer if this is agreed to by the employee.

If the employer agrees to allow one or more employees to work a hybrid working model, a Hybrid Working Policy document should be created so that all staff are aware of how the new arrangement will operate. Because many employers now have experience with employees working from home, they should already be aware of the challenges and advantages it can bring. This will be an advantage for employers and HR managers as they put together their Hybrid Working Policy.

What information should be included in a Hybrid Working Policy?

The rules and limitations surrounding the company’s hybrid working policy should be clearly outlined in the Hybrid Working Policy, including:

- Are there any roles within the company which may not be suitable for remote working

- Will employees need to follow a hybrid working schedule

- Are there certain tasks which you, as an employer, would prefer to be taken care of in the office rather than at home (or vice versa)

- While working remotely, is the employee allowed to work anywhere or are there limitations. Examples of this may be that the employee must stay in the country or cannot work in public settings due to cybersecurity concerns

- What hours should an employee be working. Are there set working hours, when should they take breaks and what is the maximum number of hours they should be working each day

The policy should include details of how staff will be managed and supported as they work from separate locations, including:

- How should employees communicate with managers and colleagues and what should be done to ensure effective and fair communication

- How should new staff be onboarded

- How will employees’ performance will be managed

- How will employees’ health, safety and wellbeing be maintained

Guidelines for remote working should be clearly defined, including:

- What equipment is suitable for remote working and how will the equipment be provided

- What are the insurance requirements for the employer and the employee

- Details of a home risk assessment

- How cyber security will be maintained

How should a Hybrid Working Policy be shared with employees?

Once you have put together a Hybrid Working Policy, what is the best way to share it with employees? When sharing the policy with employees, you may want to share it with all or multiple employees at the same time. As employees may be working from different locations, it’s likely not possible to physically hand out the document to each employee.

You could email the policy to employees. However, emails are not always an effective way of getting your employees' attention. In a 2019 survey, 34% of respondents said that they sometimes ignore HR emails from their employer, while 5.7% even said that they always ignore HR emails. The reason for this may be that employees are simply overwhelmed by the number of emails they receive at work.

A better way of getting employees to read your new Hybrid Working Policy is by sharing it with them through an app on their smartphones. BrightPay Connect is a cloud add-on to BrightPay payroll software which includes an employee app which can be used to take care of a number of HR tasks. With BrightPay Connect, employers will have access to their own employer dashboard from where they can upload employee documents to be shared with employees through the employee app. Employers can share documents with individual employees, multiple employees or all employees if they wish to do so. This means employees can easily access all their documents in one place, be it their individual contract of employment or company-wide documents. Since the documents are available on the employees' phones, it also means they can be accessed anytime, anywhere.

When a document is shared with employees this way, each employee will receive a push notification on their mobile to notify them that the document has become available for them to view. With push notifications, because users can instantly read the alert on their device, they are less likely to ignore it like they may do with an email. Furthermore, employers can track who has and who has not read each document and so you can give them a nudge if needs be.

Reviewing and updating your Hybrid Working Policy

As hybrid working is still a relatively new concept for many employers, the policy should be reviewed regularly. Employers may want to make changes to the policy as the needs of the business and employees change. The updated policy can be quickly reshared on BrightPay Connect and employees, are once again alerted to it by push notification.

As well as sharing documents, you can also easily share payslips with employees using BrightPay Connect. Other HR functions of BrightPay Connect which are done using the employee app are annual leave management and updating employee information. To learn more about the many benefits of BrightPay Connect and how they can improve your business and ease the transition to hybrid working, book a free online demo today.

Related articles:

Sep 2021

14

BrightPay’s 2021 Customer Survey Results

Earlier this year, BrightPay conducted our annual Customer Satisfaction Survey. At BrightPay we are constantly trying to improve our products as well as our customer service. Our Customer Satisfaction Survey helps us identify in which areas we should make improvements. As it is an annual survey, it allows us to monitor customer satisfaction over time and evaluate the success of the changes we have made and the efforts we have put in throughout the year.

A total of 1169 customers took part in our survey. Just over half of those surveyed were employers on a standard BrightPay licence while the remaining were accountants or payroll bureaus who run payroll for multiple clients.

Below are some of the key stats from the survey:

For 2021 BrightPay received a 99.5% customer satisfaction rate. This means that our customer satisfaction rate has remained over 99% for the 7th year in a row.

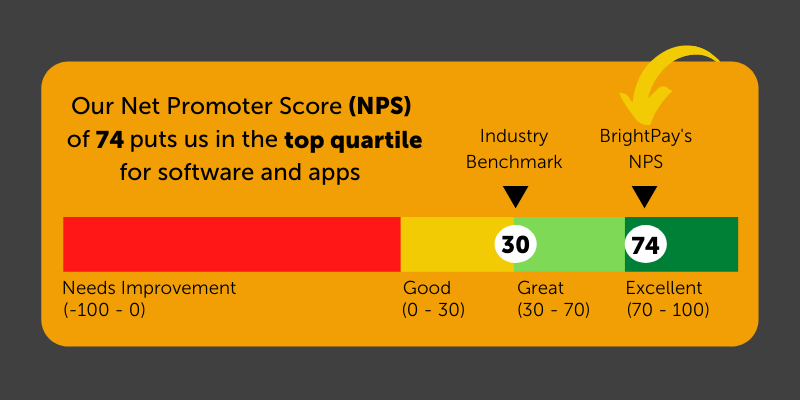

BrightPay’s 2021 Net Promoter Score (NPS) is 74. An NPS represents how likely customers are to recommend your product or service to others. With the industry average NPS score being 30, a score of 74 puts us in the top quartile for software and apps.

Of the 1169 customers surveyed, 166 had started using BrightPay within the last 12 months. 98.8% of our new users said that the software was easy to use. This score is thanks to our functionality and our user-friendly interface.

At BrightPay, unlike other payroll software providers, we do not charge for customer support. Because we do not profit from your need for help, this motivates us to make our software as user-friendly as possible. BrightPay customers can speak to one of our payroll experts by phone or email. If you need help switching from your old payroll software provider to BrightPay, we have a team of payroll migration experts on hand to help. As well as this, to help our customers, we hold free weekly webinars where we discuss current payroll topics and answer your payroll queries. We also have helpful videos, documents, guides and eBooks available on our website. It is because of this that our customer support has achieved a 97.5% satisfaction rate.

98.7% of customers surveyed said that they save both time and money by using BrightPay. This is through using our integrations with accounting packages, pension providers and a payments platform that allows you to pay employees, subcontractors, and HMRC, all in real-time.

Payroll bureaus and accountants can also save time by using our batch payroll processing feature which allows you to perform payroll tasks for multiple clients at the same time.

Another way you can save time and money is by using our optional cloud add-on BrightPay Connect, which 42% of BrightPay users surveyed said they also use. BrightPay Connect includes an employer dashboard which gives you a complete overview of the payroll information including managing employee leave, sharing payslips and other documents with employees. It also automatically backups the payroll data to the cloud every 15 minutes.

BrightPay Connect includes an employee self-service app which 99.1% of our customers surveyed said they love. From the app, employees can view current and historic payslips, request annual leave, view personal employment documents such as their contract of employment or companywide documents such as a monthly newsletter.

The 2020/2021 financial year was one like no other for BrightPay and for our customers. We all had to change the way we worked in order to adapt to the new world we found ourselves in. During the COVID-19 crisis, keeping up to date with the ever-changing furlough scheme and other wage support measures put in place by the UK government took centre stage for payroll processers. 99% of customers surveyed said they were satisfied with our handling of COVID-19 thanks to our software upgrades, free online webinars, online support documents and our phone and email support.

BrightPay would like to thank all those who took the time to take part in our Customer Satisfaction Survey. We believe that by listening to our customers' needs we can continue to grow and improve as a company. The full Customer Satisfaction Survey infographic can be viewed here. If you would like to find out more about BrightPay and BrightPay Connect, book a free online demo today.

Aug 2021

10

It’s time to go paperless: how an employee app can help

COVID-19 has accelerated the move to paperless systems for businesses all over the world. In retail we saw outlets curtailing the use of cash due to fear of spreading the virus; causing payment habits to evolve faster than ever. With more of us working remotely, the office has also seen rapid innovation and it has become crucial that businesses digitalise their paper forms. While some of us may have found the move to digital difficult at first, many of us are now used to it and can easily visualise a future where paper is no longer needed in the workplace. The pros of a paperless workplace far outweigh the cons and it has the ability to revolutionise the way we work.

The move to paperless is nothing new in the world of payroll processing. Going back to a time where payroll was done manually and without the help of software is unimaginable to most payroll processers. However, if you are still using paper anywhere in your workflow, it’s time to make the change and stop using it altogether.

BrightPay Connect is a cloud add-on to our payroll software that can help you to digitalise payroll and HR processes, allowing you to cut down on your use of paper and even stop using it altogether. So how can BrightPay Connect help you achieve this?

BrightPay Connect digitalises the following tasks:

- Sharing documents with employees such as contracts of employment, staff handbooks etc.

- Distributing payslips to employees

- Annual leave management

What are the benefits of digitalizing payroll processes?

1. Your company can save money

In the UK, surveys have found that the average amount spent by businesses on printing is £700 per employee. With 30% of print jobs not even being picked up from the printer and 50% of print jobs ending up in the bin within 24 hours, businesses are essentially throwing money away. A document such as a staff handbook can be as long as 100 pages. Say you have 40 employees, that adds up to 4000 pages and a lot of money being spent on paper and ink. Sharing the staff handbook through a cloud portal cuts out this cost altogether.

2. It is more convenient for you and your employees

With BrightPay Connect, staff have the ability to access important documents through the employee self-service app on their phone. This means they no longer have to store physical documents that can often be lost or get thrown away. It also means that if you would like to update or change any of the information in the document, it is easy to do so. Once the document has been updated, employees will receive a push notification to let them know the new updated document is ready to be viewed. Sharing a document online with a few clicks of a mouse is far more convenient than having to print off, sort through and physically distribute reams of paper. It also doesn’t matter where an employee is; in the office, working from home, or even on their holidays, everyone will have access to the document at the same time.

3. You can save yourself hours of time

Paper-based processes are notoriously slow and are more prone to error which can end up taking you hours to correct. One way you can save time with BrightPay Connect is by digitalising your annual leave management processes. Instead of having employees submit paper forms, the employee can request leave wherever or whenever suits them; be it from their desk or even in their own time through the BrightPay Connect mobile or tablet app. Once a request for leave has been made, the relevant manager will receive a notification on their own BrightPay Connect dashboard. From the dashboard, employers can either approve or deny the leave request. Through your dashboard, you can view a real time, company-wide calendar where you can see which employees are on leave, when they are on leave and the type of leave, saving you hours of time when dealing with annual leave requests.

4. It improves accountability

Another great benefit of using BrightPay Connect's online document sharing feature instead of paper is that it allows for accountability. From the employer dashboard, users have the ability to track who has read the documents which have been shared with them and who hasn’t. When it comes to managing annual leave through BrightPay Connect, you can assign users to manage requests from specific employees. You also will have a record of who has requested leave, when, and who has dealt with the request.

5. It improves security

Employee documents and especially payslips, are highly confidential documents which contain sensitive personal information. It is the responsibility of the employer to ensure that the employees' information is kept safe and secure. If you are still sharing paper payslips with employees, you are leaving them at high risk of a data breach. In the BrightPay Connect mobile app, employees will receive an email and a push notification when their latest payslip becomes available to be viewed or downloaded. From the app, employees can also view and download all past payslips. BrightPay Connect uses a design structure that maximises security. Each user will have their own login details and unique password. BrightPay Connect utilises the Microsoft Azure platform, keeping the employee’s personal information secure.

6. It helps you stay ahead of the competition

Technology is always evolving and by not moving from manual paper processes to digital ones, you are at risk of being left behind of the competition. Companies are having to continuously innovate to keep up with customers' expectations and payroll is no different. The digital transformation has changed employees’ expectations. To attract and retain top talent, employers need to replace old manual processes with digital solutions. In a recent employee survey, 91% of employees said they want digital solutions and 88% think that technology is a vital part of the employee experience.

7. You are helping the environment

Lastly, the biggest advantage of going paperless is that you are helping to save the environment. By curtailing the use of paper in the workplace not only are you saving trees, but you are also helping to reduce pollution, save water and cut down on the use of fossil fuels which are used to make ink. Turning a single tree into 17 reams of paper releases around 110 lbs of C02 into the atmosphere. It has become the responsibility of businesses to cut down on carbon emissions and going paperless is the first step you can take.

It is becoming increasingly important for businesses to make more environmentally friendly choices. In a recent BrightPay UK customer survey, 69% of respondents said that they would like to make more environmentally friendly decisions for their business. From the same survey, 42% said that it was either extremely important or very important for them to choose suppliers who make a conscious effort to reduce the impact they have on the environment.

Read about our own sustainability efforts here.

Why not book a free online demo of BrightPay Connect today and find out more about its benefits and how it can help your business go paperless.

Related articles:

Jul 2021

27

BrightPay Connect: More than just a cloud back-up

In BrightPay’s 2021 customer survey, we asked you which features of BrightPay Connect you were aware of. While the majority of customers were aware of all BrightPay Connect’s features, there were customers who admitted that they use BrightPay Connect solely for its automatic back-up of payroll data to the cloud.

It is understandable why this feature is of the utmost importance to many of our customers. The thoughts of something happening to your computer and you permanently losing important payroll data just doesn't bear thinking about. Also, the convenience of never having to manually back-up data again is a time-saver that you now could not live without.

However, if you are only using BrightPay Connect to back-up your data to the cloud it means you are missing out on a wide range of features that could benefit you, your business and your employees. You may feel the value of our cloud back-up feature is enough to justify the amount you pay for BrightPay Connect but by not taking advantage of our many other features, you could be missing out.

Employer dashboard

Even if you are only using BrightPay Connect as a cloud back-up, you should already be familiar with the employer dashboard. From the dashboard you can view all employees’ contact details, employees’ payslips, any outstanding amounts due to HMRC and reports that have been set up in BrightPay on the desktop application. Here is also where you will receive notifications when there are tasks that require your attention, for example if you have a new employee leave requests to complete. From the dashboard, employers can also access a company-wide annual leave calendar, making it easier to manage all staff leave.

Employers have the option to invite as many users as they wish to the BrightPay Connect employer dashboard at no additional cost. Colleagues can be added as co-administrators, or an external accountant can be added as a standard user which will give them access to the payroll data which has synchronised with the payroll software.

Employee self service

When you use BrightPay Connect you can invite employees to access their own self-service platform through any computer, tablet, or smartphone. Once logged in, employees will have the ability to:

- View or download all past and current payslips

- View or download other important employee documents which have been shared with them such as contracts of employment, staff handbooks, P60s etc.

- View their own personal annual leave calendar and their leave balance remaining

- Request time off anywhere, anytime; even on the go, straight from their smartphone

- Receive push notifications on their mobile when their newest payslip has become available, when a leave request has been approved or denied or when a new document has been made available to them

- Request updates or changes to the information their employer has on file for them

When employees have access to their own self-service platform, it means the employer can better manage their staff while giving them a sense of control and flexibility over their work life. Giving employees the power to access documents, request leave and update their information through their phone means less time spent by employers or managers on administrative tasks.

BrightPay Connect’s multi-user access feature means managers can be assigned to deal with annual leave requests from specific employees. For example, if you have a sales department, the Sales Manager can be assigned to deal with all requests from that department.

To start taking advantage of these great benefits simply log in to your employer dashboard to send your employees a welcome email containing instructions on how they can log in to their own self-service portal. View here for more information on how to get your employees started. Or why not request a free online demo of BrightPay Connect to learn more about how it works.

Related articles:

- Pay Employees Directly through BrightPay

- 6 payroll mistakes (and how to easily avoid them)

- Up your Payroll Game with an Online Client Portal