Jul 2021

15

Educate clients on BrightPay Connect using our new online resources

How to introduce new services to existing clients

When it comes to growing your practice, your focus may be on attracting new clients. However, introducing new services to your existing clients is also a great way to grow your business and increase its profitability. Selling new services to the clients you already have can be easier to do, as they already trust you and the services you provide.

Once you have decided on the new services you would like to introduce, how do you promote these new solutions to your clients? Email, your website and social media are all channels that can be used to promote your new services. However, promoting a new service isn’t enough if you do not effectively communicate the benefits of the new services being offered. Educating your clients on the full benefits of a service and instructing them on how to use it, means they will be able to get the most out of it, improving customer satisfaction.

Introducing your clients to the benefits of BrightPay Connect

So, you have decided to introduce BrightPay Connect, our optional cloud add-on into your practice. By linking payroll data and access to the cloud, this functionality offers you significant online benefits to enhance your payroll services, strengthen client relationships and increase profits. You may understand how much you, your clients and your clients’ employees can benefit from using BrightPay Connect but what’s the easiest way to inform clients of these benefits?

At BrightPay, we’ve done the work for you and have put all the information your clients need in one place. Below are three options for sharing the information with your clients:

1. Direct them to our new Client Hub Webpage

To bring clients up-to-date on your new services simply send them a link to the new Client Hub webpage on our website. There they will find:

- A client-focused demo video of how to use BrightPay Connect.

- A full list of BrightPay Connect’s features and how your clients can benefit from them.

- Information on the employee self-service app.

- A link to our Connect Employee Starter Pack with information on how to get started using Connect.

- Instructions on how your clients can invite employees to start using the app.

- Instructions on how your clients can invite line managers, department managers, HR managers and other colleagues to the employer dashboard.

- Links to other useful resources.

2. Send them our Client Hub PDF

Rather than sending your clients straight to our website, you can send them our Client Hub document instead. The document contains all the same information as the webpage and can be downloaded and read anywhere, on any device. The document could also be attached to emails being sent out to clients as a way of promoting this new range of services.

3. Embed our Client Hub PDF onto your own website

Creating a page on your own website where you can display all the information your clients need on BrightPay Connect is easier than you think. You can create a simple webpage where you have all your information on the new service you are offering and how much it costs etc. On the same page you can embed our Client Hub PDF, by simply pasting the code below into the HTML on your website:

<p><iframe src="https://www.brightpay.co.uk/guides/Client-Hub-UK.pdf" width="1080" height="1092"></iframe></p>

Visit here for help on how to embed code onto your website. Below is how the PDF will look once added:

For more information on how BrightPay Payroll Software and BrightPay Connect can automate payroll processes and help your practice become more efficient watch back our webinar ‘Optimising your payroll offering to improve profitability’.

Related articles:

- Payroll transformed: How client cloud platforms supercharge your bureau

- From process to profit: Four ways payroll processing can add to your bottom line

- The Future of Payroll: Pay employees in 90 seconds

Jul 2021

5

July 2021 Changes to Furlough Pay and COVID-19 Statutory Sick Pay Rules

How will furlough pay rules change in July?

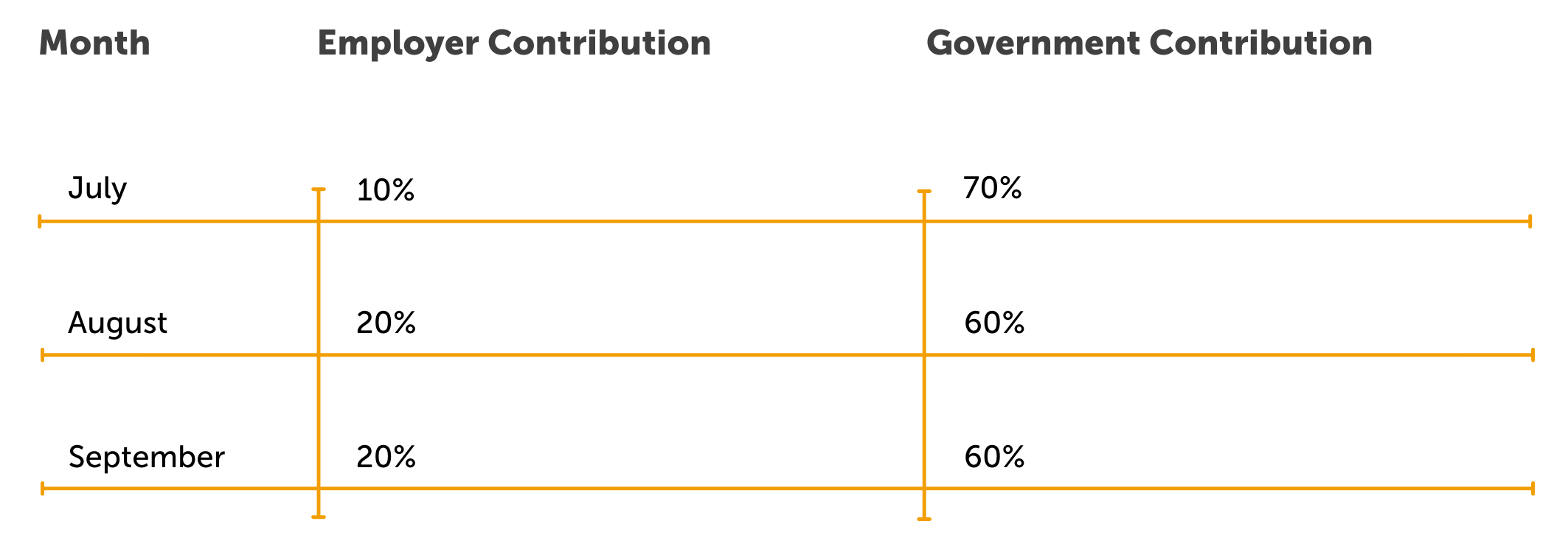

As of the 1st of July, 2021 employers will need to begin to contribute furlough pay for unworked hours. For July, the government will contribute 70% of the employees’ wages (up to £2187.50) while employers will be required to contribute the remaining 10% (up to £312.50). Employers will also need to pay any National Insurance and pension contributions. From August until the scheme ends on September 30th, the government will contribute 60% of their employees’ wages (up to £1875) while employers will be required to contribute the remaining 20% (up to £625).

The image below shows the contribution percentages for the furlough scheme from July to September 2021.

How will Statutory Sick Pay rules change in July?

When someone in your ‘support bubble’ (or your ‘extended household’ if living in Scotland or Wales) has tested positive for COVID-19 or is showing symptoms of COVID-19 you should self-isolate. Starting Monday, July 6th, employees who are self-isolating for this reason will now be eligible for SSP. The employee must self-isolate for at least 4 days to be eligible for SSP and is only entitled to SSP for any days they were self-isolating from July 6th onwards.

Related articles:

Jun 2021

21

Avoid penalties & pay HMRC within 90 seconds (even on weekends)

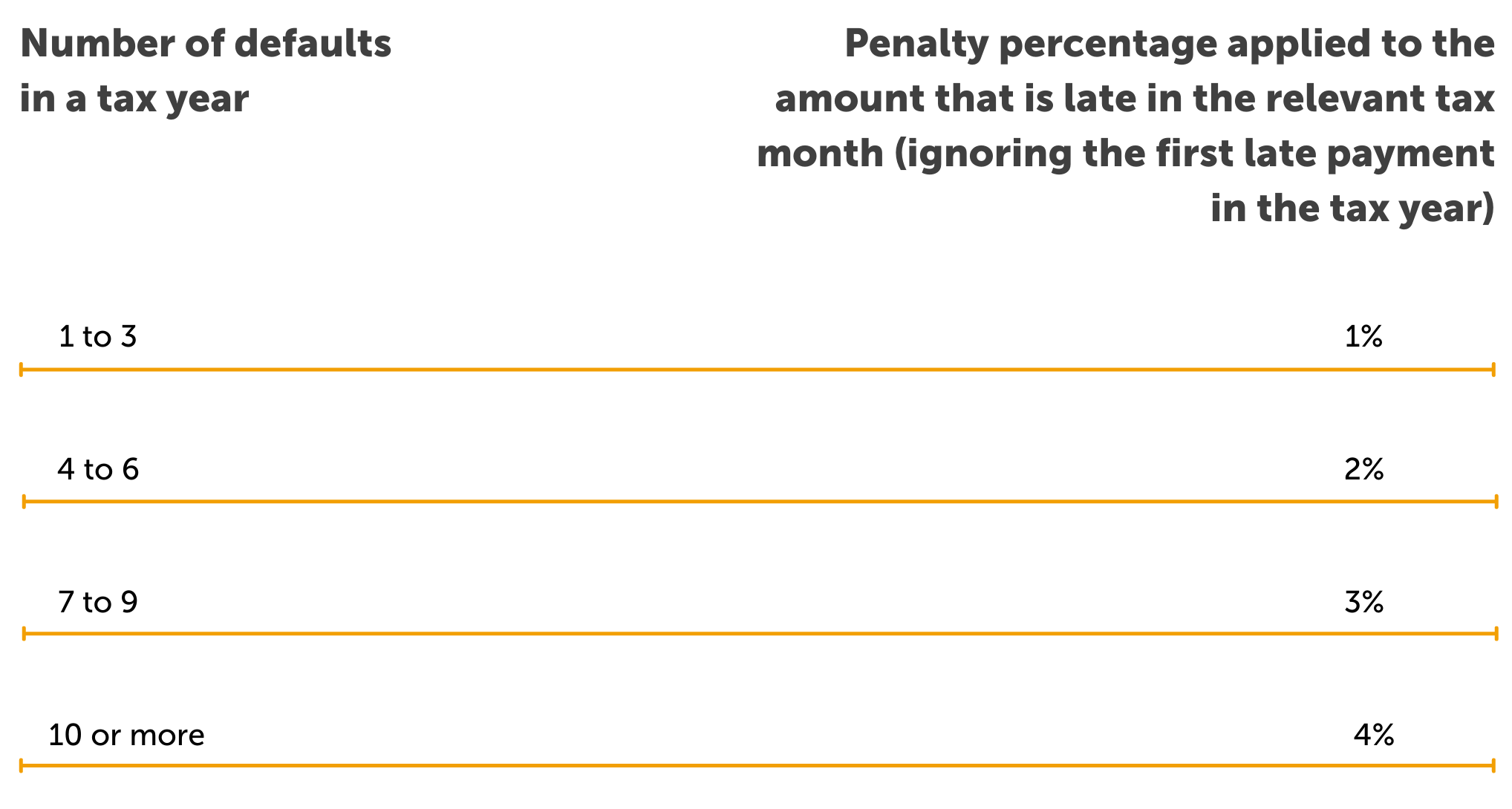

The late payment of income tax, National Insurance Contributions (NIC), student loan deductions and income tax due under the Construction Industry Scheme (CIS) can lead to penalties for employers and contractors of all sizes. With so much to think of when running a business, forgetting to pay your PAYE bill on time each period, can end up costing you.

Penalties for overdue payments:

Your bill must be paid by the 22nd of the next tax month if you pay monthly or by the 22nd after the end of the quarter if you pay quarterly. It can be easy to forget to pay on time, especially if you pay by card online, by Bacs or by cash or cheque at your bank, as with these methods you will need to allow 3 business days for your payment to process. If you are paying by direct debit for the first time you will need to give 5 business days for your payment to process and once set up, this method takes 3 business days to process. The waiting time for payments to process means payment deadlines can easily be missed, especially when weekends and bank holidays need to be considered.

What steps can you take to insure you don’t miss payments to HMRC?

Choose a payroll software that displays amounts due and keeps track of payments to HMRC

Your payroll software should facilitate the recording of payments made to HMRC. BrightPay is a payroll software which has a HRMC Payments tab from which you can view a detailed summary of your tax, NIC and student loan liabilities for the current period. From here you can also add any CIS deductions, tax refunds from HMRC or any funding from HMRC which may apply. Your amount due to HMRC will be displayed, and once a payment has been made, you can enter the amount paid and payment date.

Having this function in the payroll software serves as a reminder to payroll processers to send their payments to HMRC.

Pay HMRC directly from your payroll software - within 90 seconds

As mentioned above, certain methods of making payment to HMRC can take between 3 to 5 business days to process. If the deadline falls on a weekend or bank holiday you must make sure your payment reaches HMRC on the last working day before it. The only method of payment that can guarantee same day payment to HMRC, even on the weekend or bank holidays, is when you make payment by Faster Payments.

New to BrightPay this year is an integration with payments platform Modulr. Since March, our customers have been using this integration to pay their employees directly from the payroll software. Now, we have added a feature which allows you to pay HMRC directly from the payroll software through Modulr, using the Faster Payments method. This means that with a few simple clicks within the payroll software, you can have your payments sent and received by HMRC in under two minutes. The simplicity and convenience of using this method over others means that payments can be made at the eleventh hour, without having to worry about penalties for overdue payments.

Book a free BrightPay demo today and learn how BrightPay can help you avoid penalties, stay compliant and make running payroll as easy as possible.

Related articles:

May 2021

25

Free Webinar: Optimising your payroll offering to improve profitability

Today, your payroll and HR processes can be more automated and streamlined than ever before. It’s now feasible for payroll to be profitable for bureaus offering it as a service.

In this webinar, we explore various ways that accountants can automate payroll processes, and ultimately, become more efficient. Discover how you can work smarter and faster with BrightPay.

What you’ll learn:

- The benefits of integrated payroll and accounting systems

- How batch processing can transform your payroll performance

- How you can streamline client communications

- Top tips for expanding your client base

- Pricing Strategies that work – what other practices are doing

The webinar takes place on 1st June at 11.00 am and is free to attend for all accountants and payroll bureaus.

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

May 2021

14

The payroll mistake that could cost you (and how to avoid a fine)

At the beginning of the pandemic, we saw a sudden rise in the number of employers who were not complying with their auto enrolment duties. The number of warnings issued to employers who failed to comply with their auto enrolment duties increased by almost 200% for the months of July, August and September 2020, compared to the previous quarter. The Pension Regulator (TPR) introduced more flexibility at the beginning of the pandemic for employers who may be struggling, allowing them more time to ensure their pension contributions were up to date.

This rise in non-compliance at the start of the pandemic coincided with a dip in both employee and employer pension contributions. Although auto enrolment responsibilities remained in place throughout the pandemic, including for employees who had been furloughed, some employees chose to opt out or reduce their contribution levels. As the country begins to reopen, pension contributions have now returned to pre-coronavirus levels. Now more than ever, employees are realising how important it is to save for their futures.

As levels of enforcement are also now back to normal, it is important that employers are staying on top of their auto enrolment duties.

What happens if you do not comply with your auto-enrolment duties?

1. You will receive a warning letter informing you that you must take care of your duties by a certain deadline.

2. If you do not meet the deadline, you will receive a statutory notice telling you to comply with your duties and/or pay any contributions you have missed or are late in paying. You may also be asked to pay any of your staff’s unpaid contributions and interest on missed contributions.

3. If you fail to comply with a statutory notice, you will be issued a penalty notice or you may be sent a fixed penalty notice. The fine is fixed at £400 and must be paid within the period set out in the penalty notice.

4. If you still do not comply with the statutory notice you may be sent an escalating penalty notice. This gives you a new deadline to comply, after which you will be fined at a daily rate of £50 to £10,000, depending on the number of staff you have.

In the year ending March 2020, TPR issued a total of £23.1m worth of fines to employers who didn’t comply with their auto enrolment duties, with one employer fined £350,000 for failing to re-enrol staff into its workplace pension scheme.

Of course, sometimes employers can make genuine mistakes when trying to keep up with auto enrolment and re-enrolment duties, however, these mistakes can be easily avoided when you use a payroll software that caters for auto enrolment and re-enrolment.

Use a payroll software that makes auto enrolment easy

If you are notified that you have eligible jobholders who must be enrolled into a scheme, you can have them all enrolled in just a few simple clicks as BrightPay allows you to enrol multiple employees at once. When enrolled, BrightPay will automatically generate letters, informing employees that they have been enrolled. The letters can be sent by email, printed, or shared via our online portal, BrightPay Connect, in a matter of seconds. Sharing employees’ letters through an online portal is not only convenient, but it also helps the environment by cutting down on paper. Read here about BrightPay’s sustainably efforts.

Auto enrolment is an ongoing responsibility, and your duties don’t end once you have enrolled your staff and sent them their letters. As employees get older or their qualifying earnings change, there may be new duties you need to perform. Luckily, BrightPay will closely monitor any changes and notify you of any new duties.

On the three-year anniversary of when your auto enrolment duties first began, you will need to re-enrol staff. Failure to re-enrol can result in a fixed penalty from TPR. BrightPay will notify you of when employees are due to be re-enrolled into a pension scheme, meaning you don’t need to try and remember this date yourself.

To find out more about how BrightPay can help you stay on top of your auto enrolment duties, check out our videos on auto enrolment or book a free online demo of our software to see it for yourself.

May 2021

11

Leaving lockdown: How to manage the annual leave backlog

Employers are well used to staff wanting to take holidays at the same time. It is inevitable that certain times of year like Easter or Christmas will be more popular than others. As we remain in lockdown, most employees will want to save their time off for when restrictions are lifted. Last year, key workers who did not get to take all their statutory annual leave entitlement due to COVID-19 were allowed carry over up to four weeks of unused holidays into the next two years. While this flexibility was necessary to protect workers' rights, it has caused an annual leave backlog that could become a real nightmare for employers to manage.

While we know that “nothing can be guaranteed”, we cannot help but feel optimistic about Boris Johnson’s tentative plan to ease all lockdown restrictions on June 21st, 2021. There is even an online petition asking the government to make June 21st, 2021 a one-off Bank Holiday, to be known as Merriweather Day, as an opportunity for families and friends to come together. Once this date was announced there was a huge scramble in workplaces for employees to get their requests in to have the week of June 21st off. While it might not be possible to please everyone and give them this time off, it is important that you deal with annual leave requests in a way which is transparent and fair.

Some employers are choosing to force staff to take holidays at a time that better suits the business. While some employees may be perfectly happy with these tactics being enforced, many others will feel hard done by that they do not have any control over the dates that they take off. Offering to buy back employees’ holiday days that are in excess of the statutory minimum is another method that is being used, however, this could end up being expensive and hard to manage for employers. So, what is the best option for all parties involved?

An employee app that manages staff holidays

BrightPay Connect, an optional add-on to BrightPay’s payroll software, is the simplest way to manage your staff's annual leave – headache free. BrightPay Connect streamlines leave requests and leave approval. This is how it works:

- The employee requests leave from the calendar in their BrightPay Connect mobile app or from their PC or tablet. This means employees can request leave anytime, anywhere.

- The employer (or the person who has been assigned to oversee the management of that employee’s annual leave) is notified of the request on the dashboard of their own BrightPay Connect account.

- The employer/manager can then either approve or deny the request at the click of a button.

- The employee will receive a notification on their device informing them of whether their request has been approved or denied.

The most popular policy of granting annual leave is on a first come, first served basis. While this policy is the most fair; depending on the system in place, it can still be difficult to keep track of which employee requested the leave first. With BrightPay Connect, you don’t have that problem as you will be able to see the order in which requests come in. Employees also have the ability to request half days or request to cancel leave that has already been granted.

In the employer’s dashboard, from the calendar tab, the employer can view a real time, company-wide calendar. At a glance, employers see which employees are on leave and the type of leave. This is especially handy nowadays when staff may be working from home and it is hard to keep track of who is off and who is not. Cloud integration means any approved leave requests will flow directly back to your BrightPay payroll software on your PC or Mac.

Using BrightPay Connect to manage employee’s leave means less conflict in the workplace and less stress all round. Book a free demo today to find out the many other ways BrightPay Connect can improve employer/employee relationships.

Register for our upcoming free webinar where we will discuss preparing for the safe return to the workplace, the furlough wind-down, redundancies and vaccine policies.

Download our free whitepaper on tips for managing employees as lockdown ends. The guide includes: important HR tips and best practices as we approach the return to workplaces. Plus, our team of employment law experts reveal what you should avoid: https://t.co/Fwm24GNpob #payroll pic.twitter.com/obedP7QG1l

— BrightPay UK (@BrightPayUK) April 27, 2021

Related articles:

Apr 2021

28

How BrightPay celebrated Earth Day 2021

As you may know, at BrightPay we recently moved into our new offices which are purpose built to be energy efficient, affording us the opportunity to record and monitor our carbon emissions. It's a new start for the team and inspired by our energy efficient offices we would like to encourage employees to live a more sustainable lifestyle overall.

To help raise awareness amongst our employees, we have established the BrightPay Green Team which is made up of 12 team members, across multiple departments. The Green Team have been working on coming up with creative ways to make the company's operations more environmentally friendly. They also aim to encourage change amongst colleagues on an individual level, at home, at work and in the community.

In our first campaign to raise awareness, the Green Team celebrated Earth Day 2021 (April, 22nd) with a number of activities planned throughout the week.

As we continue to work remotely, we encouraged everyone to get involved and share photos of their activities online.

The BrightPay Team getting involved in Earth Day celebrations.

We started off our ‘Earth Week’ with ‘Meat Free Monday’. The production of meat and dairy products account for around 14.5% of global greenhouse gas emissions each year and so we encouraged employees to eat vegetarian or vegan meals for the day. On Tuesday we encouraged employees to take a walk in their local area. On Wednesday we asked employees to unplug devices, cut down on emails and have a ‘digital clean-up' to save C02 emissions. Thursday, April 22nd, was Earth Day and to celebrate we had a live online talk from Dr Emma Reeves, Senior Ecologist at the Forest, Environmental Research & Services (FERS) Ltd who discussed reducing our waste, the benefits of living a more eco-friendly lifestyle and the small changes we as individuals can make to help the planet. Friday was ‘Fresh Friday’ where we encouraged employees to go litter picking in their local areas.

Earth week was a success and we accomplished what we set out to do, which was to raise environmental awareness amongst our colleagues and encourage involvement in the company's sustainability efforts.

We will continue our dedication to creating a greener future. Subscribe to BrightPay’s sustainability newsletter to follow our journey.

Related articles:

Apr 2021

14

The Coronavirus Job Retention Scheme: Past, Present & Future

With the Coronavirus Job Retention Scheme (CJRS) to remain in place until September 30th, 2021 in the hope of aiding economic recovery, we are going to look at some of the key milestones of the scheme so far and how the scheme will change between now and September.

March 2020 – June 2020

The government paid 80% of furloughed employees wages up to a cap of £2,500, as well as employer National Insurance contributions and pension contributions. The rules at this time meant that employees had to be fully furloughed for a minimum of 21 days, and they were not allowed to work while they were on furlough.

July 2020 – October 2020

CJRS entered its second phase on 1 July 2020, and during these few months, the CJRS was only available to employers that have used CJRS 1 and only for employees they have previously furloughed. The government contribution to employees’ wages reduced month-on-month as the scheme was winding down. There were also some benefits to this part of the scheme, as flexible furlough was introduced, allowing furloughed employees to return to work part time, with no minimum furlough period.

October 2020 – April 2021

CJRS was once again due to end, but after mounting pressure, the scheme was extended at the eleventh hour, initially until March and then April of this year. The extended months of the furlough scheme were nicknamed CJRS 3 as it brought with it a new set of scheme rules, including the 80% government subsidy being reinstated.

April 2021 – September 2021

During the Budget, the chancellor announced that the furlough scheme would be extended yet again, and this time, it has been extended until the end of September 2021. With this extension, apart from eligibility changes in May, the rules will continue as they are currently until the end of June. However, the levels of subsidy support will change again from 1st July, where employers will be asked to contribute a percentage of their employees' wage from July onwards as the scheme winds down.

The past year has been very frustrating for payroll processors. Not only had you the added workload of processing furlough pay and making subsidy claims, but you also had to learn about the various changes to the Coronavirus Job Retention Scheme.

There was a lot of time involved in learning, and keeping up to date with changes, which were being announced very frequently. At the beginning, there were times when changes were even being made every week, and it was difficult to keep up to date with the latest guidance.

At BrightPay, we kept the payroll software up to date to cater for the relevant scheme changes. We tried to automate as much as possible in the payroll software to make your life easier. BrightPay has a furlough pay calculator, including support for flexible furlough, which is something many other payroll software providers did not cater for. We also have a CJRS claim report, to make it easier for users when calculating amounts for furlough claims.

In a recent survey, BrightPay achieved a 98.6% rating for our overall handling of COVID-19 including customer support, payroll upgrades, COVID-19 webinars and online support. We also won a COVID-19 Hero Award, and this is because of our response to COVID-19 and how we have helped our customers throughout the past year. The judges recognised that we went above and beyond to support payroll professionals at a time when they were under pressure with government schemes and trying to interpret guidance.

Join our free webinar where we will discuss CJRS rule changes, furlough extensions and other HMRC quirks.

To learn more about BrightPay’s features and how they can benefit your business, book a free demo today.

Related articles:

Apr 2021

12

CJRS: Recent Changes to Furlough Reference Period Rules

The Coronavirus Job Retention Scheme (CJRS) has been in place for over a whole year now. With this milestone comes changes to how an employee's furlough pay should be calculated. If you’re in a position where employees are fully furloughed, you do not need to work out the employee’s usual hours and furloughed hours. However, if an employee is flexibly furloughed, you will be required to work out the employee’s usual hours, their actual hours worked and their furloughed hours for each claim period.

How to calculate hours for workers who were eligible for furlough under the original scheme

Regardless of whether these workers were actually placed on furlough, the following three rules should be followed when working out furlough pay.

- For employees with fixed hours, the usual hours calculation is based on their normal contractual hours at the end of the last pay period ending on or before 19th March 2020. If an employee with fixed hours was on annual leave, off work sick, or on family-related statutory leave at any time during the last reference period, the usual hours should be calculated as if the employee had not taken that leave.

- Where the employee’s pay varies, their ‘usual hours’ will be the higher of the average number of hours worked in the 2019/20 tax year or the hours worked in the corresponding calendar period in the year before the furlough claim period.

- As we have passed the one-year anniversary of the furlough scheme, where the furlough claim period is March 2021 onwards, the corresponding calendar period 2019 should be used, as opposed to 2020. This is to prevent the issue where an employee may have been furloughed in the same month last year, and so would only have received 80% of 80% of pay. If your employee did not work for you in the lookback period for the month you’re claiming for, you can only use the averaging method to calculate 80% of their wages.

How to calculate usual hours for workers who were not eligible for furlough under the original scheme

For workers who were not eligible for furlough under the original scheme, for example, new joiners after the previous cut-off date of 19th March 2020, a different pay reference period exists.

Where these employees are contracted to work a fixed number of hours, the calculation is based on the wages payable in the last pay period ending on or before 30th October 2020.

Where neither 19th March 2020 nor 30th October 2020 reference dates apply, the employee is not eligible for periods starting before 1st May 2021. If you made a payment of earnings to the employee which was reported to HMRC on an RTI submission between 31st October 2020 and 2nd March 2021, they may be eligible for periods starting on or after 1st May 2021 and their reference date will be 2 March 2021.

For other employees, you’ll calculate ‘usual hours’ based on the average number of hours worked in the 20/21 tax year up to the day before the employee’s first day spent on furlough on or after either:

- 1 November 2020 (for those with a reference date of 30 October 2020)

- 1 May 2021 (for those with a reference date of 2 March 2021)

If you would like further information on how the furlough scheme rules are going to change between now and September 2021, join us for our upcoming free webinar where we will examine these changes and what they mean for your business.

Related articles:

Mar 2021

24

Payroll in the Connected Era: How integration has transformed the world of payroll

Application programming interface (API) integration makes our lives easier by simplifying processes. Put simply, API integration facilitates connectivity between two or more applications. APIs are everywhere and many of us use them on a daily basis. An example of an API is using your Facebook login credentials to sign into a third-party website or when you use your PayPal account to pay on an e-commerce site.

How can API integration help simplify your payroll processing?

BrightPay’s integration with HMRC, accounting software packages, pension providers and an employee self-service portal can help you improve your business and make life easier for you when processing payroll. Communication between BrightPay and other platforms means you can halve the amount of time that needs to be spent entering payroll data.

Some of the benefits of API integration when processing payroll include:

- Increased efficiency

- Increased productivity

- Time savings

- Reduced errors

- Data accuracy

- Simple processing

Coming soon: Pay employees directly through BrightPay

Coming soon to BrightPay – our latest API integration with payment platform Modulr will allow you to pay your employees quickly and securely, directly through BrightPay. Saving you time, maximising efficiency, and eliminating costly payroll errors. Learn more about BrightPay's integration with Modulr here.

Upcoming Webinar

On Tuesday, March 30th at 11am, join us for a live webinar where we will discuss the benefits of integration between your payroll software and your accounting software. We will discuss how BrightPay’s integration with Accounts IQ, Clear Books, FreeAgent, FreshBooks, Kashflow, Quickbooks, (Online), QuickFile, Sage One, Twinfield, Xero and Zoho can streamline payroll processes. There will also be a live demonstration of how this integration works within the software.

Webinar Agenda:

- The importance of automation

- What is payroll journal integration?

- How BrightPay’s journal integration can help your business

- The benefits of integrated payroll & accounting systems

- Other API integrations in BrightPay

Book your place now to join the live webinar on Tuesday, March 30th at 11am.

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related articles:

- Payroll Software: Why integration with accounting packages is a must

- BrightPay announces API integration with AccountsIQ

- What’s not to LOVE about BrightPay’s integration with FreeAgent

.png)