Jun 2021

1

Customer Update: June 2021

Welcome to BrightPay's June update. Our most important news this month include:

-

The importance of automated backups

-

BrightPay & QuickFile: Connecting Payroll and Accounting Software

-

P11D & working from home expenses: What you need to know

Leaving Lockdown & The Ongoing Need for Furlough

Although the UK is approaching the end of the roadmap out of lockdown, many businesses will need to avail of the furlough scheme until its very end in September 2021. Join BrightPay for a free webinar on 16th June where we discuss the furlough changes that are taking effect from the beginning of July.

Disaster Recovery and How Cloud Backups Can Help

Data loss poses a serious and unpredictable risk for many businesses. Never lose your payroll data again with BrightPay Connect as it maintains a chronological history of your backups. You can restore and download any of the backups to your PC or Mac at any time.

Digital Banking and its Impact on the Payroll Sector

Rather than using the traditional Bacs payment services to pay employees, you can use Faster Payments Service to send money in real-time between bank accounts. A digital payments infrastructure offers greater payroll flexibility, reducing unnecessary stress.

How to Manage the Annual Leave Backlog

A self-service system is the simplest way to manage your staff's annual leave – both from a HR and employee perspective. Give employees control to request annual leave, view leave taken and leave remaining all through an app on their smartphone or tablet.

Make your Payroll Bureau Service Stand Out

Introducing new cloud technologies to your clients and their employees can make it easier to grow your practice while saving money, time and improving efficiencies. Download this guide to discover easy steps you can take to ensure your bureau service stands out.

May 2021

21

What are the biggest GDPR advantages of BrightPay Connect?

BrightPay Connect is an online payroll and HR tool that offers significant benefits to help your business comply with the GDPR legislation. BrightPay Connect is an add-on to BrightPay on your PC or Mac that introduces powerful new features. The main objective of BrightPay Connect is to increase the efficiency and effectiveness of payroll work to keep in line with the GDPR guidelines by linking your payroll data to the cloud to enable new features.

Automatic Cloud Backup

Are you keeping your payroll files safe and protected? It is important to keep them protected in case of the event of fire, theft, cyber-attacks and damaged computers. BrightPay Connect is the solution. When you link an employer to BrightPay Connect, it will be automatically synchronised to the cloud as you run your payroll or make any changes. It is hosted on Microsoft Azure for ultimate performance and reliability. BrightPay Connect keeps a chronological history of all backups which can be restored at any time.

Employee Self-Service Portal

Are you trying to find ways to improve your time-management skills? You can invite employees to their own self-service online portal which can be accessed using a smartphone app or any web browser. Employees will be able to securely access and download payslips, P60s, P45s, submit annual leave requests and view leave taken and leave remaining and also view the personal details you currently hold for them, and request to make updates such as change of address, etc.

Bureau / Employer Dashboard

Are you looking for an easy and secure way to share documents? BrightPay Connect provides a self-service dashboard to both accountants and employers so they can access payslips, payroll reports, amounts due to HMRC, annual leave requests and employee contact details. You can also securely share resources, upload HR documents and get payroll data approval from the client electronically.

No Conflicting Payroll Copies

BrightPay Connect includes improved remote working functionality, including a ‘version checking’ feature when opening an employer, and an ‘other users check’ when opening an employer to prevent the risk of conflicting copies.

Two Factor Authentication

Two Factor Authentication is a second layer of protection to re-confirm the identity for users logging into Connect through an internet browser or through BrightPay. This improves security, protects against fraud and lowers the risk of GDPR data breaches as users can access sensitive employer and employee data in Connect with the increased security layer. Click here to find out more about how this feature works.

Data Input

Bright Pay Connect allows users to securely send payroll entry requests and payroll approval requests to their clients, changing the way payroll bureaus interact and communicate with clients. Once the hours are added/imported, information can be automatically synchronised to the employer file. Bureaus can then securely send a payroll summary back to the client for approval through BrightPay Connect. This will eliminate the need to exchange emails, reduce the double entry requirement and minimise errors from manual data input. Inputting data through BrightPay Connect’s secure portal will help with GDPR compliance.

Additionally, there is an audit trail of the requests being approved by the client. The audit trail includes each of the steps taken by your client and includes payroll files approved and submitted by the client.

HR & Annual Leave Management

BrightPay Connect also includes an employee calendar, which can keep record of all employees past and future leave including annual leave, unpaid leave, absence leave, sick leave and parenting leave. Employers can upload sensitive HR documents such as contracts of employment.

24/7 Online Access

Do you want to be in control at anytime and anywhere? BrightPay Connect allows mobile and online access at any time of the day. This fulfils the GDPR best practice recommendation to provide remote access to a secure system where individuals have direct access to their personal payroll data.

If you are interested in BrightPay Connect, why not attend one of our free online demos!

Related articles:

- The Key to Keeping in Touch with Employees while Working from Home

- 10 Benefits of using a Cloud Payroll Portal to Manage Employees Annual Leave

- The key to getting payroll information from your clients on time

- 3 Benefits of Employee Apps That You Never Knew

May 2021

14

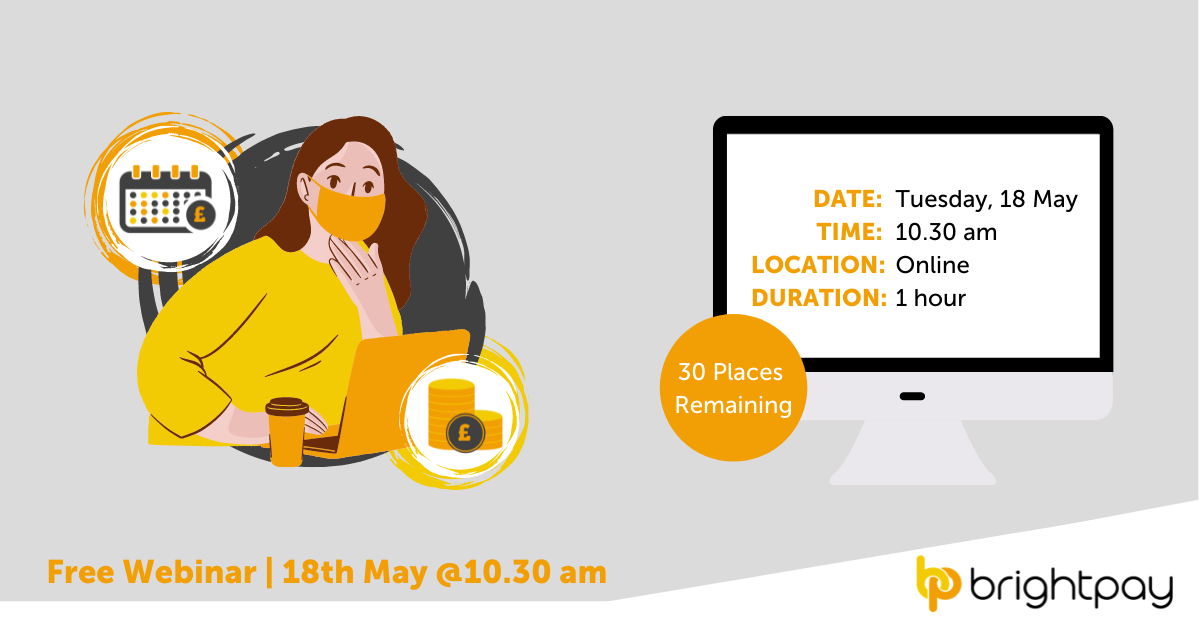

Free webinar: Leaving lockdown

Finally, the country is beginning to reopen and there is an end of COVID-19 in sight! BrightPay are hosting a free online webinar where our team of experts discuss the recent changes to the furlough scheme including the extension of the scheme until 30th September 2021.

Join our upcoming webinar on 18th May at 10.30 am BST and learn:

- Changes to scheme eligibility

- The wind-down of subsidy rates

- The challenge of reference periods

- The dos and don’ts of furlough agreements

- How BrightPay caters for furlough pay

- COVID-19 & Redundancies

- Vaccine Policy – Do You Need One?

- Managing the annual leave backlog

Don’t miss out – book your free seat here

Free eBook

Download a free copy of our latest eBook: Top tips for managing employees as lockdown ends (and what you should avoid). We discuss the need for a Vaccine Policy and other challenges that employers and HR managers will face over the coming months as the country re-opens and employees start requesting annual leave.

Related articles:

May 2021

4

Customer Update: May 2021

Welcome to BrightPay's May update. Our most important news this month include:

-

BrightPay celebrates Earth Day 2021

-

The Coronavirus Job Retention Scheme: Past, Present & Future

-

Can employees be furloughed more than once?

Don’t miss the P60 deadline

You need to provide a P60 for each employee on the payroll who was working for you on the last day of the tax year (5 April). All employers are legally obliged to issue P60s to employees by 31 May. You could face hefty fines from HMRC if you miss the deadline.

How to manage employees as lockdown ends

As the UK draws closer to the end of lockdown and employees return to the workplace from furlough, employers and HR managers have a busy few months ahead. In this guide, we highlight important HR tips and best practices to remember as we approach the return to the workplace (and mistakes to avoid).

Connecting payroll & payments

Eliminate the need to create bank files and forget the manual workload associated with making payments to employees and subcontractors. Join our free upcoming webinar to find out more about BrightPay’s new Direct Payments functionality. Click here to find out more.

Leaving Lockdown: Furlough, Redundancies & Vaccines in the Workplace

This webinar will discuss the furlough wind-down, redundancies and how to implement a vaccine policy in the workplace. Discover how the furlough rules are changing in May and how the government subsidy will gradually decline from July onwards.

Never lose your payroll data again

With our add-on product, BrightPay Connect, you don't need to worry about manually backing up your payroll data. BrightPay Connect maintains a chronological history of your backups. You can restore or download any of the backups to your PC or Mac at any time.

Upcoming webinar – How to choose the right payroll software for your business

There are so many payroll software providers on the market and each offer different packages and add-on products that choosing the right one for your business can become overwhelming. Join our free online webinar where we can help you make the right decision.

Apr 2021

29

Don’t miss the P60 deadline

All employers are legally obliged to issue P60s to employees by 31 May. This is a deadline, so aim to send them before this date. You can use your payroll software, such as BrightPay, to produce them. They can be issued to employees in paper form or electronically. Employees need their P60 to claim back overpaid tax, to apply for tax credits, or as proof of income if applying for a loan or a mortgage.

Does this include all employees?

You need to provide a P60 for each employee on the payroll who was working for you on the last day of the tax year (5 April). Therefore, you’re not required to issue P60s to employees who have left your business during the tax year.

How do I issue P60s in BrightPay?

- The P60 option is located within the Employees menu

- Select an employee who is in active employment as of 5th April from the left-hand listing

- Click P60 on the menu bar and simply select the P60 option you require

![]()

Go paperless. We encourage employers to supply P60s digitally to employees. There are many digital options available to you in BrightPay such as email or through the secure online portal, BrightPay Connect. If you do decide to print P60s, there is no need to buy special print paper, as P60 layouts produced by BrightPay have been approved by HMRC for printing on to plain paper.

Read about BrightPay’s sustainability journey.

What happens if I miss the deadline?

If you miss the 31 May deadline to issue P60s to employees, you could face hefty fines from HMRC. The initial penalty for missing the deadline is £300, followed by an additional fine of £60 per day after that. So, if you miss the deadline, make sure to give your employees their P60s as soon as possible or the fine will keep increasing. However, if you miss the P60 deadline due to a genuine error and you take steps to issue the P60 as soon as possible, a fine is less likely.

To assist employers in completing the 2020/21 tax year and transitioning to tax year 2021/22, BrightPay have compiled a list of frequently asked questions, answered by payroll experts.

Related Articles:

Apr 2021

23

Working from Home Tax Relief 2021/22

Working from home became normality for many people since the beginning of the COVID-19 pandemic in March 2020, and still is one year later. A recent survey estimates that 60% of us are still working from the confines of our own homes.

Some good news is that if your employer requires you to work from home, you can benefit from the working-from-home allowance. Employers can pay you £6 a week extra tax-free. And if your employer doesn’t add this allowance to your payslip, you can claim it yourself.

Employees can claim tax relief for additional household costs if you have to work from home on a regular basis, either for all or part of the week. This includes if you have to work from home due to COVID-19. However, you cannot claim tax relief if you choose to work from home. You can apply through the government's dedicated site where you can also check if you are eligible to claim. To claim, you'll need a Government Gateway User ID and password.

Additional household costs include things like extra heating & electricity expenses, work-related calls, internet connection and metered water bills. They don’t include costs that would stay the same whether you were working at home or in an office, for example, rent.

You’ll get tax relief based on the rate at which you pay tax. For example, if you pay the 20% basic rate of tax and claim tax relief on £6 a week you would get £1.20 per week in tax relief (20% of £6). You do not receive this money by cheque as it is done by altering your tax code that indicates to your employer how much tax to take off your payslip. Less tax will be taken off your payslip, meaning you’ll take home more.

You may also be able to claim tax relief on equipment you’ve bought for work, such as a laptop, office chair or mobile phone.

You can now claim for the 2021/22 tax year.

Related Articles:

Apr 2021

1

Customer Update: April 2021

Welcome to BrightPay's April update. Our most important news this month include:

-

BrightPay 2021/22 is Now Available – What’s new?

-

Ensure a smooth switch into the New Tax Year

-

The Impact the National Minimum Wage Increase has on Furloughed Employees

Furlough Extension: How the Rules are Changing

The furlough scheme has once again been extended, this time until the end of September 2021. The rules in relation to scheme eligibility, the levels of subsidy support, and the reference period used for newly eligible employees are all due to change between now and September.

Introducing BrightPay’s New Integration with Clear Books, FreshBooks, QuickFile and Zoho

We are delighted to announce our new API integration with even more accounting software solutions including Clear Books, FreshBooks, QuickFile and Zoho. This joins our growing list of Integration options created by us to ensure our customers save time and reduce the risk of errors.

Coming Soon: Pay Employees Directly through BrightPay

BrightPay’s new integration with Modulr will give you a fast, secure and easy way to pay employees through BrightPay. Processing payroll and paying employees shouldn’t be separate tasks and we have a solution! Coming next week.

IR35 - Are you Ready?

IR35 rules take effect 6th April. It is fast-approaching and recent studies found that 30% of businesses are unprepared despite organisations having had an additional year to prepare for the extension. Take action now with just under 1 week to go.

Greener Supply Chain with BrightPay

Here at BrightPay we take environmental responsibility very seriously and are committed to developing our business towards ecological sustainability at both a company and an individual level. Our new carbon efficient offices will open in 2021. We have also recently established a passionate Green Team to educate, promote and inspire sustainability to our employees and our loyal customers. Subscribe to BrightPay’s sustainability newsletter to follow our journey.

Mar 2021

19

The Key to Keeping in Touch with Employees while Working from Home

One of the biggest frustrations for many employees who now work from home is not having access to the physical paper-based files they had in the office. Many organisations still rely on a HR cabinet which stores sensitive employee data such as contracts of employment, annual leave requests and appraisal documents. Due to COVID-19, the new remote working culture has created many new challenges, data security being a significant one. How secure is your filing cabinet, particularly when you aren’t in the office?

Without the added challenge of a pandemic, HR productivity and managing HR workflows are everyday issues. Common tasks such as the managing of annual leave requests/cancelling requests or dealing with employee queries such as, ‘‘Can I have a copy of my last 3 payslips?’’ can take up unnecessary amounts of time.

BrightPay Connect can help. BrightPay Connect is an optional cloud add-on to BrightPay's payroll desktop application that offers employers flexibility and online benefits, making the payroll process easier.

Along with many other features, BrightPay Connect offers a HR Document Upload feature which allows managers to share documents with individuals, teams or the whole company at the touch of a button. Distribute the company handbook to all employees or upload an individual’s contract of employment, performance reviews or training material. The document upload feature ensures company documents are organised and that employees can securely access HR information anytime, anywhere using their smartphone or tablet device.

Regular communication is an essential way to help your teams adjust to home working. Without it your employees can feel disconnected, morale can dip, and priorities can become confused.

BrightPay Connect’s HR Document Upload tool can be used to distribute COVID-19 mandatory documents such as a COVID-19 Safe Working Policy, the company newsletter or details of the Return-to-Work Policy. The notification system will stand out and draw employees to read the communications via an employee app, avoiding it becoming lost in their email inbox.

Sending this important information directly to the employee’s phone is so much more powerful than simply sending a company-wide email. The click rate of a push notification is 7 times higher than that of email, and so it’s a great way of communicating with employees when it comes to important updates.

Things can – and should – be much simpler in your HR department. And with BrightPay Connect, that’s the new reality. Book a demo of BrightPay Connect today and see how you can eliminate time-consuming HR tasks.

Related articles:

Mar 2021

10

1 Year On: BrightPay & Covid-19

It’s been exactly one year since BrightPay sent all employees to work from home for 2 weeks as a mysterious flu-like disease called COVID-19 began spreading across Ireland and the UK. Those 2 weeks have turned in 52 weeks... and counting.

On March 10th 2020, employees were given access to all the tools and resources needed to work from home well in advance of the lockdown panic that came towards the end of March 2020. BrightPay worked with employees to try and strike a balance between ensuring employees could be productive and focused when not in the office, whilst also juggling often hectic home lives as we all adjusted to lockdown. Keeping in-touch and keeping moral up was a key priority.

The company was in a fortunate position to be able to continue employing all members of staff during such a scary and uncertain time. BrightPay’s COVID-19 response plan involved additional staffing and increased hours to assist customers. With payroll being an essential service and part of every business, the show had to go on!

BrightPay has been at the forefront for employers and accountants when it comes to the Coronavirus Job Retention Scheme (CJRS) and were one of the first payroll software providers to release software upgrades to cater for the furlough scheme as changes were announced. BrightPay's overall response to COVID-19 was rated 98.6% in a recent customer survey, and this included payroll upgrades, webinars, online guidance and customer support.

BrightPay won the COVID-19 Hero Award (supplier) at the Accounting Excellence Awards that took place recently. There were a number of criteria that were considered by the panel for this award. Judging took into account the speed, time and relevance of businesses’ COVID-19 response and how many customers accessed it.

Despite all the COVID-19 scheme changes, upgrades and webinars, the developers have been kept busy constantly improving the software and introducing new features. BrightPay’s optional add-on product, BrightPay Connect now supports two-factor authentication sign in. This means you can add an extra layer of security to the employer login on your BrightPay Connect account in case your password is stolen.

As remote and flexible working are now the new normal, BrightPay in tandem with BrightPay Connect will soon allow for a completely seamless "working from home" experience where there are multiple individuals who work on or require access to the same employer files. BrightPay Connect can help you prevent conflicting copies of the payroll, including an ‘other user check’ and a ‘version check’ when opening the payroll.

Let’s hope we all return to a somewhat normal life within the next year, and that I won’t be writing ‘working from home 104 weeks later’ this time next year. BrightPay wishes you the very best as we enter Year 2 of living with COVID-19.

If you are looking to change payroll software provider or looking to bring your payroll in-house, please don’t hesitate to get in touch. Book a free 15-minute online demo to see how BrightPay can change your world of payroll.

Related Articles:

Feb 2021

8

10 Reasons why People are Switching to BrightPay

Payroll software has evolved a great deal in the past decade. Advances in digital technology and cloud computing have helped to create a new breed of payroll software, with platforms that offer streamlined and automated processes, integration with accounting software and links to other helpful third-party apps and business solutions.

So, if you’re a payroll bureau that’s looking to update its systems, or an accounting firm that wants to upgrade its outsourced payroll offering, how do you choose the best software? To make it easier for you, we have summarised the key reasons why you should switch to BrightPay today.

Book a demo to discover more about BrightPay or read on to find out more.

1. At the forefront for COVID-19

With the Coronavirus Job Retention Scheme being processed through payroll software, our development and support teams have been working hard to provide a quick response with ample payroll upgrades. We have been at the forefront for our customers both with product upgrades and expert guidance. We were awarded a COVID-19 Hero Award (Suppliers) at the Accounting Excellence Awards.

2. Furlough Pay Calculator

BrightPay provides a furlough pay calculator to assist users with calculating pay for furloughed employees, including support for flexible furlough. BrightPay also includes a CJRS Claim Report to help you work out how much to claim when making a claim through HMRC’s online claim portal.

3. Automatic enrolment at no extra cost

Auto enrolment is free with all BrightPay licences. BrightPay automates many tasks and ensures employers comply with their pension duties, for example, BrightPay automatically assesses employees each pay period and notifies you when you have auto enrolment duties to perform. BrightPay includes direct integration with a number of pension schemes including NEST, The People’s Pension, Smart Pension and Aviva.

4. Integration with accounting & bookkeeping software

Directly send the payroll journal to your accounting software from within BrightPay. You no longer need to export the journal via a CSV file and upload it manually through your accounting software. It’s secure and reduces the risk of errors making it more seamless. BrightPay includes integration with Sage One, Quickbooks Online, Xero, FreeAgent, AccountsIQ, Twinfield and Kashflow.

5. Batch Payroll Processing

Process payroll for multiple companies at the same time with BrightPay. Batch finalise open pay periods, batch send RTI & CIS submissions to HMRC and batch check for coding notices. This feature is available for accountants and payroll bureaus who process payroll for a number of clients. It enables you to save time on administrative tasks, especially if you have a large number of single-director companies on your payroll, or payrolls that don’t change from week to week.

6. Free CIS Module

BrightPay caters for all subcontractor types, including companies, trusts, sole traders and partnerships on a weekly and/or monthly basis. BrightPay also creates CIS300 monthly returns for submitting to HMRC. The CIS module is free with all BrightPay licences.

7. Payroll software you can trust

We have been developing payroll software for almost 30 years and our products are trusted by over 320,000 businesses across the UK and Ireland. With a 99% customer satisfaction rate, it’s no surprise that BrightPay won Payroll Software of the Year awards in both 2018 & 2019.

8. Free Friendly Customer Support

We're here to help you every step of the way with FREE phone and email support. We also have a whole range of step-by-step guides and video tutorials available on our website. Not only do our team of experts offer product advice, but we also run free online webinars and distribute free eBooks regarding legislative updates and changes. Whether it’s Auto Enrolment, GDPR, Employment Legislation or COVID-19 Furlough Schemes, you will always be kept one step ahead.

9. Online access anywhere, anytime

With the BrightPay Connect optional add-on, you can access a whole range of payroll and HR features anywhere anytime. As well as the peace of mind of having your payroll data automatically backed up to the cloud, you will also have access to a secure online employer dashboard and employee smartphone and tablet app. Access employee payslips, run payroll reports, view amounts due to HMRC, manage your employees’ leave, upload and distribute HR documents, send notifications to employees and much more.

10. Cost-effective solution with a 60-day free trial

BrightPay's 60 day free trial is a great way for you to discover just how easy BrightPay is to use without having to make any commitment. The trial version has full functionality with no limitations on any of the features, including auto enrolment, CIS, payrolling of benefits, integration with accounting systems and much more. There is no obligation to buy. We will not ask you for any credit card details or get you to sign any contract. Should you decide to purchase BrightPay, our pricing structure is simple and straightforward with no hidden charges, in-year upgrade charges or additional charges for customer support.

But don’t just take our word for it. Have a read of our customer testimonials to see why 99% of customers would recommend BrightPay.

Book a free online demo of BrightPay to avail of a free migration consultation with the BrightPay team. You will be assigned a dedicated account manager to help you through your decision making and setup process, ensuring a smooth transition to BrightPay.

Download Free Trial | Book a Demo