Mar 2022

22

BrightPay 2022/23 is Now Available. What's New?

BrightPay 2022/23 is now available (for new customers and existing customers).

Over the past year, we have continued to focus the majority of our development efforts on bringing a version of BrightPay to the cloud, which we plan an announcement on soon. But work on BrightPay for Windows and macOS continues. Here’s an overview of what’s new in 2022/23:

2022/23 Tax Year Updates

- There are no changes to tax bands and rates for 2022/23 in England, Wales and Northern Ireland. For Scottish tax codes, the bands have been updated for 2022/23. The emergency tax code remains the same as it was in 2021/22.

- 2022/23 employee and employer National Insurance contribution rates, thresholds and calculations, including:

- Support for new Veterans NIC

- Support for new Freeports NIC

- Support for Mariners NIC

- 2022/23 Student Loan and Postgraduate Loan thresholds.

- 2022/23 Statutory Sick Pay rates.

- 2022/23 rates and average weekly earnings thresholds for Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay and Statutory Parental Bereavement Pay.

- 2022/23 rates and calculations for company cars, vans and fuel.

- Ability to process 2022/23 HMRC coding notices.

- April 2022 National Minimum/Living Wage rates.

- Eligible employers can continue to claim Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

- 1.25% Health and Social Care Levy note appears by default on payslips, as requested by HMRC. It can be turned off if need be.

- BrightPay 2022/23 version 22.1 (released on 24/03/2022) also contains the following updates announced in the 2022 Spring Statement:

- Increase to the National Insurance Primary Threshold for Class 1 NICs.

- Annual Employment Allowance limit increased to £5,000.

Automatic Enrolment Updates

- 2022/23 qualifying earnings thresholds.

- For 2022/23, the minimum required pension contribution level continues to be 8%, at least 3% of which must be contributed by the employer.

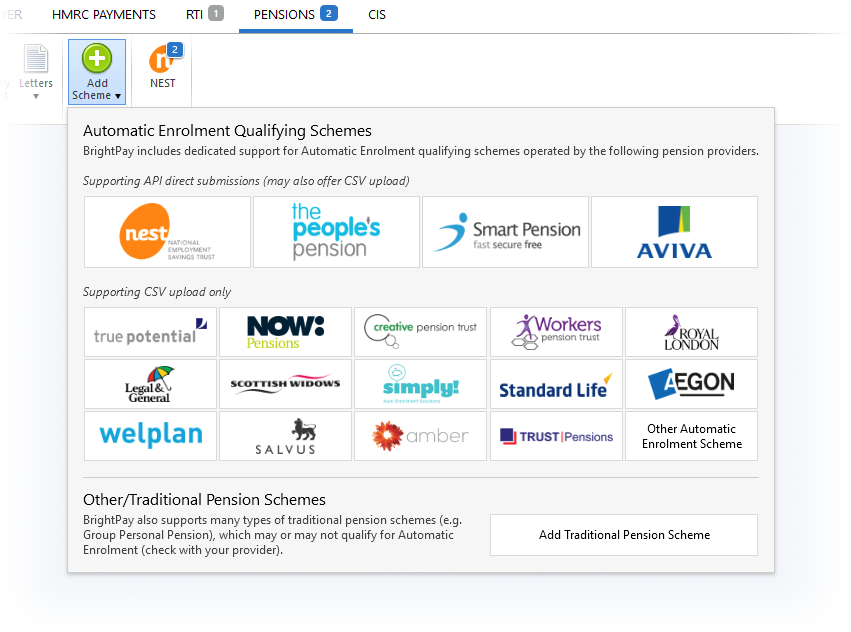

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions to ensure continued compatibility with all pension scheme providers.

BrightPay (for Windows) is now 64-bit

BrightPay for Windows is now a 64-bit application. This does not make any difference to the experience of using BrightPay or its functionality, but it comes with a few nice optimisations:

- 64-bit apps just run better on 64-bit versions of Windows (which our telemetry shows us nearly 95% of our customers are using).

- 64-bit apps are able to access more computer memory than 32-bit apps can. This means that BrightPay will more smoothly handle employer files with a very large number of employees, which for certain operations can see memory spikes.

A 32-bit version of BrightPay for Windows will continue to be made available for those who need it.

(This does not affect BrightPay for macOS, which has always natively supported 64-bit Macs where applicable.)

Other New Features and Updates in 2022/23

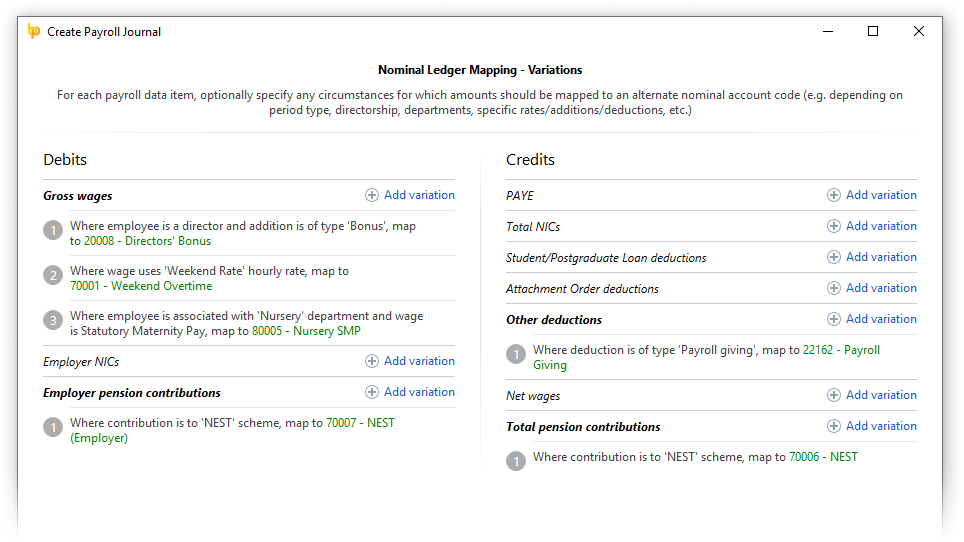

- Support for manual journal entries. This can be used to account for things like Employment Allowance or recovered statutory pay in journals, as well as anything else.

- Improves handling of employee payment/bank details – changes to details now automatically apply across the whole tax year, meaning that finalised payslips no longer need to be re-opened first.

- The user interface for finalising and re-opening payslips now uses progress bars.

- Several additional minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

Includes all updates made to BrightPay during the 2021/22 tax year

Here's a quick reminder of some of the main areas of improvement:

- Ability to pay employees, subcontractors, or HMRC using Modulr.

- Supports the latest UK and London Living Wage rates, announced in November 2021.

- Various improvements to validation and on-screen guidance to aid data accuracy and quality.

- Support for additional Automatic Enrolment pension scheme providers.

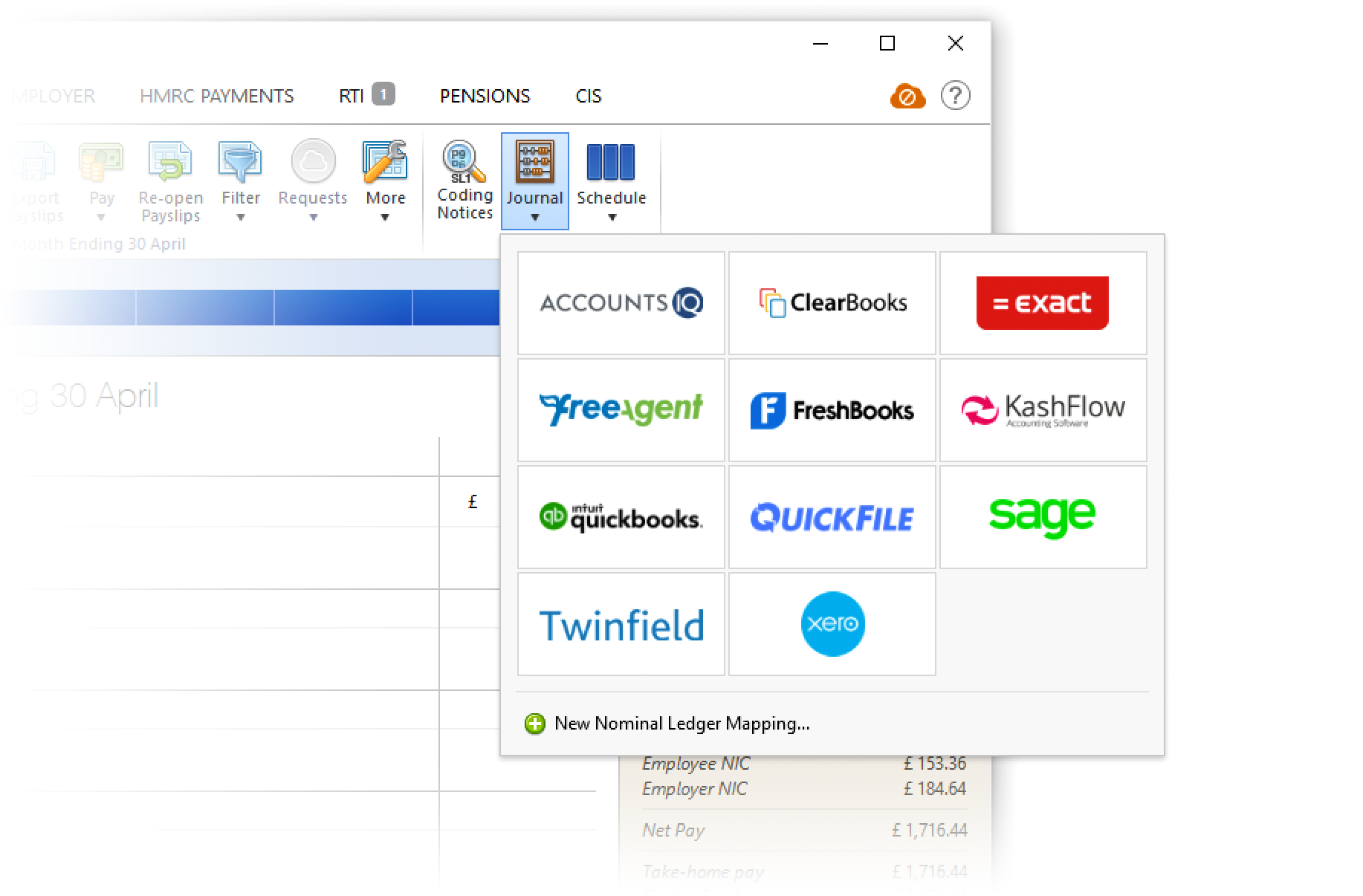

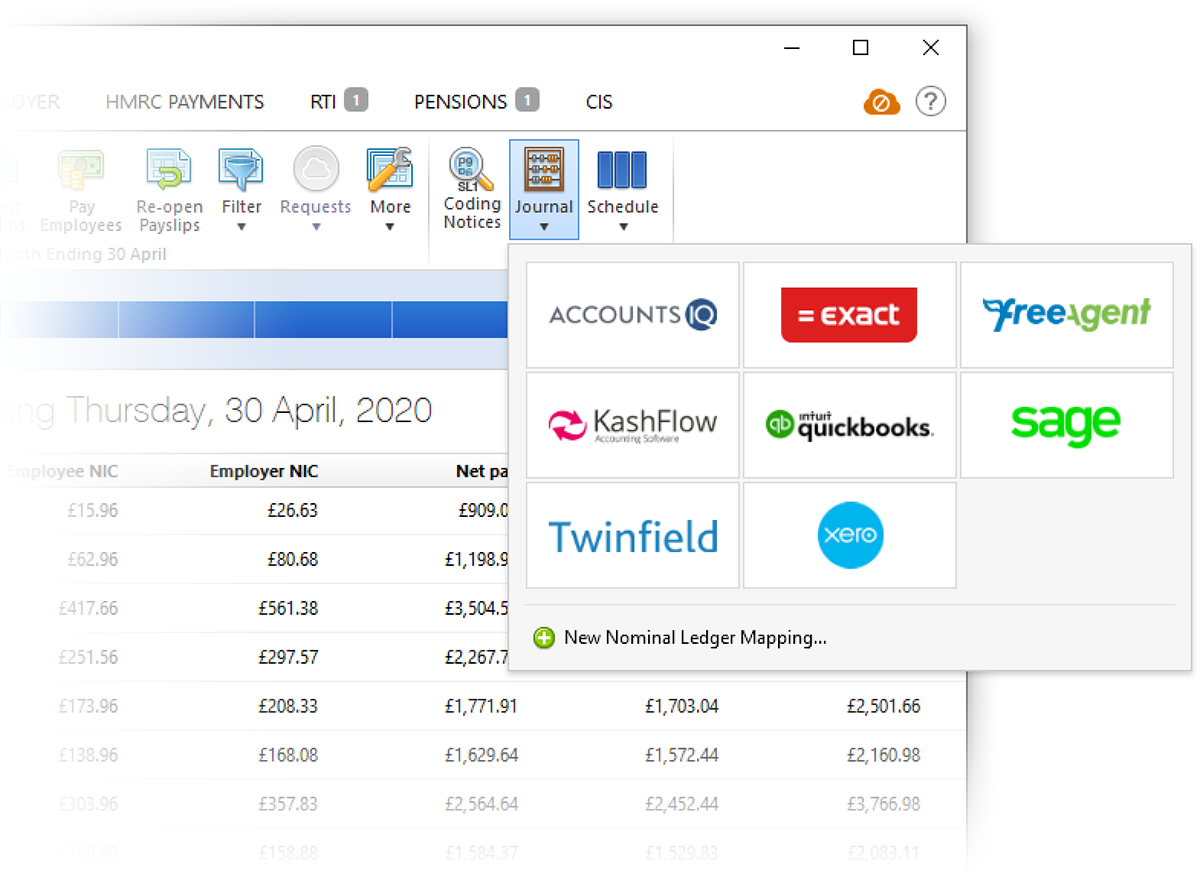

- Support for posting payroll journals to additional accounting software providers.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Mar 2021

22

BrightPay 2021/22 is Now Available. What's New?

BrightPay 2021/22 is now available (for new customers and existing customers).

2020 was challenging. Many of our development plans for the year had to be changed or postponed due to the need to cater for the Coronavirus Job Retention Scheme (CJRS) and the Coronavirus Statutory Sick Pay Rebate Scheme (CSSPRS) in BrightPay (not to mention the withdrawn-at-the-last-minute Job Support Scheme (JSS), which we invested many development hours on to no avail). We also have an Irish version of BrightPay, which likewise required additional time and attention on the equivalent schemes in the Republic of Ireland. And of course all of this had to be done in suboptimal conditions, with staff working remotely from home, often with young children. Demanding as it was, our team really stepped up, and as a company we were awarded with the COVID Hero Supplier Award at the Accounting Software Excellence Awards 2020.

At the same time, we have been working hard to bring a version of BrightPay to the cloud. While we have nothing to announce just yet, I can confirm it's going well, but it is still very much in development. We have a beta version planned, but cannot yet commit to a timeframe.

And so, given the time spent on COVID-19 features, along with that on cloud development, there hasn't been as much time as in previous years to spend on new features for BrightPay 2021/22. But we do have some new features, and we hope you'll find them useful. Rest assured that time-constraints have not caused any sacrifices to be made on quality – our goal to make the best payroll software continues as usual.

Here’s a quick overview of what’s new in 2021/22:

2021/22 Tax Year Updates

- 2021/22 tax bands. The emergency tax code has changed from 1250L to 1257L. When importing from the previous tax year, L codes are uplifted by 7, M codes are uplifted by 8 and N codes by 6.

- 2021/22 employee and employer National Insurance contribution rates, thresholds and calculations.

- 2021/22 Student Loan and Postgraduate Loan thresholds. Support for the new Student Loan Plan 4.

- 2021/22 rate of Statutory Sick Pay, including continued support for COVID-19 related periods of sick leave (in which SSP is paid from day one).

- 2021/22 rates and average weekly earnings thresholds for Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay and Statutory Parental Bereavement Pay.

- 2021/22 rates and calculations for company cars, vans and fuel.

- Support for off-payroll workers.

- Ability to process 2021/22 HMRC coding notices.

- April 2021 National Minimum/Living Wage rates. The top minimum wage age threshold has been reduced from 25 to 23.

- Eligible employers can continue to claim Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

- Continued support for the Coronavirus Job Retention Scheme (CJRS) and the Coronavirus Statutory Sick Pay Rebate Scheme (CSSPRS).

Automatic Enrolment Updates

- 2021/22 qualifying earnings thresholds.

- For 2021/22, the minimum required pension contribution level continues to be 8%, at least 3% of which must be contributed by the employer.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions to ensure continued compatibility with all pension scheme providers.

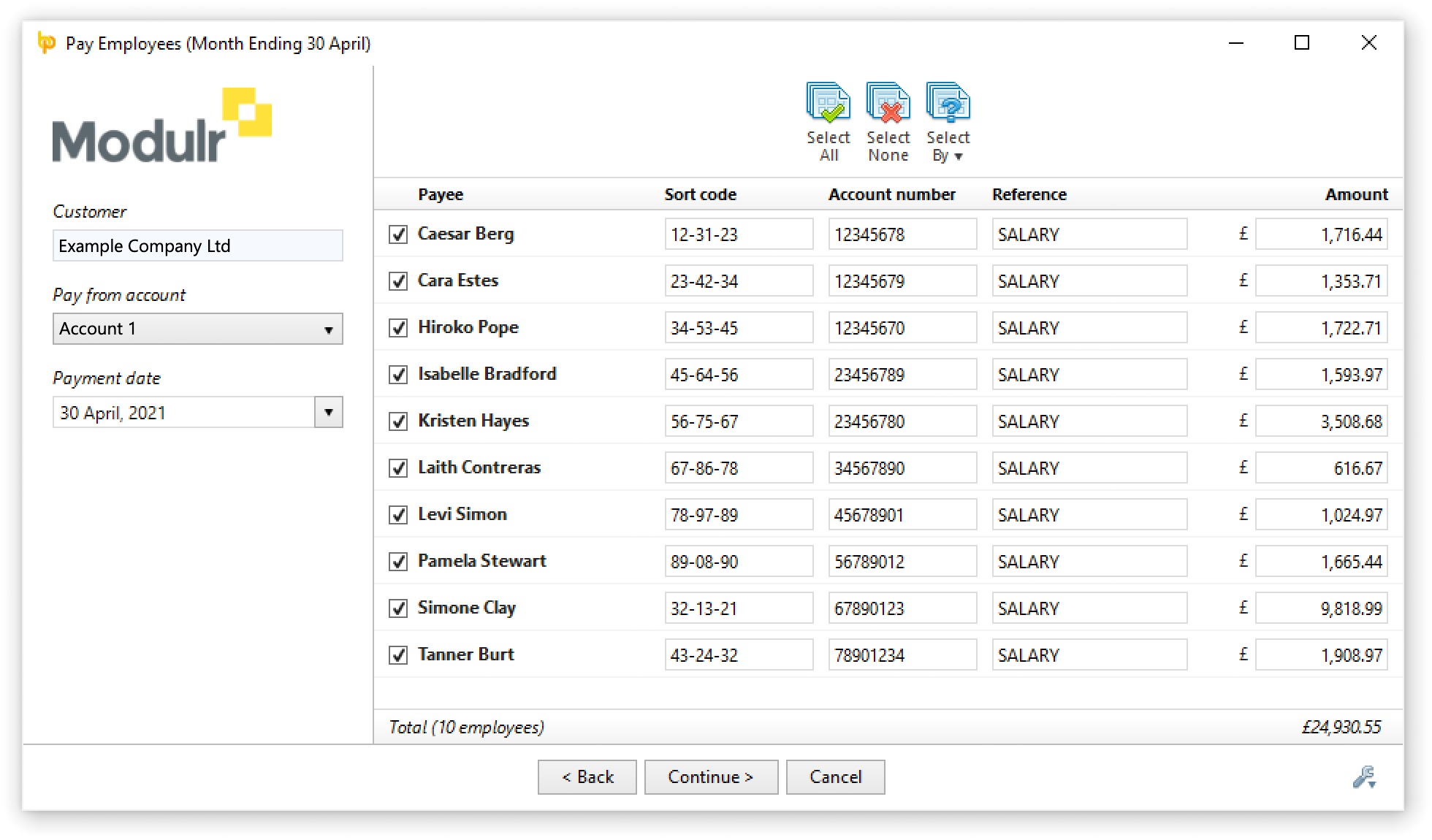

Pay Using Modulr

You can now create and send payment requests to Modulr directly from BrightPay, provided you have an active Modulr account that is set up for making payments. Payee information and amounts are automatically populated using the data from your payroll, making it a simple, fast and efficient way to pay your employees (or subcontractors).

More Journal API Support

BrightPay 2021/22 now supports posting journals directly via API to FreshBooks, QuickFile and ClearBooks.

Other New Features and Updates in 2021/22

- The way of setting up a pay schedule for the tax year has been changed in response to customer feedback, making it easier and more flexible.

- Ability to auto-zeroise individual basic payments, additions and deductions for each pay period (i.e. repeat them into the next pay period as usual, but with a zero amount)

- Ability to auto-generate works numbers.

- BrightPay now shows the total "number of employees" in many more on-screen summaries and report documents.

- CIS – New custom P&D Statement template design that is able to contain much more information than the standard HMRC template (e.g. breakdown of hourly payments, addition subcontractor information, etc.)

- CIS – BrightPay is now smarter about automatically ticking/unticking and including/excluding subcontractors from various lists or reports by default depending on whether they received any pay in a tax period.

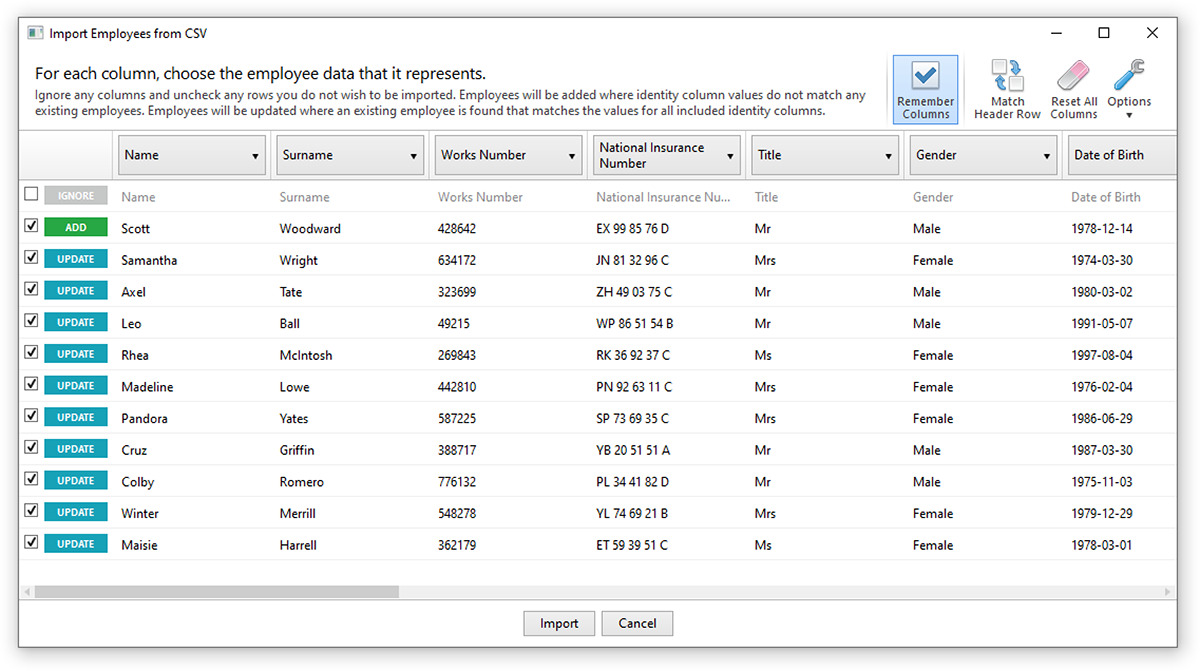

- More employee fields are importable from CSV, and a few column options have been added to Analysis.

- Several additional minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

Includes all updates made to BrightPay during the 2020/21 tax year

Although 2020/21 updates were primarily focused on the CJRS, we did add a few other enhancements, all of which are of course included in BrightPay 2021/22. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Supports the latest UK and London Living Wage rates, announced in November 2020.

- New message in HMRC Payments that lets you know when the equivalent annualised NIC-able pay would put you in excess of the Apprenticeship Levy threshold.

- New "Amount due to HMRC" column is available to be displayed on the BrightPay startup window.

- BrightPay now uses the Microsoft Edge WebView2 Runtime to display web-based content, ensuring technical compatibility with the requirements of modern web services.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Oct 2020

26

Solving the recent "blank screen" issue with BrightPay's Quickbooks integration.

BrightPay is built on a technology called WPF, which is part of Microsoft’s very popular .NET Framework. For .NET development on Windows, WPF has been the first-choice framework for over a decade, and is still very much going strong.

From its beginnings, WPF has included the ability to display and interact with web-based content in a special user interface component called WebBrowser. BrightPay uses WebBrowser to display the “log in” web pages that are required for certain API integrations (e.g. when submitting pension contributions or posting payroll journals to certain providers). WebBrowser has worked well, but it has one aspect that is beginning to cause problems.

WebBrowser is based on Microsoft’s Internet Explorer browser, which has an end-of-life support date of 21 August 2021, meaning that from then on it will no longer receive security updates. Apart from that, Internet Explorer lacks support for many modern technologies, and the web development community has been cheering on its deprecation for years.

In September 2020, BrightPay customers started to notice that our integration with QuickBooks (for posting payroll journals) is no longer working – the log in process results in a blank screen. This is happening because Intuit (the creators of Quickbooks) have dropped their support for Internet Explorer – they are now using technology that is simply too modern for Internet Explorer (and therefore BrightPay's use of WebBrowser) to handle. In the coming months and years, one by one, many other cloud-based software providers will no doubt be doing the same.

So where does this leave BrightPay? Well, you might be aware that in 2015, Microsoft released the first version of their successor to Internet Explorer: the Edge browser. It wasn’t until 2019 that a WPF component for using Edge in Windows applications was made available. This component, called WebView, is not perfect, however, and comes with some technological shortcomings that made us decide to not adopt it right away.

Despite the shortcomings with WebView, when Intuit made their announcement that they would not support Internet Explorer anymore, we created a version of BrightPay that uses WebView and began testing it internally. But not long after, Intuit revised their announcement, confirming that they would not be supporting the Edge browser either. This left us in a bit of a quandary.

Earlier this year, Microsoft released a new version of Edge, based on the same technology that powers the Google Chrome browser. Although it has the same name as the Edge browser from 2015, it is completely different (and Intuit have confirmed that the new Edge will be supported by Quickbooks). Microsoft have also since announced that they will be releasing a component to allow WPF applications to use the new Edge browser, called WebView2, in Q4 2020. This is a much better component than WebView, with wider support, less restrictions and improved deployment. It’s the obvious solution to our Quickbooks problem, except that at the time of writing this, it has still not been released. But it will be soon.

And so, our only real choice is to wait until the WebView2 component is available. As soon as it is, we will prioritise its integration. When that's done, BrightPay customers who need to post journals to Quickbooks should no longer have any issues.

In the meantime, BrightPay version 20.6 contains the WebView component (based on the legacy Edge browser), as we have found that despite Intuit’s claim to not support legacy Edge, it seems to still work for posting journals to Quickbooks anyway. Hopefully, it will continue to do so until WebView2 is available.

Please note that to use WebView in BrightPay 20.6, you (i) must have Windows 10 version 1803 or higher and (ii) you must not run BrightPay in administrator mode. Otherwise, BrightPay will fall back to using the Internet Explorer-based WebBrowser, and the Quickbooks integration will not work. Also, to be able to support WebView (and in preparation for supporting WebView2), BrightPay now requires the .NET Framework version 4.7.2 or higher. If your computer does not already have this version, you will need to download and install it manually to be able to continue using BrightPay.

NOTE: BrightPay for Mac users are not affected by any of this.

UPDATE (January 2021): WebView2 was released in November 2021, and we were able to integrate it into BrightPay and complete a successful pilot test run with some of our customers. I'm pleased to confirm that BrightPay 20.8 (now available for everybody) contains WebView2, and so should put an end to browser incompatibility problems for once and for all.

Jul 2020

1

CJRS calculations have changed in BrightPay from version 20.5 onwards

When guidance for the Coronavirus Job Retention Scheme (CJRS) was first published in April 2020, HMRC did not provide comprehensive instructions on how to calculate the amounts for every scenario. Like other software providers, we were left to make certain assumptions with very little time for development.

One such scenario for which no official guidance was initially provided by HMRC was the handling of pay reference periods that are only partly encapsulated by a CJRS claim period (e.g. the week ending 3 May in a claim for 1–31 May).

BrightPay's initial handling of this scenario was to ignore the pay reference period start and end dates, and work solely from the pay date, i.e. if a pay date was encapsulated by a claim period, then BrightPay would include the full amount in the claim, regardless of whether the pay reference period start and end dates were fully or partially within the claim period. This reasoning is consistent with other payroll calculations (e.g. that for average weekly earnings for statutory pay), and was deemed adequate by HMRC in our communications with them.

Later, HMRC published new guidance on how to handle part pay reference periods that involved apportioning the pay by the number of encapsulated days in a claim period. For example, if an employee was paid £500 for the week ending 3 May, then the new guidance stated that only £500 ÷ 7 × 3 (£214.29) should be accounted for in a claim for 1–31 May (with the other 4 days in a previous claim).

At first, there was no urgency to update BrightPay, as claim period dates were flexible anyway, and as long as claim period dates were selected that aligned with the pay reference period dates (including the pay date), everything worked out.

But from July 2020, things are changing again.

From July 2020 onwards, to support flexible furlough, HMRC require that claim dates are strictly within a single calendar month. And so to meet this new obligation, we have had no choice but to change the CJRS calculation in BrightPay 20.5 to work the updated way, splitting pay reference periods where required and apportioning them by the number of days, regardless of pay date. (BrightPay 20.5 also supports flexible furlough, as well as the updated rules and rates for August, September and October.)

For many of our customers, this calculation change will not make a difference. But those who pay in lieu (e.g. a July pay date for June payroll), or those for whom an already submitted claim period ending 30 June did not actually cover all of June's earnings, will need to check and ensure that all reclaimable amounts are accounted for and submitted to HMRC prior to making July claims. Going forward, depending on the pay schedule and CJRS claim dates, it may also be necessary to finalise pay periods further in advance of when they would normally be finalised, to ensure that amounts from the beginning of such periods are picked up in a CJRS claim.

Mar 2020

19

BrightPay 2020/21 is Now Available. What's New?

BrightPay 2020/21 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2020/21 Tax Year Updates

- There are no changes to tax bands, rates or the emergency tax code in 2020/21. BrightPay continues full support for Welsh Rate of Income Tax (WRIT) and Scottish Rate of Income Tax (SRIT).

- 2020/21 employee and employer National Insurance contribution rates, thresholds and calculations.

- 2020/21 Student Loan and Postgraduate Loan thresholds.

- 2020/21 rate of Statutory Sick Pay, including support for COVID-19 related periods of sick leave (in which SSP is paid from day one).

- 2020/21 rates for Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, and Statutory Shared Parental Pay.

- Support for new Parental Bereavement Leave and Statutory Parental Bereavement Pay.

- 2020/21 rates for company cars, vans and fuel. BrightPay now allows input of 'zero emission miles' for cars with a C02 rating of less than or equal to 50g/km (which is now used in the calculation of cash equivalent).

- Support for real-time PAYE tax and Employer Class 1A NICs due on year-to-date termination awards over the £30K annual threshold and on year-to-date sporting testimonial payments over the £100K annual threshold.

- Ability to process 2020/21 HMRC coding notices.

- April 2020 National Living Wage rates.

- Eligible employers can continue to claim Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC. For 2020/21, the maximum Employment Allowance claim has been increased to £4,000.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications, including the new De Minimis State Aid declaration on the EPS. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

- Support for off-payroll workers subject to April 2020 rules. Off-payroll working rules have been postponed until April 2021.

Automatic Enrolment Updates

- 2020/21 qualifying earnings thresholds.

- For 2020/21, the minimum required pension contribution level continues to be 8%, at least 3% of which must be contributed by the employer.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions to ensure continued compatibility with all pension scheme providers.

- Additional one-off contributions can now be optionally persisted to following pay periods.

- Makes it more clear on the Automatic Enrolment journey report when an assessment is part of automatic re-enrolment.

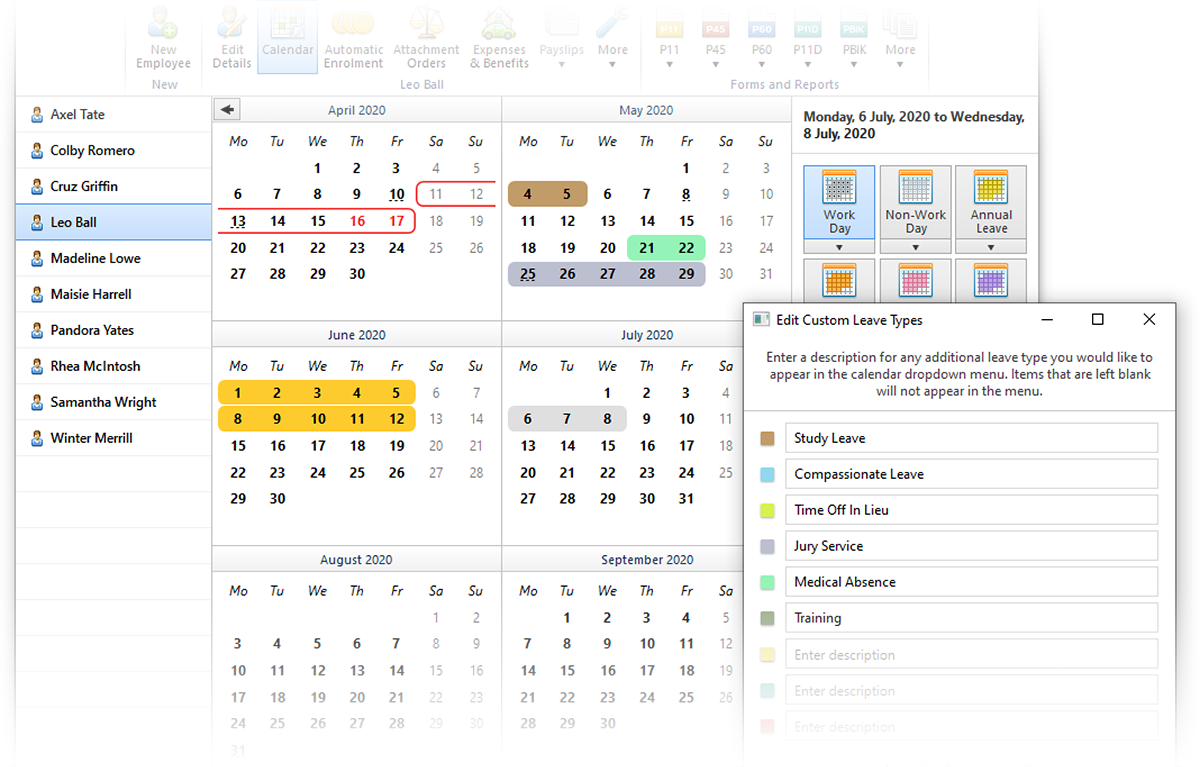

Define and Set Custom Leave Types on Employee Calendar

- You can now define up to nine additional custom types of employee leave. Six of the custom types are set up with default descriptions, which you can edit, add to, or remove as need be.

- Custom leave types act like the existing built-in kinds of leave, in that they are mutually exclusive and can only be applied to working days. They can be set on a per-employee basis, or batch set for multiple employees at once.

- Custom leave types also appear on the employer calendar. Mouse-hover tooltips have been added to the various views of the employer calendar to help determine what each colour indicates where it's not clear.

- A new Calendar Report (which replaces the previous Print Calendar functionality) gives you the power and flexibility to create and/or share a customised report of employee leave that can be filtered by type of leave, and presented individually for each employee, or as a summary containing multiple employees.

More Journal API Support

Along with the API support added for Sage, Quickbooks and Xero in 2019/20, BrightPay 2020/21 now supports posting journals directly via API to FreeAgent, Kashflow, Twinfield and AccountsIQ. The option to create a CSV journal is also still available where supported.

Update Employees from CSV File

BrightPay has traditionally only allowed new employees to be added from a CSV file. Now, you can both add new employees and update existing employees from a CSV file. (The same has been done for subcontractors).

BrightPay Connect

- The Connect tab on the start-up window now directly shows your sign-in status.

- The list of employers (in the Open/Create Employer tab of start-up window) now shows cloud icons for employers that are linked to the signed-in BrightPay account.

- Ability to download and import a 2019/20 Connect backup into BrightPay 2020/21 (only applies for employers which have not yet been linked and synchronised for 2020/21).

- When an employer is opened in BrightPay 2020/21 that is not linked to Connect, but it is known that the 2019/20 version of that file was linked to Connect, BrightPay will now automatically prompt you to link the 2020/21 file to Connect.

Other 2020/21 Updates in BrightPay

- Annual leave entitlement calculations now include 'upcoming booked annual leave days', which can optionally be included on reports and payslips.

- When zero-ising payslips (or subcontractor payments), new options to set amount to zero, or remove items altogether.

- Ability to create an SSP1 document in BrightPay.

- When importing payments from CSV, any lines which failed to import (e.g. due to not matching an employee pay record, or due to the matching pay record being already finalised) are now clearly indicated in the response dialog (instead of the previously unhelpful 'X of Y succeeded' message).

- Public holidays on employee calendar are now shown with a dotted text underline (rather than appearing as if they were non-working days by default).

- In analysis, if the column ordering settings of a report is manually changed from the 'default' settings (which are derived from employee UI display preferences), and then that report is saved, the custom ordering is now maintained, and this report will no longer receive 'default' column ordering settings when it is re-opened.

- Ability to import saved reports from another BrightPay data file into the currently open file.

- Allows one of the added emergency contacts for an employee to be set as the 'primary' contact. New analysis columns (and a new report) for emergency contact details have been added.

- New 'notes' input for parenting leave and attachment orders.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

Includes all updates made to BrightPay during the 2019/20 tax year

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2019/20, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2020/21. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Supports the latest UK and London Living Wage rates, announced in November 2019.

- New flexibility and control over when an employee's P60 and P11D are to be made available in Self Service in Connect.

- Ability to batch print, email and export P45 for multiple employees.

- Ability to print, export or email currently open payslips (i.e. those which have not yet been finalised). Such payslips are decorated with a 'DRAFT' watermark.

- Bureau features

- New 'Bureau Statistics Report' which shows various totals for each employer for informational or billing purposes. Accessed via the BrightPay startup window employer menu, it can be viewed/printed or exported to CSV.

- Ability to batch check for coding notices for multiple employers.

- Ability to sort employers by label colour on the BrightPay startup window.

- Improved interface and workflow for viewing/entering the 'average weekly earnings' for statutory parenting pay, including new warnings where BrightPay detects that there are more or fewer historic payment records than expected.

- Several new payroll period summary column options for amounts "in previous period" (allowing you to compare current and previous period amounts on the period summary view). Also new column options for tax code, NI number, department, payment method and directorship.

- Improves rounding of calculated weighted departmental amounts (which prevents penny differences both in analysis and when posting a departmental journal).

- Ability to ignore BrightPay's "Auto enrolment scheme contributions are below minimum level" warning for any given membership (e.g. where employee has opted down).

- Coding notices – where an employee is unable to be matched, the NINO or works number that HMRC have on file is now clearly shown to help determine why.

- 'Contracted hours per week' and 'Is payment to a non-individual' fields are now available as column options in Analysis.

- When using the ’Select By’ button in lists of employees, the ’Name Initial’ and ’Surname Initial’ options now show grouped selection choices (e.g. A–F, G–L, etc., depending on total number of selectable employees).

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Mar 2019

20

BrightPay 2019/20 is Now Available. What's New?

BrightPay 2019/20 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2019/20 Tax Year Updates

- 2019/20 rates, thresholds, triggers and calculations for PAYE tax, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Automatic Enrolment pensions, company cars, vans and fuel.

- The emergency tax code has changed from 1185L to 1250L. When importing from the previous tax year, L codes are uplifted by 65, M codes are uplifted by 71 and N codes by 59.

- Full support for the 2019/20 Welsh Rate of Income Tax (WRIT) codes, rates and thresholds, as well as continued support for those of the Scottish Rate of Income Tax (SRIT).

- Support for the new Postgraduate Loan deductions.

- Ability to process 2019/20 HMRC coding notices (including new PGL1 and PGL2 notices).

- April 2019 National Living Wage rates.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

Automatic Enrolment Updates

- From April 2019 onwards, the minimum required pension contribution level is 8%, at least 3% of which must be contributed by the employer. BrightPay 2019/20 now uses and validates against this increased level by default. Where pre-April 2019 minimum levels were being used in 2018/19, BrightPay 2019/20 will automatically uplift them on import.

- With the concept of 'staging' for automatic enrolment now very much in the past, BrightPay is instead focused on asking for and working with the Next Re-enrolment Date.

- Various improvements have been made to make the automatic re-enrolment process more clear:

- For opted-out or ceased employees (as well as employees who are flagged for re-enrolment) the previous opt out/cessation date is now clearly visible and can be edited if need be.

- If an employee is marked as opted out or ceased, but the opt-out/cessation date is not known, BrightPay now flags for automatic re-enrolment anyway (and allows the missing date to be entered).

- Redesigned menu when adding a new pension scheme:

- The auto enrolment qualifying schemes are now categorised by API/CSV support, and ordered by popularity.

- The traditional pension scheme 'types' have been removed – when adding a traditional scheme you can now simply set the tax relief and AVC options directly instead of having to first choose the right type.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions.

Real Time Information

- As mentioned in the release notes for the most recent upgrade to BrightPay 2018/19, the EYU (Earlier Year Update) submission is no longer supported by HMRC and has now been removed from BrightPay altogether. To make corrections to 2018/19 or 2019/20 payroll data going forward, an Additional FPS is to be used.

- Ability to exclude an employee pay record from an FPS if it has zero amounts only.

- Ability to force include an employee's starter/leaver declaration on an FPS submission that covers a different period to the employee's starting/leaving period.

- Ability to unmark an unsent submission as contributing towards the Number of Unsent RTI Submissions count in BrightPay.

- New HMRC Receipt document which presents HMRC's response to an RTI submission in a clear, shareable format.

More Flexible Journals

A popular customer request has been to create a 'departmental' payroll journal in BrightPay. We've went one step further, allowing not only for a simple departmental mapping of nominal account codes, but for an advanced multi-option mapping as well.

For example, if you want to map commission paid to directors on a weekly basis in the sales department to a particular account code, you now can.

For Xero journals, BrightPay now supports including the department as the Xero tracking option, including where employees are split across multiple departments.

To make all this easier to manage, the Create Journal window in BrightPay now remembers it's size and position between usages.

Journal API Support

BrightPay now supports posting journals directly to Sage, Quickbooks and Xero via API (while continuing to offer the creation of a CSV journal as an option if need be).

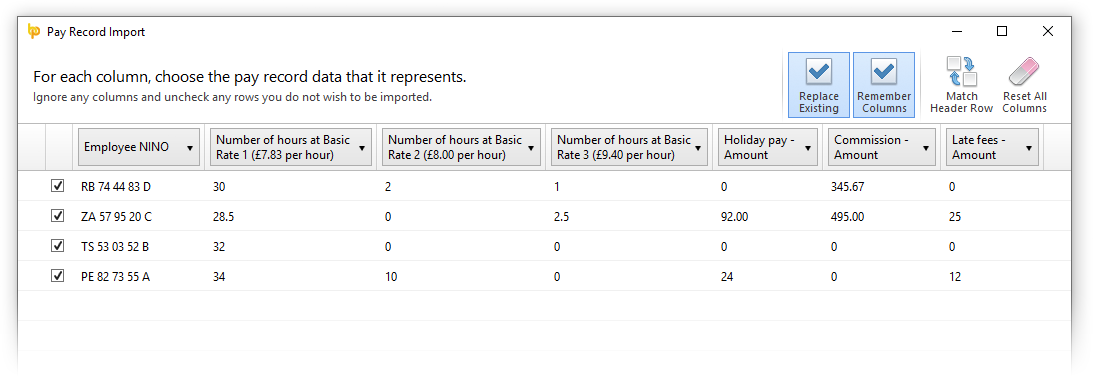

Importing Pay Records from CSV

We have significantly improved the power and flexibility of how pay records are imported from CSV, effectively allowing an entire pay run to be imported from a single CSV file if need be.

- Multiple pay items (of a single payment type, or mixed types) can now be imported from a single CSV line.

- Daily/hourly payments can more easily be imported under a named employer-wide daily/hourly rate

- Additions/deductions can more easily be imported under an employer-wide addition/deduction type

- The Import from CSV window has been redesigned to be more user-friendly and intuitive.

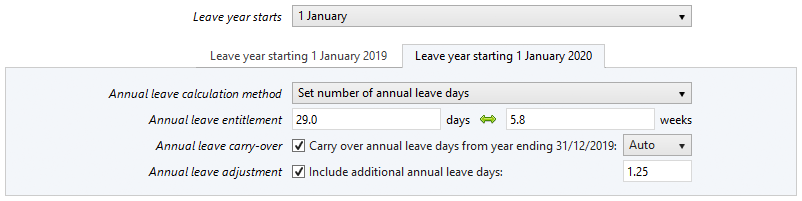

Improved Support for Offset Annual Leave Year

A popular customer request has been for BrightPay to better handle the definition, carry-over and adjustment of annual leave in the situation where the annual leave year is offset from the tax year.

In BrightPay 2019/20, you can now enter the annual leave settings for each overlapping year individually, giving you full control and helping you work out entitlements more accurately.

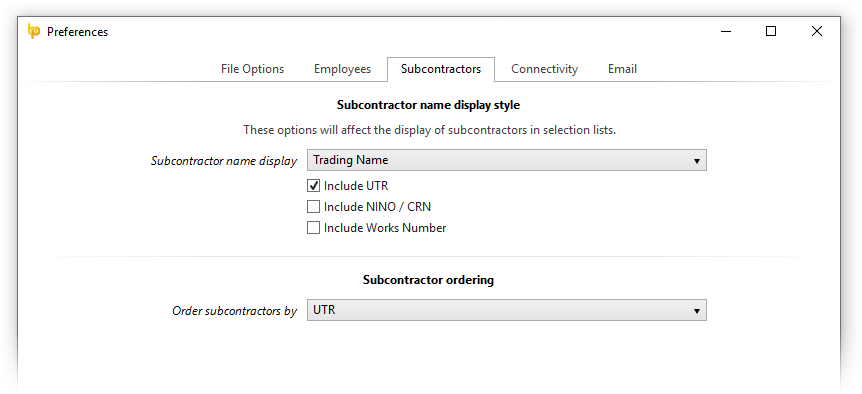

CIS Updates

- You can now customise how subcontractors are displayed and ordered across the BrightPay interface.

- When selecting from a list of subcontractors, BrightPay now includes a new 'Select By' button that allows you easily and quickly select only the subcontractors that match specific criteria.

- New Payments menu in the subcontractor toolbar which includes various handy functions including the ability to batch print multiple P&D statements for a single subcontractor.

- New CIS Year End Statement document.

- Ability to unmark an unsent submission as contributing towards the Number of Unsent CIS Submissions count in BrightPay.

- New HMRC Receipt document which presents HMRC's response to a CIS submission in a clear, shareable format.

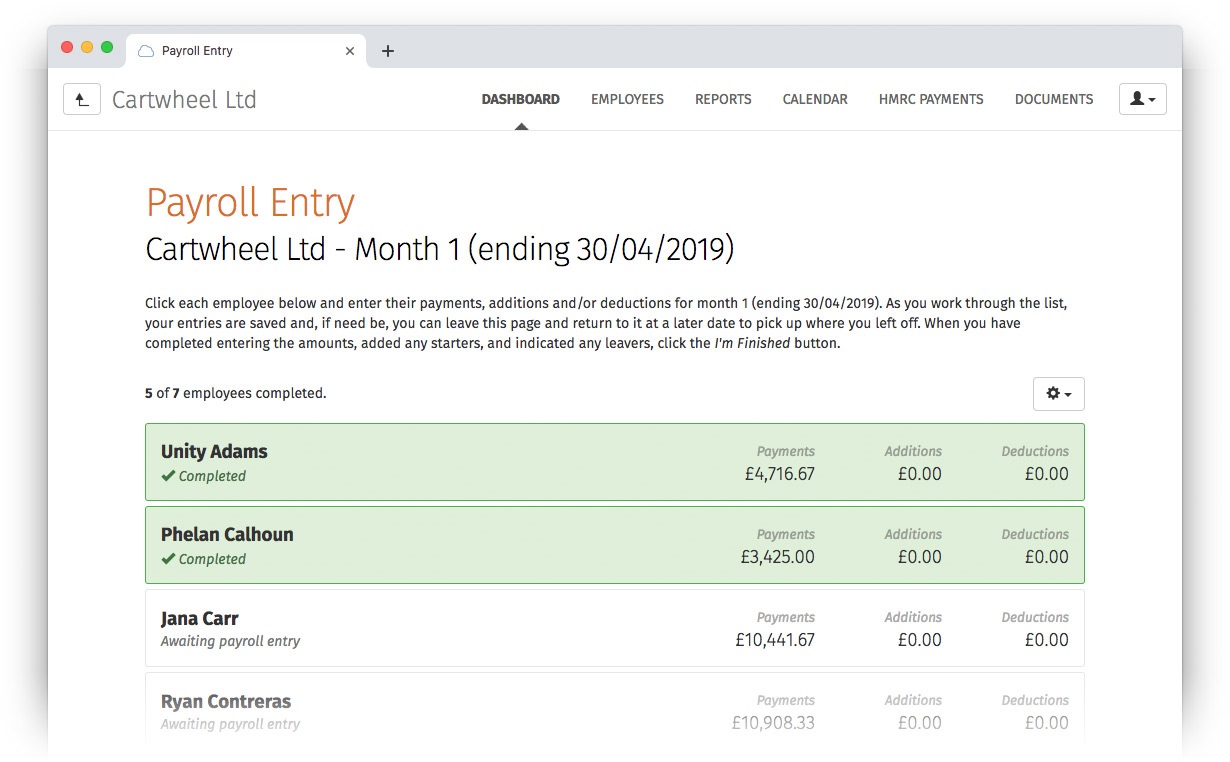

BrightPay Connect

In late 2018 we introduced a powerful new feature for Bureau customers of BrightPay Connect: the ability to request client payroll entry and/or approval for a payroll run, which is then automatically facilitated though a secure, GDPR-compliant process within the BrightPay Connect dashboard.

Sign in to your BrightPay Connect account and click the Requests header link to find out more.

Other 2019/20 Updates in BrightPay

- When hovering over the 'number of submissions' for an employer on the BrightPay startup window, a popup displays what the number(s) represent.

- The full description of an hourly or daily payment is now shown on-screen for finalised pay periods.

- BrightPay will now prompt you to change an apprentice employee who is set to be on NI table H but is over 25 years old.

- On the employee calendar, the parenting leave info panel now shows the total number of KIT days taken for the selected period of leave.

- Corrects handling of Statutory Adoption Pay and Statutory Shared Parental Pay in weeks beyond the week that employee took their 10th KIT day (or 20th SPLIT day).

- When selecting which analysis columns to include in a report, they are now grouped by category.

- New analysis columns:

- Separate 'cash equivalent' columns for each of the benefit/expense types.

- Total attachment order deductions excluding admin charge.

- Primary department name.

- Adds a 'description' field for all kinds of benefits, and shows the entered description for each benefit on the payroll interface.

- Options to show separate benefit payments on employee payslip, rather than just a rolled up 'taxable benefits' figure.

- The Number of Actionable Coding Notices is now shown on the coding notices toolbar icon, and is available as a column on the BrightPay startup window.

- New A4 payslip template, designed to be used where there are too many items to fit on the A5 template.

- As part of our new licensing model, Bureau customers can now view/edit the list of employers for which they have access.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

Includes all updates made to BrightPay during the 2018/19 tax year

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2018/19, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2019/20. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Ability to send enrolment/contribution submissions directly to the People's Pension via API.

- Ability to quickly create an new/additional employment for a previous/existing employee.

- Coding notice checks can now use agent credentials if available.

- Many improvements to emailing documents directly from BrightPay:

- Ability to specify the default starting body content to use when emailing a document.

- Ability to quickly turn on/off the stored email signature.

- When emailing a document, there is a new menu to quickly select and re-use recently used body content.

- Email body content now accepts 'Markdown' formatting.

- Ability to edit the list of saved third-party email recipients

- New startup window column for Next Estimated Pay Date.

- Two new tick boxes in BrightPay Preferences to indicate where Next Estimated Pay Date is in the past (which shows a red background colour for applicable employers on the startup window) or indicate where Next Estimated Pay Date is within X days (where X is customisable – shows a yellow background colour for applicable employers on the start screen).

- Ability to batch finalise the payroll for multiple employers.

- Ability to select employers by label colour when preparing a batch operation.

- Ability to persist a “Net to Gross” setting going forward (i.e. rolling net pay).

- Ability to create a bank file for paying HMRC.

- Allows a deduction to be calculated as a percentage of Auto Enrolment qualifying earnings.

- Enables subcontractors with zero amounts in a pay period to be excluded from a CIS300 submission.

- When in Payroll, the name of the active employee (i.e. the part of large text title) can now be clicked to navigate directly into the Employee > Edit Details screen for that employee.

- Employment Allowance report

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Mar 2018

20

BrightPay 2018/19 is Now Available. What's New?

BrightPay 2018/19 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2018/19 Tax Year Updates

- 2018/19 rates, thresholds and calculations for PAYE tax, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Automatic Enrolment earnings thresholds and triggers, company cars, vans and fuel.

- The emergency tax code has changed from 1150L to 1185L. When importing from BrightPay 2017/18, L codes are uplifted by 35, M codes are uplifted by 39 and N codes by 31.

- Full support for the 2018/19 Scottish Rate of Income Tax (SRIT) codes, rates and thresholds.

- April 2018 National Living Wage rates.

- Ability to process 2018/19 HMRC coding notices.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EYU, EXB, CIS300, CISREQ).

Automatic Enrolment Updates

- From April 2018 onwards, the minimum required pension contribution level is 5%, at least 2% of which must be contributed by the employer. BrightPay 2018/19 now uses and validates against this increased level by default. Where pre-April 2018 minimum levels were being used in 2017/18, BrightPay 2018/19 will automatically uplift them on import.

- With all employers in the UK now having staged for Auto Enrolment, BrightPay no longer relies on a Staging Date for assessment – all un-actioned employees are automatically assessed and flagged for action as required.

- Where submissions are outstanding for a pension scheme, BrightPay now more clearly shows the numeric indicators on the Enrolment Summary and/or Contributions Summary buttons for that scheme, depending on the type of submission(s) outstanding.

- The salutation of Auto Enrolment letters can now be customised.

- Auto Enrolment letters can now be quickly printed via the new Letters menu in the PENSIONS section of BrightPay.

- New letter template to tell staff who are already a member of a scheme about the April 2018 minimum contribution increases.

- New Automatic Enrolment Journey Report replaces the previous Assessment Report.

- Automatic Re-enrolment date and Declaration of Compliance date can now be shown as columns on the BrightPay startup window.

- Improved handling of the situation in which Auto Enrolment duties are ignored for one or more pay periods.

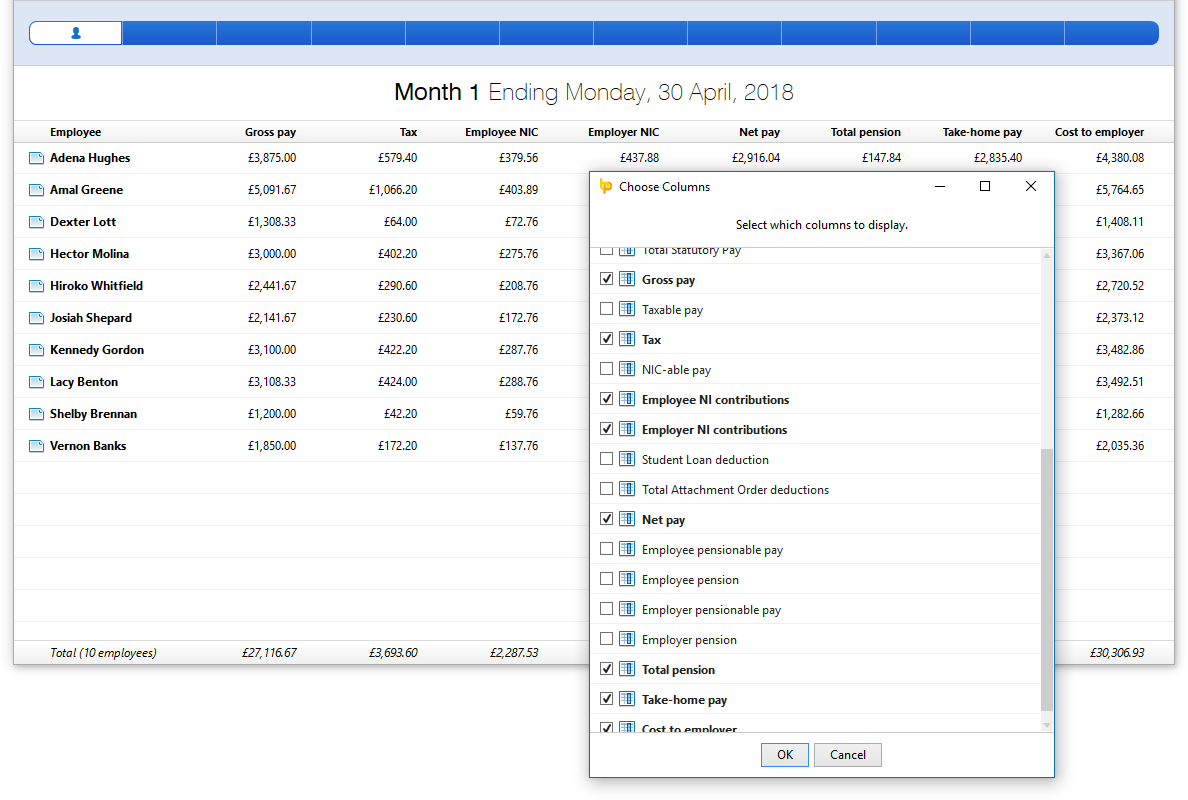

Ability to Edit the Columns of the Period Summary View

A popular customer request has been to show columns for number of hours worked and pension contributions on the BrightPay period summary view. In BrightPay 2018/19, you can now easily include these, as well as many more additional column options.

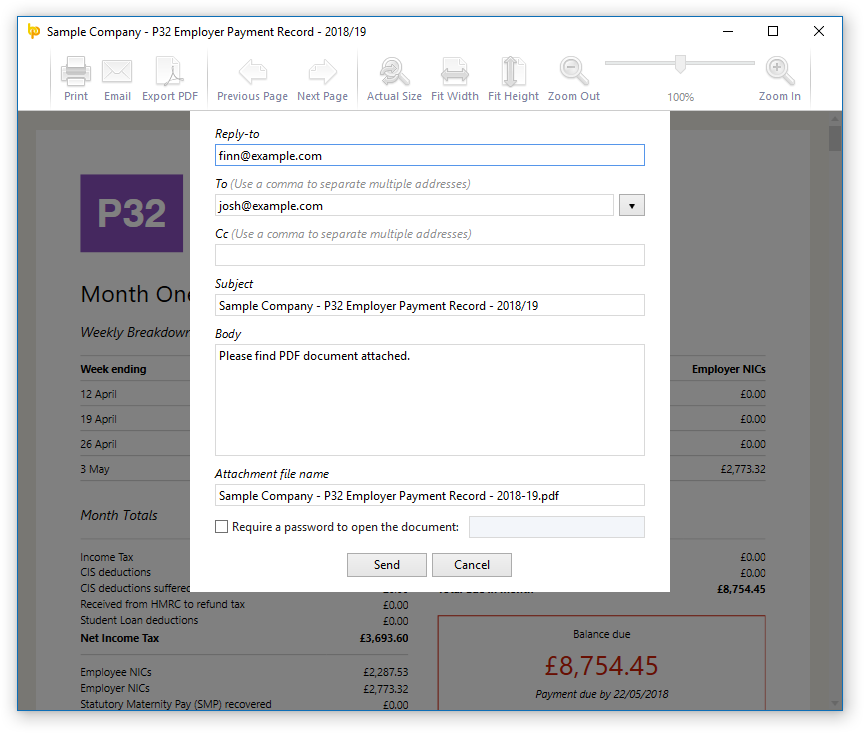

Ability to Quickly Email any Document/Report

There is a new Email button in the print preview of documents and reports in BrightPay which allows you to easily send it as a PDF attachment in an email. Where and when applicable, BrightPay makes it easy and quick to select the relevant employee, client or previously used recipient.

Note: In version 18.0, there are a few document types for which email support is not yet available (e.g. P45, SMP1, etc) – we will be adding support for these very soon.

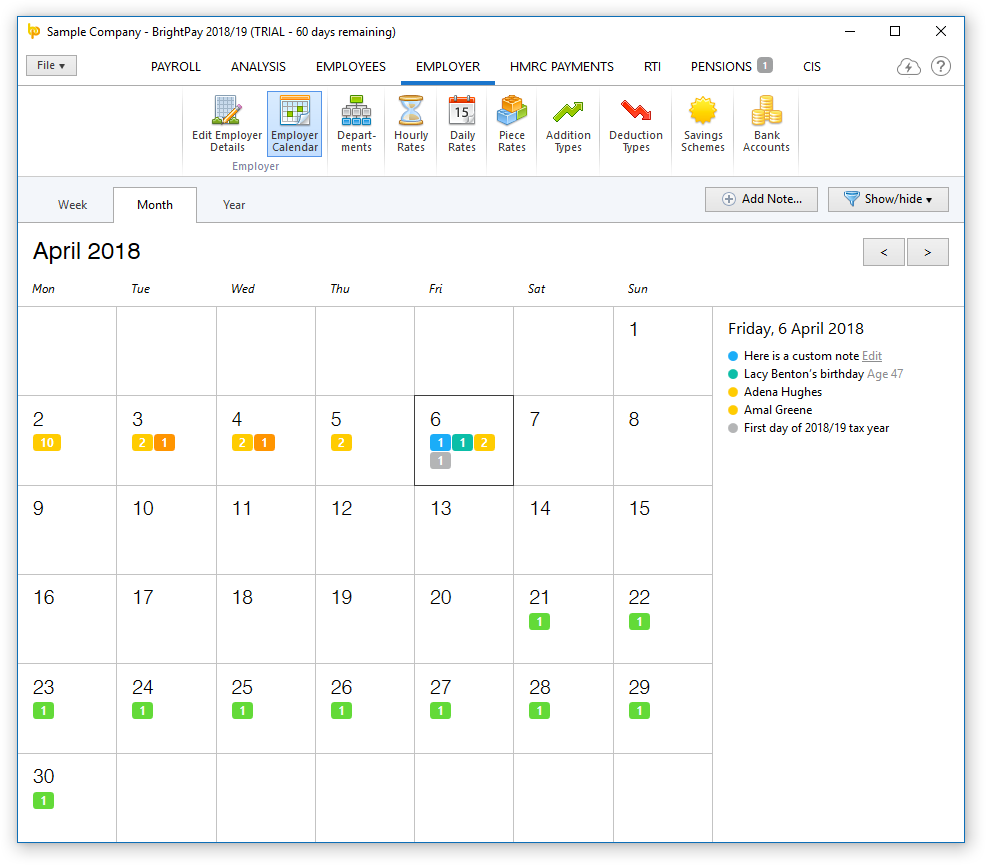

New Feature: Employer Calendar

There is a new employer-wide calendar in the EMPLOYER section of BrightPay which amalgamates all the employee events along with other key payroll dates into a single view:

- Switch between Year, Month or Week view.

- Shows combined events for all employees (i.e. those entered on the employee calendar, as well as birthdays)

- Includes general tax year events and deadlines.

- Ability to filter which kinds of events are displayed on calendar and in the day event list.

- Ability to add/edit/delete your own notes.

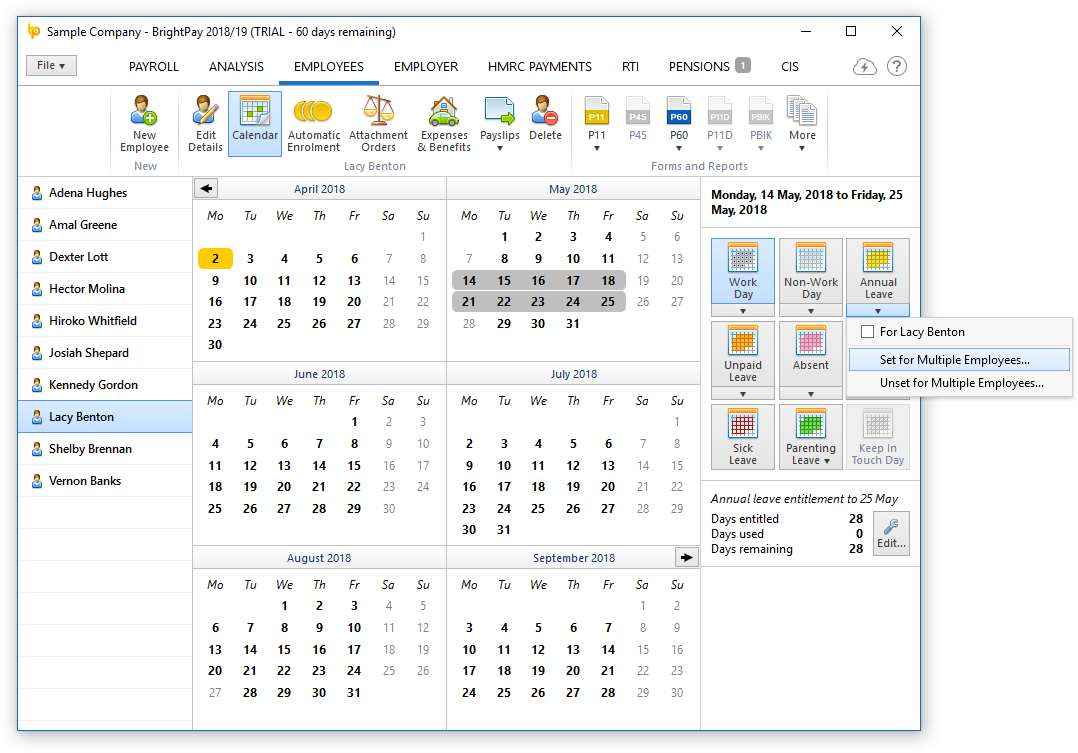

Employee Calendar Improvements

- Ability to batch set working days, non-working days and leave days for multiple employees at once.

- Holding the Ctrl key allows you to select (or unselect) multiple arbitrary days on the calendar.

Bureau Improvements

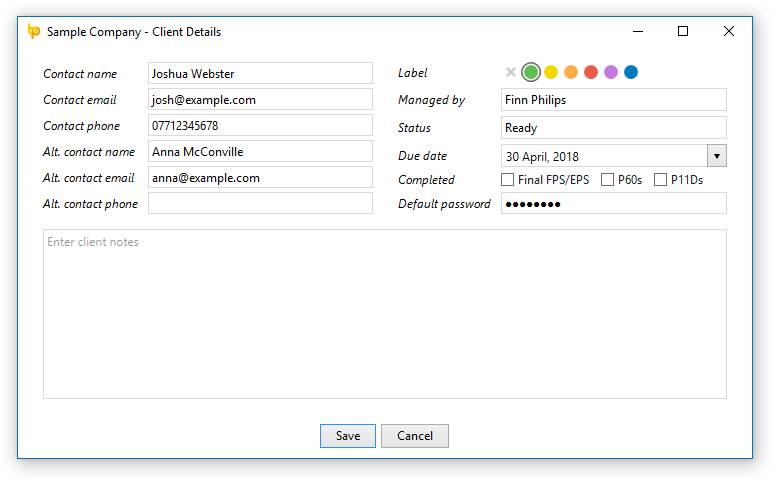

Several new Client Details fields have been added:

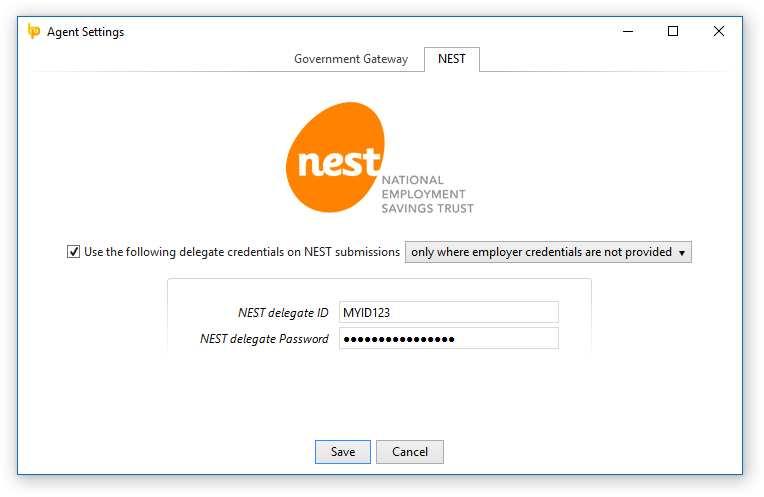

In BrightPay Agent Settings, you can now enter your own NEST delegate ID and password to use globally in NEST submissions:

Other 2018/19 Changes in BrightPay

- We've made several key architectural improvements for dealing with large employer files (e.g. those with hundreds or even thousands of employees) with regard to both speed of execution and computer memory usage. This will be something we continue to improve as time goes on.

- When a text input field receives focus via keyboard tabbing, its content is all selected automatically.

- Adds several more customisability options for payslip production.

- When zero-ising payslips, you can now choose to zero-ise only the overtime (or non-overtime)hourly/daily payments.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be explicitly hidden on printed payslip.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be given a custom description to appear on printed payslip.

- Enables specific period payments, daily payments, hourly payments, piece payments and additions to 'contribute to gross for minimum wage' or not.

- Ability to set whether or not an hourly rate/payment should accrue hour-based annual leave entitlement.

- For 'accrued' annual leave days/hours, ability to manually specify additional accrued days/hours not accounted for in payroll (i.e. an adjustment).

- Annual leave accrual is now calculated up to end of the currently open pay period (rather than up to the end of the last finalised pay period).

- Printing page setup is now centralised into the File menu of BrightPay.

- Ability to control whether or not the PDF export settings are remembered between usages.

- Enables traditional pension schemes to use employer AVCs.

- Includes Student Loan Plan on FPS

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

Includes all updates made to BrightPay during the 2017/18 tax year

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2017/18, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2018/19. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Additions or deductions can be set up to calculate as a percentage of the payslip’s basic, gross or net pay.

- Hourly and daily rates with the same 'description', whether set up at employer level or employee level, are all reported under a single column in analysis.

- Ability to make additions 'notional' i.e. only contributing towards taxable, NIC-able and/or pension-able pay, without actually giving the payment to the employee (also works for CIS-able pay and subcontractors).

- Ability to include declaration on FPS (or EYU) that an employee's payment is being made to a non-individual.

- Ability to easily switch one or multiple employees from one auto enrolment pension scheme to another.

- Any automatic enrolment pension scheme contribution can now include additional one-off amounts

- Any automatic enrolment pension scheme contribution (whether employee or employer, standard or one-off) can now be entered as a percentage amount or a fixed amount.

- Support for sending enrolment and contributions submissions directly to Aviva via API.

- New/updated documents and reports (e.g. Statutory Pay Calculation and Schedule, Attachment Orders Summary, SMP1, SPP1, SAP1, Employee Count, Employee Address Labels)

- Net to gross functionality can now do ‘Take-home pay to gross’ and ‘Cost-to-employer to gross’.

- Improvements to handling of 'no longer enrolled' employees in selection lists.

- TUPE support

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Here’s some of the new things coming in April/May 2018:

- Journal API support for Quickbooks, Xero and Sage

- API support for The People’s Pension

- Improved and more flexible CIS P&D statement

- Exciting new BrightPay Connect features.

Mar 2017

20

BrightPay 2017/18 is Now Available. What's New?

BrightPay 2017/18 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2017/18 Tax Year Updates

- 2017/18 rates, thresholds and calculations for PAYE tax, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Automatic Enrolment earnings thresholds and triggers, company cars, vans and fuel.

- The emergency tax code has changed from 1100L to 1150L. When importing from BrightPay 2016/17, L codes are uplifted by 50, while M codes are uplifted by 55 and N codes by 45.

- Full support for Scottish Rate of Income Tax (SRIT) codes, including the new 2017/18 Scottish higher tax rate threshold.

- Support for an expanded range of National Insurance Number formats.

- April 2017 National Minimum/Living Wage.

- Ability to process 2017/18 coding notices.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Full support for the new 2017/18 Apprenticeship Levy, including levy calculation, allowance and reporting amounts on an EPS submission.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all RTI, EXB and CIS submission types.

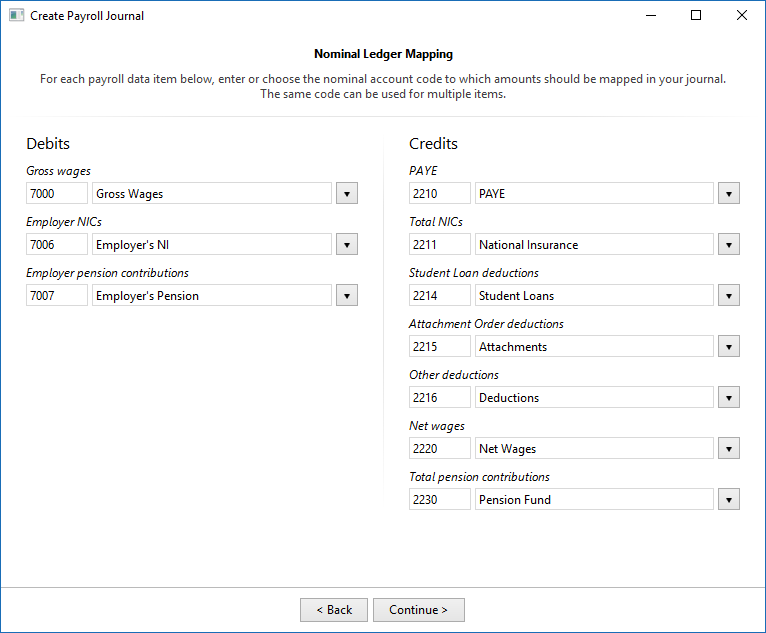

Payroll Journal

BrightPay 2017/18 enables you to produce a CSV payroll journal for import into your accounting software. This feature is accessed via the new Journal button on the payroll toolbar, and provides the following:

- The file formats and default nominal ledger code mappings are included for Exact, Kashflow, Quickbooks, Sage and Xero. These built-in mappings can be tailored to meet your own requirements, or you can create your own nominal ledger mapping from scratch if need be.

- Specify the journal date range – payslips finalised with a pay date in the range you select are included.

- Include individual journal records for each employee, or merge the employee records into rolled up records for each unique payment date.

- If required, you can use alternate nominal codes for payroll items relating to directors.

- Use a specific nominal code for any custom employer-wide item you have set up in BrightPay (i.e. addition/deduction types, hourly/daily/piece rates, pension schemes, savings schemes, etc.)

- Preview journal on screen, export preview to PDF, or print.

- Export journal CSV file for import into your accounting software.

Several accounting software providers can accept a direct upload of a payroll journal via an API, negating the need to export/import a CSV file. We plan to add this functionality for supporting providers soon.

Please get in touch if you'd like to see built-in support for any other accounting software providers.

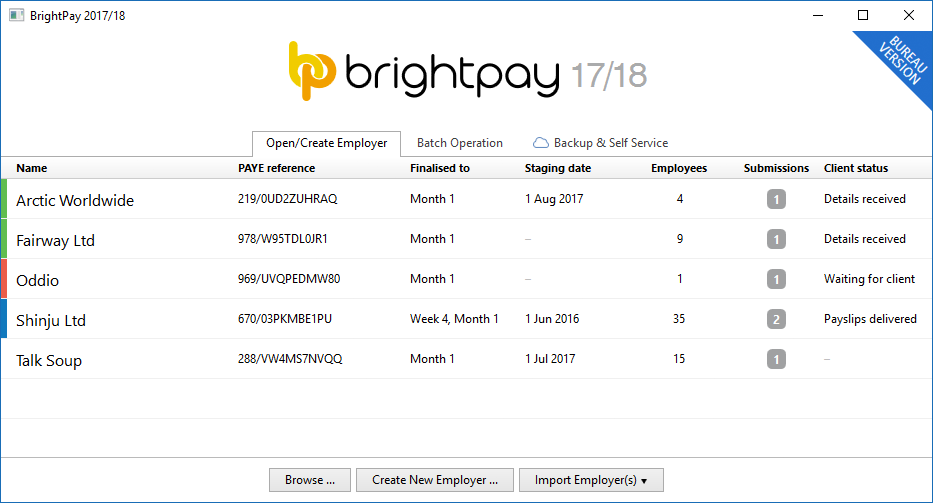

Bureau Features

BrightPay 2017/18 includes several new features specifically targeted at accountants, bookkeepers, or other payroll bureau service providers. These bureau features are exclusive to the bureau version of BrightPay.

Improvements to BrightPay Startup Window

The columns on the BrightPay startup window can now be customised, and you can order the list of employers on the startup screen by any column. To help make this personalisation more useful, the size and position of the startup window will now be remembered between launches.

The data on the startup window now more reliably updates by itself - you no longer have to open a file to get it to do so.

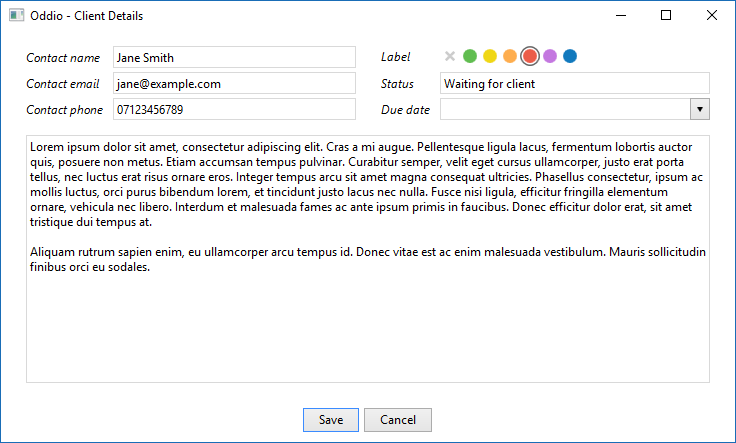

Client Details

You can now record the following client information for each employer in BrightPay:

- Contact name, email address and phone number

- Status

- Due date

- Notes

- Label colour

This information can be edited directly from the startup window by right-clicking on an employer and selecting the new View/Edit Client Details menu option (this menu also includes a quick one-click link to set a label colour), or it can be entered via the new Client Details tab in Edit Employer Details when a file is opened in BrightPay.

Perhaps most usefully, these client details can be shown as columns on the BrightPay startup window, enabling you to more effectively manage your client workflows as an individual or across a team.

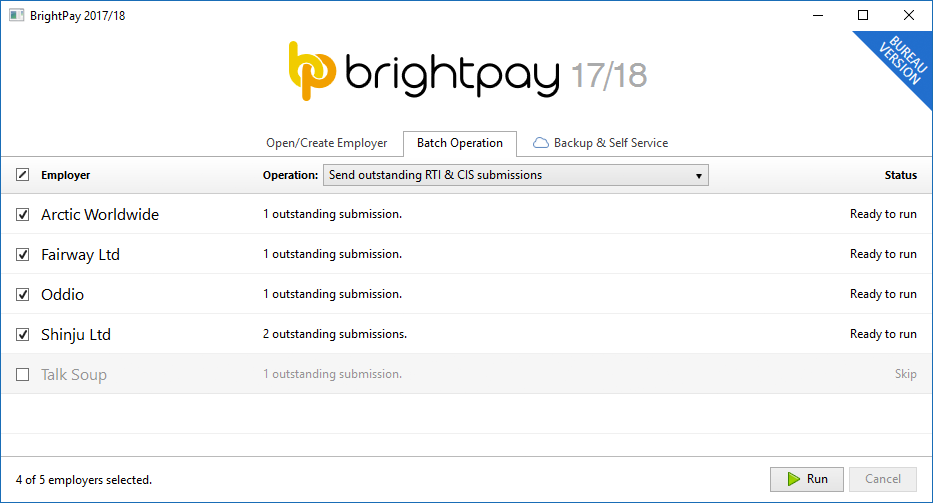

Batch Send RTI Submissions for Multiple Employers

A new Batch Operation tab on the BrightPay startup window enables you to process or perform a task on multiple employer files with a single click.

The first supported batch operation is to send all outstanding RTI and CIS submissions.

We have plans to add more batch operations in future.

Keep Your Client Documents and Files Organised

In BrightPay 2017/18, exported documents and files (e.g. payslips, P30s, reports, pension CSV files, journals, snapshots, etc.) are automatically organised into a separate folder structure for each of your clients by default. (If you don't want this, you can revert back to the previous functionality of exporting all files to a single location in BrightPay Preferences.)

BrightPay Connect

In case you missed it, we launched "BrightPay Cloud" in summer 2016. We have now rebranded this as BrightPay Connect. It works exactly as it has to date, including some further refinements and new features for 2017/18.

We have a detailed web page about BrightPay Connect here. Here's a quick overview of what it's all about:

- BrightPay Connect provides a secure, automated and user-friendly way to backup and restore your payroll data on your PC or Mac to and from the cloud.

- BrightPay Connect provides a web/mobile based self service dashboard for your employees, enabling them to:

- View/download their payslips and other payroll documents

- View their calendar, and make requests for annual leave.

- View and edit their personal details.

- BrightPay Connect provides a web/mobile based self service dashboard for employers and clients of payroll bureaux, enabling them to:

- Access the payroll documents and data for each of their employees.

- View an employer-wide payroll calendar.

- View payroll reports exactly as you have set them up in BrightPay.

- View the schedule of HMRC payments, outstanding amounts, and access the P30 for each tax period.

BrightPay Connect is built for security, reliability and stability, and costs just £49 per employer. Bulk pricing is available for bureaus.

Other 2017/18 Changes in BrightPay

- The foundational technology of BrightPay has been updated to the latest version, which immediately brings many performance, reliability and security improvements (and opens up new possibilities to our development team!). A side effect of this update, however, is that BrightPay 2017/18 cannot be run on Windows XP. We've attempted to make all customers aware of this change several times over the past six months, and our telemetry now shows that less than 1% of our customers still run on Windows XP. So while we do apologise for any inconvenience this causes, with the improvements gained it is unquestionably the best decision for our customers as whole.

- BrightPay 2017/18 will automatically offer to import your BrightPay 2016/17 files on first launch.

- New feature: Piece of Work rates – if you pay (or part pay) your employees by a unit other than salary, the hour or the day, BrightPay now caters for you.

- Additions and deductions can be calculated as a percentage of payslip basic, gross or net pay.

- BrightPay 2017/18 now allows you to adjust the 5.6 weeks statutory holiday weeks entitlement figure for annual leave calculation types.

- Support for Automatic Re-Enrolment.

- Real Time Information – more flexible workflow allows you to come back and check for a response from HMRC for an already sent submission, rather than having to start the submission process over from scratch.

- Expenses and Benefits:

- Company car information is now reported on the FPS submission.

- Vouchers and credit cards can now be payrolled.

- Support for new 'Serious Ill Health Lump Sum' indictor on FPS submission.

- Support for custom hourly/daily rate multipliers.

- Support for starters with no starter declaration.

- Improves how pay dates are entered when finalising payslips – you can now set a different pay date for individual employees if need be. When re-opening and re-finalising payslips, the previously used pay date is remembered.

- Import from Moneysoft 2016/17 (at the time of writing, this supports importing the basic details for employers, employees and subcontractors only).

- Royal London contributions now use a tax monthly based contribution schedule.

- Optimisations to data file size and installation package size.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

Includes all updates to BrightPay 2016/17 since March 2016

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2016/17, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2017/18. See our release notes for full details. Here's a quick reminder of the main areas of improvement:

- Statutory Minimum Wage flagging and reporting.

- Retroactive Statutory Sick Pay.

- Centralised agent sender credentials and details.

- Support for several new Auto Enrolment scheme providers.

- Ability to disable carry-over of shortfall amount between HMRC pay periods.

- Ability to include employer logo and further customise the layout of Auto Enrolment letters.

- Batch P11 and P60.

- NEST – ability to override contributions schedule dates, validate groups and payment sources, and send payment approval requests

- CIS – ability to import pay records from a CSV file, zeroise payment records and print a tax period summary.

- Mid Year start summary report.

What's Next?

17.0, 17.1, 17.2, 17.X... we're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Aug 2016

11

Introducing BrightPay Cloud

We’re pleased to announce that BrightPay Cloud is now available.

BrightPay Cloud brings several new features to BrightPay. These are described over on the dedicated BrightPay Cloud section of our website, and they aren’t covered in the same detail here. In this article, I’ll give you a background to BrightPay Cloud, where it currently stands, and where we’re heading next.

Background

When we launched BrightPay in the UK back in 2011, the payroll software landscape was different. There was no RTI, and Auto Enrolment was still half a decade away for most employers. After noticing that the majority of payroll software product options had stagnated and were drawing many complaints from their customers, we entered BrightPay into the market as a nice, modern, easy to use and fairly priced alternative. We had our work cut out for us over the subsequent years adding features and responding to the big industry changes as they transpired. We’re very pleased to have been successful in our endeavours, as attested to by a browse through the BrightPay customer testimonials.

One feature area that has been trending in recent years is cloud functionality. BrightPay has always had a certain amount of cloud connectivity – software updates, licensing, emailing payslips and help documentation are all powered via the cloud, as are features like RTI and NEST submissions, as well as Auto Enrolment staging date checking. But there have been a number of big requests from customers over the years that we have not provided a solution for.

Until now.

Automatic Cloud Backup

Your payroll data is important. You need it to pay your employees accurately and on-time and to comply with HMRC reporting requirements. It’s not something you want to lose.

But backing up this important data often succumbs to human error. For example, we’ve heard from many customers over the years who requested that BrightPay would regularly remind them to backup their payroll data, simply because they forget. But a problem with a solution like this is that manually backing up data adequately is complicated. It’s not good enough to keep a backup of your files on your computer, as you can lose everything if your computer breaks. USB keys are handy, but they get lost. An off-site storage solution with data redundancy and geo-replication works great, but not everyone’s an IT expert.

So we wanted to provide a backup solution for BrightPay that just works.

With BrightPay Cloud, your payroll data gets automatically backed up to a secure cloud repository without you having to do anything – it’s that simple. As you run your payroll or make any other changes to data in BrightPay, it synchronises in the background. And it doesn’t just keep the latest backup - it keeps a history of backups, so even if you accidentally delete or change anything only to realise the mistake much later, you’re still covered. You can restore a cloud backup onto your current computer, or onto a new computer, at any time.

Employee Self Service

Many employers have already transitioned from printed payslips to digital payslips, often delivered via email. But wouldn’t it be great if employees had somewhere they could go to not only get their latest payslip, but to also access their entire history of payslips and other payroll documents at their own convenience? And what if they could easily see their own calendar of leave and personal tax details without having to contact HR?

BrightPay Cloud provides this facility through a feature called Employee Self Service. Using Employee Self Service, employees can do all the aforementioned tasks using their PC, Mac or smartphone. They can also make requests for leave and submit updates to their personal details, which, if approved, automatically synchronise back down to BrightPay on your PC or Mac.

You can set up Employee Self Service for your entire workforce or just a subset of employees, and you can control what they see and which features they have access to. Self Service will automatically notify your employees via email when their latest payslip or P60 is available.

How does BrightPay Cloud ensure employees always have access to the latest data? Well, as mentioned above, BrightPay Cloud automatically backups up your data to the cloud as you make changes. Self Service is powered by your most recent backup, and so, it just works.

Bureau Client Self Service

Accountants and payroll bureaux get both of the above features with BrightPay Cloud – employer data files are automatically backed up, and your client’s employees can all get access to Employee Self Service.

But there’s more. Using BrightPay Cloud, you can provide an Employer Dashboard for your clients as well, allowing them to not only view their employees’ information, but also see an employer-wide calendar, access payroll reports that you define in BrightPay, and view the schedule of HMRC payments and liabilities.

Your clients can also use their Employer Dashboard to approve the leave requests and personal details update requests made by their employees, all of which synchronises back down to your data in BrightPay. You can give access to as many contacts for your clients as need be.

Data Protection and Security

Our number one priority when creating BrightPay Cloud has been security. We spent a lot of time getting the best possible foundation and architecture in place before doing anything else.

The various data repositories and services which make up BrightPay Cloud are built using a compartmentalised design that maximises security. Strong encryption is used to store all data, as well as in communication with your PC or Mac. All popular kinds of attack are protected against. Your data is accessible only by you.

We selected the Microsoft Azure platform to power BrightPay Cloud, giving us reliability, scalability, data redundancy, geo-replication and timely security updates out of the box.

It’s worth noting that the most common weakness in any system like BrightPay Cloud is a poor password, so when choosing a password please remember to select something adequate, keep it safe, and change it often.

Pricing

BrightPay Cloud costs just £49 per employer, per tax year (plus VAT). That price gives you a full year of cloud backups and Self Service for ALL your employees. When you renew BrightPay Cloud in the following year (at the same price), we will maintain the previous year’s data.

Bureau users, who may wish to purchase BrightPay Cloud for multiple clients, can get a bulk discount depending on how many employers they require (see pricing for details). The BrightPay Cloud pricing model is employer-based, unlike that for BrightPay on your PC or Mac, because it runs on a cloud platform that costs us in direct proportion to its usage. But we're competitively priced, and you still get the same support at no extra cost.

So What’s Next?

Our immediate plan is to continue making improvements to BrightPay, while enhancing BrightPay Cloud with advanced configurability, more features and additional access options.

We received a lot of responses to our recent BrightPay customer survey, which we have used to build a prioritised development plan. You can expect see several more BrightPay upgrades during the 16/17 tax year, and some nice new features for 17/18.

We’ve started building Self Service mobile apps for BrightPay Cloud to make it even easier and more convenient for employees to access their payroll information. And we have plans for improved branding and customisation, timesheets and more HR features.

We get asked from time to time about any plans we may have for a complete cloud version of BrightPay which could be used entirely via your web browser. While this is something we are continually looking at as we monitor the industry and customer expectations, we don’t have any announcements at this stage. Rest assured that even if we do go down that route in the future, the existing PC/Mac version is not something that would go away any time soon – we foresee a long lifespan for BrightPay and BrightPay Cloud, and look forward to working with you for many years to come.

Mar 2016

23

BrightPay 2016/17 is Now Available. What's New?

BrightPay 2016/17 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2016/17 Tax Year Updates

- 2016/17 rates, thresholds and calculations for PAYE, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, and Statutory Shared Parental Pay.

- The emergency tax code has changed from 1060L to 1100L. When importing from BrightPay 2015/16, L codes are uplifted by 40, while M codes are uplifted by 44 and N codes by 36.

- Full support for Scottish Rate of Income Tax (SRIT) codes.

- The new NI category H is available for apprentices under 25 in qualifying circumstances. Payments to class H employees are not liable to Class 1 secondary NICs.

- With the abolishment of Contracted Out Pension, HMRC have discontinued NI categories D, E, K, I and L. When importing from BrightPay 2015/16, employees in any of these categories are moved into the equivalent non-contracting-out category.

- Support for Plan 1 and Plan 2 Student Loan deductions.

- Ability to process 2016/17 coding notices.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all RTI submission types.

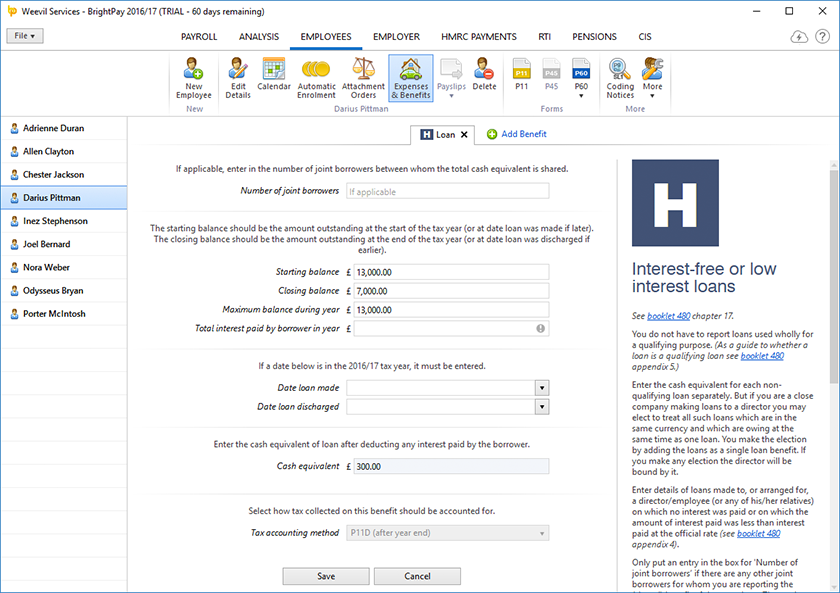

Expenses and Benefits

BrightPay 2016/17 allows you to record all types of reportable expenses and benefits that you provide to your employees:

- Assets transferred (cars, property, goods or other assets)

- Payments made on behalf of employee

- Tax on notional payments

- Vouchers and credit cards

- Living accommodation

- Mileage allowance and passenger payments

- Car and fuel

- Vans and fuel

- Private medical treatment or insurance

- Qualifying relocation expenses payments and benefits

- Services supplied

- Assets placed at the employee’s disposal

- Other items (Class 1A)

- Other items (Non-Class 1A)

- Income Tax paid but not deducted from director’s remuneration

- Interest-free or low interest loans

- Travelling and subsistence payments

- Entertainment

- General expenses allowance for business travel

- Payments for use of home telephone

- Non-qualifying relocation expenses

- Other expenses

BrightPay can produce a P11D for sending to HMRC after year end which includes your Class 1A NICs declaration and details of the expenses and benefits provided including cash equivalents.

If you register for payrolling of benefits by 5 April 2016, BrightPay 2016/17 also supports calculating the PAYE on expenses and benefits in each pay period.

We will be back-porting some of the expenses and benefits features to BrightPay 2015/16 to allow you to send your P11D for the 2015/16 tax year. Look out for an upgrade in April/May.

Note: Expenses/benefits and P11D are not available for Free Licence customers.

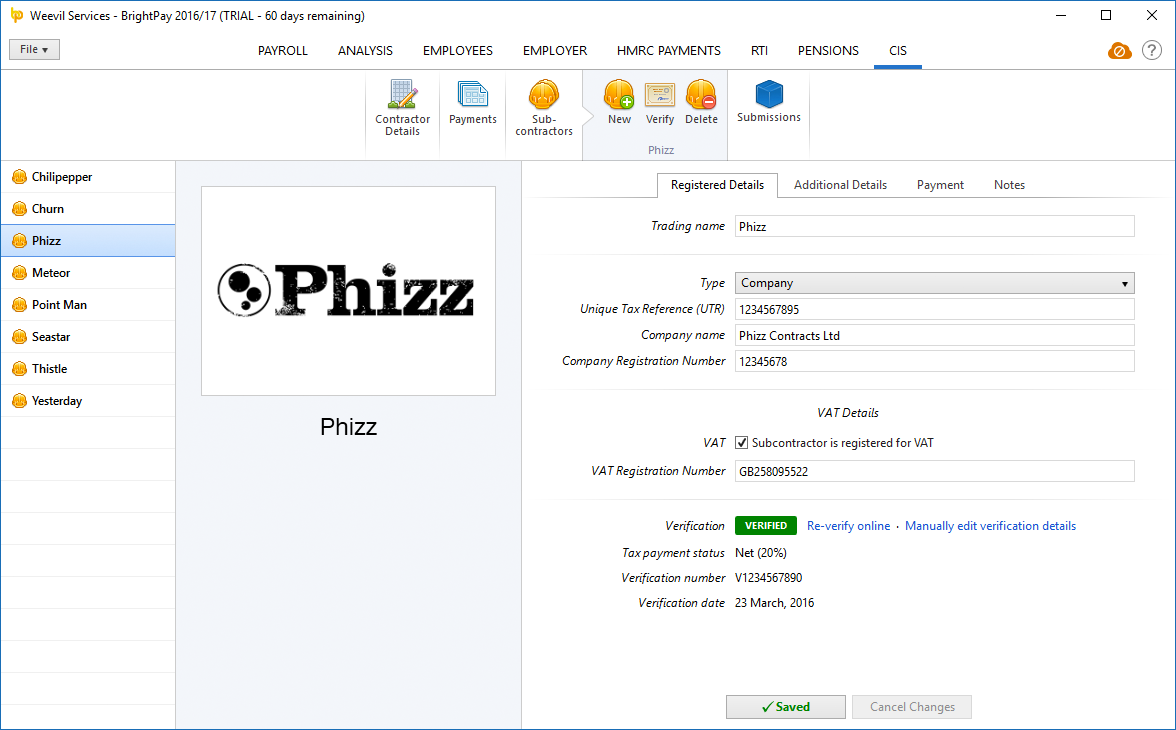

Construction Industry Scheme (CIS)

BrightPay 2016/17 has full support for paying subcontractors under the Construction Industry Scheme (CIS):

- Add/edit subcontractors, or import from CSV.

- Pay subcontractors tax weekly or tax monthly (all year or part year).

- Customisable basic pay, daily rates, hourly rates, additions, deductions, etc.

- Record cost of materials and VAT.

- Calculate CIS deduction amounts according to subcontractor's tax payment status.

- Print, export to PDF, or email Subcontractor Payment and Deduction Statements.

- Send CISREQ subcontractor verification submissions and apply response data.

- Send CIS300 monthly returns.

- BrightPay tracks the number of unsent CIS submissions, similar to RTI.

- Report on CIS data in BrightPay Analysis (some built-in CIS reports are available)

Note: CIS is not available for Free Licence customers.

Pensions and Automatic Enrolment

If you have not yet entered your Automatic Enrolment Staging Date in BrightPay, you can now connect directly to the Pensions Regulator and retrieve it automatically from within BrightPay.

BrightPay 2016/17 now tracks the number of enrolment/contributions submissions that you have not yet submitted to your pension scheme provider. The number is shown on the main PENSIONS tab, and contributes to the total number shown on the Open Employer screen (which also includes RTI and CIS).

We'll be continuing to update Automatic Enrolment during the 2016/17 tax year and provide dedicated support for more pension scheme providers.

Coming Soon: BrightPay Cloud

BrightPay Cloud will allow you to connect your BrightPay employer data to a web based service that provides:

Secure Online Backup

Automatically backs up your BrightPay data to the cloud. A historical set of backups is maintained. Your data file can be restored from an online backup at any time.

Employee Self-Service

Enables employees to log in to a web-based portal using their PC, Mac or smartphone to retrieve payslips, view their calendar, request annual leave, view/update personal information, and more.

Bureau Client Self-Service

Enables payroll bureaux to provide an online portal not only for their customer's employees (i.e. employee self-service as described above), but also an employer portal for direct use by their employer customers, enabling them to view payroll reports, P30s, calendar, all employee information, and more.

BrightPay Cloud will work directly with BrightPay 2016/17, but also allow you to upload your BrightPay 2015/16 data to immediately have a full year of historical data to power the self-service features.

BrightPay Cloud will cost £49 per employer per tax year (with discounted bulk pricing for bureaux also available).

We'll have more news very soon. As a BrightPay customer, you'll be the first to know. Watch this space!

Other 2016/17 Changes in BrightPay

- Ability to import employees from an FPS XML file.

- When importing from HMRC Basic PAYE Tools, you can choose to do so from the previous tax year or the current tax year.

- Pension-able gross can be split into separate employee and employer pension-able gross amounts.

- Basic pay, daily pay and hourly pay can now be explicitly flagged as liable/not-liable to PAYE, NICs, employee pension, and employer pension.

- Additional Statutory Paternity Pay is no longer relevant and is removed in BrightPay 2016/17.

- The NIC Upper Accrual Point is no longer relevant and is removed from BrightPay 2016/17.

- New wider range of built-in reports.

- Pension provider enrolment/contributions submissions and file formats have been updated to the latest versions.

- Ability to view submission logs for NEST web service submissions.

- An HMRC payment date is no longer required to be able to progress to the next HMRC pay period. Any pay period can be clicked into at any time.

- Ability to report on HMRC payment amounts in Analysis.

- Employee passwords can be randomly generated.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

BrightPay 16/17 is the same price as BrightPay 15/16 (including FREE for small employers with up to three employees). Support will continue to be free of charge for all users.

We’re pleased to announce that BrightPay Cloud is now available.

We’re pleased to announce that BrightPay Cloud is now available.