Mar 2015

23

BrightPay 2015/16 is Now Available. What's New?

BrightPay 15/16 is now available to download. Here’s a quick overview of what’s new:

2015/16 Tax Year Updates

- 2015/16 rates, thresholds and calculations for PAYE, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, and Statutory Shared Parental Pay.

- The emergency tax code has changed from 1000L to 1060L.

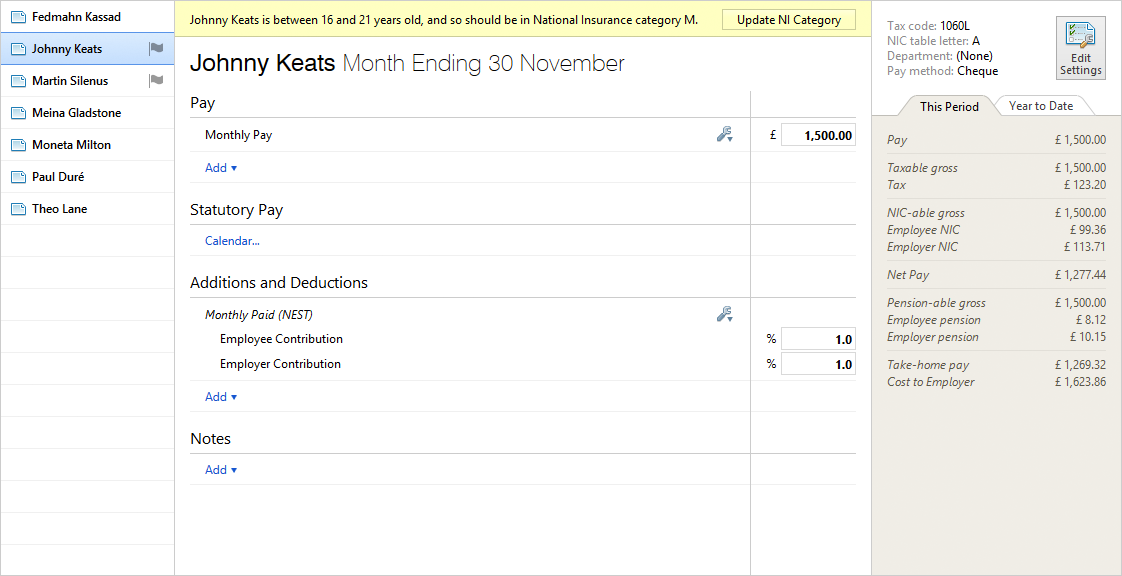

- Support for the newly introduced National Insurance category letters for employees under 21 years old:

- M – Standard rate contributions

- Z – Deferred rate contributions

- I – Contracted-out Salary Related standard rate contributions

- K – Contracted-out Salary Related deferred rate contributions

- Eligible employers can continue to claim the £2000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all RTI submission types.

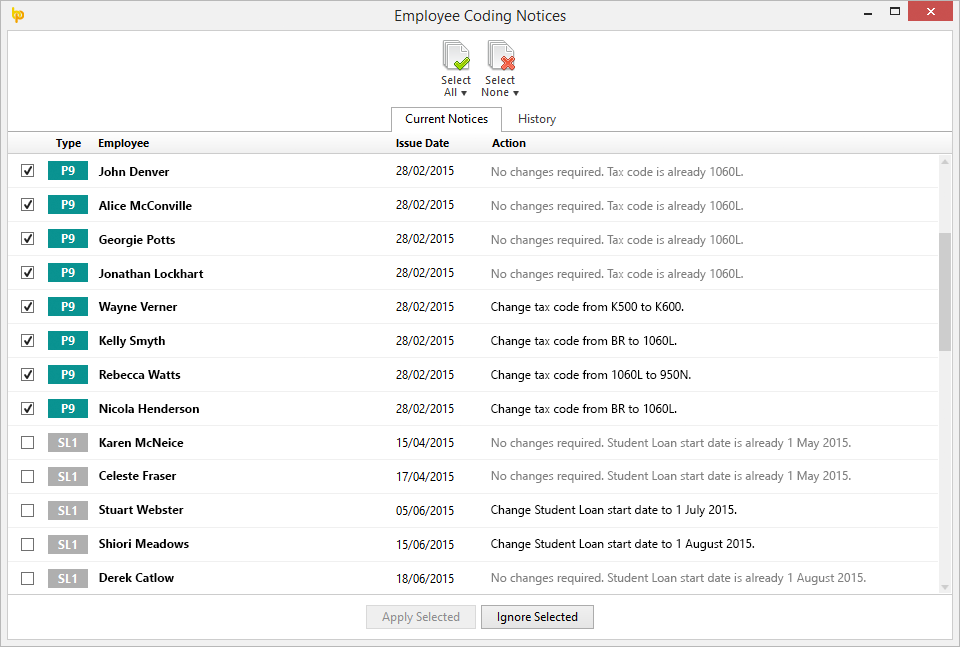

PAYE Coding Notices

BrightPay 2015/16 includes the ability to retrieve and process employee PAYE coding notices directly from HMRC (P9, PB, P6B, SL1, SL2).

To use this feature, ensure the notice options in your HMRC PAYE dashboard are all set to Yes. Only new coding notices issued after this instruction will be available for download.

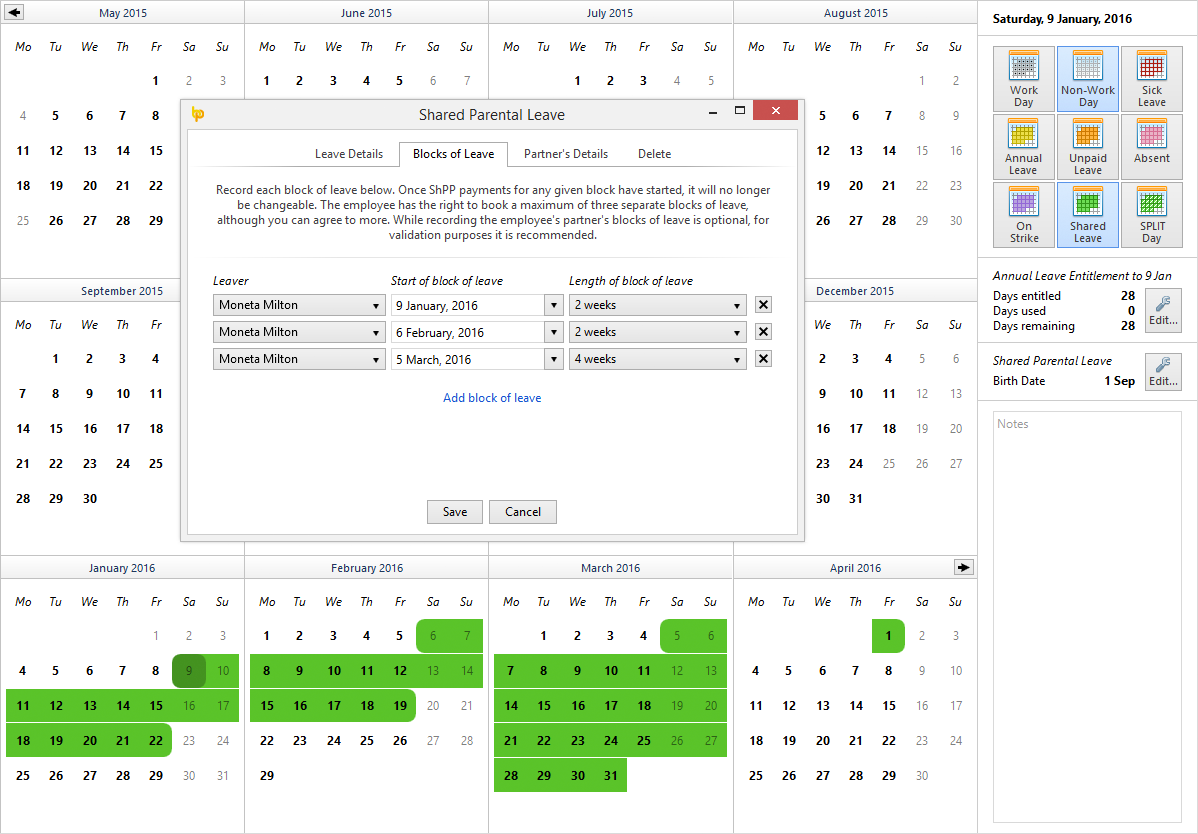

Shared Parental Leave

Shared Parental Leave (SPL) is a new legal entitlement for eligible parents of babies due (or children placed for adoption) on or after 5 April 2015. SPL lets parents choose either to have one parent take the main child caring role, or to share the child caring responsibilities evenly, depending on their preferences and circumstances. Unlike maternity/adoption leave, eligible employees can stop and start their SPL and return to work between periods of leave.

BrightPay 2015/16 has full support for Shared Parental Leave and Statutory Shared Parental Pay (ShPP).

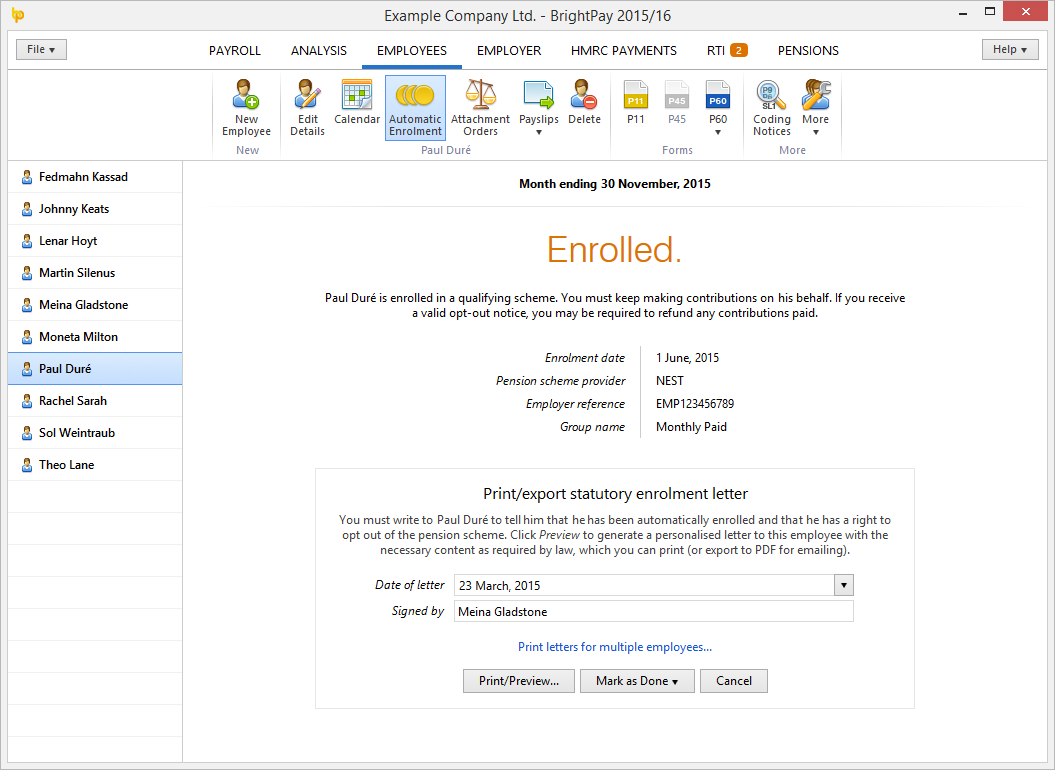

Pensions and Automatic Enrolment

With the first wave of small employers (i.e. those with less than 50 employees) set to stage for Automatic Enrolment in January 2016, this tax year will be busy.

We first introduced support for Automatic Enrolment in BrightPay 2014/15, providing the ability to set up qualifying pensions schemes, assessment, postponement, enrolment, opt-ins, opt-outs, employee communications, and more. We have dedicated support for NEST, NOW: Pensions, The People's Pension and Scottish Widows.

In BrightPay 2015/16 we have improved Automatic Enrolment support and added several new features:

- There is now a dedicated PENSIONS tab for setting up Automatic Enrolment in BrightPay, adding/editing pensions schemes, and exporting enrolment and contribution files.

- Batch processing – multiple employees can now be postponed or enrolled (and as well as other actions) together in a single click. Multiple communications can be printed together.

- Ability to override BrightPay's assessment of an entitled worker or non-eligible jobholder (e.g. if the employee's pay would normally put them in a different category).

- Ability to continue enrolment from a previous tax year or continue enrolment from other payroll software.

We'll be continuing to update Automatic Enrolment during the 2015/16 tax year and provide dedicated support for more pension scheme providers.

Improved Reminders

For years, BrightPay has given reminders of important actions and detected potential data errors as you process your payroll. In 2015/16, we've improved the system to handle even more reminders and give much improved visual feedback.

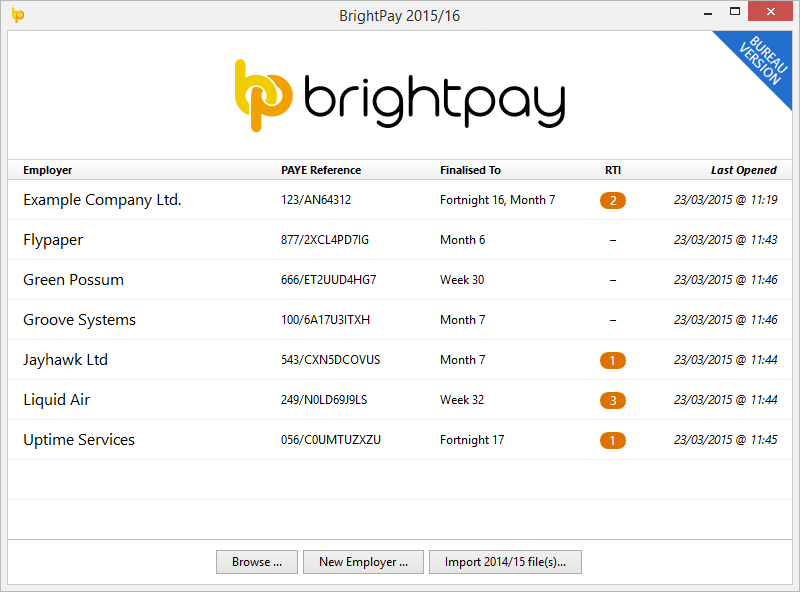

New Start-up Window

Standard and Bureau users alike will benefit from the extra employer information included in the new BrightPay start up window:

Other 2015/16 Changes in BrightPay

- Ability to batch print, email or export one or multiple payslips for a single employee.

- Automatic prompt to create an EPS when recoverable amounts are detected in an HMRC payment.

- A new summary of calendar events in the current period for the currently selected employee appears in the bottom right of main payroll screen.

- Support for Direct Earnings Attachment orders.

- New ability to set up an addition or deduction to repeat to a date beyond the current tax year.

- Improved Statutory pay descriptions.

- New ability to hide 'zero' payments, additions and deductions on printer (or emailed/exported) payslips.

- Employer's HMRC Sender password is now securely masked in the BrightPay user interface.

- Lots and lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

BrightPay 15/16 is the same price as BrightPay 14/15 (including FREE for small employers with up to three employees). Support will continue to be free of charge for all users.

Mar 2014

24

BrightPay 14/15 is Now Available. What's New?

BrightPay 14/15 is now available to download. Here’s a quick overview of what’s new:

2014/15 Budget Changes

- 2014/15 PAYE thresholds

- 2014/15 National Insurance contributions rates and thresholds

- 2014/15 Student Loan threshold

- 2014/15 Statutory payments rates and thresholds

- The emergency tax code has changed from 944L to 1000L.

- Eligible employers can claim the new £2000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Retirement of the regional employer NICs holiday scheme

- Statutory Sick Pay is no longer recoverable

Automatic Enrolment

BrightPay 14/15 has complete functionality to enable you to automatically enrol your employees into a qualifying pension scheme:

- BrightPay allows you to record your automatic enrolment staging date. When the staging date has been reached, automatic enrolment functionality will automatically kick in.

- BrightPay will assess your employees, monitor eligibility criteria, and let you know:

- who must be enrolled into a qualifying scheme

- who has the right to opt in to be enrolled in a qualifying scheme

- who can request to join a pension scheme

- BrightPay walks you through all the various automatic enrolment processes:

- postponing assessment

- enrolling employees

- handling opt-ins and joining

- handling opt-outs and refunds

- BrightPay enables you to generate tailored communication letters and notices to employees

- BrightPay tracks records on a period by period basis, allowing you to see exactly what changes, actions and contributions are made throughout the year. You can produce custom reports with the exact information you require.

- BrightPay has dedicated support for the automatic enrolment qualifying pension scheme offered by the National Employment Savings Trust (NEST), allowing you to:

- set up your NEST scheme, group and payment sources

- create enrolment and contribution submission CSV files for uploading to NEST

- We plan to add dedicated support for other pension scheme providers, but for now BrightPay offers generic support for any automatic enrolment qualifying scheme which you can use in conjunction with BrightPay's built-in reporting tools to operate your scheme.

For more information on automatic enrolment, see our automatic enrolment blog or the guide for employers on The Pensions Regulator website.

Real Time Information (RTI)

This time last year we launched BrightPay 13/14 with full support for RTI.

In 14/15, there are some new features and improvements:

- From 2014/15, HMRC will be introducing penalties for late Full Payment Submissions (FPS). To help determine whether any late filing penalties are due, HMRC request that a late reporting reason be included with late submissions. BrightPay will detect when an FPS is late, and prompt you to select a reason.

- Support for the new FPS contracted hours worked per week bands

- Ability to set/change the Payroll ID for any employee (start of year or mid year)

- New Employment Allowance indicator on EPS

- Bank account information on EPS

- Improvements to the RTI interface in BrightPay, including the ability to view total amounts of the values in an FPS.

- We received feedback from HMRC about the most common data errors that occur in submissions from BrightPay customers, and so have made many improvements to prevent these from happening. For example:

- Improved wording on notifications

- Better validation at the data entry stage

- Forced UK data formats for users on non-English operating systems

- RTI messages and logs are now stored in a compressed format in your data file, which should greatly help to reduce file size.

BrightPay – New Features

With RTI and Automatic Enrolment, the last couple of years have seen many changes to UK payroll. This in turn has required a lot of supporting development to be done on BrightPay. So with these out of the way, we are excited to get back to adding unique features and making BrightPay the best payroll software on the market. Here are the new features we've completed for this first 14/15 release:

- Ability to add an addition (new or existing type) to multiple payslips at once

- Ability to add a deduction (new or existing type) to multiple payslips at once

- Ability to set a note on multiple payslips at once

- Ability to edit the FPS settings for multiple payslips at once

- Ability to record absence and strike on employee calendar

- Ability to record part day annual leave, unpaid leave, absence or strike on employee calendar

- Ability to print the employee calendar and overview of leave for one or multiple employees

- Ability to print a summary of company annual leave entitlement

- Ability to create a BrightPay employer file without a password (and remove the password from an existing file)

- Ability to see the most recent time a payslip was printed, emailed, or exported.

- Ability to import employee details from Bright Contracts

But that's not all – we've got some great plans for what's coming next. And like previous years, you won't have to wait until 15/16 – we'll be releasing new features to 14/15 users when they are ready. Watch this space!

Other Improvements in BrightPay 14/15

- Improved aesthetics (including graphics fixes for Windows 8 users).

- Performance enhancements – we've upgraded much of the core technology that powers BrightPay to the latest version, bringing with it faster and better number crunching.

- Minor user interface tweaks to make BrightPay even easier to use.

- Lots of minor bugs have been squashed.

BrightPay 14/15 will be the same price as BrightPay 13/14 (including FREE for small employers with up to three employees). Support will continue to be free of charge for all users.

Sep 2013

23

What's New in BrightPay 13.5?

BrightPay 13.5 is a free upgrade to our 2013/14 payroll software. It adds many new features to BrightPay, including some popular customer requests.

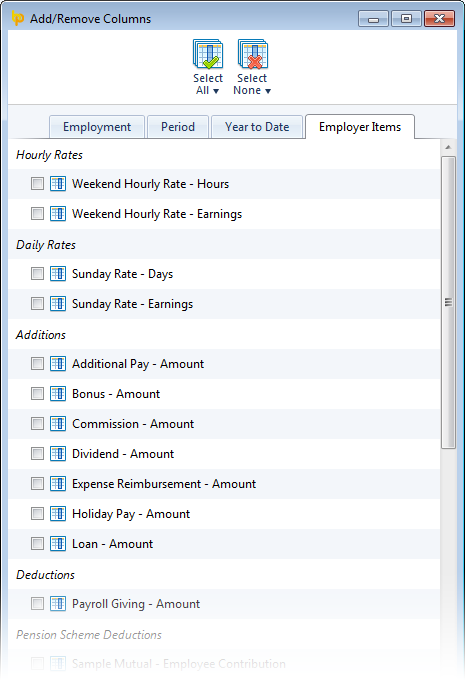

Ability to Report on Specific Employer Items in Analysis

Until now, BrightPay's analysis feature was limited to reporting on the common payroll data that could apply to any employee's payslip in any period (e.g. gross pay, tax, NICs, etc.).

Until now, BrightPay's analysis feature was limited to reporting on the common payroll data that could apply to any employee's payslip in any period (e.g. gross pay, tax, NICs, etc.).

A popular request from customers was the ability to report on the employer specific data that is editable under the main Employer tab of BrightPay, including:

- Specific addition and deduction types

- Specific hourly and daily rates

- Specific pension scheme deductions

- Specific savings scheme transactions

This feature is now available in BrightPay 13.5. As you add/edit the above items and use them in payslips, their amounts become available for reporting in Analysis.

Also, to make it easier to build your reports, the Add/Remove Columns feature in BrightPay has now been organised into tabs.

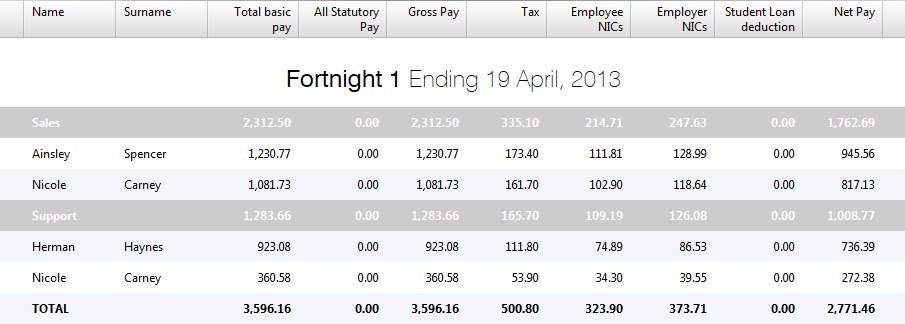

Improved Departmental Reporting

When reporting by department, BrightPay now groups the departmental records in a more logical, useful way. An employee in multiple departments can now have his/her payroll values split out into each department within the results for a single period.

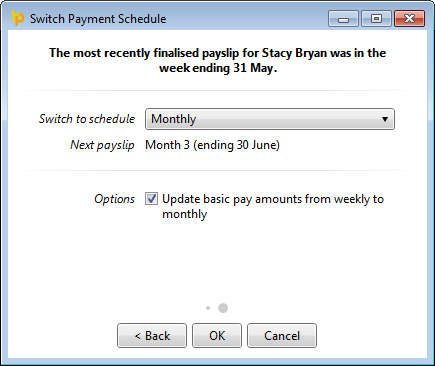

Ability to Switch Employees to a New Payment Schedule Mid Tax Year

Do you have employees who are switching from being paid weekly to being paid monthly? Or the other way around? Perhaps some need to switch to or from a fortnightly or 4-weekly pay schedule?

This feature is now available in BrightPay 13.5. In any period, you can now switch one, multiple or all employees to a new payment schedule. This can be done as many times as is required throughout the tax year.

Here's how it works (for example, when switching from weekly-paid to monthly-paid):

Here's how it works (for example, when switching from weekly-paid to monthly-paid):

- Finalise an employee's payslips up until the final week that she should receive a weekly payment.

- Her next payslip will be set up in the following week. You want her next payslip to be in the following month instead, so choose this week in BrightPay and go to More > Switch Employee(s) Payment Schedule...

- More than one employee can be switched if need be. Select the relevant employees and click Continue.

- Select 'Monthly' as the new payment schedule.

- BrightPay will automatically determine the next available month to switch to, or, if no monthly schedule has been set up, allow you to do so.

- To prevent doubling up on payroll amounts, employees can only be switched to a later month that does not overlap with any already finalised weeks.

- If there are one or more weeks which could be finalised before switching to a monthly schedule, BrightPay will warn you.

- You can optionally choose to have the employee's basic pay automatically adjusted from weekly to monthly.

- Click OK. BrightPay will remove the weekly payslip that is no longer relevant, and create the employee's first monthly payslip.

Other New Features and Fixes

- Ability to ignore 'zero pay' payslips in analysis.

- Fixes a bug in which an EPS (or NVR) cannot be created for mid-year-start employers.

- Fixes a bug in which BrightPay will not accept an employee start date for mid-year-start employers.

- Other minor fixes and performance improvements.

Upgrading

When you next launch BrightPay, the upgrade should be automatically detected – simply follow the instructions on-screen. If you have any problems upgrading, please contact us.

Aug 2013

22

Rate BrightPay and Win £1,000 in Amazon Vouchers

We'd greatly appreciate your time (a few minutes!) to share your feedback on BrightPay in the AccountingWEB Software Satisfaction Awards Survey.

As well as helping us to improve BrightPay, your feedback could also enable us to become one of the lucky few shortlisted for a prestigious AccountingWEB Software Satisfaction Award!

AccountingWEB are offering those that participate in the survey the chance to win a top prize of £1,000 in Amazon vouchers or one of five £100 Amazon vouchers.

Apr 2013

3

What's New in BrightPay 2013/14?

We released BrightPay 13/14 (version 13.0) on 19th March, 2013. It has since been downloaded nearly 2000 times, and we've received some great feedback. Big thanks to all our customers!

This morning, we released our first maintenance release, version 13.1. This is an important update which contains several minor new features, improvements and bug fixes. When you launch BrightPay, it will check for and offer to download this update automatically. Alternatively, click Check for Updates in the Help menu. To download the upgrade manually, click here.

So, as the title of this blog posts asks ... What's New?

Real Time Information

First and foremost, the most obvious new feature in BrightPay 2013/14 is full, HMRC recognised support for RTI. We believe that we have the best RTI implementation on the market. We've already covered RTI support in previous blog entries (e.g. here, here and here), so won't go into the same detail now. But here are a few tips which you may not have already picked up:

- The number of pending RTI submissions is always visible, showing in an orange box in the main RTI tab.

- Until RTI submissions are sent, they are automatically updated with any changes you make to employer, employee or payment details.

- You can send multiple RTI submissions at once, and continue to use the rest of BrightPay while submissions are sending.

- You can view the Gateway Logs for each RTI submission to see the exact back and forth messaging between BrightPay and HMRC during the submission process.

- If the worst happens during the sending of an RTI submission (e.g. power failure), BrightPay will gracefully cancel the submission and allow you to restart the process when you are back up and running.

- You can edit the default RTI submission timeout in File > Preferences.

- If you have sent an RTI submission to HMRC outside of BrightPay, you can mark it as being already sent in BrightPay (having done so, you can also unmark it as being already sent).

Refined User Interface Design

Since the beginning, of all the work that has gone into creating BrightPay, the most by far has been in the design of the user interface (UI). BrightPay 2013/14 is our best yet. We refined how it looks and feels, making managing your payroll an even better, easier experience. Some of the highlights:

- Less is more. A major part of BrightPay's design over the years has been to show only what's relevant on screen, without the unnecessary visual clutter that plagues so many software applications. In BrightPay 2013/14, we took it even further, optimising the screen real estate and refining the layout of commonly used features.

- Edge-to-edge design with more breathing space. We removed unnecessary lines and borders while slightly increasing some of the space between on-screen controls. Overall, it makes BrightPay cleaner and clearer.

- More 'flat' design. A big trend in UI design is the use of 'flat' design, without visual effects such as gradients, drop shadows and bevels. We have have evolved the design of BrightPay in line with this concept, keeping it modern, fresh and simple.

New Payroll Features

The addition of RTI has over-shadowed some of the other new features and improvements in BrightPay 2013/14. But that doesn't make them any less important. The majority of these are in response to customer feedback and requests, so remember, if there's something that you would like to see in BrightPay, don't hesitate to get in touch.

- Named hourly and daily rates. You can now add a named hourly or daily rate and make it available for use by all employees, or save it just for one employee. There is no limit on the number of rates that can be added, and each can be specifically marked as an overtime rate. There are various ways in which one might use this feature, and so we've put it in various places in BrightPay:

- Manage global named rates (i.e. those available for use by all employees) in Employer > Hourly/Daily Rates

- Manage an employee's named rates in Edit Employee > Payment tab.

- Choose or add a new global, employee, or one-off named rate directly in payroll in the new hourly/daily payment rate selection.

- Edit addition and deduction types. You can now edit BrightPay's built-in list of addition and deduction types, as well as add your own.

- Live calculation as you type. In BrightPay 2013/14, payslip totals now re-calculate as you type. In fact, throughout BrightPay, all text input fields will now update and validate as you type. It's a subtle, but big improvement.

- The payslip totals calculation preview now shows only the relevant totals. For example, it won't show Statutory Payment amounts or Student Loan deductions unless there are any. Similarly, things like the separation of taxable and NIC-able additions and deductions are only shown if applicable.

- A new Cost to Employer field shows the total employer liability for each employee.

- New starter and leaver processes. With RTI, the P45, P45 Part 3 and P46 are no longer relevant. Starter and leaver details are now reported in real time along with other employee and payment information. With this in mind, the starter and leaver processes for BrightPay 2013/14 have been re-thought. For example, before RTI, when an employee was to leave, you would make their final payments, and then afterwards prepare the P45 with the leaver details. Now, you must enter the leaver details before making the final payment, so that the relevant FPS submission is complete and correct. To aid this, BrightPay now lets you confirm starter and leaver details as you finalise payslips. If you enter starter/leaver details in advance, BrightPay will pick them up in the relevant pay period. You can still print a P45 (or export a digital copy).

- An employee's department(s) and payment method/details are now tracked and recorded on a period-by-period basis.

- Two new options have been added to printing, emailing and exporting payslips:

- Ability to show employee's address

- Ability to show employee's number of annual leave days remaining

- Several enhancements have been made to the Pay Employees feature:

- Ability to indicate the available monetary denominations for the cash requirement.

- Ability to edit employee bank details directly within this feature.

- Ability to use smart tags in naming the bank payments file name.

- New Bank of Scotland bank payments file format.

- The annual leave year start date can now be customised for each employee, so that BrightPay will now correctly calculate annual leave days remaining for annual leave schedules which do not align with the tax year (e.g. January to December).

- Support for the Regional Employer National Insurance Contributions Holiday for New Businesses scheme.

- Ability to manually set any Attachment Order as being a priority order, with correct handling.

- 'Holiday Funds' have been renamed to the more appropriate 'Savings Schemes'.

This list covers all the important updates. There are many more minor ones, as well as 'under the hood' performance and reliability improvements.

And we're not done yet! We'll continue to bring you new features during the course of the 2013/14 tax year. Keep an eye on this blog for details.

Bright Contracts – Employment Contracts and Handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Feb 2013

6

RTI – Frequently Asked Questions

The 2013/14 tax year is almost here, and with it, Real Time Information (RTI). From 6th April 2013, employers will report their payroll information to HMRC in real time, on or before every payday.

BrightPay 2013/14, with full RTI support, will be available soon. Over the past few months, we have been asked several questions about RTI, and how it will work in BrightPay. Below are some of the common questions and answers.

Top Points to Remember

- All employees need to be included in BrightPay before your first RTI submission is sent, even if they are not paid on the first payday.

- To avoid major headaches later on, ensure that all your employee information (name, address, gender, NINO, DOB, etc.), as well as your employer PAYE reference and Accounts Office reference, are correct.

- Each time you finalise payslips in BrightPay, an FPS will be automatically prepared.

- It's OK if you make mistakes in an FPS or EPS submission - they can be rectified.

- You no longer have send a P45, P45 Part 3, or P46 for starters and leavers. You just need to ensure you enter correct start/leave dates before their first/final paydays.

- You no longer have to send a P35 or P14 at year end. They are replaced by the final FPS and final EPS.

- There will be no additional charge for RTI functionality in BrightPay.

When will BrightPay 2013/14 with full RTI functionality be available?

BrightPay 2013/14 will be released on Tuesday, 19th March, 2013.

When can I start sending RTI submissions?

On or after 6th April 2013. HMRC will not accept any RTI submissions sent before 6th April. This will not stop you from processing your payroll using BrightPay. If you process payroll before 6th April, BrightPay will prepare and save any required RTI submissions. From 6th April, you will be then able to send them.

What will my first RTI submission be?

Your first RTI submission will be due on or before your first payday in the 2013/14 tax year.

If you have 250 employees or more, your first submission must be an Employee Alignment Submission (EAS), which simply contains the details of all your employees, allowing HMRC to align their records with yours. BrightPay will detect if you have 250 or more employees, and guide you through submitting an EAS.

If you have less than 250 employees, you do not need to send an EAS (although you still can if you choose to). Instead, HMRC will align their records with yours when you send your first Full Payment Submission (FPS). An FPS is sent on or before each payday, and informs HMRC about the payments and deductions for each employee. BrightPay automatically prepares an FPS each time you finalise one or more payslips. If you did not send an EAS, BrightPay will include all the necessary alignment details in your first FPS, which includes a listing of all your employees, whether they were paid in the first pay period or not.

So, before you send your first RTI submission (be it an EAS or first FPS), it is very important that you first ensure all individuals in your employment are included in BrightPay. This includes temporary and casual workers, as well as employees paid below the LEL (Lower Earnings Limit) who, though they may have no deductions, now need to be accounted for through the payroll.

What information will be sent to HMRC on each payday?

Each time you pay your employees, you will send a Full Payment Submission (FPS) to HMRC. BrightPay will prepare an FPS each time you finalise one or more payslips.

An FPS contains:

- employer registration details (PAYE reference, Accounts Office reference, etc.)

- personal identifiable details for each employee (name, address, NINO, date of birth, gender, etc.)

- employment details for each employee (directorship, starter information, leaver information, etc.)

- year to date figures for each employee (tax, NICs, Student Loan deductions, pension contributions, statutory pay, etc.)

- figures for the relevant period for each employee (payment date, gross pay, an estimation of hours worked, indication of unpaid absence or strike, etc.)

If no employees are paid on a particular payday, an FPS is not required. Instead, BrightPay will notify HMRC of this in your next Employer Payment Summary (EPS) submission (which is otherwise used to notify HMRC of reductions you are entitled to make to the totals already submitted on FPS submissions e.g. statutory parenting pay).

Is there any new information in the FPS that I haven't had to send to HMRC before?

There are a few new pieces of information that were not previously included in P45, P46, P35 or P14 submissions:

- An estimation of hours worked. Either (a) Up to 15.99 hours per week (b) 16-29.99 hours per week or (c) 30 hours or more per week. For employees who are paid using an hourly rate only, BrightPay will select the correct option automatically. For employees paid a set amount each week or month, you will need to choose the appropriate option (BrightPay, by default, will use (c) 30 hours or more per week)

- An indication that the employee is on an irregular payment pattern. For example, this would apply to casual or seasonal employees (where the employment contract continues) or where the employee will not be paid for at least a further three months but is still in your employment (e.g.parenting/sabbatical leave). Setting this indicator will ensure that HMRC does not assume an employee has left your employment.

What if the information I send in an FPS is incorrect?

You've just sent an FPS, only to realise that you forgot to include overtime! This, and other accidents which affect the amounts reported on an FPS, could happen to you, and will most certainly happen to many other employers.

HMRC are aware of this possibility, and are flexible in how you handle it. You can re-send the FPS with correct figures, or you can continue anyway, and in the next FPS the year to date figures will be reconciled. BrightPay will cater for either approach.

If, after 19th April 2014, you realise that the information on your final FPS was incorrect, BrightPay will let you submit an Earlier Year Update (EYU) submission to make the adjustments as required.

Do I still need to send a P45 for an employee who is leaving (and a P45 Part 3 or P46 for a new start)?

No. BrightPay will automatically include starter and leaver details in relevant FPS submissions. With RTI, HMRC will already have the details of an employee's previous employment, and so there is now much less information about an employee's previous employment that you need to record in BrightPay.

But there is an important change to the process of recording an employee's start or leave date in BrightPay. Before RTI, a P45 Part 3 or P46 could be sent to HMRC up to 30 days after the employee started. Similarly, a P45 could be sent up to 30 days after an employee left. It was common (and perfectly acceptable) that an employer would notify HMRC only after making a first or final payment. But with RTI, you need to ensure that the start/leave date is set before sending the first or final FPS. To help ensure that you do this, BrightPay now allows you to confirm starter/leaver details when finalising payslips.

You will, however, still be required to provide a P45 copy to your employee when they leave, for their own records. BrightPay will still allow you to print this (or export it to PDF) as before.

What about the end of the tax year? Is a P35/P14 required?

The P35 and P14 are no longer applicable. Your final FPS (and/or EPS) will contain the end of year declarations that were previously included on the P35, as well as the final payment figures for each employee that were previously included on P14 forms.

How did the RTI pilot in 2012/13 go? Were there any lessons learnt by HMRC and/or employers?

For the most part, it went well, and was a very worthwhile exercise. Lots of issues were ironed out on both sides, ensuring that RTI in 2013/14 is as smooth as possible for the rest of us!

To help ensure you have the correct details for each of your employees before the 2013/14 tax year begins, we have created a Request Form that you can have your employees complete and return to you.

One of the main lessons learnt by employers was that information for each employee (name, address, date of birth, NINO, gender) should be accurate and up to date from the very start of the tax year. If it's not, or if you change employee information mid-year, HMRC may not be able to align their records with yours, creating big headaches for you and your affected employee(s).

To help resolve this problem in 12/13, HMRC introduced a Payroll ID for each employee, which they suggested should be the employee's Works Number. But Works Numbers can change. And so some difficulties were faced when HMRC incorrectly inferred a change in Works Number to be a new employment. In 13/14, BrightPay, along with many other software providers, will leave the Works Number alone, and automatically assign a unique Payroll ID for each employment.

Will there be an additional charge for RTI functionality in BrightPay 2013/14?

No.

With RTI, payroll is changing, but our simple pricing model and free support is not. Rest assured that once you have purchased a 2013/14 BrightPay licence, that's it.

Does BrightPay 2013/14 have HMRC Software Recognition?

BrightPay received full recognition in 2012/13, and we are in the process of being tested for 2013/14 recognition. HMRC have advised us that there may be delays in processing applications for 2013/14 recognition. Keep an eye on our website for updates.

If you have any more questions, please call or email us. We are confident that RTI will be easy with BrightPay 13/14

Bright Contracts – Employment Contracts and Handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Nov 2012

28

Creating RTI-ready payroll software - a BrightPay 2013/14 update

Over the past few months, we have been keeping you up to date on RTI and how it will affect your operations as an employer. You may have already started to prepare for the change.

The RTI development for BrightPay 2013/14 is on track and going well. As the lead software architect for BrightPay, my top priorities are:

- to ensure that the RTI experience in BrightPay 2013/14 is as seamless and easy to use as possible. We are not just adding an RTI layer of on top of the existing software design, but are instead rethinking the core design where we feel it's necessary to do so to make RTI function as simply and clearly as possible.

- to ensure that RTI support in BrightPay 2013/14 is in full compliance with HMRC specifications and guidelines. For you, the employer, it should just work or, in the case of an issue, make it very clear what you need to do to make it work.

- to ensure that BrightPay 2013/14 is completed (and thoroughly tested!) on schedule.

As well as RTI support in BrightPay 2013/14, we're also working on other improvements and new features (including some common customer requests - watch this space!). We're very happy with our progress so far and we will have more updates for you soon. We're really excited about bringing you a better BrightPay.

As always, please feel free to pick up the phone or email us with any queries regarding RTI, or anything else - we are always available for a quick response. Follow us on Twitter (@BrightPayUK) where we try to regularly post useful and helpful information. It might also be worth following HMRC on Twitter (@HMRCgovuk) for additional RTI updates or to take part in one of their popular Twitter Q&A sessions.

The future is Bright for payroll software.

Bright Contracts – Employment Contracts and Handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Aug 2012

27

What's New In BrightPay Version 12.4?

BrightPay version 12.4 was released on 27th August 2012. We're really pleased to continue to improve BrightPay as the 2012/13 payroll year progresses. Thank you to all customers who have provided feedback so far. If you'd like to see a new feature in BrightPay, please don't hesitate to get in touch.

Here are some of the new things to look out for in 12.4:

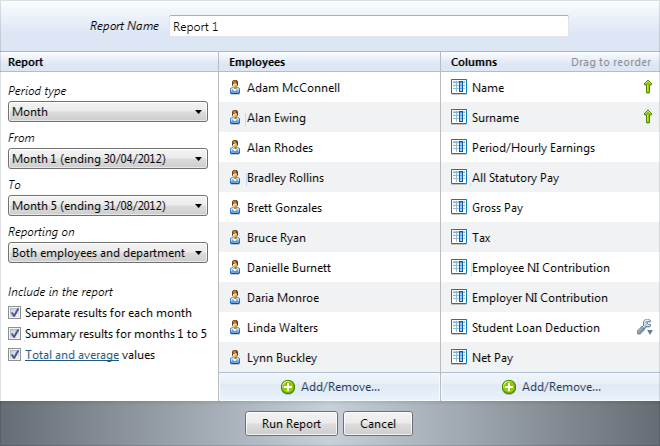

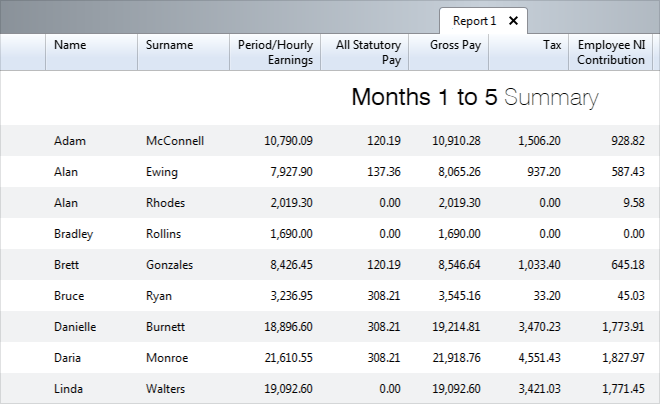

New and Improved Analysis & Reporting

- Simplified, clearer and more elegant user interface.

- Ability to run separate or combined employee and department reports.

- Drag and drop re-ordering of report columns.

- Performance - significantly faster report execution and more responsive scrolling of large reports.

- Column headings stay in place as the report data is scrolled.

- Clearer separation of report data sets (and improved report summary)

- Improved printing, including ability to customise the print title.

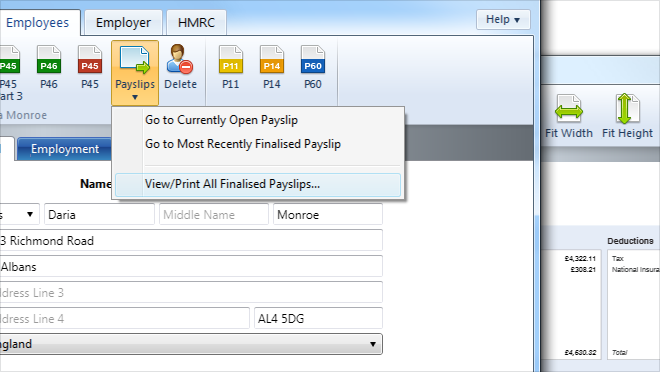

Employee Payslip Quick Links

Some handy links, including the ability to print all payslips for a particular employee.

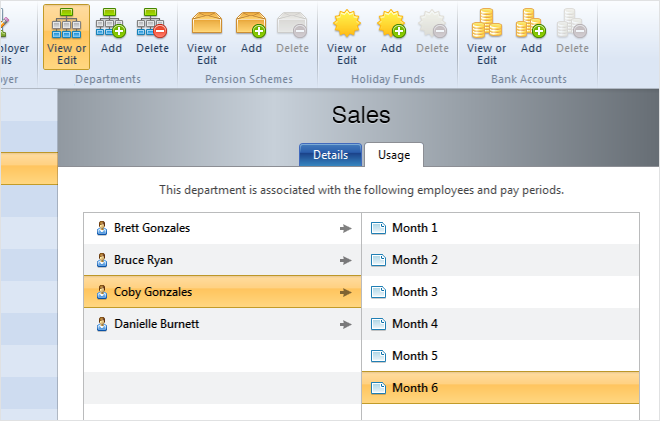

Track usage of Departments, Pension Schemes and Holiday Funds

See which employees relate to which departments, pension schemes and holiday funds at any point in the payroll year.

Other Fixes and Improvements

- Improved data validation messages throughout

- New Bank of Ireland BACS format

- More flexible handling of P30 adjustments

- Fixes a display issue in which a black bar can appear behind the main tabs at the top of the BrightPay window when Windows 7 Aero Glass is disabled

- Fixes some minor bugs and user interface quirks

Have you tried BrightPay yet? If not, download it today and start your fully featured 60-day free trial.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll & Auto Enrolment Software