Aug 2017

1

Proposed State Pension Age Changes: How will it affect you?

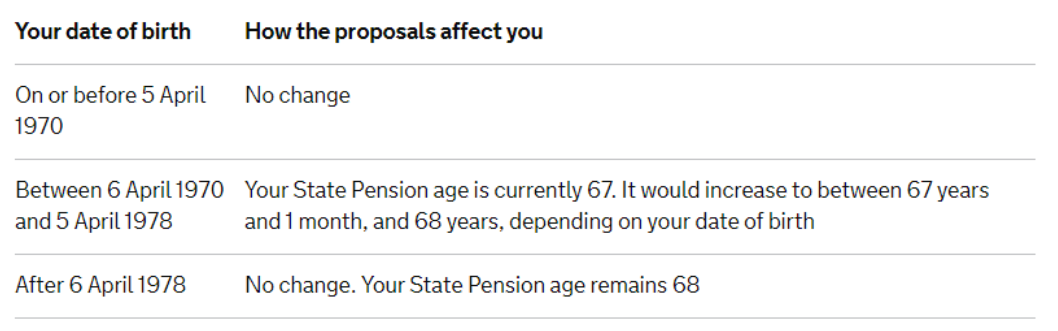

Millions of men and women may have to wait a year longer to receive their state pension after the Government have announced plans to raise the retirement age to 68 earlier than planned.

Under current legislation, the State Pension age increase from 67 to 68 is to be phased in between the years 2044 and 2046. The Government, however, now plan to implement this increase seven years earlier. Should this proposed change go ahead, this means that the State Pension age will thus increase to 68 between 2037 and 2039 instead.

Who will be affected?

Based on the new proposal, men and women born between April 6 1970 and April 5 1978 will be affected. This equates to approximately six million people, who are currently aged between 39 and 47.

No one born before April 5, 1970 will be affected by the change. Currently, those born since April 6 1978 already face a state pension age of 68.

Will these changes go ahead?

At present, this is simply a Government proposal and will therefore need to be approved by Parliament. In response to the new plans, Secretary of State for Work and Pensions, David Gauke said:

“Combined with our pension reforms that are helping more people than ever save into a private pension and reducing pensioner poverty to a near record low, these changes will give people the certainty they need to plan ahead for retirement”.

Auto enrolment has helped more than 8 million people to save into a workplace pension, in order to boost their retirement pot.

Feb 2017

10

Higher rate Scottish Taxpayers to pay more

The new tax year will see thousands of Scots having to pay more in income tax compared to their British counterparts earning the same salary.

This follows the announcement that the wage at which Scots will start to pay the 40p income tax rate will remain frozen at £43,000 in tax year 2017-18. For the rest of the UK, this threshold will increase to £45,000 when the new tax year commences in April.

As a result, it is estimated that approximately 370,000 higher rate taxpayers in Scotland will pay up to £400 more than people earning the same in the rest of the UK.

Under devolved powers, Scotland is able to vary the rates of Scottish income tax (SRIT) by up to 10% from those set by the government in Whitehall.

Sep 2016

11

Student Loans - which Plan type to use?

On 6th April 2016, a new plan type for student loans was introduced by HMRC. Employers should now be deducting student loan repayments from their employees using either Plan 1 or Plan 2.

A query that regularly comes into our BrightPay Helpdesk is 'How do I know which plan type to use?'

HMRC provide the following guidance on how you can determine an employee’s student loan plan type:

- check the Student Loan Start Notice (SL1)

- ask your new employee to fill in the starter declaration checklist

- ask your employee to go online to the Student Loan Company website at www.slc.co.uk/students/loan-repayment.aspx – if they do not know their plan type already.

HMRC also advise that if you receive an SL1 with a start date prior to 6 April 2016 and there is no plan type shown, you should make deductions under Plan 1.

Generic notifications have been sent by HMRC to those employers who haven’t reported any student loan deductions for a specific employee, but for whom deductions are expected. Where two generic notifications have been sent to an employer already, HMRC will begin contacting such employers to discuss the matter further.

Aug 2016

25

Declaration of Compliance - Don’t risk a fine!

With holiday season upon us, if you are a payroll bureau and your client's declaration of compliance deadline is fast approaching, you can help them to avoid a fine by starting the declaration as soon as possible and ensuring that it’s completed on time.

A declaration of compliance must be submitted to the Pensions Regulator within 5 months of your client’s staging date to inform them of what actions they have been performed to meet their auto enrolment duties.

If you are performing some auto enrolment tasks on your client's behalf, it is important that you both agree in advance who will be completing the declaration so that there is no confusion.

The Pensions Regulator produces a declaration checklist to help gather all the information needed to complete the declaration.

Aug 2016

17

Payroll giving to charity on the rise

According to provisional figures recently released by HMRC, approximately £130 million was donated to charity during tax year 2015/16 through payroll giving.

This represented an increase of 3% compared to the previous tax year, but this is still somewhat down on the amounts donated in tax year 2012/13 when a record £155 million was raised via payroll giving.

Payroll Giving is a simple, tax effective way to give to charity directly from an employee's pay.

Employers can set up a scheme with a Payroll Giving agency of their choice. Employees can then authorise their employer to deduct charitable donations from their pay.

Such donations are deducted after NIC but before PAYE is calculated, and are then sent to the payroll giving agency, who pass them on to chosen charities.

For employers who have set up a scheme with a payroll giving agency, BrightPay provides a preset 'Payroll Giving' deduction to facilitate employees who wish to donate in this manner.

Further information on payroll giving can be found at Payroll Giving - GOV.UK

Apr 2016

4

Preparing for your move to BrightPay - Useful Guidance

Moving from one payroll software to another can sometimes be a daunting task, but with preparation this needn't be.

To help with this preparation, we have put together the following guidance to assist you with the migration to BrightPay from a previous payroll software:

Check if your current software allows the exporting of employee information

BrightPay facilitates the importing of employee information in CSV format. Therefore if your current payroll software allows the export of employee information in CSV format (or to Excel, which can subsequently be converted to CSV format), BrightPay's import utility can be used. Should your current payroll software not allow the export of employee information, then employee details will need to be set up manually within BrightPay.

Allow yourself enough time

It is important to allow yourself enough time to perform an import before your next payroll run is due for the company. Performing the import well in advance of your next payroll due date will allow you to review and check the employee data you have brought in and also to manually enter in additional employee information, if required.

Allowing yourself enough time is also particularly important if you are required to manually set up your employees (and if applicable their mid-year cumulative pay information), due to your current payroll software not allowing the export of employee data.

Choose a convenient time to migrate to BrightPay

For most companies, the easiest time to migrate to a new payroll software is at the start of a new tax year, as this only requires the importing of employee details. As employees will start the new tax year with zero balances, there is no requirement to import across mid-year cumulative pay information.

If migrating to BrightPay at the start of the tax year isn't viable, then an import of both employee and their mid-year pay information can be performed in BrightPay at any point in the tax year (should your current software allow the export of such information). If migrating to BrightPay mid-year, then it may be more convenient to perform this task after a tax period end, to avoid split P32 records. Make sure to select the option 'Continue Partway in the Tax Year' when setting up your employer details in BrightPay, to facilitate the mid-year import.

Familiarise yourself with BrightPay's terminology

Payroll software providers can often differ slightly on the terminology they use within their software - for example, what is known as 'works number' in BrightPay may be known as 'employee number' in another payroll software. Before performing a CSV import into BrightPay, it is therefore recommended to familiarise yourself with the terminology used in BrightPay and to find its equivalent in your existing software, if different. This will assist at the import stage, when matching columns to the data it represents. Please click here to view a list of the terminology used in BrightPay.

Still have access to your previous software at time of import into BrightPay

It is advisable to still have access to your previous payroll software when performing your migration to BrightPay - this is in case you need to create a new export file in your previous software (for example, employee data hasn't exported out correctly, mid-year totals are for the wrong period etc.) or you wish to cross-check employee data after import. If your previous software licence has expired and a new export file is needed, you may be left with having to manually set up your employee information.

Run a parallel payroll with your previous software

If you do still have access to your previous software, then a useful exercise is to run both your old payroll system and BrightPay side-by-side for a period of time. This is a good way to determine that everything has been set up correctly in BrightPay and there are no inaccuracies.

Important note: if running parallel pay runs, ensure that only one RTI submission is submitted, from either your old or new system.

Follow BrightPay's dedicated support documentation

BrightPay currently has dedicated support documentation to assist you with migrating to BrightPay from SAGE, IRIS, Moneysoft and HMRC Basic PAYE Tools.

If you are migrating from another payroll software, please refer to our support documentation on Importing using a CSV File - Other Software and Importing using an FPS File - Other Software

Feb 2016

12

Are you one of the 3.7 million couples missing out on the Marriage Allowance?

Recent statistics show that only 8% of couples eligible for the Marriage Allowance have actually claimed it, with approximately 3.7 million couples still missing out.

The Marriage Allowance was introduced this tax year, and is a way for couples to transfer a proportion of their personal allowance between them. This could represent a saving of up to £212 per year for eligible couples.

To be eligible for the Marriage Allowance, the following must apply:

- You must be married or in a civil partnership.

- One of you needs to be earning £10,600 or less (not including any of your £5,000 tax-free savings interest).

- The other one of you needs to be a basic-rate taxpayer (couples with a higher- or additional-rate taxpayer aren't eligible for this allowance).

- Both of you must have been born after 6 April 1935.

If you are eligible and wish to apply for the marriage allowance, this can be done at www.gov.uk/marriage-allowance by completing the application. After going through the application process you'll be notified immediately if you're eligible for the allowance via email. You can also apply over the phone on 0300 200 3300.

It doesn't matter when in this tax year you apply – you will get the full financial benefit for the full tax year as long as you apply by 5 April 2016.

Once you have successfully applied, there will be no need to apply every year going forward. Your personal allowance will transfer automatically to your partner every year until one of you cancels the marriage allowance or you inform HMRC that your circumstances have changed eg, because of divorce, employment pushing you into a higher rate tax threshold or death.

Oct 2015

7

Chancellor announces extension of shared parental leave and pay to working grandparents

Chancellor George Osborne has announced that he will extend shared parental leave and pay to working grandparents, in recognition of the crucial role that working grandparents play in providing childcare for their families.

Approximately seven million grandparents are said to be involved in childcare, with evidence suggesting that nearly 2 million grandparents have given up work, reduced their hours or have taken time off work to help their families who cannot afford childcare costs. More than half of mothers rely on grandparents for childcare when they first go back to work after maternity leave, and over 60 per cent of working grandparents with grandchildren aged under 16 provide some childcare.

Consultation on the new measure will begin in the first half of 2017, with the aim of implementing the policy by 2018. The extension of shared parental leave and pay to working grandparents will ensure that hardworking families can structure their lives in a way that will work best for them and will provide flexible working arrangements for grandparents without the fear of losing their job.

Sep 2015

19

Young adults planning early for retirement

The launch of automatic enrolment into workplace pensions in 2012 is being hailed as helping to develop a greater pension savings culture across the UK.

A new study carried out by charity The National Skills Academy for Financial Services (NSAFS) and AXA Investment Managers, has found that today’s young adults in the UK are likely to start thinking about their retirement plans at the age of 27, compared to their parent’s generation who on average did not start thinking about life after work until the age of 41.

Similarly, research conducted by NEST in 2014 also found that people aged under 30 were embracing automatic enrolment more than any other age group, with just one in every 20 workers aged between 22 and 29 choosing to opt out of their workplace pension scheme.

Stephanie Condra, market strategist at AXA Investment Managers, said: “It’s never too early or too late to get ready for retirement.”

Approximately five million people have so far been placed in a workplace pension, and there are around another five million still to be placed in a scheme as auto-enrolment continues to be rolled out across employers.

Aug 2015

6

The Pensions Regulator issues warning to SMEs

The Pensions Regulator (TPR) has issued a stark warning to hundreds of thousands of small employers, after new research has shown that almost two thirds of SMEs do not know the exact date they need to comply with new workplace pension duties.

Research is published twice a year by the Regulator and tracks awareness of automatic enrolment among employers and intermediaries. Encouragingly, results of the survey show that the majority of employers due to stage between now and November 2015 have started preparing and are aware of their staging date, however awareness amongst those due to stage in 2016 and beyond drops significantly.

Speaking on the subject, Charles Counsell, executive director of automatic enrolment at TPR has said, ‘The challenge of ensuring 1.8 million employers meet their duties by April 2018 is significant and the research shows many employers are still not preparing early enough. We continue to develop new tools on our website to simplify the process for employers and we are using a diverse range of communications to reach out to employers, but my message to employers remains clear: start getting your plans in place or you risk a financial penalty.’

The Pensions Regulator advises that employers should start preparing for automatic enrolment 12 months ahead of their staging date - the date set in law for when their duties will start. Failure to meet auto-enrolment duties could ultimately lead to employers receiving a fixed penalty notice, and the possibility of escalating penalties applied per day for failing to comply with a statutory notice.