May 2020

21

Unemployment set to skyrocket despite the Coronavirus Job Retention Scheme

If you had told me six months ago that a global pandemic would force us into lockdown, everyone would be working from home, people stopped hugging each other and that the government would be paying 80% of our wages I would have laughed at you and demanded a big gulp of whatever you were drinking. But, as the media likes to drive home every chance they get, these are unprecedented times that we are living in.

The uncertainty has been one of the most overarching aspects of the current crisis and, although everyone seems to be doing their best (especially HMRC with the CJRS) what if our best is simply not good enough?

Rishi Sunak announced last week that the Coronavirus Job Retention Scheme is being extended to October and that soon employees’ wages would be shared between the government and the employers. And while this was welcome news, it now turns out that this particular concession won’t be effective until August, whereas the rest of Europe are already sharing furlough with their respective governments.

The CJRS has been a very noble attempt to support the economy and has ensured that millions of UK citizens aren’t without a wage and that businesses stay afloat. But the sheer length of the current crisis and the damage it is doing to millions of businesses just simply may not be sustainable. Employees are required to completely remove themselves from work thus ceasing all activity and production. And with part-time work not allowed until August, this is another nail in the coffin for many job prospects and people’s job security.

Already unemployment is set to increase up to 9% and that is with the CJRS in its current form. There are also mutterings that those covered by the furlough scheme will, from August, need to have 40% of their wages covered by the employers or else support will be discontinued. But in August, it is most likely that social distancing measures will still be in full effect plus current travel restrictions and guidelines. How can a restaurant or theatre support 40% of their staff wages if they can only operate at 25% capacity? Never mind the blow businesses will suffer as people simply might not be ready to go out and socialise. Being allowed to go for a pint and actually doing it are two different things altogether.

On top of this, there are lots of issues surrounding manufacturing jobs with limited productivity and disrupted supply chains. There is also concern for employees who are able to work but may not wish to do so for health reasons. These people and jobs are all part of a growing number that are being revealed as vulnerable to being made redundant.

I don’t mean to be all doom and gloom; rather, we need to be pragmatic and realise that, despite not being at crazy levels of unemployment like other countries, we are nowhere near done and the measures currently in place will not sustain the workforce that existed pre-coronavirus. A second wave of unemployment seems to be imminent despite the government’s “best” efforts. Something needs to be done soon to address these concerns and protect not just the economy, but the people of the UK.

COVID-19 & Payroll

Interested in finding out more about COVID-19 and Payroll? Visit BrightPay's COVID-19 Resources Hub for the latest updates on the Coronavirus Job Retention Scheme, HMRC’s Claim Portal, COVID-19 Related SSP and much more.

May 2020

19

Claim Guidance for Coronavirus Statutory Sick Pay Claim

HMRC has released further information for employers who are planning to submit a claim under the Coronavirus Statutory Sick Pay Rebate Scheme. HMRC have confirmed that the coronavirus Statutory Sick Pay Rebate Scheme will launch online on 26 May.

Where employers are registered for PAYE Online and they have a Government Gateway User ID, the employer will require this for their claim. If the employer is not enrolled for PAYE Online, they will need to enroll now. If an employer has an agent that is authorised to operate PAYE Online for their client, the agent can claim under this scheme on behalf of the employer.

Employers will need the following for the claim:

- Employer PAYE reference

- Contact name or number

- Bank account details – sort code and account number

- The total amount of Statutory Sick Pay (Coronavirus related) that has been paid to employees in the claim period

- Dates for the Statutory Sick Leave period – start and end dates

- The number of employees being claimed for

The employer must keep records for the statutory sick payments they wish to claim from HMRC, to include:

- The National insurance number for each employee being claimed for

- Start and end dates for the period of sick leave an employee was off sick

- The reason why the employee could not work

- Details of the qualifying dates in the period the employee could not work

Claims for multiple employees and multiple pay periods can be submitted by an employer at the one time. The start date of the claim period will be the earliest pay period the employer is submitting the claim for and the end date of the claim being the most recent pay period on the claim. HMRC has advised that employers must keep the records for the SSP paid and claimed under this scheme for three years after the date they receive the payment from HMRC.

The Statutory Sick Pay (Coronavirus) (Funding of Employers’ Liabilities) Regulations 2020 legislation to provide for eligible employers to reclaim some, or all, of their Statutory Sick Pay has been presented before Parliament to take effect from 26 May 2020.

Regulations have also been laid in Northern Ireland – ‘The Statutory Sick Pay (Coronavirus) (Funding of Employers’ Liabilities) (Northern Ireland) Regulations 2020.’

May 2020

13

Furlough Scheme to be available until 31st of October

Chancellor Rishi Sunak has advised the Coronavirus Job Retention Scheme will be available for employers for furloughed employees until the end of October 2020 and will introduce a new flexibility option under the scheme from August. This will apply to all regions and sectors in the UK economy.

The Coronavirus Job Retention Scheme (CJRS) was introduced for four months from 1st March by the government because of the coronavirus pandemic in order to give financial support to businesses and employees. Under this scheme all employers, regardless of size or business sector, can claim from HMRC a payment for 80% of the wage costs for employees that were furloughed up to a maximum of £2,500 per month per employee. If the employer can afford to top up the additional 20% of the employee’s wages they can pay the employee the additional amount if they wish.

There were suggestions that the furlough amount reclaimable would drop to 60% but it was confirmed the scheme would remain at 80% of the wage costs for employees that were furloughed, up to a maximum of £2,500 per month. An option of flexibility for the CJRS will be introduced in August that furloughed employees will be able to return to work on a part time basis where the employer will be asked to pay a percentage of the employees’ wage costs. This will only be available for employers that are already using the furlough scheme. This new flexibility will help with businesses reopening and help boost the economy. More details will be available by the end of May.

The government intends to explore options for furloughed employees that wish to partake in training or learning new skills in the furlough period and will work in conjunction with the Devolved Administrations to ensure people across the Union are supported.

Chancellor Sunak advised that 7.5 million employees have so far been furloughed by employers, which is approximately 29% of the workforce in the UK. There are 935,000 employers availing of the CJRS and so far over £10 billion has been claimed by employers using this scheme.

COVID-19 & Payroll Webinar

Interested in finding out more about COVID-19 and Payroll? Join BrightPay for our free webinars where we discuss the Coronavirus Job Retention Scheme, Furlough Leave, HMRC’s Claim Portal and COVID-19 Related SSP. Places are limited - click here to book your place now.

May 2020

12

How to introduce BrightPay Connect to clients

Introducing a new service to your payroll clients isn’t always as simple as we’d like it to be. Yes, you know that it would be great for their business and maybe they do too, but it’s likely that they’ll still need some convincing to get them over the line and on board. So, here are 3 things to keep in mind when introducing BrightPay Connect as a new payroll process.

What Does Your Client Need

Before you make your case to your clients, you need to be sure that you’re offering them the best service for their business. Every client is different in one way or another, and this means that a one-size-fits-all approach to their payroll just isn’t going to work. It’s also not going to give them confidence in your ability if they think you don’t understand their business, so doing your homework here will really pay off.

In order to get your client on board with your new payroll offering, it’s useful to think about what challenges they’re facing right now regarding payroll, and whether BrightPay Connect is a right fit for them. BrightPay Connect offers a whole range of additional HR benefits, so think about how these extras can save your clients time. Begin your introduction by showing your clients that they’re in safe hands because you fully understand their payroll challenges and you’ve got just the product to help them make their payroll processes even easier than it’s ever been before.

How Can You Provide Added Value

So now that you’ve established how BrightPay Connect can modernise your client’s payroll process, it’s time to pitch the benefits to them. For most clients, this is a simple case of informing them about the HR features they may not have themselves including:

- Client payroll portal

- Payslip library

- Employee payroll app

- Annual leave management

- HR document upload feature

- Automated payroll reports

You can also present BrightPay Connect as a time saving opportunity by explaining to them that the cloud functionality frees them up to dedicate additional resources to other aspects of the business.

What’s The Bottom Line

Every client, whether big or small, is always trying to find new ways to cut costs, reduce administration and maximize profits (without cutting quality services). And in today’s climate, most businesses don’t have any choice in keeping their costs down as much as possible. So, one of the best ways you can sell your payroll services to your clients is by simply showing them just how cost effective it is.

BrightPay Connect offers highly competitive pricing options where users are billed based on usage. The usage subscription model is based on the number of active employees in the billing month. The more clients you have the lower your cost per employee, which means you can pass the savings along to them. You can also find ways to make it even more tempting to your clients, such as offering them a free trial period, or a special deal if they refer a new client to your bureau. This is totally up to you, but don’t be afraid to be creative with how you cost this service.

Book a demo of BrightPay Connect to see how you can help your clients with a new and improved payroll service offering.

May 2020

8

Thank you for your wonderful comments!

The BrightPay team have received lots of words of praise and thanks over the past few weeks. Here's a selection of some of the wonderful comments that have been sent in. We would like to thank everyone for their positive feedback, your kind words are very much appreciated and encourage us to keep going during in these challenging times.

Thank you. Stay Safe.

Apr 2020

30

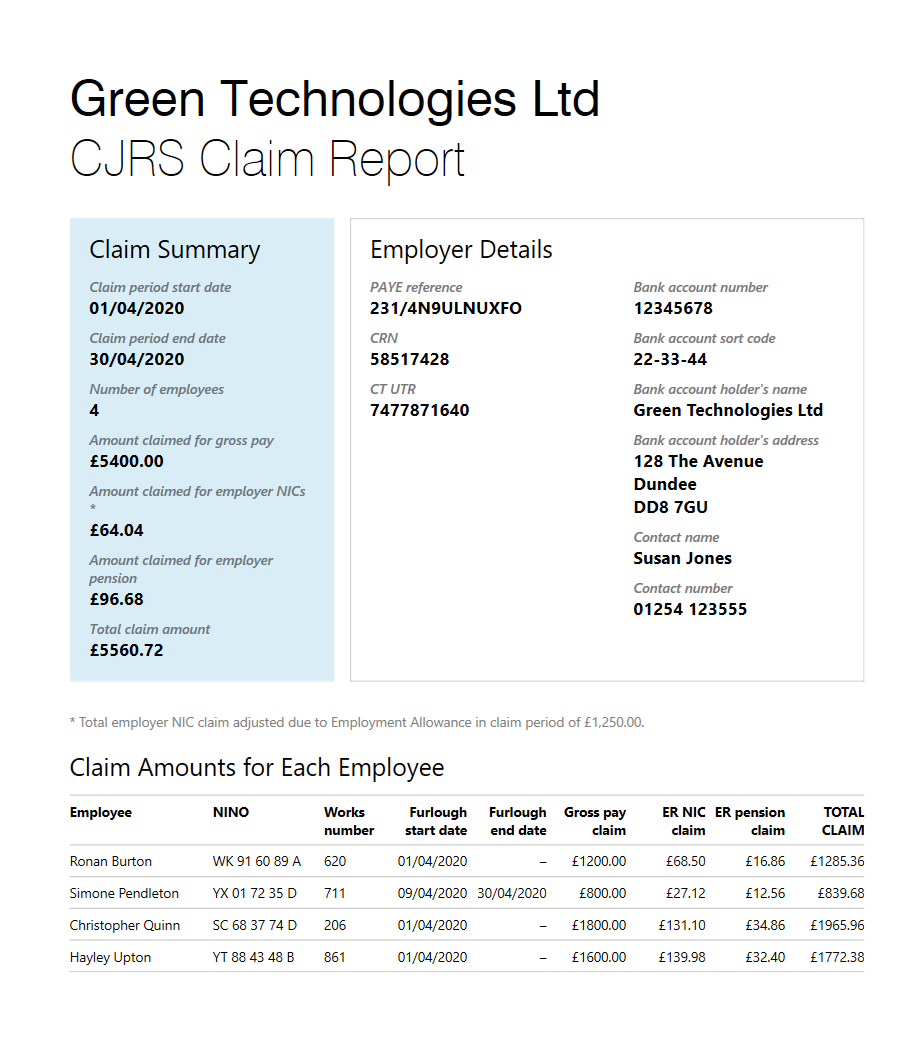

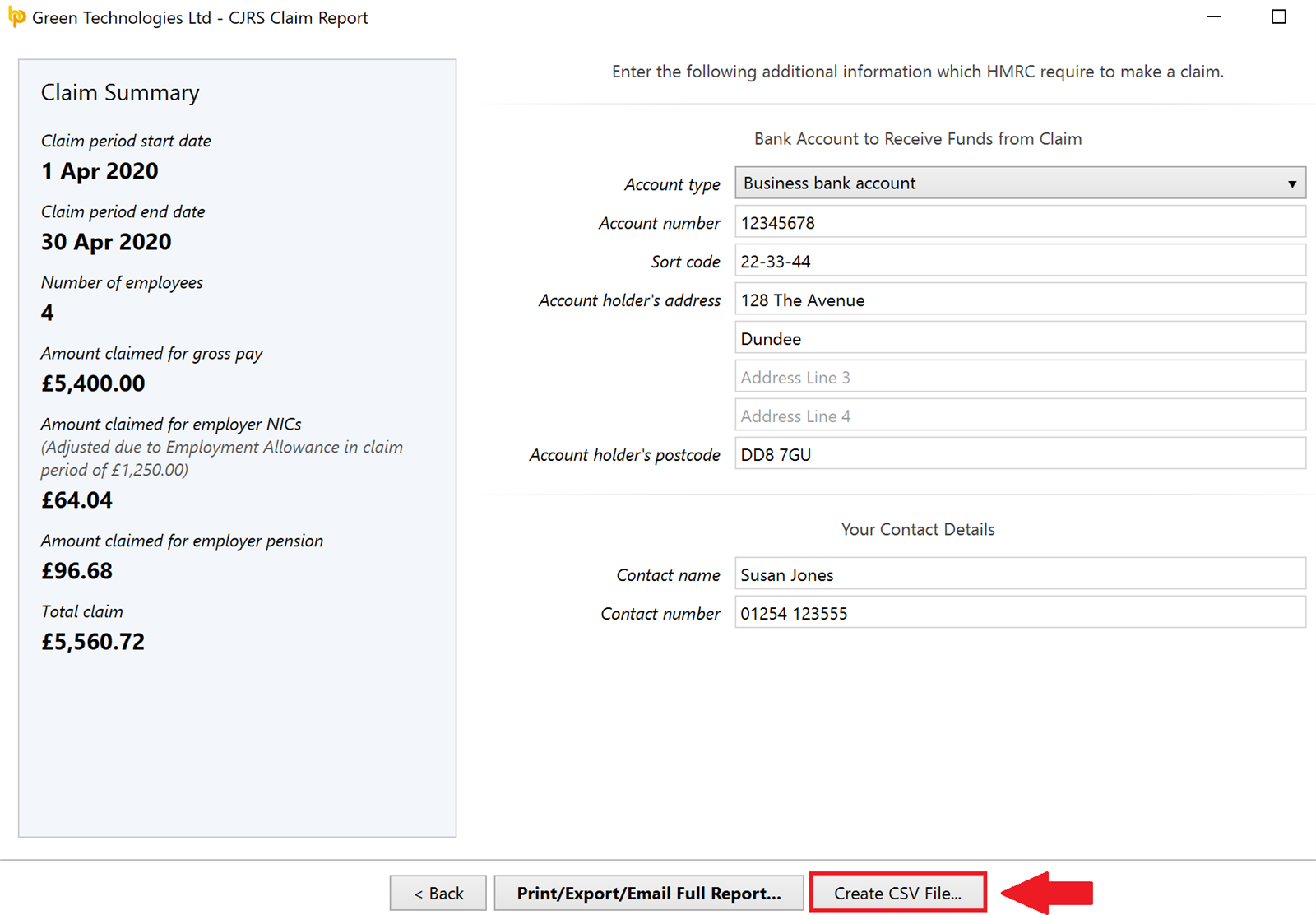

BrightPay release CJRS claim report

A CJRS Claim Report was released on the 23rd April in BrightPay to assist users in ascertaining the amounts needed for input into HMRC's Coronavirus Job Retention Scheme online service.

BrightPay’s CJRS Claim Report includes claim amounts for each employee detailing furlough start date, furlough end date (if known), gross pay claim, employer NIC claim, employer pension claim and the total claim amount.

Employers will need to make a claim for wage costs through an online portal on GOV.UK, which was launched on 20th April. The only way to make a claim is online. HMRC has worked to make the portal simple to use and any support you need is available on GOV.UK. Businesses will need their Government Gateway user ID and password to login to the online portal.

Video Tutorial: See how BrightPay's CJRS Claim Report works

How to make a claim

You’ll need to provide the following to make a claim:

- The bank account number and sort code you’d like HMRC to use when they pay the claim.

- The name and phone number of the person in your business for HMRC to call with any questions.

- Your Self-Assessment UTR (Unique Tax Reference), Company UTR or CRN (Company Registration Number), where applicable.

- The name, employee number and National Insurance number for each of your furloughed employees.

- The total amount being claimed for all employees and the total furlough period.

If you have fewer than 100 furloughed staff, you will need to input your information directly into the system for each employee.

If you are an employer with more than 100 employees, you will need to upload a file with additional information for each employee, including the claim amount per furloughed employee and the furlough start and end date (if known) for each furloughed employee. If you have more than 100 employees, BrightPay gives users the option to create a CSV file, ready to be uploaded into HMRC's online service containing the details of your claim.

Free COVID-19 & Payroll Webinar

What You Need To Know about HMRC’s Claim Portal, COVID-19 Related SSP & Furlough Leave

All businesses, regardless of size, will be affected by the government measures for the foreseeable future. As the COVID-19 virus spreads across the UK, the government has introduced measures for employers to continue to pay their employees and to support businesses.

This webinar covers:

- Claiming for wages through the Coronavirus Job Retention Scheme

- How BrightPay’s CJRS Claim Report works

- Catering for COVID-19 Related Statutory Sick Pay (SSP)

- How furlough leave applies to your employees

Apr 2020

29

Coronavirus Job Retention Scheme: What are the employment law issues?

The Coronavirus Job Retention Scheme allows employers to access financial support to continue paying part of their employees’ salary that would otherwise have been laid off due to COVID-19. Essentially, it’s a way of preventing layoffs and redundancies.

If you have any employees who have been placed on a leave of absence, they would be considered a furloughed employee. Changing the status of an employee to a furloughed worker remains subject to existing employment law. Earlier guidance said you had to give employees notice of being placed on furlough. Most recent guidance stated that you have to provide written notice and you must keep a record of this for 5 years.

BrightPay have put together a template letter that employers can use to give to employees that are being placed on furlough leave.

Generally, where an employee’s contract contains a layoff or short term clause, employers should be able to place employees on furlough leave. However, where there is no such clause, it is best advised to get agreement from the employee. Where employers are not topping up the 80% government payment, employers should write to their employees seeking agreement from the employee, as a 20% reduction in salary will be a change to the terms and conditions of their employment.

Given the current situation, it’s expected that most employees would agree to the changes, as the alternative probably works out worse for the employee. That said, employers are advised to get agreement from their employees as part of their furlough leave process.

On another note in relation to employment issues, if an employer is making a decision on who to offer furlough to, equality and discrimination laws apply in the usual way.

Employees that have been furloughed have the same rights as they did previously. That includes Statutory Sick Pay entitlement, maternity rights, other parental rights, rights against unfair dismissal and to redundancy payments.

When the government ends the scheme, you must make a decision, depending on your circumstances, as to whether employees can return to their duties. If not, it may be necessary to consider termination of employment, i.e. redundancy. Any redundancies at the end of this scheme will still have the same statutory obligations attached, as these individuals are still treated as being employed while they are furloughed.

Additional Resources:

- Template Furlough Letter

- Template Letter - Furlough Leave Extension

- Template Letter - Rejecting Furlough Request

Join BrightPay for a free COVID-19 webinar where we discuss what you need to know about remote working, processing SSP, the Coronavirus Job Retention Scheme and placing employees on furlough leave.

Places are limited - Click here to book your place now.

Apr 2020

27

Coronavirus Statutory Sick Pay Rebate Scheme Updates

The Coronavirus Statutory Sick Pay Rebate scheme was introduced to repay employers the current amount of Statutory Sick Pay paid to current or former employees on or after 13th March 2020 for periods of sickness. The amount an employer can claim is for up to 2 weeks sick leave for an employee that cannot work due to the following:

- Have coronavirus

- Are self-isolating at home

- Due to public health guidance the employee is shielding

Only the current rate of SSP can be claimed, even if the employer pays the employee more than the current rate of SSP. Employers do not have to have doctor’s fit note from their employees for this claim. An employer’s claim amount cannot be more than the maximum of €800,000 of state aid in accordance with the EU Commission temporary framework. This is when included with other aid obtained under this framework. There is a lower maximum for the aquaculture and fisheries sector of €120,000 and the agriculture sector of €100,000. Unfortunately at present, the online service with HMRC is not available yet in order to claim the COVID-19 Related Statutory Sick Pay. HMRC will announce when this service will be available.

Conditions an employer must meet in order to be eligible to claim under this scheme are:

- An employer has less than 250 employees on 28th February 2020

- An employer has a PAYE scheme that was set up and commenced on or before 28th February 2020

- The employees they are claiming for were on sick leave due to coronavirus

If employers or charities are connected, once they have in total less than 250 employees on or before 28th February, they can avail of this scheme. All employees such as full-time and part-time employees, employees on zero-hour or flexible contracts or employees with agency contracts are covered under this scheme.

The employer must keep records for the statutory sick payments they wish to claim from HMRC such as:

- National insurance number for each employee being claimed for

- Start and end dates for the period of sick leave the employee could not work

- The reason why the employee could not work

- Details of the qualifying dates in the period the employee could not work

Join BrightPay for a free COVID-19 webinar where we discuss what you need to know about remote working, processing SSP, the Coronavirus Job Retention Scheme and placing employees on furlough leave.

Places are limited - Click here to book your place now.

Apr 2020

21

Coronavirus Job Retention Scheme: Which employees are eligible?

The Coronavirus Job Retention Scheme is a temporary scheme open to all UK employers for four months starting from 1 March 2020. It is designed to support employers whose operations have been severely affected by COVID-19.

If you have any employees who have been placed on a leave of absence, they would be considered a furloughed employee. Employers can claim for 80% of furloughed employees’ usual monthly wage cost, up to £2,500 a month, plus the associated Employer NI contributions and minimum automatic enrolment employer pension contributions on that wage.

All UK companies are eligible: limited companies, sole traders who employ people, LLPs, partnerships, and charities. Employers can use this scheme anytime during this period. Claims can be backdated until the 1 March if applicable, and grants will be prorated if your employee is only furloughed for part of a pay period.

Which employees are eligible?

Prior to now, furloughed employees must have been on your PAYE payroll on 28 February 2020, but this has now been extended to 19th March. This brings into scope a large number of people who fell outside the scheme because they had recently changed jobs.

It’s available to all employees on a contract, including:

- full-time employees

- part-time employees

- employees on agency contracts

- employees on flexible or zero-hour contracts

You can claim for employees that were employed as of 19 March 2020 and were on your PAYE payroll on or before that date; this means that you will have made an RTI submission notifying HMRC of a payment to that employee on or before 19 March 2020. For employees that were employed as of 28 February 2020 and on payroll (i.e. an RTI submission was sent to HMRC) and were made redundant or stopped working for you after that, and before 19 March, they can also qualify for the scheme if you re-employ them and put them on furlough.

A business may need to furlough all employees if it has temporarily closed down, as in hospitality or non-food retail. However, you do not need to place all your employees on furlough. You can choose to furlough a group of employees, whilst key workers continue to work, or to rotate groups between furloughing and working.

However, those employees who you do place on furlough cannot undertake work for you. This scheme is only for employees who are not working. While on furlough, an employee cannot undertake work for or on behalf of the organisation, but if their contract of employment permits, they may take on new employment with an alternative employer whilst on furlough.

Even if an employee is working, but on reduced hours, or for reduced pay, again, they will not be eligible for this scheme and you will have to continue paying the employee through your payroll and pay their salary subject to the terms of their employment contract.

- If an employee is on unpaid leave, they cannot be furloughed, unless they were placed on unpaid leave after 28 February.

- If an employee has more than one job they can be furloughed for each job. Each job is separate, and the cap applies to each employer individually. Employees can be furloughed in one job and receive a furloughed payment but continue working for another employer and receive their normal wages.

- If an employee is on or plans to take maternity leave, the normal rules apply, and they are entitled to claim SMP. The same applies if the employee qualifies for adoption, paternity or shared parental pay.

- Employees who are unable to work because they have caring responsibilities resulting from COVID-19, for example, employees that need to look after children, can be furloughed.

When calculating claim values for directors of owner-managed companies you can only consider the salary that has been subject to PAYE, not any dividends paid to those directors. They are essentially furloughing themselves, and the understanding is that they do no income-generating work for their business while on furlough, but they can continue to run the business from a statutory perspective, for example preparing their accounts and returns. This also applies to salaried individuals who are directors of their own personal service company (PSC).

Furlough Pay or SSP?

You can claim back from both the Coronavirus Job Retention Scheme and the SSP rebate scheme for the same employee but not for the same period of time. When an employee is on furlough, you can only reclaim expenditure through the Coronavirus Job Retention Scheme, and not the SSP rebate scheme. Likewise, if a non-furloughed employee becomes ill, or needs to self-isolate or shield themselves, then you might qualify for the SSP rebate scheme, enabling you to claim up to two weeks of SSP per employee.

Furloughed employees retain their statutory rights, including their right to Statutory Sick Pay. This means that furloughed employees who become ill must be paid at least Statutory Sick Pay (subject to them meeting the eligibility criteria). It’s up to the employer to decide whether to move these employees onto SSP or to keep them on furlough, at their furloughed rate.

- If a furloughed employee who becomes sick and is moved onto SSP, employers can no longer claim for the furloughed salary. Employers are required to pay SSP themselves, although they may qualify for a rebate for up to 2 weeks of SSP.

- If employers keep the sick furloughed employee on the furloughed rate, they remain eligible to claim for these costs through the furloughed scheme.

If an employee has a condition which makes them extremely vulnerable and received a letter from the NHS, they are strongly advised to shield themselves. Shielding is in place to protect extremely vulnerable people from coming into contact with coronavirus. Employers can claim for furloughed employees who are shielding, if they are unable to work from home and you would otherwise have to make them redundant. This also applies to those who need to stay home with someone who is shielding.

Furlough Periods

An employee can be furloughed for a minimum period of three consecutive weeks. When they return to work, they must be taken off furlough. Employees can be furloughed multiple times, but each separate instance must be for a minimum period of 3 consecutive weeks.

The scheme was originally available for a maximum of three months from 1 March, but this has since been extended to four months. The individual could remain furloughed even after the scheme ends, but in this instance, the employer would not have any grant funding to cover their wages. Depending on your circumstances, it may be necessary to consider termination of employment (redundancy). Grants cannot be used to substitute redundancy payments.

Join BrightPay for a free COVID-19 webinar where we discuss what you need to know about remote working, processing SSP, the Coronavirus Job Retention Scheme and placing employees on furlough leave. Places are limited - Click here to book your place now.

Apr 2020

14

Details of what an Employer needs to Claim for Furlough Employees

HMRC has announced that the online portal or service for employers to make claims relating to the Coronavirus Job Retention Scheme is planned to be launched on 20th April 2020. In order to process the claim employers must have:

- A PAYE scheme that was created and commenced on 28th February 2020

- Enroll for HMRC’s PAYE Online service

- Have a UK bank account

Employers will need the following for the claim:

- Employer PAYE reference

- Self-Assessment Unique Taxpayer Reference or Corporation Tax Unique Taxpayer Reference or Company Registration Number

- Contact name and number

- Bank account details – sort code and account number

- The number of furloughed employees

- Names for all furloughed employees

- National Insurance numbers for all furloughed employees

- Payroll or works numbers for all furloughed employees

- Dates for the furloughed period – start and end date

- Amount for the claim (per the minimum length of furloughing of 3 consecutive weeks)

An employee that was furloughed has to be on furlough leave for a minimum of 3 weeks in a row in order to be eligible under the reclaim scheme. Employees may have been placed on furlough leave multiple times but each period has to be a minimum of 3 weeks in a row.

The amount the employer is coming to claim from HMRC must be calculated by the employer. They may use records from their payroll software to help ascertain the amount of the claim. Where employees were already placed on furlough leave claims can be backdated until 1st March. Authorised agents that have the capacity to act on behalf of their clients for PAYE matters will be able to claim on behalf of their clients. But agents with permission to file only and payroll bureaus will not have the ability to access this service on behalf of their clients. But file only agents may have to assist their clients in order to be able to make the claim and are being encouraged by HMRC to help where they can.

HMRC will check each claim made for each employer and if the employer fulfils the criteria for the scheme then payment will be made by HMRC into the UK bank account by BACs transfer. HMRC reserves the right to audit any employers’ claim under this scheme.