Feb 2020

19

BrightPay 2020/21 is now available to pre-order

BrightPay 2020/21 is scheduled for release the week ending 27th March. We will send you another email once it is released and ready to download. This further email will also be accompanied by a full list of the new 2020/21 features and legislative updates.

New BrightPay Connect Subscription Pricing Model

From April 2020, BrightPay Connect customers will be billed on a usage subscription model based on the number of employees in the billing month. This monthly subscription pricing model means that you only pay for what you use. For the vast majority of customers, this new billing model will result in a reduced annual cost.

Invoicing will be monthly in arrears e.g. usage in April 2020 will be billed and payable in May 2020.

You will need to enter some basic information on our new online billing system, which will be available shortly. We will notify all Connect customers once it is available.

Note: Your payroll software desktop licence will continue to be charged on a per tax year basis.

What do you need to do now?

Nothing. Your BrightPay payroll software 2019/20 licence will continue to work as normal until the end of the tax year. Pre-order BrightPay 2020/21 today and we will email you when it is available to download. Our BrightPay Connect billing system will be available shortly and we will notify all Connect customers when it is up and running.

Jan 2020

30

Customer Update: January 2020

Welcome to BrightPay's January update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

Easily integrate BrightPay with your accounting software

-

BrightPay Connect monthly subscription pricing - How will it work?

-

What the Tory victory means for IR35 and off-payroll working

Free Webinar: Last chance to register!

Payroll transformed: How cloud platforms supercharge the payroll process for employers

Join BrightPay for a free webinar where we look at cloud innovation and how it is positively impacting the payroll process for employers. Not in the distant or even medium-term future: this is happening right now. Register now to see how next-generation cloud features can revolutionise your business.

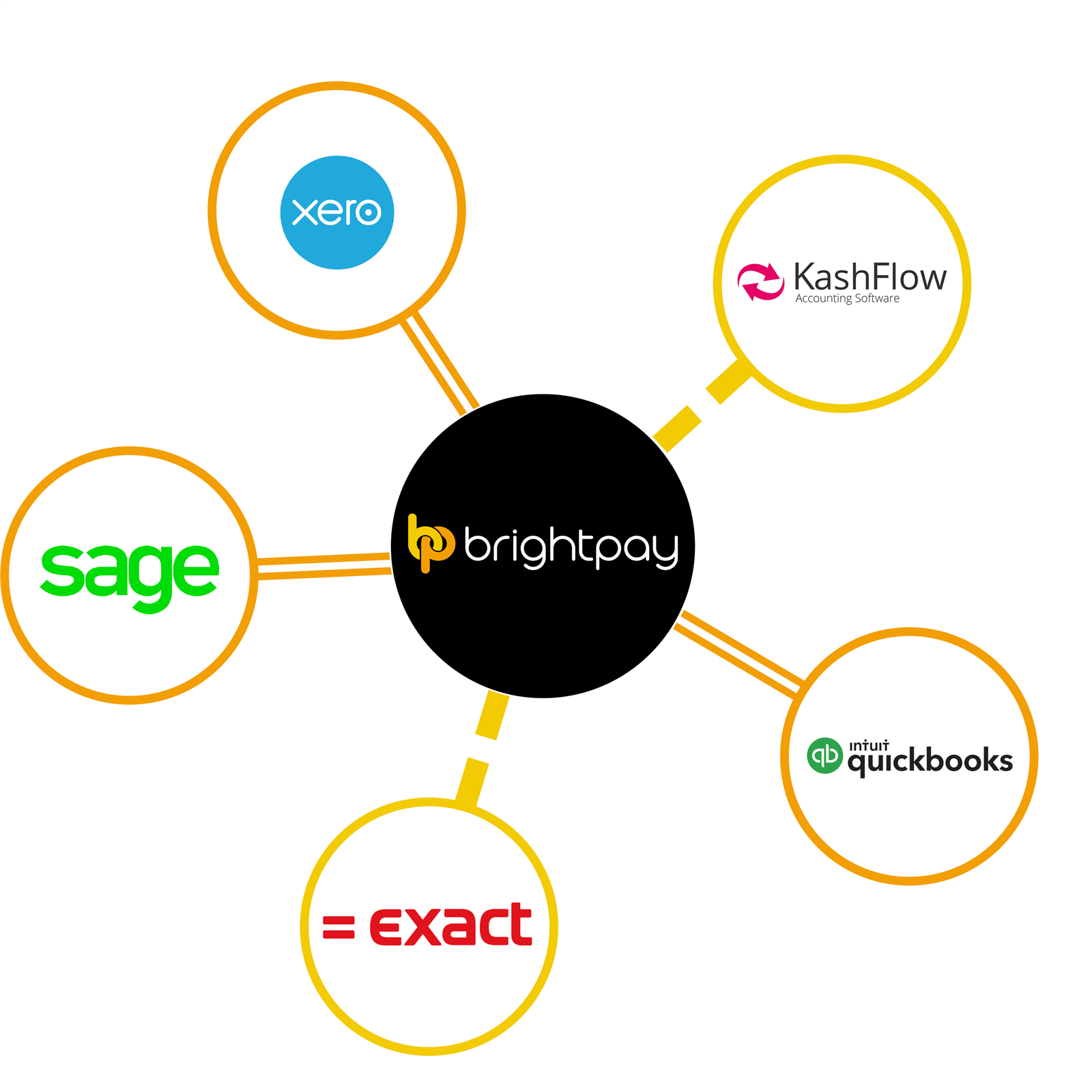

Easily integrate BrightPay with your accounting software

BrightPay’s payroll journal feature allows users to create wage journals from finalised pay periods so that they can be added into various accounting packages. With this direct integration, users will be able to send the payroll journal to the accounting package directly from within BrightPay. BrightPay includes direct API integration with Sage One, Quickbooks Online and Xero, and coming soon is integration with FreeAgent, AccountsIQ, Kashflow and Twinfield.

Employer obligations: Simple ways to comply using BrightPay Connect

There's been a lot of talk recently about online client platforms. They can bring many benefits to both employers and employees alike - from online payslip access to annual leave management to a HR document hub. But can cloud payroll portals really help with employer obligations? Here we look at how BrightPay Connect can help with record keeping requirements, employment law obligations and GDPR compliance.

Annual Leave Management: Say Goodbye to Paper Trails and Excel Spreadsheets

Minimum Wage Rates Increase from 1st April 2020

It has been announced that on the 1st April 2020 the minimum wage will increase by amounts ranging from 4.6% to 6.5%. An employee's age and if they are an apprentice will determine the rate they will receive. BrightPay can track employee hourly rates against the National Minimum/Living Wage (including apprentices), UK Living Wage, London Living Wage, or they can be marked as not eligible.

Jan 2020

28

Employer obligations: Simple ways to comply using online payroll portals

There's been a lot of talk recently about online client platforms. They can bring many benefits to both employers and employees alike - from online payslip access to annual leave management to a HR document hub.

But can cloud payroll portals really help with employer obligations? Here we look at how BrightPay Connect can help with record-keeping requirements, employment law obligations and GDPR compliance.

Record-Keeping Requirements

By law, employers must retain certain documentation relating to their employees for specific minimum periods. Good cloud systems will record this information for you, meaning everything is stored securely online.

Not only is BrightPay Connect useful for keeping a record of payroll information, but employers can also use it to hold various employment and leave records. Sometimes record-keeping can be something that we let slip or are perhaps not as diligent as we might be with say, payroll files, where we tend to be very diligent.

If you have an inspection, the inspector will want to see all of the employee records, whether it’s pay records, annual leave, sick leave, maternity leave, and they’ll expect the records to be readily accessible. With BrightPay Connect, you can access the calendar and reporting features to see at a glance who has taken leave, and when, so should an inspector arrive, you can simply log into Connect to access the records, rather than getting into a panic about what is saved where.

Employment Legislation

For employers, there’s also compliance with employment legislation. This will be even more important over the coming months, as three new pieces of employment legislation come into force on 6th April 2020.

One of the changes being introduced is the introduction of a day-one right to receive a written statement of terms and conditions (more commonly known as a contract of employment). At the moment, this needs to be given to new employees, no later than two months after the beginning of their employment, so this new day-one timeframe requirement from this April of providing an employee with their contract on their first day of employment will be a big change for many employers. For employers who use Bright Contracts to create contracts of employment, the software will soon be updated in line with the new legislation.

Free Webinar: Employment Law Update - Register now

If you are on leave or not based at the same location as the new employee, meeting that day-one deadline could be challenging, and that’s where the online employer and employee portals can help. Being able to upload employment contracts and other employee documentation onto the cloud from any location, and share it with the employee, could be a lifesaver. With BrightPay Connect, the documents and resources hub also offers an activity log, which gives the date and time stamps in relation to when an employee accessed the document.

GDPR Compliance

In the new world of GDPR, non-compliance will be a continuous threat to all businesses. BrightPay Connect offers significant benefits to help your business or practice comply with GDPR legislation.

GDPR Remote Access for Employees

The GDPR legislation includes a best practice recommendation, whereby organisations should provide individuals with remote access to a secure system, which would give them direct access to their personal information. An online employee portal, such as BrightPay Connect, will store employee’s information online, giving the employee access to personal data that employer has on file for them. The employee can update their contact information easily, with changes instantly and seamlessly updated in the payroll software.

Data Security

Your data accuracy and compliance improve even further when you add in the ability to automatically backup payroll data in the cloud. If you only keep your payroll data on your desktop, you are at risk of losing the information. How prepared are you for a disaster recovery situation? Would employees still get paid if the information was lost? Without cloud backup, the consequences would be dire. But now, these problems can be solved quickly, and that’s because of cloud innovation.

Cloud integration introduces the ability to automatically and securely backup the payroll data to the cloud. BrightPay Connect maintains a chronological history of all your backups, and these backups can be restored at any time if required. It’s simply an added layer of data protection to safeguard your payroll data.

Book a demo today to discover more ways that BrightPay Connect can help you comply with your employer obligations.

Jan 2020

28

Parental Bereavement Leave

Research suggests that 1 in 10 employees are likely to be affected by the death of a loved one during their employment. In response to this, "Jack’s Law" has been introduced through the Parental Bereavement (Leave and Pay) Act. This will come into force in April 2020 and now gives employed parents, who have lost a child, the right to take paid statutory leave to allow them time to grieve.

Who is entitled to this leave?

All employees have a ‘day one’ right to this bereavement leave. Parents and primary carers will be entitled to paid bereavement leave if they have been employed for a continuous period of 26 weeks. Female employees who suffer a stillbirth after 24 weeks of pregnancy will still be entitled to up to 52 weeks of maternity leave and/or pay, as will a mother who loses a child after it is born.

What is the entitlement?

- Bereaved parents will be entitled to take two weeks’ bereavement leave.

- There are rules around when this leave is available to be used and how it should be taken.

- Paid bereavement leave is paid at the lower of £151.20 a week or 90% of salary. As this is a statutory payment, it is at the employer’s discretion if you wish to top-up this amount.

Employers should now put plans in place to introduce and manage the Parental Bereavement Leave policy. You will need to determine if you will give a top-up payment and the approach you will take to communicating this to your staff.

Other considerations

Different religions have their own bereavement traditions and funeral rites. If you were to refuse an employee to observe their beliefs and customs, it could amount to religious discrimination. Employees who suffer a loss may experience mental health issues such as depression and/or anxiety. This could constitute a disability under the Equality Act. It is advisable to look into further training on the Equality Act to prevent potential issues from religious discrimination or mental health arising.

The Bright Contracts Handbook will be updated shortly to include a new Parental Bereavement Leave Policy.

Jan 2020

8

Minimum Wage Rates Increase from 1st April 2020

It has been announced that on the 1st April 2020 the minimum wage will increase by amounts ranging from 4.6% to 6.5%. The National Minimum Wage (NMW) is the minimum pay per hour that most employees are entitled to by law. An employee's age and if they are an apprentice will determine the rate they will receive.

These rates were recommended to the government by the Low Pay Commission, an independent body that advise on the national minimum wage and living wage. It is estimated that approximately three million workers will see pay increases due to the new rates being introduced. Employees aged 25 and over will see a rise of 51p from £8.21 to £8.72, which will result in an increase of £930 annually.

Please see the current rates and the new rates below:

| Rates from 1 April 2019 are | Rates from 1 April 2020 will be | |

| 25 yrs old and over | £8.21 per hour | £8.72 per hour |

| 21-24 yrs old | £7.70 per hour | £8.20 per hour |

| 18-20 yrs old | £6.15 per hour | £6.45 per hour |

| 16-17 yrs old | £4.35 per hour | £4.55 per hour |

| Apprentices under 19 or 19 or over who are in the first year of apprenticeship |

£3.90 per hour | £4.15 per hour |

It has also been recommended by the Low Pay Commission that the national living wage will be paid to employees aged 21 and over. The National Living Wage is an obligatory minimum wage currently paid to employees aged 25 and over that was introduced in April 2016. The government aims to achieve this recommendation by 2024.

Jan 2020

3

New Year, New HR Resolutions!

Start 2020 with some HR goals to put you on the front foot. Make your goals achievable and easy and you won’t be one of the 80% of people whose resolutions have fallen by the wayside by February 1st! Consider how technology could help you achieve a leaner you in 2020…

1. Cut out the fat…

Hate all those repetitive admin tasks that keep popping up over and over like manually recording your employees annual leave, amending employees’ personal details, making sure they are receiving and reading important company updates? Well, now is the time to get rid of them. Consider how an online platform could take care of those tasks and many more.

2. Get out and about more…

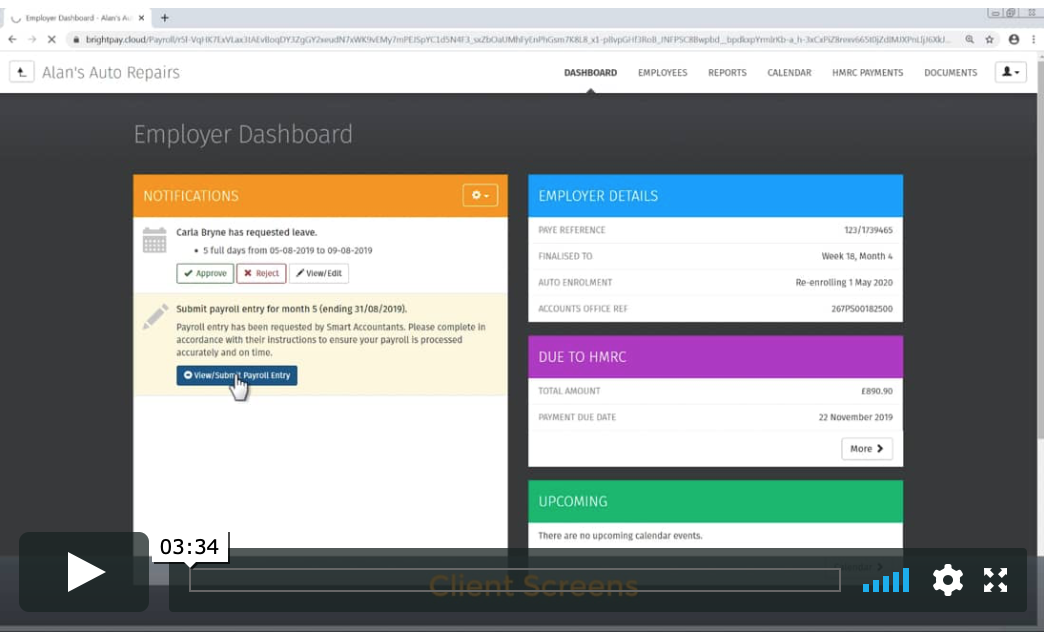

Manage your HR tasks from almost anywhere by using your Employer Dashboard to monitor your employees annual leave requests, review your payroll reports and keep an eye on your HMRC payments. As long as you have an internet enabled device, it can all be at your fingertips… anytime, anywhere!

3. Communicate better…

Use online document upload features to distribute, track and manage any information you want your staff to have access to. Contracts, policies, training, schedules, you name it. You have the peace of mind of knowing your employees have that information at their fingertips and that you can see a log of when and how often they are accessing it.

4. Face your fears….

GDPR and cybersecurity. The two scariest words in the English language. Free yourself from that fear with a robust online portal. Fully secure servers, individually password protected and fully GDPR compliant.

Book a demo today to discover how you can revolutionise your business processes for 2020 and beyond.

Dec 2019

20

All I want for Christmas is the perfect cloud platform

What springs to mind when you hear the word ‘cloud’ will vary from person to person. Some will think of the weather as they look, grumbling, out their front window. But others will be thinking about all that extra storage on their iPhone. See, the meaning of the word has changed in recent times and most of us will now think the latter. But what about those who haven’t a notion what you’re on about? What is the cloud?

The cloud is a general term for any computing service that involves hosting over the internet to deliver computing services in lieu of a hard drive. Services such as storage, payroll and HR information. The other key feature is that you can access these services or information anytime, anywhere from any device that is connected to the internet. In fact, you’re already using cloud services if you use social media, Google Drive and Dropbox to name but a few. And now the cloud has become a must-have for any business who wishes to keep up with the times.

I can hear some of you now: “it sounds great but my employees would never use something like that”. Well, that’s where you’re wrong. A recent survey found that 48% of people believe technological advances will change the face of the workplace and a whopping 87% of those said they would be happy to adapt to technological changes if the right tools were given to them. Wow! So how do I know which cloud platform to choose for my business?

I’m glad you asked! Our experts got together for a brainstorming session and found that there are four key things to look out for when choosing the right cloud platform for your business - cost, compliance, simplicity and connection.

- Cost - Your upfront costs should be minimised - it shouldn’t be an expensive luxury reserved for big corporations. Make sure it provides the option of having multiple users so you can delegate and give access to various people to manage payroll tasks and HR requests on your behalf.

- Compliance - Make sure it takes into account your obligations as an employer with regards to things like the GDPR legislation, record keeping requirements and automatic enrolment duties. A good platform will have compliance built-in as standard and will manage it seamlessly.

- Simplicity - The most important thing to increase uptake of a cloud platform is to make sure it is user-friendly and reduces the chance of human error. Look out for simplistic interfaces and whether or not training and support is available. The best of the best will offer this for free. You should also be able to get set up and ready to go with minimal disruption to your business.

- Connection - Make sure it offers features that are attractive to employees such as a downloadable app, a self-service portal and company-wide messaging features. Because at the end of the day, your employees won’t give a damn about how excited you might be about it unless it works for them too. These features tie in with our ever-increasing digitally-minded workforce and will make them feel more in control and engaged.

So there you have it… off you go now! Good luck scouring through the internet trying to find the perfect cloud platform. But….., well, ...it is Christmas after all and I’m feeling generous. Ah what the heck, I’ll just let you in on a secret which is the best cloud platform for businesses out there: our very own BrightPay Connect.

BrightPay Connect is an add-on to BrightPay’s award-winning payroll software and ticks literally every single box I just mentioned over the course of this post. I’ve done enough talking so instead let me show you. Book a demo today to find out if BrightPay Connect is the perfect fit for your business.

Merry Christmas everyone! Don’t say I didn’t get you anything!

Dec 2019

11

New Living Wage Rates Announced

The Living Wage Week ran from 11th to 17th November 2019 and as part of this week, the new Living Wage rate details were revealed on Monday 11th November 2019. The Mayor of London announced the London rate for the Living Wage whereas the UK rate is announced countrywide at the same time.

The UK Living Wage rate has increased by 30p per hour to £9.30, an increase of 3.3%.

The new London Living Wage, announced by the Mayor of London, Sadiq Khan, has increased by 20p from £10.55 to £10.75 per hour. This is a 1.9% increase and this rate is £2.54 higher than the legal minimum wage set by the Government. This helps reflect the higher cost of living facing families in the city.

There are now 1,700 London Living Wage accredited employers in London such as London City Airport and Crystal Palace Football Club. With this increase, London full time employees who receive the Living Wage will be almost £5,000 better off than other employees in London on the minimum wage.

According to the Trust for London, almost 20% of employees in London are paid less than the Living Wage which include 60% of jobs in the hotel and restaurant sector and 40% in the retail sector.

For information about the Living Wage Foundation and Living Wage Week visit the Living Wage Foundation website.

Dec 2019

6

Advisory Fuel Rates updated from 1st December 2019

HMRC has issued details regarding the latest Advisory Fuel Rates for company cars.

From the 1st December 2019 employers may use the old rates or new rates for one month. Employers are under no obligation to make supplementary payments to reflect the new rates but can do so if they wish. Hybrid cars are treated as either petrol or diesel cars for this purpose for the fuel rates.

The rates are as below:

| Engine Size | Petrol- amount per mile | LPG - amount per mile |

| 1400cc or less | 12 pence | 8 pence |

| 1401cc to 2000cc | 14 pence | 9 pence |

| Over 2000cc | 21 pence | 14 pence |

| Engine Size | Diesel - amount per mile |

| 1600cc | 9 pence |

| 1601cc | 11 pence |

| 2000cc | 14 pence |

For fully electric cars the Advisory Electricity Rate is 4 pence per mile. But electricity is not a fuel for car fuel benefit purposes. Please click here to see all details as per HMRC.

Dec 2019

5

Customer Update: December 2019

Welcome to BrightPay's December update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

How to choose the right Cloud HR platform for your business

-

Batch processing in BrightPay - so hot right now

-

Flexible working in the world of accountancy

The interactive digital payslip has arrived - Free for BrightPay Customers

You can now do so much more than simply manage the payslip process. BrightPay Connect offers an online self-service platform and an employee app. Employees have 24/7 easy access to view the payslips anytime, anywhere, using your smartphone, tablet or desktop computer. Historic payslips and P60s are available to access and download. BrightPay Connect offers employees:

- Ability to request annual leave on the go

- Current and historic payslip library

- Access to uploaded HR documents, such as contracts of employment and company handbooks

- View leave taken and leave remaining

- Holiday leave yearly calendar

- Access to edit and update personal contact details

Client Payroll Approval. This is what you must be offering as a service (and why clients will LOVE it)

BrightPay Connect’s Payroll Approval Request allows bureau users to securely send their clients a payroll summary before the payroll is finalised. Clients can then review and authorise the payroll details for the pay period through their online employer dashboard. Ultimately, your client will be accountable for ensuring the payroll information is 100% correct before the payroll is finalised. Additionally, there is an audit trail of the requests being approved by the client.

New AccountingWEB Live Conference for Accountants - Will you attend?

The popular AccountingWEB online platform has announced a new conference for accountants. AccountingWEB Live is a unique blend of technology showcase, educational workshop and inspiring content. As well as a full content programme, AccountingWEB Live will feature showcases from the UK’s leading technology brands, demonstrating the latest products, updates and solutions. We are delighted that BrightPay will exhibit at AccountingWEB Live next year to showcase our latest features.

New BrightPay Connect Subscription Pricing Model

From April 2020, customers will be billed on a usage subscription model based on the number of active employees in the billing month. Once signed up for a BrightPay Connect account, you will be invoiced monthly in arrears through our new online billing system. There are no contracts or ties. Should you decide to stop using Connect, no notice is required. Payroll Bureaus on a bureau package will be charged based on the total number of active employees in respect of clients that are synchronised to BrightPay Connect (not on a client-by-client basis).

Why employee apps are the future of payroll

The advancement of employee mobile apps offers many different advantages for employers, employees, and the business as a whole. Payroll apps will streamline payroll processing while reducing the number of payroll queries from employees. The BrightPay Connect self-service app provides a digital payslip platform where employees benefit from secure access anytime, anywhere, using their smartphone or tablet. Through these app features, you can provide your employees with access to GDPR compliant self-service tools, a payslip library and a user-friendly holiday leave management facility.