Mar 2019

20

BrightPay 2019/20 is Now Available. What's New?

BrightPay 2019/20 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2019/20 Tax Year Updates

- 2019/20 rates, thresholds, triggers and calculations for PAYE tax, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Automatic Enrolment pensions, company cars, vans and fuel.

- The emergency tax code has changed from 1185L to 1250L. When importing from the previous tax year, L codes are uplifted by 65, M codes are uplifted by 71 and N codes by 59.

- Full support for the 2019/20 Welsh Rate of Income Tax (WRIT) codes, rates and thresholds, as well as continued support for those of the Scottish Rate of Income Tax (SRIT).

- Support for the new Postgraduate Loan deductions.

- Ability to process 2019/20 HMRC coding notices (including new PGL1 and PGL2 notices).

- April 2019 National Living Wage rates.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

Automatic Enrolment Updates

- From April 2019 onwards, the minimum required pension contribution level is 8%, at least 3% of which must be contributed by the employer. BrightPay 2019/20 now uses and validates against this increased level by default. Where pre-April 2019 minimum levels were being used in 2018/19, BrightPay 2019/20 will automatically uplift them on import.

- With the concept of 'staging' for automatic enrolment now very much in the past, BrightPay is instead focused on asking for and working with the Next Re-enrolment Date.

- Various improvements have been made to make the automatic re-enrolment process more clear:

- For opted-out or ceased employees (as well as employees who are flagged for re-enrolment) the previous opt out/cessation date is now clearly visible and can be edited if need be.

- If an employee is marked as opted out or ceased, but the opt-out/cessation date is not known, BrightPay now flags for automatic re-enrolment anyway (and allows the missing date to be entered).

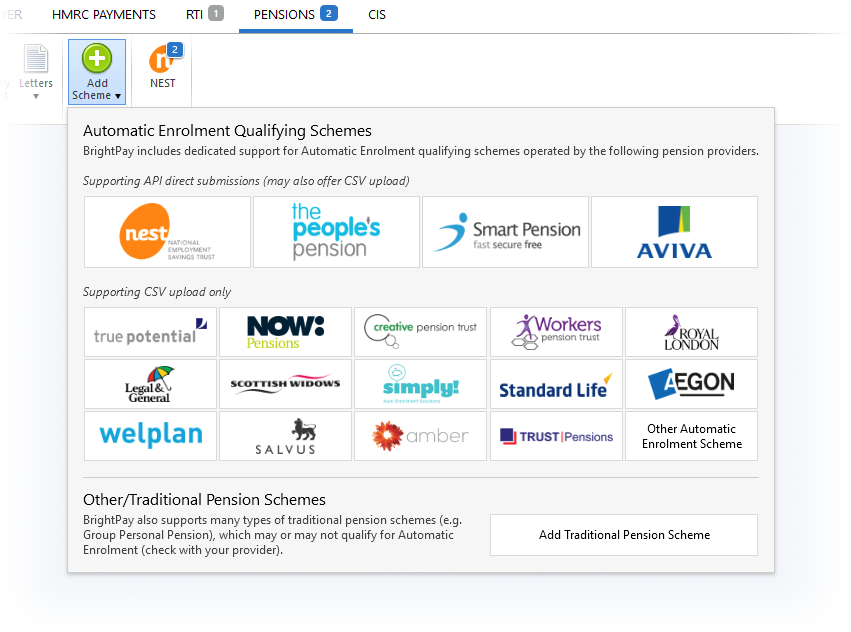

- Redesigned menu when adding a new pension scheme:

- The auto enrolment qualifying schemes are now categorised by API/CSV support, and ordered by popularity.

- The traditional pension scheme 'types' have been removed – when adding a traditional scheme you can now simply set the tax relief and AVC options directly instead of having to first choose the right type.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions.

Real Time Information

- As mentioned in the release notes for the most recent upgrade to BrightPay 2018/19, the EYU (Earlier Year Update) submission is no longer supported by HMRC and has now been removed from BrightPay altogether. To make corrections to 2018/19 or 2019/20 payroll data going forward, an Additional FPS is to be used.

- Ability to exclude an employee pay record from an FPS if it has zero amounts only.

- Ability to force include an employee's starter/leaver declaration on an FPS submission that covers a different period to the employee's starting/leaving period.

- Ability to unmark an unsent submission as contributing towards the Number of Unsent RTI Submissions count in BrightPay.

- New HMRC Receipt document which presents HMRC's response to an RTI submission in a clear, shareable format.

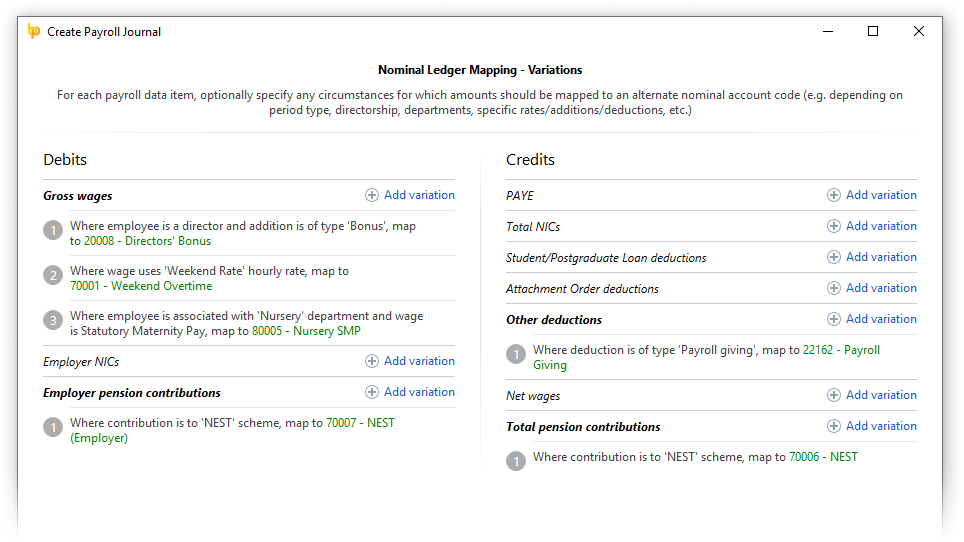

More Flexible Journals

A popular customer request has been to create a 'departmental' payroll journal in BrightPay. We've went one step further, allowing not only for a simple departmental mapping of nominal account codes, but for an advanced multi-option mapping as well.

For example, if you want to map commission paid to directors on a weekly basis in the sales department to a particular account code, you now can.

For Xero journals, BrightPay now supports including the department as the Xero tracking option, including where employees are split across multiple departments.

To make all this easier to manage, the Create Journal window in BrightPay now remembers it's size and position between usages.

Journal API Support

BrightPay now supports posting journals directly to Sage, Quickbooks and Xero via API (while continuing to offer the creation of a CSV journal as an option if need be).

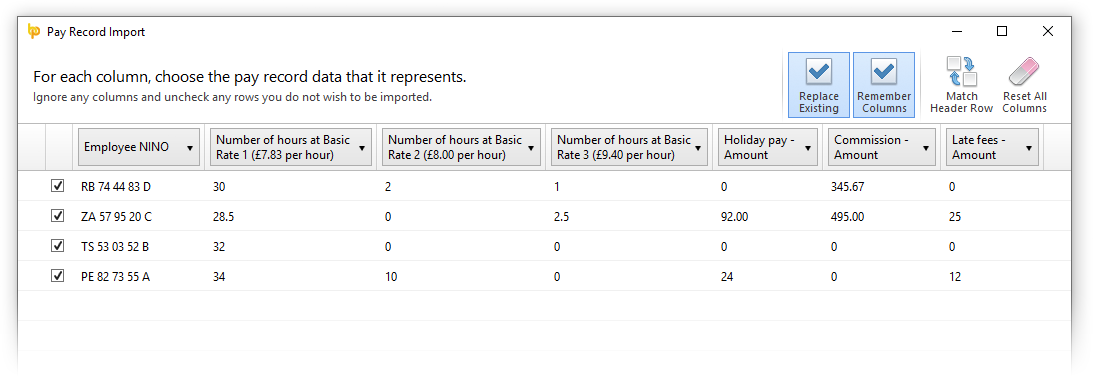

Importing Pay Records from CSV

We have significantly improved the power and flexibility of how pay records are imported from CSV, effectively allowing an entire pay run to be imported from a single CSV file if need be.

- Multiple pay items (of a single payment type, or mixed types) can now be imported from a single CSV line.

- Daily/hourly payments can more easily be imported under a named employer-wide daily/hourly rate

- Additions/deductions can more easily be imported under an employer-wide addition/deduction type

- The Import from CSV window has been redesigned to be more user-friendly and intuitive.

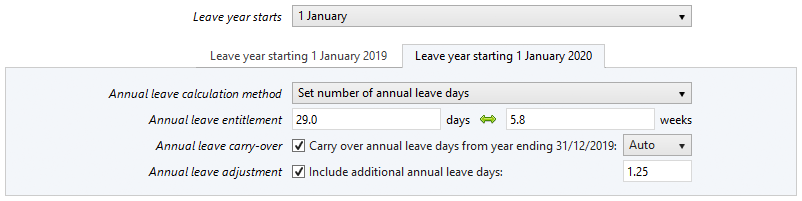

Improved Support for Offset Annual Leave Year

A popular customer request has been for BrightPay to better handle the definition, carry-over and adjustment of annual leave in the situation where the annual leave year is offset from the tax year.

In BrightPay 2019/20, you can now enter the annual leave settings for each overlapping year individually, giving you full control and helping you work out entitlements more accurately.

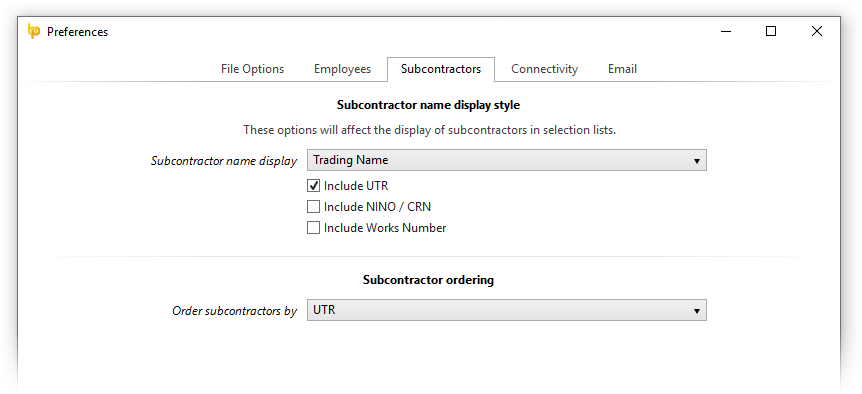

CIS Updates

- You can now customise how subcontractors are displayed and ordered across the BrightPay interface.

- When selecting from a list of subcontractors, BrightPay now includes a new 'Select By' button that allows you easily and quickly select only the subcontractors that match specific criteria.

- New Payments menu in the subcontractor toolbar which includes various handy functions including the ability to batch print multiple P&D statements for a single subcontractor.

- New CIS Year End Statement document.

- Ability to unmark an unsent submission as contributing towards the Number of Unsent CIS Submissions count in BrightPay.

- New HMRC Receipt document which presents HMRC's response to a CIS submission in a clear, shareable format.

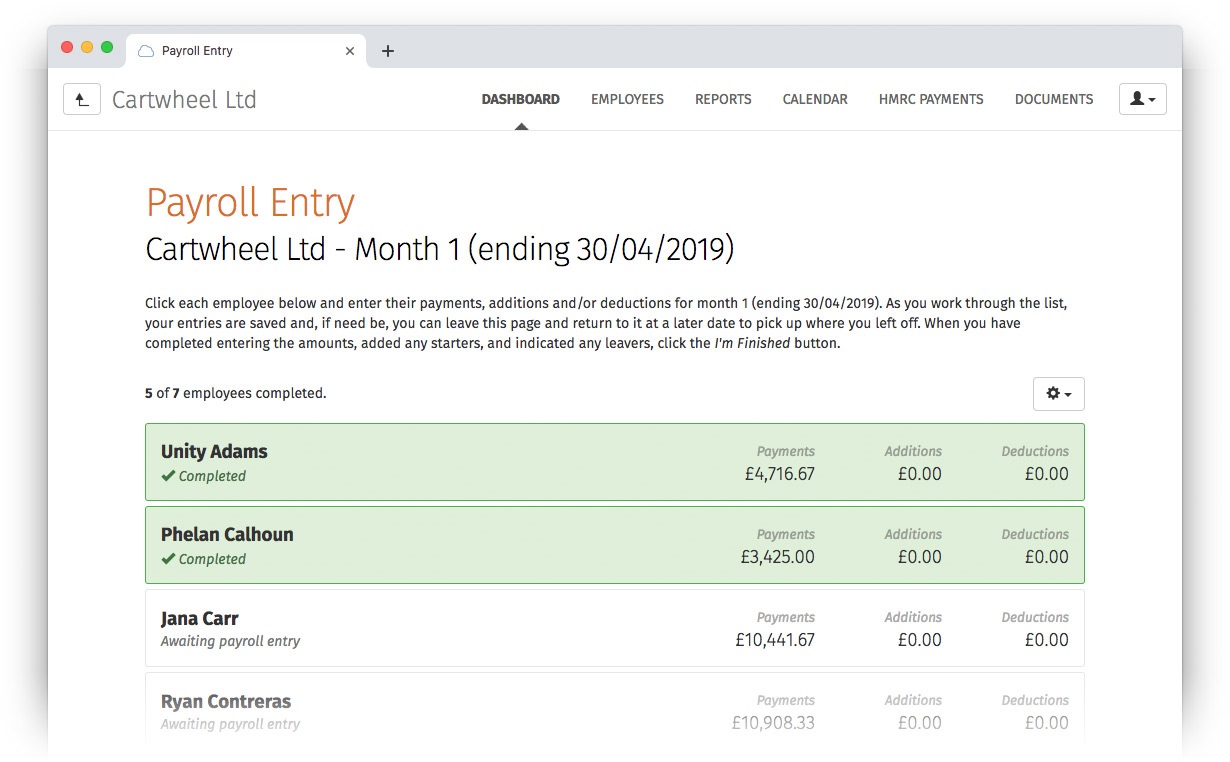

BrightPay Connect

In late 2018 we introduced a powerful new feature for Bureau customers of BrightPay Connect: the ability to request client payroll entry and/or approval for a payroll run, which is then automatically facilitated though a secure, GDPR-compliant process within the BrightPay Connect dashboard.

Sign in to your BrightPay Connect account and click the Requests header link to find out more.

Other 2019/20 Updates in BrightPay

- When hovering over the 'number of submissions' for an employer on the BrightPay startup window, a popup displays what the number(s) represent.

- The full description of an hourly or daily payment is now shown on-screen for finalised pay periods.

- BrightPay will now prompt you to change an apprentice employee who is set to be on NI table H but is over 25 years old.

- On the employee calendar, the parenting leave info panel now shows the total number of KIT days taken for the selected period of leave.

- Corrects handling of Statutory Adoption Pay and Statutory Shared Parental Pay in weeks beyond the week that employee took their 10th KIT day (or 20th SPLIT day).

- When selecting which analysis columns to include in a report, they are now grouped by category.

- New analysis columns:

- Separate 'cash equivalent' columns for each of the benefit/expense types.

- Total attachment order deductions excluding admin charge.

- Primary department name.

- Adds a 'description' field for all kinds of benefits, and shows the entered description for each benefit on the payroll interface.

- Options to show separate benefit payments on employee payslip, rather than just a rolled up 'taxable benefits' figure.

- The Number of Actionable Coding Notices is now shown on the coding notices toolbar icon, and is available as a column on the BrightPay startup window.

- New A4 payslip template, designed to be used where there are too many items to fit on the A5 template.

- As part of our new licensing model, Bureau customers can now view/edit the list of employers for which they have access.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

Includes all updates made to BrightPay during the 2018/19 tax year

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2018/19, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2019/20. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Ability to send enrolment/contribution submissions directly to the People's Pension via API.

- Ability to quickly create an new/additional employment for a previous/existing employee.

- Coding notice checks can now use agent credentials if available.

- Many improvements to emailing documents directly from BrightPay:

- Ability to specify the default starting body content to use when emailing a document.

- Ability to quickly turn on/off the stored email signature.

- When emailing a document, there is a new menu to quickly select and re-use recently used body content.

- Email body content now accepts 'Markdown' formatting.

- Ability to edit the list of saved third-party email recipients

- New startup window column for Next Estimated Pay Date.

- Two new tick boxes in BrightPay Preferences to indicate where Next Estimated Pay Date is in the past (which shows a red background colour for applicable employers on the startup window) or indicate where Next Estimated Pay Date is within X days (where X is customisable – shows a yellow background colour for applicable employers on the start screen).

- Ability to batch finalise the payroll for multiple employers.

- Ability to select employers by label colour when preparing a batch operation.

- Ability to persist a “Net to Gross” setting going forward (i.e. rolling net pay).

- Ability to create a bank file for paying HMRC.

- Allows a deduction to be calculated as a percentage of Auto Enrolment qualifying earnings.

- Enables subcontractors with zero amounts in a pay period to be excluded from a CIS300 submission.

- When in Payroll, the name of the active employee (i.e. the part of large text title) can now be clicked to navigate directly into the Employee > Edit Details screen for that employee.

- Employment Allowance report

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Mar 2019

18

GDPR, Payslips & the Cornucopia of sensitive employee payroll data

I know you've all been dying for another one so here it is; a brand spanking new GDPR blog! Well… if you’re like me then you cannot get enough of GDPR. For my birthday, my pals over at BrightPay got me an extra special GDPR gift in the form of two new Bureau features called ‘Client Payroll Entry’ and ‘Client Payroll Approval’.

So we all know how much of a nightmare it is inputting timesheet data from your clients into your payroll software. The back and forth, and the mistakes. Because if you duplicate the data, the margin for error is in turn doubled. Not only this but the payroll data is sent to the bureau in the form of emails, word documents, spreadsheets, sometimes even a phone call. We’ve talked before about emails and GDPR but in case you missed it, it’s better to avoid.

Emails are not the most secure channel, especially for the vast amount of sensitive employee data being transmitted. If you do use email to send clients payslips, it is strongly advisable to ensure payslips are encrypted and deleted from email servers once sent. And of course, you would need to ensure passwords are used on all payslips.

So what this new Payroll Entry Feature does is put the onus on the client to input their own payroll data into the secure employer dashboard, thus reducing the back and forth and making sure all that important data is sent through a secure portal. Once the payroll data has been submitted to the bureau, hey presto - the bureau has all of the accurate payroll information, ready to download to the payroll software.

Before, this would have had to be approved via email and then sent to the client who would send back what needed to be rectified and then back and forth, back and forth again. It’s a mess! But with the second new feature from BrightPay Connect is the Payroll Approval feature - the bureau sends the client a preview of payroll summary statement to the secure BrightPay Connect portal, the client reviews it, approves it and then *ping* the bureau has confirmation that the payroll is correct and everyone lives happily ever after.

With these new BrightPay Connect features the exchange of information is super secure; no one is getting in! The online portal is also protected by username and password with role and permission based access for each user. This is the stuff that GDPR dreams are made of as it places the responsibility of security into the hands of you, the people, who GDPR was made for.

If you want to get technical *puts on glasses and lab coat* - “The BrightPay Connect service is a web based application hosted on the Microsoft Azure platform. All data transmitted to and from the cloud service is secured using SSL over HTTPS. This includes data sent via web browsers and data sent from payroll applications”. - BrightPay Connect

Book your demo today at https://www.brightpay.co.uk/connect/

Related Articles:

Mar 2019

14

Customer Update: March 2019

Big changes are happening to payslips in 2019 - are you ready for them?

Every new year brings with it a host of changes and 2019 is no different. Here’s a quick recap of the two most important changes that have happened/are yet to happen to our lovely payslips in the 2019/20 tax year.

BrightPay 2019/20 is now available to pre-order

BrightPay 2019/20 and BrightPay Connect are now available to pre-order. BrightPay 2019/20 is scheduled for release week ending 22nd March. We will send you an email once BrightPay 2019/20 is released and ready to download. All customers will also receive a full list of new features when BrightPay 2019/20 is released.

Pre-order BrightPay 2019/20 here

Thinking about switching to BrightPay? Book a demo today

BrightPay won Payroll Software of the Year 2018 at the Accounting Excellence awards. With a 99% customer satisfaction rate, our products are used to process the payroll for over 200,000 businesses across the UK and Ireland.

“BrightPay is so much better than the software that we used previously. I get my work done much faster, and it is just so easy to use.” - Simon Gledhill, Gerard Tool & Die Limited

Book a demo | 60 day free trial | More testimonials

Auto Enrolment Phasing - The Second Coming

Under automatic enrolment, minimum pension contributions are required to increase over time. The first increase took place last April at the start of the 2018/19 tax year. The second increase will take place on 6th April 2019, with the total minimum contribution rate increasing to 8%, representing a 3% employer and 5% employee contribution. These increases are seamlessly handled by BrightPay 2019/20.

A Quick Recap: What's new in BrightPay 2019/20

With the 2019/20 tax year fast approaching, this 60 minute webinar will cover the main legislative changes coming into effect and how they will be handled in BrightPay 2019/20, as well as the new functionality we will be introducing into the software. We will also look at a quick introduction to the BrightPay Connect add-on product.

BrightPay Connect’s Employee SmartPhone App

BrightPay’s employee self-service smartphone and tablet app is available with our BrightPay Connect add-on. Employee mobile apps offer many benefits for employers, employees, and the business as a whole. The user-friendly portal will streamline payroll processing while reducing the number of payroll queries from employees.

Read more | Book a BrightPay Connect demo

EU Settlement Scheme: What employers can do to help their EU employees

The UK is due to leave the European Union on the 29th of March 2019. There are thousands upon thousands of EU citizens currently employed by British companies that will end up being illegal workers if they do not apply for settled status by the deadline. You as the employer, have an obligation to prepare them for this and make sure that your house is in order.

Bureaus: The benefits of an online payroll approval facility

A time consuming part of payroll is requesting and receiving employee hours and timesheets from your payroll clients. Today, managing and tracking this information is much easier thanks to online tools and applications. Ultimately, your client becomes accountable for ensuring the payroll information is 100% correct before the payroll is finalised.

Read more | Book a BrightPay Connect demo

Bureaus: Keeping your clients payroll data secure to avoid data breaches & fines

Security is extremely important in payroll bureaus. After all, you are handling the personal and financial data of your clients and your client’s employees, which puts you at risk of data breaches and cyber attacks. In order to comply with the current GDPR legislation, you also need to follow a strict process when processing the payroll data, and make sure that your system meets the GDPR regulation standards.

Mar 2019

11

Auto Enrolment Phasing - The Second Coming

Ten million people have joined workplace pension schemes since auto enrolment began in 2012. The scheme faced its first major test in April, when the total minimum pension contributions increased from 2% to 5%.

Under automatic enrolment, minimum pension contributions are required to increase over time. This happens on set dates - the 6th of April 2018 and the 6th of April 2019 - and is a key feature of automatic enrolment. By law, a total minimum amount of contributions must be paid into a pension scheme. The employer must make at least the minimum employer contribution towards this amount and employees must make up the difference. It is an employer’s responsibility to make sure these increases are implemented.

In 2019, the minimum contribution levels will rise again on the 6th of April, with the employer paying a minimum of 3% of qualifying earnings towards the pension. Staff members will have to make up whatever shortfall remains of the new total minimum contribution up to 8%, including the employer's contribution. These increases should be seamlessly handled by payroll software.

| Date effective | Employer minimum contribution |

Staff contribution | Total contribution |

| Before 6th April 2018 | 1% | 1% | 2% |

| 6th April 2018 to 5th April 2019 | 2% | 3% | 5% |

| 6th April 2019 onwards | 3% | 5% | 8% |

If a member does not wish to pay the increased contributions due, they can choose to opt-out of the pension scheme, or they may be allowed to remain at the lower contribution rate after the increase. This will mean they continue to be a member of the scheme, but as contributions are below the minimum level required by law, the scheme will not be a qualifying auto enrolment pension scheme.

Opt-outs as a result of Phasing

Since April 2018, many pension providers have said that they have seen very little impact on opt-out rates as a result of the higher contributions. In the two months after the April 2018 increase, the opt-out rate rose by approx. 0.2% to 8.2%. In a survey of nearly 350 employers, 88% said that the increase in minimum auto enrolment contribution rates in April 2018 had not reduced scheme participation. Prior to the increases, there were fears of a bigger spike, with the Department for Work and Pensions (DWP) projecting opt-out rates as high as 28%.

There was also a very low percentage of workers who opted to reduce their contribution rate to the previous 1% contribution level. One employer with 30,000 workers enrolled had just 40 employees choosing to remain at the lower amounts.

Steve Webb from Royal London said: “We have seen very little impact of April’s rise in contributions. The rise coincided with the annual boost to tax thresholds, some annual pay rises and an increase in the living wage, all of which will have cushioned the rise in contributions. Inertia also remains a powerful force and will continue to be so as long as contributions remain at relatively modest levels.”

Employers are predicting that opt-out rates will remain low as auto enrolment contribution rates are set for another increase this year.

Click here for more information about phasing / increases to minimum contributions.

Mar 2019

6

EU Settlement Scheme: What employers can do to help their EU employees

Unless you’ve been living under a rock the past 2 years (which to be fair would have been more fun) you’ll know that the UK is due to leave the European Union on the 29th of March 2019. Yes, good ol’ Brexit has become everyone’s new favourite B word, everyone's favourite news story and everyone’s favourite topic of conversation at family dinners. Wherever on the political spectrum you lay and whether or not you think there will be another referendum; or that some miracle could happen that would save the UK from the unending embarrassment we have found ourselves in, the fact remains that we are due to leave the EU in March this year. And it doesn’t change the fact that there are thousands upon thousands of EU citizens currently employed by British companies that will end up being illegal workers if they do not apply for settled status by the deadline. You as the employer, have an obligation to prepare them for this and make sure that your house is in order.

We love our EU nationals, no matter what was voted, and we want them to stay. So what happens? European nationals and their family members currently in the UK have the option to apply under the current system for a permanent residence document. This involves providing evidence that the EU national has spent a continuous period of 5 years in the UK. This can be proved by providing P60s for each year of employment so this is where your payroll department can help.

As Theresa May’s deal has been taken out back with the rest of the rubbish, the new EU settlement scheme will now come into effect bang on the 29th of March 2019 with no transition period. As mentioned, the scheme allows those who have been residing in the UK for 5 years to apply for “settled status” but also those who do not yet have 5 years continuous residence to apply for “pre-settled” status. In the event of a no-deal (which is looking ever more likely much to the sheer delight of Boris Johnson) the deadline for applications will be the 31st of December 2020.

Now, we are people and therefore we are the WORST so what is inevitably going to happen? People are going to forget to apply for the required settled and pre-settled status by the deadline! What will happen then? If you believe the papers it will be chaos! We can only speculate. But what we do know is that, as an employer, if there are any EU nationals that have not applied that are in your employment, you are now employing people who are in the UK unlawfully and you are breaking the law.

What can you do to prevent this? What you can do is offer practical support and resources to your EU employees. You can do this by hosting information workshops, providing them with documentation to support their application in advance, and by doing a company wide audit of which of your employees will be affected. You can also schedule catch-ups to see where they are and what support they need. Amazingly, the government have decided to scrap the £65 application fee (never thought I’d see the day they would say no to a bit of cash) so that’s one less moral dilemma to worry about.

Speak to your HR department, speak to your payroll department, speak to your employees. You can also download the EU settlement employee toolkit from the government website that helps equip employers with the right tools and information to support EU citizens and their families to apply to the EU Settlement Scheme.

Mar 2019

4

BrightPay 2019/20 is now available to pre-order

BrightPay 2019/20 and BrightPay Connect are now available to pre-order. BrightPay 2019/20 is scheduled for release week ending 22nd March. We will send you an email once BrightPay 2019/20 is released and ready to download. All customers will also receive a full list of new features when BrightPay 2019/20 is released.

Pre-order BrightPay 2019/20 Here

Important information for all customers - BrightPay’s pricing structure is changing

We introduced the initial version of BrightPay over seven years ago. Since then, we’ve added hundreds of powerful features and enhancements, with many more planned for the future. We have invested a considerable amount in technology and resources and we intend to continue our program of development into the future.

To enable this ongoing level of investment, we are increasing our pricing from 2019/20 onwards in order to continue to provide you with the best payroll software in the UK.

View BrightPay 2019/20 Pricing

We believe our pricing remains excellent value and continues to be very competitive when compared to the options from other providers. We will continue to offer full support at no extra cost.

For customers with three or less employees (who have been using our ‘Free’ version to date), BrightPay will cost just £49 (plus VAT) per year from April 2019, and will include full unrestricted functionality as well as free telephone and email support.

What do you need to do now?

Nothing, your BrightPay 2018/19 licence will continue to work as normal until the end of the tax year without any additional cost. Pre-order BrightPay 2019/20 today and we will email you when the software is available to download.

We’d like to thank you for being a valued customer and for your continued support.

Feb 2019

18

Cloud innovation and the future of payroll services

Payroll servicing is evolving to a move towards automation and cloud flexibility for you, your clients and their employees. The latest technological advancements mean your payroll and HR processes can be more integrated into the cloud and streamlined with your payroll software than ever before.

The process of managing your client’s annual leave requests, recording leave on payroll software, sending payslips and payroll reports, updating contact details and managing employee HR documents can be time-consuming, frustrating and a costly process. More importantly, where is all this information stored? Many bureaus are still managing their clients’ workforces with old fashioned spreadsheets, manual processes and paper forms.

Today, payroll management is all about efficiency and there are several exciting developments that are happening right now in the cloud. It is now feasible for payroll to be profitable for bureaus offering it as a service. These day-to-day administrative payroll tasks can be process-driven and handled by cloud technology. The payroll and HR landscape is fast evolving as savvy bureau businesses move towards new-world online technologies.

Free Webinar for Payroll Bureaus

BrightPay are co-presenting a free webinar with the world’s most highly rated advisor to accountants, Steve Pipe.

- BrightPay: Cloud innovation will be central to the future of payroll services

During the webinar, BrightPay will discuss cloud innovation and how it will be central to the future of payroll services. Be ready to offer a new level of payroll and HR related services by embracing cloud innovation. Find out how to use automation tools to become more efficient, comply with new GDPR legislation and grow your practice. - Steve Pipe: How to use payroll to pay off your mortgage in 5 years

During the webinar, Steve Pipe will show you how to earn enough extra money from payroll to pay off an average size mortgage in 5 years. Steve will discuss a powerful new step-by-step system for using payroll to win really high-quality new clients. Discover how you can make payroll one of your most profitable and strategically important service lines.

View webinar agenda | Register for webinar

Related Articles:

Feb 2019

13

Customer Update: February 2019

Free Webinar: How to use payroll to pay off your mortgage in 5 years

BrightPay is co-presenting a free webinar with the world’s most highly rated advisor to accountants, Steve Pipe. Discover how you can make payroll one of your most profitable and strategically important service lines. During the webinar, Steve Pipe will discuss a powerful new step-by-step system for using payroll to win really high-quality new clients.

View webinar agenda | Register for webinar

Pre-order BrightPay 2019/20 today!

BrightPay and BrightPay Connect are now available to pre-order. BrightPay is not available to download yet. We will send you an email closer to the new tax year once BrightPay 2019/20 is released and ready to download.

Pre-order BrightPay 2019/20 | Important Pricing Update

5 Reasons to Switch to BrightPay

- Awarded 2018 Payroll Software of the Year at the Accounting Excellence awards.

- BrightPay is used to process the payroll for over 160,000 businesses in the UK

- 99% customer satisfaction rate for BrightPay and a 99% satisfaction rate for customer support.

- Free phone and email support plus a range of online help guides, online training sessions and tutorial videos.

- 94% of customers report time saving benefits and 86% report cost saving benefits when using BrightPay.

Book a demo | Customer testimonials

Further increases to the minimum auto enrolment contribution rates

On the 6th April 2018, the total minimum auto enrolment contribution rate increased from 2% to 5%, representing a 2% minimum employer contribution with employees contributing the balance. Minimum contributions will undergo further increases on 6th April 2019, with the total minimum contribution rate increasing to 8%.

Minimum Contribution Increases (Phasing)

Payroll Bureaus - Say goodbye to manual payroll entry

We are sure you don’t enjoy that endless back and forth email exchange between you and your clients to request information about the time records and employee hours for their payrolls. BrightPay Connect is making things easier by allowing you to securely send payroll entry requests and payroll approval requests to your clients.

Find out more | Client Payroll Entry & Payroll Approval | Book a demo

9 reasons why client cloud platforms will be central to the future of payroll services

Payroll servicing is evolving to encompass a move towards cloud access and flexibility for you, your clients and their employees. Be ready to offer a new level of payroll and HR related services by embracing cloud innovation. This checklist will make it feasible to offer cloud platforms to clients while streamlining your payroll processing and increasing your profits.

Employee Self-Service: Reduce your workload immediately

BrightPay Connect includes a powerful and secure online portal for employees. With the online portal, employees can view a payslip library where they can download historic payslips and payroll documents, eliminating requests to their manager. Employees can also update their basic personal details including their postal address, contact details, and emergency contact details on any internet browser or from the employee smartphone app. This will ultimately reduce administration duties for managers.

How to make your payroll bureau more secure

Security is extremely important in payroll bureaus. After all, you are handling the personal and financial data of your clients and your client’s employees, which puts you at risk of data breaches and cyber attacks. Choosing a reliable system is the first step to keep all your clients’ data secure and avoid any risks.

Don’t mess with the minimum wagers or HMRC will make you pay

Back in August, the government made headlines in a name and shame exercise of epic proportions where they published the names of 239 employers who underpaid more than 22,000 employees. HMRC identified 5 main areas as reasons for national minimum and living wage underpayments.

Customer Case Study: Trendzer

Trendzer was using a complex and clunky payroll solution that offered only paper payslips up until December 2014. “We wanted an automated solution that was user-friendly and easy to manage. After trialling a few systems, we decided BrightPay was the best solution out there. BrightPay stood out to us as it was very simple to use and it had a clear, intuitive interface.”

Did you miss it? Important Pricing Update for BrightPay 2019/20

We introduced the initial version of BrightPay over seven years ago. Since then, we’ve added hundreds of powerful features and enhancements, with many more planned for the future. To keep pace with the value that BrightPay provides, we’re increasing our pricing from 2019/20 onwards. This will ensure that we can continue to develop and support the best payroll software in the UK.

Read more | View new features | View pricing

Steve Pipe’s gift copy of this Amazon best-selling book. Do you want it?

The book comes with an invitation to an executive briefing Steve Pipe has arranged for you. As you probably know, Steve is a former UK Entrepreneur of The Year who, according to LinkedIn, is also the world’s most highly rated accountant. The executive briefing starts at 11.00 am on the 4th of April, and you can reserve a virtual seat as our guest here. Best of all, you will also be able to instantly download your gift copy of the Amazon best-selling book that Steve first published his research in, AND the step-by-step system that makes it all really easy to do.

Are you missing out on BrightPay's newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Jan 2019

31

Important Pricing Update for BrightPay 2019/20

We introduced the initial version of BrightPay over seven years ago. Since then, we’ve added hundreds of powerful features and enhancements, with many more planned for the future.

We have invested a considerable amount on technology and people and we intend to continue our program of development into the future.

To keep pace with the value that BrightPay provides, we’re increasing our pricing from 2019/20 onwards. This will ensure that we can continue to develop and support the best payroll software in the UK.

Details of the new BrightPay pricing can be viewed on our website. We believe our pricing remains excellent value and continues to be very competitive when compared to the options from other providers. We will continue to offer full support at no extra cost.

For customers with three or less employees (who have been using our ‘Free’ version to date), BrightPay will cost just £49 per year from April 2019, and will include full unrestricted functionality as well as free phone and email support. Your BrightPay 2018/19 free licence will continue to work until the end of the tax year without any cost.

We’d like to thank you for being a customer and for your continued support.

Jan 2019

25

Don’t mess with the minimum wagers or HMRC will make you pay

Back in August, the government made headlines in a name and shame exercise of epic proportions where they published the names of 239 employers who underpaid more than 22,000 employees. These underpayments totaled in excess of £1.44 million. That might not seem like a lot in relation to the sheer amount of employees who were underpaid, but on average it would amount to £65 per employee. That would cover a tv license for a year, a new winter coat, or a cheeky Nando’s. My point is, it’s all relative and it was their hard-earned money. Even worse is that all underpayments happened to people who were on minimum or living wage. An added kick in the teeth!

Well the HMRC agreed! They are cracking down on companies who are underpaying their workers. The back pay identified by the HMRC was for more workers than in any other previous ‘name and shame’ exercise. Not only that but the fines wholloped onto the devious employers totalled an eye-watering £1.97 million, which is ironically, more than the underpayments themselves.

In fact, funding for minimum wage enforcement has doubled since 2015 with the government set to spend £26.3 million in 2018/19. The scheme is now in its fifth year and has identified £10.8 million in underpayments and have fined employers in excess of £8.4 million. So although you might be trying to save a few pennies Ebenezer Scrooge, the ghost of paychecks past will inevitably come back to haunt you.

But what about me? I’m an honest business owner who pays my employees - I feel very attacked right now! Ok, so the 5 main areas identified by HMRC as reasons for national minimum and living wage underpayments as:

- Taking deductions from wages for costs such as uniforms

- Underpaying apprentices

- Failing to pay travel time

- Misusing the accommodation offset

- Using the wrong time periods to calculate pay

So as you can see, besides underpaying apprentices, the majority of payroll deductions are as a result of money being offsetted from employees’ wages. Now, this could be on a purpose, pre-calculated or if you will pardon the pun or by penny pinching grinches. OR more so, (and the latter is most likely) you’ve gone and messed up the bloody deductions!

Let me tell you where you’re going wrong. Many employers are not using a payroll software system to do all these mind-boggling calculations for you. And that’s just the payroll calculations. It can get even more complicated for employers using Basic PAYE tools as this tool does not calculate the workplace pension contributions. Instead, this is a manual process.

Yes that’s right, there is software that can do these calculations for us now and even provide payslips to employees (yes, it’s the law to provide payslips to employees). Using a dedicated employer payroll software means that all of those pesky deductions are calculated and processed for your employees by a machine that is much smarter than you. It means a massive reduction in error, no underpayments and most importantly no fines from HMRC and your company name included on the Wall of Shame.

The best payroll software out there right now (as voted by the public) is BrightPay. I could talk about all the benefits that it would bring to your company and life in general but instead read for yourself what its customers have got to say about it on BrightPay’s Customer Testimonials page. You can also book a free demo at https://www.brightpay.co.uk/pages/book-BrightPay-Demo/.

Trust me, you won’t regret it!

Written by Aoibheann Byrne | BrightPay Payroll Software

Related articles:

- Customer updates: January 2019

- Viva La Revolution - Client Payroll Entry is here

- 5 traits of a successful payroll bureau service