Oct 2017

2

Brexit - There’s an elephant in the room!

Brexit is becoming the “elephant in the room” for many companies waiting for government updates and its implications on how the new deal will work out. Many HR and payroll professionals are no doubt anticipating how such a huge shift in the political scene will change existing legislation.

However, while it’s easy to get distracted by how Brexit will change the current HR and payroll landscape in the future, there are more current, pressing concerns at hand.

Remember these key Legislative Compliance Payroll Updates:

Data Protection Changes

It is now confirmed that the upcoming General Data Protection Regulation (GDPR) will affect all UK companies. Businesses will need to start future-proofing their procedures and policies before the data protection changes come into effect in May 2018.

Non-compliance by businesses could lead to fines of up to £20 million or 4% of a company’s annual global turnover in the prior year. Bringing your company’s policies in line with the approaching changes will ensure a smoother transition and avoid any penalties for non-compliance.

Gender Pay Gap Reporting

If a business, either private or voluntary, has more than 250 employees it needs to be aware of legislative changes regarding gender pay gap reporting. The new law came into effect on 5th April, 2017 with employers required to publish their first report on 5th April, 2018 relating to their data from 2016/17. The results must be published on the employer’s website and a government website. Failing to do so will result in enforcement proceedings.

You can find more information on what the EU is doing regarding Gender Pay Gap Reporting by clicking here.

Pay Rate Changes

New rates for the National Living Wage and National Minimum Wage came into effect April 2017. The Living Wage rose to £7.50 for employees aged 25 or over and who are not in their first year of apprenticeship. The National Minimum Wage rose to £7.05 for employees aged between 21 and 24, it increased to £5.60 for those between the ages of 18 and 20 and lastly, it increased to £4.05 for 16 to 17 years old.

Statutory Maternity/Paternity/Adoption Pay has risen to £140.98 per week. It is a company’s payroll department that have the responsibility of ensuring the above increases have already taken place since their implementation dates last April.

Overseas Workers

Last April, salary thresholds for foreign employees increased. The Tier 2 (general) salary increased to £25,000 for experienced workers and Tier 2 (intra-company transfer) rose to £30,000. There was also a reduction to £23,000 for graduate trainees with the number of places rising to 20 a year for each company.

Changes to the immigration rules means that businesses who sponsor foreign employees on a Tier 2 (general) visa now must pay a skills charge of £1,000 per employee. For companies with less than 250 employees, the charge is £364. Both charges are on top of normal visa application fees.

Case against Dudley Metropolitan Borough Council

A recent judgement by the Employment Appeal Tribunal (EAT) confirms that payment for normal voluntary overtime must be included in the calculation of workers holiday pay.

Be Prepared, Be Proactive

Payroll Managers should be proactive and aware of the above current legislation. Key changes are on the way once Brexit finally arrives but it is so important to keep an eye on developments and focus on current issues at hand, making allowances for existing legislative changes.

Sep 2017

27

What do you mean…. “Do I have a backup?”

One of the most common calls I get on the support line is from a distressed customer who tells me they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer, holding files to ransom or fire or water damage to the computers in the office.

The first question I’ll ask on a call of this type will be “do you have a backup?”. Honestly, I can’t tell you the number of people that say “No” to this. People are also mistakenly under the impression that we have a copy of their payroll data. Unfortunately this is never the case, we do not have access to the employer’s payroll information so this can add to the customer's stress levels as you can imagine!

We would always stress the importance of taking a backup of your payroll information.

You would have your computers and office equipment insured against anything happening so why would you not do the same for your data? Think of your backup as your information’s insurance policy, after all it is almost irreplaceable or at the very least a major inconvenience to try and rebuild your payroll.

In a lot of cases, the call to our customer support line comes too late for us to be of any real assistance and the only advice we have to give is to start over and process payroll from the beginning again.

We never think anything like this will happen to us, but take it from me, it does, so go ahead and take out that insurance policy and backup before it is too late!

The following links will guide you to taking a backup in your software or book a demo of BrightPay Connect our latest cloud add on that offers an automated online backup feature :

- BrightPay UK: https://www.brightpay.co.uk/docs/17-18/backing-up-restoring-your-payroll/

- BrightPay Ireland: https://www.brightpay.ie/docs/2017/backing-up-restoring-data-files/backing-up-your-payroll-data/

- Thesaurus Payroll Manager: https://www.thesaurus.ie/docs/2017/processing-payroll/backup-data-files/

Sep 2017

26

42 Year Low in UK Unemployment

The UK's unemployment rate has fallen to its lowest level since 1975, according to official figures which also show a growing gap between price rises and wage growth. The unemployment rate fell to 4.3% in the three months to July, down from 4.4% in the previous quarter and 4.9% a year earlier.

The employment rate, which measures the proportion of people aged 16- 64 in work, hit 75.3% - the highest since comparable records began in 1971. In total, there are 32.1 million people at work in the UK, according to the figures, or 181,000 more than the previous quarter.

While that performance suggests the labour market is continuing to shrug off uncertainties and other headwinds in the wake of the Brexit vote, the figures also highlighted a worsening squeeze for family budgets. It is also reported that average wage growth remained static at an annual rate of 2.1% over the same three months. With inflation coming in at 2.9%, the real value of wage growth is falling.

Sep 2017

18

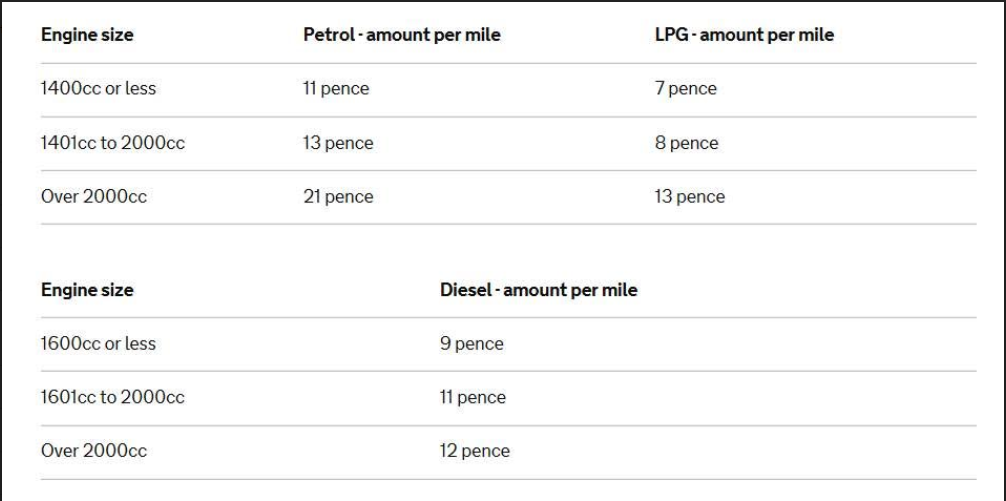

Latest Advisory Fuel Rates for Company Cars

For company cars, HMRC has released details regarding the latest Advisory Fuel Rates. From the date of change, employers may use the old rates or new rates for one month. Employers are under no obligation to make supplementary payments to reflect the new rates but can do so if they wish. Hybrid cars are treated as either petrol or diesel cars for this purpose for the fuel rates.

The changes are to engine size from 1401cc to 2000cc and to LPG engine over 2000cc. To view the latest rates click here.

The rates are as below:

Sep 2017

11

GDPR - what businesses need to know

Data protection and how personal data is managed is changing forever. On 25 May 2018 the new General Data Protection Regulation (GDPR) will come into force. The GDPR is a European privacy regulation replacing all existing data protection regulations.

Current data protection legislation in the UK dates back to 1998, predating current levels of internet usage and cloud technology, making it unsuitable for today’s digital economy.

The GDPR will apply to any personal data of EU citizens, regardless of whether it is stored within or outside the EU. Most, if not all companies, process a level of personal data, whether it is customer details or employee details, therefore businesses need to be aware and plan for the new legislation.

What is Personal Data?

The GDPR substantially expands the definition of personal data. Under GDPR, personal data is any information related to a person, for example a name, a photo, an email address, bank details, their personnel file, or a computer IP address.

High Penalties

Ignoring the new legislation is ill advised as there are tough new fines for non-compliance. Companies or organisations found to be in breach of the legislation will face fines of up to 4% of annual global revenue or 20 million Euros, whichever is greater.

GDPR & Brexit

The UK will not have departed the EU on 25 May 2018 and will still be an EU member state. The GDPR will consequently become domestic law and compliance will be mandatory.

Key Changes

Some of the key changes included as part of the GDPR include:

Consent must be clear, distinguishable from other matters and provided in an easily accessible form, using clear and plain language. It must be as easy to withdraw consent as it is to give it.

Breach Notifications; where a breach occurs, the Information Commissioner’s Office and affected data subjects must be notified within 72 hours of the breach coming to light.

Data subjects will have additional rights, including:

- Access Rights: data subjects may obtain from a data controller confirmation as to whether or not personal data concerning them is being processed, where and for what purpose.

- Right to be Forgotten; data subjects will have the right to request that their personal data be erased, or ceased to be processed.

- Data Portability: data subjects will have the right to receive the personal data concerning them, and the right to transmit that data to another controller.

To Do

If you haven’t already started planning for GDPR click here for guidance on how to prepare.

BrightPay - Payroll and Auto Enrolment Software

Bright Contracts - Employment Contracts and Handbooks

Sep 2017

11

New Student Loan Plan 1 Thresholds for 2018-19

It has been confirmed that the student loan repayment threshold will rise to £18,330 for Student Loan Plan 1 for the new tax year 2018-19 by the Student Loans Company. This will come into effect from 6th April 2018. Student Loan Plan 1 is for pre-2012 loans and the current 2017-18 threshold is £17,775. This new threshold will apply to all borrowers who have a Plan 1 loan for whom employers make student loan deductions.

For Student Loan Plan 2, which is for post 2012 loans, there will be no change to the current threshold of £21,000 in the new tax year. There is no change to the student loan repayment threshold for postgraduate loans, which is also £21,000.

In BrightPay 2018-19, the new student loan repayment thresholds for Plan 1 will automatically be calculated and the appropriate student loan deduction applied.

Sep 2017

1

Parental Bereavement (Pay and Leave) Bill

The Parental Bereavement (Pay and Leave) Bill has been introduced to Parliament on 19 July 2017.

Under the proposed new law, employed parents who suffer the death of a child will for the first time be entitled to statutory paid leave. The law is supported by the government in line with its initiative to “enhance the rights and protections in the workplace” to ensure that grieving parents in employment receive paid leave to mourn away from the workplace.

Kevin Hollinrake MP who introduced the Bill said: “This is such an important Bill for parents going through the most terrible of times. There is little any of us can do to help, but at least we can make sure that every employer will give them time to grieve.”

At present, under the Employment Rights Act, there are no legal requirements for employers to give paid leave to grieving parents. Employees, however, have a right to take a “reasonable” amount of unpaid time off work to make arrangements following the death of a dependant.

The new Bereavement Law will make it compulsory for employers to offer two weeks of paid bereavement leave to parents after the death of a child under the age of 18 or in full-time education. The Bill states that grieving parents must be paid no less than 90 per cent of their average weekly earnings, or £139.58 per week (which was the statutory weekly rate in force at the time the Bill was originally published, but is currently £140.98), whichever is lesser. This amendment could help parents deal with the financial implications of bereavement, including paying for funeral arrangements.

It has not yet been confirmed whether or not the law will include parents who have lost a child during pregnancy.

The Bill is expected to have its second reading in the House of Commons in the autumn. In the meantime, the Department for Business, Energy and Industrial Strategy will be talking to employers, employee representatives and campaigners to better understand the needs of bereaved parents.

Aug 2017

21

Customer Update: August 2017

BrightPay Customer Survey: The Results are in

In our recent survey, we were delighted to discover that our customer satisfaction rate has slightly improved since last year from 99.2% to 99.8%. The satisfaction rate for BrightPay’s customer support is 98.6% which is also an improvement on last year.

Employers warned by The Pensions Regulator regarding Fake Exemption Certificates

Employers are being made aware of an apparent scam of exemption certificates for automatic enrolment purposes being offered by at least one company. An investigation is being undertaken by The Pensions Regulator into this company offering what is described as 'Certificates of Auto Enrolment Exemption' to employers.

Bright Contracts Webinar: Keeping your business compliant with Employment Law

As busy employers it can be difficult to keep up-to-date with the constant changes in employment law. In this webinar we discuss what is new in employment law, give you key facts about the legislation that you need to know and highlight areas that will help ensure your business remains compliant.

News for Bureaus

Watch our latest video to see how BrightPay Connect can benefit your payroll bureau

BrightPay Connect our latest cloud add-on works alongside BrightPay Payroll. Payroll information is stored in the cloud and can be accessed online by you and your clients anywhere. BrightPay Connect offers additional innovative payroll and HR features that will enhance client relationships and increase revenue for your bureau.

Free CPD Auto Enrolment Webinars with NEST, Workplace Pensions Direct, Aviva & Pension PlayPen

Join BrightPay and our guest speakers to understand what the future holds for auto enrolment covering re-enrolment, auto enrolment and new employer's, Basic PAYE tools and all you NEED to know about choosing a pension scheme. Registration is free.

New Employers & Auto Enrolment

From the 1st of October 2017, clients who become an employer for the first time will immediately have AE duties to complete for any staff they employ. Worryingly, according to research conducted by The Pensions Regulator (TPR), 49%, almost half of accountants asked did not know that new employers would have AE duties.

Find out more Register for free CPD webinar

News for Employers

Watch our latest video to see how BrightPay Connect can improve your annual leave processing

BrightPay Connect our latest cloud add-on works alongside BrightPay Payroll. Payroll information is stored in the cloud and can be accessed online by you and your employees. BrightPay Connect offers additional innovative payroll and HR features that streamline your annual leave management and payroll processing.

Understanding your Declaration of Compliance

An employer's declaration of compliance is one of the most important automatic enrolment duties and it should not be left until the last minute. It is never too early to start preparing. This blog will take you through the various steps employers will need to understand to successfully complete their Declaration of Compliance.

Proposed State Pension Age Changes: How will it affect you?

Under current legislation, the State Pension age increase from 67 to 68 is to be phased in between the years 2044 and 2046. The Government, however, now plan to implement this increase seven years earlier. Should this proposed change go ahead, this means that the State Pension age will thus increase to 68 between 2037 and 2039 instead.

Aug 2017

18

Customer Survey - The Results are in!

Opinions and feedback from BrightPay customers matter to us. We love to hear comments and suggestions from users in order to improve the customer experience.

We recently conducted a customer survey in August, to get an insight into what customers think about BrightPay and find out what new features our customers want. Some of this year’s suggestions included more integration with pension providers, improved reporting and full functionality for the Mac version of BrightPay. Our development team are currently working on these improvements.

The survey also looked at customer satisfaction rates, software performance and customer support. We were delighted to discover that our customer satisfaction rate has slightly improved since last year from 99.2% to 99.8%. The satisfaction rate for BrightPay’s customer support is 98.6% which is also an improvement on last year.

Similar to last year, many customers agree that BrightPay saves them time (99.5%) and money (99.3%). Our new features that have been added to BrightPay within the last 12 months have been beneficial to customers, including batch RTI submissions, payroll journal export, integration with pension providers and improved importing processes.

BrightPay Connect

Our optional HR & cloud add-on, BrightPay Connect, is 1 year old this week. BrightPay Connect offers a secure online backup to the cloud, with online access for both employers and employees. 100% of BrightPay Connect customers rated both the secure online backup and the online access for employers and employees as excellent, very good or good.

Watch this short video for an overview of how BrightPay Connect can meet your payroll and HR needs.

Customer Testimonials

We also received a number of customer testimonials from the survey - all of which will be added to the BrightPay website in due course. Some of our favourite testimonials received include:

- “I was more than a little stunned to find BrightPay - I phoned on 3 separate occasions just to make sure that they really didn't charge for emailed payslips, or have a fixed charge per payslip for enrolled employees and it was unlimited companies and unlimited employees. The plus side goes on and on, as yet I have to find a minus.”

- “We found BrightPay two years ago but allowed our payroll manager to talk us out of changing because of the disruption. What a waste of a year! There was nothing on the market that came anywhere near BrightPay in cost and ease of use and the more we use it the more we love it.”

- “BrightPay defines what a software company should be. You continue to stand head and shoulders above any other software vendors that we deal with as far as quality of the product, quality of support, and knowledge of the product by those who do the supporting.”

- “I was daunted by the prospect of running a payroll for the first time, but BrightPay has made it simple and fun! I cannot wait until the end of the month to press on the bp icon on my desktop now!”

Prize Winners

As a thank you for taking part in the survey, we are giving away four £50 Amazon vouchers. We are delighted to announce that the winners are:

- Alex Smith - TaxAssist Plymouth

- Laurie Carpenter - B&N Regal (Abingdon) Ltd

- Simon Close - SICA Support

- Richard Penney - Dr Penney's Surgery

The BrightPay team will be in contact with the winners shortly.

We appreciate all the feedback received from this year’s survey and would like to say a massive thank you to everyone who took part.

Aug 2017

14

Voluntary Overtime must now be included in Holiday Pay Calculations

The Employment Appeal Tribunal (EAT) has dismissed an appeal by Dudley Metropolitan Borough Council, ruling that voluntary overtime should be taken into account when calculating holiday pay. This landmark legal victory now means that employers must now incorporate regular voluntary overtime when calculating holiday pay. Unite Union are now advising employers to urgently address this issue and ensure they are compliant.

This ruling will affect a large number of employees throughout the UK who get paid for regular voluntary overtime but do not receive any annual leave entitlement payment for working it. This legal victory sets a legal binding precedent that employment tribunals throughout the UK are obliged to adhere to.

This landmark case involved an appeal that was brought by Dudley Metropolitan Borough Council and this is the first case that the Employment Appeal Tribunal decided to confirm that payments to employees for voluntary duties only should be included in the calculation of employees’ annual leave entitlement pay. In the EAT findings, under the European Union’s Working Time Directive, there is no distinction between contractually required work and tasks that are performed voluntarily under other special or separate arrangements, because levels of normal remuneration have to be maintained when calculating holiday pay in relation to the guaranteed four weeks of annual leave provided under EU law.

The EAT also upheld that where voluntary shifts, standby and call-out payments form part of normal pay, they should be included in holiday pay calculations so that no employee would be deterred from taking annual leave at no financial disadvantage.

The findings in the case of Dudley Metropolitan Borough Council v Mr G. Willetts and others builds on previous findings in the case Unite legal services took in 2014. This appeal resulted in a ruling covering holiday pay for employees that were contractually obliged to perform overtime.

56 employees of Dudley Metropolitan Borough Council, who were Unite members, took the case against Dudley Metropolitan Borough Council. These employees are employed by the Council as tradesmen who worked on maintaining the council’s stock of houses. They worked regular overtime on a voluntary basis only, which included working overtime on Saturdays. In order to deal with emergency call-outs and repairs, the employees decided to organise and a standby rota every four weeks.

For some employees, this additional voluntary overtime equated to approximately £6,000 per annum along with their basic salary. The Council paid the employees the amount due for the voluntary overtime worked, but the voluntary overtime was not included in their holiday pay calculations. The omission of this additional holiday pay was costing the employees between £350 and £1,500 per year, depending on the amount of voluntary overtime undertaken.

Howard Beckett, Unite’s Assistant General Secretary for legal services said:

“The ruling means unscrupulous employers no longer have carte blanche to fix artificially low levels of ‘basic’ hours and then contend the rest of time as ‘voluntary’ overtime that did not have to be paid in respect of annual leave.

Unite will be liaising with Dudley Metropolitan Borough Council and its legal team over reaching a satisfactory settlement for our members. In the meantime we would urge other employers who have been fleecing workers of their holiday pay to get their house in order or face legal action…”.