Dec 2016

8

Auto Enrolment & the Small Employer Market

Auto enrolment is being rolled out in stages across all employers, and started with the larger employers in October 2012. By October 2018 all employers will be required to offer workplace pension schemes to eligible workers.

New employers (or new PAYE scheme users) will begin to reach their staging date depending on when PAYE income was first payable. These employers will have a staging date of between 1 May 2017 and 1 February 2018.

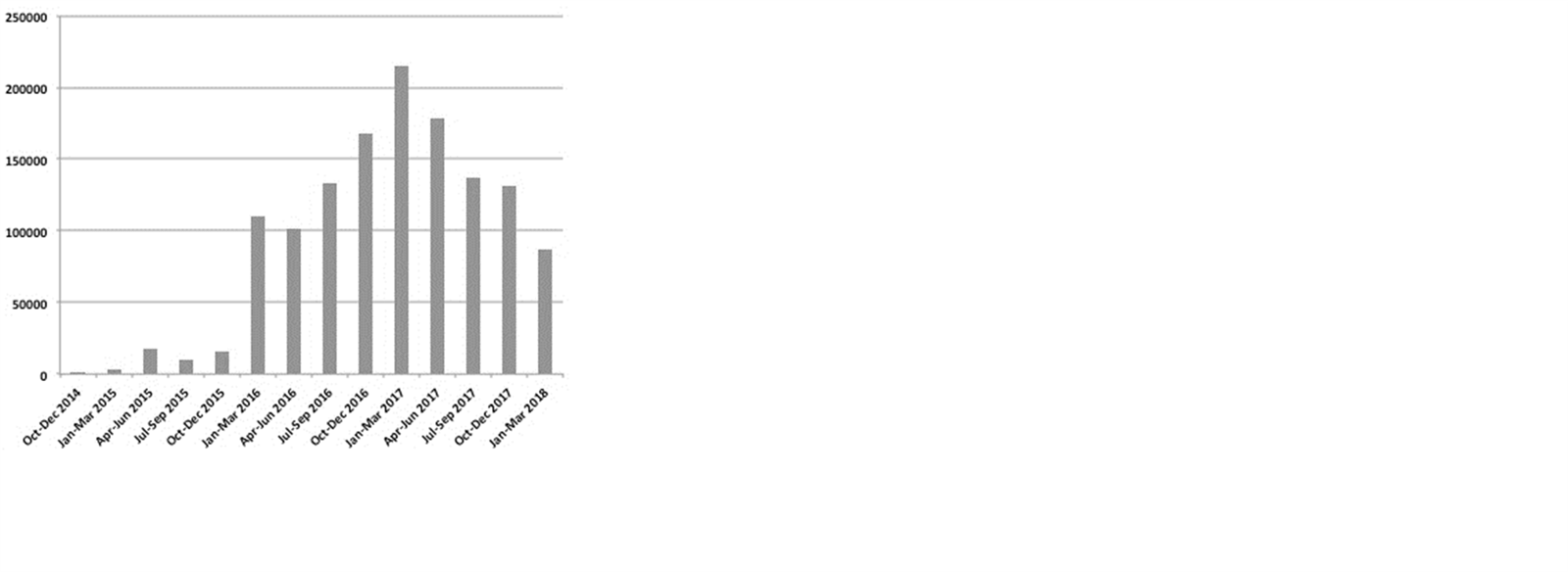

By the end of October this year, almost 300 thousand employers had completed their declaration of compliance, enrolling over 6.8 million eligible jobholders into a workplace pensions scheme. The Pensions Regulator estimates that, over the next three years, over 1 million small and micro employers will need to act as a result of auto enrolment.

The so called tsunami is almost upon us and it keeps growing each quarter, with the largest number of employers reaching their staging date early next year. You can see from the image below that auto enrolment will affect 170 thousand employers within the next three months.

A lot of the companies staging before now will probably have had their own HR people or in- house accountant to help them through the enrolment process. The vast majority of those staging from now onwards will have no in-house expertise. These employers may not have the knowledge or experience to make informed decisions when it comes to their AE obligations.

With the vast quantity of information available, employers are fast becoming confused and overwhelmed. These clients will require help understanding the implications for them, their employees and their business.

So, payroll bureaus have a gift-wrapped business opportunity! And this is business you don’t have to go chasing. Read more about offering AE as a service with BrightPay’s free guides.

Nov 2016

30

New Proposed Statutory Payment Rates Announced for 2017-18

For the new tax year 2017-18, the Department for Work and Pensions have published the proposed statutory payment rates for benefits and pensions. The recovery amounts have not been published yet. Here is a link to the full list published - https://www.gov.uk/government/publications/proposed-benefit-and-pension-rates-2017-to-2018.

Please see some rates details below:

| 2016-17 | 2017-18 | |

| SAP, SMP, SPP, SSPP | ||

| Earnings threshold | £112.00 | £113.00 |

| Standard Rate | £139.58 | £140.98 |

| SSP | ||

| Earnings threshold | £112.00 | £113.00 |

| Standard Rate | £88.45 | £89.35 |

Nov 2016

16

Huge increase in The Pension Regulator's fines for Non-Compliance

The Pension Regulator's quarter figures for 1st July to 30th September 2016 have been released and there has been a huge rise in the number of notices and penalties issued to employers for non-compliance with auto-enrolment.

In this quarter The Pension Regulator issued 15,073 compliance notices, an increase of over 344% from the last quarter with 3,392 being issued. 3,728 fixed penalty notices carrying fines of £400 were also issued, an increase of 861 from the last quarter, up by 30%. Between July and September The Pension Regulator also issued 576 escalating penalty notices, up from 38 in the previous quarter. Depending on the size of the employer, these escalating penalty notices can carry a daily fine ranging between £50 and £10,000 per day.

The Pensions Regulator (TPR) says the rise is in line with the sharp increase in employers reaching their deadline to comply with auto-enrolment duties.

Since auto-enrolment was introduced in 2012 the following have been issued:

• 741 escalating penalty notices

• 26,040 compliance notices

• 6,779 fixed penalty notices.

A regulator spokesperson said: “Although the vast majority of employers are successful in meeting their duties, the minority of employers who fail to listen to warnings from us are subject to fines.”

The latest compliance and enforcement bulletin also emphasizes that explanations given by employers for non-compliance such as illness, being short staffed or confusion about their duties or miscommunication between employers and their advisers/agents are not a “reasonable excuse”.

Nov 2016

11

Making Tax Digital – How agents can prepare their business

Our good friends and tax software specialists, BTCSoftware, have been closely following the developments of HMRC’s Making Tax Digital programme. They have put together a handy overview which gives some background to the initiative, in particular Agent Services.

Agent Services encompasses the way accountants and tax advisers will be identified and authorised on HMRC’s systems to access client tax data and use other information facilities.

The guide is co-authored with accountingweb and also gives advice on how agents can prepare their practice and their clients for MTD’s arrival.

You can download a free copy here.

Nov 2016

7

New Living Wage Rates Announced

Annually, the first week in November is Living Wage Week and as part of this week, the new living wage rates details are revealed. The Mayor of London announces the London rate for the Living Wage whereas the UK rate is announced countrywide at the same time.

The new London Living Wage, announced by the Mayor of London, Sadiq Khan, has increased by 3.7%, from £9.40 to £9.75 per hour. This helps reflect the higher cost of living facing families in the city. The UK Living Wage rate has increased by 20p from £8.25 to £8.45, an increase of 2.4%. The Government's current minimum wage for over 25s is £7.20, which is £1.25 less than this rate.

There are nearly 1000 London-based employers that have agreed to pay their staff the Living Wage hourly rate, this is an increase of 300 employers. In total nearly 1,000 employers have signed up since Living Wage Week last year bringing the total number of accredited Living Wage organisations to nearly 3000. New companies that have signed up are RSA Insurance Group, Curzon Cinemas, the British Library.

For information about the Living Wage Foundation and Living Wage week visit the Living Wage Foundation website

- See more at: https://www.cipp.org.uk/news-publications/news/voluntary-living-wage-rates-announced.html#sthash.3zt9o68v.dpuf

Nov 2016

2

After Auto Enrolment Staging - What happens next??

Once you have completed the initial setup of auto enrolment you will need to complete a set of tasks on an ongoing basis. Clients will need to comply with their ongoing duties to avoid being fined by the Pensions Regulator.

Ongoing Assessment: All employees must be monitored on an ongoing basis to see if there are any changes to their worker category. For example, if an employee turns 22 or their qualifying earnings increase then they may become an eligible jobholder. Even if this occurs after staging, your client will still need to carry out new AE assessment duties for this individual employee.

Your payroll software should easily monitor the ages and earnings of any new and existing staff. Good payroll will automatically notify you of any changes to an employee's status therefore there should be no need to run a report every pay period. Any employees that become eligible will need to be enrolled and an AE communication letter issued to them.

Record Keeping: Clients must keep records of their auto enrolment activities for six years. They must also keep any employee opt-out notices for a period of four years. By law, there are two different types of records that an client must keep.

- Pension staff records- including employees names and addresses that have been enrolled, records of when the contributions were paid to the pension scheme, any opt-out notices and much more.

- Pension Scheme records - including the client pension scheme reference and scheme name and address.

These records or reports should be available in your payroll software

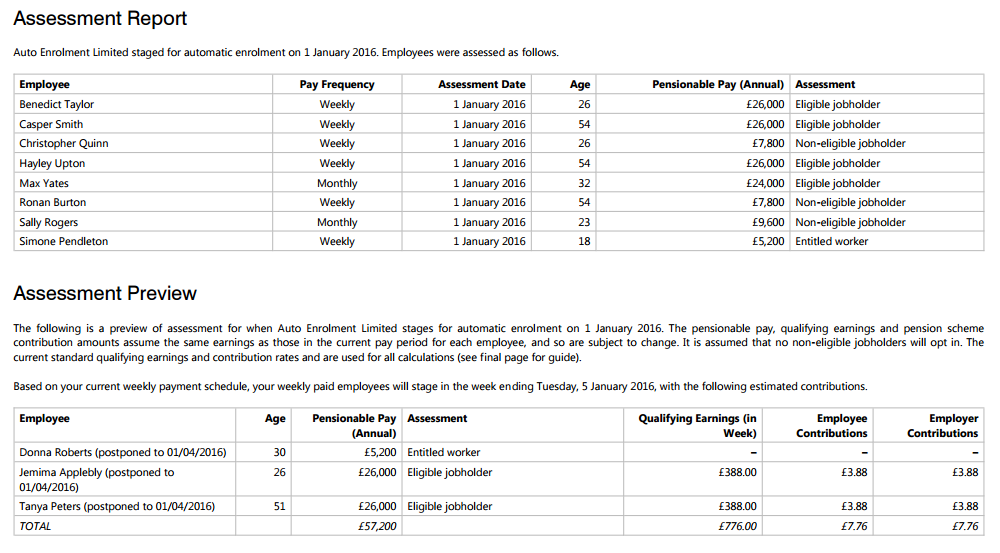

Post Assessment Report: A useful report to run is a post assessment report after your client has staged. The report will give your client a clear picture of what has taken place on the staging date for each employee. Your payroll software should easily produce this report to include each employee, pay frequency, assessment date, employee’s age, pensionable pay and assessment category. It would also be valuable to see employees who have been postponed. PDF Example post assessment report.

Pension Submission: Your payroll software should work and support your auto enrolment pension scheme. Each pension provider requires their data files in a certain format. Check to see if your payroll allows for the easy transfer of data files to the pension scheme. Some providers such as NEST and Smart Pension offer a direct integration or an API facility between payroll and pension provider which will save you time each pay period. Read: How useful will the NEST API tool be?

Paying Contributions: Your client will need to pay the correct level of employee and employer contributions to the AE pension scheme in a timely fashion. The contribution amounts will either be based on a fixed amount or a percentage of earnings. You payroll software should easily calculate both fixed or percentage amounts for you. One you have set up the contribution calculation basis then you payroll should deduct the correct amounts automatically for you.

To conclude..

The responsibility for meeting your automatic enrolment duties ultimately lies with your client. However if you are contracted to carry out AE on behalf of your client then you have an obligation to fulfill the terms of the contract. View a full list of Auto Enrolment Features in BrightPay.

25% BrightPay when you Switch!!

New bureau customers can now save 25% when they switch to BrightPay. To avail of the discount, you can purchase online or contact our sales team on 0845 3004 304 or [email protected] and quote '25% Discount Sale'.

*Offer applies to new bureau customers who switch from a different payroll software provider for the first year subscription only. Applies to BrightPay 16/17 bureau licences only.

Oct 2016

20

Cyclical Automatic Enrolment

Cyclical automatic re-enrolment occurs approximately every three years after an employer’s staging date. Essentially cyclical reenrolment is a repeat of the process the employer carried out on their staging date (or deferral date if they used postponement to postpone all their workers at staging).

However there are some key differences between automatic reenrolment and automatic enrolment:

• While both automatic re-enrolment and automatic enrolment apply to eligible jobholders, automatic re-enrolment will only apply to eligible jobholders who have already had an automatic enrolment date with that employer.

• Postponement cannot be used with automatic re-enrolment. If the eligible jobholder criteria are met by a worker on the automatic re-enrolment date, automatic re-enrolment must take place with effect from that date.

Crucially, the employer does not have to assess all their workers to identify if any meet the eligible jobholder criteria. Instead they must assess only the workers who have opted out or voluntarily ceased active membership of a qualifying scheme. The assessment of worker categories carried out on the cyclical automatic reenrolment date is separate to the employer’s usual assessment process, which they run each pay reference period to identify whether automatic enrolment or any information requirements are triggered.

Key points:

• Another declaration of compliance will need to be completed

• 1 date for all staff - if you are eligible you must be enrolled

• Postponement cannot be used

Source: pension regulator

Oct 2016

20

At 30 September 2016 36% of employees now auto-enrolled

In a recent survey of employees in the UK undertaken by YouGov, on behalf of the workplace pension provider Smart Pension, has resulted in more than one third of employees have now set up a pension through the government's auto-enrolment initiative.

Results of the survey regarding employees about what type of pensions they have are:

• 36% said their pensions were created under auto-enrolment,

• 28% said they had non-auto-enrolled workplace pensions,

• 17% had a standard personal pension (SPP),

• 8% had a self-invested personal pension (SIPP) and

• 7% had a stakeholder pension.

• 6% had no idea what sort of pension they have

• 17% said they have no pension

Will Wynne, co-founder and MD of Smart Pension, said: “Auto-enrolment has already overtaken every other form of pension, including personal pensions, in a very short space of time. The initiative is clearly gaining momentum and looks on track to hit targets over the next two years when 1.8m small and micro firms have staged.”

Opt-outs

19% of UK employees said they would either opt out or have opted out of their workplace scheme, this is higher than the governments targeted figure of 15% opt-out rate. Currently the government's own figures are circa 10%, almost half than the amount resulted per the poll.

The main reason employees are opting out are due to lack of available monies (26%) or they would not want to invest in a pension (17%). 48% of employees did not want to think of preparing and saving for old age although 56% of employees believed they were not preparing adequately for retirement and saving enough. The results of the survey showed that most employees could afford to invest more money in their pension but they had no intention of doing so.

A separate poll found 55% of employers thought auto-enrolment was a burden and 38% said it was unfair, but 72% said they felt it would not hold back growth plans.

Oct 2016

14

NINOs with prefix 'KC' will be accepted by HMRC from 15th November

National Insurance Numbers had been issued with the prefix of KC by Jobcentre Plus (on behalf of the Department for Work and Pensions). These National Insurance numbers are valid. HMRC had issues with these NINOs with the KC prefix as HMRC has not included the KC prefix as a valid prefix on their list of valid prefixes to software developers. So HMRC's systems did not recognise the prefix KC and most payroll software did not recognise it either. But from 15 November 2016, as advised by HMRC, employers will be able to submit RTI data to HMRC for employees using this NINO prefix.

Some software products, including HMRC’s Basic PAYE Tools, may not be updated before April 2017. If this applies to you then you should continue to follow this guidance when submitting your returns:

• Do not enter the NINO for the employee - this field should be left empty

• The employee's address has to be entered, the first two lines are the minimum requirement

• You do not need to request a new NINO as the NINO with the KC prefix is valid.

Oct 2016

6

Are you up to date with family friendly leave?

Family friendly leave has developed significantly in recent years. Keeping abreast of what’s what can be challenging for employers.

BrightPay’s employment law experts have designed a free webinar for employers, which will give attendees an overview of Maternity, Paternity, Shared Parental Leave and Parental Leave how to process them directly through payroll.

The webinar will highlight frequently asked questions in relation to the leave types mentioned above, such as:

- Who is eligible?

- How employees apply?

- Pay and other benefits during family friendly leave.

- Managing family friendly leave efficiently and legally!

The webinar will give attendees a chance to ask any questions you may have, with an interactive Q&A session at the end of the webinar.

Places are limited for this webinar. Don’t miss out – book your place now!

If you cannot attend the webinar, don't worry – the webinar will be recorded and as long as you have registered you will receive a link to the recording afterwards.

Bright Contracts – Employment Contracts and Handbooks.

BrightPay – Payroll & Auto Enrolment Software.