Oct 2013

21

New PAYE messages to employers from HMRC from 21st October

From this week HMRC will start to send four types of new messages to employers to help them keep their PAYE up-to-date.

These messages will take two formats:

1. The first three are generic electronic messages to warn the employer that their PAYE submissions and payments appear to have fallen into arrears.

2. The fourth one will be a letter, telling an employer that HMRC are cancelling a PAYE scheme that has been inactive for 120 days.

The electronic messages are not penalty notices and therefore an employer should not appeal against them. These messages do not replace the existing compliance communications, which will continue as now.

The aim of these messages is to help employers comply with their PAYE obligations and in particular get their businesses to submit and pay their PAYE to HMRC on time. This will help them get ready for 6 April 2014 when in-year penalties for late reporting and late payment will replace the current end-of-year PAYE penalties. HMRC wants to receive payments and returns on time; it does not want to charge penalties.

The messages warn that the employer may incur penalties in future, even if they have done nothing wrong for 2013-14 (for example if they are a smaller employer taking advantage of the current relaxation for ‘on or before’ reporting). If this is the case the employer does not need to contact HMRC but they should be preparing for 2014-15.

HMRC will update the wording of these messages in April 2014.

Oct 2013

14

8 Reasons why HMRC cancel Employer PAYE Schemes

- You have made no submissions using PAYE in Real Time

- You have not made any payments to HMRC

- You are not an annual payer

- There is no evidence that you want to claim CIS Deductions Suffered

- You have not received an advance from HMRC

- You have not had any periods of Construction Industry Liability

- There is no evidence that you have had any employees

- There is no evidence that Class 1A NIC is due

Where any of these conditions apply your employer scheme will be cancelled and a letter issued to your business address to advise you of the action taken. Once the scheme has been cancelled you will not be able to submit any PAYE submissions in Real Time. If your scheme should not have been cancelled the letter covers who you should contact in HMRC to request that your scheme is reopened.

Oct 2013

11

GOOD NEWS PROPOSED FOR COMMUTERS

The Mayor of London, Boris Johnson, has proposed that season tickets for commuters be considered as a salary sacrifice to give tax relief to those who have to travel to work. He has suggested that they be treated the same as the current Child Care Voucher or Cycle to Work Scheme. The employer would buy the season ticket and deduct the cost from the employee’s pay before tax is deducted. Therefore the employee would have the benefit of the ticket but pay tax on a lesser amount.

At the moment this is only a proposal and has been forwarded to the Chancellor for consultation.

Oct 2013

7

UNIVERSAL CREDIT – GOOD NEWS FOR UK EMPLOYERS

Universal Credit is a new single monthly payment for people on low incomes or out of work. It aims to ensure that people are better off working that claiming benefits.

This means that they would not lose all their benefits if they take up employment and are receiving a low income and their Universal Credit would only reduce gradually as their income increases.

WHAT WILL THIS MEAN FOR EMPLOYERS

Employers will benefit from this in a number of ways.

It will be easier to fill jobs either short time or with irregular hours.

It will mean that more flexible working hours can be put in place for existing employees without needing to recruit new employees and the expense that would incur.

Employers will be able to access people registered on Universal Jobmatch and thereby fill vacancies more quickly.

Universal Credit Payments are linked to the amount an employed Universal Credit claimant has earned. Since RTI (Real Time Information) was introduced HMRC already has the required information on each employee.

Universal Credit is being rolled out gradually and a national roll out will occur from October 2013.

Between April 2013 and 2017 Universal Credit will replace Income based Jobseekers Allowance, Income-related Employment and Support Allowance, Income Support, Working Tax Credit, Child Tax Credit and Housing Benefit. By 2017 it will be paid to everyone who has the right to receive it.

Oct 2013

4

Married couples in UK to receive £200 tax break

The Prime Minister has proposed married couples should get breaks worth up to £200 a year.

However the allowance will not be available to couples that include higher rate taxpayers – in which one spouse is paid £42,285 from 2015/16 – this could be a double blow for higher earners, particularly in the wake of the child benefit cuts on families with one earner on more than 60,000 a year.

The proposal, will also let people transfer £1,000 of their personal tax allowance to their spouse or civil partner.

The measure will come into force in April 2015 if passed by parliament, just one month before the next national election and is expected to benefit around 4 million couples including same-sex couples in civil partnerships. From next year, same-sex couples will be able to marry under a new law passed by parliament in July.

Sep 2013

23

What's New in BrightPay 13.5?

BrightPay 13.5 is a free upgrade to our 2013/14 payroll software. It adds many new features to BrightPay, including some popular customer requests.

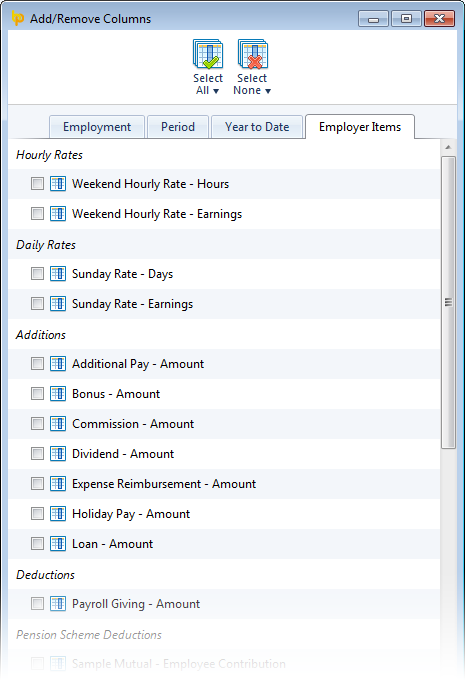

Ability to Report on Specific Employer Items in Analysis

Until now, BrightPay's analysis feature was limited to reporting on the common payroll data that could apply to any employee's payslip in any period (e.g. gross pay, tax, NICs, etc.).

Until now, BrightPay's analysis feature was limited to reporting on the common payroll data that could apply to any employee's payslip in any period (e.g. gross pay, tax, NICs, etc.).

A popular request from customers was the ability to report on the employer specific data that is editable under the main Employer tab of BrightPay, including:

- Specific addition and deduction types

- Specific hourly and daily rates

- Specific pension scheme deductions

- Specific savings scheme transactions

This feature is now available in BrightPay 13.5. As you add/edit the above items and use them in payslips, their amounts become available for reporting in Analysis.

Also, to make it easier to build your reports, the Add/Remove Columns feature in BrightPay has now been organised into tabs.

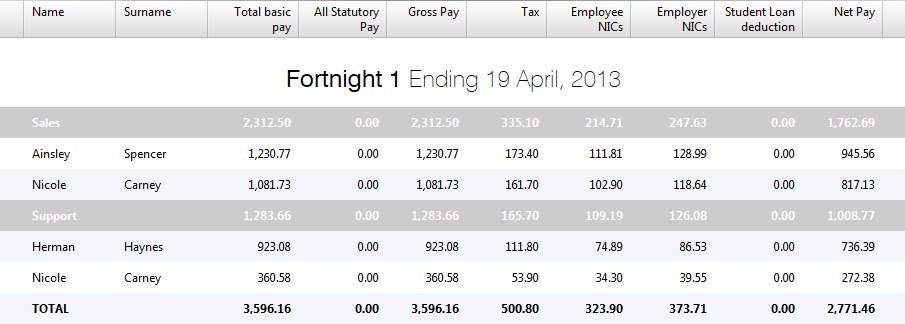

Improved Departmental Reporting

When reporting by department, BrightPay now groups the departmental records in a more logical, useful way. An employee in multiple departments can now have his/her payroll values split out into each department within the results for a single period.

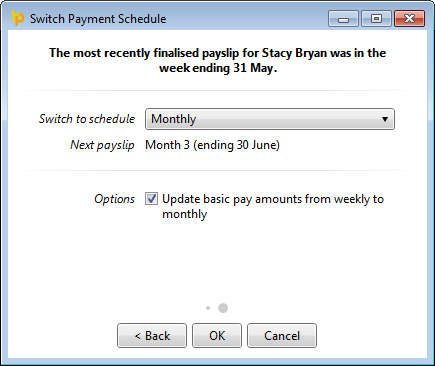

Ability to Switch Employees to a New Payment Schedule Mid Tax Year

Do you have employees who are switching from being paid weekly to being paid monthly? Or the other way around? Perhaps some need to switch to or from a fortnightly or 4-weekly pay schedule?

This feature is now available in BrightPay 13.5. In any period, you can now switch one, multiple or all employees to a new payment schedule. This can be done as many times as is required throughout the tax year.

Here's how it works (for example, when switching from weekly-paid to monthly-paid):

Here's how it works (for example, when switching from weekly-paid to monthly-paid):

- Finalise an employee's payslips up until the final week that she should receive a weekly payment.

- Her next payslip will be set up in the following week. You want her next payslip to be in the following month instead, so choose this week in BrightPay and go to More > Switch Employee(s) Payment Schedule...

- More than one employee can be switched if need be. Select the relevant employees and click Continue.

- Select 'Monthly' as the new payment schedule.

- BrightPay will automatically determine the next available month to switch to, or, if no monthly schedule has been set up, allow you to do so.

- To prevent doubling up on payroll amounts, employees can only be switched to a later month that does not overlap with any already finalised weeks.

- If there are one or more weeks which could be finalised before switching to a monthly schedule, BrightPay will warn you.

- You can optionally choose to have the employee's basic pay automatically adjusted from weekly to monthly.

- Click OK. BrightPay will remove the weekly payslip that is no longer relevant, and create the employee's first monthly payslip.

Other New Features and Fixes

- Ability to ignore 'zero pay' payslips in analysis.

- Fixes a bug in which an EPS (or NVR) cannot be created for mid-year-start employers.

- Fixes a bug in which BrightPay will not accept an employee start date for mid-year-start employers.

- Other minor fixes and performance improvements.

Upgrading

When you next launch BrightPay, the upgrade should be automatically detected – simply follow the instructions on-screen. If you have any problems upgrading, please contact us.

Sep 2013

18

Childcare Vouchers - a win-win situation for all involved!

Childcare vouchers play a vital role for employers as they endeavor to hold onto their skilled and experienced workforce and also cut costs. By introducing childcare voucher schemes employers can reap financial benefits.

Employers who provide childcare vouchers for employees can save up to 12.8% on National Insurance Contributions (on the value of the vouchers up to £55 per week). The more employees with nursery/crèche costs are encouraged to claim childcare vouchers; the greater the saving for your business.

Childcare vouchers allow working parents to save on registered childcare costs through their employer. By taking part of their salary in vouchers, rather than paying the child-minder or registered crèche directly from their net pay, a working parents' tax burden is reduced and their employers also save money - so it is a “win-win” situation for all involved.

Childcare vouchers are a flexible, legal method for working parents to pay for all forms of registered childcare including day nurseries, registered child-minders, crèches and playgroups, after-school and breakfast clubs, holiday schemes and workplace nurseries.

So How Do Childcare Vouchers Work?

The first £55 per week (£243 per month) of childcare vouchers that an employee receives through their payroll is exempt from income tax and national insurance contributions. This means that a parent paying basic rate tax could save up to £77 per month on registered childcare.

Couples who work for companies each offering the childcare voucher scheme are both entitled to claim up to £243 each per month of their salary as childcare vouchers. These joint tax exemptions could mean a family saving of as much as £154 per month on registered childcare costs.

Childcare voucher schemes are very easy to set up and put into practice. Due to the tax incentives involved childcare vouchers are a business investment, not an expense.

To find out more about childcare vouchers visit http://www.employersforchildcare.org

To find out how to set up Childcare Vouchers in BrightPay see http://www.brightpay.co.uk/docs/13-14/processing-payroll/childcare-vouchers/

Sep 2013

11

Missed RTI Deadline? – Expect a Letter from HMRC

167,000 employers have missed one or more deadlines for the new RTI reporting system for PAYE income tax. These employers will now receive a letter from HMRC.

HMRC previously sent a chasing letter to companies that missed a deadline in June, and instructions on how to use RTI were sent in October 2012 and again in February 2013.

Although a few companies may not report because their PAYE scheme is unused or no longer operating, but in these cases employers are still required to let HMRC know by contacting the Employer Helpline.

Certain employers are also required to operate a PAYE scheme for employee expenses and benefits, in this case they should either submit a nil EPS every month, or contact HMRC to change their scheme to annual reporting. The Tax Office will not contact employers who have already registered their PAYE scheme as an annual scheme.

Over 85 percent of employers - 1.6 million employers and 40 million individuals - are now using RTI, with HMRC recently contacting employers via an on-line survey to estimate how companies are coping.

A temporary relaxation for small businesses was recently extended to April 2014 due to manageability concerns as The Institute of Chartered Accountants in England and Wales warned it would be "impossible" for many businesses to comply.

Aug 2013

31

UK - Holiday pay should reflect overtime payments

A recent judgment has bent the rules under the Working Time Regulations and moved the UK closer to EU law

Calculating the correct amount of holiday pay owed to an employee under the Working Time Regulations 1998 has historically proven to be a tricky task for employers. The regulations require employers to identify an employee’s ‘normal working hours’ and a ‘week’s pay’ when calculating holiday pay and specifically say that non-contractual hours of work should be ignored. In practice, this isn’t as easy as it sounds.

A 2011 case, Williams v British Airways, shed some light on the situation. The European court held the regulations should be interpreted in the spirit of European working time law and that holiday pay should be calculated with reference to both basic pay and any other pay “intrinsically linked” to the work, such as overtime. Now those principles have been tested for the first time in the case Neal v Freightliner [2013]

Neal worked a 35-hour week at Freightliner’s depot in Birmingham. His contract required him to work 7-hour shifts, and also stated that he may have to work overtime when necessary. His shifts and working hours were determined by a roster system. He regularly worked up to nine hours each day and occasionally up to 12 hours to cover for his colleagues. He received enhanced pay premiums when working over and above his contractual seven hours a day. Neal believed he had to work the significant hours set out in the rosters and felt his holiday pay should reflect the actual pay he received rather than his basic salary alone.

The employment tribunal, applying the Williams case, highlighted that the Working Time Regulations do not adequately implement European law on working time. The tribunal held that hours worked by Neal over and above his contractual seven hours were “intrinsically linked” to his performance of his role, and it was irrelevant whether the overtime was voluntary or not.

It rejected the employer’s argument that workers might be encouraged to undertake paid overtime to manipulate the level of their holiday pay, concluding that, in practice, employers control the levels of overtime offered and accepted by their staff.

Neal had been underpaid in respect of his holiday pay entitlement and the parties arranged an out of court settlement.

This decision could be tested by the higher courts but, for the time being, any paid overtime (whether voluntary or not) should now be considered alongside other premiums in employers’ holiday pay calculations. In effect, these calculations are moving towards being based on workers’ average earnings in the 12 weeks leading up to their holiday.

Employers should review their overtime arrangements to ensure they have sufficient control over them, and can avoid abuse and manipulation of holiday pay. As an added complication, this decision relates to the four weeks’ holiday pay that workers are entitled to under European law. It does not apply to the additional 1.6 weeks’ holiday that workers receive under UK law. So it seems likely that the judgment will be appealed to clear up the confusion and avoid a situation where there are different rules for different weeks of a worker’s holiday. As always, if in doubt, employers should seek legal advice when calculating holiday pay to avoid receiving a costly and time-intensive tribunal claim.

Aug 2013

30

To Avoid Child Benefit Tax Trap – Parents Must Act Now - HMRC

Although approximately 400,000 people with higher incomes have opted out of receiving Child Benefit, parents on higher incomes who still receive Child Benefit must register with HMRC for self assessment by 5th October to avoid a steep penalty.

HMRC is currently writing to 2 million high rate taxpayers reminding them that if their income is above £50,000 and they or their partner have received Child Benefit in the tax year 2012/13, they are required to complete a self assessment tax return and pay the High Income Child Benefit tax charge.

If they fail to do so and this was intentional, HMRC says it may levy a penalty of between 10pc and 100pc of the amount due.

Introduced on 7th January this tax commences when one person earns an annual income of £50,000. Households with one person earning £60,000 or more lose the payment completely. Child Benefit is worth £20.30 a week for the first child and £13.40 a week for every sibling.

HMRC estimates around 600,000 people will be affected by the charge, which has been widely criticised as unjust because households where both partners earn £49,000 are able to keep the full payment.

If you opted out from receiving Child Benefit then no further action is required.

A spokesperson for HMRC stated, "HMRC is committed to helping people pay the right amount of tax. If you have had certain changes to your income in the last year, including those affected by the changes to Child Benefit, you have until October 5 to register for self assessment."