Jan 2022

12

New Statutory Payment Rates for 2022-23

National Insurance rates and thresholds and Statutory Payment rates have been confirmed by HMRC for the 2022-23 tax year. The weekly earnings thresholds Lower Earnings Limit (LEL) will rise to £123. The first six weeks of Statutory Maternity Pay (SMP) and Statutory Adoption ay (SAP) will remain as 90% of the employee’s average weekly earnings. For week seven and the remaining weeks, the statutory weekly rate will be whichever is lower: 90% of the employee’s average weekly earnings or £156.66.

For Statutory Paternity Pay (SPP), Statutory Shared Parental Pay (ShPP) and Statutory Parental Bereavement Pay (SPBP) the payment will be whichever is lower: 90% of the employee’s average weekly earnings or £156.66.

Please see some rate details below:

| Statutory Adoption Pay | 2021-22 | 2022-23 |

| Earnings threshold | £120.00 | £123.00 |

| Standard rate | £151.97 | £156.66 |

| Statutory Maternity Pay | 2021-21 | 2022-23 |

| Earnings Threshold | £120.00 | £123.00 |

| Standard rate | £151.97 | £156.66 |

| Statutory Paternity Pay | 2021-21 | 2022-23 |

| Earnings Threshold | £120.00 | £123.00 |

| Standard rate | £151.91 | £156.66 |

| Statutory Shared Parental Pay | 2021-21 | 2022-23 |

| Earnings Threshold | £120.00 | £123.00 |

| Standard rate | £151.91 | £156.66 |

| Statutory Sick Pay |

2021-21 | 2022-23 |

| Earnings Threshold | £120.00 | £123.00 |

| Standard rate | £96.35 | £99.35 |

Related articles:

Jan 2022

6

Customer Update: January 2022

Welcome to BrightPay's January update. Our most important news this month include:

-

5 payroll resolutions for the new year

-

New Advisory Fuel Rates from 1st December 2021

-

Five key payroll trends to watch out for in 2022

5 ways to boost the efficiency of your payroll process

Boost the efficiency of your payroll process by using cloud technology. BrightPay Connect enables your HR and payroll processes to be more streamlined than ever before. Join our webinar to find out how your business can benefit.

How to make a profit while streamlining your payroll services

Kick-off the new year by aligning your payroll software around key goals that will help propel your company into the future! By introducing cloud technology to your payroll such as BrightPay Connect, your payroll and HR processes can be more streamlined than ever before.

2022 is the year of the payroll app

An employee app has many benefits, including improving employee engagement and reducing admin work for employers. BrightPay Connect gives employees access to their payslip library 24/7, the ability to request annual leave, and update personal details. Book a free 15-minute online demo to see for yourself.

Extending the hybrid-working plan

Due to current COVID-19 restrictions, it is advised that people work from home (if they can). Download our free e-book to find out how payroll technology can help your business adapt to remote working again and how to best manage employees.

Take the repetitiveness out of payroll

Without integrated systems, you will find yourself entering payroll data repeatedly because the information needs to be inputted into multiple systems. BrightPay’s range of APIs include direct integration with pension providers, eleven accounting software packages, and our newest integration with payments platform Modulr, to pay employees through BrightPay.

Jan 2022

5

Take the repetitiveness out of payroll

Each pay period, many busy payroll bureau managers find themselves having to input the same payroll data into both their accounting and payroll software. And while the repetitiveness of these tasks might not be in the same bracket as Greek mythological figure Sisyphus, the process can still be quite monotonous. If you haven’t heard of him, Sisyphus was a badly-behaved king who endured a unique punishment. Judged harshly by the gods, he was doomed to push a large rock up a steep hill, only to find it rolling back on nearing the top. Cruelly he was damned to repeat this task for all eternity.

Without integrated systems, you will find yourself entering payroll data repeatedly because the information needs to be in both the payroll and accountancy software. Having to repeat data entry tasks is a negative drain on time, and it also means the payroll will be more prone to human error. Luckily, the evolution of payroll software is not a myth, and technology now exists to reduce this type of endless payroll data entry.

Accounting software integrations rescuing your time

BrightPay Payroll Software’s Application Programming Interface (API) integration feature allows it to easily communicate with and directly send the payroll journal to eleven different accounting packages, including QuickBooks, Sage, Xero and FreeAgent. Because BrightPay’s payroll journals can match all the file formats used by the accounting packages, the need for double entry of information is eliminated. This means there is less chance of errors that can crop up during duplication, which also omits the need to log errors on the payroll diary.

What can you do to improve your #payroll services and how you deliver them?

— BrightPay UK (@BrightPayUK) December 14, 2021

1??Where can you save time?

2??How can you improve client communications?

3??How can you become more profitable?

Register for this upcoming webinar to find out more: https://t.co/DyS5MXDiGt pic.twitter.com/vEKoRPVskP

More BrightPay APIs equals better workflows

BrightPay also has APIs that cater for a quicker pension contribution process. Through BrightPay, you have the ability to send pension-related files in one simple click to the relevant pension systems, removing repetitive data entry and saving you valuable time. BrightPay has direct API integration with pension providers NEST, The People’s Pension, Smart Pension and Aviva.

One of our newest integrations is with payment platform, Modulr, allowing you to pay employees directly through the payroll software. This means you no longer need to create bank files as all the pay information is sent straight to Modulr. All you need to do is set up a Modulr accounts, go in and approve the payments, and employees can be paid in minutes.

Eternal workflow efficiency instead of endless graft

Payroll integration technology now exists that simplifies the potentially burdensome task of sharing payroll journals, pension files and bank files. Because BrightPay’s APIs ensure easy communication with those software solutions, payroll staff need no longer be subject to eternal repetition of routine tasks.

Book an online demo today to find out more about how BrightPay’s integrations can help you.

Dec 2021

28

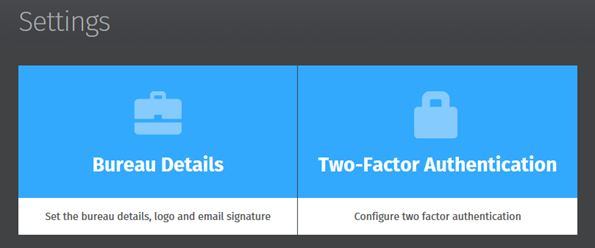

Additional data protection with two-factor authentication

As the digital world becomes more and more advanced, cyber threats are on the rise. According to a recent report from Microsoft, enabling two-factor authentication (2FA) blocks 99.9% of automated attacks on your accounts. This is because there is an additional security layer that the hacker must crack. Most major websites and banks offer an option to enable two-factor authentication and it is recommended that you turn it on wherever possible as prevention is better than the cure!

Payroll software should be no exception when it comes to adding an extra layer of security. That’s why BrightPay’s add-on product BrightPay Connect has the option for users to enable 2FA when logging in. The account administrator can enable this feature in the Settings tab on their main dashboard in BrightPay Connect.

Tick the box for ‘Enable two-factor authentication’ and Save Changes. When any user on the Connect account tries to sign into Connect via an internet browser or through BrightPay they will have to enter the security code sent by email or text as a second security feature.

BrightPay Connect’s two factor authentication feature adds an additional layer of security to an already secure hosted platform as data stored on Connect is backed up to Microsoft Azure servers. By enabling this feature, users will have more reassurance that their payroll data or client’s payroll data is safer and even more secure.

BrightPay is a leading UK payroll software that makes managing payroll quick and easy for accountants, payroll bureaus and employers. BrightPay’s optional online add-on product BrightPay Connect enables cloud payroll software features including an automatic cloud backup, an annual leave management tool, an employer dashboard, an employee self-service portal and much, much more. Book a free online demo of BrightPay and BrightPay Connect to learn about how you can run your payroll more efficiently and most importantly, safer.

Related articles:

Dec 2021

22

Documents you must share with employees (and how you should share them)

What documents do I need to share with a new employee?

When hiring a new employee or worker there is certain information which you, the employer, must share with them. On the employee’s first day, they must be provided with a document known as a ‘principal statement’. The principal statement must include:

- The employer’s name

- The employee/worker’s name, their job title and/or description of work and their start date

- The employee/worker’s pay and how often they will be paid

- The employee/worker’s hours of work

- The employee/worker’s holiday entitlement

- Location/locations that the employee/worker will be working from (further details will need to be included if the employee is expected to work abroad)

- The length of the employment

- The length of the probation period and its conditions

- Information on any benefits

- Employee training information

Other information which the employee must be given on their first day which can be included on the ‘principal statement’ or can be provided separately includes:

- Sick pay and procedures

- Information on paid leave (eg. parental leave, bereavement leave.)

- Notice periods

Within two months of the employee starting, they must be given a ‘wider written statement’ which must include information on:

- Pensions and pension schemes

- Collective agreements

- Information on any other right to non-compulsory training provided by the employer

- Disciplinary and grievance procedures

Providing employees with payslips

For each pay period, employees must receive an itemised payslip which clearly shows:

- Total pay before deductions

- Total pay after deductions

- Amounts of any variable or fixed deductions

- A breakdown of how the wages will be paid if more than one payment method is used

What other documents should you share with employees?

While it is a legal requirement to share the documents which are listed above with employees, it is also important to clearly communicate company policies and procedures with employees. Examples could be an employee handbook, an IT policy, a working from home policy or a code of conduct document. Documents such as these helps establish what behaviour is expected of employees by the employer and to explain any consequences of breaching the guidelines. Not keeping employees up to date on what the company expects from them in terms of ethics and morals could result in legal or financial consequences for your business.

A regular staff newsletter is another example of a document that may be shared with employees. While not imperative, newsletters can be used as a way of keeping employees informed of staff events while also reinforcing your company culture.

How do I share documents with employees?

All documents should be easily accessed by employees. While you can share physical documents with employees, to save time and money, it is better to share these documents digitally. Sharing documents by email is another option but this can also become time-consuming. One of the best ways of sharing documents with employees is through an online employee portal where you can share tailored documents with individual employees or share company documents with multiple employees at once.

BrightPay Connect is an optional cloud add-on to BrightPay’s payroll software that allows employers to upload documents through their own online portal. Employees can then access these documents anytime, anywhere from the BrightPay Connect employee app on their smartphones or from an internet browser. Sharing documents with employees this way means they are instantly available for employees to view, whether in the office or working from home. Employees will receive a push notification on their mobile every time a new document has been uploaded or when the employer has updated a document. From the employer dashboard, you can also keep track of which employees have viewed which documents.

How can I generate employee documents?

BrightPay’s sister product Bright Contracts, syncs with BrightPay’s payroll software and allows you to easily create tailored employee contracts and staff handbooks which fully conform to the latest employment law guidelines. When there are any changes in employment law, Bright Contracts will automatically send you an update, making it easy for you to comply with employment law, even with no HR experience. These documents can then be uploaded via BrightPay Connect’s employer dashboard and shared instantly with employees.

To learn more about sharing documents with employees using BrightPay Connect, book a free online demo today.

Related articles:

Dec 2021

20

Christmas Opening Hours 2021

All of the staff here at BrightPay would like to thank you for your valued custom in 2021. We would like to take this opportunity to wish you and your families a Merry Christmas and a prosperous New Year.

Here are our opening hours for the Christmas period:

| Monday 20th | 09:00 - 13:00 | 14:00 - 17:00 |

| Tuesday 21st | 09:30 - 13:00 | 14:00 - 17:00 |

| Wednesday 22nd | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 23rd | 09:00 - 13:00 | 14:00 - 17:00 |

| Friday 24th | Closed |

| Saturday 25th | Closed |

| Sunday 26th | Closed |

| Monday 27th | Closed |

| Tuesday 28th | Closed |

| Wednesday 29th | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 30th | 09:00 - 13:00 | 14:00 - 17:00 |

| Friday 31st | 09:00 - 13:00 | 14:00 - 17:00 |

| Saturday 1st January | Closed |

| Sunday 2nd January | Closed |

| Monday 3rd January | Closed |

To contact our support team you can call us on 0345 939 0019, email us at [email protected] or complete our online form.

Dec 2021

14

New Advisory Fuel Rates from 1st December 2021

The Advisory Fuel Rates that will come into effect from 1st December 2021 have been announced by HMRC. Employers may use the old rates for up to one month from the date the new rates apply. Employers are under no obligation to make supplementary payments to reflect the new rates but can do so if they wish. Hybrid cars are treated as either petrol or diesel cars for this purpose for the fuel rates. For fully electric cars the Advisory Electricity Rate are 5 pence per mile. Click here to view details per HMRC.

The new rates are as below:

| Engine size | Petrol - amount per mile | LPG - amount per mile |

| 1400cc or less | 13 pence | 9 pence |

| 1401cc to 2000cc | 15 pence | 10 pence |

| Over 2000cc | 22 pence | 15 pence |

| Engine size | Diesel - amount per mile |

| 1600cc or less | 11 pence |

| 1601cc to 2000cc | 13 pence |

| Over 2000cc | 16 pence |

Related articles:

Dec 2021

10

Real Living Wage Rates Increase

The Living Wage Week took place from 15th to 21st November 2021 and the New Living Wage rates details were announced. The real Living Wage is the only UK wage rate that is paid voluntarily by nearly 9,000 employers and is an hourly pay rate set independently and is updated every year. It is calculated based on the basic cost of living in the UK. Employees aged 18 years of age and older can be paid this new rate from 15th November by employers who pay the Living Wage and all employees should have this rate applied by 15th May 2022.

The new London Real Living Wage announced by the Living Wage Foundation, has increased by 20p from £10.85 to £11.05 per hour. This helps reflect the higher cost of living facing employees in London. The UK Living Wage rate has increased to £9.90 from £9.50, an increase of 40p or 4.2%. The Government's current national minimum wage for over 23s is £8.91, though it will increase to £9.50 from 1st April 2022, which is £99p less than this rate currently.

Nearly 300,000 employees will be affected by the new real living wage increase. A full-time weekly employee being paid the new Living Wage rate of £9.90 will earn £1,930 more annually than an employee on the current national minimum wage for over 23s. An employee working the same hours per week in London being paid the new Living Wage rate of £11.05 will earn £4,173 more per year compared to an employee on the National Minimum Wage for over 23s.

More than 3,000 employers have been accredited by the Living Wage Foundation since the start of the Coronavirus pandemic. New companies that have signed up are Fujitsu, Aviva, Everton FC and Burberry. For information about the Living Wage Foundation and Living Wage Week visit the Living Wage Foundation website here.

Related articles:

Nov 2021

29

5 payroll resolutions for January 2022

New year’s resolutions can divide people into two camps. Those who love to start the new year with a clean slate and fresh goals, and those who’ve lost all optimism and scoff at their naivety. Understandably, there are cynics. Changing your behaviour is hard and more often than not, these resolutions fail. The resolutions most likely to fail are those that are too vague with no clear path on how to achieve them.

If you’re setting resolutions for your business or job this year, then break them up into manageable and uncomplicated steps. You’ve likely heard of SMART goals – specific, measurable, achievable, realistic, and time limited. If you’re looking to improve your business, for example, the payroll service you offer, then using this established tool is how you can go about it. Rather than simply saying “I want to make my payroll services better for clients” or “I want to reduce the time I spend on payroll”, decide on specific goals which will help you achieve this.

Achieving payroll goals for 2022

1. Provide an employee app for your clients

This one is a specific, easily achievable goal that can help you provide a better payroll service to your clients. Employee apps have risen in use in recent years and are popular among employers and employees alike. BrightPay Connect, the cloud add-on to BrightPay Payroll Software, includes one and your clients will immediately gain extra value from it. Their employees can book their annual leave through the employee app, view confidential documents, and use it to view their payslips. From a marketing perspective, an employee app can also have multiple benefits. The extra value if offers can encourage customer loyalty, and its frequent use by clients and their employees can increase awareness of your business.

2. Offer clients instant access to reports

Similar to the goal above, this is a simple and achievable step that you can take to improve your payroll services. By using BrightPay Connect, you can offer your clients access to payroll reports whenever they like. This can be more convenient for your clients and can reduce the amount of back-and-forth communication between you and the client.

Once you finalise payroll on BrightPay Payroll Software, the report will automatically become available for the client to view via their BrightPay Connect self-service portal. Your clients will also be able to use the portal to access a number of preprogramed reports, as well as any other payroll reports which have been set up and saved on the payroll application.

3. Spend less time on manual entry

By setting this goal you can reduce the overall time you spend on delivering your payroll services. How can you go about this? First, decide where you want to reduce manual entry. For example, your payroll journal is a good place to start. By using a payroll software which is integrated with the accounting software you use, you can send your payroll journal directly to it. This means you no longer need to spend time on double entry and manually copying figures from your payroll software into your general ledger.

4. Process payroll for multiple clients at once

This goal goes back to your aim of spending less time on payroll. Not all payroll software has batch processing, but one that does is BrightPay. This feature allows you to complete a number of tasks for multiple clients at once. You can batch finalise open pay periods, batch send outstanding RTI and CIS submissions to HRMC, and batch check for coding notices. This can end up saving you a huge amount of time, especially if you have a lot of single director clients whose payroll doesn’t change from month to month.

5. Review your GDPR compliance

It’s always advisable to review your compliance with GDPR and ensure you’re keeping your client’s payroll data secure. By keeping on top of this, you can assure clients that security is a priority for your practice. Make sure the data you collect is the minimum amount required and remember to provide your clients and their employees access to their personal information. Again, an employee app can help with this. Using BrightPay Connect, employees can view and update their personal information, whenever they like.

Discover more:

Now that you’ve decided on what steps you can take to improve your payroll services, make sure you have the right payroll software and employee app to support you. Book a demo today to discover more about BrightPay and BrightPay Connect. BrightPay also offers a 60-day free trial of its payroll software, an ideal way to test out the software to see if it’s the right fit for your business. The free trial version has full functionality with no limitations on any of the features.

Related Articles:

Nov 2021

26

The must-have integration for Xero customers

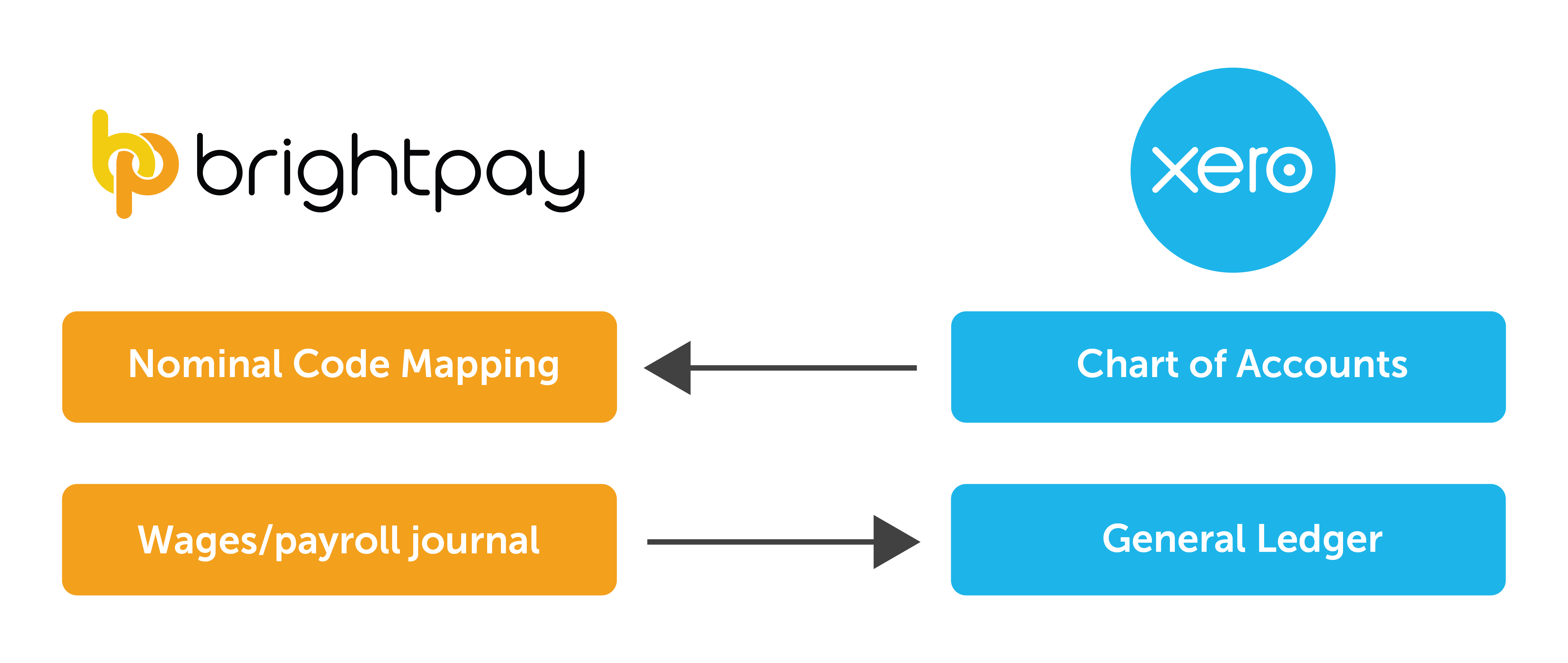

Customers of Xero accounting software now have the option of integrating their accounting package with their payroll software. With BrightPay payroll software, Xero customers can make use of an API (Application Programme Interface) to send their payroll journal directly from BrightPay to their general ledger in Xero. This straight-forward integration saves time, increases efficiency and make the payroll workflow that much smoother. A free trial of BrightPay is available to Xero customers through Xero’s marketplace.

The importance of integrating your accounting software:

As your business grows, so too do the number of financial tools you need to successfully manage your employees, operations, and customers. The amount of software you need, can at times, be overwhelming, confusing, and inadvertently result in time being wasted.

API integrations have become increasingly popular because, aside from their obvious benefit of saving you time, they also mitigate the risk of mistakes, reduce administrative tasks, and free you up, allowing you to focus on other responsibilities.

Save time:

With your payroll system communicating directly with your accounting software, you no longer need to spend time on the tedious task of manually exporting, importing, and entering figures multiple times. Instead, you can send payroll information to the correct account with just a click of a button.

Reduce data entry and errors:

Double entry of figures is well known for producing errors. By using the API, you will be able to send payroll information quickly and reliably, without the chance of human error. Nor will you have to spend time searching for errors and correcting them.

Improve efficiency:

With the API integration, you can benefit from a quicker and smoother workflow. Once the initial set-up is complete, you can begin sending your payroll information to the relevant ledgers. Where there are circumstances for which payroll figures should be mapped to an alternative nominal account, you can set these up as exceptions.

How does the BrightPay and Xero integration work?

An Application Programming Interface is a software intermediary that allows two applications to talk to each other. It helps to make communication between the two applications faster.

- When you sign into your Xero account in BrightPay, your nominal ledger accounts will be retrieved from Xero.

- Then, you map each payroll data item to the relevant nominal accounts.

- The payroll journal can include records for payslips across multiple pay frequencies and a nominal account can be used for multiple items.

- Learn more about how the integration works here.

What other integrations does BrightPay offer?

Along with Xero, BrightPay includes payroll journal API integration with several other accounting packages, such as Sage, QuickBooks Online, FreeAgent, and AccountsIQ. This is not the only integration BrightPay offers. The payroll software also includes integrations with various pension providers which helps make submitting pension files and carrying out auto-enrolment easier and quicker. Users of the software have direct API integration with NEST, The People’s Pension, Smart Pension, and Aviva.

Learn more:

If you’re interested in learning how BrightPay can improve your payroll services and save you time, schedule a 15-minute demo with a member of our team today. Or, to try the software for yourself, download your free 60 day trial today.

Related Articles: