Feb 2013

5

RTI - lessons from the RTI pilot

One of the main lessons learnt from the RTI pilot was that all employee information (name, date of birth, address and valid National Insurance number) should be accurate and up to date.

Click here for a form which you can give to your employees to help cleanse your data.

Another lesson related to the use of Works Numbers or Payroll IDs by HMRC. A change in Works Number sometimes resulted in duplicate records in HMRC's system with a corresponding overstatement of liability. To overcome this potential problem, BrightPay, in common with many other software providers, will treat the Works Number as your own and assign a separate Payroll ID for RTI purposes.

Bright Contracts – Employment Contracts and Handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Jan 2013

17

Preparing for RTI

RTI may seem pretty scary but BrightPay will look after all the heavy lifting. We hope that you will be pleasantly surprised at just how easy and unintrusive you will find the whole RTI experience.

There are one or two things you need to consider in preparation for RTI.

Your first RTI submission, which will occur on or before your first payday in 2013-14 (but not before 6th April 2013) is known as your "first full payment submission" or first FPS for short. BrightPay, as with all RTI submissions, will prepare and submit this first FPS automatically for you, with your OK of course. The difference between the first FPS and subsequent FPS submissions is that the first FPS will include details of all employees whether or not they were included in your first payroll run e.g. if you operate both weekly and monthly payrolls for the same company, the first FPS, triggered by the first weekly payroll run, will include details of all your monthly paid employees (even though they will have zero in all the pay and tax fields). Subsequent FPS submissions will only include details for employees actually paid in the applicable payroll run.

Therefore it is important that all individuals currently in your employment are included in BrightPay before the first RTI submission is made.

Another thing to bear in mind is that each RTI submission will need to include information for temporary and casual workers and employees paid below the National Insurance Lower Earnings Limit. So, even though there are no deductions made from these individuals, they now need to be accounted for through BrightPay.

Finally, you will need to include new information in your payroll records, the main one being hours worked. This is not the actual number of hours but, instead, an applicable scale (a) Up to 15.99 hours per week (b) 16-29.99 hours per week or (c) 30 hours or more per week. For employees who are paid using an hourly rate, BrightPay will allocate this scale automatically. However, for employees paid a set amount each week or month, you will need to review the default scale which is set at (c) above.

One other new item is the "Irregular Employment Pattern Indicator" e.g. casual or seasonal employees (where the employment contract continues) or where employee will not be paid for at least a further 3 months but is still regarded as an employee e.g. maternity

If you are running a payroll bureau service, you need to consider procedural changes to ensure that the above issues are covered. Make sure that these changes are put in place well in advance of the 6th April.

Bright Contracts – Employment Contracts and Handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Nov 2012

28

Creating RTI-ready payroll software - a BrightPay 2013/14 update

Over the past few months, we have been keeping you up to date on RTI and how it will affect your operations as an employer. You may have already started to prepare for the change.

The RTI development for BrightPay 2013/14 is on track and going well. As the lead software architect for BrightPay, my top priorities are:

- to ensure that the RTI experience in BrightPay 2013/14 is as seamless and easy to use as possible. We are not just adding an RTI layer of on top of the existing software design, but are instead rethinking the core design where we feel it's necessary to do so to make RTI function as simply and clearly as possible.

- to ensure that RTI support in BrightPay 2013/14 is in full compliance with HMRC specifications and guidelines. For you, the employer, it should just work or, in the case of an issue, make it very clear what you need to do to make it work.

- to ensure that BrightPay 2013/14 is completed (and thoroughly tested!) on schedule.

As well as RTI support in BrightPay 2013/14, we're also working on other improvements and new features (including some common customer requests - watch this space!). We're very happy with our progress so far and we will have more updates for you soon. We're really excited about bringing you a better BrightPay.

As always, please feel free to pick up the phone or email us with any queries regarding RTI, or anything else - we are always available for a quick response. Follow us on Twitter (@BrightPayUK) where we try to regularly post useful and helpful information. It might also be worth following HMRC on Twitter (@HMRCgovuk) for additional RTI updates or to take part in one of their popular Twitter Q&A sessions.

The future is Bright for payroll software.

Bright Contracts – Employment Contracts and Handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Nov 2012

28

RTI - New Employers may opt out

From 05th November new employers registering with HMRC will automatically join RTI by default.

There will be instances where employers will not want to join RTI immediately therefore employers can opt out. Reasons for opting out may include;

- The employer already operates other PAYE schemes

- They may wish to use software from a company which is not yet RTI ready

- The employer indicates that they are entitled to claim exemption from online filing and will need to operate PAYE manually. Exemptions will be considered in line with current guidance

These opt outs will only be available between 5 November 2012 and 5 April 2013.

Further information is available from HMRC at http://www.hmrc.gov.uk/manuals/pommanual/PAYE5011.htm

BrightPay 2013/14 will be RTI ready. All necessary functionality to operate RTI for your payroll will be provided in the same simple and user-friendly manner you've come to expect. BrightPay 2013/14 will be available to download for new and existing customers before April 2013. We'll keep you up to date between now and then with the latest information, including an overview of how RTI will work in BrightPay 2013/14.

Please be assured that there will be NO price increase for BrightPay 2013/14 or additional charges for RTI functionality.

Bright Contracts – Employment Contracts and Handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Oct 2012

28

RTI - the human dimension

One of the biggest concerns for payroll operators with RTI is "What happens if the RTI submission is wrong?".

The regulations state that the RTI file must be transmitted before or at the time of the payroll period update. With most payroll software the RTI transmission and the payroll period update will be part of the one process. However, it can be fairly common for the update to occur and then the operator realises that something was missed, like an overtime amount or some promised bonus. At present (prior to RTI), all the operator has to do is reverse or correct what they have just processed. But how would RTI deal with this?

This very scenario was one of the main issues brought up by us and other payroll software developers during the various RTI workshops organised by HMRC. It would be unworkable if there was some complicated resubmission process. Also, the periodic payroll processing would become very stressful if the implication of getting it wrong every now and again was a lot more work.

HMRC took this on board and conceded that once the year to date figures in the next RTI submission were correct, then the employer's obligations have been met. There is also a procedure in place if an incorrect RTI submission is made for a final pay period (e.g. week 52 or month 12).

The year to date or cumulative amounts are the most important items in the RTI submission with relatively minor importance being placed on the pay or tax figures for a particular pay period.

So, all of you payroll operators can relax. You are allowed to be human now and again!

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Oct 2012

10

How to Prepare for RTI - 5 Key Points

Even if you have not yet enrolled in the RTI scheme or you have not yet received notice of the implementation date for RTI into your organisation, as an employer, enrolment is inevitable.

The earlier you start to prepare for RTI, the smoother the implementation of the new scheme will be on you and your employees.

As an employer it is important that you are prepared. There are steps and procedures that you can implement now in order to prepare.

1. Cleanse current employee data

Audit the data held for all current employees ensuring it complies with the HMRC FPS submission requirement. If this data is incomplete, or requires verification, then initiate this process now eliminating any obstacles in good time before your first FPS submission. This will ensure the majority of data entry is complete prior to implementation date also. Include data capture requests with payslips to ensure employees read the request.

2. Educate current employees

Communicate with employees advising them why it is vital for the personal information held on file to be accurate and complete. Implement procedures to facilitate two way communication between employees and managers, to answer any queries your employees may have and to facilitate the advising of changes to personal information.

3. Prepare and implement formal procedures for new employees

Prepare new employee data request forms to be completed upon commencement of employment and prior to the first payment to the employee. This should encompass all the information HRMC requires you to hold for RTI purposes. Implement this procedure now to identify common errors, issues or shortfall in communication and methods to improve this process.

4. Train the administrative staff that will operate RTI

Develop an in-house training programme to:

- identify training requirements

- develop a suitable training plan

- educate staff on RTI requirements and operation

5. Implement payroll control procedures

Prepare in-house procedures to ensure periodical payroll data is complete and accurate prior to signing off the periodical payroll using reports produced from your payroll software. Identify the data checks or audit procedures that can be made to eliminate errors and the associated reports that your payroll software may be able to produce or allow you to customise to complete this task.

Having a series of control procedures in place will eliminate errors in submission to HMRC under the RTI scheme. The earlier these are implemented the sooner they will become an integral part of the payroll process.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Oct 2012

2

HMRC starting to send penalty notices for late P35s

The 2011-12 Employer Annual Returns (P35 and P14s) were due by 19 May 2012. These returns are now over 4 months late and HMRC has started to send penalty notices if their records indicate that they have not yet received your return.

The penalty will be £100 per 50 employees for each month the return is outstanding, from 20 May 2012 to 19 September 2012. So an employer with 50 or less employees will receive a £400 penalty.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Sep 2012

18

National Minimum Wage increases from 01st October 2012

The Department for Business, Innovation and Skills has announced that the rates of national minimum wage applicable to pay reference periods starting on or after 1 October 2012 will be as follows:

- the main adult rate (for workers 21 and over) will increase by 11p to £6.19 an hour (currently £6.08 an hour

- the rate for 18-20 year olds will remain at £4.98 an hour

- the rate for 16-17 year olds will remain at £3.68 an hour

- the rate for apprentices will increase by 5p to £2.65 an hour (currently £2.60 an hour).

From the same date, the daily accommodation offset rate will increase from the current £4.73 to £4.82.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll & Auto Enrolment Software

Sep 2012

11

Thousands of higher rate taxpayers to receive warning letters from HMRC this month.

Thousands of higher rate taxpayers who have failed to submit tax returns will receive letters from HM Revenue & Customs (HMRC) this month, reminding them that they have only one month left to take up a special opportunity being offered by the tax authority.

The Tax Return Initiative is aimed at people liable to pay tax at rates of 40 per cent and above and who have been told to submit a Self Assessment tax return for 2009/10 or earlier, but have not done so. The campaign is also available to anyone who has tax returns to submit for these years.

People have until 2 October to tell HMRC they want to take part, submit completed returns, and pay the tax and National Insurance Contributions (NICs) that they owe. By coming forward voluntarily through the campaign, launched on 3 July, people will receive better terms, and any penalty they pay will be lower than if HMRC comes to them first.

After 2 October, if they have not submitted their tax returns and paid what they owe, HMRC will use its legal powers to pursue outstanding returns and any unpaid tax and NICs. Penalties of up to 100 per cent of the tax due, or even criminal investigation, could follow.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll & Auto Enrolment Software.

Aug 2012

27

What's New In BrightPay Version 12.4?

BrightPay version 12.4 was released on 27th August 2012. We're really pleased to continue to improve BrightPay as the 2012/13 payroll year progresses. Thank you to all customers who have provided feedback so far. If you'd like to see a new feature in BrightPay, please don't hesitate to get in touch.

Here are some of the new things to look out for in 12.4:

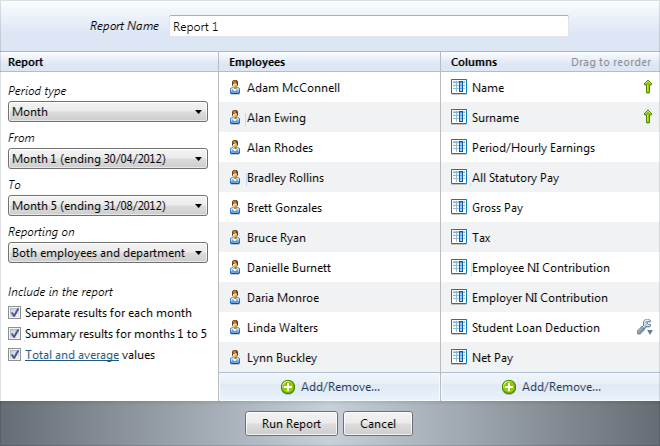

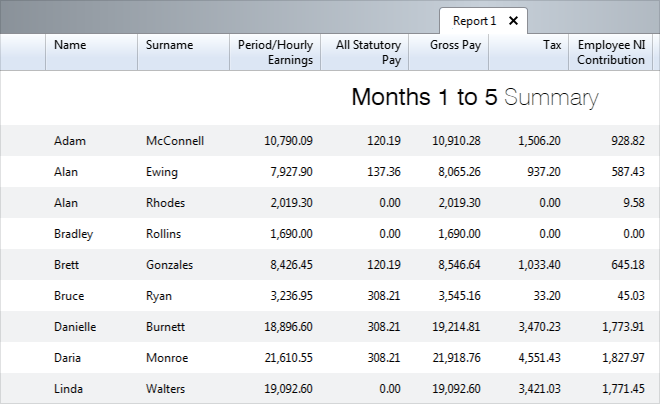

New and Improved Analysis & Reporting

- Simplified, clearer and more elegant user interface.

- Ability to run separate or combined employee and department reports.

- Drag and drop re-ordering of report columns.

- Performance - significantly faster report execution and more responsive scrolling of large reports.

- Column headings stay in place as the report data is scrolled.

- Clearer separation of report data sets (and improved report summary)

- Improved printing, including ability to customise the print title.

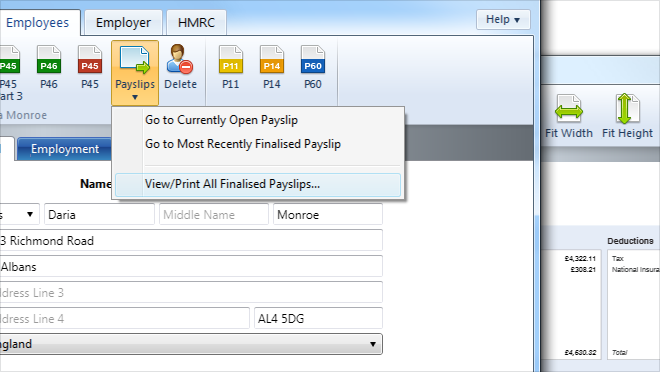

Employee Payslip Quick Links

Some handy links, including the ability to print all payslips for a particular employee.

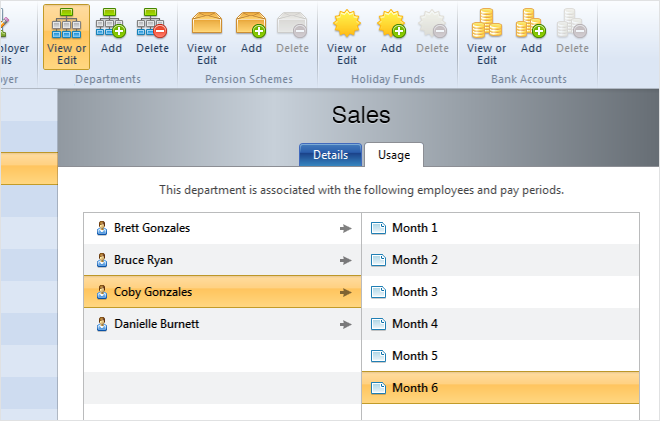

Track usage of Departments, Pension Schemes and Holiday Funds

See which employees relate to which departments, pension schemes and holiday funds at any point in the payroll year.

Other Fixes and Improvements

- Improved data validation messages throughout

- New Bank of Ireland BACS format

- More flexible handling of P30 adjustments

- Fixes a display issue in which a black bar can appear behind the main tabs at the top of the BrightPay window when Windows 7 Aero Glass is disabled

- Fixes some minor bugs and user interface quirks

Have you tried BrightPay yet? If not, download it today and start your fully featured 60-day free trial.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll & Auto Enrolment Software