Nov 2021

16

What to include on a payslip and how they should be shared with employees

By law, employers must provide all employees with a payslip for each pay period. As well as giving employees a rundown of their earnings and any deductions there might be to their pay, payslips may be required as proof of income when applying for a mortgage or other loans. Payslips should be provided to employees either before or on the day they receive payment and are usually generated within the payroll software. According to ACAS, payslips must include:

- Total pay before deductions

- Total pay after deductions

- Amounts of any variable or fixed deductions

- A breakdown of how the wages will be paid if more than one payment method is used

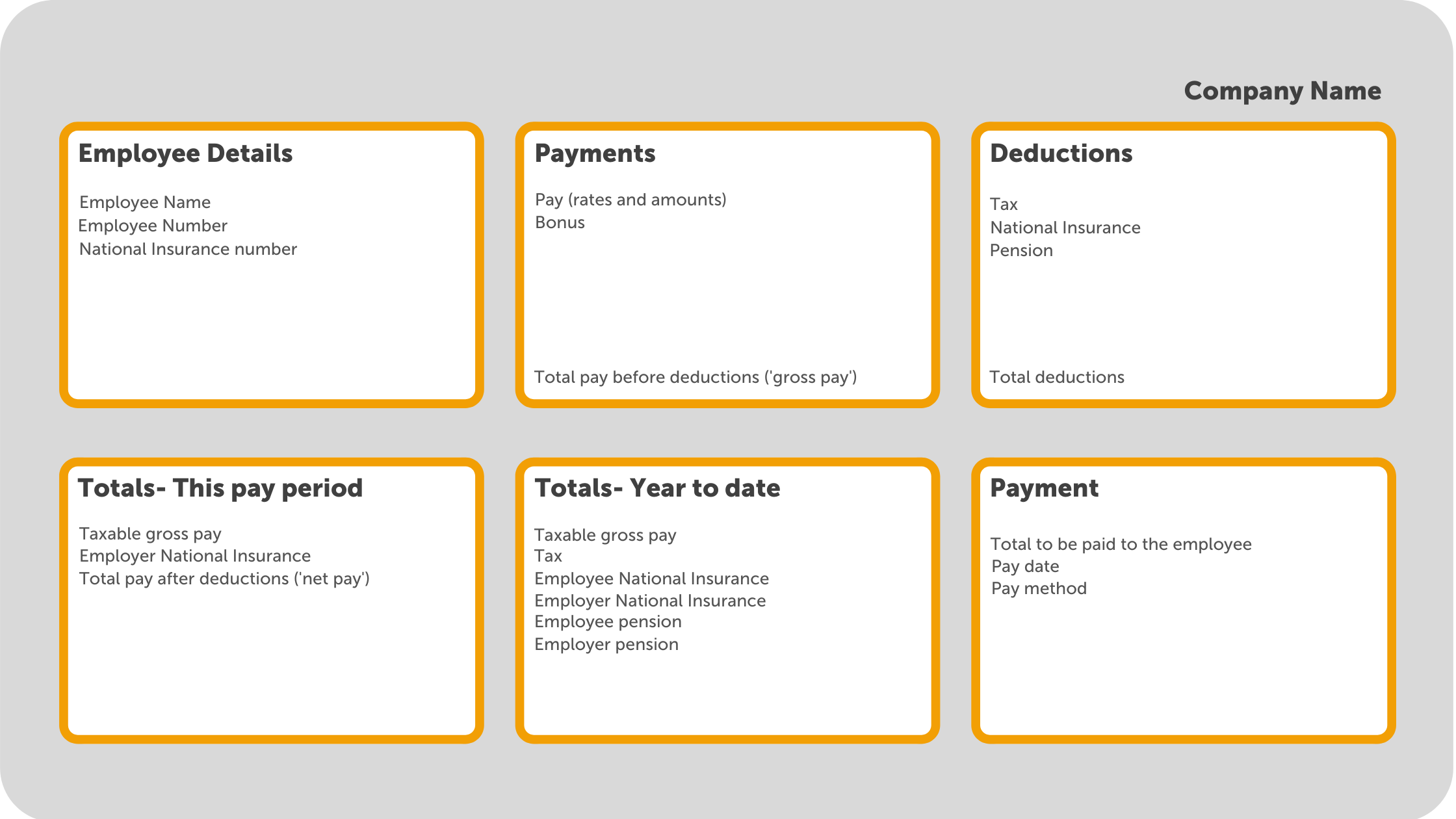

Below is an example of information you may find on a payslip:

How should payslips be shared with employees?

- Employees’ payslips should be provided to them as at least one of the following:

- A hard copy

- Attached in an email

- An online copy

Giving employees a printed copy of their payslip is becoming less common. As well as the fact many businesses are digitising their paper processes, a payslip contains a lot of sensitive employee information, and a printed payslip could easily fall into the wrong hands. When emailing payslips, it is important that the payslip is password protected. More and more businesses are choosing to opt for sharing payslips with employees online. Not only do they save on paper on ink, but they are also more secure and can be easily retrieved when needed.

How can I provide employees with online payslips?

Some payroll software providers include an option to share employees' payslips through an online portal. BrightPay payroll software has a cloud add-on, BrightPay Connect, which includes an employee self-service mobile app where employees can view and download all new and historic payslips. Once a payslip becomes available, the employee will receive a push notification on their phone. If they do not have access to the app, they can also access their employee portal online from any device.

Sharing employees' payslips through an online portal such as BrightPay Connect is the best way to avoid payslip data breaches and insure you are in compliance with UK data protection laws. It also means that employees will always have access to all their past payslips and won’t need to come to their employer to request them.

Can you produce payslips using Basic PAYE tools?

You can use Basic PAYE tools (BPT) to produce payslips for your employees. However, the payslips produced will not include all the details which you are required to provide by law. By using a payroll software such as BrightPay, the payslips produced will contain all the information required by law, while also being customizable with the option of including additional information.

To find out more about how you can share payslips with employees online, book a free online demo of BrightPay Connect today.

Related articles:

Nov 2021

10

Brexit and GDPR

GDPR’s impact on payroll

The General Data Protection Regulation (GDPR) came into effect in May 2018, and it brought the biggest changes in data privacy regulation in over 20 years. Payroll processors deal with personal and sensitive employee information all the time (e.g., names, emails, addresses, bank details, social security numbers, etc), so it’s critical that this information is kept secure and compliant with the GDPR.

Many companies had to review their data handling processes and equip themselves with new tools to ensure GDPR compliance. For example, keeping payroll records stored safely by using an online cloud server such as BrightPay Connect.

Brexit and GDPR

The EU GDPR is an EU Regulation, and it no longer applies to the UK since Brexit. However, the provisions of the EU GDPR have been incorporated directly into UK law and will be now known as UK GDPR. In simple terms, there’s virtually no difference between the UK version of GDPR and the original EU GDPR. Data can continue to flow as it did before, in most circumstances.

How BrightPay Connect is helping with GDPR

BrightPay Connect is an add-on product to BrightPay payroll software. It provides a remote and secure online portal where you can access payslips, payroll reports, amounts due to HMRC, annual leave requests and employee contact details. The portal allows employers to share and upload HR documents in a secure environment hosted on Microsoft Azure.

BrightPay Connect automatically backs up the payroll data to the cloud every 15 minutes and once again when closing the file. It keeps a chronological history of all backups which can be restored or downloaded anytime, keeping payroll records safely stored at all times, with no risk of losing them.

But that’s just a quick taster of the features that BrightPay Connect has to offer. Book a 15-minute demo today and see for yourself. Or if you are new to BrightPay, why not try our payroll software for free for 60 days. The free trial is fully featured with all functionality.

Don’t take our word for it! View our library of BrightPay Connect testimonials on our website from real customers.

Related articles:

Nov 2021

4

How BrightPay can help with your IR35 obligations

IR35 - also known as “off-payroll working rules” has been both a much-needed bit of legislation to tackle people not paying enough tax, and a massive headache for businesses. It has been marred in controversy since being rolled out to the private sector in April of this year due to mixed messages and confusion on how to properly comply

Basically, since the reforms were introduced, instead of the individual letting HMRC know if they’re an employee or contractor, and therefore treated differently when paying tax, the onus is now on the client engaging them to let HMRC know.

So this is now proving to be a headache as off-payroll workers are not entitled to receive or have deducted from their pay things like statutory payments such as SSP, SMP etc, National Minimum/Living Wage rate, holiday pay, student loans and automatic enrolment pension scheme contributions. So where the hell do you even start? How do you know who should be off-payroll or not?

First of all, you can quickly and easily check employment status for tax here. Once you have identified a worker who is inside IR35 you set them up on BrightPay Payroll Software and tick “off-payroll worker” which will disable entitlements that do not apply to contractors who fall inside the off-payroll working rules. Then, once the employee has been set up, BrightPay will automatically disable some settings such as student loans and annual leave entitlements.

Further to this, if a user tries to add statutory leave, BrightPay will automatically flag this to you and the statutory payment will not be processed. For automatic enrolment, an alert will appear for off-payroll workers for you to mark them as being exempt, which then disables any auto-enrolment features that may appear. Then, when making a full payment submission, it will automatically include details of workers who fall inside IR35, ready to send to HMRC.

If you are the contractor who is working for a large/medium-size company or public sector and are deemed to be inside IR35 then BrightPay has your back here too. Salaries paid to you via your own limited company can be paid without deductions of PAYE and NIC. This is because taxes have already been suffered on the payments from your client.

Now doesn’t that sound like a dream? Get someone to do all the hard work for you - sounds like my cup of tea. By using BrightPay you’ll save yourself a lot of time and energy, but more importantly, remain compliant in a time when HMRC are cracking down hard. One less stress to worry about in these very stressful times! For a full demo on all these amazing features head over to BrightPay and see what all the fuss is about!

Written by Aoibheann Byrne

Related Articles:

Nov 2021

2

BrightPay wins ‘Payroll and HR Software of the Year 2021’

BrightPay was announced as the WINNER of Payroll and HR Software of the Year 2021 at this year’s Institute of Certified Bookkeepers (ICB) LUCA awards.

Last night, the ICB held their annual awards in Leicester Square, London. The LUCA awards are considered the ‘Oscars’ of the bookkeeping profession and are awarded in recognition of the year’s outstanding bookkeepers and the many organisations and software services that support the valuable work they do. This year was even more special as not only were the awards held in-person again, but they were also celebrating the 25th Anniversary of ICB's inception. ICB members and students vote to decide the winners of each category. BrightPay are thrilled and honoured to have won Payroll and HR Software of the Year 2021, beating out tough competition from fellow nominees being Intuit Quickbooks, Moneysoft, Sage Payroll, and Xero Payroll.

Picture: Paul Byrne, CEO of BrightPay, poses with the award, a statuette of Luca Pacioli, the Cistercian monk who is credited with first documenting the process of double-entry bookkeeping.

An award-winning payroll software

The award for Payroll and HR Software of the Year comes just under a year after BrightPay won the COVID-19 Hero Supplier Award at the Accounting Software Excellence Awards 2020. During 2020 and beyond, BrightPay quickly responded to frequent changes to payroll legislation, allowing our customers to carry on processing their payroll uninterrupted.

It is a credit to the entire team at BrightPay, amidst the pandemic and throughout 2021, that they continued to develop BrightPay Payroll Software. New and enhanced features were added, all the while BrightPay continued to deliver excellent support to our customers.

Not simply a payroll software

A particular exciting aspect of this award is the ‘HR’ in the title. While BrightPay has been well known for its excellent payroll functionality, we have been working hard on delivering more and more useful HR features to our customers. Bookkeepers using BrightPay alongside the optional cloud add-on, BrightPay Connect, have access to a more streamlined workflow between human resources and payroll.

- Using BrightPay Connect’s self-service portal, annual leave can be requested by clients’ employees and approved by the employer before flowing back into the payroll software.

- With the self-service portal, bookkeepers can also offer their clients access to run and view payroll reports whenever they like. With the reports automatically available to their clients, it improves the bookkeeper’s workflow as well as saving them time.

- Once payroll has been finalised, payslips are automatically sent to employees’ Connect portal. Employees have access to their payslip archive at any time. It ensures they never lose a payslip, and they have access to them whenever they require it.

To discover more about BrightPay’s features such as batch processing capabilities, integration with numerous accounting packages, and the ability to streamline your payment methods, download a 60-day free trial of BrightPay now. To learn more about BrightPay Connect’s payroll and HR functionality, book a demo today.

Related Articles:

Nov 2021

1

Customer Update: November 2021

Welcome to BrightPay's November update. Our most important news this month include:

-

Autumn Budget 2021 – An Employer Focus

-

Horror Stories about Data Loss (and how payroll backups can help)

-

Automatic enrolment checklist for your clients

How to Make a Profit while Streamlining your Payroll Services

New cloud technologies are positively impacting the way bureaus and accountants offer payroll services to their clients. Join us for a free webinar on 23rd November where our experts discuss 6 tips for payroll success while making a profit.

5 Tips for a Better Payroll Process from Start to Finish

New cloud technologies are positively impacting the way employers process payroll and manage employee leave. Join us for a free webinar on 25th November where our experts discuss how you can streamline the entire process from start to finish.

Easily Manage Attachment of Earnings Orders with BrightPay

BrightPay allows users to easily add an attachment of earnings order to an employee’s payslip. Once it is set up, BrightPay will continue to apply the Attachment Order to the employee’s payslip from the relevant payslips.

Good News for Accountants: Pay Your Clients’ Employees Instantly

Are you looking for an easy and fast way to pay employees, subcontractors and HMRC? BrightPay’s integration with the payments platform, Modulr, eliminates the need to create bank files when paying employees. Find out more and register for our upcoming webinar on 11th November at 10 am.

Good News for Employers: Pay Employees Instantly

Are you looking for an easy and fast way to pay employees, subcontractors and HMRC? BrightPay’s integration with the payments platform, Modulr, eliminates the need to create bank files when paying employees. Find out more and register for our upcoming webinar on 11th November at 12 pm.

Payroll and Accounting Software Integration - The Best of Both Worlds

BrightPay includes direct API integration with some of the UK’s leading accounting packages such as Sage, QuickBooks and Xero. This accounting software integration allows for the payroll data to be sent directly into the accounting system from within BrightPay. Book an online demo of BrightPay today to see how the accounts integration features can benefit your business.

The Year that was: 2021 in Review

2021 was a year of both personal and business challenges. COVID-19 changed life as we knew it and resulted in a lot of changes being made worldwide. New policies were introduced, people's places of work changed as well as a number of other adjustments.

Join Bright Contracts for a look back at 2021 where we detail all the employment law changes that were made and a look forward as to what the year 2022 will bring.

Oct 2021

29

National Living Wage to Increase on 1st April 2022

In the Budget 2021 the Chancellor of the Exchequer announced new National Living Wage (NLW) and National Minimum Wage (NMW) details in line with those recommended by The Low Pay Commission (LPC) and these new rates will take effect from 1st April 2022.

| Current Rates | Rates from April 2022 | |

| 23 years and over | £8.91 per hour | £9.50 per hour |

| 21 - 22 years old | £8.36 per hour | £9.18 per hour |

| 18 - 20 years old | £6.56 per hour | £6.83 per hour |

| 16-17 years old | £4.62 per hour | £4.81 per hour |

| Apprentices under 19 or 19 or over who

are in the first year of apprenticeship |

£4.30 per hour | £4.81 per hour |

The National Living Wage, the statutory minimum for workers aged 23 and over, will increase by 6.6% to £9.50 per hour. An employee's age and if they are an apprentice will determine the rate they will receive.

Related articles:

- Autumn Budget 2021 – An Employer Focus

- What to include on a hybrid working policy

- Payslips explained: Top tips to help your employees

Oct 2021

29

Autumn Budget 2021 – An Employer Focus

Chancellor of the Exchequer, Rishi Sunak, presented the Autumn Budget 2021 to Parliament on 27th October 2021. The main points to be noted by employers are:

- The personal tax allowance will remain the same, £12,570 for the tax year 2022-23.

- The Higher Rate Threshold (HRT), when higher earners start to pay 40% tax, remains at £50,270.

- The National Insurance Upper Earnings Limit (UEL) threshold will remain the same in 2022-23 and will remain frozen until 2026.

- The new National Insurance Levy of 1.25% will come into effect from April 2022 via a temporary increase to National Insurance Contributions (NICs) for Class 1 (employee and employer), Class 1A, Class 1B and Class 4 (self-employed). From April 2023 NIC will revert back to 2021/22 rates where a new Health and Social Care (H&SC) levy will be a separate deduction for this 1.25% levy. The Health and Social Care levy will also apply to employment earnings of those over State Pension Age (category letter C).

- For 2022-23 tax year company car percentages will increase from 1% to 2% for vehicles first registered before 6th April 2020 with 0kg/km rate. Vehicles first registered on or after 6th April 2020 will increase by 1%. The rates will be frozen then for the next two tax years 2023-24 and 2024-25.

- The Employment Allowance remains at £4,000 for eligible employers where the Class 1 National Insurance Contributions liabilities were less than £100,000 in the previous tax year.

- The National Living Wage for workers aged 23 and over will rise to £9.50 per hour from 1st April 2022, this represents an increase of 6.6%.

- The pay freeze for some public sector workers will end and pay rises will be given over the next three years.

Related articles:

Oct 2021

28

Re-enrolment: Don’t let your software let you down

When it comes to pension re-enrolment, do you know which of your employees need to be placed back into the pension scheme, and when? Perhaps you do. However, it is much more likely that you rely on your payroll software to notify you when re-enrolment is due, ensuring you don’t miss any deadlines.

However, perhaps you should double check that your confidence in your payroll software isn’t unwarranted. Are you certain that your payroll software automatically notifies you when re-enrolment is due, or do you in fact, have to manually check for this information?

What is re-enrolment?

Every three years, employers are required to re-enrol certain employees. This involves assessing the employee’s eligibility for auto enrolment and re-enrolling them into a pension scheme. The employer will then need to complete a re-declaration of compliance to inform The Pensions Regulator (TPR) that their duties have been met. An employer must submit their re-declaration within five months of the third anniversary of the automatic enrolment staging date. If you have no staff to re-enrol, you will still need to submit a re-declaration of compliance.

How to choose your re-enrolment date:

The re-enrolment date is chosen by the employer and can occur anytime within a six-month timeframe of the ‘staging date’ or ‘duties start date’ three-year anniversary. It can be set three months before or three months after the anniversary date. Regardless of whether you used postponement at your staging date, re-enrolment occurs three years after your staging date, not your deferral date.

For example, if your duties start date was 1st April 2018, you can choose to re-enrol on any day between the 1st January 2021 and 30th June 2021. In this example, the deadline for completing the re-declaration of compliance would be 31st August 2021.

Employee Assessment:

- Employees who are eligible for re-enrolment are:

- Aged between 22 and up to the State Pension Age

- Earn over £10,000 a year

- Employees who have previously left the scheme or who have reduced their contributions to below the statutory minimum requirement for auto enrolment.

Employees who are not eligible can request to join the scheme.

BrightPay payroll software monitors any changes to an employee’s work status each pay period. As soon as you reach your re-enrolment date in the payroll, BrightPay will automatically assess the employees and will determine which employees qualify for re-enrolment. If employees meet the criteria, on-screen flags and alerts will appear to notify you that you now have re-enrolment duties to perform.

Employee notification:

After re-enrolling eligible employees into a pension scheme, they must be notified in writing of their re-enrolment within six weeks of their re-enrolment date. BrightPay will automatically prepare the employee’s enrolment letter. These letters can be printed, exported to PDF, emailed to the employee, or if you are a BrightPay Connect customer, the letter can also be automatically added to the employee's self-service portal.

Choose the best payroll software for re-enrolment:

Unlike other payroll software where you must check for re-enrolment duties, BrightPay Payroll automatically assesses employees and will notify you immediately when re-enrolment is due. This feature helps avoid last minute stress, back-dating pension contributions, and potential fines. To learn more about BrightPay’s full payroll functionality and how it can improve your payroll processes, schedule a personal demo and speak to a member of our team today.

Related Articles:

Oct 2021

26

The hassle-free way to maximise profits from payroll processing

Accountants and payroll bureaus sometimes find that processing payroll takes a lot longer than they would like. Because of this, some accountants may be making little to no profit from offering payroll as a service. Nevertheless, it is a service expected by customers. If you aren’t making a profit from payroll processing, this could be down to not using the right payroll software. By switching to a payroll software that automates tasks you can transform payroll from a time-consuming manual process and into an easy process where certain tasks take care of themselves, saving you both time and money.

Accountants and payroll bureaus, have you found that that offering #payroll as a service is not cost-effective and that it can be a time-consuming and tedious process? If so, this doesn’t need to be the case. Discover how by joining our upcoming #webinar: https://t.co/fd7pWygAgm pic.twitter.com/jbsl9eVuaw

— BrightPay UK (@BrightPayUK) October 15, 2021

Not only can you make a profit from processing payroll but depending on what payroll software you use it can be an opportunity to maximise profits by allowing you to offer new services to your clients which you may not have considered before. When it comes to introducing your staff and your clients to new services, you may think you have enough on your plate and that it would take up too much of your time. However, BrightPay Connect, a cloud add-on to BrightPay Payroll software, has little to no learning curve, allowing you to immediately begin offering additional services to clients. Offering new features such as a self-service dashboard for clients, a mobile app for their employees or giving your clients access to new HR tools is a lot easier than you think.

In our upcoming free webinar “Optimising your payroll offering to improve profitability” you can find out all you need to know to stop payroll processing from being a loss leader and turn it into a money spinner. Register now.

In the webinar you’ll learn:

- The benefits of integrated payroll and accounting systems

- How batch processing can transform your payroll performance

- How you can streamline client communications

- Top tips for expanding your client base

- Pricing strategies that work – what other practices are doing

Please note: This webinar is specifically designed for accountants, bookkeepers, and payroll bureaus.

Webinar Information:

The webinar takes place on 28th October at 11.00 am and is free to attend for all accountants and payroll bureaus.

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related articles:

Oct 2021

20

Payroll client platforms are the way of the future

Payroll bureaus have more choice than ever when it comes to which cloud portals to use. Understandably, it can be hard to see the wood for the trees when looking for the right payroll software for you and your clients. But choosing the right cloud client product you can make a world of difference to the payroll service you offer your clients, and the value they enjoy as a result.

The option of BrightPay Connect can enhance and improve your client relationship by automating many of the daily payroll administration tasks. With the introduction of any new service, accountants and bureaus should focus on what benefits BrightPay Connect can bring to your clients. We’ve compiled a list of the payroll, HR and cloud benefits of choosing BrightPay Connect.

BrightPay Connect Benefits For Bureaus

1. Cost-Effectiveness

Who doesn’t like a product that saves time, effort and money? Not only is BrightPay Connect the best way for bureaus to modernise payroll and access multiple clients from one platform, but it’s also very cost-effective. This means you can potentially pass the savings along to your clients for an even better value payroll service.

2. Multi-Company Platform

Juggling several clients at once, no matter what industry you’re in, is no mean feat. BrightPay Connect makes it easier than ever thanks to its automatically synchronized system that enables you to see all of your clients’ payroll summaries in one place.

3. Client Dashboard

Oftentimes clients will still play a significant role in their payroll process. In particular, clients like to be able to see their payroll information easily without having to request it from their payroll bureau and wait for it to be sent over. With BrightPay Connect, clients can easily log-on and view payroll reports, see updated data, receive notifications, view employee payslips, access the annual leave calendar and check on progress.

4. Client Entry Feature

With BrightPay Connect, payroll bureaus will have the ability to send a request to clients to upload their employee hours. Clients can enter the payroll data or upload a CSV file. The information included in the Payroll Entry Request (payments, additions, deductions and new starters) will seamlessly flow through to the bureau’s portal, ready for payroll processing.

5. Client Approval

If your clients want to be able to review and approve payroll before it’s finalised, the client approval feature allows them to do just that. You simply send them their payroll summary which they can approve or reject. When the client gives it the go-ahead, move forward with finalising the payroll, secure in the knowledge that the information included is 100% accurate and everyone’s happy.

6. Automatic Cloud Backup

Data security is a top priority for all bureaus and accountants. With BrightPay Connect’s cloud backup feature, you can rest easy knowing that your clients’ payroll data is in safe hands. The system backs up automatically every 15 minutes, as well as when a file is closed. If a mistake is made you can easily check through the backup history to restore an earlier, mistake-free version.

7. Branding Abilities

BrightPay Connect allows you to add your bureau’s own branding. This includes your contact details, company name and logo. The branding facility enhances the service you provide your clients and helps to promote your company and grow your business.

8. Better Reports

Payroll reports are an important part of any bureau’s service. With BrightPay Connect, you can make sure your reporting is as comprehensive and user-friendly as possible. Any reports that are set up on your payroll software are available to clients to access online. Additionally, your clients will be able to view reports and download them as a PDF or as a CSV file.

9. HMRC Payments

Clients can check what HMRC payments are due and paid, as well as your P30 reports which break everything down.

10. Annual Leave Management

BrightPay Connect isn’t just about payroll. It also includes some really helpful HR features that allow for annual leave management - both from the employers perspective and the employees. Employees can view their leave balance and request leave. Employers can approve or deny leave requests and view the company-wide leave calendar. And the best thing about this? Once a leave request has been approved it automatically syncs with the payroll software so everyone is getting paid the right amount.

11. Employee Self-Service

The clever and user-friendly employee dashboard allows your clients’ employees to view their P60, P45, or P11Ds in addition to their payslips and other payroll information. They can also download these files as PDFs and print them. On top of all of this, employees can access their annual leave dashboard too.

12. Employee Smartphone & Tablet App

Unlike some other payroll products out there, BrightPay Connect has an Android/iOS employee application compatible with smartphones and tablets. The benefit of this payroll app is in how it allows client employees to access all of their payroll and annual leave information mentioned above, anytime and anywhere at the tap of a finger.

13. Multiple User Functionality

One of the most unique features of BrightPay Connect is how it allows both bureaus and employers to add as many users as they like, with various access tiers. This means that some users can only view HR documents and approve employee leave requests, others can access payroll information, while others have the ability to view employers and employees that have been marked as confidential. Who has what access permission is up to you. This really allows bureaus and their clients to cater the system to their needs for a truly bespoke payroll process.

Book a demo of BrightPay Connect to see how you can help your clients with a new and improved payroll service offering.

Related Articles:

.png)