Jan 2018

31

BrightPay & Aviva: Hello one-click pension submissions.

Time-consuming pension file CSV uploads can now become a thing of the past as BrightPay have teamed up with Aviva to bring both employers and payroll bureaus a one-click pension submission. Using Aviva’s API technology, files can be directly sent from one system to another electronically. An API facility is a similar concept to RTI where one system (i.e. payroll software) can instantly communicate with another system (i.e. pension provider.

If Aviva is your chosen workplace pension scheme you can simply send your pension contributions to Aviva in an instant. There is no need to leave the BrightPay application to submit your pension contributions as the Aviva API accesses the pension file that BrightPay has created. This pension file can then be sent through to the Aviva portal with just a few clicks on BrightPay.

Whether you process payroll and automatic enrolment (AE) for your small business or for your payroll bureau’s multiple clients, you can easily comply with your legal duties without having to tirelessly toggle between tabs on your PC.

BrightPay are pleased to be the first payroll software to offer this API integration with Aviva. BrightPay and Aviva customers are saving invaluable time each pay period. If you’d like to see how BrightPay can streamline other tedious automatic enrolment tasks you can book an online demo today. Find out more on our Aviva API webpage.

Written by Cailín Reilly.

Jan 2018

19

Recognised Overseas Pension Schemes notification list

The list of Recognised Overseas Pension Schemes (ROPS) notifications has been updated. 17 schemes have been added and 1 scheme has been removed. This is a list of workplace pension schemes that have told HMRC they meet conditions to be a ROPS and have been asked to be included on the list.

The ROPS notifications list is updated and published on the 1st and 15th day of each month. The list will be published on the next working day if this date falls on a weekend or UK public holiday. From time to time, the list is updated at short notice to temporarily remove schemes while reviews are carried out. For example, this could be when there is suspected fraudulent activity.

The requirements for ROPS changes from 6th April 2017.

You need to meet the new requirements on or after the date you transfer from one scheme to another. HMRC can’t guarantee these are ROPS or that any transfers to them will be free of UK tax. The responsibility lies with you to find out if you have to pay tax on any transfer of pension savings.

HMRC will usually pursue any UK tax charges (and interest for late payment) arising from transfers to overseas entities that don’t meet the ROPS requirements even when they appear on this list. This includes where the ROPS requirements have changed and where taxpayers are overseas. HMRC will also charge penalties in appropriate cases.

Related Articles:

Nov 2017

13

If you think compliance is expensive – try non-compliance

As an employer, your declaration of compliance is a legal duty. If you do not complete it within 5 months of commencing your Automatic Enrolment (AE) duties, then you have not completed your legal requirements of Automatic Enrolment and may face fines. Even if an employer did not enrol any member of staff, a declaration of compliance must be completed.An employer can process their own declaration or authorise an agent to complete this on their behalf. The declaration is completed via The Pensions Regulator’s website. You can start the declaration now by clicking here.

Don’t delay or you could face prosecution – it is a criminal offence if an employer fails to put their employees into a pension scheme and/or provide false information in a declaration of compliance. The maximum punishment can be 2 years in prison if The Pensions Regulator proceeds with prosecution. The Pension Regulator’s checklist provides details of all the information you need when submitting your client’s or your own AE declaration.

What information does an employer need to provide?

You need your letter code and PAYE reference to access the online service. The letter code is unique to every employer and a 10-digit reference beginning with ‘1’. It is on all correspondence an employer receives from The Pension Regulator, you can contact customersupport@autoenrol.tpr.gov.uk if you do not know it or have never received it. To contact customer service you must provide:

- Employer Name

- Employer Address

- PAYE Scheme Reference

- Your Contact Details

An employer’s PAYE reference can be found on correspondence from HMRC when first registered as an employer or from their payroll software.

The Pensions Regulator (TPR) is ensuring that all employers fulfil their duties required by the Pensions Act 2008. It is essential that all employers understand that even if they employ only one person they have certain legal duties for Automatic Enrolment. And if they choose to employ a new member of staff after 1st October, 2017 those duties apply from the day the new employee starts.

Remember, Automatic Enrolment is a continuous duty for all employers, and does not end after the staging date or duties start date (if you don’t have a staging date).

Avoid penalties by understanding how to meet your duties:

- Keep records of all AE activities for 6 years and opt-out notices for 4 years

- Monitor staff ages and earnings - as staff become eligible they must be enrolled

- Enrol employees and issues correspondence to them.

- Pay contributions to their pension scheme

All responsibility ultimately lies with employers.

Related Articles

Oct 2017

25

Does Automatic Enrolment apply to you?

The Pensions Regulator (TPR) is ensuring that all employers fulfil their auto enrolment duties required by the Pensions Act 2008. It is essential that all employers understand that if they employ just one person, they have certain legal duties for automatic enrolment. After the 1st October 2017, new employers who employ their first member of staff will have to comply with auto enrolment from the day the new employee starts.

So what do you do?

- If you already have an employee(s) and they commenced work with you before 2nd April 2017 you should find out what your duties are by using TPR’s duties checker. There are also video tutorials online to help with understanding how to process Automatic Enrolment (AE) in our payroll software BrightPay.

- If you’ve employed new staff between 2nd April 2017 and 30th September 2017 you can find out when your AE duties commence by clicking here.

- If you’re employing a new member of staff after 1st October 2017, you need to prepare early and find out what you need to do. Watch a replay of a recent webinar where we discuss New Employers and their Auto Enrolment Duties to assist with your preparations.

- When your duties start you must assess your employees to see if they meet the earnings and age conditions. If your employee needs to be put into a pension scheme, you need to carry out certain auto enrolment tasks to meet your legal duties. If you find that your employees are not eligible to be put in a pension scheme, you are still required to notify your staff that they have a right to join or opt in to a pension scheme and you must still complete your declaration of compliance.

- All employers have ongoing AE duties regardless of whether they have employees in a pension scheme or not. Every time you process your payroll, you are required to assess your staff’s earnings and age to see if they need to be placed in a pension scheme and if so, calculate how much you need to pay into this scheme. You must also manage requests to join or leave the pension scheme.

- As an employer, you need to think about what costs are involved with your legal duties. Alternative payroll software providers have AE as an additional charge to your payroll costs. HMRC’s Basic PAYE Tools does not provide assessment of your employees or automatically enrol your employees into a pension scheme. With BrightPay, AE is included in our payroll software at no additional cost and provides a pre-assessment tool to get an overview of what AE will look like before an employer reaches their staging date.

Oct 2017

18

5 simple scenarios to stop pension scams

A pension scam – when someone tries to con you out of your pension money – will often start by someone contacting you unexpectedly with one of many pension scenarios. If you find yourself in one of these scenarios make sure to act fast to prevent becoming a victim of a pension scam.

1. You have received a cold call offering a free pension review.

Hang up! Scammers will often impersonate government-backed organisations in order to swindle you out of your savings. These organisations will never offer you a free pension review.

2. You have been offered advice about your pension.

Pension scammers can act as Financial Advisors. Be sure to check the FCA list of approved advisors. If the advisor is not on that list then they are not regulated and you are not protected.

3. You have been told you need to act fast to secure a ‘limited time offer’.

Don’t be rushed into making a decision about your pension. Scammers will try to rush you, offering ‘discounts’ that are likely to be time sensitive. Take the time you need to ensure the legitimacy of the deal. This may mean ‘missing out’ but could be the difference between keeping your pension fund secure and losing all your savings.

4. Your friend has recommended an investment to you.

You might trust that your friend is financially wise but this confidence in your friend can translate to you being scammed. Always do your research on a company. Don’t take someone else's word!

5. You have been offered an unbelievable deal.

Be cautious of unregulated investments that offer exclusive or exotic sounding investments, often described as ‘overseas’. Many of these investments claim ‘guaranteed returns’. If you think something sounds too good to be true - it probably is.

Aug 2017

1

Proposed State Pension Age Changes: How will it affect you?

Millions of men and women may have to wait a year longer to receive their state pension after the Government have announced plans to raise the retirement age to 68 earlier than planned.

Under current legislation, the State Pension age increase from 67 to 68 is to be phased in between the years 2044 and 2046. The Government, however, now plan to implement this increase seven years earlier. Should this proposed change go ahead, this means that the State Pension age will thus increase to 68 between 2037 and 2039 instead.

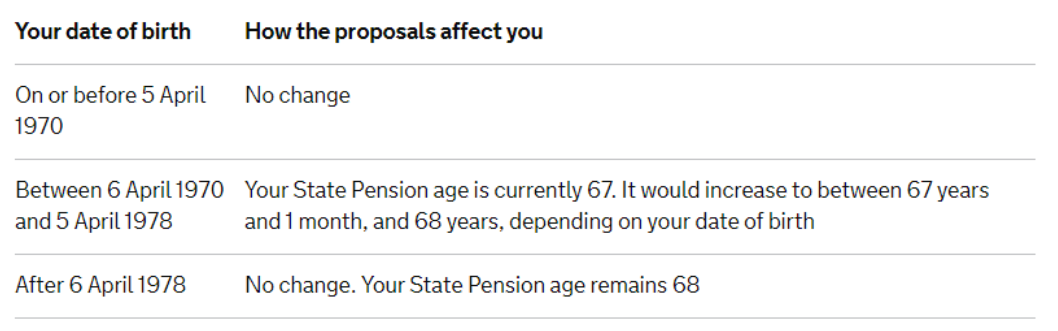

Who will be affected?

Based on the new proposal, men and women born between April 6 1970 and April 5 1978 will be affected. This equates to approximately six million people, who are currently aged between 39 and 47.

No one born before April 5, 1970 will be affected by the change. Currently, those born since April 6 1978 already face a state pension age of 68.

Will these changes go ahead?

At present, this is simply a Government proposal and will therefore need to be approved by Parliament. In response to the new plans, Secretary of State for Work and Pensions, David Gauke said:

“Combined with our pension reforms that are helping more people than ever save into a private pension and reducing pensioner poverty to a near record low, these changes will give people the certainty they need to plan ahead for retirement”.

Auto enrolment has helped more than 8 million people to save into a workplace pension, in order to boost their retirement pot.

Jul 2017

7

Employers warned by The Pension Regulator regarding Fake Exemption Certificates

Employers are being made aware of an apparent scam of exemption certificates for automatic enrolment purposes being offered by at least one company. An investigation is being undertaken by The Pension Regulator into this company offering what is described as 'Certificates of Auto Enrolment Exemption' to employers.

Employers were advised by the company when purchasing this fake certificate, that holding it meant that the employer did not have automatic enrolment duties. The cost being charged to employers for this worthless 'Certificate of Auto Enrolment Exemption' is £58. TPR does not have any such documents or accept any such documents as evidence of automatic enrolment exemption.

Any employer who is offered the chance to buy a certificate of exemption or any similar sounding document exempting them from automatic enrolment duties is being urged to decline the offer and contact TPR immediately.

TPR’s Director of Automatic Enrolment, Darren Ryder said:

"Most independent advisers offer legitimate services that assist employers with their workplace pension duties. Nevertheless, employers need to take care when they are seeking help or advice about what they need to do about automatic enrolment. We will work to root out the small number of organisations that are looking to prey on hard-working employers, abusing their trust and tricking them out of their money."

Jul 2017

5

Auto enrolment and the new client

All bureau payroll providers will, by now, be very familiar with how to deal with clients who have had a staging date allocated to them by the Pensions Regulator.

However, this staging process is nearing an end and new employers, who take on staff after 1st October 2017, will have immediate automatic enrolment duties. They will no longer be allocated a staging date by the regulator.

These employers will still be able to postpone for up to three months to allow them the time to choose and set up a pension scheme.

Heretofore, it was essential that any postponement communication was sent to postponed employees within 6 weeks of the staging date. Under the new regime, the staging date will now be referred to as the duties start date. This duties start date will be the date that the first employee started. Any postponement communication will now need to be sent within 6 weeks of the duties start date.

If the first employee is a director, then the company will have no AE duties until such time as a second employee commences. In this case it is the start date of this second employee that becomes the duties start date.

Example

ABC Limited commences trading on 1st December 2017 and has one employee, being a director. On 1st March 2018, ABC Limited takes on a new employee.

The duties start date for ABC Limited is 1st March 2018 and ABC Limited has no AE duties until this date. If ABC Limited decides to postpone, a communication will need to issue on or before 12th April 2018. Assuming that ABC Limited is paying monthly, on 31st March, when it is processing its payroll, it may choose to postpone (for up to 3 months) and issue the communication at the time of doing the March payroll.

If the postponement is for 3 months then, when processing the payroll at 30th June 2018, being completion of the postponement period, all employees must be assessed and enrolled if necessary. The same ongoing duties still apply and, each pay period, all non-enrolled staff should be assessed for age and earnings to see if they need to be enrolled or given the option to enrol.

There are transitional rules for employers taking on their first employer between 2nd April 2017 and 30th September 2017.

BrightPay payroll software will guide the user through the process for new employers. Find out how to enter a new employer's duties start date in BrightPay.

May 2017

15

Understanding Your Employer Auto Enrolment Ongoing Duties

Auto enrolment is not a one off job and employers need to carry out a number of tasks on an ongoing basis. Automatic enrolment is a continuing responsibility for employers. Employers must complete the following tasks in order to remain fully compliant with the law.

Record keeping:

Employers must continually keep records of their auto enrolment activities including names and addresses of employees they have enrolled, records of when the contributions were paid to the pension provider, opt in requests, pension scheme reference or registry numbers and information that was sent to the pension provider. These records must be kept for a period of six years. Opt out requests or notices must be kept for four years.

Ongoing employee assessment:

You must complete an employee assessment each pay period to monitor any changes to an employee's age and earnings. For example, if an employee turns 22 or their qualifying earnings increase then they may become an eligible jobholder. Payroll software should handle this automatically for you. Be aware, HMRC’s Basic PAYE Tools will not cater for employee assessment. Additionally, new staff must also be assessed to see if they are eligible for enrolment.

Enrolling staff after the staging date:

All existing or new staff that become eligible will need to be enrolled into the pension scheme. As part of this, eligible jobholders will need to receive an enrolment letter informing them of how auto enrolment will affect them now that they have become eligible. These employees will have the right to opt out of the scheme within the opt out period.

Avoid Auto Enrolment Fines

Ultimately the responsibility of auto enrolment is with the employer. Employer payroll software will make auto enrolment must easier to manage these new duties on an ongoing basis. The Pensions Regulator will fine employers who fail to submit their declaration of compliance or comply with their duties. Make sure you avoid fines and fully complete all of the mandatory duties required.

Over 100,000 businesses now process their payroll through BrightPay. BrightPay is free for employers with three or less employees, £89 + VAT / per tax year for an employer licence and £229 + VAT / per tax year. Download a BrightPay 60 day trial to see just how user friendly it is.

May 2017

15

Employer fined £42k for Non-Compliance of Automatic Enrolment Duties

Employer Johnson Shoes Company’s automatic enrolment staging date was 1st May 2014 and they had to file their declaration of compliance within the 5 months after the staging date by 30th September 2014, but they failed to do so by the deadline.

Johnsons were contacted by The Pensions Regulator several times advising them of their automatic enrolment duties and how to fulfil these duties. But Johnsons’ lack of action regarding their duties made The Pensions Regulator to use their enforcement methods.

TPR issued a Fixed Penalty Notice of £400 to Johnsons but Johnsons refused to pay this fine and asked TPR to review the penalty as they stated the pressures of work were the reason they did not fulfil their duties. As TPR had sent Johnsons several reminders in the year leading up to their staging date, giving Johnsons plenty of time to prepare, this excuse was not deemed to be a reasonable excuse by the TPR so the fine remained.

An Escalating Penalty Notice was issued which in Johnsons case was £2,500 per day due to the number of employees they have. This escalated to £40,000 total fine. As Johnsons also refused to pay this EPN fine The Pensions Regulator lodged a money claim with the County Court in order to recover the amount owed. In the end Johnsons were ordered to pay the £40,000 plus £2,000 in legal fees that The Pensions Regulator had to pay at the beginning of their claim, so total cost of £42,000 for Johnsons.

Johnsons are now fully compliant for automatic enrolment and their employees that are in the automatic enrolment pension scheme are in the same position as they would have been if Johnsons had been compliant at their staging date.

In a regulatory intervention report produced by The Pension Regulator it states this case shows that early engagement with the employer where non-compliance is identified is necessary. This cost to Johnsons could have been prevented if Johnsons had of being prepared for automatic enrolment and not ignored the communication from The Pensions Regulator.