Jul 2017

10

The story behind BrightPay Connect ….. in 60 seconds.

We started out with the idea of automating the payroll backup to a secure location and, while that backup was being stored remotely, to optionally allow employee access to their current and historic payslips.

Then we were asked if we could provide a way for employees to change their personal details and this was followed by a suggestion that maybe the employees could request leave and that the employer, in deciding whether to approve these requests, would be able to view a company wide calendar to see who else was off on the requested dates. BrightPay Connect, an optional cloud add on was born.

More recently, we added the ability to upload documents, for example employment contracts, to the employee portal, so that all such documents would be easily accessible and the employer would also know if and when they had been opened by the employees.

Although it was not our intention starting out, it now appears that we have ended up with a fairly complete HR system suitable for most small businesses and, no doubt, the list of HR features will continue to grow.

As an employer, you can also provide access to your accountant or anyone else you might want to share with. You can also specify different access levels so that, for example, the person approving holiday requests doesn’t get to see how much your employees are paid.

The 2 things that customers really rave about are (1) you are up and running in seconds, as this is all the time it takes to sync all of your employees and (2) you can access your employees’ details from anywhere, from any device.

Book a BrightPay Connect Demo today to see how you and your employees can benefit.

BrightPay - Payroll and Auto Enrolment Software

Bright Contracts - Employment Contracts and Handbooks

May 2017

15

Keep your payroll data safe against Ransomware

Ransomware, like the name suggests, is when your files are held for ransom. It is a type of malware that essentially takes over a computer and prevents users from accessing their data until such time as a ransom is paid. The ransomware encrypts data on the computer using an encryption key that only the attacker knows. If you want to decrypt them, you have to pay. If the ransom isn’t paid, the data is often lost forever.

A ransomware attack, also known as WannaCry or WeCrypt, recently spread across the globe and is believed to have affected over 200,000 organisations. The cyber-attack struck banks, hospitals and government agencies in more than 150 countries, exploiting known vulnerabilities in Microsoft operating systems.

How to protect against a ransomware attack?

- Think before you click – It is important to look for malicious email messages that are often concealed as emails from companies or people you regularly interact with online. It is important to avoid clicking on links or opening attachments in those messages, since they could unleash malware. However, unlike many other malicious programs, WannaCry has the ability to move around a network by itself. Once the virus is inside an organisation, it will hunt down vulnerable machines and infect them too.

- Keep software up to date – Users should ensure that security updates are installed on their computer as soon as they are released. Last month, the NSA revealed software vulnerabilities in a Windows Server component which allows files to spread within corporate networks. Since then, Microsoft has released software patches for the security holes. Anyone who applied this patch more than likely was not affected by WannaCry. However, not everyone has installed these updates and so these users are susceptible to an attack. It is also important to note that the vulnerability does not exist within Windows 10, but is present in all versions of Windows prior to that, dating back to Windows XP. Support for Windows XP was discontinued in 2014, and so if you are using XP it is recommended to upgrade to a more secure system. It is important to keep all software packages up to date to maximise protection against attacks.

- Keep backups of data files – Users should regularly back up their data, which will make it possible to restore files without paying a ransom. This can be done by saving files to a USB key, external server or a cloud sharing facility such as Dropbox or Google Drive. Individual software packages may also offer a backup facility, enabling you to automatically back up sensitive data, for example BrightPay Connect allows users to easily backup payroll data.

How can BrightPay Connect help?

BrightPay Connect allows employers to automatically and securely backup payroll data to a highly secure cloud server. Payroll data (including payslips, payroll reports, auto enrolment records etc.) is automatically backed up every 15 minutes ensuring that you will never lose your payroll data if you are the victim of an attack.

You may decide that you only want to use BrightPay Connect for payroll backups, however, the features listed below can also be availed of.

With BrightPay Connect, employers can invite their employees to their own self-service portal. Employees can login to their own personal account, be it on their PC, tablet or smartphone, where they can view payroll documents relevant to them, with a full history of payslips, P60s and auto enrolment documents. Employees can also request annual leave and view annual leave remaining through their portal.

Furthermore, BrightPay Connect provides users with an annual leave management facility and a document upload facility, where all information is stored within the same location. With the document upload, employers can upload employee contracts & staff handbooks, training manuals, employment documents and much more, which can be accessed by employers and employees on any device.

Find out more about BrightPay Connect with an online demo.

Dec 2016

21

The top 5 benefits of using BrightPay Connect for Automatic Enrolment

Auto Enrolment Overview

Auto enrolment has been introduced because people in the UK are living longer lives but not saving enough for retirement. The government estimates that as much as 7 million people do not have adequate savings to provide for them in retirement. The government will also be unable to cope with the increasing number of people retiring in the future.

By law, every employer in the UK has auto enrolment (AE) duties to complete. Employers must enrol all eligible jobholders into an AE workplace pensions scheme. The employer must also contribute to the employee’s pension pot. It is called automatic enrolment because it is automatic for employees but it’s not automatic for employers.

To comply with automatic enrolment, employers need to complete a number of AE duties, including employee assessment, communications, process employee requests, calculate contributions and deductions and submit files to the chosen pension provider. There will be additional duties to perform if the employer chooses to postpone AE. Employees will also have certain rights including being able to opt out, opt in or join the pension scheme.

BrightPay Connect & Auto Enrolment

Employers can reap huge benefits from cloud software. BrightPay Connect is the latest add-on that integrates directly with your BrightPay payroll. Cloud software provides flexibility and online access on the go where your payroll and certain auto enrolment data can be accessed on any device. Auto enrolment functionality should be included free of charge as part of your payroll software package. Payroll should allow you to automate and simplify your automatic enrolment duties. For efficient and successful AE compliance, BrightPay Connect offers significant online advantages for automatic enrolment including:

- Auto Enrolment Communications

Employees can be given access to their own online self-service portal where they can access and download their payroll documents. Communicating with employees about their AE rights is a compulsory part of complying with AE. You must notify all employees about their worker category, give information about how AE applies and let them know their rights. BrightPay Connect can help with the process of sending AE communications. You will have the option of sending and making the AE communications available on each employee's online portal where they can view, download or print the letter.

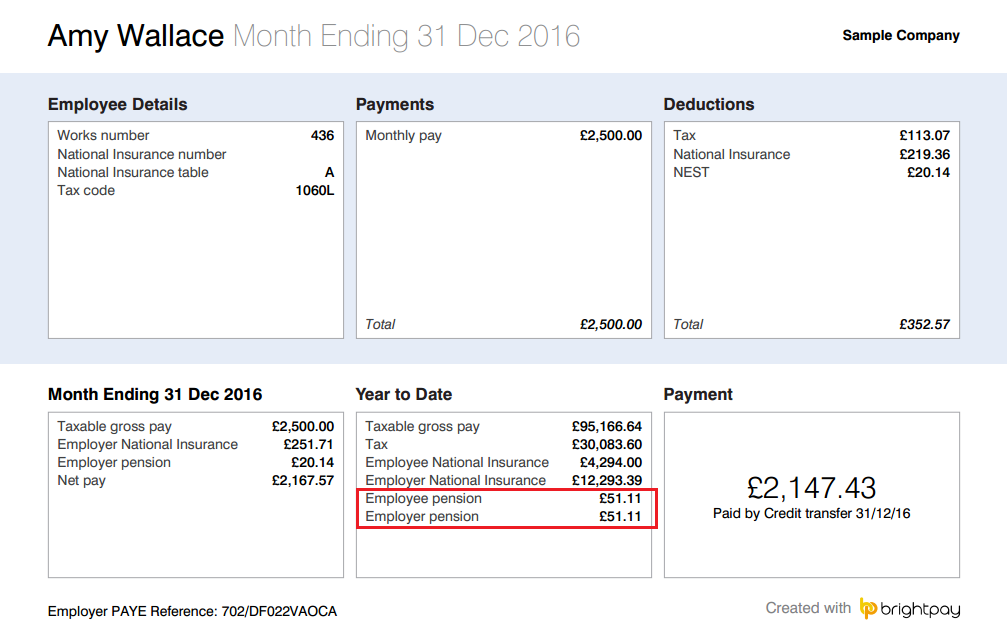

- Interactive Payslips

Part of an employer's duty is to calculate the correct contributions and deductions for each employee. This information should be visible on the employee's payslips displaying the employee and employer contribution amounts. BrightPay Connect allows employees to view and download all current and historical payslips. These interactive payslips will show these auto enrolment contributions for you. See a sample BrightPay payslip below.

- AE Compliance

To ensure compliance, it is essential that your staff records are correct, including employee dates of birth, salaries, National Insurance numbers, contact details and amounts being paid into the pension scheme each pay period. Having the correct information will ensure you have what is needed to run auto enrolment effectively. On the employee portal, employees can keep their contact details up to date and make any changes should their contact details need to be modified. As BrightPay Payroll and BrightPay Connect are fully integrated keeping up to date with your AE staff records is easy.

- AE Reporting

You are legally required to keep certain information and records for the purposes of AE. Poor record keeping could result in a fine being issued by the Pensions Regulator. All employers must provide certain information to the Pensions Regulator to let them know that they have complied with their AE duties. Auto enrolment reports can be set up and saved in your BrightPay payroll. Any saved reports will then be available to the payroll bureau and to the employer on BrightPay Connect.

- Mobile Access

People want their information on the go. Payroll bureaus, employers and employees can access their payroll data on any smartphone, desktop computer, tablet or laptop. Accessing your payroll and auto enrolment data on BrightPay Connect allows the processes to be easier and more flexible. Online access also allows for better communication regarding automatic enrolment between workers, employers and bureaus.

How BrightPay can help with Auto Enrolment

BrightPay payroll offers full auto enrolment functionality to take the hard work out of the employer duties for you. What’s more, there is NO additional charge for auto enrolment. Your payroll and auto enrolment duties must still be processed on the desktop BrightPay Payroll application.

The AE process in BrightPay Payroll

BrightPay can automate a lot of the administrative auto enrolment processes for you. Simply enter in the staging date and the rest is easy. When setting up your AE pension scheme, you will have the ability to set up your contribution rates too. Once you reach the staging date in BrightPay, the payroll will automatically assess all employees for you. From there, BrightPay will automatically produce the appropriate letters for each employee which can be printed, emailed directly to the employee, downloaded or uploaded to the BrightPay Connect self-service portal. Other AE tasks are seamlessly handled, including postponement, processing opt in, opt out or join requests, support for AE pension schemes and AE reporting.

Find out just how easy the entire process can be. Book a BrightPay Connect demo today.

Sep 2016

9

BrightPay to showcase BrightPay Cloud at Accountex

We are excited to be able to showcase our new BrightPay Cloud product at Accountex 2017!!!

BrightPay have just launched an innovative online tool for payroll bureaus, employers and employees. BrightPay Cloud is an add-on to BrightPay Payroll bringing exciting new online features to our customers. BrightPay cloud is not a ‘cloud version’ of the desktop version of BrightPay. Rather, BrightPay Cloud provides a way to connect your payroll data to the cloud to enable new features.

Processing your payroll will still be managed and maintained on your BrightPay Payroll which will remain a desktop based solution. We recognise that employers and their employees want a certain level of cloud functionality to access their payroll information on the go, online and at anytime.

BrightPay Cloud Explained

- Automated Cloud Backup

Until now, BrightPay customers had to manually back up their payroll data. Even if your data is regularly backed up onto your computer, you could lose it all if your computer is broken, lost or stolen. Manually backing up succumbs to human error along the way too. Using BrightPay Cloud, your payroll data will be automatically backed up every 15 minutes to a secure cloud facility. Any changes you make to your payroll data in BrightPay will automatically be synced back to the Cloud.

- Payroll Bureau Dashboard

Bureaus can view each client's payroll information on one online dashboard including the employer's paye reference code, payroll reports, employer annual leave calendar, when the last payroll has been finalised to and more. Payroll bureaus can invite their clients to their own personal self service employer portal. Likewise employers can also invite their accountant to BrightPay Cloud. Bureaus can also view the schedule of HMRC payments, any outstanding payments due and access the P30 for each tax period. The bureau dashboard allows you to save time, reduce admin and collect your clients payroll information as you need it.

- Employee & Employer Self Service

Employers can access their own self service dashboard online where they can view their employees information, manage holiday leave requests, access payroll reports and view scheduled HMRC payments and liabilities. Employers can also grant their employees access to an interactive, online self service portal. Employees can log on and view their payslips and other relevant payroll documents such as P60’s. Employees can even request annual leave from the self service portal. A notification will then be visible on the employer's dashboard and also emailed to them informing them of any employee request.

- Bureau Branding / White Labeling

Accountants or payroll bureaus may wish to brand BrightPay Cloud with their own logo. Not only does the Cloud allows accountants to add value to their existing payroll services but also helps position their company branding with their clients. Employers will additionally have the feature to brand their self service portal with their branding.

For more info click - BrightPay Cloud Features or BrightPay Cloud Overview.

Accountex 2017

BrightPay will be back again at Accountex 2017. With over 6,500 visitors through the door, Accountex is the place to be to meet the very best of accountants, suppliers and key influencers in the accounting space. For BrightPay, it is the perfect platform to introduce our latest Cloud product to the accounting industry. Drop by our stand and say hello. Our team would be happy to take you through the benefits and features of BrightPay Cloud.

Aug 2016

11

Introducing BrightPay Cloud

We’re pleased to announce that BrightPay Cloud is now available.

BrightPay Cloud brings several new features to BrightPay. These are described over on the dedicated BrightPay Cloud section of our website, and they aren’t covered in the same detail here. In this article, I’ll give you a background to BrightPay Cloud, where it currently stands, and where we’re heading next.

Background

When we launched BrightPay in the UK back in 2011, the payroll software landscape was different. There was no RTI, and Auto Enrolment was still half a decade away for most employers. After noticing that the majority of payroll software product options had stagnated and were drawing many complaints from their customers, we entered BrightPay into the market as a nice, modern, easy to use and fairly priced alternative. We had our work cut out for us over the subsequent years adding features and responding to the big industry changes as they transpired. We’re very pleased to have been successful in our endeavours, as attested to by a browse through the BrightPay customer testimonials.

One feature area that has been trending in recent years is cloud functionality. BrightPay has always had a certain amount of cloud connectivity – software updates, licensing, emailing payslips and help documentation are all powered via the cloud, as are features like RTI and NEST submissions, as well as Auto Enrolment staging date checking. But there have been a number of big requests from customers over the years that we have not provided a solution for.

Until now.

Automatic Cloud Backup

Your payroll data is important. You need it to pay your employees accurately and on-time and to comply with HMRC reporting requirements. It’s not something you want to lose.

But backing up this important data often succumbs to human error. For example, we’ve heard from many customers over the years who requested that BrightPay would regularly remind them to backup their payroll data, simply because they forget. But a problem with a solution like this is that manually backing up data adequately is complicated. It’s not good enough to keep a backup of your files on your computer, as you can lose everything if your computer breaks. USB keys are handy, but they get lost. An off-site storage solution with data redundancy and geo-replication works great, but not everyone’s an IT expert.

So we wanted to provide a backup solution for BrightPay that just works.

With BrightPay Cloud, your payroll data gets automatically backed up to a secure cloud repository without you having to do anything – it’s that simple. As you run your payroll or make any other changes to data in BrightPay, it synchronises in the background. And it doesn’t just keep the latest backup - it keeps a history of backups, so even if you accidentally delete or change anything only to realise the mistake much later, you’re still covered. You can restore a cloud backup onto your current computer, or onto a new computer, at any time.

Employee Self Service

Many employers have already transitioned from printed payslips to digital payslips, often delivered via email. But wouldn’t it be great if employees had somewhere they could go to not only get their latest payslip, but to also access their entire history of payslips and other payroll documents at their own convenience? And what if they could easily see their own calendar of leave and personal tax details without having to contact HR?

BrightPay Cloud provides this facility through a feature called Employee Self Service. Using Employee Self Service, employees can do all the aforementioned tasks using their PC, Mac or smartphone. They can also make requests for leave and submit updates to their personal details, which, if approved, automatically synchronise back down to BrightPay on your PC or Mac.

You can set up Employee Self Service for your entire workforce or just a subset of employees, and you can control what they see and which features they have access to. Self Service will automatically notify your employees via email when their latest payslip or P60 is available.

How does BrightPay Cloud ensure employees always have access to the latest data? Well, as mentioned above, BrightPay Cloud automatically backups up your data to the cloud as you make changes. Self Service is powered by your most recent backup, and so, it just works.

Bureau Client Self Service

Accountants and payroll bureaux get both of the above features with BrightPay Cloud – employer data files are automatically backed up, and your client’s employees can all get access to Employee Self Service.

But there’s more. Using BrightPay Cloud, you can provide an Employer Dashboard for your clients as well, allowing them to not only view their employees’ information, but also see an employer-wide calendar, access payroll reports that you define in BrightPay, and view the schedule of HMRC payments and liabilities.

Your clients can also use their Employer Dashboard to approve the leave requests and personal details update requests made by their employees, all of which synchronises back down to your data in BrightPay. You can give access to as many contacts for your clients as need be.

Data Protection and Security

Our number one priority when creating BrightPay Cloud has been security. We spent a lot of time getting the best possible foundation and architecture in place before doing anything else.

The various data repositories and services which make up BrightPay Cloud are built using a compartmentalised design that maximises security. Strong encryption is used to store all data, as well as in communication with your PC or Mac. All popular kinds of attack are protected against. Your data is accessible only by you.

We selected the Microsoft Azure platform to power BrightPay Cloud, giving us reliability, scalability, data redundancy, geo-replication and timely security updates out of the box.

It’s worth noting that the most common weakness in any system like BrightPay Cloud is a poor password, so when choosing a password please remember to select something adequate, keep it safe, and change it often.

Pricing

BrightPay Cloud costs just £49 per employer, per tax year (plus VAT). That price gives you a full year of cloud backups and Self Service for ALL your employees. When you renew BrightPay Cloud in the following year (at the same price), we will maintain the previous year’s data.

Bureau users, who may wish to purchase BrightPay Cloud for multiple clients, can get a bulk discount depending on how many employers they require (see pricing for details). The BrightPay Cloud pricing model is employer-based, unlike that for BrightPay on your PC or Mac, because it runs on a cloud platform that costs us in direct proportion to its usage. But we're competitively priced, and you still get the same support at no extra cost.

So What’s Next?

Our immediate plan is to continue making improvements to BrightPay, while enhancing BrightPay Cloud with advanced configurability, more features and additional access options.

We received a lot of responses to our recent BrightPay customer survey, which we have used to build a prioritised development plan. You can expect see several more BrightPay upgrades during the 16/17 tax year, and some nice new features for 17/18.

We’ve started building Self Service mobile apps for BrightPay Cloud to make it even easier and more convenient for employees to access their payroll information. And we have plans for improved branding and customisation, timesheets and more HR features.

We get asked from time to time about any plans we may have for a complete cloud version of BrightPay which could be used entirely via your web browser. While this is something we are continually looking at as we monitor the industry and customer expectations, we don’t have any announcements at this stage. Rest assured that even if we do go down that route in the future, the existing PC/Mac version is not something that would go away any time soon – we foresee a long lifespan for BrightPay and BrightPay Cloud, and look forward to working with you for many years to come.

We’re pleased to announce that BrightPay Cloud is now available.

We’re pleased to announce that BrightPay Cloud is now available.