Mar 2020

18

Customer Update: March 2020

Welcome to BrightPay's March update. Our most important news this month include:

-

Covid-19 - Are you Ready?

-

The Challenge of the Coronavirus & Remote Working with BrightPay

-

Statutory Sick Pay (SSP) & Covid 19

BrightPay 2020/21 is now available to pre-order

BrightPay 2020/21 is scheduled for release the week ending 27th March. We will send you another email once it is released and ready to download. This further email will also be accompanied by a full list of the new 2020/21 features and legislative updates.

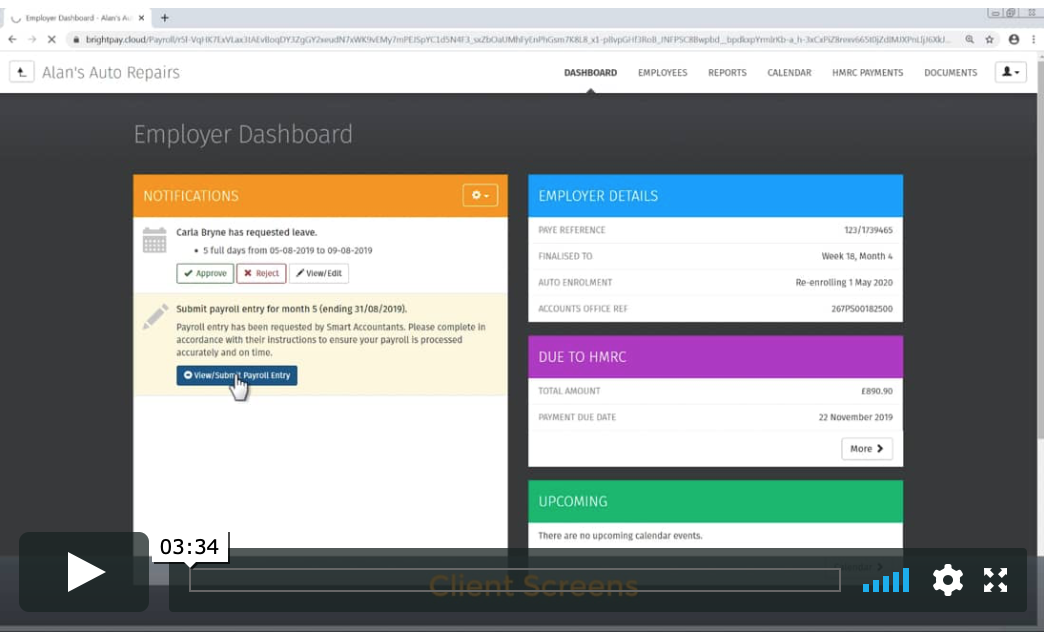

The Challenge of the Coronavirus & How BrightPay can Facilitate Remote Working

Businesses are understandably concerned about the steps they should be taking to manage the risk of COVID-19. We would like to provide reassurance to our customers that BrightPay is well prepared. Many businesses are now putting precautionary measures in place to combat the spread of the virus and to protect their employees. BrightPay can facilitate the option to work from home, which is one of the primary ways businesses are changing the way they operate.

How BrightPay Connect pricing is calculated

BrightPay Connect customers will be billed on a usage subscription model based on the number of employees in the billing month. This monthly subscription pricing model means that you only pay for what you use. For the vast majority of customers, this new billing model will result in a reduced annual cost.

BrightPay Connect is priced based on the number of active employees in a particular month. This means that you won't be charged for employees who left before the start of the month, or who are on the payroll but not due to start until after the month-end. The cost per month is scalable, depending on the number of active employees. The cost per employee reduces as you add more employees.

How to Handle SSP & Covid 19

HMRC have advised that if you need to take time off work to self-isolate due to Covid 19, the first 3 waiting days that normally apply for SSP will be disregarded and you will be entitled to receive SSP from the first day.

As this is a unique case and BrightPay is programmed to take into account the usual 3 waiting days, an override should be performed in BrightPay by simply marking the previous 3 days on the employee's calendar as sick leave. The SSP to be applied will then be from their first actual day of self-isolation/sick leave. The government will work with stakeholders over the coming months to set up a repayment mechanism as soon as possible.

Feb 2020

19

BrightPay 2020/21 is now available to pre-order

BrightPay 2020/21 is scheduled for release the week ending 27th March. We will send you another email once it is released and ready to download. This further email will also be accompanied by a full list of the new 2020/21 features and legislative updates.

New BrightPay Connect Subscription Pricing Model

From April 2020, BrightPay Connect customers will be billed on a usage subscription model based on the number of employees in the billing month. This monthly subscription pricing model means that you only pay for what you use. For the vast majority of customers, this new billing model will result in a reduced annual cost.

Invoicing will be monthly in arrears e.g. usage in April 2020 will be billed and payable in May 2020.

You will need to enter some basic information on our new online billing system, which will be available shortly. We will notify all Connect customers once it is available.

Note: Your payroll software desktop licence will continue to be charged on a per tax year basis.

What do you need to do now?

Nothing. Your BrightPay payroll software 2019/20 licence will continue to work as normal until the end of the tax year. Pre-order BrightPay 2020/21 today and we will email you when it is available to download. Our BrightPay Connect billing system will be available shortly and we will notify all Connect customers when it is up and running.

Jan 2020

30

Customer Update: January 2020

Welcome to BrightPay's January update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

Easily integrate BrightPay with your accounting software

-

BrightPay Connect monthly subscription pricing - How will it work?

-

What the Tory victory means for IR35 and off-payroll working

Free Webinar: Last chance to register!

Payroll transformed: How cloud platforms supercharge the payroll process for employers

Join BrightPay for a free webinar where we look at cloud innovation and how it is positively impacting the payroll process for employers. Not in the distant or even medium-term future: this is happening right now. Register now to see how next-generation cloud features can revolutionise your business.

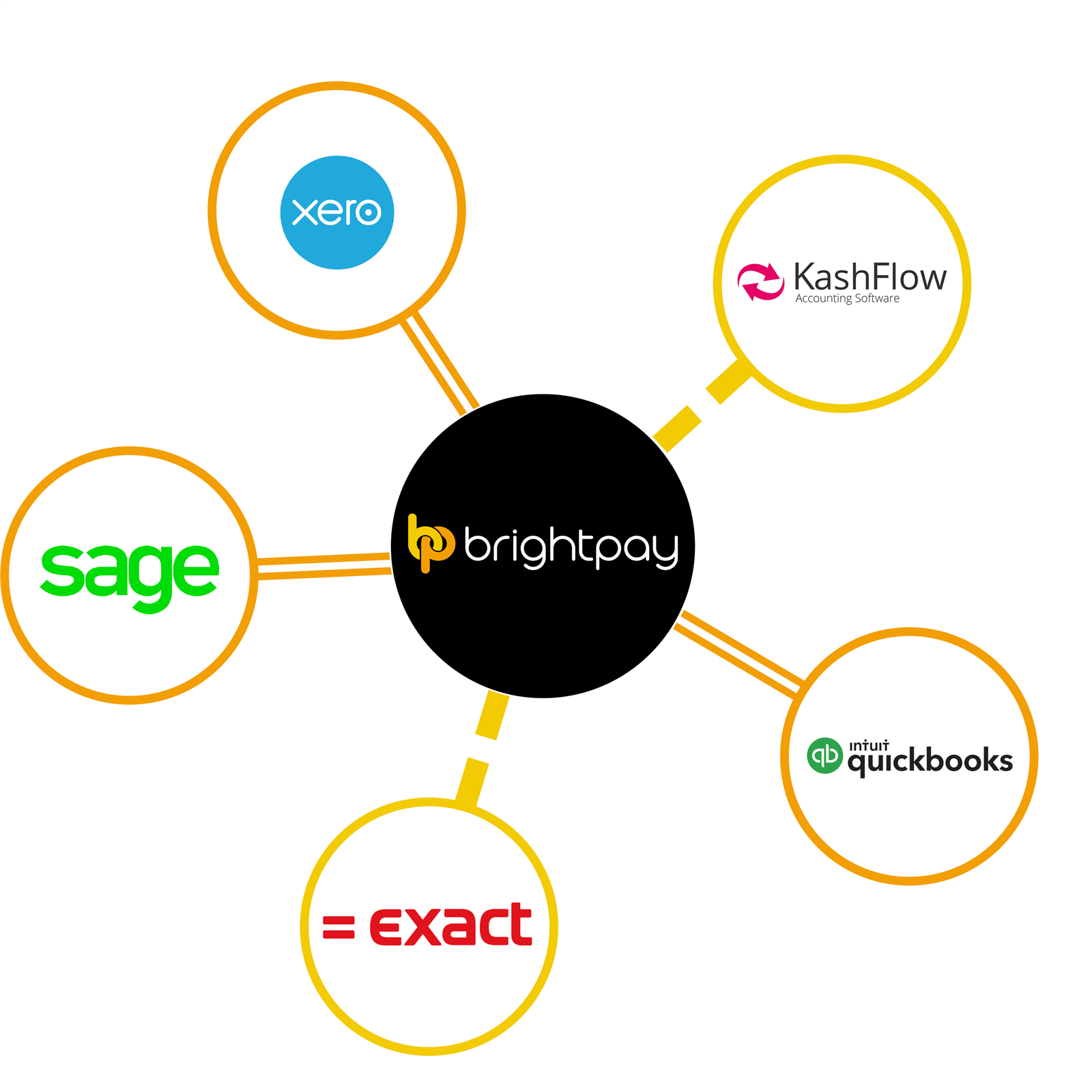

Easily integrate BrightPay with your accounting software

BrightPay’s payroll journal feature allows users to create wage journals from finalised pay periods so that they can be added into various accounting packages. With this direct integration, users will be able to send the payroll journal to the accounting package directly from within BrightPay. BrightPay includes direct API integration with Sage One, Quickbooks Online and Xero, and coming soon is integration with FreeAgent, AccountsIQ, Kashflow and Twinfield.

Employer obligations: Simple ways to comply using BrightPay Connect

There's been a lot of talk recently about online client platforms. They can bring many benefits to both employers and employees alike - from online payslip access to annual leave management to a HR document hub. But can cloud payroll portals really help with employer obligations? Here we look at how BrightPay Connect can help with record keeping requirements, employment law obligations and GDPR compliance.

Annual Leave Management: Say Goodbye to Paper Trails and Excel Spreadsheets

Minimum Wage Rates Increase from 1st April 2020

It has been announced that on the 1st April 2020 the minimum wage will increase by amounts ranging from 4.6% to 6.5%. An employee's age and if they are an apprentice will determine the rate they will receive. BrightPay can track employee hourly rates against the National Minimum/Living Wage (including apprentices), UK Living Wage, London Living Wage, or they can be marked as not eligible.

Dec 2019

5

Customer Update: December 2019

Welcome to BrightPay's December update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

How to choose the right Cloud HR platform for your business

-

Batch processing in BrightPay - so hot right now

-

Flexible working in the world of accountancy

The interactive digital payslip has arrived - Free for BrightPay Customers

You can now do so much more than simply manage the payslip process. BrightPay Connect offers an online self-service platform and an employee app. Employees have 24/7 easy access to view the payslips anytime, anywhere, using your smartphone, tablet or desktop computer. Historic payslips and P60s are available to access and download. BrightPay Connect offers employees:

- Ability to request annual leave on the go

- Current and historic payslip library

- Access to uploaded HR documents, such as contracts of employment and company handbooks

- View leave taken and leave remaining

- Holiday leave yearly calendar

- Access to edit and update personal contact details

Client Payroll Approval. This is what you must be offering as a service (and why clients will LOVE it)

BrightPay Connect’s Payroll Approval Request allows bureau users to securely send their clients a payroll summary before the payroll is finalised. Clients can then review and authorise the payroll details for the pay period through their online employer dashboard. Ultimately, your client will be accountable for ensuring the payroll information is 100% correct before the payroll is finalised. Additionally, there is an audit trail of the requests being approved by the client.

New AccountingWEB Live Conference for Accountants - Will you attend?

The popular AccountingWEB online platform has announced a new conference for accountants. AccountingWEB Live is a unique blend of technology showcase, educational workshop and inspiring content. As well as a full content programme, AccountingWEB Live will feature showcases from the UK’s leading technology brands, demonstrating the latest products, updates and solutions. We are delighted that BrightPay will exhibit at AccountingWEB Live next year to showcase our latest features.

New BrightPay Connect Subscription Pricing Model

From April 2020, customers will be billed on a usage subscription model based on the number of active employees in the billing month. Once signed up for a BrightPay Connect account, you will be invoiced monthly in arrears through our new online billing system. There are no contracts or ties. Should you decide to stop using Connect, no notice is required. Payroll Bureaus on a bureau package will be charged based on the total number of active employees in respect of clients that are synchronised to BrightPay Connect (not on a client-by-client basis).

Why employee apps are the future of payroll

The advancement of employee mobile apps offers many different advantages for employers, employees, and the business as a whole. Payroll apps will streamline payroll processing while reducing the number of payroll queries from employees. The BrightPay Connect self-service app provides a digital payslip platform where employees benefit from secure access anytime, anywhere, using their smartphone or tablet. Through these app features, you can provide your employees with access to GDPR compliant self-service tools, a payslip library and a user-friendly holiday leave management facility.

Nov 2019

14

Customer Update: November 2019

Welcome to BrightPay's November update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

IR35 clampdown - Three BBC presenters are made pay back a total of £92,000

-

Expand your payroll services with online client platforms

-

3 GDPR myths you need to ignore

Online payslips offering enhanced GDPR security

Manually approving requests, keeping track of the employees’ annual leave and inputting new data into the payroll software takes a lot of time and can be a frustrating administrative burden for both payroll and HR staff. To make the process easier for all parties involved, the BrightPay Connect app provides a self-service platform that employees can access anytime, anywhere, using the smartphone app or online portal.

CPD Accredited Webinar: Expand your payroll services with online client platforms

Standing out in a crowd of other payroll bureau providers is no easy task, and it’s getting more difficult all the time. Difficult, but not impossible. As a payroll bureau, you need to find unique ways to differentiate your practice from all the others.

Cloud innovation and online client portals are making it easier than ever before for bureaus to offer value-added service. Savvy bureaus are implementing client online dashboards customised with their own bureau branding to effectively differentiate themselves, in order to stand out from their competitors.

Accountants rewarded who take a leap of faith into the cloud

All of us, in the hyper-connected internet era, have found ourselves at a loss when using some software, website or app. You just want to do one thing, or you want to set something up and... you just can’t. It might feel like specific software or apps are testing us in some way. Only those who can navigate through the narrow tunnels of this software are genuinely worthy, in some weird twist on the Arthurian legend of Excalibur.

Clients can now input their employee hours into BrightPay

BrightPay Connect allows bureau users to securely send payroll entry requests and payroll approval requests to their clients, changing the way payroll bureaus interact and communicate with clients. Clients can securely add their employee’s hours saving bureaus hours of administrative time each pay period. Ultimately, your client will be accountable for ensuring the payroll information is 100% correct before the payroll is finalised. Additionally, there is an audit trail of the requests being approved by the client.

Do you want more empowered employees?

Despite the political and social chaos of the moment, we do live in more enlightened times, and employees have more rights now than ever before. Part of that evolution involves empowerment, an integral aspect of BrightPay Connect’s appeal. Payroll bureaus can now offer their clients’ employees easier online access to manage their own payroll information, annual leave, personal contact data and payslips on the go.

Employees can browse and download their history of payslips and other payroll documents, view their payroll calendar, including annual leave, sick leave, and parenting leave, make changes and direct annual leave requests, fully informed.

Oct 2019

17

Customer Update: October 2019

Welcome to BrightPay's October update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

Are employees receiving the National Minimum Wage?

-

BrightPay Connect’s smartphone app

-

Online payslips offering enhanced GDPR security

Free webinar: Payroll transformed - How cloud platforms supercharge the payroll process for employers

The relationship between employees and the employer is no longer one-directional. What software has created is a new collaborative framework in which employers can easily engage with their employees while managing payroll and HR processes. Payroll software with cloud integration envelops the day-to-day tasks like annual leave management, payslip distribution and backing up your payroll. Register for this FREE webinar where we’ll zoom in on six exciting ways that employer cloud platforms have transformed the payroll process.

Changes to Student Loans from 6th April 2020

New rates for the tax year 2020/21 for Student Loan Plans 1 and 2 have been announced by the Department of Education. The new rates will apply to all current and future borrowers for whom employers make Student Loan deductions. In BrightPay 2020/21, the new student loan repayment thresholds for both plans will automatically be calculated and the appropriate student loan deduction applied.

New Feature Announcement: Batch Operations for Payroll Bureaus

BrightPay users have the ability to batch process multiple employers at the same time. This feature is very useful for bureau users, especially for those with a lot of single-director companies or payrolls that don’t change from week to week. The Batch Operation function enables users to process or perform a task on multiple employer files with a single click. Batch processing is available to finalise payslips, to check for coding notices and to send outstanding RTI & CIS submissions for multiple employers at the same time.

Have you heard of our smartphone app which is free for employees?

BrightPay’s employee self-service smartphone and tablet app is available with our cloud add-on BrightPay Connect. The user-friendly app streamlines the payroll processing while reducing the number of payroll queries from employees. The benefits for employees include:

- Instant access to current & historic payslips.

- Request leave on the go.

- View holiday leave remaining and leave taken.

- View HR documents such as employee contracts & handbooks.

- Edit personal contact information including address and phone number details.

Free webinar for payroll bureaus: Cloud platforms - the next generation payroll trend that every bureau should adopt

Online client platforms are transforming payroll services to increase the efficiency and effectiveness of payroll work. BrightPay is running a series of free webinars where we look at cloud innovation and how it’s positively impacting the way bureaus and accountants offer payroll services. Join us for our upcoming webinar as we take a look at what’s new with cloud technology and how it may affect your payroll processing.

Jun 2019

4

Customer Update: June 2019

The hidden benefits of an employee self-service system

The ability for employees to view and edit their own data is one of the most important advancements of HR in recent years. Providing employees with remote access to view personal information is also a best practice recommendation of the GDPR. It's obviously true that employees have a lot to gain from a self-service system, but what about HR personnel, managers and everyone else involved in the payroll and HR process? They benefit too!

Payroll Implications of Brexit

Britain is currently like a cat that waits at the door crying to be let out but once the door is open, decides it doesn’t want to leave anymore. But never mind all these bigwigs in Westminster saying how this will affect that and so on; today I want to talk about what Brexit means for the unsung heroes of HR, in particular, payroll. How will leaving the EU affect their everyday work life? We have put together four key areas to note.

DIY payroll: Empowering clients with self-service remote access

There’s a lot of talk these days about ‘customer-centricity’, in particular integrating your clients into the processes that serve them. The internet makes it easy for clients to help themselves because they can access specific functionality that isn’t confined to a single location or computer. Download our free guide where we discuss DIY payroll and more ways that innovation is improving payroll as a service.

BrightPay back with a bang at Accountex 2019

The BrightPay team were back at Accountex again this year for our fifth year in a row. It was great to meet with so many existing customers and new customers and get to speak with them face-to-face. Don’t miss out - if you didn’t attend, make sure to book a demo and download our brochure today to find out about our newest features.

Download brochure | Book a demo

Three quick things that will really help accountants

18 months ago, the book “What’s next for accountants” stayed at Number 1 on Amazon for three weeks, and was hailed by accountants and gurus across the world as a “must read”. We have persuaded the author (Shane Lukas) to celebrate the 20th anniversary of his business by giving you three ground-breaking gifts.

New User Management Interface for Connect

Our new User Management feature for BrightPay Connect makes it more seamless and quicker for users to be set up or amended. It offers the option to select permissions for multiple employers at one time for a standard user. There is also a new permission to allow standard users to connect and synchronise employers from BrightPay to Connect and a new feature to mark an employer as confidential.

Happy Birthday GDPR!

Yes, that’s right folks, on May 25th of this year our beloved GDPR turns 1 year old! *dries eyes* - they grow up so fast. We all know that GDPR has been a resounding success but we also know that, like all 1 year olds, there's been some teething problems. So let’s take a look back through our photo album of the past year and see how our little trooper has fared over its first year.

Digital trends that every employer should know

It’s predicted that by 2020, the global workforce would be dominated by millennials and generation X. That means by next year, over 70% of the global workforce will be under the age of 40. A younger workforce presents knock-on effects for the entire business. As an employer, you need to adapt to meet the expectations of this new generation of employees; they’re very different from the workforce that preceded them.

From the support desk: Can BrightPay be accessed from multiple users on different machines?

BrightPay employer data files can be stored on a shared network drive or cloud drive to be accessed by multiple PCs or Macs. The BrightPay software application must be installed on each individual PC or Mac you wish to use to access the shared location. A single BrightPay licence allows for up to ten installations.

More FAQs | Online Documentation | Video Tutorials

Key issues facing your payroll department in 2019

The CIPP unveiled their latest “Future of Payroll Report” (2019) for the second year running and surprisingly, it’s not a total snoozefest! The report acknowledges that whilst payroll software and technology make things easier, the number of enquiries does not decrease and payroll departments need to be on the ball to be in a position to answer these queries effectively.

Apr 2019

16

Customer Update: April 2019

Why employees love self-service apps (And you should too!)

As a concept, self-service is nothing new. From paying at the supermarket self-service checkouts to online banking, consumers don’t want to have to wait for assistance if they know they can get it themselves. It’s no different in the workplace. With a self-service system, employees can download payslips, request annual leave, look at policies and HR documents and update personal information - all without once contacting HR personnel.

Read more | BrightPay Self-Service App

NEW: Payroll Journal Direct API Integration with Accounting Packages

BrightPay now includes direct API integration with Sage One, Xero and Quickbooks Online. With this direct integration, users will be able to directly send the payroll journal to the accounting package from within BrightPay. This accounts software integration eliminates the need to export CSV files from the payroll software and import them into the accounting system, saving time and reducing the risk of errors.

Payroll Bureaus: The 7 Unmistakeable Benefits of Client Payroll Entry

BrightPay Connect is better than ever before. Bureau customers now have the ability to send requests to clients through BrightPay Connect’s secure portal. Requests can be sent to get client approval of the payroll summary before the payroll is finalised or to ask clients to upload their employees’ timesheets and payments, known as Client Payroll Entry.

BrightPay 2019/20 is now available to download - What’s new?

The release includes exciting new features to make your payroll journey easier and less time consuming, including:

- 2019/20 legislative changes

- Automatic Enrolment Updates

- Real Time Information

- More Flexible Journals

- Journal API Support

- Importing Pay Records from CSV

- Improved Support for Offset Annual Leave Year

- CIS Updates

- BrightPay Connect - Cloud Add-on

See what’s new | Buy now | Download BrightPay 2019/20

Looking for customer support? See if our website can help!

It's currently a busy time for our customer support and phone lines with the 2018/19 tax year coming to an end and the new tax year commencing. We have updated our FAQs to include the top 10 questions that we get asked. You can also search our online support documents before getting in touch. You may get the answer to your query so much more quickly!

Visit FAQs | Visit Online Docs

Payroll Bureaus: The big four: How payroll leapt into the future

In the six years since BrightPay was launched, a new wave of payroll innovation and cloud access has completely remoulded the sector, from onerous, manual input into a low effort, dynamic and automated service offering. Download our free guide for payroll bureaus where we look at four specific areas where cloud innovation is already impacting the future of payroll.

Payslips in the cloud is the future for payroll

When it comes to being GDPR compliant, you might think that you only need to password protect all the payroll reports and payslips. There is nothing in the GDPR legislation that states it is no longer permissible to email payslips, that doesn’t mean you can email payslips without protecting the information you send. There is a strict process that needs to be followed.

Accountex 2019 - will you be there?

It’s that time of year again where accountants, bookkeepers, practice managers and finance directors are preparing to travel from all over the UK to Accountex. Discover the latest technical tools from over 250 exhibitors that could help you run your practice more efficiently and productively. After winning Payroll Software of the Year 2018 at the Accounting Excellence awards, the BrightPay team are back with a bang this year, our fifth year in a row.

Auto Enrolment Phasing - Part Two

Minimum auto enrolment contribution rates faced further increases on 6th April 2019, with the total minimum contribution rate now at 8%. Employers are now required to contribute a minimum of 3%. Employees need to contribute the remaining 5%. Find out more about the various scenarios that can occur and how to handle them in BrightPay.

Mar 2019

14

Customer Update: March 2019

Big changes are happening to payslips in 2019 - are you ready for them?

Every new year brings with it a host of changes and 2019 is no different. Here’s a quick recap of the two most important changes that have happened/are yet to happen to our lovely payslips in the 2019/20 tax year.

BrightPay 2019/20 is now available to pre-order

BrightPay 2019/20 and BrightPay Connect are now available to pre-order. BrightPay 2019/20 is scheduled for release week ending 22nd March. We will send you an email once BrightPay 2019/20 is released and ready to download. All customers will also receive a full list of new features when BrightPay 2019/20 is released.

Pre-order BrightPay 2019/20 here

Thinking about switching to BrightPay? Book a demo today

BrightPay won Payroll Software of the Year 2018 at the Accounting Excellence awards. With a 99% customer satisfaction rate, our products are used to process the payroll for over 200,000 businesses across the UK and Ireland.

“BrightPay is so much better than the software that we used previously. I get my work done much faster, and it is just so easy to use.” - Simon Gledhill, Gerard Tool & Die Limited

Book a demo | 60 day free trial | More testimonials

Auto Enrolment Phasing - The Second Coming

Under automatic enrolment, minimum pension contributions are required to increase over time. The first increase took place last April at the start of the 2018/19 tax year. The second increase will take place on 6th April 2019, with the total minimum contribution rate increasing to 8%, representing a 3% employer and 5% employee contribution. These increases are seamlessly handled by BrightPay 2019/20.

A Quick Recap: What's new in BrightPay 2019/20

With the 2019/20 tax year fast approaching, this 60 minute webinar will cover the main legislative changes coming into effect and how they will be handled in BrightPay 2019/20, as well as the new functionality we will be introducing into the software. We will also look at a quick introduction to the BrightPay Connect add-on product.

BrightPay Connect’s Employee SmartPhone App

BrightPay’s employee self-service smartphone and tablet app is available with our BrightPay Connect add-on. Employee mobile apps offer many benefits for employers, employees, and the business as a whole. The user-friendly portal will streamline payroll processing while reducing the number of payroll queries from employees.

Read more | Book a BrightPay Connect demo

EU Settlement Scheme: What employers can do to help their EU employees

The UK is due to leave the European Union on the 29th of March 2019. There are thousands upon thousands of EU citizens currently employed by British companies that will end up being illegal workers if they do not apply for settled status by the deadline. You as the employer, have an obligation to prepare them for this and make sure that your house is in order.

Bureaus: The benefits of an online payroll approval facility

A time consuming part of payroll is requesting and receiving employee hours and timesheets from your payroll clients. Today, managing and tracking this information is much easier thanks to online tools and applications. Ultimately, your client becomes accountable for ensuring the payroll information is 100% correct before the payroll is finalised.

Read more | Book a BrightPay Connect demo

Bureaus: Keeping your clients payroll data secure to avoid data breaches & fines

Security is extremely important in payroll bureaus. After all, you are handling the personal and financial data of your clients and your client’s employees, which puts you at risk of data breaches and cyber attacks. In order to comply with the current GDPR legislation, you also need to follow a strict process when processing the payroll data, and make sure that your system meets the GDPR regulation standards.

Feb 2019

13

Customer Update: February 2019

Free Webinar: How to use payroll to pay off your mortgage in 5 years

BrightPay is co-presenting a free webinar with the world’s most highly rated advisor to accountants, Steve Pipe. Discover how you can make payroll one of your most profitable and strategically important service lines. During the webinar, Steve Pipe will discuss a powerful new step-by-step system for using payroll to win really high-quality new clients.

View webinar agenda | Register for webinar

Pre-order BrightPay 2019/20 today!

BrightPay and BrightPay Connect are now available to pre-order. BrightPay is not available to download yet. We will send you an email closer to the new tax year once BrightPay 2019/20 is released and ready to download.

Pre-order BrightPay 2019/20 | Important Pricing Update

5 Reasons to Switch to BrightPay

- Awarded 2018 Payroll Software of the Year at the Accounting Excellence awards.

- BrightPay is used to process the payroll for over 160,000 businesses in the UK

- 99% customer satisfaction rate for BrightPay and a 99% satisfaction rate for customer support.

- Free phone and email support plus a range of online help guides, online training sessions and tutorial videos.

- 94% of customers report time saving benefits and 86% report cost saving benefits when using BrightPay.

Book a demo | Customer testimonials

Further increases to the minimum auto enrolment contribution rates

On the 6th April 2018, the total minimum auto enrolment contribution rate increased from 2% to 5%, representing a 2% minimum employer contribution with employees contributing the balance. Minimum contributions will undergo further increases on 6th April 2019, with the total minimum contribution rate increasing to 8%.

Minimum Contribution Increases (Phasing)

Payroll Bureaus - Say goodbye to manual payroll entry

We are sure you don’t enjoy that endless back and forth email exchange between you and your clients to request information about the time records and employee hours for their payrolls. BrightPay Connect is making things easier by allowing you to securely send payroll entry requests and payroll approval requests to your clients.

Find out more | Client Payroll Entry & Payroll Approval | Book a demo

9 reasons why client cloud platforms will be central to the future of payroll services

Payroll servicing is evolving to encompass a move towards cloud access and flexibility for you, your clients and their employees. Be ready to offer a new level of payroll and HR related services by embracing cloud innovation. This checklist will make it feasible to offer cloud platforms to clients while streamlining your payroll processing and increasing your profits.

Employee Self-Service: Reduce your workload immediately

BrightPay Connect includes a powerful and secure online portal for employees. With the online portal, employees can view a payslip library where they can download historic payslips and payroll documents, eliminating requests to their manager. Employees can also update their basic personal details including their postal address, contact details, and emergency contact details on any internet browser or from the employee smartphone app. This will ultimately reduce administration duties for managers.

How to make your payroll bureau more secure

Security is extremely important in payroll bureaus. After all, you are handling the personal and financial data of your clients and your client’s employees, which puts you at risk of data breaches and cyber attacks. Choosing a reliable system is the first step to keep all your clients’ data secure and avoid any risks.

Don’t mess with the minimum wagers or HMRC will make you pay

Back in August, the government made headlines in a name and shame exercise of epic proportions where they published the names of 239 employers who underpaid more than 22,000 employees. HMRC identified 5 main areas as reasons for national minimum and living wage underpayments.

Customer Case Study: Trendzer

Trendzer was using a complex and clunky payroll solution that offered only paper payslips up until December 2014. “We wanted an automated solution that was user-friendly and easy to manage. After trialling a few systems, we decided BrightPay was the best solution out there. BrightPay stood out to us as it was very simple to use and it had a clear, intuitive interface.”

Did you miss it? Important Pricing Update for BrightPay 2019/20

We introduced the initial version of BrightPay over seven years ago. Since then, we’ve added hundreds of powerful features and enhancements, with many more planned for the future. To keep pace with the value that BrightPay provides, we’re increasing our pricing from 2019/20 onwards. This will ensure that we can continue to develop and support the best payroll software in the UK.

Read more | View new features | View pricing

Steve Pipe’s gift copy of this Amazon best-selling book. Do you want it?

The book comes with an invitation to an executive briefing Steve Pipe has arranged for you. As you probably know, Steve is a former UK Entrepreneur of The Year who, according to LinkedIn, is also the world’s most highly rated accountant. The executive briefing starts at 11.00 am on the 4th of April, and you can reserve a virtual seat as our guest here. Best of all, you will also be able to instantly download your gift copy of the Amazon best-selling book that Steve first published his research in, AND the step-by-step system that makes it all really easy to do.

Are you missing out on BrightPay's newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!