Jan 2019

22

Customer Update: January 2019

Simplify your annual leave management with BrightPay Connect

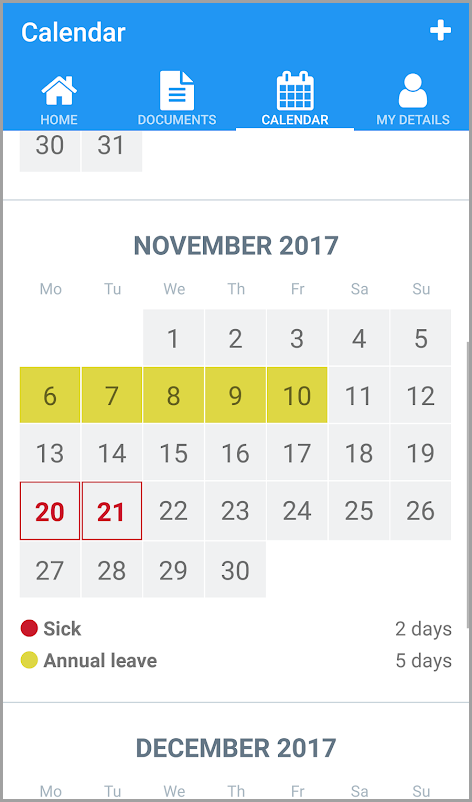

Annual leave management is something a lot of payroll and HR staff consider to be an administrative nightmare. Having to manually approve requests, keeping track of employees annual leave remaining and inputting leave into the payroll software can be a frustrating requirement that takes up far too much time. Nowadays, employers prefer an all-in-one, self-service option, and that’s what BrightPay Connect offers.

Read more | Book a BrightPay Connect demo

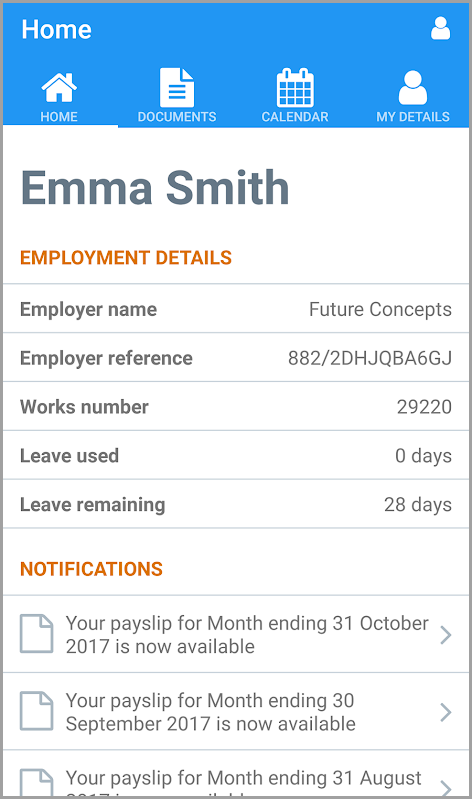

Our new Smartphone Employee App - Online Payslip & Leave Request Features

The BrightPay Connect smartphone app introduces powerful features providing a digital payslip platform where employees benefit from secure access anytime, anywhere, using their smartphone or tablet. The employee app is available to download on any Android or iOS device. Through these app features, you can provide your employees with access to GDPR compliant self-service tools, a payslip library and a user-friendly holiday leave management facility.

Find out more | Book a BrightPay Connect demo

New Feature - Direct Integration with The People's Pension

BrightPay now offers direct integration with The People’s Pension. This integration links the payroll software and pension provider together so that users can seamlessly submit pension files to The People’s Pension from within BrightPay. With just one click, users can instantly submit contribution files to The People’s Pension, eliminating the need to export the file and then login to The People’s Pension portal to upload the file.

Reasons to switch to BrightPay

- BrightPay has a 99% customer satisfaction rate and a 99% satisfaction rate for customer support.

- 99.5% of users describe BrightPay's interface as user friendly.

- 99% of customers think that BrightPay offers value for money.

- 86% of customers report cost saving benefits and 94% report time saving benefits.

Emailing Payslips, Employee Consent & GDPR Recommendations

Businesses must provide their employees with information on what happens to their payroll data. Employee personal data can be stored and managed by a payroll bureau, bookkeeper or accountant for the sole benefit of correctly paying their wages, paying the correct tax and providing a payslip. All of this legitimately falls under the remit of the GDPR legislation.

BrightPay to exhibit at Accountex 2019 in May

That’s right, the BrightPay Team will be back at Accountex this year with a bigger and better stand. Don’t forget to call over and visit us and find out why BrightPay is the accountants favourite payroll software provider. Accountex is a world-class conference and exhibition offering free CPD workshops on all the latest knowledge and information about industry products and trends. Admission is FREE to pre-registered visitors.

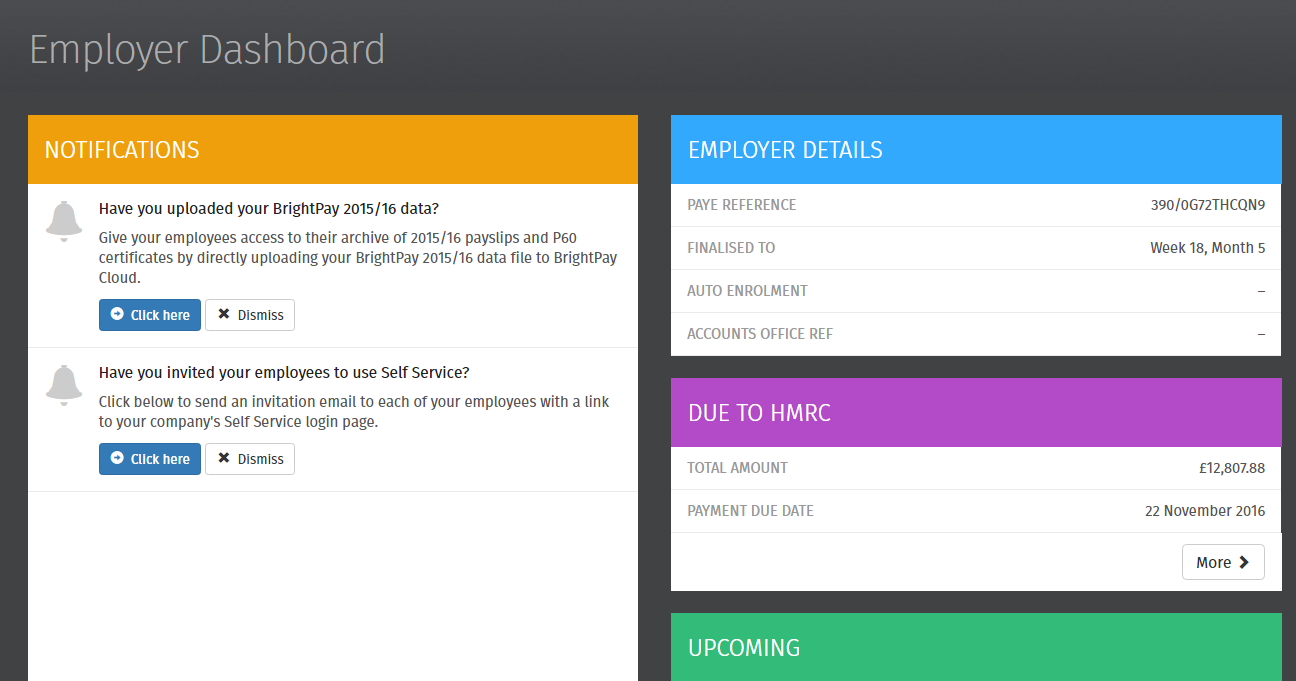

BrightPay Connect snapshot video for Employers

BrightPay Connect, our cloud add-on, works alongside BrightPay Payroll. Automatically store payroll information in the cloud and enable online access anywhere, anytime for you, your accountant and your employees. Watch this video to see what you are missing!!

The Auto Enrolment Whistleblowers

Auto enrolment compliance is still very much at the forefront of The Pensions Regulator’s (TPR) objectives. However, a small minority of employers are still not complying with their auto enrolment duties. Some employers tell their employees that they would face a pay cut if they joined a workplace pension scheme. Others tell their employees that they have in fact been enrolled when a pension scheme has not even been set up. These employers are hoping that their auto enrolment duties will simply disappear or that their employees won’t even notice that they are being denied their rights.

Read our Customer Case Study: Carlton Auto Engineering

We are a small, family run, motor vehicle repair workshop which is part of a national franchise group. Having decided that Sage 50 was not for me, I looked on the HMRC website for suggestions for alternative payroll suppliers. I found BrightPay and others (IRIS, 12pay, payroo, etc). Having watched the BrightPay demonstration video I decided to register for an online demo which showed me how simple the software was and how quickly I could process our wages.

BrightPay 60 Day Free Trial

The BrightPay trial is completely free for 60 days and includes full functionality, auto enrolment features and free support. The first thing to do is download and install BrightPay, which you can do by clicking here. There are also detailed online help guides available online to help you with the setup.

Plus more for accountants...

Did you miss out on some of these new BrightPay Connect bureau features?

BrightPay Connect now includes essential features that will help you keep an audit trail of your client's employee hours and timesheets. The new client upload and payroll approval features will reduce your administrative tasks, increase productivity and improve how you manage your payroll workflows between you and your clients. BrightPay Connect now allows your clients to manage and send their employees hours to the bureau each pay period through the client portal which then synchronises with the client file on BrightPay on the bureau's PC.

Invaluable Time Savings with BrightPay Connect

Payroll documentation and client payroll reports that have been set up and saved on the BrightPay desktop application will automatically be synced to BrightPay Connect. Clients can then log in and view. This includes payslips, periodic payroll reporting, P60s, and P45s. Using the password protected self-service portal, your clients and their employees will be able to login online to view their payroll data that is only relevant to them. This will eliminate the administrative work and time it takes to send these documents to clients and their employees each pay period.

Learn more about the benefits for bureaus

The Accountant’s guide to planning the tax return season - (Accounting Web blog)

Most people seem happy to let life drift along, accepting the ups and downs without trying to influence outcomes. While that can reduce the pressure on standard day-to-day activities, when it comes to the tax return season, a little positivity is a necessity, while a high degree of control freakery is almost certainly going to be even more helpful.

Find out what Philip Fisher thinks

5 Traits of a Successful Payroll Bureau Service

Sure, accounting school was the best; invites to the coolest parties, skipping the queue in all the nightclubs, boys and girls falling at your feet. But now it’s time to buckle up because you’re a boss now, a sexy one, and playtime is over. But how do you succeed in the cutthroat and unforgiving world of payroll? Well I’m here to tell you. Here are 5 life changing tips on how to grow your payroll business.

Are you missing out on BrightPay's newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Nov 2018

28

Customer Update: December 2018

BrightPay announces API integration with The People’s Pension

BrightPay now offers direct integration with ‘The People’s Pension’. This integration links the payroll software and pension provider together so that users can seamlessly submit pension files to The People’s Pension from within BrightPay. With just one click, users can instantly submit contribution files to The People’s Pension, eliminating the need to export the file and then login to The People’s Pension portal to upload the file.

BrightPay Connect’s New Bureau Feature: Client Payroll Entry (NOW LAUNCHED)

BrightPay Connect’s newest feature gives payroll bureaus the ability to send payroll requests to their clients. Clients can enter payments, additions and deductions for their employees and can also add new starters through their online employer dashboard. The information entered by the client will seamlessly flow through to the bureau’s portal, ready to sync back to the payroll software. Book a demo to see how seamlessly this new feature works.

Find out more | Book a BrightPay Connect demo

Free BrightPay Connect’s New Bureau Feature: Client Payroll Approval (NOW LAUNCHED)

The Payroll Approval facility enables bureaus to securely send their clients a payroll summary before the payroll is finalised. Clients can then review and approve the payroll for the pay period through their online employer dashboard. Ultimately, your client will be accountable for ensuring that the payroll information is 100% correct before the payroll is finalised. Book a demo to see how useful this new feature will be.

Find out more | Book a BrightPay Connect demo

Switch to BrightPay today and get 50% off plus one FREE BrightPay Connect licence (worth £49)

New customers can now save when they switch to BrightPay. Get 50% off a BrightPay 2018/19 licence PLUS receive one free BrightPay Connect 2018/19 licence. Offer valid for 2018/19 licences for the first year subscription only.

Book a demo | Purchase BrightPay

5 star rating on Software Advice website

Software Advice is the leading software review website for businesses navigating the software selection process. We are delighted to say that BrightPay has maintained a five star rating ?????.

Review BrightPay here | Trial BrightPay here

What are the biggest GDPR advantages of BrightPay Connect?

BrightPay Connect is an online payroll and HR solution that offers significant benefits to help your business comply with GDPR legislation. BrightPay Connect is an add-on product to the payroll software. BrightPay Connect increases the efficiency and effectiveness of payroll work within the remit of the GDPR guidelines.

Gift your employees this Christmas with One4all

With HMRC's Trivial Benefits scheme, you can gift a benefit up to the value of £50 completely tax-free to every member of staff. Gift your employees this Christmas with a One4all gift voucher and save over £48 per employee. With thousands of stores to choose from, it's the perfect way to show your employees you care.

What do BrightPay Customers really think?

BrightPay has a whopping 99% customer satisfaction rating and has just been awarded the 2018 Payroll Software of the Year award. Here is what our customers say:

- Have used Sage before and BrightPay has better functionality and is easier to use. Tim, Alan Barker and Co

- Compared with the payroll software I used before, BrightPay is a joy to use. John, Acumen Business Services

- I have always found BrightPay easy to use and excellent value for money. Liz, North Star Payroll

- BrightPay is an excellent, easy to use product that has made my payroll processes fast, efficient and effective. Lesley Ann, Laws Accountants

Read BrightPay Customer Testimonials

Change announced to Apprenticeship Levy

The Chancellor Philip Hammond announced at the Conservative Party Conference that from April 2019 large employers paying the apprenticeship levy will be able to transfer up to 25% of their apprenticeship levy funds to businesses in their supply chain.

RTI - An Irish Perspective - Will it work in Ireland?

Ireland is set to follow in the footsteps of the UK and introduce Real Time Reporting which is called PAYE Modernisation in the Irish PAYE system. The Irish Government is recommending employers to prepare for PAYE Modernisation and familiarise themselves with their new responsibilities.

The Accountant’s guide to planning the tax return season - (Accounting Web blog)

Most people seem happy to let life drift along, accepting the ups and downs without trying to influence outcomes. While that can reduce the pressure on standard day-to-day activities, when it comes to the tax return season, a little positivity is a necessity, while a high degree of control freakery is almost certainly going to be even more helpful.

Find out what Philip Fisher thinks

Benefits of BrightPay Connect for Employers

Employers can login online at any time to see up-to-date payroll information. Payroll data is stored in the cloud and can be accessed online however the payroll itself must be processed on your existing BrightPay desktop application. BrightPay Connect is an optional add-on that offers employers flexibility and online benefits, thus simplifying the process of payroll management.

Find out more | Book a demo | Watch video

Data Protection complaints increase since GDPR

Data protection complaints to the UK’s ICO rose to 4,214 in July compared to just 2,310 complaints received in May before the GDPR came into force. A spokesperson for the ICO said the increase was expected, as more users became aware of data protection because of publicity around the new rules and following a series of high-profile data scandals involving some well-known household names, like Morrison’s and Dixons Carphone.

Are you missing out on BrightPay's newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Oct 2018

8

Customer Update: October 2018

BrightPay wins ‘Payroll Software of the Year’

BrightPay was announced the winner of ‘Payroll Software of the Year’ at this year’s AccountingWEB’s Software Excellence Awards. It’s a great achievement for BrightPay to win this prestigious award, especially considering the number of larger software companies offering payroll.

Free CPD Webinar: GDPR 5 Months on!

This FREE CPD accredited webinar will look at what’s new in GDPR, how it may affect your business and what we have learned from the GDPR 5 months on. We will also have a look at how BrightPay can help your organisation utilise the new regulation to benefit you, your customers and your employees. The webinar will include a demo of how our new client entry feature can save you time and help you work towards GDPR compliance.

BrightPay Connect’s New Bureau Feature: Client Payroll Entry (Launching Soon)

BrightPay Connect’s newest feature gives payroll bureaus the ability to send payroll requests to their clients. Clients can then enter payments, additions and deductions for their employees and can also add new starters through their online employer dashboard. The information entered by the client will seamlessly flow through to the bureau’s portal, ready to sync back to the payroll software. Book a demo to see how useful this new feature will be.

BrightPay Connect’s New Bureau Feature: Client Payroll Approval Request (Launching Soon)

The Payroll Approval Request allows bureau users to securely send their clients a payroll summary before the payroll is finalised. Clients can then review and approve the payroll for the pay period through their online employer dashboard. Ultimately, your client will be accountable for ensuring that the payroll information is 100% correct before the payroll is finalised. Book a demo to see how useful this new feature will be.

New Customers: 50% Discount + 1 FREE BrightPay Connect Licence

New customers can now save when they switch to BrightPay. Get 50% off a BrightPay 2018/19 licence and one free BrightPay Connect 2018/19 licence. Offer valid for 2018/19 licences for the first year subscription only.

Book a demo | Purchase BrightPay

BrightPay secures investment from Hg

We are very excited to announce that BrightPay has secured investment from Hg, a specialist technology investor. This partnership benefits BrightPay as we can access the experience and support of Hg and its network, whilst retaining voting control of the business. “It’s great to secure an investment from a firm who both knows our market and has the experience to help us develop the business.”

BrightPay Connect: The GDPR Survival Toolkit

BrightPay Connect is tailored to help you overcome some of the key challenges that the GDPR presents when processing payroll. The payroll itself is still processed on BrightPay’s desktop application, however, the payroll information is stored online on a secure cloud server, allowing us to bring you even more benefits to help you with GDPR compliance.

BrightPay Connect: The perfect HR solution for your business

BrightPay Connect has built-in features giving employers an easy to use HR solution where employers can seamlessly manage employee leave and upload HR documents, such as contracts of employment. Employees can request leave through their employee portal or smartphone app. These features will automate and streamline many of the day-to-day HR functions that you deal with.

BrightPay Connect | HR features

72 Hours: The timeline of a GDPR breach

With the GDPR now in full effect, it is important to be aware of the consequences that apply to those businesses that have chosen not to comply with the new data protection legislation. Any company now found to not be in compliance can face a fine of €20 million or 4% of their annual turnover, whichever is greater.

Are you missing out on BrightPay's newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Aug 2018

1

Customer Update: GDPR Special Edition

GDPR: Frequently Asked Questions

Our GDPR experts have put together a list of some of the frequently asked questions that we have been asked by our customers regarding the General Data Protection Regulation. Additionally, the legislation states that whenever a data controller (e.g. business / employer) uses a data processor (e.g. payroll bureau) there needs to be a written contract or Data Processor Agreement in place.

View all FAQs | Template Data Processor Agreement

Free CPD Webinar: GDPR 5 Months on!

This FREE webinar will look at what’s new in GDPR, how it may affect your business and what have we learned from the GDPR 5 months on. We will also have a look at how BrightPay can help your organisation utilise the new regulation to benefit you, your customers, suppliers and employees. The webinar will include a demo of how our new timesheet upload feature can save you time and help you work towards GDPR compliance.

Privacy Policies - A GDPR Requirement

One of the main principles of the GDPR is that data shall be processed lawfully, fairly and in a transparent manner. These three elements overlap and all three must be satisfied in order to demonstrate compliance. The GDPR stipulates that anywhere personal data is being collected, either directly or indirectly, Privacy Notices should be in place.

GDPR: The Right to Erasure at a Glance

Individuals have gained the ‘right to erasure’ or commonly known as the ‘right to be forgotten’. This new right came into force with the implementation of the GDPR. It essentially allows individuals to request for erasure of their personal details verbally or in writing.

How can BrightPay Connect Help with GDPR?

Our optional add-on, BrightPay Connect is an online payroll and HR self-service tool that offers significant benefits to help your business or practice comply with the GDPR legislation. Accountants, employers and employees can instantly access their payroll information, enabling many routine payroll and HR related tasks to be automated. BrightPay Connect significantly increases the efficiency and effectiveness of payroll work within the remit of the GDPR guidelines.

BrightPay Connect & GDPR | Book a demo

3 GDPR Compliant Ways to Distribute Payslips

By law, employers must provide employees with payslips which include personal data such as proof of earnings, tax paid and any pension contributions. It is advisable that businesses take steps to protect and securely send this payslip information.

Are you missing out on BrightPay's newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Jun 2018

5

Customer Update: June 2018

Free Webinar: Payroll Data & GDPR - What you need to know

Employers must take steps to protect and securely manage employees’ personal data to comply with GDPR. Equally, where a business outsources their payroll to a third party (payroll bureau), they are legally obliged to provide assurances to safeguard the payroll information they manage on behalf of their clients. Places are limited.

Auto Enrolment: The True Consequences of Non-Compliance

If an employer fails to comply with auto enrolment, the Pensions Regulator will take enforcement action. Although the rollout of auto enrolment began in 2012, it is now that the true consequences of non-compliance are coming to light.

How has BrightPay prepared for GDPR?

Data Protection has always been a concern for BrightPay and we have always aimed to act with complete integrity in this regard. In preparation for GDPR, we have had to complete a total review on how we gather, maintain and use data. We have taken steps to securely protect our customers information including increased encryption, securely deleting files from our servers and updating our privacy policies in line with GDPR.

Key changes | Updated privacy policy

GDPR - What to include in your template Data Processor Agreement

Whenever a data controller uses a data processor there needs to be a written contract in place. The contract is important so that both parties understand their responsibilities and liabilities. The GDPR sets out certain information which needs to be included in the contract.

Find out more | Template Data Processor Agreement

BrightPay Connect’s NEW Employee Smartphone App

BrightPay’s employee self-service smartphone and tablet app is available with our cloud add-on BrightPay Connect. The advancement of employee mobile apps offers many different advantages for employers, employees, and the business as a whole. For employers and HR Managers, the user-friendly portal will streamline payroll processing while reducing the number of payroll queries from employees.

How BrightPay Connect can help with GDPR!

Where possible, the data controller should offer self-service remote access to a secure system providing individuals with access to their personal data. BrightPay Connect is a self-service option which provides online access 24/7. Employees can view and download current and historic payslips, P45’s and P60’s. Annual leave can also be requested which flows through as a notification for the employer to approve. Employee contact information can be edited and updated, keeping records accurate at all times.For payroll bureaus, your clients can instantly access payslips, payroll reports, an employee leave calendar, and amounts due to HMRC.

Are you an employer who has to provide a pension?

If you are employing staff for the first time this year, it’s important to understand what to do and when, so you can meet your automatic enrolment duties on time. Your legal duties begin on the day your first member of staff starts work. This is known as your duties start date. Even if you think you won’t need to put staff into a scheme, you will still have duties.

Are you missing out on BrightPay's newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Mar 2018

26

April Customer Newsletter - BrightPay 18/19 released

***** Please confirm whether you want to hear from us (GDPR related) - Important Update ****

From May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. This is due to the GDPR legislation. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

BrightPay 2018/19 is Now Available. What's New?

The release includes exciting new features to make your payroll and auto enrolment journey easier and less time consuming including:

- Auto enrolment minimum contribution increases (phasing) including letters

- Enhanced feature to email documents & reports

- Improved calendar features

- BrightPay Connect - Improved GDPR security and cloud functionality

- 2018/19 Scottish Rate of Income Tax (SRIT) codes, rates and thresholds

- Payroll journal export to Sage, Xero, Quickbooks, Exact & Kashflow

- API integration with Aviva

- April 2018 National Living Wage rates

See what’s new | Buy now | Download BrightPay 2018/19

You need to activate your BrightPay Connect licence to backup your data

After purchasing BrightPay Connect, you will need to activate your licence key code. If the licence is not activated, your payroll data will not backup automatically. Employees will not be able to access their payslips or request leave on the self-service portal. Activate your licence key code now to start availing of the many cloud benefits. Haven’t tried BrightPay Connect yet?

Book a demo today | Find out more

BrightPay Announces API Integration with Aviva

BrightPay are delighted to announce that we are the first payroll software on the market to offer direct integration with Aviva. An API is a fully integrated tool that directly links both the payroll and pension provider together. This integration allows customers to submit their pension data file to the Aviva online portal from within BrightPay.

Free Bright Contracts Webinar: UK Employment Law Overview

As busy employers it can be difficult to keep up-to-date with the constant changes in employment law. In this webinar our employment law experts discuss what is new in employment law, recent employment law cases and have a look at the most frequently asked questions that come through our support line.

Register for free webinar | Bright Contracts

For Payroll Bureaus / Accountants

Payroll Data and GDPR: What you need to know about consent, emailing payslips, and your legal obligation

In this guide, we will specifically look at the impact of GDPR on your payroll processing and address the biggest areas of concern. We will walk you through some important steps to achieve GDPR compliance.

Download here | Register for GDPR webinar

Understanding Minimum Contribution Increases (Phasing) and its Implications

Your clients will need to be ready to implement the increased minimum contribution rates for auto enrolment from April 2018 and April 2019. Our guide and free webinar look at what you must know about processing the increases in contribution rates in 2018 (and clients should thank you for it).

Download white paper | Register for free webinar

How BrightPay Connect can help with GDPR!

Under the GDPR legislation, where possible the controller should be able to offer self-service remote access to a secure system which would provide the individual with direct access to his or her personal data. BrightPay Connect is a self-service option which will give your payroll clients and their employees online remote access to view payslips and other payroll documents 24/7.

Feb 2018

1

Customer Update - February 2018

Free Webinar: What does GDPR mean for your business?

The countdown is on!! The General Data Protection Regulation (GDPR) comes into effect on 25th May 2018, however this date is a deadline as opposed to a starting point. With hefty non-compliance fines, it is important to make sure you are prepared. Register now for our free webinars designed specifically for employers and bureaus.

Employer Webinar (13th March) | Bureau Webinar (6th February)

Increased minimum contribution rates from April 2018

The automatic enrolment minimum contribution rates are increasing on 6th April 2018. The minimum employer contribution rate will rise from 1% to 2% of the employee’s earnings, while the total minimum contribution will increase substantially from 2% to 5%. How will this ‘phasing’ process affect opt-out rates and the public perception of automatic enrolment?

Find out more | Register for free webinar

BrightPay Newsletter - Are you missing out?

GDPR is changing how we communicate with you. After May 2018, we will not be able to email you about webinar events, special offers or other news without you subscribing to our newsletter. Don’t miss out - sign up to the BrightPay newsletter today!

BrightPay & Aviva: Hello one-click pension submissions

BrightPay is delighted to announce that we now offer API pension integration with Aviva. This integration allows users to send enrolment and contribution files to Aviva at the click of a button, eliminating the need to manually save and upload files. Reduce your workload and the risk of error due to manual processing.

Pre-order BrightPay 2018/19

BrightPay and BrightPay Connect are now available to pre-order. We will send you an email closer to the 6th April once your new BrightPay is released and ready to download.

Keep your payroll data secure with BrightPay Connect

With BrightPay Connect, you don't need to worry about manually backing up your payroll data. The add-on will automatically and securely backup your payroll information each pay period ensuring that you never lose your payroll data. This also protects the payroll data against ransomware and similar threats.

Automatic Enrolment: Shaping the savings landscape

Since 1 October 2017, thousands of start-up businesses have instant pension duties, and more than half will have to enrol staff into a workplace pension. The Pensions Regulator highlights the success of auto enrolment to date in its fifth annual commentary and analysis report.

Dec 2017

5

Customer Update - December 2017

5 simple scenarios to stop pension scams

A pension scam – when someone tries to con you out of your pension money – will often start by someone contacting you unexpectedly with one of many pension scenarios. If you find yourself in one of these scenarios make sure to act fast to prevent becoming a victim of a pension scam.

Sign up to BrightPay’s newsletter

Do you want to hear more about future CPD events, free ebooks, industry updates and special offers? Subscribe to BrightPay’s newsletter today. You will have the option to unsubscribe at anytime.

Does automatic enrolment apply to you?

It is essential that all employers understand that if they employ just one person, they have certain legal duties for automatic enrolment. After the 1st October 2017, new employers who employ their first member of staff will have to comply with auto enrolment from the day the new employee starts.

Free Webinar - What does GDPR mean for your business?

All businesses process large amounts of personal data, not least in relation to their customers and their own employees. Consequently, the GDPR will impact most if not all areas of businesses and the impact it will have cannot be overstated. Places are limited.

Bureau Webinar: 6th February | Employer Webinar: 13th March

How to avoid harassment in the workplace

The recent allegations against Harvey Weinstein in the US have created somewhat of a snowball effect worldwide with thousands of women and men speaking out about their accounts of sexual harassment and assault, many of them being work related.

Cut down on payroll processing time with BrightPay Connect

Employers across the UK are automating the process of providing payroll and HR documents to employees, such as payslips, P60s, employment contracts and company handbooks. Annual leave management can also be simplified and automated giving you more time to focus on pressing business matters.

Out with the staging date - in with the duties start date!

The ‘duties start date’ is the date that an employee first begins to work for a company. For those recruiting after October 1st 2017, it is important to be aware that as soon as their new hire begins working for them, their automatic enrolment duties will also begin straight away.

Did you know BrightPay offers a free licence to micro businesses?

BrightPay offers a free employer licence to businesses with up to three employees which includes payslip and auto enrolment functionality? Also, our standard employer licence is just £99 + VAT per tax year. BrightPay has a 99% customer satisfaction rate.

Download free 60-day trial | Book a demo

More for bureaus -

Payroll for bureaus: From loss leader to profit centre

New technologies can positively impact the way bureaus offer payroll services. There are several exciting developments that are happening right now in the cloud. Be ready to offer a new level of payroll and HR services by embracing new-world online technologies.

Free CPD Webinar - The Future of Auto Enrolment

Auto enrolment has well and truly evolved since the rollout began in 2012. There are a number of changes coming over the next 12 months that payroll bureaus need to be aware of, including instant duties for new employers, increases in minimum contribution rates and automatic re-enrolment.

Accountants are making the big switch to BrightPay

BrightPay has been operating in the UK since 2012. Year on year, more accountants are moving payroll providers to BrightPay for several reasons. You may ask yourself, why are so many accountants and payroll bureaus moving to BrightPay.

The benefits of offering cloud payroll services

The payroll landscape is changing and many payroll bureaus are offering clients a certain level of cloud functionality that automates otherwise time consuming tasks. Online access to payroll information for your clients and their employees offers significant benefits for today's bureau which can will streamline many workforce management tasks.

Oct 2017

19

Customer Update: October 2017

“What do you mean….Do I have a backup”? - A day in the life of Customer Support

One of the most common calls I get on the support line is from a distressed customer who tells me they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer, holding files to ransom or fire or water damage to the computers in the office.

What does GDPR mean for your Payroll Bureau? (Bureaus only)

Data protection and how personal data is managed is changing forever. On 25 May 2018, the new General Data Protection Regulation (GDPR) will come into force. The GDPR is a European privacy regulation replacing all existing data protection regulations. Register now for our free, CPD accredited webinar to find out how this new legislation will affect your payroll bureau.

Why is everyone switching to BrightPay?

We recently conducted a customer survey where we asked our customers just what they thought of BrightPay. The good news is, our customer satisfaction rate has improved from 99.1% (2016) to 99.8% (2017). We also received a number of testimonials from our customers.

Have you seen BrightPay Connect in action?

BrightPay Connect is an optional cloud and HR add-on which offers an employee online self service, automatic cloud backup, annual leave management and more. We are offering BrightPay bureau customers one free BrightPay Connect 2017/18 licence.

Claim your free licence here | Book a demo

Auto Enrolment: New Employers, Phasing & Re-enrolment (Bureaus only)

What does the future hold for automatic enrolment (AE)? Over the next year we will see payroll bureaus dealing with new challenges when it comes to AE compliance. Watch our webinar on demand where we discuss the future of automatic enrolment. Guest Speaker: Henry Tapper from the Pension PlayPen joins us.

Do you need help with your employee contracts?

Our sister product, Bright Contracts enables users to create tailored, professional contracts of employment and staff handbooks. What was once a very expensive and time-consuming process can now be done on your PC.

Aug 2017

21

Customer Update: August 2017

BrightPay Customer Survey: The Results are in

In our recent survey, we were delighted to discover that our customer satisfaction rate has slightly improved since last year from 99.2% to 99.8%. The satisfaction rate for BrightPay’s customer support is 98.6% which is also an improvement on last year.

Employers warned by The Pensions Regulator regarding Fake Exemption Certificates

Employers are being made aware of an apparent scam of exemption certificates for automatic enrolment purposes being offered by at least one company. An investigation is being undertaken by The Pensions Regulator into this company offering what is described as 'Certificates of Auto Enrolment Exemption' to employers.

Bright Contracts Webinar: Keeping your business compliant with Employment Law

As busy employers it can be difficult to keep up-to-date with the constant changes in employment law. In this webinar we discuss what is new in employment law, give you key facts about the legislation that you need to know and highlight areas that will help ensure your business remains compliant.

News for Bureaus

Watch our latest video to see how BrightPay Connect can benefit your payroll bureau

BrightPay Connect our latest cloud add-on works alongside BrightPay Payroll. Payroll information is stored in the cloud and can be accessed online by you and your clients anywhere. BrightPay Connect offers additional innovative payroll and HR features that will enhance client relationships and increase revenue for your bureau.

Free CPD Auto Enrolment Webinars with NEST, Workplace Pensions Direct, Aviva & Pension PlayPen

Join BrightPay and our guest speakers to understand what the future holds for auto enrolment covering re-enrolment, auto enrolment and new employer's, Basic PAYE tools and all you NEED to know about choosing a pension scheme. Registration is free.

New Employers & Auto Enrolment

From the 1st of October 2017, clients who become an employer for the first time will immediately have AE duties to complete for any staff they employ. Worryingly, according to research conducted by The Pensions Regulator (TPR), 49%, almost half of accountants asked did not know that new employers would have AE duties.

Find out more Register for free CPD webinar

News for Employers

Watch our latest video to see how BrightPay Connect can improve your annual leave processing

BrightPay Connect our latest cloud add-on works alongside BrightPay Payroll. Payroll information is stored in the cloud and can be accessed online by you and your employees. BrightPay Connect offers additional innovative payroll and HR features that streamline your annual leave management and payroll processing.

Understanding your Declaration of Compliance

An employer's declaration of compliance is one of the most important automatic enrolment duties and it should not be left until the last minute. It is never too early to start preparing. This blog will take you through the various steps employers will need to understand to successfully complete their Declaration of Compliance.

Proposed State Pension Age Changes: How will it affect you?

Under current legislation, the State Pension age increase from 67 to 68 is to be phased in between the years 2044 and 2046. The Government, however, now plan to implement this increase seven years earlier. Should this proposed change go ahead, this means that the State Pension age will thus increase to 68 between 2037 and 2039 instead.