Jul 2021

5

July 2021 Changes to Furlough Pay and COVID-19 Statutory Sick Pay Rules

How will furlough pay rules change in July?

As of the 1st of July, 2021 employers will need to begin to contribute furlough pay for unworked hours. For July, the government will contribute 70% of the employees’ wages (up to £2187.50) while employers will be required to contribute the remaining 10% (up to £312.50). Employers will also need to pay any National Insurance and pension contributions. From August until the scheme ends on September 30th, the government will contribute 60% of their employees’ wages (up to £1875) while employers will be required to contribute the remaining 20% (up to £625).

The image below shows the contribution percentages for the furlough scheme from July to September 2021.

How will Statutory Sick Pay rules change in July?

When someone in your ‘support bubble’ (or your ‘extended household’ if living in Scotland or Wales) has tested positive for COVID-19 or is showing symptoms of COVID-19 you should self-isolate. Starting Monday, July 6th, employees who are self-isolating for this reason will now be eligible for SSP. The employee must self-isolate for at least 4 days to be eligible for SSP and is only entitled to SSP for any days they were self-isolating from July 6th onwards.

Related articles:

Nov 2017

9

Trivial Benefits in Kind

Instead of a taxable cash Christmas bonus, why not give your employees a seasonal gift – a turkey or a nice bottle of wine?

In order to provide these gifts – it must be ensured that the gift falls under trivial benefits in kind.

Trivial benefits apply where the benefit:

- Is not cash or a cash voucher

- Costs £50 or less

- Is not provided as part of a salary sacrifice or other contractual arrangement

- Is not provided in recognition of services performed by the employee as part of the employment, or in anticipation of such services

Accordingly, gifts that cost under the £50 limit would qualify. It is also possible to provide employees with a gift voucher (not a cash voucher) where the limit is £50 or less. They can only be provided as a gesture of goodwill be it at Christmas or other such seasonal occasions.

Employers no longer need to report such trivial benefits on P11ds or PAYE Settlement Agreements (PSA). However, if the gifts have a value in excess of £50 or cannot be counted as trivial benefit, then the gift must be reported on the form P11d and Class 1A NICS may be payable on the value of the gift.

£300 Annual Cap

There is an annual trivial benefits cap of £300 that is applied to directors or other office-holders of “close companies” (close company is a limited company that’s run by 5 or fewer shareholders) and to members of their families or households. The £300 annual cap does not apply to other employees.

Oct 2017

2

Brexit - There’s an elephant in the room!

Brexit is becoming the “elephant in the room” for many companies waiting for government updates and its implications on how the new deal will work out. Many HR and payroll professionals are no doubt anticipating how such a huge shift in the political scene will change existing legislation.

However, while it’s easy to get distracted by how Brexit will change the current HR and payroll landscape in the future, there are more current, pressing concerns at hand.

Remember these key Legislative Compliance Payroll Updates:

Data Protection Changes

It is now confirmed that the upcoming General Data Protection Regulation (GDPR) will affect all UK companies. Businesses will need to start future-proofing their procedures and policies before the data protection changes come into effect in May 2018.

Non-compliance by businesses could lead to fines of up to £20 million or 4% of a company’s annual global turnover in the prior year. Bringing your company’s policies in line with the approaching changes will ensure a smoother transition and avoid any penalties for non-compliance.

Gender Pay Gap Reporting

If a business, either private or voluntary, has more than 250 employees it needs to be aware of legislative changes regarding gender pay gap reporting. The new law came into effect on 5th April, 2017 with employers required to publish their first report on 5th April, 2018 relating to their data from 2016/17. The results must be published on the employer’s website and a government website. Failing to do so will result in enforcement proceedings.

You can find more information on what the EU is doing regarding Gender Pay Gap Reporting by clicking here.

Pay Rate Changes

New rates for the National Living Wage and National Minimum Wage came into effect April 2017. The Living Wage rose to £7.50 for employees aged 25 or over and who are not in their first year of apprenticeship. The National Minimum Wage rose to £7.05 for employees aged between 21 and 24, it increased to £5.60 for those between the ages of 18 and 20 and lastly, it increased to £4.05 for 16 to 17 years old.

Statutory Maternity/Paternity/Adoption Pay has risen to £140.98 per week. It is a company’s payroll department that have the responsibility of ensuring the above increases have already taken place since their implementation dates last April.

Overseas Workers

Last April, salary thresholds for foreign employees increased. The Tier 2 (general) salary increased to £25,000 for experienced workers and Tier 2 (intra-company transfer) rose to £30,000. There was also a reduction to £23,000 for graduate trainees with the number of places rising to 20 a year for each company.

Changes to the immigration rules means that businesses who sponsor foreign employees on a Tier 2 (general) visa now must pay a skills charge of £1,000 per employee. For companies with less than 250 employees, the charge is £364. Both charges are on top of normal visa application fees.

Case against Dudley Metropolitan Borough Council

A recent judgement by the Employment Appeal Tribunal (EAT) confirms that payment for normal voluntary overtime must be included in the calculation of workers holiday pay.

Be Prepared, Be Proactive

Payroll Managers should be proactive and aware of the above current legislation. Key changes are on the way once Brexit finally arrives but it is so important to keep an eye on developments and focus on current issues at hand, making allowances for existing legislative changes.

Sep 2017

26

42 Year Low in UK Unemployment

The UK's unemployment rate has fallen to its lowest level since 1975, according to official figures which also show a growing gap between price rises and wage growth. The unemployment rate fell to 4.3% in the three months to July, down from 4.4% in the previous quarter and 4.9% a year earlier.

The employment rate, which measures the proportion of people aged 16- 64 in work, hit 75.3% - the highest since comparable records began in 1971. In total, there are 32.1 million people at work in the UK, according to the figures, or 181,000 more than the previous quarter.

While that performance suggests the labour market is continuing to shrug off uncertainties and other headwinds in the wake of the Brexit vote, the figures also highlighted a worsening squeeze for family budgets. It is also reported that average wage growth remained static at an annual rate of 2.1% over the same three months. With inflation coming in at 2.9%, the real value of wage growth is falling.

Sep 2017

18

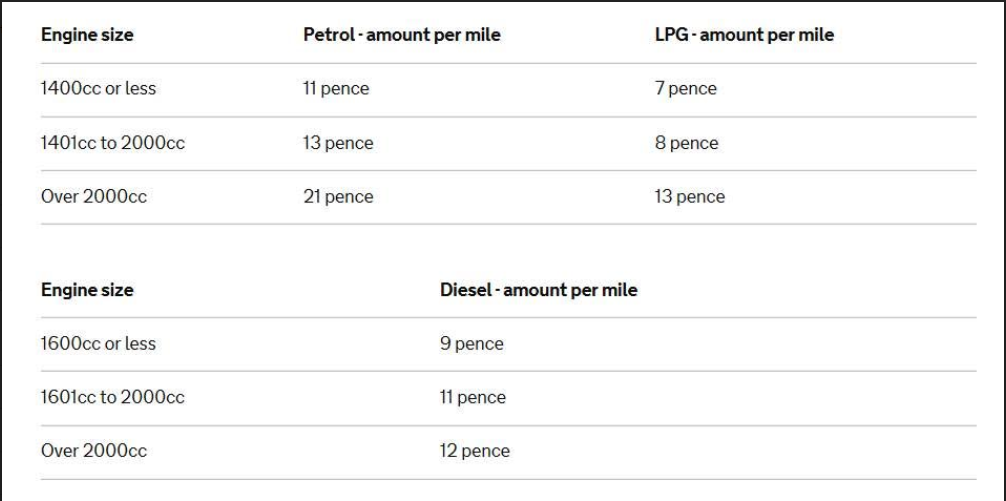

Latest Advisory Fuel Rates for Company Cars

For company cars, HMRC has released details regarding the latest Advisory Fuel Rates. From the date of change, employers may use the old rates or new rates for one month. Employers are under no obligation to make supplementary payments to reflect the new rates but can do so if they wish. Hybrid cars are treated as either petrol or diesel cars for this purpose for the fuel rates.

The changes are to engine size from 1401cc to 2000cc and to LPG engine over 2000cc. To view the latest rates click here.

The rates are as below:

Aug 2017

14

Voluntary Overtime must now be included in Holiday Pay Calculations

The Employment Appeal Tribunal (EAT) has dismissed an appeal by Dudley Metropolitan Borough Council, ruling that voluntary overtime should be taken into account when calculating holiday pay. This landmark legal victory now means that employers must now incorporate regular voluntary overtime when calculating holiday pay. Unite Union are now advising employers to urgently address this issue and ensure they are compliant.

This ruling will affect a large number of employees throughout the UK who get paid for regular voluntary overtime but do not receive any annual leave entitlement payment for working it. This legal victory sets a legal binding precedent that employment tribunals throughout the UK are obliged to adhere to.

This landmark case involved an appeal that was brought by Dudley Metropolitan Borough Council and this is the first case that the Employment Appeal Tribunal decided to confirm that payments to employees for voluntary duties only should be included in the calculation of employees’ annual leave entitlement pay. In the EAT findings, under the European Union’s Working Time Directive, there is no distinction between contractually required work and tasks that are performed voluntarily under other special or separate arrangements, because levels of normal remuneration have to be maintained when calculating holiday pay in relation to the guaranteed four weeks of annual leave provided under EU law.

The EAT also upheld that where voluntary shifts, standby and call-out payments form part of normal pay, they should be included in holiday pay calculations so that no employee would be deterred from taking annual leave at no financial disadvantage.

The findings in the case of Dudley Metropolitan Borough Council v Mr G. Willetts and others builds on previous findings in the case Unite legal services took in 2014. This appeal resulted in a ruling covering holiday pay for employees that were contractually obliged to perform overtime.

56 employees of Dudley Metropolitan Borough Council, who were Unite members, took the case against Dudley Metropolitan Borough Council. These employees are employed by the Council as tradesmen who worked on maintaining the council’s stock of houses. They worked regular overtime on a voluntary basis only, which included working overtime on Saturdays. In order to deal with emergency call-outs and repairs, the employees decided to organise and a standby rota every four weeks.

For some employees, this additional voluntary overtime equated to approximately £6,000 per annum along with their basic salary. The Council paid the employees the amount due for the voluntary overtime worked, but the voluntary overtime was not included in their holiday pay calculations. The omission of this additional holiday pay was costing the employees between £350 and £1,500 per year, depending on the amount of voluntary overtime undertaken.

Howard Beckett, Unite’s Assistant General Secretary for legal services said:

“The ruling means unscrupulous employers no longer have carte blanche to fix artificially low levels of ‘basic’ hours and then contend the rest of time as ‘voluntary’ overtime that did not have to be paid in respect of annual leave.

Unite will be liaising with Dudley Metropolitan Borough Council and its legal team over reaching a satisfactory settlement for our members. In the meantime we would urge other employers who have been fleecing workers of their holiday pay to get their house in order or face legal action…”.

Jun 2017

7

Company Cars - Advisory Fuel Rates from 1st June 2017

For company cars, HMRC has issued details regarding the latest Advisory Fuel Rates. From the date of the change, employers may use the old rates or new rates for one month. Employers are under no obligation to make supplementary payments to reflect the new rates but can do so if they wish. Hybrid cars are treated as either petrol or diesel cars for this purpose for the fuel rates.

The only change is to Petrol engine over 2000. The rates are as below:

| Engine size | Petrol - amount per mile | LPG - amount per mile |

| 1400cc or less | 11 pence | 7 pence |

| 1401cc to 2000cc | 14 pence | 9 pence |

| Over 2000cc | 21 pence | 14 pence |

| Engine size | Diesel - amount per mile |

| 1600cc or less | 9 pence |

| 1601cc to 2000cc | 11 pence |

| Over 2000cc | 13 pence |

Apr 2017

12

Employers Must Publish Their Gender Pay Gap Differences

The Equality Act 2010 (Gender Pay Gap Information) Regulations 2017 for private and voluntary-sector employers comes into effect at the start of the new tax year. With that, large companies (i.e. those with over 250 employees) will legally have to reveal the gender pay gap in their workforce. Thousands of employers will begin recording their gender pay gap figures for the first time and must publish their results before the end of the tax year.

At 18.1%, the difference between the average pay for men and women is at an all time low. The new legislation hopes to drastically reduce the gap. Experts are suggesting that these reporting provisions will likely do more for pay equality than equal pay legislation has done in decades. The government are hoping that by exposing company’s pay disparities they will be forced to take action and eliminate gender pay gaps, arguing that it could increase annual GDP by £150 billion.

Unfortunately, the 18.1% pay gap does not show the differences in the rate of pay for comparable jobs. The Office for National Statistics has provided an interactive tool to discover the gender pay gap for your job. According to the government the reasons for gender inequality are complex and can include:

- more women work in lower paid jobs or sectors.

- women are more likely to work part-time, which can mean a lower rate of pay.

- Under representation of women in senior roles. This may be due to stereotypical attitudes about gender roles, lack of flexible working or women taking time to look after their family.

The Equality and Human Rights Commission will enforce the following rule where: Companies who employ more than 250 people must provide data about their pay gap, the proportion of male and female employees in different pay bands, a breakdown of how many women and men get a bonus and their gender bonus gap. This legislation applies to over 9,000 companies, with over 15 million employees.

Jun 2014

4

Changes to Holiday Pay Calculations

As we enter the summer holiday season employers need to ensure that they are paying their employees correctly during annual leave.

A recent decision by the European Court of Justice (ECJ) will impact how some annual leave pay is calculated.

Do you pay employee’s commission? Is the commission calculated based on the amount of sales made or actual work carried out? If yes, according to the ECJ, holiday pay should include commission pay.

The decision was made in the case of Locke v British Gas Trading and Others. Locke was a Sales Representative whose commission made up approximately 60% of his remuneration. After taking two weeks leave in 2011, Locke suffered financially as he was unable to generate sales for the period he was on annual leave.

The ECJ ruled that the purpose of annual leave is to allow a worker to enjoy a period of rest and relaxation with sufficient pay. By not including commission payments with holiday pay, employees are less likely to take annual leave so as to avoid financial hardship.

It has been left to the national courts to determine how to calculate the commission to which a worker is entitled, however the court did suggest that taking an average amount of commission earned over a certain period, e.g. the previous 12 months.

Employers are advised to review their commission policies to establish which, if any, payments need to be included in annual leave pay.