May 2022

5

Direct payment platforms – taking your bureau to the next level

Paying employees and making payments to HMRC, each pay period can be a timely task for bureaus. Not only from an admin point of view, but also the time it takes to manually create bank files, rectify any errors that crop up, and ensuring that payments land in employees’ bank accounts on time. It’s a lot to juggle on top of everything else on your to-do list.

Imagine if there was a sophisticated system that integrated with your payroll software. A system that allowed you to pay employees, subcontractors and HMRC easily and smoothly, eliminated manually uploading bank files, and improved the security and time-efficiency of your payments…

Modulr, a direct payments platform, is integrated with BrightPay Payroll Software and can do all of the above for you. Modulr completely streamlines the entire payment process of your payroll workflow, leaving you with more time to attend to other business matters. Here are three key ways that BrightPay’s integration with Modulr can take your bureau to the next level.

Pay employees in just 90 seconds

Modulr allows you to pay employees in just 90 seconds from within the payroll software. It’s an all-in-one seamlessly integrated payments system. The integration can save you time by removing the need to double and triple-check that all pay amounts are correct, as this information flows directly from the payroll software.

Modulr allows you to schedule payments in advance and you can make any last-minute changes to clients’ employees’ payments if needs be, on any day of the week. This gives you much greater flexibility when making payments, in comparison to more traditional payment methods.

Increases your payments’ security and reduce errors

Modulr provides added layers of protection for payments through a range of security features. Their partnership with the authenticator app, Authy, is an optional feature that provides two-factor authentication when logging in. Two-factor authentication means that there are two forms of identification required when logging in. These can include a code that is sent to your phone number or email address, or can include biometrics such as a fingerprint. This ensures that only authorised users can approve payments within the client’s company. If the client would rather that you authorise the payments for them, this can be done also. Once the payments have been approved, they will be sent straight to employees’ bank accounts within 90 seconds or at the scheduled time. Modulr’s network is also fully encrypted, protecting your payments from any potential cyber-hacks or ransomware.

Having a direct payments system in place eliminates the likelihood of any data input errors and uploading issues to occur, saving you time rectifying any payment submission problems should they arise. This gives you peace of mind, knowing that your clients’ employees will be paid on time, every time.

Direct payments to HMRC

BrightPay is a fully HMRC complaint payroll software. This integration with Modulr automates most of the workload involved in submitting HMRC payments. No longer do you have to export and upload files from multiple locations – it can all be done from one centralised location – within your payroll software. Your HMRC payments will also be sent and received by HMRC in just 90 seconds.

Want to learn more?

To discover more about BrightPay’s integration with Modulr, please read our webpage on the topic.

Interested in learning more about BrightPay? Sign up for a free 15-minute demo today. We are one of the leading providers of payroll software for accountants in the UK, are a fully HMRC complaint payroll software and have a 5-star rating on Trustpilot.

Oct 2021

29

National Living Wage to Increase on 1st April 2022

In the Budget 2021 the Chancellor of the Exchequer announced new National Living Wage (NLW) and National Minimum Wage (NMW) details in line with those recommended by The Low Pay Commission (LPC) and these new rates will take effect from 1st April 2022.

| Current Rates | Rates from April 2022 | |

| 23 years and over | £8.91 per hour | £9.50 per hour |

| 21 - 22 years old | £8.36 per hour | £9.18 per hour |

| 18 - 20 years old | £6.56 per hour | £6.83 per hour |

| 16-17 years old | £4.62 per hour | £4.81 per hour |

| Apprentices under 19 or 19 or over who

are in the first year of apprenticeship |

£4.30 per hour | £4.81 per hour |

The National Living Wage, the statutory minimum for workers aged 23 and over, will increase by 6.6% to £9.50 per hour. An employee's age and if they are an apprentice will determine the rate they will receive.

Related articles:

- Autumn Budget 2021 – An Employer Focus

- What to include on a hybrid working policy

- Payslips explained: Top tips to help your employees

Feb 2021

22

Plan for Jobs - £1,000 for Traineeships

In the July 2020 Plan for Jobs announced by Chancellor Rishi Sunak, an investment fund of £111 million is available to assist the largest development ever for traineeships and employers that provide a traineeship. An employer can claim a £1,000 bonus for each trainee that is enrolled under this new traineeship programme. The new project will help young people learn new skills and experience that will assist them in finding employment or an apprenticeship or equip them for further study options.

Registration for applicants for this scheme can now be made online here. The bonus of £1,000 will be available to employers to claim until 31st July 2021 and will help employers with the traineeship costs such as uniforms, travel cost and providing facilities. The maximum number of trainees an employer can claim under this programme is 10 trainees. Employers can claim this incentive of £1,000 per trainee for any trainee placement they have since 1st September 2020

The traineeship programme period will last for a period of at least 6 weeks and can be as long as 12 months. The programmes will help the trainees develop skills for the workplace such as digital skills in conjunction with English and maths skills. Traineeships will be combined with job placements for a minimum of 70 hours.

Research has shown that traineeship programmes have previously assisted nearly 120,000 young people since 2013 and two thirds of trainees either progress to employment or study further or partake in an apprenticeship within six months of completing the traineeship programme.

This scheme encourages and assists employers to help train or educate young people in conjunction with the apprenticeship scheme. Under the apprenticeship scheme employers can claim £2,000 for any new apprentice aged under 25 that is hired and £1,500 for any new apprentice aged 25 or older. This scheme will end in March 2021 and over 10,000 have already availed of this scheme.

Related articles:

- Minimum Wage Increase on 1st April 2021

- Changes to the Kickstart Scheme

- New Proposed Statutory Payment Rates Announced for 2021-22

Feb 2021

12

Minimum Wage Increase on 1st April 2021

The Low Pay Commission’s recommendations for the new National Minimum Wage were approved by Government and these new wage rates will come into effect on the 1st April 2021. The National Living Wage of £8.91 per hour will now be paid to employees aged 23 years and over instead of the previous age threshold of 25 years and older. This is an increase of 2.2% from £8.72.

The National Minimum Wage (NMW) is the minimum pay per hour most employees are entitled to by law. An employee's age and if they are an apprentice will determine the rate they will receive. The hourly rate for the minimum wage depends on an employee's age and whether they are an apprentice:

- The apprentice rate is applicable to apprentices aged under 19 and those aged 19 or over when they are in the first year of their apprenticeship

- Employees under 23 years old are entitled to the National Minimum Wage

- Employees aged 23 or over are entitled to the National Living Wage

Rates from 1 April 2021 will be:

Related articles:

Jan 2021

26

New Proposed Statutory Payment Rates Announced for 2021-22

As there was no Autumn Statement or Budget from Chancellor Rishi Sunak, the financial secretary to the Treasury, Jesse Norman announced a written ministerial statement in the House of Commons with details of the increase of the National Insurance thresholds. The 2020 Autumn Spending Review confirmed that the personal tax allowance and tax basic rate threshold would increase by 0.5%. This is based on the consumer price index.

This would mean that the personal tax allowance for 2021-22 would increase by £70 from £12,500 to £12,570 and the tax basic rate threshold for 2021-22 would increase to £37,700 from £37,500.

The annual National Insurance threshold for Small Employer’ Relief remains at £45,000.

Please see some rates details below:

Statutory Adoption Pay |

2020-21 | 2021-22 |

| Earnings threshold | £120.00 | £120.00 |

| Standard rate | £151.20 | £151.97 |

Statutory Maternity Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £151.20 | £151.97 |

Statutory Paternity Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £151.20 | £151.97 |

Statutory Shared Parental Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £151.20 | £151.97 |

Statutory Sick Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £95.85 | £96.35 |

Nov 2020

18

New Real Living Wage Rates Announced

The Living Wage Week took place from 9th to 15th November 2020 and as part of this week the new living wage rates details were announced. The new rates apply to employees aged 18 years of age and older from 9th November 2020, but employers who are already part of this scheme will have six months to apply the new pay rises.

The new London Real Living Wage announced by the Living Wage Foundation, has increased by 10p from £10.75 to £10.85 per hour. This helps reflect the higher cost of living facing families in the city. The UK Living Wage rate has increased by 20p from £9.30 to £9.50, an increase of 2.1%. The Government's current national minimum wage for over 25s is £8.72, which is £78p less than this rate.

It is estimated that over 250,000 employees will be affected by the new real living wage increase. An employee working 37.5 hours per week being paid the new Living Wage rate of £9.50 will earn more than £1,500 more annually compared to an employee on the current national minimum wage for over 25s. And an employee working the same hours per week in London being paid the new Living Wage rate of £10.85 will earn more than £4,000 per year compared to an employee on the national minimum wage for over 25s.

The total number of accredited Living Wage organisations is nearly at 7,000. Over 800 employers have been accredited by the Living Wage Foundation since the start of the Coronavirus pandemic. New companies that have signed up include Capital One, Tate & Lyle and All England Lawn Tennis Club.

An upgrade to BrightPay payroll software has now been released catering for the new Living Wage rates. For information about the Living Wage Foundation visit the Living Wage Foundation website here.

Mar 2020

13

Budget 2020 – An Employer Focus

Chancellor of the Exchequer Rishi Sunak presented Budget 2020 to Parliament on 11th March 2020. The main points to be noted by employers are:

- The personal tax allowance will remain the same at £12,500 for the new tax year 2020-21.

- There are no changes to the PAYE tax thresholds from 6th April 2020.

- The National Insurance threshold will increase by £868, from £8,632 to £9,500 for 2020-21.

- The Employment Allowance has increased to £4,000 from £3,000 for eligible employers.

- From April 2020 the government will restrict the Employment Allowance to employers with an employer National Insurance contributions (NICs) bill below £100,000 in the previous tax year.

- Employees aged 25 and over will receive the National Living Wage of £8.72 an hour and it was announced that it is planned that the National Living Wage (NLW) will increase by two thirds by 2024 that will equate to £10.50 per hour.

- In relation to the Coronavirus, as previously announced by the Prime Minister Statutory Sick Pay (SSP) will be paid from the first day of sick leave rather than day four and the government will refund Statutory Sick Pay for 14 days to employers with less than 250 employees.

- A temporary Coronavirus Business Interruption Loan Scheme will be available for businesses from the government to help pay employees’ wages and business costs.

Jan 2018

12

2018-19 Rates and Thresholds for Employers

For 2018-19 the new personal allowance for an employee is £11,850.

The 20% PAYE tax threshold is for annual earnings up to £34,500.

The UK higher tax rate of 40% is on annual earnings from £34,501 to £150,000.

The UK additional tax rate is 45% on annual earnings over £150,001.

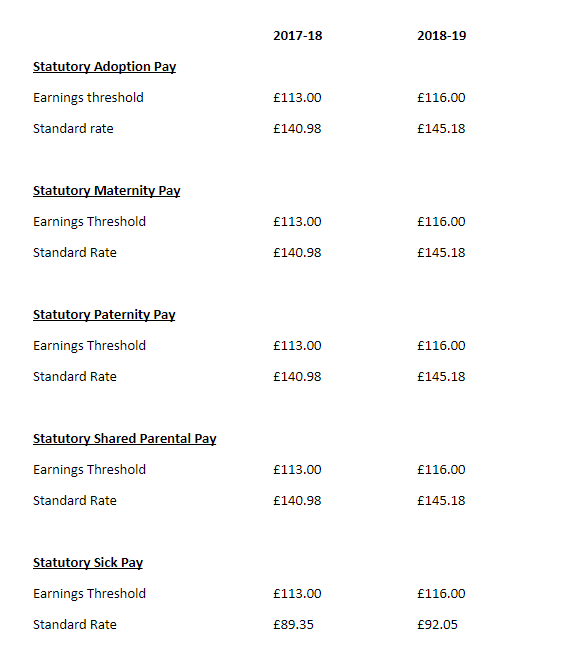

For the new tax year 2018-19, the Department for Work and Pensions have published the statutory payment rates for benefits and pensions.

Click here to see the full list published.

Please see some rates details below:

Jan 2018

5

The UK’s gender pay gap has risen. Here’s how you can help.

The Prime Minister has announced that she is taking action to close the pay gap between male and female employees and ultimately improve workplace equality.

This push being taken by the Prime Minister came after new figures were published. The figures showed that the UK’s overall gender pay gap has risen to 18.4%. Interestingly, the gap for full time workers has fallen from 9.4% in 2016 to 9.1% in 2017.

By law, businesses with 250 plus employees must report the pay gaps and bonus data as a mandatory requirement.

In a bid to seal the gender pay gap The Prime Minister is now asking all companies for their help.

“The gender pay gap isn’t going to close on its own – we all need to be taking sustained action to make sure we address this.”

Here are some of the recommended ways that all businesses can help:

- Ensure there are female representatives at senior level. This can be achieved by ensuring there are opportunities to progress for females within a company. This can also be achieved by introducing a return to work scheme for women.

- Publish gender pay gap information. This can prove helpful in closing the gender pay gap if all companies, even those with fewer than 250 employees, publish this information.

- Make flexible working a reality. This should be advertised with a new position from the start.

Related Articles:

Dec 2017

18

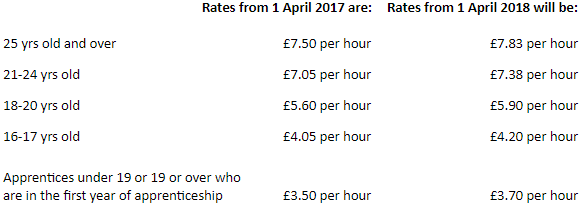

Minimum Wage Increase on 1st April 2018

The Low Pay Commission’s Autumn 2017 report has been published and on the 1st April 2018, the minimum wage will increase again.

The National Minimum Wage (NMW) is the minimum pay per hour most employees are entitled to by law. An employee's age and if they are an apprentice will determine the rate they will receive.