Sep 2022

28

Mini budget reveals big changes for payroll

On the 18th of October 2022, there was an announced reversal of some of the measures previously outlined in September's mini-budget.

The new chancellor, Jeremy Hunt, has made changes to the mini-budget, ahead of the medium-term fiscal plan at the end of October. Hunt will be reversing almost all of the tax cuts, that the previous chancellor, Kwasi Kwarteng, announced in September. Hunt stated that stability is the objective and that this new approach will cost taxpayers much less than originally planned.

Whether you’re an accountant, payroll bureau, business owner or payroll professional, you’re probably wondering what effect this will have on how you run payroll.

Below, we’ve listed the changes which will most affect payroll processors and what steps, if any, you need to take to implement these changes.

1. Income tax stays the same

The reduction of the basic rate of income tax by 1% will be scrapped ‘indefinitely’, and so will remain at 20%.

What do I need to do?

No action from payroll processors is required.

2. Health & Social Care Levy scrapped

- The planned abolishment of the Health and Social Care Levy will go ahead as planned. From 6th November 2022, the temporary increase to National Insurance (NI) contributions will end and the rates which were applicable in the 2021/22 tax year will apply once again.

- The 1.25% Health and Social Care Levy will no longer come into force next year.

- Those who pay National Insurance on an annual basis will pay a blended rate of NI for the 2022/23 tax year to take into accountant the changes in NI rates throughout the year.

The blended rates are as follows:

| National Insurance Class | Main rate | Additional rate |

| Directors | 12.73% | 2.73% |

| Class 1A and 1B | 14.53% | N/A |

| Class 4 | 9.73% | 2.73% |

What do I need to do?

The new rates will mean that payroll software providers will need to update their software from November 6th to account for these changes.

3. IR35 rules to remain the same

It was previously announced that rules regarding off-payroll working would return to what they were pre-2017, however this is now no longer the case. The reform, which would have cost £2bn a year, has now been cancelled and IR35 rules will remain the same.

What do I need to do?

No action from payroll processors is required.

4. Retained EU Law (Revocation and Reform) Bill

The Retained EU Law (Revocation and Reform) Bill is a new bill which will end all EU retained laws by 31st December 2023 to make way for new regulations, tailor-made for the UK.

What do I need to do?

This bill could potentially have massive implications for UK employment law, so it is one to watch in the coming year.

Further changes to the mini-budget

Hunt introduced other changes to the mini-budget, which included:

- The universal help on energy prices will only apply for six months, until April 2023 (instead of the two years that it was originally intended for)

- There will be no rise in corporation tax

- The basic rate of income tax will remain at 20%

- No cuts on dividend tax rates

- New VAT-free shopping for overseas visitors will no longer be going ahead

- There will be no freeze on alcohol duty rates

Related articles:

Sep 2022

16

3 signs your payroll process is outdated

Staying on top of the latest digital business trends isn’t just difficult, it can be quite costly too. From banking apps, to Making Tax Digital – digital processes are becoming the mainstream. The payroll industry is no different and how well you keep up with the rapidly changing industry can often depend on the payroll software you use.

When your business becomes more digitalised, this can have a ripple effect on your entire company – from boosting employee satisfaction to increasing the competency and efficiency of your payroll workflow. But how do you know if your business’ payroll process is outdated, and if so, how can you update it? Let’s look at the top 3 signs your payroll process is outdated, with some easy-to-use tools you can start using today to modernise your business.

Having paper-based payslips

Do you still send employees’ paper-based payslips? Whether you send them by post or leave them in the break room for employees, these can both pose security risks. For example, if you leave payslips around the office floor, or even somewhere such as underneath a till, there’s a good chance that someone in the company could pick up the wrong payslip; exposing a staff member’s personal data to unauthorised persons.

Another way you can distribute payslips is by email. However, this can post security risks, as people might forget their password, or their payslips might get sent to the wrong email, exposing sensitive data to unauthorised users.

Luckily, these days there are much more secure and cost-effective alternatives for distributing your employees’ payslips. One way is by having staff use an employee app that syncs with your payroll software. This streamlines your payroll process by letting your payroll software distribute payslips automatically, at a time of your choosing. Employees can then view, print and download their payslips from anywhere, at any time, from their employee app on their iOS or android device. This streamlines your payroll process by letting your payroll software distribute payslips for you.

BrightPay’s cloud extension, BrightPay Connect, can offer employees access to their own employee app, where they can access payslips from anywhere at any time. As well as a payslip hub, an employee app can come with many other innovative features, such as an annual leave tool and a HR document hub.

Payments take days to land in employees’ bank accounts

If wages take days to land in employees’ bank accounts, it can leave you feeling on edge until you know they’ve been paid. Not only that, but if an error occurs and an employee is underpaid, for example, it could leave them waiting for up to a week to be paid what they are owed. Not to mention the manual workload that’s involved in creating bank files and rectifying such errors, each pay period.

Thankfully, there are faster, easier and more reliable methods of paying employees – some can even allow employees to be paid in as little as 90 seconds. An example of this would be using BrightPay’s integration with Modulr, a direct payments platform that lets you pay employees, HMRC and subcontractors in under 90 seconds, through your payroll software. This saves you time by removing the need to export bank files,and offers your business a more flexible solution to pay employees.

Manually backing up your payroll data

Manually backing up your payroll data to your PC, a third-party cloud server or an external hard drive isn’t just time-consuming, it can also pose security risks. For example, if your PC got hacked, or your external hard drive wasn’t ejected properly, you could potentially lose your data backups or employees’ payroll information could be leaked to unauthorised users. On top of that, manually backing up your payroll data each pay period takes time and it can be easy to forget to do it.

That’s why having your payroll data automatically backed up for you can save you time, while providing your business with a more digitalised and up-to-date solution. This ensures that your payroll data is backed up securely and remotely in the cloud, which increases your GDPR compliance and improves the overall security of your business. Allowing technology to do this tedious work for you in the background means you can attend to other important matters of your business.

A great example of this can be seen in BrightPay’s cloud extension, BrightPay Connect, which backs up your payroll data automatically to the cloud every 15 minutes, and once again when you exit the software. These backups are stored chronologically on the secure Microsoft Azure platform.

BrightPay is one of the UK’s leading providers of payroll software for SMEs. Interested in learning more about their cloud extension, BrightPay Connect? Book a free online 15-minute demo today. To stay up to date with all the latest payroll news and legislative updates, sign up to our weekly newsletter here.

Apr 2022

6

6 payroll mistakes (and how to avoid them)

Payroll is an essential aspect of any business and one which is important to get right. Whether you are running payroll for the first time as a new business or if you have decided to begin to run your payroll in-house, having previously outsourced to a payroll bureau; here are six mistakes to watch out for when processing payroll.

1. Not complying with HMRC

When you run payroll, you need to report payroll information to HMRC. You may be charged penalties if you do not report the correct information to HMRC or if you do not submit the information on time. It is necessary that you use a HMRC recognised software that can report PAYE information online and in real time, known as RTI. Using a HMRC recognised software is needed for:

- Recording your employees’ details.

- Working out your employees’ pay and deductions.

- Working out any statutory pay your employees’ may be entitled to.

- Working out how much you owe to HMRC.

2. Not complying with GDPR

When processing payroll, you are dealing with a lot of personal information. Using a GDPR compliant payroll software means you and your employees can rest assured that all personal data is stored and managed in a safe and secure manner.

3. Not complying with automatic enrolment

It is a legal requirement for employers to enrol eligible employees into a workplace pension scheme which both the employer and the employee will contribute to. There are certain auto enrolment duties that employers must carry out in order to be fully compliant. Some of these duties are once off actions and others are ongoing duties which involves monitoring changes in your employees age and earnings. Every three years, employers must carry out the re-enrolment of any staff who may have left the scheme.

4. Not backing up payroll data

When running payroll, it is highly recommended that you always keep a backup of all payroll data. It is also advised that this back up is saved somewhere other than on the hard drive of the computer you use to process payroll. Using a cloud platform or an external device to back up data is the safest option to ensure you never lose valuable information, should something happen to your computer.

5. Having inexperienced or untrained staff run payroll

While using the right software has made processing payroll easier than ever before, it is still not something that should be assumed is easy and straightforward to do. When staff running payroll are inexperienced or untrained, you are leaving your business open to problems like employees being paid the wrong amounts, penalties for non-compliance, time wasted correcting errors and overall damaging your reputation as a business. It is also important staff keep up to date and informed with any changing HMRC legislation or employee entitlements.

6. Inefficiency and human error

Your efficiency when running payroll will depend greatly on the level of automation used. Automation cuts down on the repetition of uncomplicated tasks. Automation not only saves your business time and money by allowing you to process payroll quicker, it also does so by reducing the possibility of human error. A payroll software must be used to automate payroll processes.

Solution:

You have two options when it comes to ensuring none of these mistakes are made by your business when processing payroll.

Option One: Outsource your payroll to a professional.

Option Two: Choose a payroll software that ensures all these mistakes are easily avoided.

While outsourcing your payroll duties to a professional might seem like the simplest option, it may not be the most cost effective one. You can save money while having the same peace of mind that your payroll is correct by running your payroll in-house with the right payroll software.

BrightPay is a multi-award-winning payroll software that automates payroll processing. The software is constantly performing tasks in the background, which helps streamline your payroll workflows. BrightPay’s integration with HMRC, accounting packages and pension providers automates payroll tasks while also ensuring that you can easily stay compliant.

BrightPay will automatically assess new employees for auto enrolment each pay period and inform you of which employees need to be enrolled. Our software will then continue to monitor staff and inform you of any changes in eligibility, giving you peace of mind that all your auto enrolment duties are taken care of. BrightPay even automatically prepares customised letters which employees must receive, informing them of their auto enrolment rights.

.png)

When it comes to the General Data Protection Regulation(GDPR), BrightPay Connect, our cloud extension, helps you stay compliant by offering a secure online portal for employers to share payslips with their employees as well as other HR documents. Our newest feature, two-factor authentication, adds a second layer of security for employers logging into BrightPay Connect. A security code will be sent to the user via email or text which needs to be entered to log in to the employer dashboard, lowering the risk of data breaches.

While there will be a learning curve with any new software, BrightPay’s user friendly interface and intuitive design makes that learning curve a lot less steep. BrightPay’s website has a comprehensive library of support documentation that takes you step by step through payroll processes. If you cannot find the answer you are looking for, BrightPay’s support team can be reached by phone or email; offering BrightPay customers free help and guidance when they need it.

Other useful resources that can be found on our website are our guides and ebooks, video tutorials, blogs and webinars. Previous webinars can be watched on demand from our website. We also host weekly live webinars which anyone can join for free.

Why not book a free demo today and discover how BrightPay can help you avoid payroll mistakes and make processing payroll a breeze.

Feb 2022

14

What the New Health and Social Care Levy means for employers

On the 7th of September 2021, the government announced a new 1.25% Health and Social Care Levy. The objective of the levy is to fund investment in the NHS, health and social care. This new plan for health and social care will lead to a permanent increase in spending.

In 2020 and 2021, government borrowing was at an all-time high, due to the COVID-19 pandemic. Because of this, it has been decided that increased taxation would be the most responsible way to fund these investments in health and social care.

What does this mean for employers?

The scheme is set to come into effect on 6th April 2022 and will mean that employees’ National Insurance contributions will increase. As an employer, if you pay Class 1, Class 1A or Class 1B National Insurance contributions, you’ll need to start paying the 1.25% increase in contributions from 6th April 2022. These changes will not affect employees who are above State Pension age and are not an employee or self-employed.

From April 2023, NICs rates will return to 2021-22 levels and the 1.25% levy will become a separate new tax. You will need to pay the separate 1.25% levy, and this will also apply to the earnings of individuals who are working and are above State Pension age.

See the gov.uk website for guidance on the Health and Social Care Levy.

What does this mean for payroll?

Your 2022/23 payroll software should be updated to cater for this increase. HMRC are also asking payroll processors to include the following message on the payslips of those affected by the increase:

‘1.25% uplift in NICs, funds NHS, health & social care’.

They are asking that this note be added so that employees understand the increase and what it is helping to fund. Users have the ability to remove this messaging, if they wish to do so.

From the 2023/24 tax year, when the levy becomes a separate tax, it will need to be shown on payslips as a new item. Your payroll software should be updated for the 2023/24 tax year to cater for this.

How do I add the HMRC message to payslips?

If you are a BrightPay customer, this message will be automatically added to the payslips of affected employees. If you are not a customer of BrightPay, depending on the software you use, this message may need to be added manually to payslips by the payroll processor.

While the 1.25% levy will show as a message by default on the payslips, it is optional. This option can be unticked under > Print Payslips > Options in the Payroll section of BrightPay 2022-23

Free Migration

If you’re looking to switch to BrightPay, we offer dedicated migration specialists to help you through the importing and set-up process. You can book a free migration consultation here.

Related articles:

Jan 2022

5

Take the repetitiveness out of payroll

Each pay period, many busy payroll bureau managers find themselves having to input the same payroll data into both their accounting and payroll software. And while the repetitiveness of these tasks might not be in the same bracket as Greek mythological figure Sisyphus, the process can still be quite monotonous. If you haven’t heard of him, Sisyphus was a badly-behaved king who endured a unique punishment. Judged harshly by the gods, he was doomed to push a large rock up a steep hill, only to find it rolling back on nearing the top. Cruelly he was damned to repeat this task for all eternity.

Without integrated systems, you will find yourself entering payroll data repeatedly because the information needs to be in both the payroll and accountancy software. Having to repeat data entry tasks is a negative drain on time, and it also means the payroll will be more prone to human error. Luckily, the evolution of payroll software is not a myth, and technology now exists to reduce this type of endless payroll data entry.

Accounting software integrations rescuing your time

BrightPay Payroll Software’s Application Programming Interface (API) integration feature allows it to easily communicate with and directly send the payroll journal to eleven different accounting packages, including QuickBooks, Sage, Xero and FreeAgent. Because BrightPay’s payroll journals can match all the file formats used by the accounting packages, the need for double entry of information is eliminated. This means there is less chance of errors that can crop up during duplication, which also omits the need to log errors on the payroll diary.

What can you do to improve your #payroll services and how you deliver them?

— BrightPay UK (@BrightPayUK) December 14, 2021

1??Where can you save time?

2??How can you improve client communications?

3??How can you become more profitable?

Register for this upcoming webinar to find out more: https://t.co/DyS5MXDiGt pic.twitter.com/vEKoRPVskP

More BrightPay APIs equals better workflows

BrightPay also has APIs that cater for a quicker pension contribution process. Through BrightPay, you have the ability to send pension-related files in one simple click to the relevant pension systems, removing repetitive data entry and saving you valuable time. BrightPay has direct API integration with pension providers NEST, The People’s Pension, Smart Pension and Aviva.

One of our newest integrations is with payment platform, Modulr, allowing you to pay employees directly through the payroll software. This means you no longer need to create bank files as all the pay information is sent straight to Modulr. All you need to do is set up a Modulr accounts, go in and approve the payments, and employees can be paid in minutes.

Eternal workflow efficiency instead of endless graft

Payroll integration technology now exists that simplifies the potentially burdensome task of sharing payroll journals, pension files and bank files. Because BrightPay’s APIs ensure easy communication with those software solutions, payroll staff need no longer be subject to eternal repetition of routine tasks.

Book an online demo today to find out more about how BrightPay’s integrations can help you.

Nov 2021

29

5 payroll resolutions for January 2022

New year’s resolutions can divide people into two camps. Those who love to start the new year with a clean slate and fresh goals, and those who’ve lost all optimism and scoff at their naivety. Understandably, there are cynics. Changing your behaviour is hard and more often than not, these resolutions fail. The resolutions most likely to fail are those that are too vague with no clear path on how to achieve them.

If you’re setting resolutions for your business or job this year, then break them up into manageable and uncomplicated steps. You’ve likely heard of SMART goals – specific, measurable, achievable, realistic, and time limited. If you’re looking to improve your business, for example, the payroll service you offer, then using this established tool is how you can go about it. Rather than simply saying “I want to make my payroll services better for clients” or “I want to reduce the time I spend on payroll”, decide on specific goals which will help you achieve this.

Achieving payroll goals for 2022

1. Provide an employee app for your clients

This one is a specific, easily achievable goal that can help you provide a better payroll service to your clients. Employee apps have risen in use in recent years and are popular among employers and employees alike. BrightPay Connect, the cloud add-on to BrightPay Payroll Software, includes one and your clients will immediately gain extra value from it. Their employees can book their annual leave through the employee app, view confidential documents, and use it to view their payslips. From a marketing perspective, an employee app can also have multiple benefits. The extra value if offers can encourage customer loyalty, and its frequent use by clients and their employees can increase awareness of your business.

2. Offer clients instant access to reports

Similar to the goal above, this is a simple and achievable step that you can take to improve your payroll services. By using BrightPay Connect, you can offer your clients access to payroll reports whenever they like. This can be more convenient for your clients and can reduce the amount of back-and-forth communication between you and the client.

Once you finalise payroll on BrightPay Payroll Software, the report will automatically become available for the client to view via their BrightPay Connect self-service portal. Your clients will also be able to use the portal to access a number of preprogramed reports, as well as any other payroll reports which have been set up and saved on the payroll application.

3. Spend less time on manual entry

By setting this goal you can reduce the overall time you spend on delivering your payroll services. How can you go about this? First, decide where you want to reduce manual entry. For example, your payroll journal is a good place to start. By using a payroll software which is integrated with the accounting software you use, you can send your payroll journal directly to it. This means you no longer need to spend time on double entry and manually copying figures from your payroll software into your general ledger.

4. Process payroll for multiple clients at once

This goal goes back to your aim of spending less time on payroll. Not all payroll software has batch processing, but one that does is BrightPay. This feature allows you to complete a number of tasks for multiple clients at once. You can batch finalise open pay periods, batch send outstanding RTI and CIS submissions to HRMC, and batch check for coding notices. This can end up saving you a huge amount of time, especially if you have a lot of single director clients whose payroll doesn’t change from month to month.

5. Review your GDPR compliance

It’s always advisable to review your compliance with GDPR and ensure you’re keeping your client’s payroll data secure. By keeping on top of this, you can assure clients that security is a priority for your practice. Make sure the data you collect is the minimum amount required and remember to provide your clients and their employees access to their personal information. Again, an employee app can help with this. Using BrightPay Connect, employees can view and update their personal information, whenever they like.

Discover more:

Now that you’ve decided on what steps you can take to improve your payroll services, make sure you have the right payroll software and employee app to support you. Book a demo today to discover more about BrightPay and BrightPay Connect. BrightPay also offers a 60-day free trial of its payroll software, an ideal way to test out the software to see if it’s the right fit for your business. The free trial version has full functionality with no limitations on any of the features.

Related Articles:

Nov 2021

16

What to include on a payslip and how they should be shared with employees

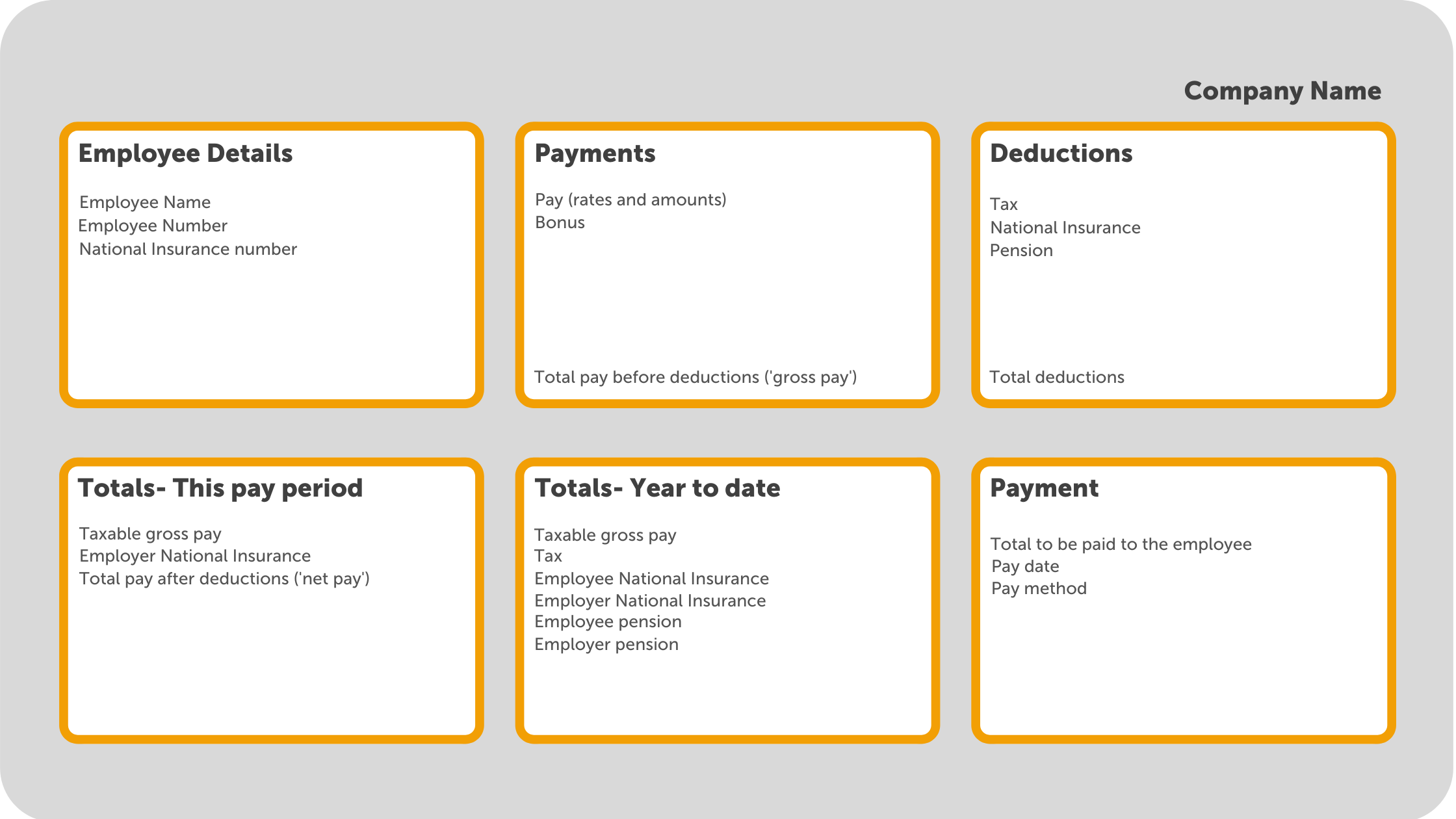

By law, employers must provide all employees with a payslip for each pay period. As well as giving employees a rundown of their earnings and any deductions there might be to their pay, payslips may be required as proof of income when applying for a mortgage or other loans. Payslips should be provided to employees either before or on the day they receive payment and are usually generated within the payroll software. According to ACAS, payslips must include:

- Total pay before deductions

- Total pay after deductions

- Amounts of any variable or fixed deductions

- A breakdown of how the wages will be paid if more than one payment method is used

Below is an example of information you may find on a payslip:

How should payslips be shared with employees?

- Employees’ payslips should be provided to them as at least one of the following:

- A hard copy

- Attached in an email

- An online copy

Giving employees a printed copy of their payslip is becoming less common. As well as the fact many businesses are digitising their paper processes, a payslip contains a lot of sensitive employee information, and a printed payslip could easily fall into the wrong hands. When emailing payslips, it is important that the payslip is password protected. More and more businesses are choosing to opt for sharing payslips with employees online. Not only do they save on paper on ink, but they are also more secure and can be easily retrieved when needed.

How can I provide employees with online payslips?

Some payroll software providers include an option to share employees' payslips through an online portal. BrightPay payroll software has a cloud add-on, BrightPay Connect, which includes an employee self-service mobile app where employees can view and download all new and historic payslips. Once a payslip becomes available, the employee will receive a push notification on their phone. If they do not have access to the app, they can also access their employee portal online from any device.

Sharing employees' payslips through an online portal such as BrightPay Connect is the best way to avoid payslip data breaches and insure you are in compliance with UK data protection laws. It also means that employees will always have access to all their past payslips and won’t need to come to their employer to request them.

Can you produce payslips using Basic PAYE tools?

You can use Basic PAYE tools (BPT) to produce payslips for your employees. However, the payslips produced will not include all the details which you are required to provide by law. By using a payroll software such as BrightPay, the payslips produced will contain all the information required by law, while also being customizable with the option of including additional information.

To find out more about how you can share payslips with employees online, book a free online demo of BrightPay Connect today.

Related articles:

Nov 2021

10

Brexit and GDPR

GDPR’s impact on payroll

The General Data Protection Regulation (GDPR) came into effect in May 2018, and it brought the biggest changes in data privacy regulation in over 20 years. Payroll processors deal with personal and sensitive employee information all the time (e.g., names, emails, addresses, bank details, social security numbers, etc), so it’s critical that this information is kept secure and compliant with the GDPR.

Many companies had to review their data handling processes and equip themselves with new tools to ensure GDPR compliance. For example, keeping payroll records stored safely by using an online cloud server such as BrightPay Connect.

Brexit and GDPR

The EU GDPR is an EU Regulation, and it no longer applies to the UK since Brexit. However, the provisions of the EU GDPR have been incorporated directly into UK law and will be now known as UK GDPR. In simple terms, there’s virtually no difference between the UK version of GDPR and the original EU GDPR. Data can continue to flow as it did before, in most circumstances.

How BrightPay Connect is helping with GDPR

BrightPay Connect is an add-on product to BrightPay payroll software. It provides a remote and secure online portal where you can access payslips, payroll reports, amounts due to HMRC, annual leave requests and employee contact details. The portal allows employers to share and upload HR documents in a secure environment hosted on Microsoft Azure.

BrightPay Connect automatically backs up the payroll data to the cloud every 15 minutes and once again when closing the file. It keeps a chronological history of all backups which can be restored or downloaded anytime, keeping payroll records safely stored at all times, with no risk of losing them.

But that’s just a quick taster of the features that BrightPay Connect has to offer. Book a 15-minute demo today and see for yourself. Or if you are new to BrightPay, why not try our payroll software for free for 60 days. The free trial is fully featured with all functionality.

Don’t take our word for it! View our library of BrightPay Connect testimonials on our website from real customers.

Related articles:

Nov 2021

4

How BrightPay can help with your IR35 obligations

IR35 - also known as “off-payroll working rules” has been both a much-needed bit of legislation to tackle people not paying enough tax, and a massive headache for businesses. It has been marred in controversy since being rolled out to the private sector in April of this year due to mixed messages and confusion on how to properly comply

Basically, since the reforms were introduced, instead of the individual letting HMRC know if they’re an employee or contractor, and therefore treated differently when paying tax, the onus is now on the client engaging them to let HMRC know.

So this is now proving to be a headache as off-payroll workers are not entitled to receive or have deducted from their pay things like statutory payments such as SSP, SMP etc, National Minimum/Living Wage rate, holiday pay, student loans and automatic enrolment pension scheme contributions. So where the hell do you even start? How do you know who should be off-payroll or not?

First of all, you can quickly and easily check employment status for tax here. Once you have identified a worker who is inside IR35 you set them up on BrightPay Payroll Software and tick “off-payroll worker” which will disable entitlements that do not apply to contractors who fall inside the off-payroll working rules. Then, once the employee has been set up, BrightPay will automatically disable some settings such as student loans and annual leave entitlements.

Further to this, if a user tries to add statutory leave, BrightPay will automatically flag this to you and the statutory payment will not be processed. For automatic enrolment, an alert will appear for off-payroll workers for you to mark them as being exempt, which then disables any auto-enrolment features that may appear. Then, when making a full payment submission, it will automatically include details of workers who fall inside IR35, ready to send to HMRC.

If you are the contractor who is working for a large/medium-size company or public sector and are deemed to be inside IR35 then BrightPay has your back here too. Salaries paid to you via your own limited company can be paid without deductions of PAYE and NIC. This is because taxes have already been suffered on the payments from your client.

Now doesn’t that sound like a dream? Get someone to do all the hard work for you - sounds like my cup of tea. By using BrightPay you’ll save yourself a lot of time and energy, but more importantly, remain compliant in a time when HMRC are cracking down hard. One less stress to worry about in these very stressful times! For a full demo on all these amazing features head over to BrightPay and see what all the fuss is about!

Written by Aoibheann Byrne

Related Articles:

Sep 2021

29

BrightPay Connect - The New Norm In HR Management

Human resources is a dynamic field that is constantly changing. HR managers are required to keep up with the times as industries and employment law evolve. Whether that means updating a company policy to reflect legislative developments, finding ways to engage employees in order to create a vibrant work culture, or using innovative new technologies to affect positive change in the workplace, HR managers have a lot on their plate.

If you’re a HR manager, you’re probably nodding your head in enthusiastic agreement right now. But did you know that BrightPay Connect has been designed with you in mind? Not only can it streamline the payroll process, but it can have significant benefits for the HR department too.

BrightPay Connect provides much needed solutions to the challenges that HR managers face everyday. These vary from data storage and protection to internal communication and leave management, in other words - all of the things that take up your time and prevent you from working on the tasks that really need your attention. That’s why Connect is quickly becoming the new norm for forward-thinking HR professionals across Ireland and the United Kingdom.

What Is BrightPay Connect?

Connect is a cloud-based add-on to BrightPay’s payroll software. It offers a vast range of powerful new features, including an employee self-service smartphone and tablet app, automated cloud back-up, online employer dashboards and so much more. Connect combines payroll and HR functionality to create a holistic product that benefits bureaus, employers, HR and payroll administrators and employees alike.

Although BrightPay’s payroll software can only be accessed on a PC, BrightPay Connect can be used on any device, anywhere. The payroll is still processed on the desktop version of BrightPay, but the payroll information is stored online on a secure cloud server. This makes it particularly useful for the rapidly growing number of businesses who are offering remote working options to their employees. Remote working presents many challenges to HR managers, many of which are addressed by Connect.

However, this doesn’t mean that only businesses with remote working employees will benefit from BrightPay Connect. Keep reading to find out how Connect can transform your HR department.

Employee apps are a growing trend in human resource management. Self-service apps can allow employees to take control of their personal data, communicate with employers, and track their annual leave. Click the link to read more: https://t.co/FHMBkHCWEi pic.twitter.com/qvPhVr1Git

— BrightPay UK (@BrightPayUK) September 22, 2021

BrightPay Connect For HR Professionals

Although BrightPay Connect has many features that can have positive impacts on HR management, there are three in particular that HR managers love.

Annual Leave Management

Managing annual leave can be time-consuming and complicated, especially if your business has a large number of employees. However, it doesn’t have to be. BrightPay Connect includes an annual leave management feature that makes the process more straightforward for both employees and HR managers.

On their self-service app, employees can request annual or unpaid leave via the employee calendar. As soon as the request has been sent it will appear on their HR manager’s BrightPay Connect online dashboard. From here, the HR manager can check the company calendar to see if anyone else will be on leave on those dates, and either approve or deny the request accordingly.

Furthermore, a time-stamped record is kept of all requests, approvals and denials, along with which manager dealt with them. This is very useful if there are multiple managers managing leave requests from their own departments.

Document Sharing and Storage

BrightPay Connect makes document sharing more efficient and effective than ever before. From their employer dashboard, employers can upload documents to Connect. These documents are then available via employee dashboards or the employee self-service app.

This feature is fully customizable, meaning that the employer can choose which employees get access to the documents uploaded. They may choose to make them available to the entire company, to a specific team or department, or to just one individual employee. Similarly, they can choose to keep them private if they need to. For example, they may upload an employee file for a new employee. By uploading it, it’s automatically stored in the cloud but nobody who shouldn’t see it will have access to it.

Employee Personal Data

Finally, BrightPay Connect makes it easier for HR managers to comply with their data protection obligations under the GDPR. One such obligation relates to giving employees access to any personal data on them that you store.

In the employee app, employees can view this information and request to make edits. One example of this in practice would be if an employee moves house and needs to update their postal address, or changes phone number and needs to replace their old number with their new one.

Every HR manager knows how important it is to comply with GDPR so the fact that BrightPay Connect helps with this is a major advantage to the cloud-based add-on.

Book Your Free BrightPay Connect Demo

To find out more about how BrightPay Connect can help you to streamline your HR process and evolve with the times, book a free demo with our Connect team today. They’ll walk you through the benefits of our industry leading add-on and show you why BrightPay Connect is fast becoming the new norm in HR management.