Sep 2022

16

3 signs your payroll process is outdated

Staying on top of the latest digital business trends isn’t just difficult, it can be quite costly too. From banking apps, to Making Tax Digital – digital processes are becoming the mainstream. The payroll industry is no different and how well you keep up with the rapidly changing industry can often depend on the payroll software you use.

When your business becomes more digitalised, this can have a ripple effect on your entire company – from boosting employee satisfaction to increasing the competency and efficiency of your payroll workflow. But how do you know if your business’ payroll process is outdated, and if so, how can you update it? Let’s look at the top 3 signs your payroll process is outdated, with some easy-to-use tools you can start using today to modernise your business.

Having paper-based payslips

Do you still send employees’ paper-based payslips? Whether you send them by post or leave them in the break room for employees, these can both pose security risks. For example, if you leave payslips around the office floor, or even somewhere such as underneath a till, there’s a good chance that someone in the company could pick up the wrong payslip; exposing a staff member’s personal data to unauthorised persons.

Another way you can distribute payslips is by email. However, this can post security risks, as people might forget their password, or their payslips might get sent to the wrong email, exposing sensitive data to unauthorised users.

Luckily, these days there are much more secure and cost-effective alternatives for distributing your employees’ payslips. One way is by having staff use an employee app that syncs with your payroll software. This streamlines your payroll process by letting your payroll software distribute payslips automatically, at a time of your choosing. Employees can then view, print and download their payslips from anywhere, at any time, from their employee app on their iOS or android device. This streamlines your payroll process by letting your payroll software distribute payslips for you.

BrightPay’s cloud extension, BrightPay Connect, can offer employees access to their own employee app, where they can access payslips from anywhere at any time. As well as a payslip hub, an employee app can come with many other innovative features, such as an annual leave tool and a HR document hub.

Payments take days to land in employees’ bank accounts

If wages take days to land in employees’ bank accounts, it can leave you feeling on edge until you know they’ve been paid. Not only that, but if an error occurs and an employee is underpaid, for example, it could leave them waiting for up to a week to be paid what they are owed. Not to mention the manual workload that’s involved in creating bank files and rectifying such errors, each pay period.

Thankfully, there are faster, easier and more reliable methods of paying employees – some can even allow employees to be paid in as little as 90 seconds. An example of this would be using BrightPay’s integration with Modulr, a direct payments platform that lets you pay employees, HMRC and subcontractors in under 90 seconds, through your payroll software. This saves you time by removing the need to export bank files,and offers your business a more flexible solution to pay employees.

Manually backing up your payroll data

Manually backing up your payroll data to your PC, a third-party cloud server or an external hard drive isn’t just time-consuming, it can also pose security risks. For example, if your PC got hacked, or your external hard drive wasn’t ejected properly, you could potentially lose your data backups or employees’ payroll information could be leaked to unauthorised users. On top of that, manually backing up your payroll data each pay period takes time and it can be easy to forget to do it.

That’s why having your payroll data automatically backed up for you can save you time, while providing your business with a more digitalised and up-to-date solution. This ensures that your payroll data is backed up securely and remotely in the cloud, which increases your GDPR compliance and improves the overall security of your business. Allowing technology to do this tedious work for you in the background means you can attend to other important matters of your business.

A great example of this can be seen in BrightPay’s cloud extension, BrightPay Connect, which backs up your payroll data automatically to the cloud every 15 minutes, and once again when you exit the software. These backups are stored chronologically on the secure Microsoft Azure platform.

BrightPay is one of the UK’s leading providers of payroll software for SMEs. Interested in learning more about their cloud extension, BrightPay Connect? Book a free online 15-minute demo today. To stay up to date with all the latest payroll news and legislative updates, sign up to our weekly newsletter here.

Sep 2022

8

6 features your payroll software should have

Running payroll can be a headache, depending on what payroll software provider you use. Nobody wants to be using outdated, clunky software that isn’t updated regularly, or one that is not compliant with the latest payroll legislation. On top of that, using outdated software can take up a lot of time that could be spent on developing your business instead.

It’s time to choose a payroll software that not only processes payroll quicker, but that automates many other payroll tasks for you, such as paying employees, and submitting payroll information to HMRC. This means less evenings spent in the office processing payroll, and more free time to focus on customers or exciting plans for the company you’ve been putting on hold.

Here are the top six features that payroll software providers should be offering your business in 2022.

1. HMRC functionality

Using a HMRC compliant payroll software is the most important feature to look out for when choosing a payroll software provider. Staying compliant with the latest legislation should be at the forefront of your decision-making process. From automatically generating FPSs to submitting RTI forms, there are many automated features out there that are available to businesses that can streamline their duties to HMRC. This allows your business to both save time and reduce the workload involved in running payroll.

2. Integration with Accounting Software

Manually re-entering figures from your payroll software into your accounting software can be a tedious part of your payroll workflow. Not only that but inputting the wrong figures or entering the same data twice can lead to errors, which can be time-consuming to rectify. Using a payroll software that’s integrated with your accounting software can transform this process into a simple and seamless task, by transferring the data from your payroll journals directly into the general ledger within your accounting package. This can greatly reduce the time you spend on payroll, each pay period.

3. Distribute payments from within the software

Running payroll and paying employees used to be entirely separate processes. Between creating bank files, ensuring all the pay information is correct, and ensuring that payments will land in employees’ accounts on time; paying employees can take up a significant amount of time each pay period. Thankfully, choosing a payroll software provider that’s integrated with a direct payment platform can now offer you the ability to pay employees from directly within the payroll software.

An example of this can be seen when using an integrated payment platform which uses the Faster Payments service, where you can pay employees in as little as 90 seconds from within the payroll software. This integration can also provide you with more flexibility in your business by letting you schedule payments in advance. This offers you peace of mind around your payments by allowing you to make any necessary last-minute changes to your payments, before they’re distributed.

4. Auto enrolment and pension integration

While auto enrolment has made saving for retirement easier for employees, it has made payroll a more time-consuming process for employers. Whether you’re assessing employees’ eligibility, enrolling them into a pension scheme or sending out enrolment letters to employees, this can be incredibly time-consuming as a busy employer.

Thankfully, with the right payroll software in place, these tasks can now be more automated from within your payroll software. The Pensions Regulator has encouraged businesses to use a software that can help you comply with these auto-enrolment duties. For an even smoother experience, we also recommend choosing a payroll software provider that is integrated with leading pension scheme providers, streamlining this process even further for you.

5. Generate payroll reports

Producing payroll reports is an important tool for many businesses, as it can be used for financial forecasting. Having a payroll software that can generates reports which can include a variety of metrics is key when it comes to analysing your business’ finances. Whether you’re looking for reports across multiple pay periods, department totals, or amounts you’ve paid to HMRC, it’s important to choose a payroll software that can accommodate this, rather than spending hours creating reports in excel from scratch.

6. Multi-user access

Whether you have multiple people in your business working on payroll, or some payroll processors working remotely, having a payroll software that allows multiple users to work in the payroll software at the same time is a must-have feature for 2022. This aligns with the growing popularity in hybrid working models and assures that no matter where your payroll processors are, they can easily access the payroll software from anywhere, at any time.

Which software do we recommend?

While there are many software providers out there, BrightPay Payroll Software provides all these features we’ve mentioned above and more, such as:

- Integration with leading accounting software, pension scheme providers and direct payment platforms, such as Modulr.

- Free migration support

- Installation on up to 10 different devices

- Excellent customer phone and email support, at no extra charge

BrightPay is one of the UK’s leading providers of payroll software for businesses, with a 5-star rating on Trustpilot and a 99.1% customer satisfaction rate.

Our 60-day free trial offers full functionality and is contract-free, so you can use our software to the fullest, without making any commitments. Interested in learning more about BrightPay? Book a free 15-minute demo online today, to see the software in action.

Get a software that offers more than just payroll…

To automate your business even further, BrightPay’s cloud extension, BrightPay Connect, provides a host of HR and payroll solutions that can revolutionise your business internally, including:

Online hub where you can upload confidential and important HR documents

- Employee app where employees can access a chronological history of their payslips that automatically sync from the payroll software

- Employer dashboard where you can view all of your employees’ payroll information at a glance

- Annual leave management tool where you can easily approve and reject leave requests and view all of your company’s leave in a user-friendly calendar format

Click here to see a one-minute video on BrightPay Connect, or book a free online demo of our cloud-extension today, to take your business to the next level.

Aug 2022

31

Our 2022 customer survey results: BrightPay in the cloud

It's that time of the year again, the BrightPay customer satisfaction survey results are in. This was our first customer survey since becoming part of Bright which, as well as being the provider of BrightPay payroll software, is a provider of accounts production, bookkeeping and practice management software.

The aim of our annual customer surveys has been to discover what we are doing right and what we can improve on. However, this year especially, one of the main objectives of our survey was to learn more about our customers' expectations, hopes and ambitions as a business, and see how we, as software providers, can best support these aspirations.

Over 1000 BrightPay users took part in this year’s survey, including accountants and payroll bureaus who process payroll for their clients, and businesses who take care of their payroll in-house.

BrightPay’s 2022 customer survey: The results

One of the first questions we ask our customers each year is “How satisfied are you with BrightPay?,” and we’re happy to announce that BrightPay have achieved a 99.1% customer satisfaction rating for 2022. This means that our customer satisfaction rate has now been 99% or higher for 9 years in a row.

Another important question for us has always been “How happy are you with our customer support?”. This year, BrightPay received an impressive customer support rating of 98.9%.

An important metric for us is our Net Promoter Score (NPS) which is used to determine how likely users are to recommend our software to a friend or colleague. BrightPay’s NPS for 2022 was 71.4, putting us well above the industry average of 40 for B2B software and SaaS.

BrightPay in the cloud

In this year's customer survey, there was a lot of focus on BrightPay’s fully cloud version*, which will become available as a Beta version later this year. We asked why you’re likely or unlikely to switch to the online version of BrightPay, and what worries or apprehensions you may have about switching to the cloud payroll software.

Reasons why users said they were interested in moving to the online version of BrightPay included:

- The ability to access the software from anywhere, at any time

- The multi-user capabilities that come with having full online access to the software

- The fact that hosting and data security is transferred to Bright

- Having the ability to scale your payroll service offering

- Having an edge over competitors

- The possibility of increasing profitability

- The ability to track user updates

- Automatic software updates

- To reduce the need for an in-house server

Reasons why users were unlikely or unsure about making the switch, were a lot less varied than those that said they were likely to switch. The majority gave the reason that they were happy with the functionality of BrightPay’s desktop version and felt no reason to move.

A number of users said that they had limited internet access or were living in areas with a slow internet connection, and so felt that an online software wasn’t an option for them. However, we are aware that a proportion of our customers may face this issue, which is why the Windows version of BrightPay will remain available.

The main theme we noticed amongst respondents who said they were unlikely to make the move were concerns of the learning curve that may be associated. Others expressed a lack of knowledge surrounding cloud technology, with comments such as “I’m not sure I understand cloud technology,” “As a small business, I’m unsure if I need it” and “I need to learn more about the cloud software’s features.” However, as you can see from the list above of why users will most likely make the switch, cloud software has many benefits, with the main ones encompassing flexibility, scalability, and security.

At BrightPay, we aim to make the migration process as automated and as seamless as possible for our users to switch from the desktop to cloud payroll solution. The online payroll software’s screen layouts and user design will be almost identical to BrightPay’s desktop version and so there will be almost no learning curve. Our aim is to ensure that the software continues to be user-friendly.

How the online version of BrightPay will look

We understand there is always apprehension when switching to a new system, but users can rest assured that the cloud software will be just as easy to use as the BrightPay you’re used to, with the added benefits.

To celebrate National Payroll week, which is from 5th - 9th September and organised by the CIPP to demonstrate the impact the payroll industry has in the UK through the collection of income tax and National Insurance, BrightPay will be holding a free online webinar. The webinar is on the evolution of payroll, from its beginnings to what we can expect in the future. Register now to confirm your place. Check out our dedicated National Payroll Week webpage for more payroll news and updates.

The development of our fully cloud version of BrightPay is progressing as expected. At the moment, we are on track for a target beta release towards the end of 2022. Fill in this form if you wish to be notified when the beta version is available to use. If you want to learn more about BrightPay and our current cloud payroll extension, BrightPay Connect, book a free online demo today.

*While you will be able to process payroll using BrightPay’s online version, features of the cloud software won’t include the same functionality as the desktop version upon initial release. However, we will be working hard to get the online software in line with the desktop version.

Apr 2022

6

6 payroll mistakes (and how to avoid them)

Payroll is an essential aspect of any business and one which is important to get right. Whether you are running payroll for the first time as a new business or if you have decided to begin to run your payroll in-house, having previously outsourced to a payroll bureau; here are six mistakes to watch out for when processing payroll.

1. Not complying with HMRC

When you run payroll, you need to report payroll information to HMRC. You may be charged penalties if you do not report the correct information to HMRC or if you do not submit the information on time. It is necessary that you use a HMRC recognised software that can report PAYE information online and in real time, known as RTI. Using a HMRC recognised software is needed for:

- Recording your employees’ details.

- Working out your employees’ pay and deductions.

- Working out any statutory pay your employees’ may be entitled to.

- Working out how much you owe to HMRC.

2. Not complying with GDPR

When processing payroll, you are dealing with a lot of personal information. Using a GDPR compliant payroll software means you and your employees can rest assured that all personal data is stored and managed in a safe and secure manner.

3. Not complying with automatic enrolment

It is a legal requirement for employers to enrol eligible employees into a workplace pension scheme which both the employer and the employee will contribute to. There are certain auto enrolment duties that employers must carry out in order to be fully compliant. Some of these duties are once off actions and others are ongoing duties which involves monitoring changes in your employees age and earnings. Every three years, employers must carry out the re-enrolment of any staff who may have left the scheme.

4. Not backing up payroll data

When running payroll, it is highly recommended that you always keep a backup of all payroll data. It is also advised that this back up is saved somewhere other than on the hard drive of the computer you use to process payroll. Using a cloud platform or an external device to back up data is the safest option to ensure you never lose valuable information, should something happen to your computer.

5. Having inexperienced or untrained staff run payroll

While using the right software has made processing payroll easier than ever before, it is still not something that should be assumed is easy and straightforward to do. When staff running payroll are inexperienced or untrained, you are leaving your business open to problems like employees being paid the wrong amounts, penalties for non-compliance, time wasted correcting errors and overall damaging your reputation as a business. It is also important staff keep up to date and informed with any changing HMRC legislation or employee entitlements.

6. Inefficiency and human error

Your efficiency when running payroll will depend greatly on the level of automation used. Automation cuts down on the repetition of uncomplicated tasks. Automation not only saves your business time and money by allowing you to process payroll quicker, it also does so by reducing the possibility of human error. A payroll software must be used to automate payroll processes.

Solution:

You have two options when it comes to ensuring none of these mistakes are made by your business when processing payroll.

Option One: Outsource your payroll to a professional.

Option Two: Choose a payroll software that ensures all these mistakes are easily avoided.

While outsourcing your payroll duties to a professional might seem like the simplest option, it may not be the most cost effective one. You can save money while having the same peace of mind that your payroll is correct by running your payroll in-house with the right payroll software.

BrightPay is a multi-award-winning payroll software that automates payroll processing. The software is constantly performing tasks in the background, which helps streamline your payroll workflows. BrightPay’s integration with HMRC, accounting packages and pension providers automates payroll tasks while also ensuring that you can easily stay compliant.

BrightPay will automatically assess new employees for auto enrolment each pay period and inform you of which employees need to be enrolled. Our software will then continue to monitor staff and inform you of any changes in eligibility, giving you peace of mind that all your auto enrolment duties are taken care of. BrightPay even automatically prepares customised letters which employees must receive, informing them of their auto enrolment rights.

.png)

When it comes to the General Data Protection Regulation(GDPR), BrightPay Connect, our cloud extension, helps you stay compliant by offering a secure online portal for employers to share payslips with their employees as well as other HR documents. Our newest feature, two-factor authentication, adds a second layer of security for employers logging into BrightPay Connect. A security code will be sent to the user via email or text which needs to be entered to log in to the employer dashboard, lowering the risk of data breaches.

While there will be a learning curve with any new software, BrightPay’s user friendly interface and intuitive design makes that learning curve a lot less steep. BrightPay’s website has a comprehensive library of support documentation that takes you step by step through payroll processes. If you cannot find the answer you are looking for, BrightPay’s support team can be reached by phone or email; offering BrightPay customers free help and guidance when they need it.

Other useful resources that can be found on our website are our guides and ebooks, video tutorials, blogs and webinars. Previous webinars can be watched on demand from our website. We also host weekly live webinars which anyone can join for free.

Why not book a free demo today and discover how BrightPay can help you avoid payroll mistakes and make processing payroll a breeze.

Apr 2022

5

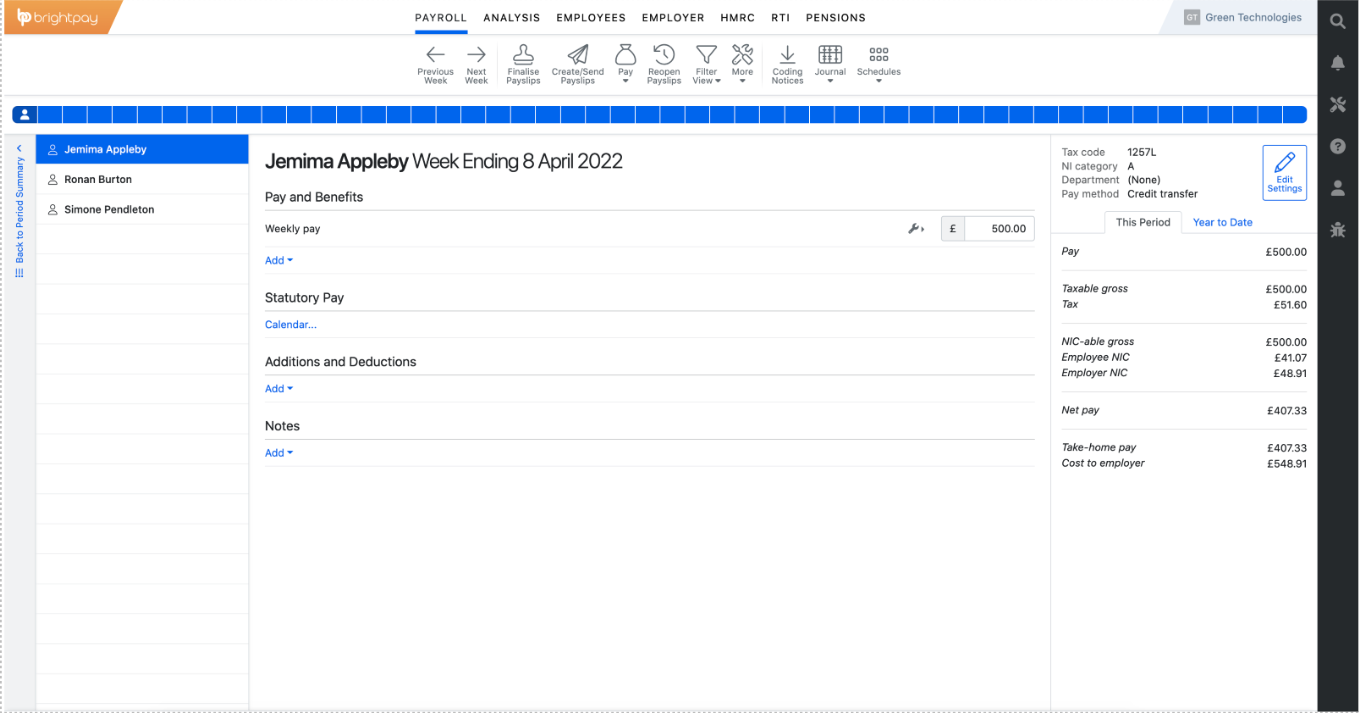

Spring Statement: Payroll changes for April and July

What changes have been made to payroll?

This year’s Spring Statement or “mini-budget” has brought some small changes to how payroll is processed, which will be happening in April and July 2022.

The first change was made to Employment Allowance, which will increase from £4,000 to £5,000 per year. This will take effect from 6th April 2022.

The National Insurance Primary Threshold will increase from £9,880 to the same level as the tax threshold, £12,570. This will take effect from 6th July 2022.

How will this affect my payroll processing?

If you’re using BrightPay, you have nothing to worry about when it comes to these changes. Our software is up to date with these new regulations, and they have been implemented in the software. You, as the payroll processor, can simply continue using BrightPay the way you always have.

How do I stay more up to date with legislation changes?

Here at BrightPay, as one of the leading payroll software providers in the UK and Ireland, we aim to provide you with the most up-to-date and innovative solutions to your day-to-day payroll processes and workflow.

BrightPay is a fully HMRC compliant software, ensuring that your business’ payroll aligns with the latest legislation. BrightPay also stores all communication logs that you have with HMRC, letting you know if your submissions contain any errors in a user-friendly format, which can save you lots of time.

BrightPay features that can help your practice

Automatic Enrolment

Find it hard to get your head around Automatic Enrolment requirements? BrightPay streamlines the entire process for you and provides full automatic enrolment functionality within the payroll software. From setting up employees’ pensions schemes and enrolling them, to sending out personalised automatic enrolment letters and re-enrolment – BrightPay makes all of this possible in a simple and user-friendly format, saving your business a hefty amount of admin workload.

CIS functionality

Unsure when it comes to paying subcontractors? BrightPay has an entire tab dedicated to CIS (Construction Industry Scheme) within the payroll software that caters to all types of subcontractors – including companies, partnerships and sole traders. You can also verify new subcontractors through HMRC from within the payroll software.

Cloud extension

Our cloud extension, BrightPay Connect, helps ensure GDPR compliance by storing your employees’ payroll data securely in the cloud. These backups are done automatically every 15 minutes, ensuring the safety and security of your employees’ payroll.

BrightPay hosts regular free online webinars including webinars on updates to changes in payroll legislation. As well as this, through our website you can find support documentation, video tutorials and payroll guides, available for you to read at any time.

Interested in learning more about BrightPay? Why not sign up for a free 15-minute demo to see how our software can enhance your business in more detail. You can also try our software for free with our 60-day free trial, so you can get the best use of our software before making any commitments.

Related articles:

Apr 2022

1

7 reasons why accountants are switching to BrightPay this year

As an accountant, switching payroll software providers can be an overwhelming decision, given the amount of options available. It’s important to choose a payroll software that can not only meet your clients’ expectations but exceed them as part of your service offering.

Here are seven reasons why accountants are making the switch this new tax year to one of the UK’s leading payroll software providers.

1. Free migration support

Switching over to new software can sometimes be a complicated and time-consuming task to undertake. On top of that, many software providers who offer migration support to their customers, require a service fee. To help take the hassle out of migrating from one payroll software to another, BrightPay offers free migration support.

When you choose to switch over to BrightPay payroll software, you will be assigned an account manager who will guide you throughout the entire setup process, at no extra cost. This ensures that you’re on your feet and ready to go once the switch over has been made.

Book a free migration call with us today and find out why accountants are switching to BrightPay. We are an award-winning payroll software provider, winning AccountingWEB’s ‘Top Payroll Product of the Year 2021’ and ‘Payroll and HR Software of the Year 2021’.

2. Batch Processing

With BrightPay, you can batch process payroll for multiple clients at the same time, which is especially useful for single-director clients whose payroll doesn’t change each pay period. This includes batch finalising payslips, batch sending any outstanding RTI and CIS submissions, along with batch checking for coding notices.

3. Online bureau and client dashboards

With our cloud extension, BrightPay Connect, you can view all of your clients’ payroll information in one secure location, through an online bureau dashboard. Here, you can send payroll requests to clients and in turn, they can enter their payments, additions and deductions for that pay period through their own employer dashboard. You can review the information the client has entered and once happy with it and you have accepted it, the information will automatically update in the payroll software. This feature means you won't have to manually add the payroll information or upload a CSV file.

You can also send a payroll summary to clients for approval before the payslips are finalised. This ensures that your clients are accountable for the accuracy of their employees’ payslips.

BrightPay Connect’s employer dashboard can also benefit your clients by streamlining HR processes. These include:

- Uploading HR or other employee documents to the portal for employees to view, print or download. Accessibility to such documents can also be customised, allowing only certain employees or departments to view them.

- Managing employees’ annual leave through a user-friendly company calendar. Here, clients can easily accept/reject employees’ annual leave requests.

- Clients’ employees have access to an employee app, where they can access payslips, easily submit annual leave requests, view important documents, and request to change any personal details the employer has on their file.

BrightPay Connect also comes with other benefits for accountants and bureaus, such as customisable branding options. Through this, your clients can see your own company name, logo and contact details when they login, enhancing your relationship with them.

Interested in learning more about BrightPay Connect? Watch this short one-minute video on how BrightPay Connect can enhance your business or book a free online demo.

4. Pay employees, subcontractors and HMRC directly through the software

Our integration with direct payments platform, Modulr, allows you to pay employees in as little as 90 seconds, directly through BrightPay. Through the integration, you can also schedule payments, which lets you make any last-minute changes, allowing greater flexibility in how you pay employees.

5. Reports

When using BrightPay, you can create your own customised reports, with over 100 data items to choose from. These reports can be viewed, printed or downloaded, at your convenience. Clients also have the ability to run reports themselves through their employer dashboard, meaning less emails and less admin work for payroll processors.

6. CIS and auto enrolment

BrightPay includes full CIS functionality at no extra cost, allowing you to process subcontractors’ payroll quickly and easily. You can also send subcontractor verification requests directly to HMRC from within BrightPay.

Setting up automatic enrolment pension schemes is also a breeze with BrightPay, simplifying the entire automatic enrolment process. BrightPay is integrated with a number of the UK’s leading pension providers and automatically assesses your clients’ employees for you, and notifies you of any changes to their work status. BrightPay also goes the extra mile by automatically generating enrolment letters for you that are customised for each employee, streamlining this task for you even further.

7. Muti-user remote access

With BrightPay, the payroll software can be installed on up to 10 different devices. This means that up to 10 different users can process the payroll or from 10 different locations. It also means that if you have employees who process the payroll working remotely, they have the ability to access the software from multiple locations.

Mar 2022

22

BrightPay 2022/23 is Now Available. What's New?

BrightPay 2022/23 is now available (for new customers and existing customers).

Over the past year, we have continued to focus the majority of our development efforts on bringing a version of BrightPay to the cloud, which we plan an announcement on soon. But work on BrightPay for Windows and macOS continues. Here’s an overview of what’s new in 2022/23:

2022/23 Tax Year Updates

- There are no changes to tax bands and rates for 2022/23 in England, Wales and Northern Ireland. For Scottish tax codes, the bands have been updated for 2022/23. The emergency tax code remains the same as it was in 2021/22.

- 2022/23 employee and employer National Insurance contribution rates, thresholds and calculations, including:

- Support for new Veterans NIC

- Support for new Freeports NIC

- Support for Mariners NIC

- 2022/23 Student Loan and Postgraduate Loan thresholds.

- 2022/23 Statutory Sick Pay rates.

- 2022/23 rates and average weekly earnings thresholds for Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay and Statutory Parental Bereavement Pay.

- 2022/23 rates and calculations for company cars, vans and fuel.

- Ability to process 2022/23 HMRC coding notices.

- April 2022 National Minimum/Living Wage rates.

- Eligible employers can continue to claim Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

- 1.25% Health and Social Care Levy note appears by default on payslips, as requested by HMRC. It can be turned off if need be.

- BrightPay 2022/23 version 22.1 (released on 24/03/2022) also contains the following updates announced in the 2022 Spring Statement:

- Increase to the National Insurance Primary Threshold for Class 1 NICs.

- Annual Employment Allowance limit increased to £5,000.

Automatic Enrolment Updates

- 2022/23 qualifying earnings thresholds.

- For 2022/23, the minimum required pension contribution level continues to be 8%, at least 3% of which must be contributed by the employer.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions to ensure continued compatibility with all pension scheme providers.

BrightPay (for Windows) is now 64-bit

BrightPay for Windows is now a 64-bit application. This does not make any difference to the experience of using BrightPay or its functionality, but it comes with a few nice optimisations:

- 64-bit apps just run better on 64-bit versions of Windows (which our telemetry shows us nearly 95% of our customers are using).

- 64-bit apps are able to access more computer memory than 32-bit apps can. This means that BrightPay will more smoothly handle employer files with a very large number of employees, which for certain operations can see memory spikes.

A 32-bit version of BrightPay for Windows will continue to be made available for those who need it.

(This does not affect BrightPay for macOS, which has always natively supported 64-bit Macs where applicable.)

Other New Features and Updates in 2022/23

- Support for manual journal entries. This can be used to account for things like Employment Allowance or recovered statutory pay in journals, as well as anything else.

- Improves handling of employee payment/bank details – changes to details now automatically apply across the whole tax year, meaning that finalised payslips no longer need to be re-opened first.

- The user interface for finalising and re-opening payslips now uses progress bars.

- Several additional minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

Includes all updates made to BrightPay during the 2021/22 tax year

Here's a quick reminder of some of the main areas of improvement:

- Ability to pay employees, subcontractors, or HMRC using Modulr.

- Supports the latest UK and London Living Wage rates, announced in November 2021.

- Various improvements to validation and on-screen guidance to aid data accuracy and quality.

- Support for additional Automatic Enrolment pension scheme providers.

- Support for posting payroll journals to additional accounting software providers.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Feb 2022

9

Case Study: Why this family run firm remains loyal to BrightPay

Fernhill Accountants are a family run accountancy firm located in Farnborough, Hampshire and have been in business since 2013. When they first started off, owner Judy Dean looked after the accountancy and taxation side of the business while her daughter Lucy later joined to take care of marketing and customer service. Fernhill Accountants’ clients are primarily micro businesses, and they have a mix of sole traders and limited companies. One of Fernhill Accountants’ first clients was a Community Interest Company (CIC), and since then they’ve built up their CIC client base. Fernhill Accountants offer bookkeeping, accounting, taxation and payroll services to their clients.

A software that grows with the business

Fernhill Accountants didn’t initially offer payroll services to their clients but when one of their CIC clients asked if they would do it, they agreed. As they were not sure if the payroll side of their business would work out and not wanting to commit resources too quickly to it, they started off by using HMRC’s Basic PAYE Tools. However, using Basic PAYE Tools to process payroll was time-consuming and because the functionality was so limited, tasks such as auto-enrolment were taking far longer than they should. “The functionality just wasn’t there. With the pensions and auto-enrolment duties coming in, it was all taking too long,” This is when Judy decided she needed to start looking for payroll software that would meet all their requirements.

Judy began researching the different payroll software available. This is when she first became aware of BrightPay. After looking into the various features of BrightPay and weighing the benefits up against other payroll systems, Judy felt confident that BrightPay could take care of her payroll needs. Reading BrightPay’s reviews on AccountingWEB reaffirmed her decision.

The importance of telephone support

Another payroll software provider which had been mentioned to Judy and which she had considered was Moneysoft. However, what helped her make the final decision was the fact that Moneysoft didn’t provide any customer phone support at that time, while BrightPay did. “One of the big reasons we went with BrightPay in the end was because you have telephone support,” Judy told us. Judy preferred speaking directly to a payroll specialist because from experience, phone support often solved problems quicker than email. And so, happy with all the information she gathered, Judy made the final decision and started using BrightPay for the 2017/18 tax year.

Time saved through integrations

Since Judy started using BrightPay to process payroll she hasn’t looked back. Straight away Judy noticed how quick and easy BrightPay was to use.

BrightPay includes direct API integration with a number of accounting packages. For Judy, BrightPay’s integration with accounting software Xero was important to have. “The integration with Xero has been great. It has saved me a lot of time. Thanks to the integration I can just send it over and adjust it if I need to – it’s so easy. I’ve also quite a few clients on BrightPay and Xero and it just flows through quite happily.” Another integration that has saved Judy time is BrightPay’s integration with pension providers, in particular, Nest. “We’ve clients who are on Nest and once we got through the initial set up it was very easy. It works out everything for you and the clients just pay them what they’re meant to pay and that’s it, job done,” she said. Judy also found the in-software notifications very handy for remembering pension related tasks, “The nudges the software gives you all the time to remind you what you need to do for auto-enrolment have been great. So yes, it works brilliantly; it’s secure and saves us so much time.”

BrightPay’s cloud add-on saves more time by cutting down on emails

Fernhill Accountants are also using the optional cloud add-on, BrightPay Connect. One of the ways Judy has saved time using BrightPay Connect is by giving clients access to an online dashboard where they can run payroll reports anytime, anywhere. “It’s more secure and saves me from having to email clients and add in the attachments. Everything the client needs is there. I don’t have to worry about making mistakes or not attaching the correct report.” “Before, when I had to save the reports and then go and find them and attach them to the emails it was taking me about 15 minutes per client each time. So now that we have BrightPay Connect we don’t need to do that anymore. It cuts out a lot of emails that would come in as well. The time saving is immense for me.” BrightPay Connect’s automatic online backup has also saved Judy time when processing payroll. “An additional benefit of BrightPay Connect is that your payroll data is automatically backed up to the cloud so we no longer have to back it up manually.”

Speaking to someone gets problems solved quicker

Another feature of BrightPay that has been very important for Judy and Fernhill Accountants is the level of assistance she receives from the support team. As mentioned, it is important for Judy that she gets to speak to someone over the phone whenever she needs help. “The support is excellent. Both email and phone. It’s great to be able to speak to a real person because when you’re not sure about what you’re doing, you don’t always explain it very well in an email. So, I find when I’m unsure about something when running payroll and I speak to BrightPay’s support team, they can kind of prise out of me what it is I’m doing or not doing and the issue gets solved a lot quicker.”

So, after four years of Fernhill Accountants using BrightPay to process payroll for their clients we asked Judy if she would be renewing her BrightPay licence next year. “Definitely, without a doubt,” Judy answered without hesitation. “When I first made the decision to use BrightPay I was hopeful that I wouldn’t be dissatisfied in any way, and I can honestly say I haven’t.”

If you want to find out exactly why Judy hasn’t looked back since making the move to BrightPay, schedule a free 15-minute demo of BrightPay and BrightPay Connect with a member of our team today. Or why not book a free 60-day trial of BrightPay and try the software for yourself with no obligation to purchase.

Feb 2022

3

5 Reasons why BrightPay receives a 99% Customer Satisfaction Rating

For the seventh year in a row BrightPay received a 99% customer satisfaction rating! The team at BrightPay are delighted to see that as we continue to grow, we are delivering on and exceeding our customer’s expectations, are providing the critical support they need, and are offering a payroll solution that works.

From the many reasons mentioned by our customers that explained why they were “extremely or very satisfied” with the software, there were five that stood out.

1. Ease of use:

Analysing the results of our survey, there was a phrase continuously repeated by our customers – “It is just so easy to use”. The easy-to-follow and intuitive interface of BrightPay payroll software is not an unexpected coincidence. We understand the importance of a well laid-out and instinctive computer software. This makes it much easier for you to learn the program and you don’t have to repeatedly go to the help guide as you automatically understand the next step in the process. That’s why, even with the development of more features and added functions to the program, we haven’t compromised on the design.

2. Functionality:

Of course, it’s no surprise that the features and functionality of BrightPay are critical to customer’s satisfaction with it. As one customer put it “it does what it says on the tin”. We know it wouldn’t be possible to achieve a 99% score without the successful delivery of auto-enrolment, journal integration, CIS, pension integration, IR35, and batch-enrolment. Such features allow you to process payroll quickly, reduce errors associated with manual-entry of figures, and carry out other duties in a more efficient manner.

3. Support:

The excellent support we deliver to our customers was another point repeatedly highlighted in the survey. The support we offer ranges from phone and email support from our payroll specialists to free product demos, webinars, guides, and other documentation. We understand the importance of customer support, both when you’re starting out using the software as well as further down the line, when unexpected situations arise and mistakes are made. That’s why customer support is included in all licences and has been free for nearly 30 years.

4. Innovation:

At BrightPay we aim to create the best customer experience possible. To do this, we continuously look for new and innovative solutions to problems payroll processors and business owners encounter on a day-to-day basis. We are happy to see our customers benefiting from our latest partnership, one that allows you to pay employees, subcontractors, and HMRC all from within BrightPay. The partnership with the payment platform, Modulr, allows you to send payments in under 90 seconds, 24/7, 365 days a year.

5. The choice of BrightPay Connect:

Working on the cloud is an absolute must for some, while for others, it’s an option which they aren’t too fussed over. With BrightPay Connect, we provide an optional cloud add-on to BrightPay payroll users. Customers can decide for themselves whether they want or need the cloud platform. If they decide to use BrightPay Connect, they have the reassurance that their data is automatically backed-up to the cloud, can send reports directly to the employer’s self-service portal, and can offer an app to employees where they can view their payslips, add annual leave, and much more.

Future Development

Through the survey, our customers gave us their feedback on the payroll software, what they loved and what they thought could be improved. This yearly survey is critical to our development strategy. From it, we know what is most important to our customers which informs what features we concentrate on developing. We know that there is always room for improvement and will continue to push ourselves to deliver the best payroll software available.

Learn more about BrightPay

If you’re interested in learning more about BrightPay and how it can improve your payroll services, schedule a 15-minute demo with a member of our team today. Or why not book a free 60-day trial of BrightPay and try the software for yourself with no obligation to purchase.

Related Articles:

Jan 2022

5

Take the repetitiveness out of payroll

Each pay period, many busy payroll bureau managers find themselves having to input the same payroll data into both their accounting and payroll software. And while the repetitiveness of these tasks might not be in the same bracket as Greek mythological figure Sisyphus, the process can still be quite monotonous. If you haven’t heard of him, Sisyphus was a badly-behaved king who endured a unique punishment. Judged harshly by the gods, he was doomed to push a large rock up a steep hill, only to find it rolling back on nearing the top. Cruelly he was damned to repeat this task for all eternity.

Without integrated systems, you will find yourself entering payroll data repeatedly because the information needs to be in both the payroll and accountancy software. Having to repeat data entry tasks is a negative drain on time, and it also means the payroll will be more prone to human error. Luckily, the evolution of payroll software is not a myth, and technology now exists to reduce this type of endless payroll data entry.

Accounting software integrations rescuing your time

BrightPay Payroll Software’s Application Programming Interface (API) integration feature allows it to easily communicate with and directly send the payroll journal to eleven different accounting packages, including QuickBooks, Sage, Xero and FreeAgent. Because BrightPay’s payroll journals can match all the file formats used by the accounting packages, the need for double entry of information is eliminated. This means there is less chance of errors that can crop up during duplication, which also omits the need to log errors on the payroll diary.

What can you do to improve your #payroll services and how you deliver them?

— BrightPay UK (@BrightPayUK) December 14, 2021

1??Where can you save time?

2??How can you improve client communications?

3??How can you become more profitable?

Register for this upcoming webinar to find out more: https://t.co/DyS5MXDiGt pic.twitter.com/vEKoRPVskP

More BrightPay APIs equals better workflows

BrightPay also has APIs that cater for a quicker pension contribution process. Through BrightPay, you have the ability to send pension-related files in one simple click to the relevant pension systems, removing repetitive data entry and saving you valuable time. BrightPay has direct API integration with pension providers NEST, The People’s Pension, Smart Pension and Aviva.

One of our newest integrations is with payment platform, Modulr, allowing you to pay employees directly through the payroll software. This means you no longer need to create bank files as all the pay information is sent straight to Modulr. All you need to do is set up a Modulr accounts, go in and approve the payments, and employees can be paid in minutes.

Eternal workflow efficiency instead of endless graft

Payroll integration technology now exists that simplifies the potentially burdensome task of sharing payroll journals, pension files and bank files. Because BrightPay’s APIs ensure easy communication with those software solutions, payroll staff need no longer be subject to eternal repetition of routine tasks.

Book an online demo today to find out more about how BrightPay’s integrations can help you.