Mar 2016

31

Budget 2016 - Employer Focus

The main points to be noted by employers from Budget 2016 announced by Chancellor George Osborne are:

• The personal tax allowance will increase by £500 from £11,000 to £11,500 from April 2017

• The higher rate tax threshold will increase to £45,000 from April 2017

• Termination payments over £30,000 which are subject to income tax currently from April 2018 will be subject to Employer National Insurance Contributions (NICs)

• Class 2 National Insurance Contributions for self-employed people will be scrapped from April 2018

• The range of benefits that are subject to income tax and National Insurance Contributions are going to be examined by the government with the aim of limiting the range of benefits subject to income tax and NIC. It is the view of the government that such benefits such as the pension saving, childcare and schemes such as the Cycle to Work will still continue to benefit from the relief of income tax and NIC when provided through salary sacrifice agreements.

• A new discount rate for employers contribution to the unfunded public service pension schemes is set at 2.8% and in 2019-20 employers will have to pay higher contributions into the scheme as a result.

• The rate of tax on loans to directors and participators will increase by 7.5% to 32.5% in April 2016.

Mar 2016

23

BrightPay 2016/17 is Now Available. What's New?

BrightPay 2016/17 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2016/17 Tax Year Updates

- 2016/17 rates, thresholds and calculations for PAYE, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, and Statutory Shared Parental Pay.

- The emergency tax code has changed from 1060L to 1100L. When importing from BrightPay 2015/16, L codes are uplifted by 40, while M codes are uplifted by 44 and N codes by 36.

- Full support for Scottish Rate of Income Tax (SRIT) codes.

- The new NI category H is available for apprentices under 25 in qualifying circumstances. Payments to class H employees are not liable to Class 1 secondary NICs.

- With the abolishment of Contracted Out Pension, HMRC have discontinued NI categories D, E, K, I and L. When importing from BrightPay 2015/16, employees in any of these categories are moved into the equivalent non-contracting-out category.

- Support for Plan 1 and Plan 2 Student Loan deductions.

- Ability to process 2016/17 coding notices.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all RTI submission types.

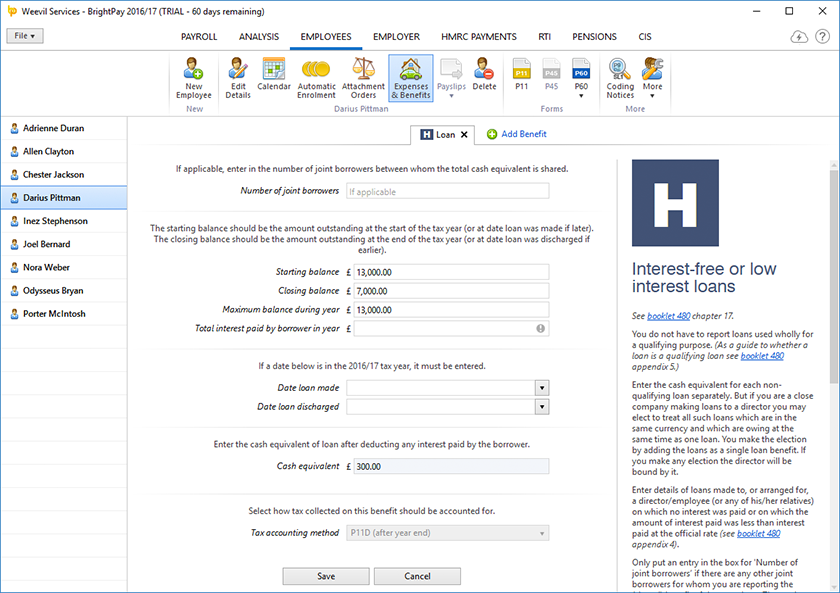

Expenses and Benefits

BrightPay 2016/17 allows you to record all types of reportable expenses and benefits that you provide to your employees:

- Assets transferred (cars, property, goods or other assets)

- Payments made on behalf of employee

- Tax on notional payments

- Vouchers and credit cards

- Living accommodation

- Mileage allowance and passenger payments

- Car and fuel

- Vans and fuel

- Private medical treatment or insurance

- Qualifying relocation expenses payments and benefits

- Services supplied

- Assets placed at the employee’s disposal

- Other items (Class 1A)

- Other items (Non-Class 1A)

- Income Tax paid but not deducted from director’s remuneration

- Interest-free or low interest loans

- Travelling and subsistence payments

- Entertainment

- General expenses allowance for business travel

- Payments for use of home telephone

- Non-qualifying relocation expenses

- Other expenses

BrightPay can produce a P11D for sending to HMRC after year end which includes your Class 1A NICs declaration and details of the expenses and benefits provided including cash equivalents.

If you register for payrolling of benefits by 5 April 2016, BrightPay 2016/17 also supports calculating the PAYE on expenses and benefits in each pay period.

We will be back-porting some of the expenses and benefits features to BrightPay 2015/16 to allow you to send your P11D for the 2015/16 tax year. Look out for an upgrade in April/May.

Note: Expenses/benefits and P11D are not available for Free Licence customers.

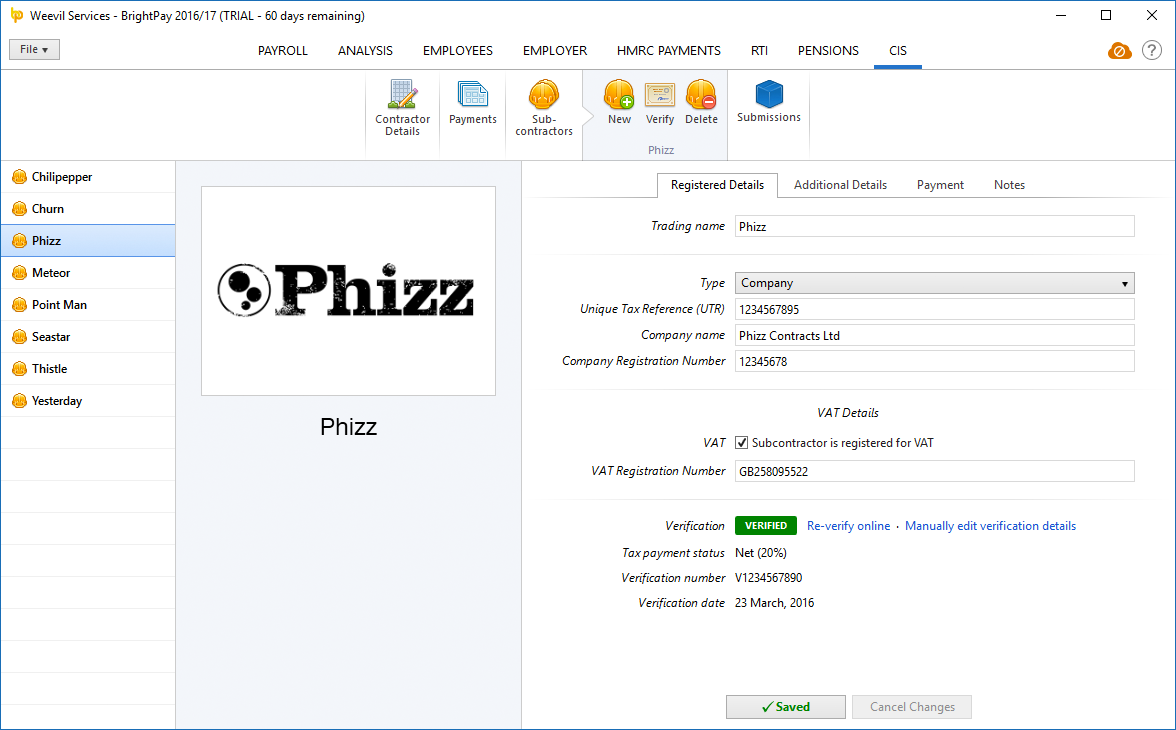

Construction Industry Scheme (CIS)

BrightPay 2016/17 has full support for paying subcontractors under the Construction Industry Scheme (CIS):

- Add/edit subcontractors, or import from CSV.

- Pay subcontractors tax weekly or tax monthly (all year or part year).

- Customisable basic pay, daily rates, hourly rates, additions, deductions, etc.

- Record cost of materials and VAT.

- Calculate CIS deduction amounts according to subcontractor's tax payment status.

- Print, export to PDF, or email Subcontractor Payment and Deduction Statements.

- Send CISREQ subcontractor verification submissions and apply response data.

- Send CIS300 monthly returns.

- BrightPay tracks the number of unsent CIS submissions, similar to RTI.

- Report on CIS data in BrightPay Analysis (some built-in CIS reports are available)

Note: CIS is not available for Free Licence customers.

Pensions and Automatic Enrolment

If you have not yet entered your Automatic Enrolment Staging Date in BrightPay, you can now connect directly to the Pensions Regulator and retrieve it automatically from within BrightPay.

BrightPay 2016/17 now tracks the number of enrolment/contributions submissions that you have not yet submitted to your pension scheme provider. The number is shown on the main PENSIONS tab, and contributes to the total number shown on the Open Employer screen (which also includes RTI and CIS).

We'll be continuing to update Automatic Enrolment during the 2016/17 tax year and provide dedicated support for more pension scheme providers.

Coming Soon: BrightPay Cloud

BrightPay Cloud will allow you to connect your BrightPay employer data to a web based service that provides:

Secure Online Backup

Automatically backs up your BrightPay data to the cloud. A historical set of backups is maintained. Your data file can be restored from an online backup at any time.

Employee Self-Service

Enables employees to log in to a web-based portal using their PC, Mac or smartphone to retrieve payslips, view their calendar, request annual leave, view/update personal information, and more.

Bureau Client Self-Service

Enables payroll bureaux to provide an online portal not only for their customer's employees (i.e. employee self-service as described above), but also an employer portal for direct use by their employer customers, enabling them to view payroll reports, P30s, calendar, all employee information, and more.

BrightPay Cloud will work directly with BrightPay 2016/17, but also allow you to upload your BrightPay 2015/16 data to immediately have a full year of historical data to power the self-service features.

BrightPay Cloud will cost £49 per employer per tax year (with discounted bulk pricing for bureaux also available).

We'll have more news very soon. As a BrightPay customer, you'll be the first to know. Watch this space!

Other 2016/17 Changes in BrightPay

- Ability to import employees from an FPS XML file.

- When importing from HMRC Basic PAYE Tools, you can choose to do so from the previous tax year or the current tax year.

- Pension-able gross can be split into separate employee and employer pension-able gross amounts.

- Basic pay, daily pay and hourly pay can now be explicitly flagged as liable/not-liable to PAYE, NICs, employee pension, and employer pension.

- Additional Statutory Paternity Pay is no longer relevant and is removed in BrightPay 2016/17.

- The NIC Upper Accrual Point is no longer relevant and is removed from BrightPay 2016/17.

- New wider range of built-in reports.

- Pension provider enrolment/contributions submissions and file formats have been updated to the latest versions.

- Ability to view submission logs for NEST web service submissions.

- An HMRC payment date is no longer required to be able to progress to the next HMRC pay period. Any pay period can be clicked into at any time.

- Ability to report on HMRC payment amounts in Analysis.

- Employee passwords can be randomly generated.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

BrightPay 16/17 is the same price as BrightPay 15/16 (including FREE for small employers with up to three employees). Support will continue to be free of charge for all users.

Mar 2016

17

Late Filing Relaxation of FPS to end on 5th April 2016

Penalties from HMRC will be issued if any late filing of a Full Payment Submission (FPS) from 6th April 2016 onwards.

Currently there is a 3 day relaxation for filing a late Full Payment Submission which is detailed per the HMRC website GOV.UK https://www.gov.uk/guidance/what-happens-if-you-dont-report-payroll-information-on-time

"HMRC won’t charge a penalty if:

• your FPS is late but all reported payments on the FPS are within 3 days of your employees’ payday (this applies from 6 March 2015 to 5 April 2016)"

The other circumstances where HMRC will not issue a penalty for late submission of an FPS are when:

• you’re a new employer and you sent your first FPS within 30 days of paying an employee

• it’s your first failure in the tax year to send a report on time (this doesn’t apply to employers who register with HMRC as an annual scheme or have fewer than 50 employees for the tax year 2014 to 2015)

Mar 2016

17

Increase in National Minimum Wage from 1st October 2016

The Low Pay Commission's (LPC) recommendations for the rates of the minimum wage for employees under 25 and apprentices has been accepted by the Government and this take effects from 1st October 2016.

These include:

21-24 year olds £6.95 per hour an increase of 3.7%

Youth Development Rate - 18-20 year olds £5.55 per hour an increase of 4.7%

16-17 Year Old Rate £4.00 per hour

Apprentice Rate £3.40 per hour an increase of 3%

The Government has introduced the National Living Wage of £7.20 per hour for employees over 25 which takes effect on 1st April 2016.

Feb 2016

16

Payroll Benefits - Have you registered?

Payrolling of benefits: From the start of the tax year 2016/17, employers can account for the tax on benefits provided to employees through PAYE each pay day. Employers must register with HM Revenue and Customs (HMRC) using the online Payrolling Benefits in Kind (PBIK) service before 6th April 2016 to start payrolling for tax year 2016/17.

HMRC will amend tax codes before the start of the tax year to remove any benefits previously included. In later years employers changing over to payrolling must register well before the start of the tax year.

Registering with HMRC allows you to payroll tax on benefits without the need to submit a form P11D after the end of the tax year. You can register with HMRC using the PBIKs service

Using the online service, you can:

• Choose which benefits and expenses you want to include in the payroll for the following tax year

• Add or remove benefits and expenses

• Exclude employees who receive benefits or expenses but don’t want them payrolled. For these employees you must continue to report the benefit or expense on a P11D (you can exclude an employee at any time in a tax year but once you’ve done this you can’t reverse the decision, in year)

The only benefits you won’t be able to payroll are:

• Vouchers and credit cards

• Living accommodation

• Interest free and low interest (beneficial) loans

Tax is collected on benefits and expenses by adding a notional value to your employee’s taxable pay in payroll, tax is then deducted or repaid as usual as per the employee’s tax code.

PBIK functionality is planned for BrightPay 2016/17.

Feb 2016

11

Automatic Enrolment: Are you prepared to deal with this potential increase in business?

Increasing your prices is never very popular with clients and you may even risk losing a small percentage of your client base. If you are a bureau, deciding what to charge for auto enrolment services can be a daunting task. Your client will want to know what they are getting in return for the additional fee, therefore, communication will be fundamental to your success. If you do get your pricing strategy right, your clients will thank you for taking the automatic enrolment duties off their hands.

Download our free AE pricing guide:

CPD Accredited - Auto Enrolment Training for Payroll Bureaus

Did you know that 44% of payroll advisors have already spoken to their clients about automatic enrolment? This year will be significant with over 500,000 employers due to stage. However, some employers still do not know that automatic enrolment applies to them. Others are burying the head in the sand and avoiding AE altogether. Find out what you need to know on BrightPay’s Auto Enrolment online training session. This training has been CPD accredited and advisors receive two CPD hours by attending.

Guest Speaker - The Pensions Regulator

Have you got a burning question for the Pensions Regulator (TPR) ?? BrightPay is delighted to announce that Neil Wilson from TPR will join us on the webinar. Neil will cover the employer duties that payroll bureaus need to be aware of along with what lesson TPR has learned since AE was launched. HE will also discuss the AE what payroll services you could offer as a bureau. Neil will cover what you need know in relation offering your services and the law.

Get in touch today to see how BrightPay can help you prepare for automatic enrolment. New customers can now get a free BrightPay 2015/16 plus 25% off 2016/17 bureau licence when you switch from a different payroll software provider.*

Book a demo with our sales team today to find out how BrightPay handles auto enrolment and how it can increase the efficiency of your bureau. You can also try out the software with a 60 day free trial.

Feb 2016

10

New Apprenticeship Levy to be Introduced for 2017-18 Tax Year

In the Finance Bill 2016 legislation will be introduced for the new Apprenticeship Levy which will take effect from 6 April 2017. Currently draft legislation has been published to introduced this new levy.

The new Apprenticeship Levy will be paid by employers and will help fund new apprenticeships in the future. This levy of 0.5% will be charged on employers’ paybills which will be based on the total employee earnings subject to Class 1 secondary NICs. The levy will be payable through Pay As You Earn (PAYE) and will be payable alongside income tax and National Insurance.

An annual allowance of €15,000 will be made available to each employer to offset against their levy payment, which calculates that the Levy will only be payable on paybills on over £3 million in that tax year. Similar to the Employment Allowance Claim, an employer who operates multiple payroll schemes will only be able to claim one annual allowance for this levy.

Jan 2016

22

Contracting-out - on its way out!

From 6th April 2016 contracting out of the additional State Pension on a defined benefit basis will cease. Employees will no longer be able to use a contracted-out salary related occupational scheme to contract out of the State Scheme and will be automatically put back into the State pension scheme. The rebate of 1.4% for employers and 3.4% for employees will also end at 5th April 2016.

With the new State Pension being introduced there will a few changes in what and how you report to HMRC:

• Employers will no longer have to report on the Full Payment Submissions to HMRC the Employers Contracting-out Number (ECON) and the Scheme Contracted-out Number (SCON)

• A requirement to report National Insurance earnings between Primary Threshold (PT) and Upper Earnings Limit (UEL), as was required prior to 2009

• It is not necessary to report the information of seperating the National Insurance (NI) earnings between the Primary Threshold (PT) and Upper Accruals Point (UAP) and UAP to Upper Earnings Limit (UEL).

• From the start of the new tax year employers will be no longer be allowed to use your Contracted-out Salary Related (COSR) occupational pension scheme to contract out employees out of the new State Pension scheme.

• The form P60 will change as there will be one less column to complete on the form.

HMRC systems will be all updated to reflect these changes from 6th April 2016 onwards and the UAP field will be removed from the Full Payment Submission (FPS) and Earlier Year Update (EYU).

Regarding the National Insurance Categories for the 2016-17 tax year the Standard Insurance tables/categories A,B,J,M,P,Q,R,T,Y and Z will replace the contracted-out National Insurance tables/categories of D,E,I,K,L,N,O and V.

Jan 2016

1

No 'Y' Suffix Tax Code from 6th April 2016

For the tax year beginning 6th April 2016 HMRC will cease to use the suffix 'Y' on tax code notifications P2, P6 and P9. As the personal tax allowance in 2016-17 will increase from £10,600 to £11,000 it will result in the basic personal allowance being higher than the maximum personal age allowance of £10,660 for people born before 6th April 1938.

All employers or pension providers will receive a P9 coding notification for the 2016-17 tax year advising the correct tax code for all individuals affected. All individuals who would have had a 'Y' suffix in their tax code previously will be issued with a P2 notice of coding informing them of their new tax code.

HMRC's systems will still accept the 'Y' suffix if submitted but HMRC have requested the 'Y' suffix not to be used by employers or payroll agents.

Dec 2015

14

10 key reasons to move from HMRC Basic PAYE Tools to BrightPay

1. BrightPay is HMRC recognised

2. RTI is fully automated

3. BrightPay will automatically import your HMRC Basic PAYE Tools data

4. BrightPay will handle all auto enrolment tasks (at no extra cost)

5. BrightPay includes the NEST API, meaning the upload of auto enrolment data is automated

6. BrightPay will perform a pre staging assessment of your workforce to establish how much auto enrolment is going to cost and to determine if you need to register with a pension scheme

7. Payslips can be emailed to employees and will contain details of any pension deductions

8. You can use postponement, giving you more time to get a pension scheme in place

9. BrightPay is free for up to 3 employee records or £89 plus VAT per annum for a single employer with unlimited employees

10. Support is included in this price

This list is not exhaustive and only covers the key points.