Dec 2021

28

Additional data protection with two-factor authentication

As the digital world becomes more and more advanced, cyber threats are on the rise. According to a recent report from Microsoft, enabling two-factor authentication (2FA) blocks 99.9% of automated attacks on your accounts. This is because there is an additional security layer that the hacker must crack. Most major websites and banks offer an option to enable two-factor authentication and it is recommended that you turn it on wherever possible as prevention is better than the cure!

Payroll software should be no exception when it comes to adding an extra layer of security. That’s why BrightPay’s add-on product BrightPay Connect has the option for users to enable 2FA when logging in. The account administrator can enable this feature in the Settings tab on their main dashboard in BrightPay Connect.

Tick the box for ‘Enable two-factor authentication’ and Save Changes. When any user on the Connect account tries to sign into Connect via an internet browser or through BrightPay they will have to enter the security code sent by email or text as a second security feature.

BrightPay Connect’s two factor authentication feature adds an additional layer of security to an already secure hosted platform as data stored on Connect is backed up to Microsoft Azure servers. By enabling this feature, users will have more reassurance that their payroll data or client’s payroll data is safer and even more secure.

BrightPay is a leading UK payroll software that makes managing payroll quick and easy for accountants, payroll bureaus and employers. BrightPay’s optional online add-on product BrightPay Connect enables cloud payroll software features including an automatic cloud backup, an annual leave management tool, an employer dashboard, an employee self-service portal and much, much more. Book a free online demo of BrightPay and BrightPay Connect to learn about how you can run your payroll more efficiently and most importantly, safer.

Related articles:

Nov 2021

29

5 payroll resolutions for January 2022

New year’s resolutions can divide people into two camps. Those who love to start the new year with a clean slate and fresh goals, and those who’ve lost all optimism and scoff at their naivety. Understandably, there are cynics. Changing your behaviour is hard and more often than not, these resolutions fail. The resolutions most likely to fail are those that are too vague with no clear path on how to achieve them.

If you’re setting resolutions for your business or job this year, then break them up into manageable and uncomplicated steps. You’ve likely heard of SMART goals – specific, measurable, achievable, realistic, and time limited. If you’re looking to improve your business, for example, the payroll service you offer, then using this established tool is how you can go about it. Rather than simply saying “I want to make my payroll services better for clients” or “I want to reduce the time I spend on payroll”, decide on specific goals which will help you achieve this.

Achieving payroll goals for 2022

1. Provide an employee app for your clients

This one is a specific, easily achievable goal that can help you provide a better payroll service to your clients. Employee apps have risen in use in recent years and are popular among employers and employees alike. BrightPay Connect, the cloud add-on to BrightPay Payroll Software, includes one and your clients will immediately gain extra value from it. Their employees can book their annual leave through the employee app, view confidential documents, and use it to view their payslips. From a marketing perspective, an employee app can also have multiple benefits. The extra value if offers can encourage customer loyalty, and its frequent use by clients and their employees can increase awareness of your business.

2. Offer clients instant access to reports

Similar to the goal above, this is a simple and achievable step that you can take to improve your payroll services. By using BrightPay Connect, you can offer your clients access to payroll reports whenever they like. This can be more convenient for your clients and can reduce the amount of back-and-forth communication between you and the client.

Once you finalise payroll on BrightPay Payroll Software, the report will automatically become available for the client to view via their BrightPay Connect self-service portal. Your clients will also be able to use the portal to access a number of preprogramed reports, as well as any other payroll reports which have been set up and saved on the payroll application.

3. Spend less time on manual entry

By setting this goal you can reduce the overall time you spend on delivering your payroll services. How can you go about this? First, decide where you want to reduce manual entry. For example, your payroll journal is a good place to start. By using a payroll software which is integrated with the accounting software you use, you can send your payroll journal directly to it. This means you no longer need to spend time on double entry and manually copying figures from your payroll software into your general ledger.

4. Process payroll for multiple clients at once

This goal goes back to your aim of spending less time on payroll. Not all payroll software has batch processing, but one that does is BrightPay. This feature allows you to complete a number of tasks for multiple clients at once. You can batch finalise open pay periods, batch send outstanding RTI and CIS submissions to HRMC, and batch check for coding notices. This can end up saving you a huge amount of time, especially if you have a lot of single director clients whose payroll doesn’t change from month to month.

5. Review your GDPR compliance

It’s always advisable to review your compliance with GDPR and ensure you’re keeping your client’s payroll data secure. By keeping on top of this, you can assure clients that security is a priority for your practice. Make sure the data you collect is the minimum amount required and remember to provide your clients and their employees access to their personal information. Again, an employee app can help with this. Using BrightPay Connect, employees can view and update their personal information, whenever they like.

Discover more:

Now that you’ve decided on what steps you can take to improve your payroll services, make sure you have the right payroll software and employee app to support you. Book a demo today to discover more about BrightPay and BrightPay Connect. BrightPay also offers a 60-day free trial of its payroll software, an ideal way to test out the software to see if it’s the right fit for your business. The free trial version has full functionality with no limitations on any of the features.

Related Articles:

Nov 2021

26

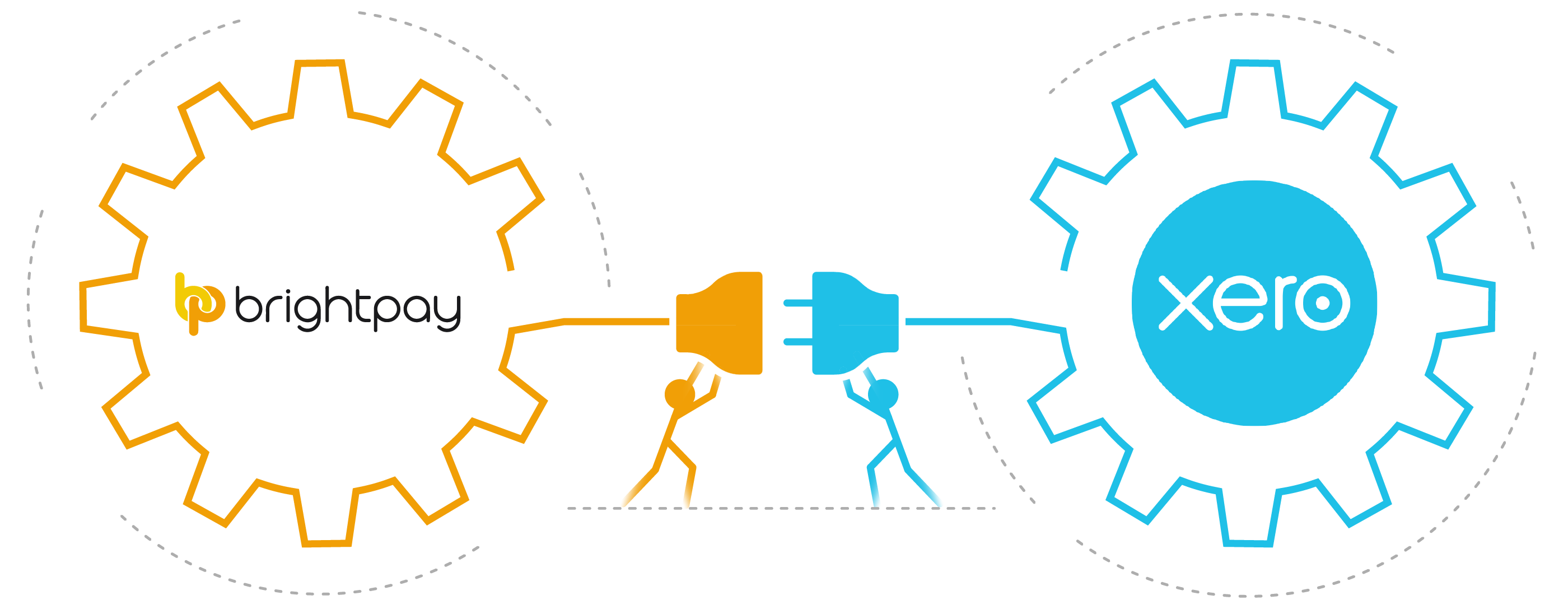

The must-have integration for Xero customers

Customers of Xero accounting software now have the option of integrating their accounting package with their payroll software. With BrightPay payroll software, Xero customers can make use of an API (Application Programme Interface) to send their payroll journal directly from BrightPay to their general ledger in Xero. This straight-forward integration saves time, increases efficiency and make the payroll workflow that much smoother. A free trial of BrightPay is available to Xero customers through Xero’s marketplace.

The importance of integrating your accounting software:

As your business grows, so too do the number of financial tools you need to successfully manage your employees, operations, and customers. The amount of software you need, can at times, be overwhelming, confusing, and inadvertently result in time being wasted.

API integrations have become increasingly popular because, aside from their obvious benefit of saving you time, they also mitigate the risk of mistakes, reduce administrative tasks, and free you up, allowing you to focus on other responsibilities.

Save time:

With your payroll system communicating directly with your accounting software, you no longer need to spend time on the tedious task of manually exporting, importing, and entering figures multiple times. Instead, you can send payroll information to the correct account with just a click of a button.

Reduce data entry and errors:

Double entry of figures is well known for producing errors. By using the API, you will be able to send payroll information quickly and reliably, without the chance of human error. Nor will you have to spend time searching for errors and correcting them.

Improve efficiency:

With the API integration, you can benefit from a quicker and smoother workflow. Once the initial set-up is complete, you can begin sending your payroll information to the relevant ledgers. Where there are circumstances for which payroll figures should be mapped to an alternative nominal account, you can set these up as exceptions.

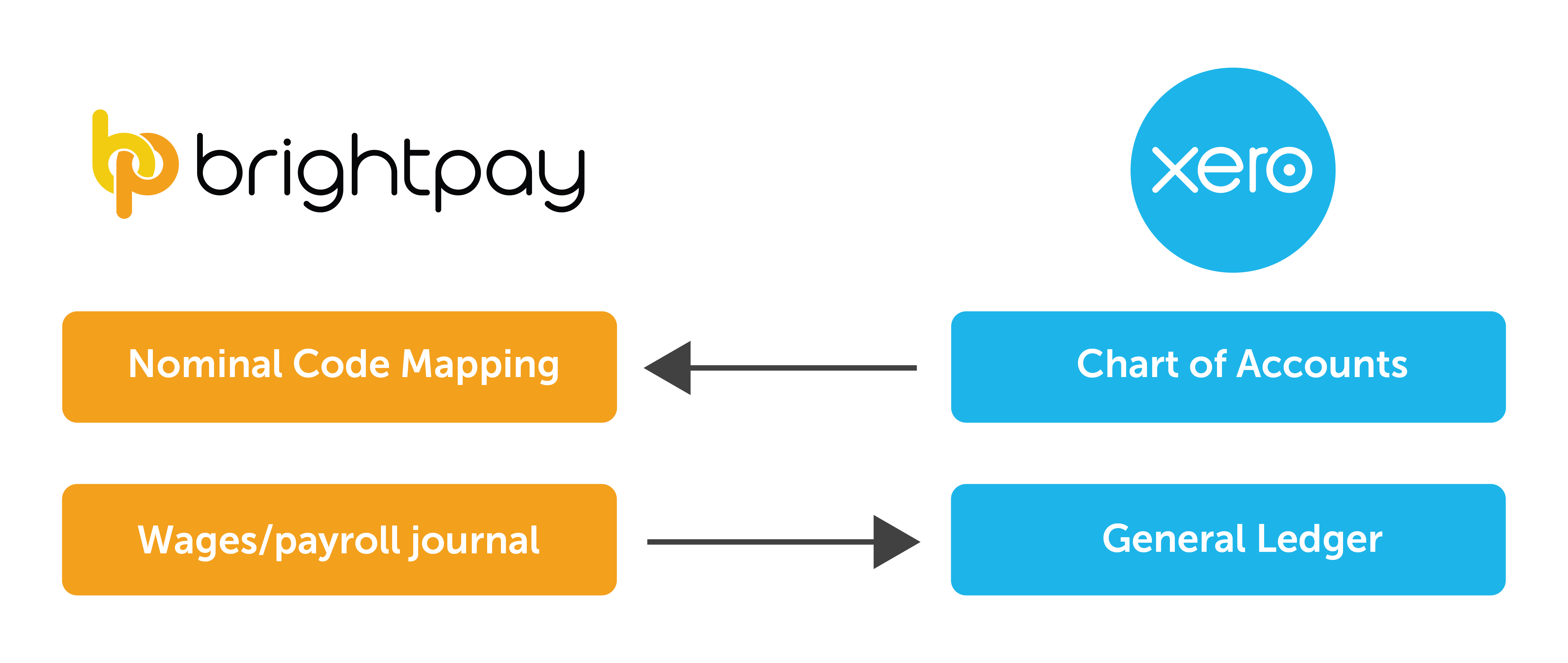

How does the BrightPay and Xero integration work?

An Application Programming Interface is a software intermediary that allows two applications to talk to each other. It helps to make communication between the two applications faster.

- When you sign into your Xero account in BrightPay, your nominal ledger accounts will be retrieved from Xero.

- Then, you map each payroll data item to the relevant nominal accounts.

- The payroll journal can include records for payslips across multiple pay frequencies and a nominal account can be used for multiple items.

- Learn more about how the integration works here.

What other integrations does BrightPay offer?

Along with Xero, BrightPay includes payroll journal API integration with several other accounting packages, such as Sage, QuickBooks Online, FreeAgent, and AccountsIQ. This is not the only integration BrightPay offers. The payroll software also includes integrations with various pension providers which helps make submitting pension files and carrying out auto-enrolment easier and quicker. Users of the software have direct API integration with NEST, The People’s Pension, Smart Pension, and Aviva.

Learn more:

If you’re interested in learning how BrightPay can improve your payroll services and save you time, schedule a 15-minute demo with a member of our team today. Or, to try the software for yourself, download your free 60 day trial today.

Related Articles:

Nov 2021

16

What to include on a payslip and how they should be shared with employees

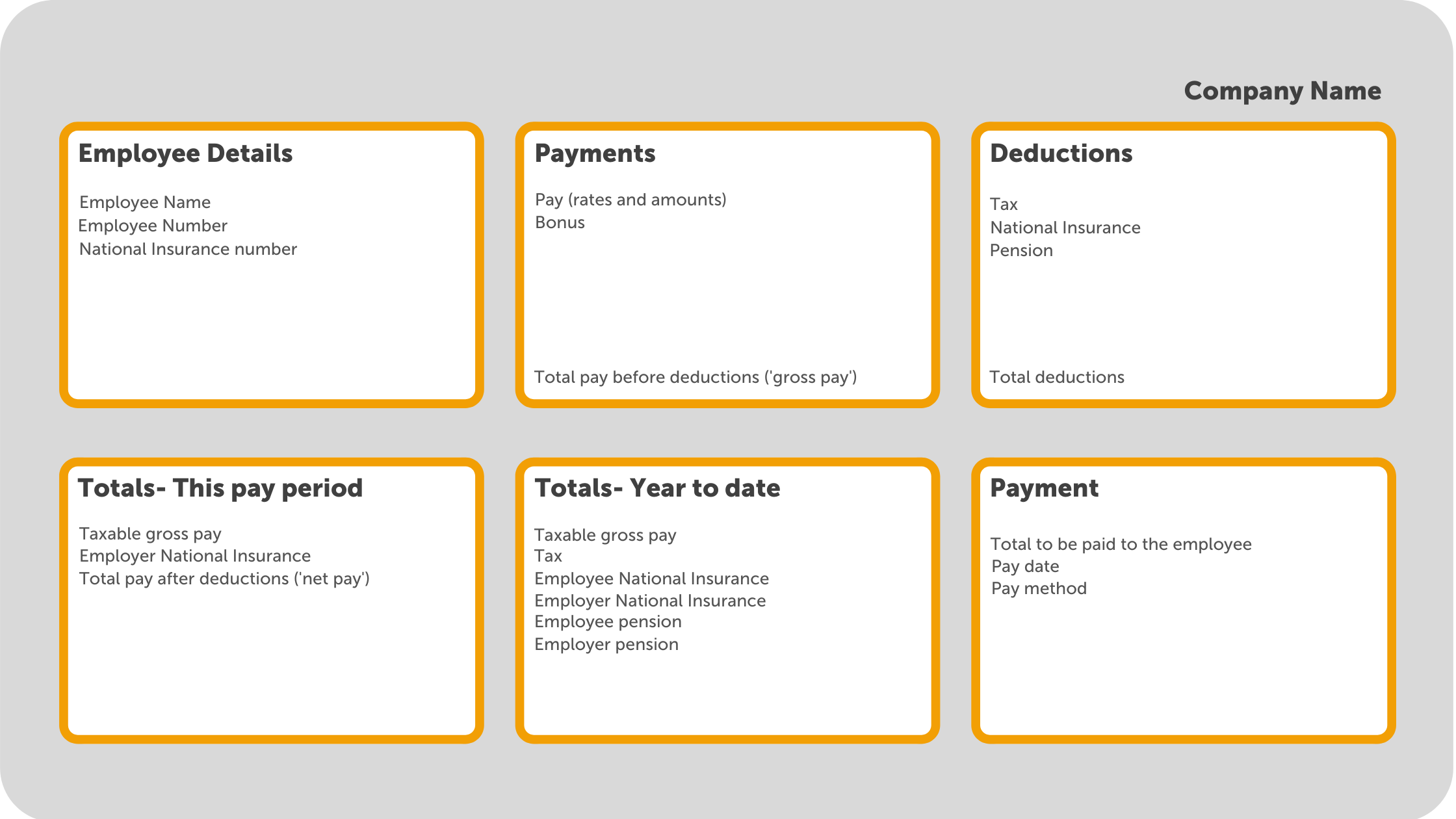

By law, employers must provide all employees with a payslip for each pay period. As well as giving employees a rundown of their earnings and any deductions there might be to their pay, payslips may be required as proof of income when applying for a mortgage or other loans. Payslips should be provided to employees either before or on the day they receive payment and are usually generated within the payroll software. According to ACAS, payslips must include:

- Total pay before deductions

- Total pay after deductions

- Amounts of any variable or fixed deductions

- A breakdown of how the wages will be paid if more than one payment method is used

Below is an example of information you may find on a payslip:

How should payslips be shared with employees?

- Employees’ payslips should be provided to them as at least one of the following:

- A hard copy

- Attached in an email

- An online copy

Giving employees a printed copy of their payslip is becoming less common. As well as the fact many businesses are digitising their paper processes, a payslip contains a lot of sensitive employee information, and a printed payslip could easily fall into the wrong hands. When emailing payslips, it is important that the payslip is password protected. More and more businesses are choosing to opt for sharing payslips with employees online. Not only do they save on paper on ink, but they are also more secure and can be easily retrieved when needed.

How can I provide employees with online payslips?

Some payroll software providers include an option to share employees' payslips through an online portal. BrightPay payroll software has a cloud add-on, BrightPay Connect, which includes an employee self-service mobile app where employees can view and download all new and historic payslips. Once a payslip becomes available, the employee will receive a push notification on their phone. If they do not have access to the app, they can also access their employee portal online from any device.

Sharing employees' payslips through an online portal such as BrightPay Connect is the best way to avoid payslip data breaches and insure you are in compliance with UK data protection laws. It also means that employees will always have access to all their past payslips and won’t need to come to their employer to request them.

Can you produce payslips using Basic PAYE tools?

You can use Basic PAYE tools (BPT) to produce payslips for your employees. However, the payslips produced will not include all the details which you are required to provide by law. By using a payroll software such as BrightPay, the payslips produced will contain all the information required by law, while also being customizable with the option of including additional information.

To find out more about how you can share payslips with employees online, book a free online demo of BrightPay Connect today.

Related articles:

Nov 2021

10

Brexit and GDPR

GDPR’s impact on payroll

The General Data Protection Regulation (GDPR) came into effect in May 2018, and it brought the biggest changes in data privacy regulation in over 20 years. Payroll processors deal with personal and sensitive employee information all the time (e.g., names, emails, addresses, bank details, social security numbers, etc), so it’s critical that this information is kept secure and compliant with the GDPR.

Many companies had to review their data handling processes and equip themselves with new tools to ensure GDPR compliance. For example, keeping payroll records stored safely by using an online cloud server such as BrightPay Connect.

Brexit and GDPR

The EU GDPR is an EU Regulation, and it no longer applies to the UK since Brexit. However, the provisions of the EU GDPR have been incorporated directly into UK law and will be now known as UK GDPR. In simple terms, there’s virtually no difference between the UK version of GDPR and the original EU GDPR. Data can continue to flow as it did before, in most circumstances.

How BrightPay Connect is helping with GDPR

BrightPay Connect is an add-on product to BrightPay payroll software. It provides a remote and secure online portal where you can access payslips, payroll reports, amounts due to HMRC, annual leave requests and employee contact details. The portal allows employers to share and upload HR documents in a secure environment hosted on Microsoft Azure.

BrightPay Connect automatically backs up the payroll data to the cloud every 15 minutes and once again when closing the file. It keeps a chronological history of all backups which can be restored or downloaded anytime, keeping payroll records safely stored at all times, with no risk of losing them.

But that’s just a quick taster of the features that BrightPay Connect has to offer. Book a 15-minute demo today and see for yourself. Or if you are new to BrightPay, why not try our payroll software for free for 60 days. The free trial is fully featured with all functionality.

Don’t take our word for it! View our library of BrightPay Connect testimonials on our website from real customers.

Related articles:

Oct 2021

28

Re-enrolment: Don’t let your software let you down

When it comes to pension re-enrolment, do you know which of your employees need to be placed back into the pension scheme, and when? Perhaps you do. However, it is much more likely that you rely on your payroll software to notify you when re-enrolment is due, ensuring you don’t miss any deadlines.

However, perhaps you should double check that your confidence in your payroll software isn’t unwarranted. Are you certain that your payroll software automatically notifies you when re-enrolment is due, or do you in fact, have to manually check for this information?

What is re-enrolment?

Every three years, employers are required to re-enrol certain employees. This involves assessing the employee’s eligibility for auto enrolment and re-enrolling them into a pension scheme. The employer will then need to complete a re-declaration of compliance to inform The Pensions Regulator (TPR) that their duties have been met. An employer must submit their re-declaration within five months of the third anniversary of the automatic enrolment staging date. If you have no staff to re-enrol, you will still need to submit a re-declaration of compliance.

How to choose your re-enrolment date:

The re-enrolment date is chosen by the employer and can occur anytime within a six-month timeframe of the ‘staging date’ or ‘duties start date’ three-year anniversary. It can be set three months before or three months after the anniversary date. Regardless of whether you used postponement at your staging date, re-enrolment occurs three years after your staging date, not your deferral date.

For example, if your duties start date was 1st April 2018, you can choose to re-enrol on any day between the 1st January 2021 and 30th June 2021. In this example, the deadline for completing the re-declaration of compliance would be 31st August 2021.

Employee Assessment:

- Employees who are eligible for re-enrolment are:

- Aged between 22 and up to the State Pension Age

- Earn over £10,000 a year

- Employees who have previously left the scheme or who have reduced their contributions to below the statutory minimum requirement for auto enrolment.

Employees who are not eligible can request to join the scheme.

BrightPay payroll software monitors any changes to an employee’s work status each pay period. As soon as you reach your re-enrolment date in the payroll, BrightPay will automatically assess the employees and will determine which employees qualify for re-enrolment. If employees meet the criteria, on-screen flags and alerts will appear to notify you that you now have re-enrolment duties to perform.

Employee notification:

After re-enrolling eligible employees into a pension scheme, they must be notified in writing of their re-enrolment within six weeks of their re-enrolment date. BrightPay will automatically prepare the employee’s enrolment letter. These letters can be printed, exported to PDF, emailed to the employee, or if you are a BrightPay Connect customer, the letter can also be automatically added to the employee's self-service portal.

Choose the best payroll software for re-enrolment:

Unlike other payroll software where you must check for re-enrolment duties, BrightPay Payroll automatically assesses employees and will notify you immediately when re-enrolment is due. This feature helps avoid last minute stress, back-dating pension contributions, and potential fines. To learn more about BrightPay’s full payroll functionality and how it can improve your payroll processes, schedule a personal demo and speak to a member of our team today.

Related Articles:

Oct 2021

26

The hassle-free way to maximise profits from payroll processing

Accountants and payroll bureaus sometimes find that processing payroll takes a lot longer than they would like. Because of this, some accountants may be making little to no profit from offering payroll as a service. Nevertheless, it is a service expected by customers. If you aren’t making a profit from payroll processing, this could be down to not using the right payroll software. By switching to a payroll software that automates tasks you can transform payroll from a time-consuming manual process and into an easy process where certain tasks take care of themselves, saving you both time and money.

Accountants and payroll bureaus, have you found that that offering #payroll as a service is not cost-effective and that it can be a time-consuming and tedious process? If so, this doesn’t need to be the case. Discover how by joining our upcoming #webinar: https://t.co/fd7pWygAgm pic.twitter.com/jbsl9eVuaw

— BrightPay UK (@BrightPayUK) October 15, 2021

Not only can you make a profit from processing payroll but depending on what payroll software you use it can be an opportunity to maximise profits by allowing you to offer new services to your clients which you may not have considered before. When it comes to introducing your staff and your clients to new services, you may think you have enough on your plate and that it would take up too much of your time. However, BrightPay Connect, a cloud add-on to BrightPay Payroll software, has little to no learning curve, allowing you to immediately begin offering additional services to clients. Offering new features such as a self-service dashboard for clients, a mobile app for their employees or giving your clients access to new HR tools is a lot easier than you think.

In our upcoming free webinar “Optimising your payroll offering to improve profitability” you can find out all you need to know to stop payroll processing from being a loss leader and turn it into a money spinner. Register now.

In the webinar you’ll learn:

- The benefits of integrated payroll and accounting systems

- How batch processing can transform your payroll performance

- How you can streamline client communications

- Top tips for expanding your client base

- Pricing strategies that work – what other practices are doing

Please note: This webinar is specifically designed for accountants, bookkeepers, and payroll bureaus.

Webinar Information:

The webinar takes place on 28th October at 11.00 am and is free to attend for all accountants and payroll bureaus.

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related articles:

Oct 2021

8

Easily Manage Attachment of Earnings Orders with BrightPay

What is an attachment of earnings order?

As an employer, you can be directed to deduct money from an employee’s pay. You will receive a formal notice, referred to as an attachment of earnings order, typically from a court, but can also be from the DWP Debt Management or from the Child Maintenance Group.

The order instructs an employer to divert money directly from an employee’s wages to pay back an outstanding debt. The order is issued because it is believed that the employee has failed or is likely to fail to pay the sums through other means. The money is sent to the court that made the order which is then forwarded to the employee’s creditor. Attachments can be issued for a number of reasons including unpaid fines and child support.

Deduct an attachment of earnings order using BrightPay

BrightPay Payroll has the facility to process a variety of attachment of earnings orders. This includes:

- Council Tax Attachment of Earnings Order

- Civil Judgment Debt Attachment of Earnings Order

- Child Support Deductions from Earnings Order

- View BrightPay’s full list of attachment of earning orders here

Fast and easy deductions:

BrightPay payroll software allows customers to easily add attachment of earnings to an employee’s payslip. In the employee’s profile, under ‘Additions and Deductions’, the user can choose from the different attachment orders available. Once selected, the description and relevant dates are added along with the amounts and status.

An AEO can either be a priority order or a non-priority order, which impacts the way deductions are calculated. If an employee has more than one order, priority orders will need to be deducted first. In BrightPay, tick the ‘priority’ box if the order is a priority order. The priority orders will be deducted in the order the employee received them.

Once it is set-up, BrightPay will continue to apply the Attachment Order on the employee’s payslip from the relevant period. To see how to apply an Attachment of Earnings Order click here.

What happens if you don’t comply?

Although attachment of earnings can be issued by different authorities, these authorities have the power to impose a fine. An employer that does not comply may be liable to a fine in the magistrate’s court, in the county court, or in the High Court. The employer must also notify the authority when the employee is no longer in its employment, or risk paying a fine.

Find out more about BrightPay Payroll:

BrightPay Payroll makes processing payroll quick and easy. Its comprehensive functionality, covering AEOs to auto-enrolment and CIS, provides a complete solution to your payroll needs. To learn more about BrightPay’s features and how they can benefit your business, book a free demo today.

Related Articles:

Aug 2021

26

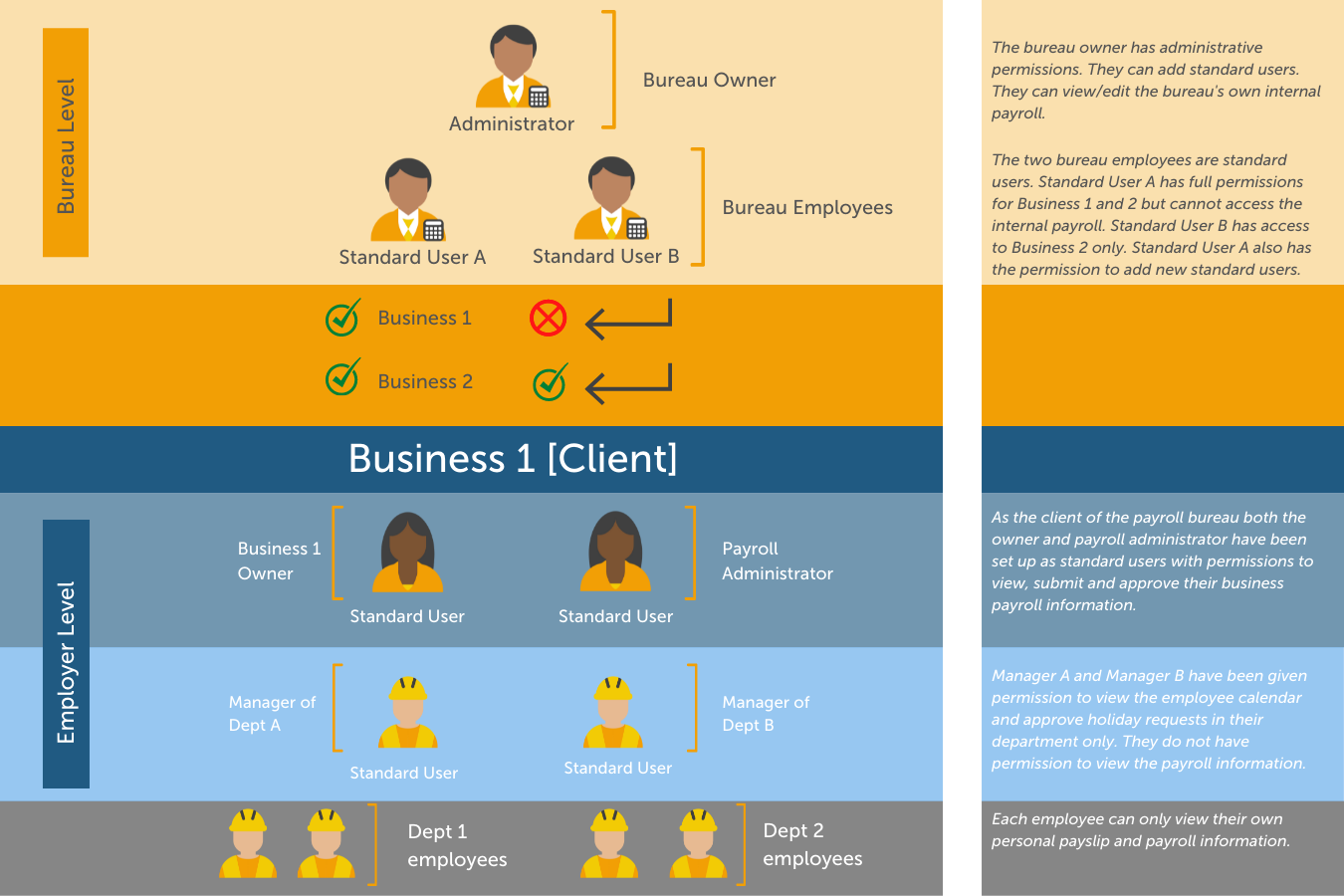

BrightPay Connect User Permissions: What a Bureau Needs to Know

BrightPay Connect’s User Management interface makes it quick and easy for bureaus to set users up or to change their permissions. The different levels of access allow for greater flexibility, security, and management of your clients’ data.

Organising your user permissions efficiently can save you and your employees time while ensuring that confidential information is kept secure. You have the option of marking certain clients as confidential, setting employees up as standard users with full access to multiple clients, and allowing standard users to connect and synchronise employers from BrightPay Payroll to BrightPay Connect.

Types of Users for Connect

There are two main types of users: Administrator and Standard User.

Administrator

- An administrator has full control over a BrightPay Connect account, with the ability to edit account settings, add other users, redeem purchase codes, connect employers and manage all employer and employee information and processes.

- You have the option of adding multiple administrators. However, all administrators can view the bureau’s own internal payroll (if it’s associated with the BrightPay Connect account), and so it is recommended to have as few administrators as possible.

Standard User

-

A standard user can have access to one or more employers in your BrightPay Connect account. Therefore, both clients and payroll staff can be set up as standard users.

- Unlike administrators, user permissions can be added for standard users so that they only have access to information that they need.

Types of Standard Users

Standard User – Payroll Staff

Payroll staff can be set up as standard users where they only have access to the clients that they are working on. You also have the option of granting the standard user access to all existing clients, along with any new clients linked to the Connect account going forward.

If required, an employer can be marked as confidential in Connect (for example, the bureau’s own internal payroll) and only administrators on the Connect account will be able to view this employer. Standard users can only access confidential employers if they are given permission to do so.

Payroll staff can also be granted access to invite other standard users (e.g. clients) to Connect, and to connect and synchronise the payroll, so that they can process payroll on the desktop application or BrightPay.

Standard User - Clients

Clients can be added as standard users so that they can only view information related to their company. If the employer details are entered in the ‘Client Details’ tab in the employer section in BrightPay, the employer can be added as a standard user by the bureau very quickly and easily.

On the employer dashboard, you will see the option to ‘Invite your client’. Selecting this populates the client’s information for a new standard user and you can then choose the permissions for the client. This will let you avail of the payroll entry and payroll approval request features, which can have significant benefits for bureaus.

Standard User – Client's Managers

As well as setting up the client as a standard user, you can also add various managers within the client’s company with restricted access. For example, you can add department managers, where they can only access employees within their department. The user can also be set up where they can only view the leave calendar and approve employee requests, without having access to the payroll information or HR documents.

Book Your Free BrightPay Connect Demo Now

If you’re interested in learning more, book your free BrightPay Connect demo. A member of our team will walk you through the various features of BrightPay Connect and explain how they can benefit you and your clients.

Related Articles:

Aug 2021

20

Payslips explained: Top tips to help your employees

As an employer, it’s easy to assume that all employees understand the information on their payslips. However, research carried out shows this is not the case. Although some employees will examine their payslip each pay period, checking the tax and other deductions, others will never glance at theirs, assuming it is correct.

Understanding a payslip can be confusing and it’s worth taking the time to explain to new and existing employees what everything means. By breaking down each piece of information displayed on their payslip, you will find it easier to resolve unexpected payroll issues that arise and to communicate the full benefits of their employment package. Importantly, if you have employees who work unpredictable shifts and periods of overtime, it can help to encourage these employees to consistently share the most up-to-date information in order for payroll to be processed more accurately.

To help your employees understand their payslips better, check out the following tips:

1. Explain the basics:

Payslips contain a lot of information so it’s useful to break down what the employee will see. This includes the gross pay, net pay, and their personal information such as their payroll number, tax code, and their National Insurance (NI) number.

2. Be clear on how their pay is calculated:

Understanding how a salary is calculated for each month can cause confusion for employees, especially if they are paid on a monthly or a 4-weekly schedule. Moreover, employees being paid different rates depending on their hours worked will need to understand the differences.

Any deductions, both variable and fixed, should be explained. This includes those required by law, for example National Insurance, income tax, or student loan repayments, as well as those agreed to by your employee. Pension contributions will also be shown on the employee’s payslip, and this can be a good opportunity to explain its benefits as well as to highlight the employer’s contribution to their pension fund.

3. Choose the right time:

Onboarding new employees is the ideal time to explain the information a payslip contains. While onboarding, the employee will likely be partaking in induction training, filling out forms, and getting ready for their new role. This is a good opportunity to go through their payslip as well as emphasise any benefits included on it, such as a bonus, commission or other rewards.

4. Use your payroll software to customise payslips:

If you use payroll software, such as BrightPay Payroll, you will be able to customise your payslips. This can help make the payslips more easily understood. For example, use a custom description for specific payment periods such as daily payments, piece payments, as well as additions or deductions.

5. Make payslips easily accessible:

Providing a digital payslip is convenient for both you and your employees. Not only does it save you money and time printing out payslips (and improves your sustainability efforts), but it also allows employees to access their payslips whenever they want. Using an employee app, such as BrightPay Connect, employees can access their payslip on an online browser or on an app on their smartphone or tablet. Additionally, employees have access to their payslip archive, a record of all their payslips which date back to when you first started using BrightPay Payroll. The payslip archive ensures they never lose their payslip and allows employees to easily access them when applying for mortgages or other financial banking options.

Find out more:

If you’re interested in learning more about BrightPay Connect and the added benefits of using an employee app, including its HR functionality, book a free BrightPay Connect demo today.

Related articles:

.png)