Aug 2019

15

Payroll transformed: How client cloud platforms supercharge your bureau

Accounting and payroll processing is best left to the experts. That’s always been true - and it remains true. The steady hand of a seasoned accountant or payroll professional is a powerful commodity that can’t be replaced by software.

But as much as things have stayed the same, other things have changed, too. The relationship between client and professional is no longer one-directional. What software has created is a new collaborative framework in which the payroll professional can thrive.

Payroll services can - and should - be a team effort. Gone are the days of payroll bureaus continuously slogging through manual processes, and the frustration of clients who need to approach their payroll services provider with every minor tweak.

In its place is software with cloud integration that envelops the day-to-day tasks like annual leave management, payslip distribution and backing up your payroll. That’s more time to focus on the essentials and provide better service.

Software can never replace the core professionalism of a payroll professional, but it can supplement it in many ingenious ways. Through self-service, through apps, through cloud backup: payroll software is about making your life easier.

You do the hard work, you get the credit, while your software hums along quietly in the background, automating and simplifying the repetitive aspects of the job and keeping you compliant.

Download our free guide where we discuss six exciting ways client cloud platforms have transformed payroll services. Not in the distant or even medium-term future: now. Here’s how cloud integration can help you today.

Jul 2019

8

BrightPay - Award-winning payroll software you can trust

After winning ‘Payroll Software of the Year’ at last years’ Accounting Excellence Awards, the BrightPay team are delighted to be shortlisted in the payroll software category again this year. The winner is decided by a public vote held by AccountingWEB, whereby members are asked to rate the software systems that they use to determine the best products on the market.

In recent months, BrightPay carried out a customer survey and we were happy to discover that we have maintained our 99% customer satisfaction rate. Recent comments from some of our happy customers include:

- “Using BrightPay has revolutionised the way we manage payroll as a practice. The staff are always extremely friendly and helpful, and especially attentive to suggestions.” - Carol Webb, Casktrak Ltd

- “After using other payroll packages for several years, I was highly delighted when I discovered BrightPay. The time I save per payroll is great and it’s the easiest, fastest and operator-friendly software I have ever used.” - Irene Hopkinson, Westmill Accountancy

- “Having tried various payroll software, BrightPay is far superior to anything else on the market and their customer support is superb.” - Helen Bower, Adder Bookkeeping Ltd

- “BrightPay is the first payroll software we have used which is truly fit for purpose. The functionality and straightforward approach of the software is second to none, and when paired with the fantastic customer support and value for money makes BrightPay the payroll software provider of choice.” - David Atyeo, Donovan Atyeo

- “This is our first year using BrightPay Connect and we are so pleased with it as it has enabled us to automate more in the way reports and how payslips are delivered to our clients. Really love the approval feature. Well done!” - Bharat Hathi, BDH Chartered Certified Accountants

Over the past year, our team of developers have been working hard to make BrightPay better than ever. We have added many new features to help our customers manage their payroll processing more efficiently.

- This year we introduced payroll journal API integration with a number of accounting packages. This allows users to send the payroll journal directly to their accounts software from within BrightPay. BrightPay currently has direct integration with Sage One, Quickbooks Online and Xero with many more currently in development.

- Another new feature this year is batch payroll processing, whereby users have the ability to finalise payslips, check for coding notices and send outstanding RTI & CIS submissions for multiple employers at the same time, which has significantly reduced the payroll processing time for payroll bureaus and accountants.

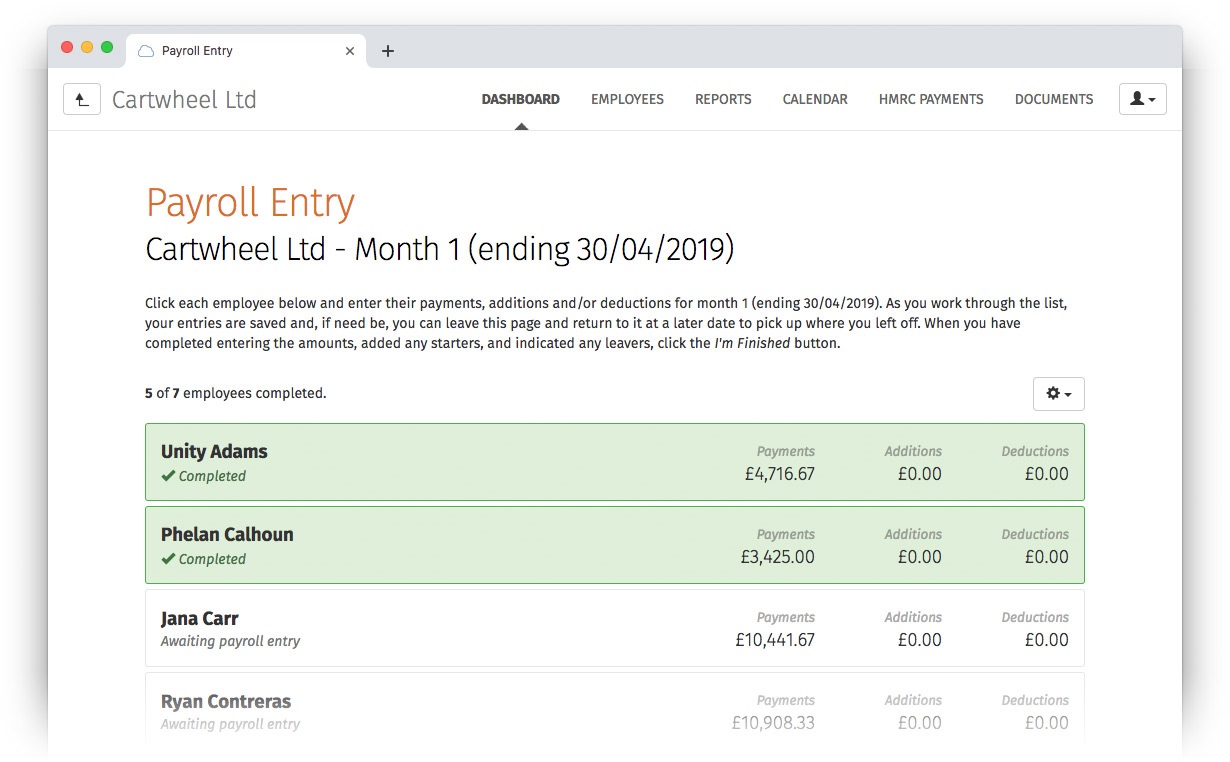

- With BrightPay Connect, we have also launched the client payroll entry and payroll approval feature, which is a game-changer for payroll bureaus and accountants. Clients can enter their payroll information into an online employer dashboard. Once reviewed by the bureau, the information is seamlessly synchronised back to the payroll software, eliminating the manual input and putting the onus on the client to make sure that the payroll information is 100% accurate.

Book an online demo today to find out more about our new features. You can also have a look at our Accounting Web Product Showcase where Ann Tighe from BrightPay shows AccountingWEB’s head of insight John Stokdyk some of the features that enable accountants to save time and boost efficiency.

Best of luck to all of the software providers who have been shortlisted for an Accounting Excellence Award.

Jul 2019

4

Top Payroll Trends in 2019

The CIPP unveiled their latest “Future of Payroll Report” (2019) for the second year running and surprisingly, it’s not a total snoozefest! The foreword by CEO Ken Pullar is a tour de force of future forward-thinking, extolling the virtues of embracing change and moving with the times in an ever changing industry. He acknowledges that whilst payroll software and technology makes things easier, the number of enquiries does not decrease and payroll departments need to be on the ball to be in a position to answer these queries effectively.

This brings me to what I feel is the most interesting part of the report - “Key Issues Facing Your Payroll Department”. The report itself was made possible by feedback so this snazzy little section has its finger on the proverbial pulse and is super useful to anyone whose bread and butter is payroll.

Surprisingly, Brexit is nowhere to be seen which makes a nice change! Instead, coming in at Number 1 with 38.50% of queries is “GDPR and Data Protection”. It just goes to show how much of a quagmire this thing still is for people. You can find a very interesting article here that may clear a few things up. In any case, your payroll processes should be GDPR compliant and if you still don’t know how to achieve this, then simply outsource it to a payroll provider who will do the hard work for you. And if you are the payroll provider, then making sure your staff are up to scratch is half the battle.

Coming in just behind GDPR is “Automatic Enrolment” with 32.50%. Yes, the same automatic enrolment that began to be rolled out back in 2012 and is by no means a new government initiative. While auto enrolment has been a huge success, enabling hundreds of pensioners to finally be able to afford that trip to Benidorm, it seems that confusion is still rife. The report makes some interesting conjecture about why this is - Is it the sheer number of employers who are hitting their automatic re-enrolment date for the first time? Is it the ins and outs, the complexity behind understanding the scheme in layman’s terms? or is it simply that payroll software is not doing enough to help the soldiers on the frontline? With more phasing imminent perhaps employers aren't aware of their obligations? Who knows? Well, you - you should know! So it’s time to brush up because it’s clear that auto enrolment queries aren’t going anywhere.

“Holiday Pay Calculations” come in at a close third (31.75%), maybe because of the changes to payslips, the rise of the gig economy coupled with some landmark Employment Tribunal rulings, businesses are getting their ducks in a row. Next is “Expenses and Benefits” (29.50%) which is likely due to the increase in employers moving to payrolling benefits and away from the traditional method of submitting P11D forms to HMRC after year end.

Next on the list is “Automation of Business Processes” which will be music to payroll software provider’s ears. Companies are always looking for ways to streamline processes and make things more efficient. It is unsurprising that this is a huge issue for people moving into 2019 with the introduction of so many new employment and payroll changes such as phasing and changes to payslips to name but a few.

The last two topics on the list are “Gender Pay Reporting”, which is slightly up from last year (24%) and still obviously a very important issue, and finally - “Implementing a New System”, (21%) which is really just the not-as-attractive cousin of “Automation of Business Processes” which we’ve already discussed.

So there you have it! A lot of information to stick in your pipe and smoke. If you recognise yourself among these statistics, or if you’ve thought “same” whilst reading any of this, then check out BrightPay's award-winning payroll software. It is fully GDPR and auto-enrolment compliant, automates all of the most confusing payroll and HR processes including holiday pay, expenses and benefits and offers incredible customer support. They are at the forefront of payroll software and will take the pain out of your payroll.

Mar 2019

20

BrightPay 2019/20 is Now Available. What's New?

BrightPay 2019/20 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2019/20 Tax Year Updates

- 2019/20 rates, thresholds, triggers and calculations for PAYE tax, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Automatic Enrolment pensions, company cars, vans and fuel.

- The emergency tax code has changed from 1185L to 1250L. When importing from the previous tax year, L codes are uplifted by 65, M codes are uplifted by 71 and N codes by 59.

- Full support for the 2019/20 Welsh Rate of Income Tax (WRIT) codes, rates and thresholds, as well as continued support for those of the Scottish Rate of Income Tax (SRIT).

- Support for the new Postgraduate Loan deductions.

- Ability to process 2019/20 HMRC coding notices (including new PGL1 and PGL2 notices).

- April 2019 National Living Wage rates.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

Automatic Enrolment Updates

- From April 2019 onwards, the minimum required pension contribution level is 8%, at least 3% of which must be contributed by the employer. BrightPay 2019/20 now uses and validates against this increased level by default. Where pre-April 2019 minimum levels were being used in 2018/19, BrightPay 2019/20 will automatically uplift them on import.

- With the concept of 'staging' for automatic enrolment now very much in the past, BrightPay is instead focused on asking for and working with the Next Re-enrolment Date.

- Various improvements have been made to make the automatic re-enrolment process more clear:

- For opted-out or ceased employees (as well as employees who are flagged for re-enrolment) the previous opt out/cessation date is now clearly visible and can be edited if need be.

- If an employee is marked as opted out or ceased, but the opt-out/cessation date is not known, BrightPay now flags for automatic re-enrolment anyway (and allows the missing date to be entered).

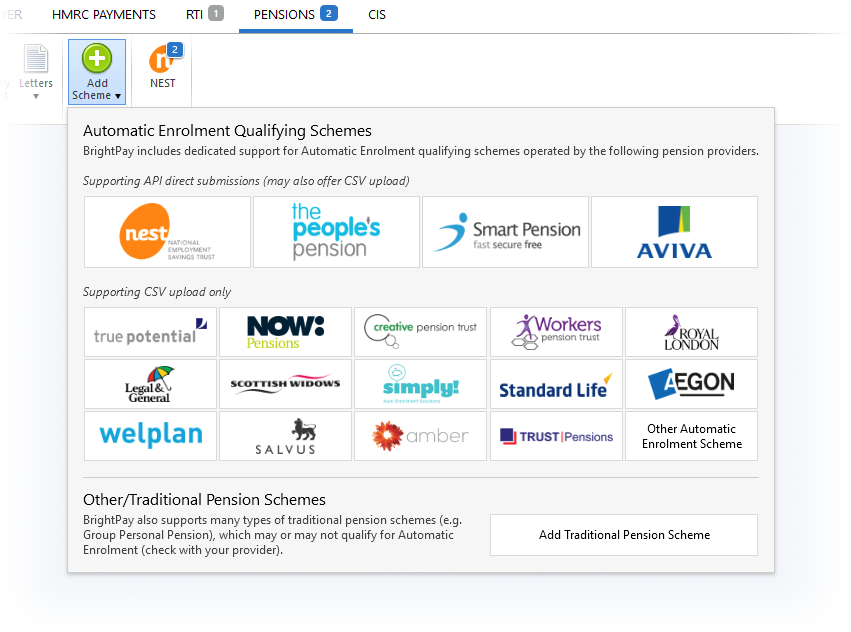

- Redesigned menu when adding a new pension scheme:

- The auto enrolment qualifying schemes are now categorised by API/CSV support, and ordered by popularity.

- The traditional pension scheme 'types' have been removed – when adding a traditional scheme you can now simply set the tax relief and AVC options directly instead of having to first choose the right type.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions.

Real Time Information

- As mentioned in the release notes for the most recent upgrade to BrightPay 2018/19, the EYU (Earlier Year Update) submission is no longer supported by HMRC and has now been removed from BrightPay altogether. To make corrections to 2018/19 or 2019/20 payroll data going forward, an Additional FPS is to be used.

- Ability to exclude an employee pay record from an FPS if it has zero amounts only.

- Ability to force include an employee's starter/leaver declaration on an FPS submission that covers a different period to the employee's starting/leaving period.

- Ability to unmark an unsent submission as contributing towards the Number of Unsent RTI Submissions count in BrightPay.

- New HMRC Receipt document which presents HMRC's response to an RTI submission in a clear, shareable format.

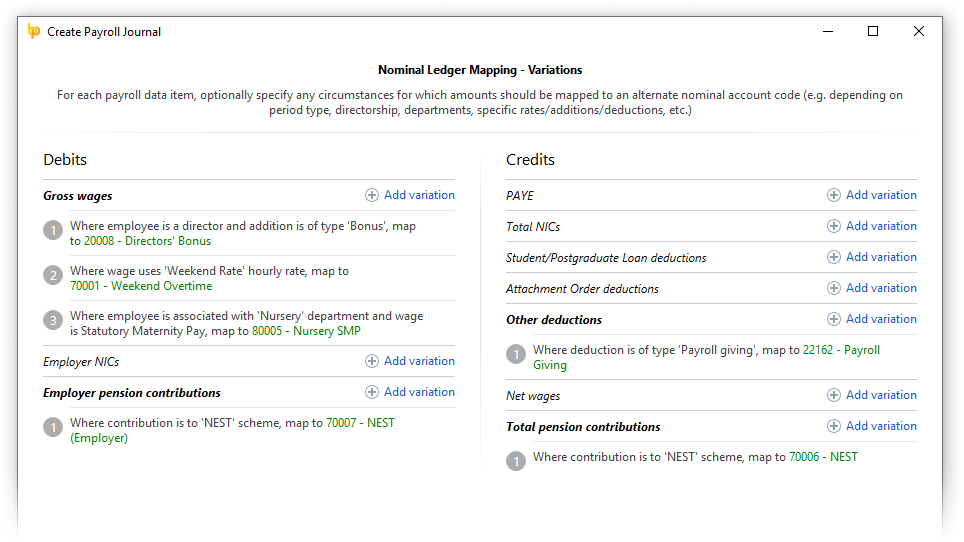

More Flexible Journals

A popular customer request has been to create a 'departmental' payroll journal in BrightPay. We've went one step further, allowing not only for a simple departmental mapping of nominal account codes, but for an advanced multi-option mapping as well.

For example, if you want to map commission paid to directors on a weekly basis in the sales department to a particular account code, you now can.

For Xero journals, BrightPay now supports including the department as the Xero tracking option, including where employees are split across multiple departments.

To make all this easier to manage, the Create Journal window in BrightPay now remembers it's size and position between usages.

Journal API Support

BrightPay now supports posting journals directly to Sage, Quickbooks and Xero via API (while continuing to offer the creation of a CSV journal as an option if need be).

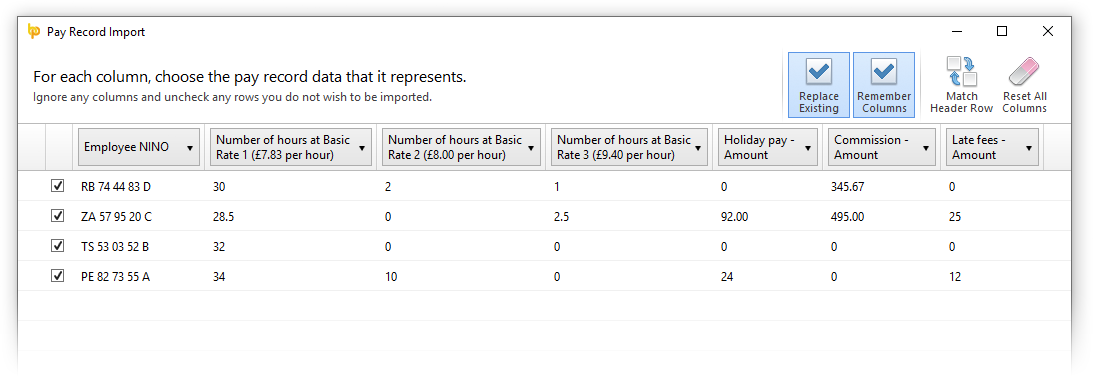

Importing Pay Records from CSV

We have significantly improved the power and flexibility of how pay records are imported from CSV, effectively allowing an entire pay run to be imported from a single CSV file if need be.

- Multiple pay items (of a single payment type, or mixed types) can now be imported from a single CSV line.

- Daily/hourly payments can more easily be imported under a named employer-wide daily/hourly rate

- Additions/deductions can more easily be imported under an employer-wide addition/deduction type

- The Import from CSV window has been redesigned to be more user-friendly and intuitive.

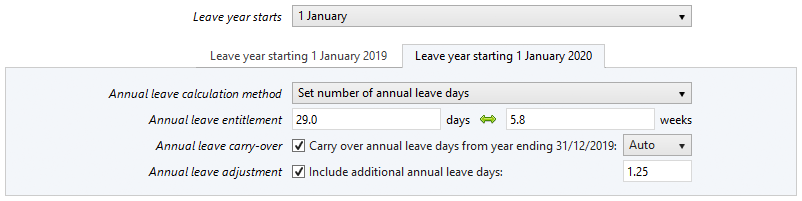

Improved Support for Offset Annual Leave Year

A popular customer request has been for BrightPay to better handle the definition, carry-over and adjustment of annual leave in the situation where the annual leave year is offset from the tax year.

In BrightPay 2019/20, you can now enter the annual leave settings for each overlapping year individually, giving you full control and helping you work out entitlements more accurately.

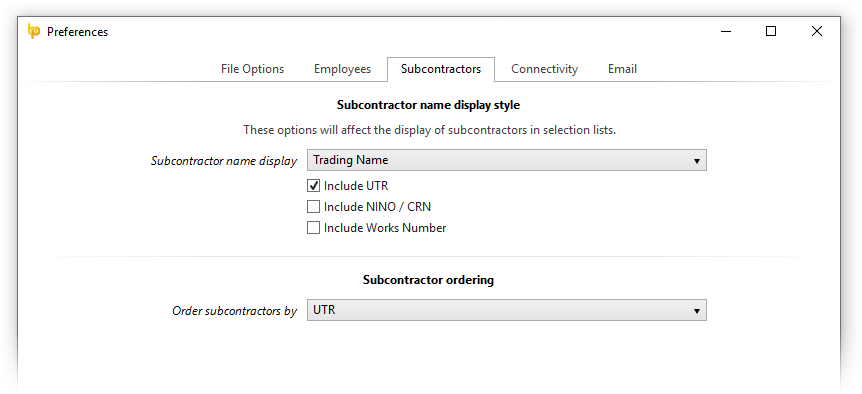

CIS Updates

- You can now customise how subcontractors are displayed and ordered across the BrightPay interface.

- When selecting from a list of subcontractors, BrightPay now includes a new 'Select By' button that allows you easily and quickly select only the subcontractors that match specific criteria.

- New Payments menu in the subcontractor toolbar which includes various handy functions including the ability to batch print multiple P&D statements for a single subcontractor.

- New CIS Year End Statement document.

- Ability to unmark an unsent submission as contributing towards the Number of Unsent CIS Submissions count in BrightPay.

- New HMRC Receipt document which presents HMRC's response to a CIS submission in a clear, shareable format.

BrightPay Connect

In late 2018 we introduced a powerful new feature for Bureau customers of BrightPay Connect: the ability to request client payroll entry and/or approval for a payroll run, which is then automatically facilitated though a secure, GDPR-compliant process within the BrightPay Connect dashboard.

Sign in to your BrightPay Connect account and click the Requests header link to find out more.

Other 2019/20 Updates in BrightPay

- When hovering over the 'number of submissions' for an employer on the BrightPay startup window, a popup displays what the number(s) represent.

- The full description of an hourly or daily payment is now shown on-screen for finalised pay periods.

- BrightPay will now prompt you to change an apprentice employee who is set to be on NI table H but is over 25 years old.

- On the employee calendar, the parenting leave info panel now shows the total number of KIT days taken for the selected period of leave.

- Corrects handling of Statutory Adoption Pay and Statutory Shared Parental Pay in weeks beyond the week that employee took their 10th KIT day (or 20th SPLIT day).

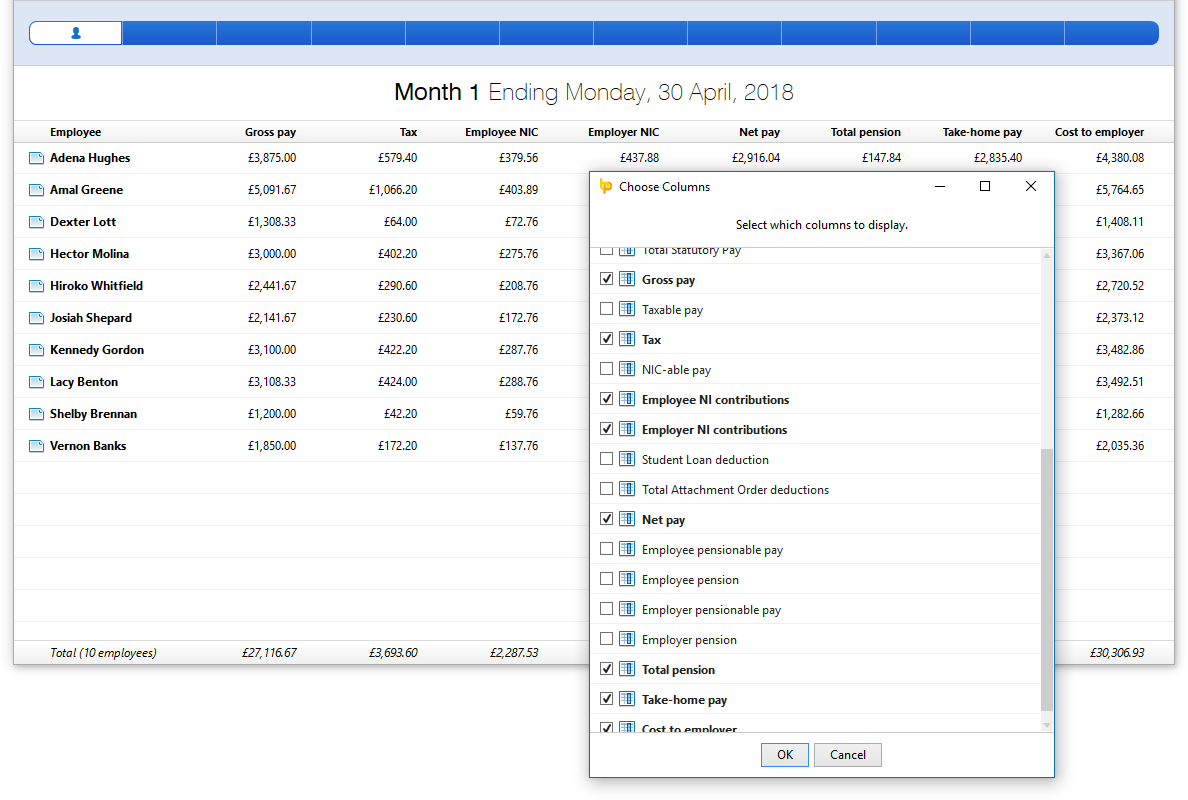

- When selecting which analysis columns to include in a report, they are now grouped by category.

- New analysis columns:

- Separate 'cash equivalent' columns for each of the benefit/expense types.

- Total attachment order deductions excluding admin charge.

- Primary department name.

- Adds a 'description' field for all kinds of benefits, and shows the entered description for each benefit on the payroll interface.

- Options to show separate benefit payments on employee payslip, rather than just a rolled up 'taxable benefits' figure.

- The Number of Actionable Coding Notices is now shown on the coding notices toolbar icon, and is available as a column on the BrightPay startup window.

- New A4 payslip template, designed to be used where there are too many items to fit on the A5 template.

- As part of our new licensing model, Bureau customers can now view/edit the list of employers for which they have access.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

Includes all updates made to BrightPay during the 2018/19 tax year

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2018/19, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2019/20. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Ability to send enrolment/contribution submissions directly to the People's Pension via API.

- Ability to quickly create an new/additional employment for a previous/existing employee.

- Coding notice checks can now use agent credentials if available.

- Many improvements to emailing documents directly from BrightPay:

- Ability to specify the default starting body content to use when emailing a document.

- Ability to quickly turn on/off the stored email signature.

- When emailing a document, there is a new menu to quickly select and re-use recently used body content.

- Email body content now accepts 'Markdown' formatting.

- Ability to edit the list of saved third-party email recipients

- New startup window column for Next Estimated Pay Date.

- Two new tick boxes in BrightPay Preferences to indicate where Next Estimated Pay Date is in the past (which shows a red background colour for applicable employers on the startup window) or indicate where Next Estimated Pay Date is within X days (where X is customisable – shows a yellow background colour for applicable employers on the start screen).

- Ability to batch finalise the payroll for multiple employers.

- Ability to select employers by label colour when preparing a batch operation.

- Ability to persist a “Net to Gross” setting going forward (i.e. rolling net pay).

- Ability to create a bank file for paying HMRC.

- Allows a deduction to be calculated as a percentage of Auto Enrolment qualifying earnings.

- Enables subcontractors with zero amounts in a pay period to be excluded from a CIS300 submission.

- When in Payroll, the name of the active employee (i.e. the part of large text title) can now be clicked to navigate directly into the Employee > Edit Details screen for that employee.

- Employment Allowance report

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Sep 2018

21

BrightPay wins ‘Payroll Software Product of the Year’

BrightPay was announced the winner of ‘Payroll Software of the Year’ at this year’s AccountingWEB’s Software Excellence Awards. The winner was decided by a public vote held by AccountingWEB, whereby members were asked to rate the software systems that they use to determine the best products on the market.

It’s a great achievement for BrightPay to win this prestigious award, especially since it is a relatively new payroll system which was introduced just six years ago. BrightPay also has a 99% customer satisfaction rate, and is used to process payroll for over 120,000 businesses across the UK and Ireland.

Marketing Manager at BrightPay, Karen Bennett says: “We’re delighted to win this award, especially after coming so close last year. It’s fantastic for BrightPay and our team to be recognised by our customers and the AccountingWEB members, and a massive thank you to everyone who voted for us.”

Paul Byrne, Managing Director, says: “It’s a real pleasure and honour to receive this award. It’s great to see such recognition for all the hard work we have put in. We work hard each year to improve the BrightPay experience for all of our customers, both in terms of the payroll software itself and the customer support that we offer.”

We would like to say a massive thank you to everyone who voted for us this year and to all of our customers. Go team BrightPay!!

Are you missing out on our newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - subscribe today!

Related Articles:

- The evolution of payroll & what does the future hold!

- BrightPay launches employee payroll smartphone app

- BrightPay Connect: The GDPR Survival Toolkit

May 2018

22

BrightPay - We don't just do payroll

As one of the largest payroll software providers in the UK and Ireland, we have a lot of customers using our payroll software, but did you know that we have a number of other useful HR software packages available?

BrightPay for Windows

BrightPay is a payroll software which is future-proof, having been programmed using modern technology, it allows the user to process and run payroll effortlessly no matter how large or complicated it may be. Having a feature-rich interface allowing the user to customise reports, set up unlimited pay rates, additions and deductions, the options are endless making the weekly/monthly pay-run a breeze!

BrightPay for MAC

As with the Windows version, BrightPay for MAC has no unnecessary limitations or pointless restrictions on what you can do. It has proven to be a breath of fresh air for many customers who have switched from competing products. Features like seamless RTI and automatic enrolment functionality have been elegantly integrated into the software along with other key features such as CIS and HMRC payments – including the Employment Allowance and Apprenticeship Levy.

Bright Contracts

This HR software allows the user to manage and create professional contracts of employment for their workers, and also includes an Employee Privacy Policy in line with the new data protection legislation, GDPR. It also has a customisable Staff/Company Handbook with all the legislative and best practice policies and procedures that are recommended for any business with staff. The software also provides a wealth of online support documentation such as template HR letters, checklists, guidelines, etc.

BrightPay Connect

BrightPay Connect is a powerful add-on to the payroll software which enables secure automatic backups of your payroll data to the cloud. The web based self-service dashboard for employers and their employees is an invaluable tool for those employers looking to put their best foot forward in terms of GDPR readiness and compliance.

Related Articles:

Mar 2018

20

BrightPay 2018/19 is Now Available. What's New?

BrightPay 2018/19 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2018/19 Tax Year Updates

- 2018/19 rates, thresholds and calculations for PAYE tax, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Automatic Enrolment earnings thresholds and triggers, company cars, vans and fuel.

- The emergency tax code has changed from 1150L to 1185L. When importing from BrightPay 2017/18, L codes are uplifted by 35, M codes are uplifted by 39 and N codes by 31.

- Full support for the 2018/19 Scottish Rate of Income Tax (SRIT) codes, rates and thresholds.

- April 2018 National Living Wage rates.

- Ability to process 2018/19 HMRC coding notices.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EYU, EXB, CIS300, CISREQ).

Automatic Enrolment Updates

- From April 2018 onwards, the minimum required pension contribution level is 5%, at least 2% of which must be contributed by the employer. BrightPay 2018/19 now uses and validates against this increased level by default. Where pre-April 2018 minimum levels were being used in 2017/18, BrightPay 2018/19 will automatically uplift them on import.

- With all employers in the UK now having staged for Auto Enrolment, BrightPay no longer relies on a Staging Date for assessment – all un-actioned employees are automatically assessed and flagged for action as required.

- Where submissions are outstanding for a pension scheme, BrightPay now more clearly shows the numeric indicators on the Enrolment Summary and/or Contributions Summary buttons for that scheme, depending on the type of submission(s) outstanding.

- The salutation of Auto Enrolment letters can now be customised.

- Auto Enrolment letters can now be quickly printed via the new Letters menu in the PENSIONS section of BrightPay.

- New letter template to tell staff who are already a member of a scheme about the April 2018 minimum contribution increases.

- New Automatic Enrolment Journey Report replaces the previous Assessment Report.

- Automatic Re-enrolment date and Declaration of Compliance date can now be shown as columns on the BrightPay startup window.

- Improved handling of the situation in which Auto Enrolment duties are ignored for one or more pay periods.

Ability to Edit the Columns of the Period Summary View

A popular customer request has been to show columns for number of hours worked and pension contributions on the BrightPay period summary view. In BrightPay 2018/19, you can now easily include these, as well as many more additional column options.

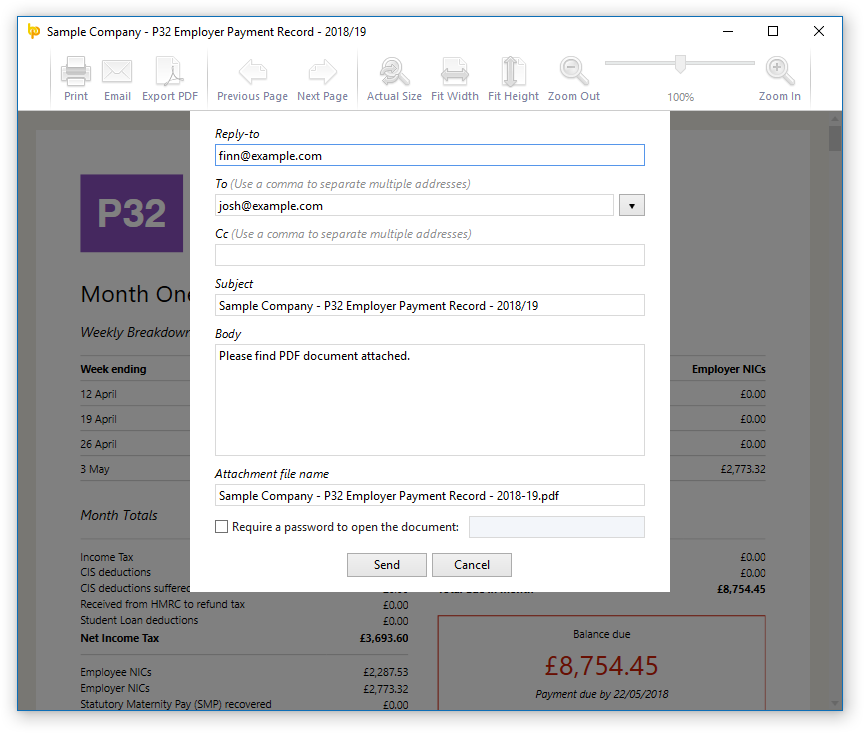

Ability to Quickly Email any Document/Report

There is a new Email button in the print preview of documents and reports in BrightPay which allows you to easily send it as a PDF attachment in an email. Where and when applicable, BrightPay makes it easy and quick to select the relevant employee, client or previously used recipient.

Note: In version 18.0, there are a few document types for which email support is not yet available (e.g. P45, SMP1, etc) – we will be adding support for these very soon.

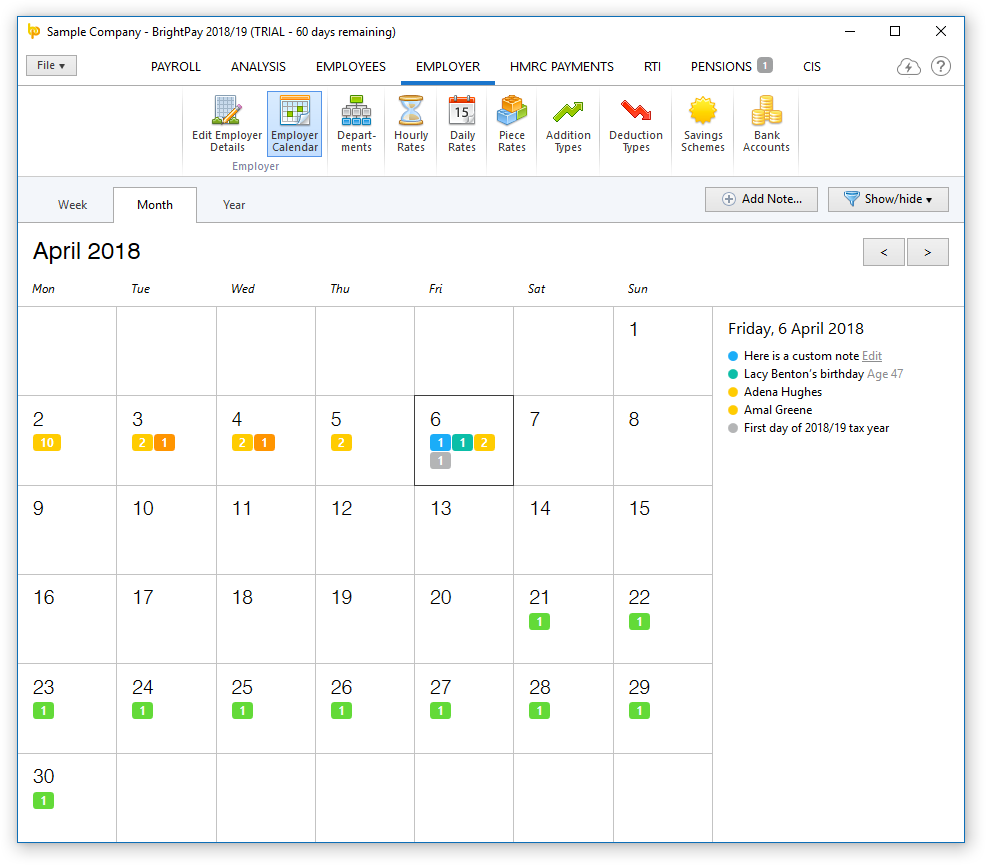

New Feature: Employer Calendar

There is a new employer-wide calendar in the EMPLOYER section of BrightPay which amalgamates all the employee events along with other key payroll dates into a single view:

- Switch between Year, Month or Week view.

- Shows combined events for all employees (i.e. those entered on the employee calendar, as well as birthdays)

- Includes general tax year events and deadlines.

- Ability to filter which kinds of events are displayed on calendar and in the day event list.

- Ability to add/edit/delete your own notes.

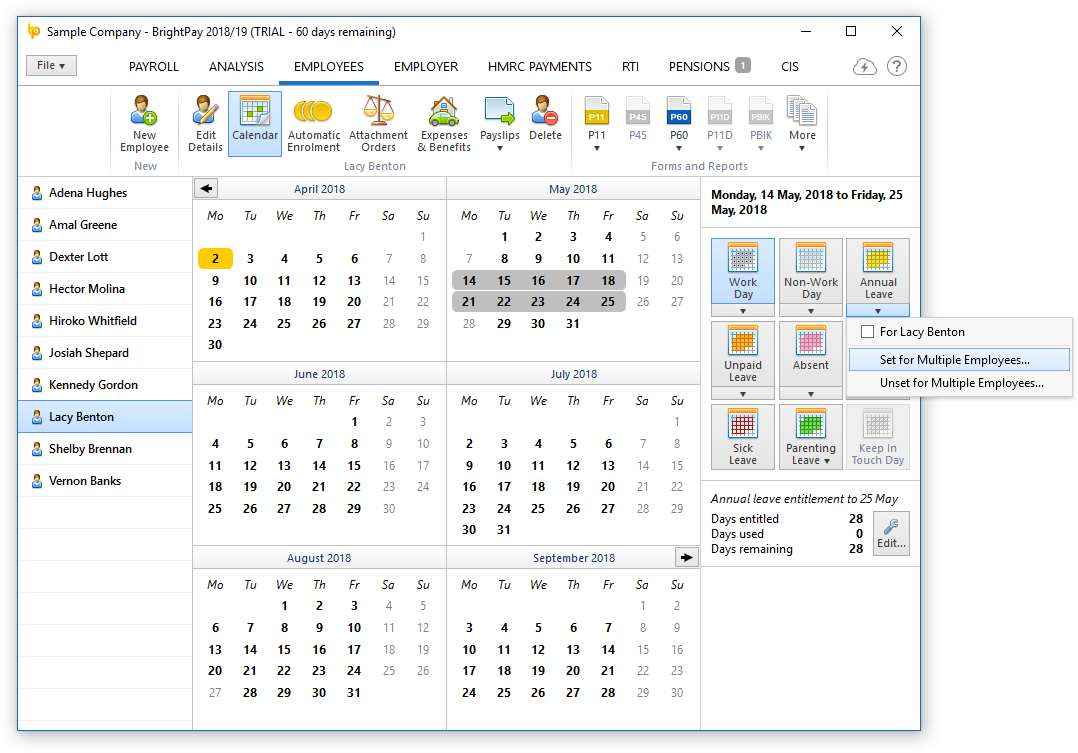

Employee Calendar Improvements

- Ability to batch set working days, non-working days and leave days for multiple employees at once.

- Holding the Ctrl key allows you to select (or unselect) multiple arbitrary days on the calendar.

Bureau Improvements

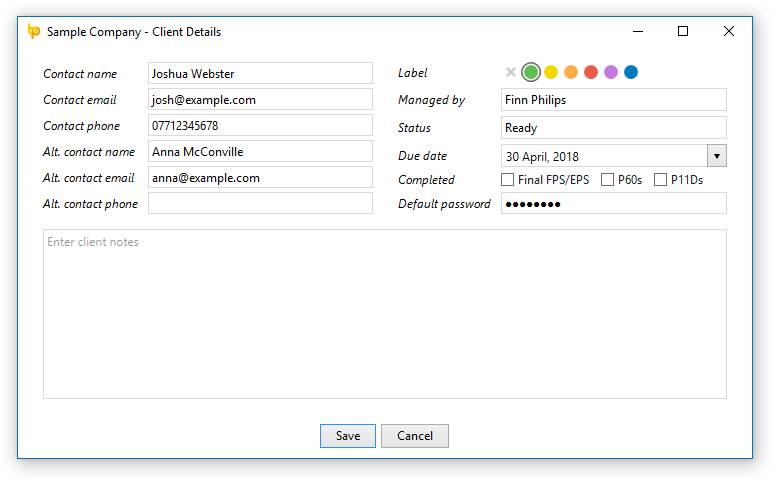

Several new Client Details fields have been added:

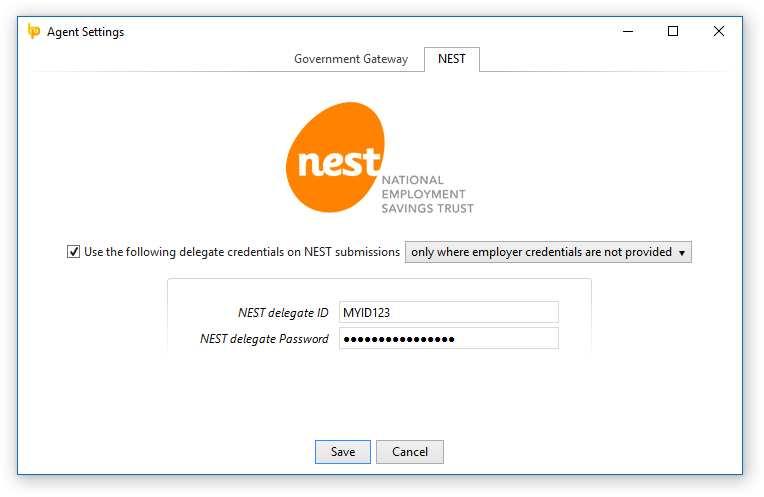

In BrightPay Agent Settings, you can now enter your own NEST delegate ID and password to use globally in NEST submissions:

Other 2018/19 Changes in BrightPay

- We've made several key architectural improvements for dealing with large employer files (e.g. those with hundreds or even thousands of employees) with regard to both speed of execution and computer memory usage. This will be something we continue to improve as time goes on.

- When a text input field receives focus via keyboard tabbing, its content is all selected automatically.

- Adds several more customisability options for payslip production.

- When zero-ising payslips, you can now choose to zero-ise only the overtime (or non-overtime)hourly/daily payments.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be explicitly hidden on printed payslip.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be given a custom description to appear on printed payslip.

- Enables specific period payments, daily payments, hourly payments, piece payments and additions to 'contribute to gross for minimum wage' or not.

- Ability to set whether or not an hourly rate/payment should accrue hour-based annual leave entitlement.

- For 'accrued' annual leave days/hours, ability to manually specify additional accrued days/hours not accounted for in payroll (i.e. an adjustment).

- Annual leave accrual is now calculated up to end of the currently open pay period (rather than up to the end of the last finalised pay period).

- Printing page setup is now centralised into the File menu of BrightPay.

- Ability to control whether or not the PDF export settings are remembered between usages.

- Enables traditional pension schemes to use employer AVCs.

- Includes Student Loan Plan on FPS

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

Includes all updates made to BrightPay during the 2017/18 tax year

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2017/18, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2018/19. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Additions or deductions can be set up to calculate as a percentage of the payslip’s basic, gross or net pay.

- Hourly and daily rates with the same 'description', whether set up at employer level or employee level, are all reported under a single column in analysis.

- Ability to make additions 'notional' i.e. only contributing towards taxable, NIC-able and/or pension-able pay, without actually giving the payment to the employee (also works for CIS-able pay and subcontractors).

- Ability to include declaration on FPS (or EYU) that an employee's payment is being made to a non-individual.

- Ability to easily switch one or multiple employees from one auto enrolment pension scheme to another.

- Any automatic enrolment pension scheme contribution can now include additional one-off amounts

- Any automatic enrolment pension scheme contribution (whether employee or employer, standard or one-off) can now be entered as a percentage amount or a fixed amount.

- Support for sending enrolment and contributions submissions directly to Aviva via API.

- New/updated documents and reports (e.g. Statutory Pay Calculation and Schedule, Attachment Orders Summary, SMP1, SPP1, SAP1, Employee Count, Employee Address Labels)

- Net to gross functionality can now do ‘Take-home pay to gross’ and ‘Cost-to-employer to gross’.

- Improvements to handling of 'no longer enrolled' employees in selection lists.

- TUPE support

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Here’s some of the new things coming in April/May 2018:

- Journal API support for Quickbooks, Xero and Sage

- API support for The People’s Pension

- Improved and more flexible CIS P&D statement

- Exciting new BrightPay Connect features.

Nov 2017

13

If you think compliance is expensive – try non-compliance

As an employer, your declaration of compliance is a legal duty. If you do not complete it within 5 months of commencing your Automatic Enrolment (AE) duties, then you have not completed your legal requirements of Automatic Enrolment and may face fines. Even if an employer did not enrol any member of staff, a declaration of compliance must be completed.An employer can process their own declaration or authorise an agent to complete this on their behalf. The declaration is completed via The Pensions Regulator’s website. You can start the declaration now by clicking here.

Don’t delay or you could face prosecution – it is a criminal offence if an employer fails to put their employees into a pension scheme and/or provide false information in a declaration of compliance. The maximum punishment can be 2 years in prison if The Pensions Regulator proceeds with prosecution. The Pension Regulator’s checklist provides details of all the information you need when submitting your client’s or your own AE declaration.

What information does an employer need to provide?

You need your letter code and PAYE reference to access the online service. The letter code is unique to every employer and a 10-digit reference beginning with ‘1’. It is on all correspondence an employer receives from The Pension Regulator, you can contact customersupport@autoenrol.tpr.gov.uk if you do not know it or have never received it. To contact customer service you must provide:

- Employer Name

- Employer Address

- PAYE Scheme Reference

- Your Contact Details

An employer’s PAYE reference can be found on correspondence from HMRC when first registered as an employer or from their payroll software.

The Pensions Regulator (TPR) is ensuring that all employers fulfil their duties required by the Pensions Act 2008. It is essential that all employers understand that even if they employ only one person they have certain legal duties for Automatic Enrolment. And if they choose to employ a new member of staff after 1st October, 2017 those duties apply from the day the new employee starts.

Remember, Automatic Enrolment is a continuous duty for all employers, and does not end after the staging date or duties start date (if you don’t have a staging date).

Avoid penalties by understanding how to meet your duties:

- Keep records of all AE activities for 6 years and opt-out notices for 4 years

- Monitor staff ages and earnings - as staff become eligible they must be enrolled

- Enrol employees and issues correspondence to them.

- Pay contributions to their pension scheme

All responsibility ultimately lies with employers.

Related Articles

Oct 2017

9

The Benefits of BrightPay Connect for Employers

BrightPay Connect offers an employee self-service portal that provides employees with online access to their personal records and payroll details. Having a self-service portal in place directly benefits all employees, from line managers and HR to employees across an organisation. Here we take a look at the key features of BrightPay Connect and how having an online portal benefits the employer.

Features of BrightPay Connect for Employers:

- The employer dashboard gives an overview of employer details, any outstanding amounts due to HMRC, upcoming calendar events (e.g. annual leave, paternity leave) and a list of notifications, including any outstanding requests that employees have made using the self-service portal.

- The online portal allows employers to go paperless by uploading all HR documents including employee contracts and handbooks, disciplinary documents, company newsletters and training material to one secure online location.

- Going paperless allows digital access to payslips and other payroll documentation such as P60s and P45s. These will be automatically available to employees on their BrightPay Connect online portal.

- Employers can easily manage all leave for their employees including annual leave, sick leave, maternity leave and paternity leave through BrightPay Connect. The employee calendar allows employers to view the number of annual leave days remaining for each employee and how frequently an employee is on sick leave. Once an employee requests annual leave, employers can authorise or reject the request with changes syncing back to BrightPay payroll.

- BrightPay Connect enables employers to tailor user access, thus protecting sensitive HR information and employees’ privacy.

Benefits of BrightPay Connect for Employees:

The employee self-service portal will save both employers and employees time. The online dashboard enables employees to complete HR related tasks such as requesting leave, updating their personal contact details and viewing online documentation. Employers can then approve requests at the click of a button. This will reduce the administrative time for the employer and the employee, increasing payroll efficiency.

Once an employer has processed their payroll through BrightPay, payslips can be made available on BrightPay Connect instantly, with automated email notifications sent to each employee. This is cost effective for the employer and also saves time printing and distributing payslips. Employees can easily access their historic payslips at any time, which saves time if the employee needs six months of statements to apply for a loan or mortgage.

Employers can notify employees of policy changes, available training courses or any other important company announcements by uploading HR documents. This improves internal communication between managers and employees. Employers can also view who has received and viewed these updates and who hasn’t.

Watch our new BrightPay Connect video to see how our online add-on can improve your payroll processing.

Book a BrightPay Connect demo today.

Sep 2017

11

New Student Loan Plan 1 Thresholds for 2018-19

It has been confirmed that the student loan repayment threshold will rise to £18,330 for Student Loan Plan 1 for the new tax year 2018-19 by the Student Loans Company. This will come into effect from 6th April 2018. Student Loan Plan 1 is for pre-2012 loans and the current 2017-18 threshold is £17,775. This new threshold will apply to all borrowers who have a Plan 1 loan for whom employers make student loan deductions.

For Student Loan Plan 2, which is for post 2012 loans, there will be no change to the current threshold of £21,000 in the new tax year. There is no change to the student loan repayment threshold for postgraduate loans, which is also £21,000.

In BrightPay 2018-19, the new student loan repayment thresholds for Plan 1 will automatically be calculated and the appropriate student loan deduction applied.