Employer Alignment Submission (EAS)

From 6th April 2013, employers will report their payroll information to HMRC in real time, on or before every payday.

Your first RTI submission will be due on or before your first payday in the 2013/14 tax year. All employees must be set up within BrightPay before your first submission is sent, even if they are not paid on the first pay day. Temporary and casual workers, as well as employees paid below the Lower Earnings Limit who, though they may have no deductions, now need to be accounted for through the payroll.

If you have 250 employees or more, your first submission must be an Employee Alignment Submission (EAS), which simply contains the details of all your employees, allowing HMRC to align their records with yours.

If you have less than 250 employees, you do not need to submit an EAS, although you can if you wish to.

Submitting an EAS to HMRC

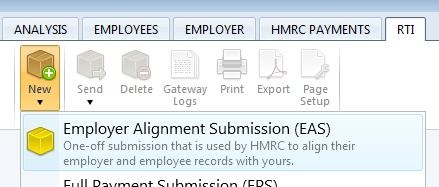

To send an EAS to HMRC using BrightPay, simply select 'RTI' on the menu bar:

1) Click New on the menu toolbar and select Employer Alignment Submission (EAS)

2) The contents of the EAS will be displayed on screen. The EAS can be printed or exported at any time before or after its submission to HMRC by clicking 'Print' or 'Export'.

3) When ready to submit the EAS to HMRC, click Send Now.

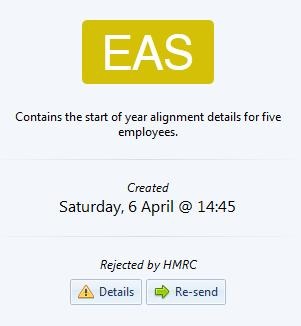

4) Confirmation details will subsequently appear on screen to indicate that your submission has been accepted by HMRC.

5) Should your submission fail, simply click on 'Details' for more information on why your submission has been rejected by HMRC and correct your employee information where required.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.