Employee Tax Relief

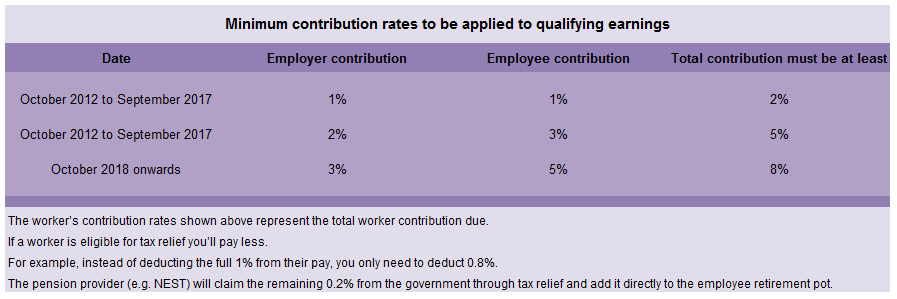

Contribution Rates

To allow you to spread the cost of your employer duties you can phase in the minimum contributions from 2013 to 2018.

There is a minimum total amount that has to be contributed by the employee, the employer, and the government in the form of tax relief.

Who is eligible for Tax Relief on Pension Contributions?

As an employer, it is important to know whether or not your workers are eligible for tax relief. It is the employers responsibility to check with HMRC, if you’re not sure about a worker’s tax relief status.

How to work out who qualifies

Workers are eligible for tax relief if they’re under age 75 and:

- they have UK earnings that are subject to income tax for the tax year

- they’re resident in the UK at some time during the tax year

- they were resident in the UK at some time during the preceding five tax years and when they joined the pension scheme

Contributions deducted and remitted after an employees 75th birthday are not eligible for tax relief.

The maximum amount of contributions on which a member can claim relief is whichever of the following is greater:

- the basic amount - currently £3,600 including the tax relief

- the amount of the individual’s UK earnings for the tax year

This means that an employee who has no relevant UK earnings may still qualify for tax relief on contributions into a registered pension scheme up to the basic amount.

The tax relief is available even if the employee is a non-taxpayer. To claim tax relief on behalf of your workers the pension provider will need the employees National Insurance (NI) number, tax relief cannot be claimed without it, therefore make sure you request each employees NI number when they commence employment. The only exception is where the employee has never had an NI number, for example if they’re an overseas worker waiting for an NI number to be given to them.

Tax Relief on Contributions

Net Pay Approach

Depending on the pension scheme in place, your employer may deduct the pension contributions from your pay before deducting tax (but not National Insurance contributions). You only pay tax on what's left. So whether you pay tax at basic, higher or additional rate you get the full relief straightaway. In these circumstances the pension rate of deduction is not reduced by the basic rate (i.e. 20%)

Depending on the type of pension scheme that you are contributing to and the administration of your pension scheme, your employer may not deduct your pension contributions from your pay, in this arrangement employees can still get tax relief.

To claim the tax relief due the employee will have to do this through their tax return for the relevant year, or if you don't complete a tax return by contacting HM Revenue & Customs (HMRC).

Basic Rate Reduction

Depending on the pension in place, the tax relief method applied to the pension contribution can be relief at source (RAS), where the pension provider claims tax relief back from HM Revenue & Customs (HMRC) on behalf of an eligible member after contributions are paid to them.

In these pension schemes the employee contribution is 1% and they're eligible for tax relief their actual contribution will be made up of:

- 0.8% from their pay – this is what the employer deducts and sends to the pension provider

- 0.2% tax relief – this is what the pension provider claims from the government on the employees behalf and tops up the employee contribution be this amount

So if an employee is eligible for tax relief the employee contribution level the employer sets for them (1% in this example) is higher than the amount the employer actually sends to the pension provider (0.8% in this example).

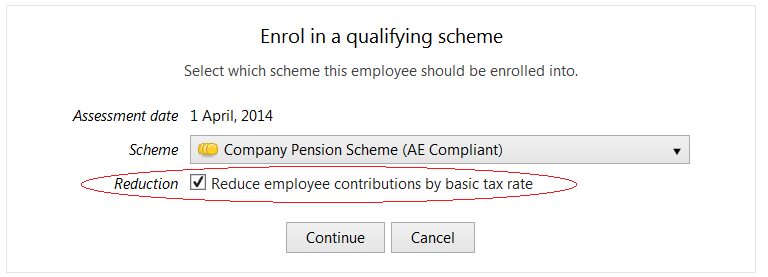

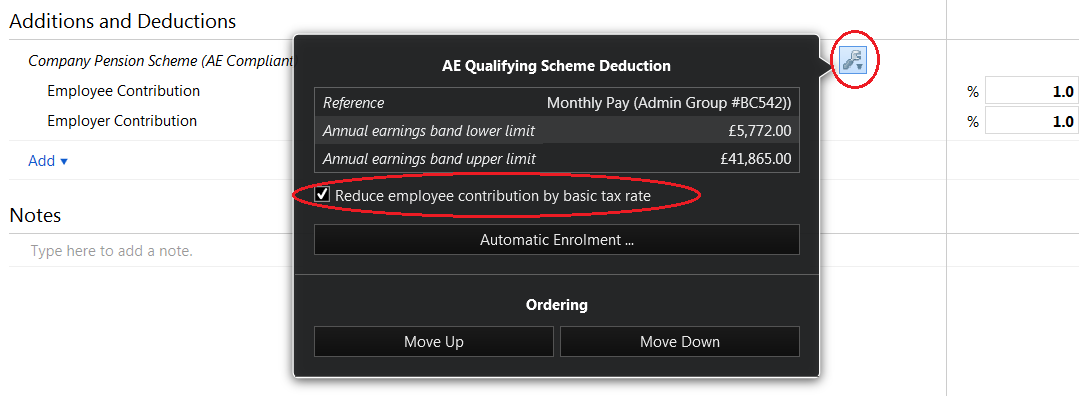

To reduce the contributions by the basic tax rate, i.e. to apply tax relief at source, to the pension contributions, within BrightPay you can

- apply the reduction when enrolling the employee

or,

2. in the payroll screen

Tax Relief and NEST

NEST apply the tax relief at source (RAS) method, where NEST claim tax relief back from HMRC on behalf of an eligible member after contributions are paid to them.

Therefore, as above, the employer will reduce eligible employee pension contributions by the basic rate of 20% remitting the balancing 80% to NEST.

NEST does not apply the Net Pay approach. Therefore employers who are operating the NEST pension scheme cannot reduce the employee salary before deducting tax.

If an employee is not eligible for tax relief, the only difference is that the contribution employers deduct will be 100% of the contribution level set within their group. So, if you set 1% as the contribution amount you will send 1% member contribution.

If NEST have your worker’s NI number, NEST will assume that the workers enrolled in NEST are eligible for tax relief unless the employer advises otherwise. If you think a worker you want to enrol in NEST isn’t eligible for tax relief you need to contact NEST by phone on 0300 020 0090. You can only do this at the point of enrolment. After enrolment the worker will need to update their tax relief status.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.