Employer Pension Scheme - Setting it up in BrightPay

Once the pension scheme is in place with the pension provider you will have to set it up in BrightPay in order to attach the pension scheme to the enrolled employees to start deductions.

SETTING UP THE COMPANY/EMPLOYER PENSION SCHEME

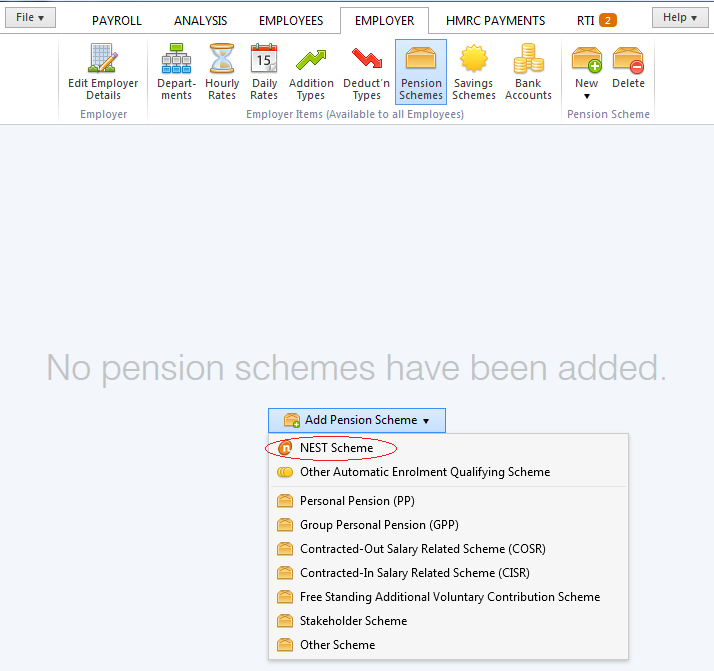

Choose the EMPLOYER menu

Select PENSION SCHEMES

Select ADD PENSION SCHEME

BrightPay will offer 2 new pension scheme options from 2014/15;

- NEST Scheme

Employer selects the NEST type and can tailor the detail of the scheme to suit the contribution, earnings, limits as required for the pension arrangements in place with NEST

Prepare csv submission files for upload to the employer NEST account - Other Automatic Enrolment Qualifying Scheme

Employer selects the Other AE qualifying pension type and can tailor the name and detail of the scheme to suit the contribution, earnings, limits as required for the pension arrangements in place with the company pension provider

Both pension schemes are set up and allow the same variables to be set by the employer, the only variances at this time is that BrightPay will create the NEST submission file. Employers can use the flexible analysis tool to build the necessary pension files as required, further default pension file submission types will follow throughout 2014/15.

For the purposes of this guide we will use a NEST Scheme as an example for guidance purposes.

Other Automatic Enrolment Qualifying Schemes will be set up in the same manner with the exception of the automated creation of the suitable submission file specification.

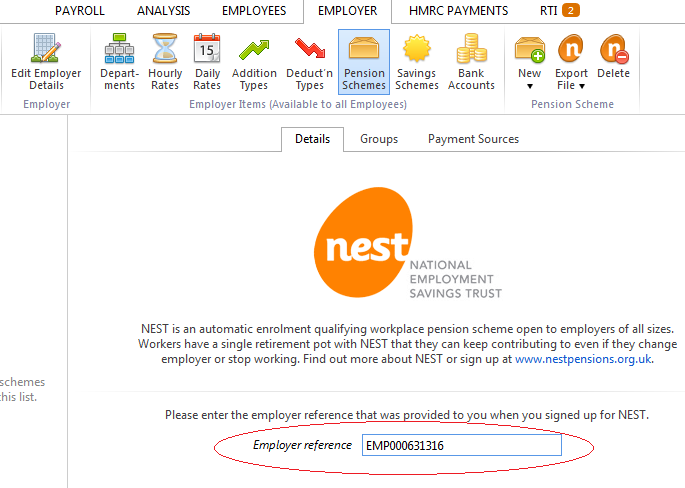

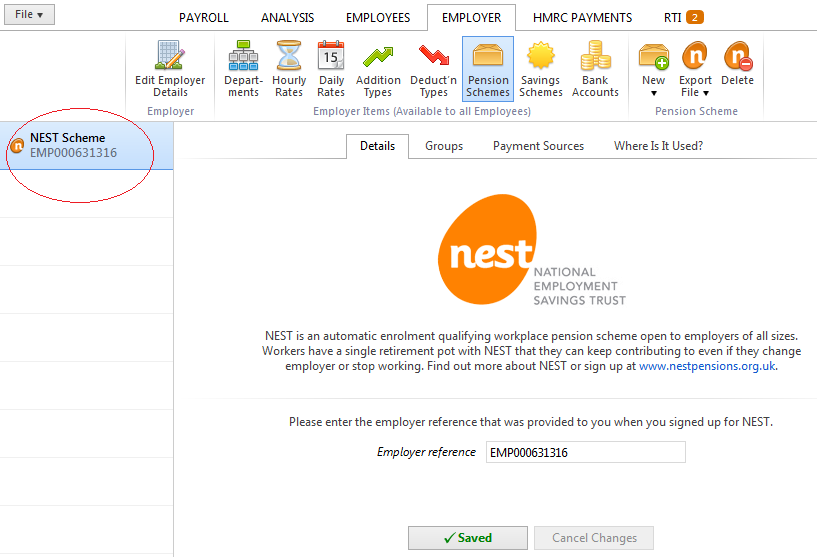

SCHEME DETAILS

Enter the EMPLOYER REFERENCE

For NEST this is the Employer ID allocated by NEST when the employer registers, this ID in in the form of EMP + 9 numbers, for example EMP000631316

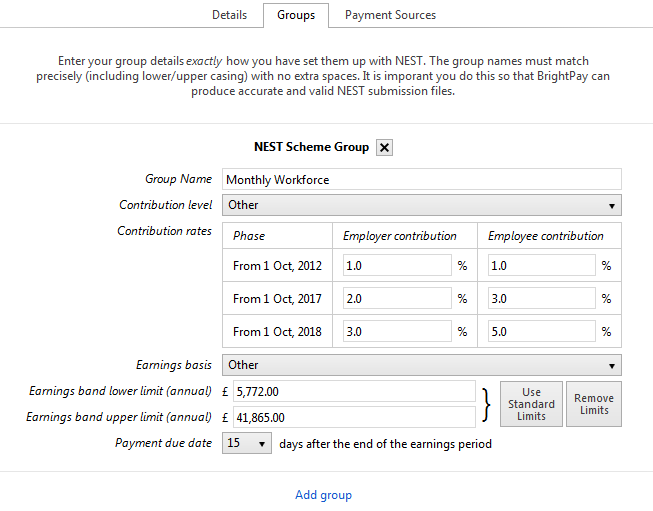

GROUPS

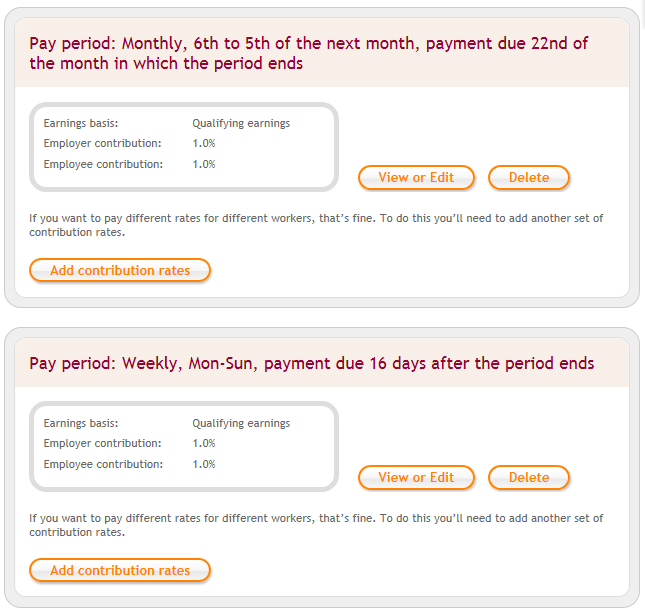

Workers are split into Groups based on;

- Pay periods (weekly/monthly/fortnightly)

- Contribution Rates (some workers may be contributing on phased basis, some may be at top rate)

- Date of remittance by the employer of the deductions to the pension provider

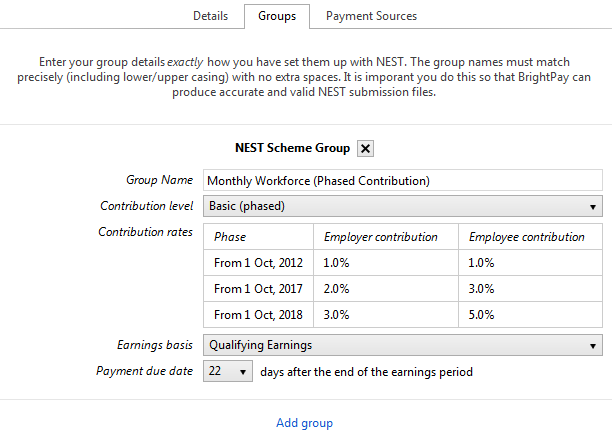

Each Group is registered with the pension provider and allocated a Group name.

Groups in NEST

Groups are designed to save you time. Each worker you enrol into NEST will go into a group. This tells NEST what you’ll pay, and when. This avoids entering the same information each time a worker is enrolled, instead they are simply added to a pre-set group.

Each group is defined by the pay period and set of contribution rates you’ve chosen. The more pay periods and sets of contribution rates you create, the more groups you’ll have.

Check your groups carefully. They’ll form part of the legal agreement between your company and the trustees of NEST.

There is no limit to the number of groups with different pay periods and contribution rates that you can set up.

Set up each Group that you have set up with NEST in BrightPay.

In NEST, when setting up the Group you will have allocated the contribution rates, earnings and remittance date to NEST for deductions.

For example;

Reflect all these same details when setting up the pension Group in BrightPay (as per below).

BrightPay facilitates the tailoring of the Group to suit your pension arrangements. The contribution rates, earnings bands and remittance schedule is set as a default meeting the minimum requirements for automatic enrolment, however each one of these is flexible to allow the employer to amend to suit their particular pension arrangements.

Add Group

Select ADD GROUP to set up all necessary Groups to match your pension Groups.

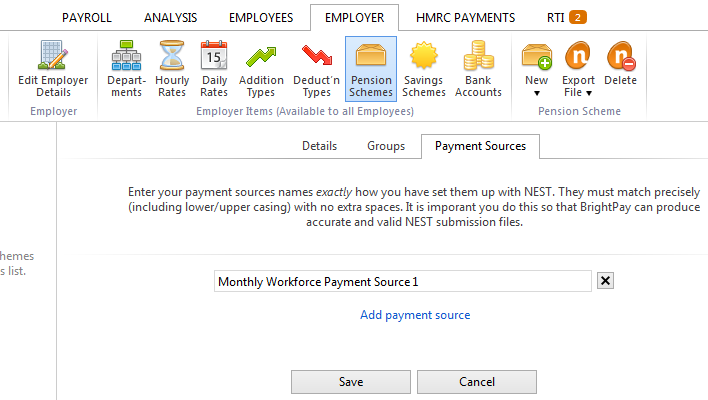

PAYMENT SOURCE

Payment Sources indicate the method of paying the contributions deducted to the Pension provider, in this case NEST. Varying Payment Sources are only required if you are paying out of varying bank accounts.

You are required to set up Payment Sources within NEST. The more payment sources you set up, the more administration you’re likely to have to do, so try to only add the ones you really need.

For every Payment Source you set up within NEST, set up the same Payment Source, with the identical Payment Source Name in BrightPay.

Add Payment Source

Select ADD PAYMENT SOURCE to set up all necessary Payment Sources to match the varying payment sources agreed and setup with your pension provider.

SETUP COMPLETE

Once the company/employer pension is complete it is added to the listing of available pension scheme into which employees may be enrolled.

Simply select a pension scheme from this listing to review or amend at any stage.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.