NIC Category Letters

National Insurance category letters

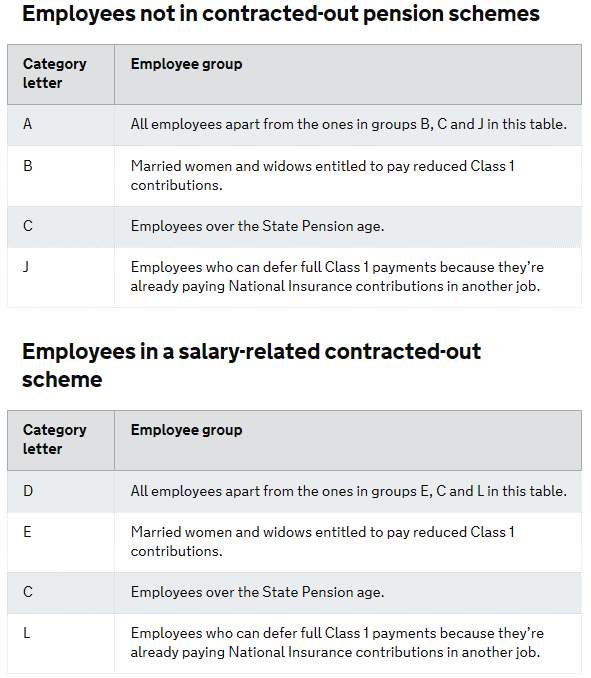

You need to know an employee’s National Insurance category to work out how much to pay for them. If you use Pay As You Earn (PAYE) payroll software it’ll ask you for the category letter to calculate your contributions.

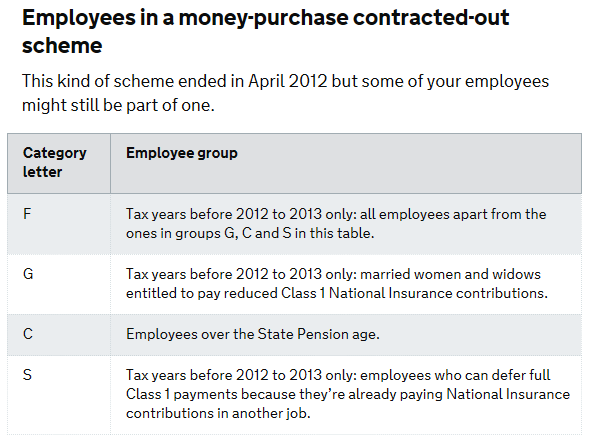

An employee’s National Insurance category letter depends on whether they have a separate (contracted-out) pension scheme and opted out of paying into the State Pension.

Most employees are category A or D.

When an employee reaches State Pension age

You have to change their National Insurance category to ‘C’ in your PAYE system. They need to show you proof of their date of birth before you do this. You must continue to pay contributions for them.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.